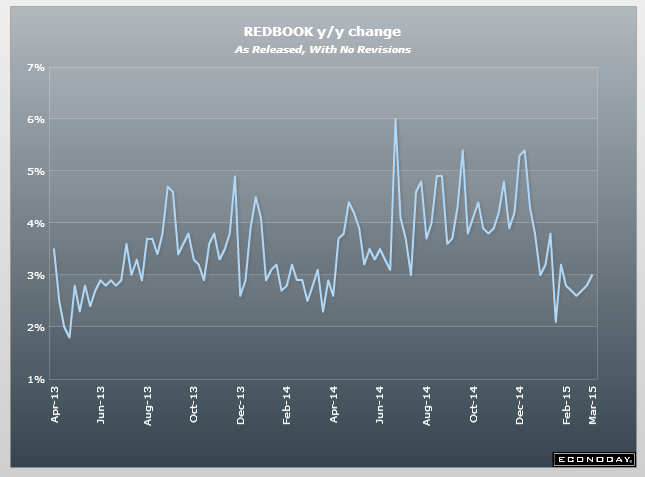

Growth still depressed, even vs last year’s winter weakness:

Same here:

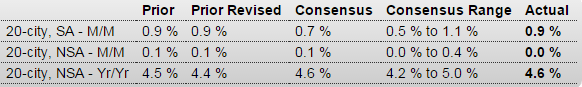

S&P Case-Shiller HPI

Highlights

Home prices are firming as the Case-Shiller composite-20 index rose 0.9 percent in January following a 0.9 percent gain in December and a 0.8 percent rise in November. This is the strongest streak for this report since late 2013. Year-on-year, however, prices are still on the soft side, up only 4.6 in January and only fractionally higher than the prior two months.

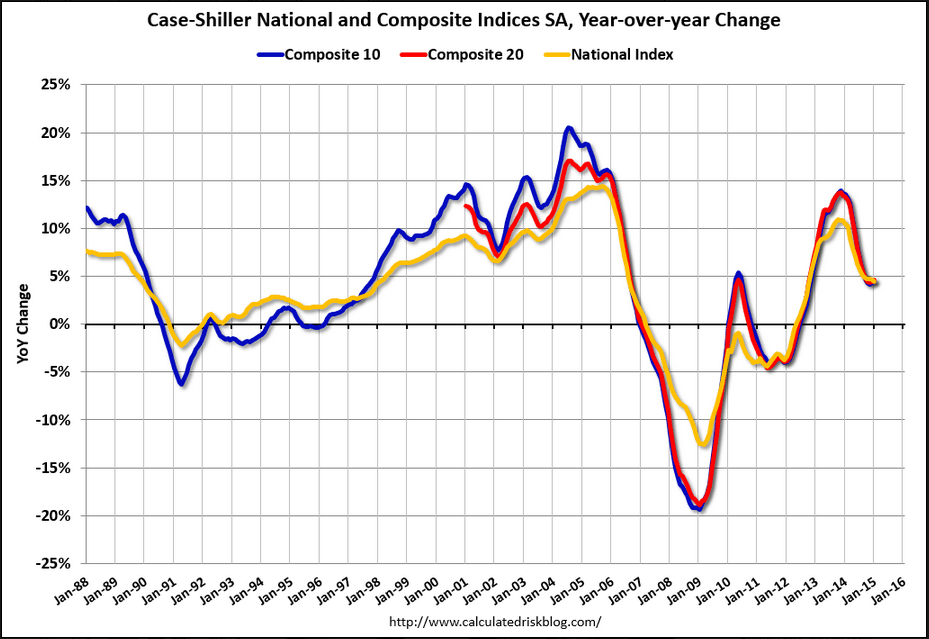

Bad here too:

Chicago PMI

Highlights

Companies sampled in the Chicago PMI report continue to report a lull in activity, at a sub-50 March index of 46.3 following 45.8 in February. On a quarterly basis, the index averaged only 50.5 in the first quarter, down steeply from 61.3 in the fourth quarter for the weakest reading since the third quarter of 2009. Respondents are citing bad weather and fallout from the West Coast port slowdown as temporary negatives, and they see orders picking up during the second quarter. Though the Chicago report, which covers both the manufacturing and non-manufacturing sectors, is often volatile, the last two months of sub-50 readings do confirm other indications of first-quarter weakness for the nation’s economy as a whole. The Dow is moving to opening lows following today’s report.

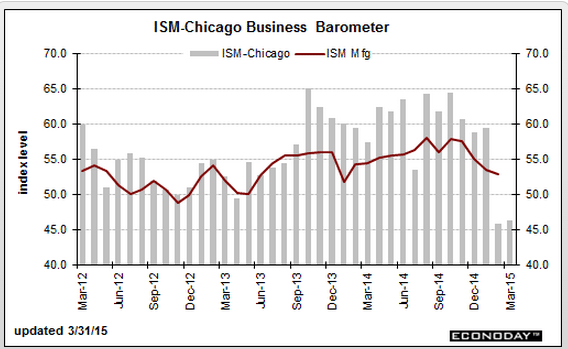

Consumer confidence is up even as retail sales growth plummets:

U.S. small-business borrowing slips in February, up on year: PayNet

By Elvina Nawaguna

March 31 (Reuters) — The Thomson Reuters/PayNet Small Business Lending Index fell to 119.2 last month from 122.4 in January. Still, the index was up 7 percent from February 2014. The index gauges borrowing by firms with $1 million or less in outstanding debt. An increase of 1 percent to 2 percent indicates businesses are borrowing to replace worn out assets, PayNet founder and President Bill Phelan said. Higher readings signal that firms are investing more to increase their production of goods and services. Small businesses account for nearly half of US GDP.