Who would have thought that with purchase apps down 10% year over year sales would fall?

So seems like borrowers aren’t stepping up to the higher mortgage rates demanded by lenders fearful of future fed rate hiking?

That means the economy stalls and the Fed doesn’t hike?

Highlights

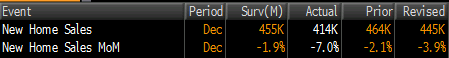

New home sales had been a bright spot in the housing sector — but not any more. Sales of new homes nose dived in December, to a 414,000 annual rate that’s below the low end estimate of Econoday’s consensus. More bad news comes from downward revisions that total 30,000 in the prior two months.

The drop in sales gave a lift to supply, at least supply relative to sales which is at 5.0 months vs 4.7 months in November. But the total number of new homes on the market actually fell, down 5,000 to an adjusted 171,000.

High prices are no doubt a factor behind the sales weakness but not a pronounced factor. The median price rose 0.6 percent to $270,200 with the year-on-year rate very modest at plus 4.6 percent which is right in line with the plus 4.6 percent year-on-year rate for sales.

Bad weather may have played a factor in December’s disappointment but heavy weather is common to all Decembers. Unattractive mortgage rates and the still soft jobs market appear to be holding down housing noticeably. On Thursday, watch for pending home sales data which track initial contract signings for sales of existing homes. The Dow is little changed following today’s results.

And note the downward slope of the last three prints: