Personal Income and Outlays

Highlights

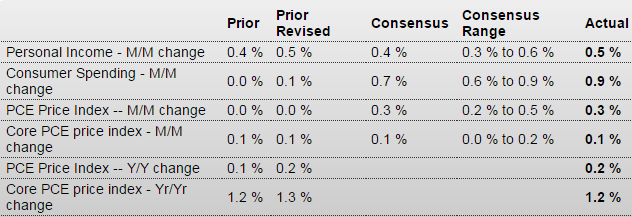

The consumer came to life in May, boosted by a 0.5 percent rise in personal income and helping to support a 0.9 percent surge in personal outlays that reflects heavy spending on autos and retail goods. And gains are not inflationary, at least yet, based on the very closely watched core PCE price index which edged only 0.1 tenth higher in May and is at a very benign 1.2 percent year-on-year rate which is actually down a tenth from an upward revised April.

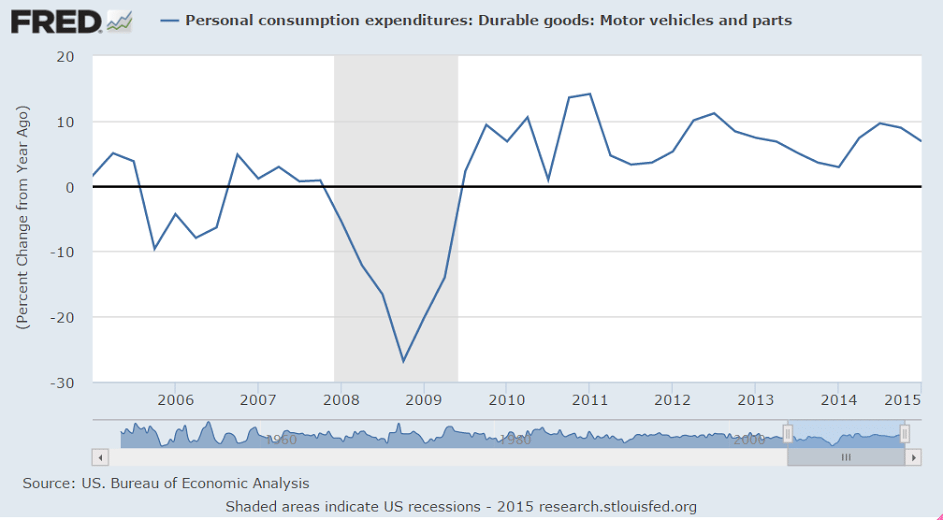

Components on the income side are very solid with wages & salaries up 0.5 percent in the month. Both proprietors’ income and rental income show especially strong gains. Spending components show special strength for durables, again tied especially to autos, and also strong gains for non-durables, here tied to higher pump prices. Spending on services once again shows an incremental gain.

Turning back to PCE prices, the overall price index looks a little hot in May at plus 0.3 percent but the year-on-year rate is unchanged at only 0.1 percent. That’s right, that’s the year-on-year rate at only the most incremental level of inflation. And the 1.2 percent year-on-year core appears to be moving in reverse, down 1 tenth in each of the last two reports and further away from the Fed’s 2 percent target.

Consumers, in an expression of their confidence, dipped into their savings to spend, with the savings rate down 3 tenths to 5.1 percent. This is a good report for the bulls, showing a strong non-inflationary bounce for the second quarter. This report won’t be keeping the doves up at night and does not move forward the Fed’s coming rate hike.

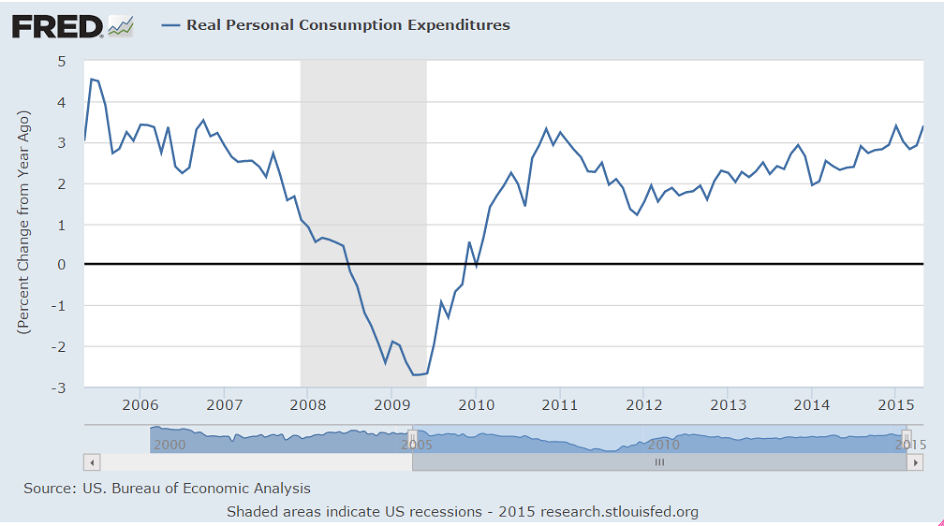

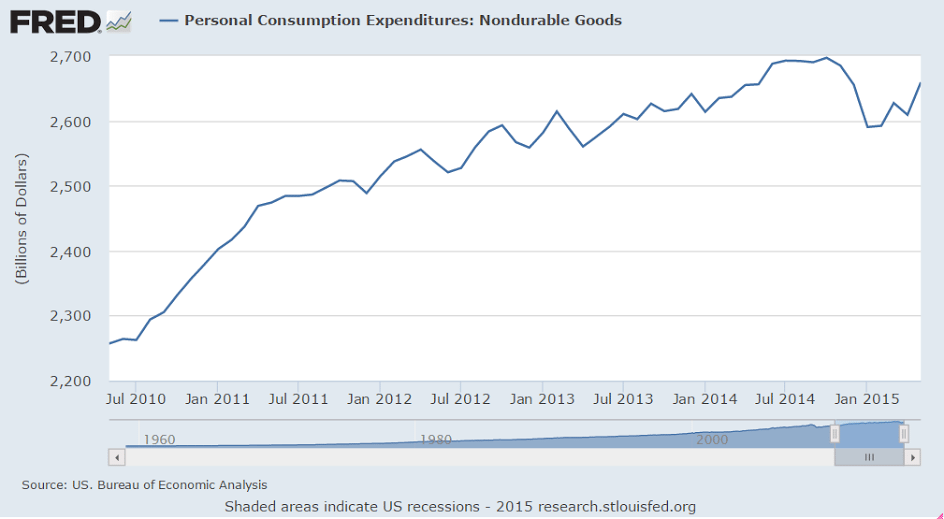

First, note the last wiggle up all the cheer leading is about, up from the previous flat one on the 5 year chart:

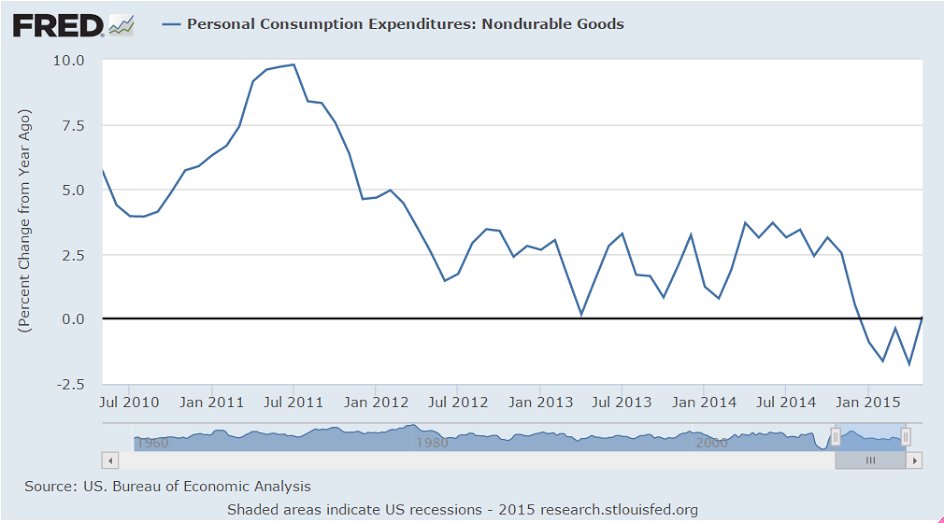

And the year over year growth rate for the last 10 years, and how the last time it got over 3% it didn’t stay there long:

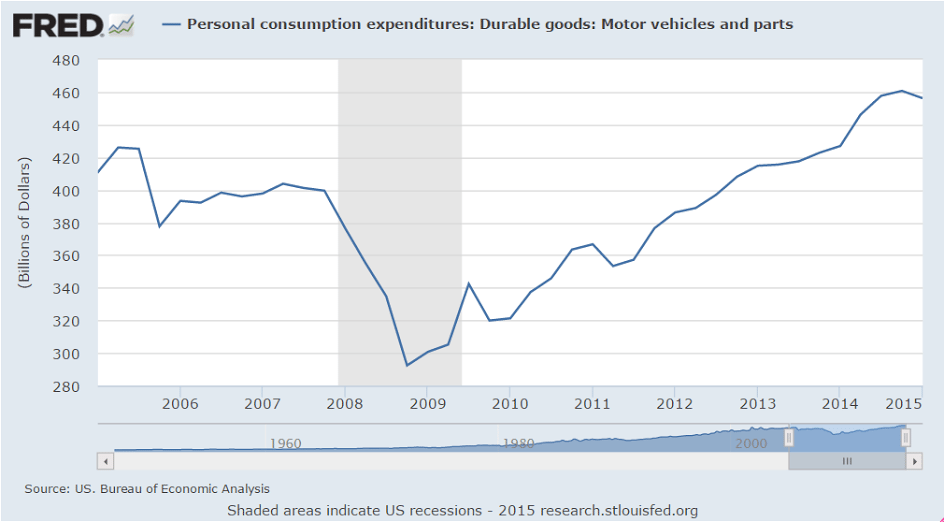

New vehicle sales may have been up for the month, but the year over year industry growth rate is generally slowing:

And retail was reported higher, but hasn’t yet even recovered from the prior dip:

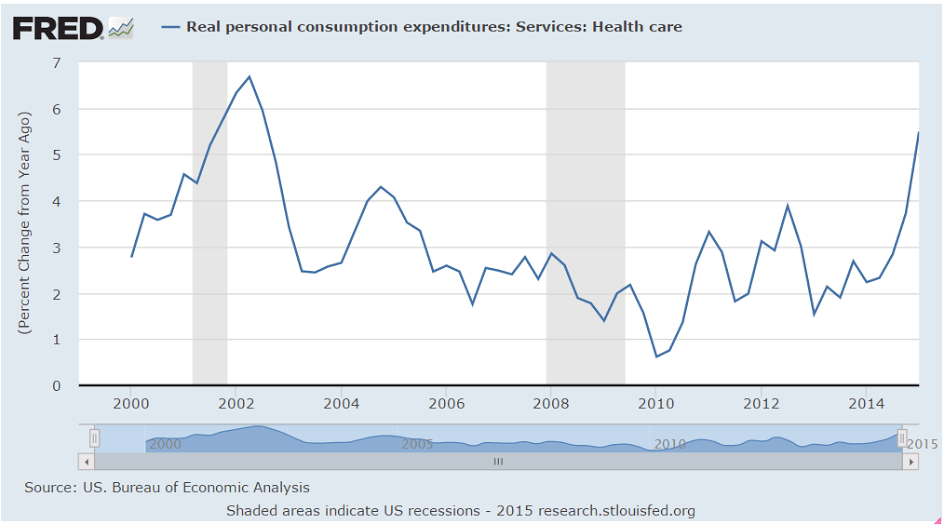

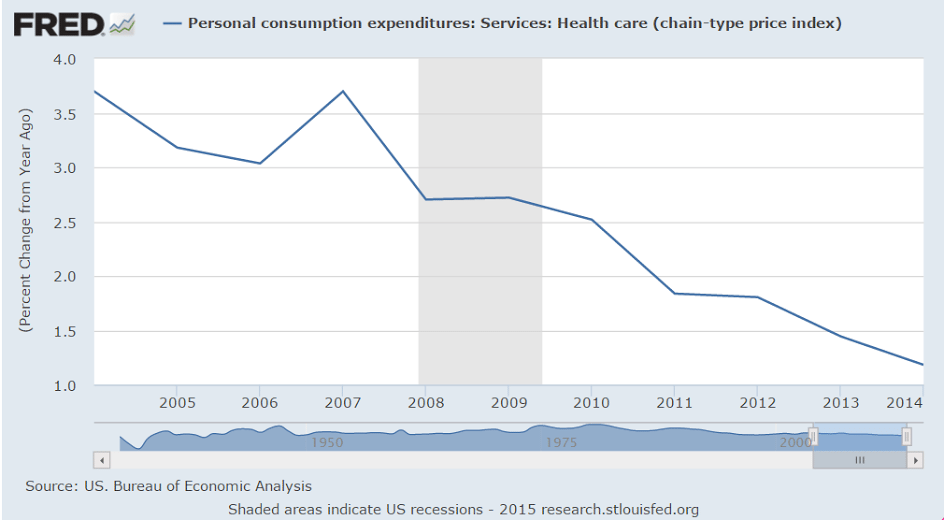

And, turns out, here’s where the growth is also coming from lately- health care premiums, which aren’t tracking with the lower growth of actual health care prices:

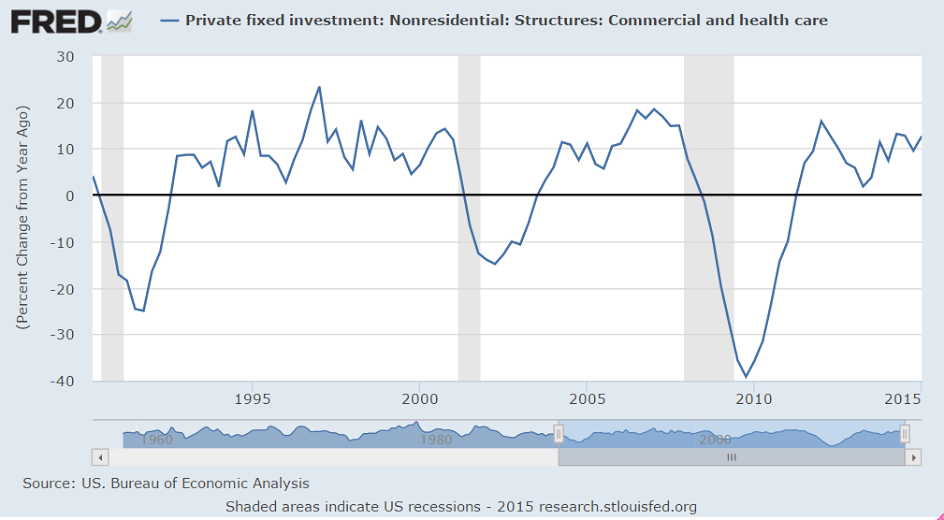

Construction appears to be growing at historical rates since the crisis dip:

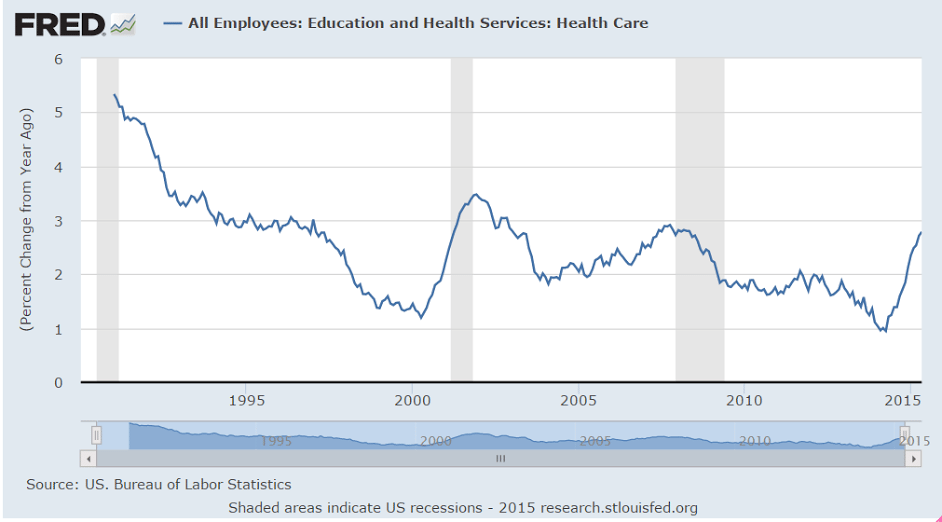

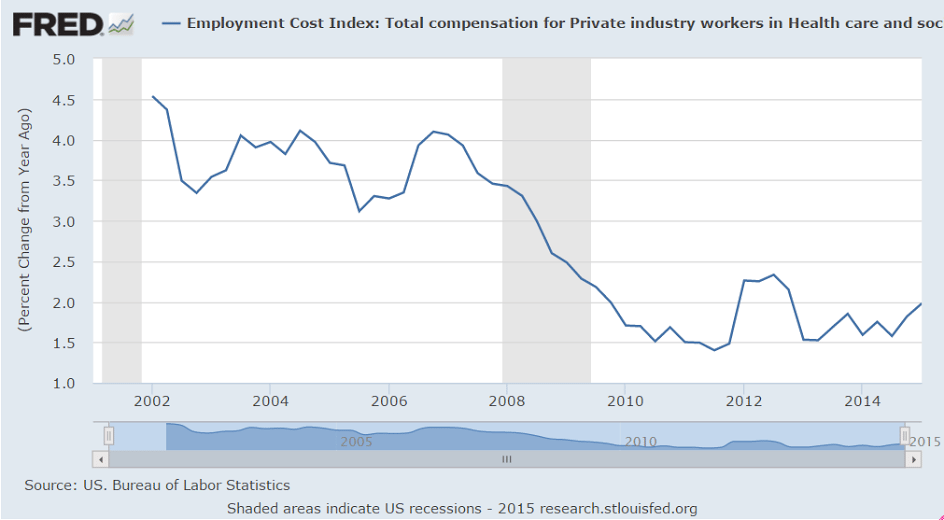

The growth in health care employment has picked up to more historic levels after a large decline, so perhaps the larger increases we’ve seen are just a case of ‘catch up’, nor does there seem to be any unusual wage growth associated with the additional employment:

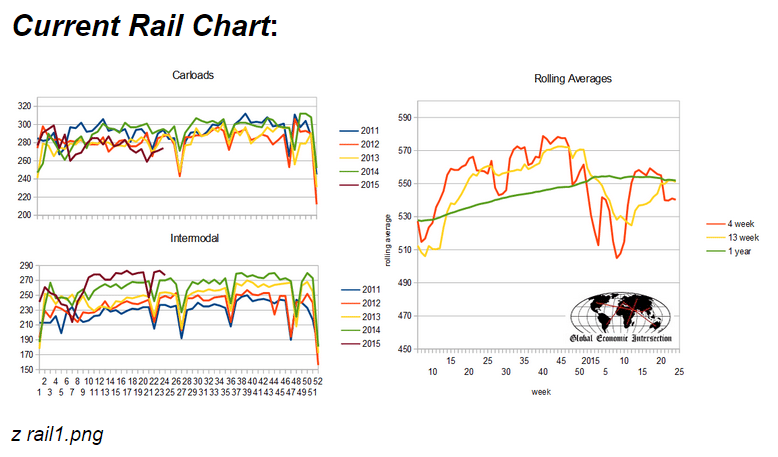

Nothing good happening here: