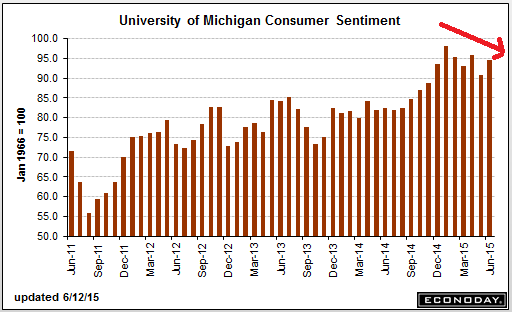

Yes, it’s a bit of a rebound from last month, and being touted as proof of a strong recovery, but it also looks like the drift down may still be in progress, much like the consumer sales showed disturbingly declining rates of annual growth even though the recent release was an uptick:

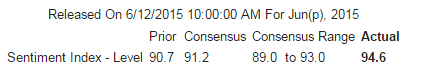

Consumer Sentiment

Highlights

This week’s retail sales and consumer sentiment reports offer a one-two punch. Consumer sentiment is back on the climb, jumping nearly 4 points to 94.6 which is well above the Econoday consensus for 91.2. The gain is centered in the current conditions component, up 6.0 points to 106.8, which offers an early signal for June-to-May consumer strength. The expectations component shows a smaller but still healthy gain, up 2.6 points to 86.8. The gain here points to confidence in the jobs outlook.

Gas prices have been edging higher but are not affecting inflation expectations which ticked lower, down 1 tenth to 2.7 percent for both the 1-year and 5-year outlooks.

Headline Retail Sales “Improve” In May 2015. We Still See a Slowing Trend.

By Steven Hansen

Retail sales improved according to US Census headline data and were at expectations. We see a continued slowing of retail sales using the year-over-year unadjusted data. Consider that the headline data is not inflation adjusted and prices are currently deflating making the data better than it seems (but still not excellent and still decelerating).

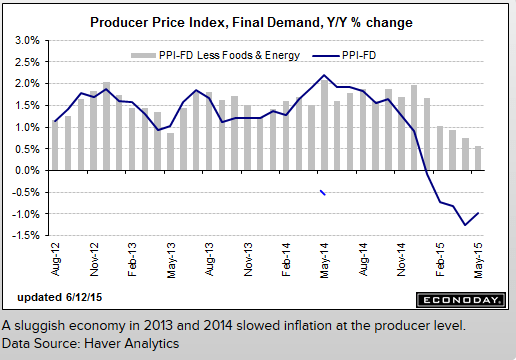

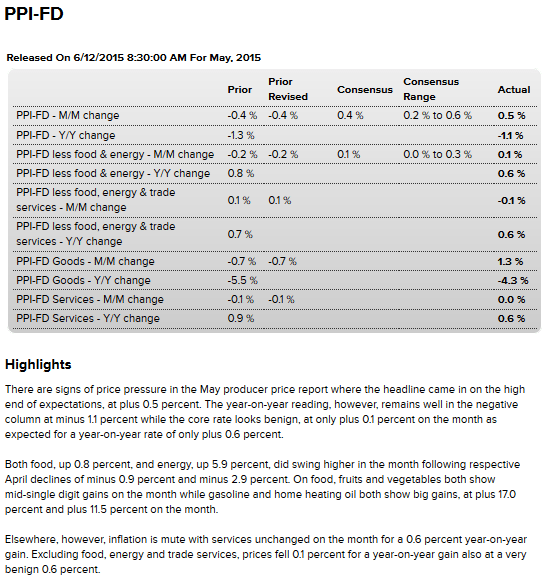

‘Inflation’ remains well below Fed targets and no hard evidence its picking up: