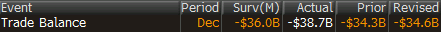

Dec trade deficit larger than expected= downward revisions to Q4 GDP

International Trade

Highlights

The trade deficit in December reversed course but still was relatively low. The trade gap widened to $38.7 billion from $34.6 billion in November. Market expectations were for a $36.0 billion deficit. Exports declined 1.8 percent in December, following a gain of 0.8 percent the month before. Imports edged up 0.3 percent after dropping 1.3 percent.

The expansion of the trade gap was led by goods excluding petroleum which jumped to $42.0 billion from $37.9 billion in November. The petroleum deficit worsened slightly to $15.6 billion from $15.3 billion in November. The services surplus improved to $19.8 billion from $19.5 billion.

Not impossible that claims have bottomed and are turning up.

Jobless Claims

Highlights

A clean look at initial jobless claims points to improvement. Initial claims for the February 1 week fell a sharp 20,000 to a lower-than-expected 331,000. The 4-week average, at 334,000, is trending 15,000 below the month-ago comparison.

Continuing claims, however, are not showing improvement. Continuing claims for the January 25 week rose 15,000 to 2.964 million with the 4-week average up 26,000 to a 2.986 million level that is more than 100,000 above the month-ago trend. The unemployment rate for insured workers, which had been at 2.1 percent as recently as November, is unchanged for a 4th week at 2.3 percent.

Doesn’t look like the Fed has much to worry about regarding ‘inflation’ from unit labor costs just yet: