Permits always lead, as there are no starts without permits. And in NY it was the rush to get multi family permits in before June 15 when a tax break expired is what caused the prior surge in permits and some starts as well and is now reversing:

Housing Starts

Highlights

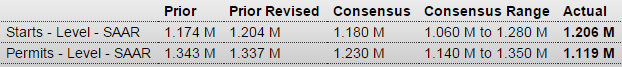

Building permits slid sharply in July but reflect in part a plunge in the Northeast where a change in New York City real estate law pulled permits into June at the expense of July. Permits fell 16 percent in July to a 1.119 million annual rate with the Northeast down 60 percent. But permits also fell in the other three regions including a steep 9.9 percent decline in the West. Turning now to starts, they inched 0.2 percent higher to a 1.206 million rate. But the decline in permits, though skewed by the Northeast, points to less strength than expected for the new home market in the months ahead.

A relative positive in the report is less weakness in permits for single-family homes which fell only 1.9 percent. Permits for multi-family homes, which are smaller in size and provide less of a boost to GDP, fell 32 percent. Housing completions came in at a 987,000 pace in the month, up 2.4 percent from June in a positive start for the third quarter.

In sum, this report is on the soft side and doesn’t increase the chances for a September rate hike from the Fed. Initial reaction in the markets is mixed with the resilience in starts offering some offset to the plunge in permits.

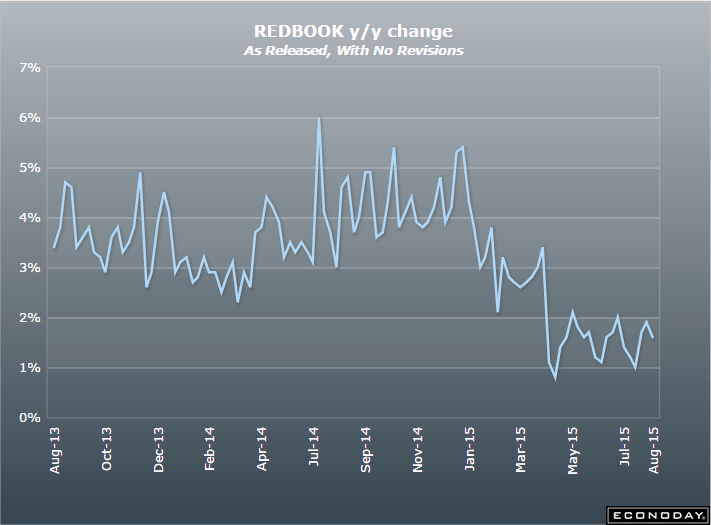

None of the retail sales indicators seems to be showing improvement:

Redbook

Highlights

Redbook’s sample continues to report soft rates of same-store sales growth, at only 1.6 percent year-on-year in the August 15 week. Sales received some boost from the tail end of tax holidays in a number of states. Despite the soft rate of growth, the month-to-month comparison with Redbook’s sample in July is favorable and hints at incremental strength for core retail sales in August.