As previously discussed, this happens with every down cycle, and is disproven every time demand picks up.

Meanwhile, real wages continue to under perform and remain disgraceful

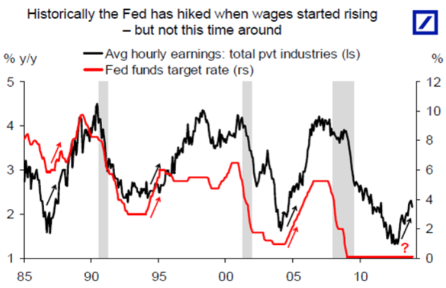

This new Fed paper says that everyone who left the labor force since early 2012 is not coming back. In other words, the labor market is tighter than the Fed thinks and the NAIRU is higher which is why wages are rising, see also chart below:

Excerpts:

“The decline in the participation rate since the first quarter of 2012 is entirely accounted for by … retirement.”

“…a plausible conjecture is that the 2008 financial crisis and associated losses of wealth might have had the effect of delaying their retirement age, while the subsequent recovery of financial wealth has allowed more of them to retire in the last few years.”

Fed: “On the Causes of Declines in the Labor Force Participation Rate”

In the attached GEP from earlier this year we also found that most of the decline in the participation rate is driven by longer-term, structural factors, such as demographics.

Happy to discuss, let us know.

Full size image