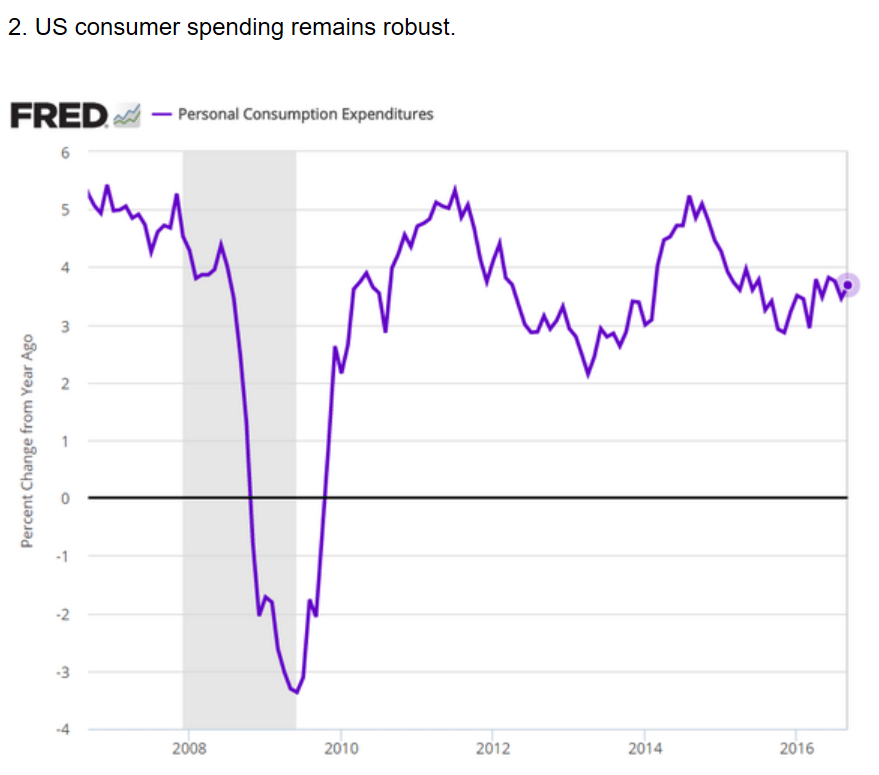

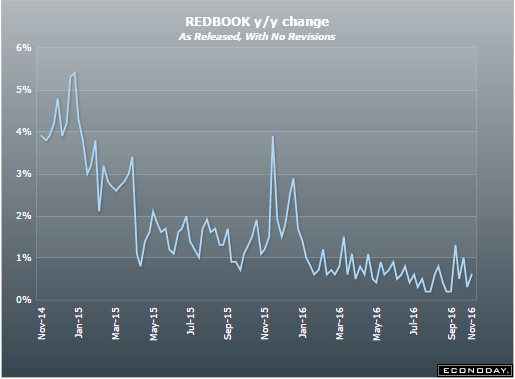

Gotta like the headlines. The growth rate remains below where it was during the beginning of the last recession…

That is, we could already be well into recession:

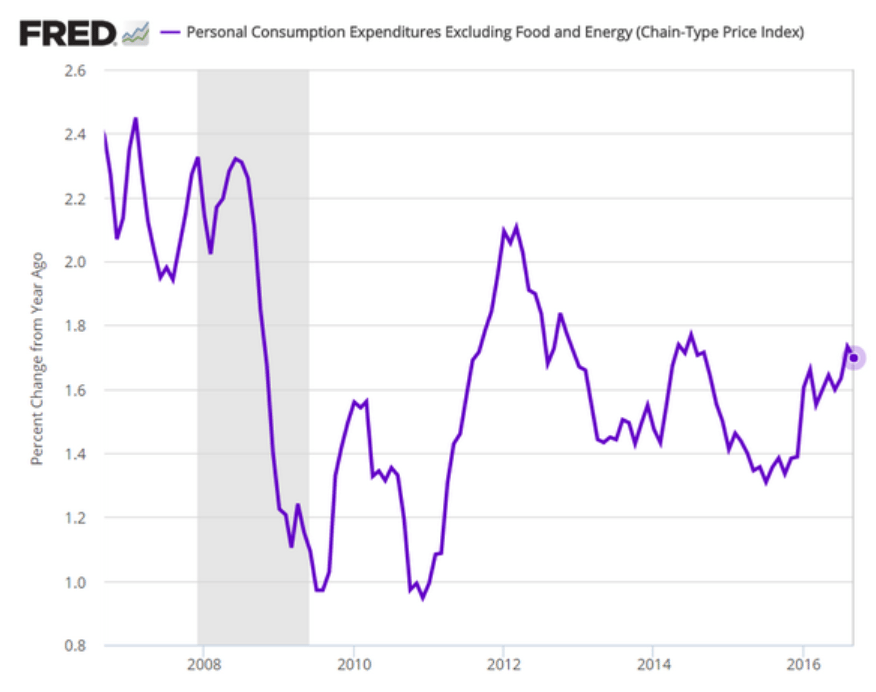

Adjusted for inflation, also below prior recession levels:

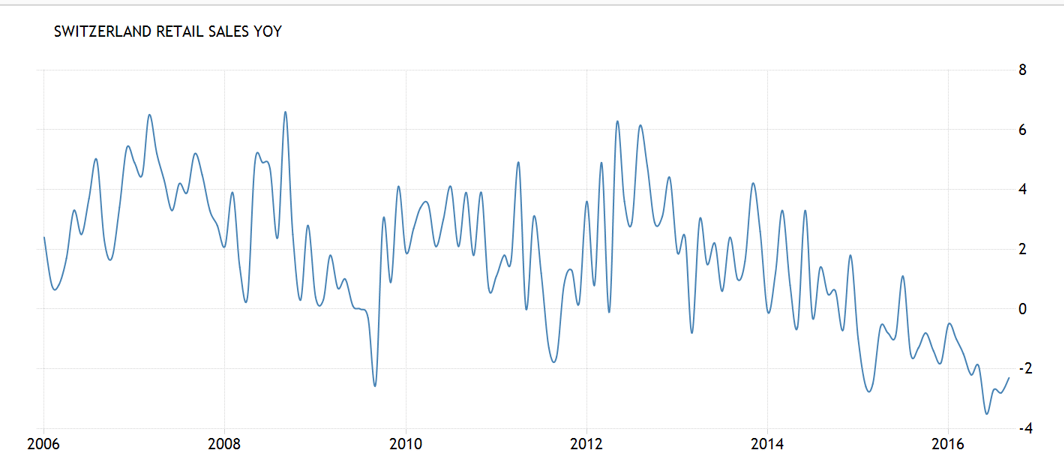

And it doesn’t seem like building $600 billion of reserves, buying US stocks, and a negative rate policy have done much for the Swiss consumer:

Not even a hint of improvement here:

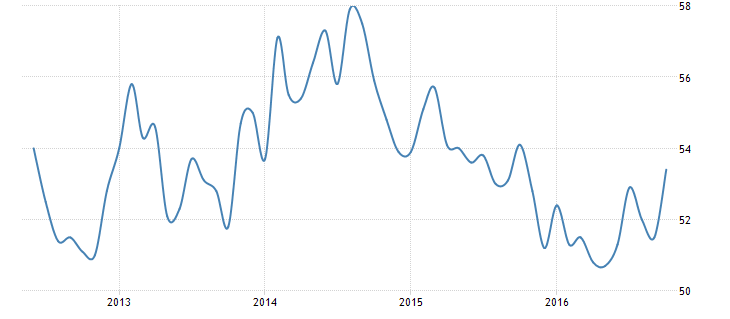

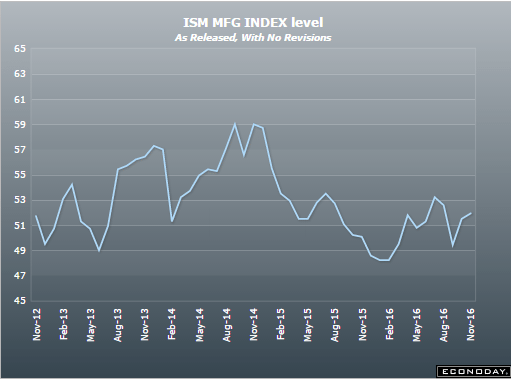

As previously discussed, manufacturing seems to be leveling off at reduced and modest levels:

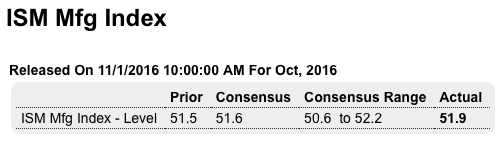

Highlights

ISM’s manufacturing sample reported no better than moderate conditions in October with the composite index at 51.9 which however is still 3 tenths better than Econoday’s consensus. But new orders are a disappointment, still showing monthly growth but, at 52.1 vs September’s 55.1, at a much slower rate. Backlog orders, at 45.5, are even softer, holding below 50 for a 4th month in a row to indicate contraction. A positive for orders is a steady though moderate rate of growth for new export orders, at 52.5 for a 1/2 point gain.

Production did pick up speed in the month, up 1.6 points to 54.6, while employment moved from 49.7 and back over 50 for the first time since June, to 52.9. Input costs also point to steady demand, rising 1.5 points to 54.5.

Yet this report tells a very different story from the manufacturing PMI released earlier this morning where readings, especially new orders, are accelerating sharply. Combining the two probably offers the most reliable indication on the factory sector, that is moderate and respectable growth going into year end.

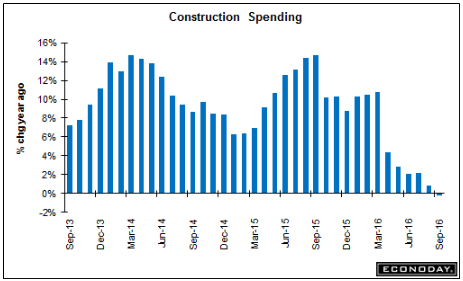

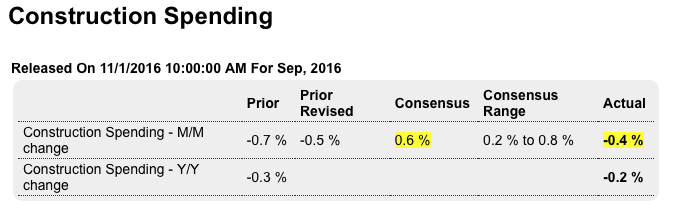

Construction continues to head south with no relief in sight. And watch for downward revisions to q3 and q4 GDP growth estimates:

Highlights

Construction spending remains weak but indications on housing do show limited improvement. Total construction spending fell 0.4 percent in September for a year-on-year decline of 0.2 percent. But residential spending rose 0.5 percent in the month with this year-on-year rate at plus 0.9 percent. The breakdown here though is mixed as the key single-family category could muster only a monthly rise of 0.1 percent. Multi-family construction is once again the strength, rising 2.0 percent in the month to extend an upward trend that reflects gains in current rental rates.

The real weak area is in the non-residential side of the report where spending on private construction fell 1.0 percent in the month and with public construction down 1.1 percent for its poorest showing since March 2014. Nearly all components on the nonresidential side show monthly declines with commercial, down 2.4 percent, and Federal spending, down 1.9 percent, showing the most weakness.

The construction sector, despite unusually low mortgage rates, has been struggling this year with the softness in single-family housing posing continued challenges for what is otherwise a strong new home market.