“… one wants to explain the empirical fact that involuntary unemployment is only associated with money-using contractual economies. In other words, real economies that do not use money and money labor contracts to organize production (e.g., feudalism, slave economies, South Sea Islanders discovered by Margaret Meed, etc) may possess important nonlinearities and even an uncertain future — but there is never an important involuntary unemployment problem. Slaves are always fully employed as well as are serfs in feudalism…….Finally it should be noted that herds of animals, schools of fish, etc organize together to solve the economic problems of What? How? For Whom? Without using money, contracts or markets, these animals still face complex nonlinear problems in their search for food and interaction with other herds. Yet animals never suffer from involuntary unemployment!.

Professor Paul Davidson

University of Tennessee

(PKT Archives)

Introduction

The current monetary system can sustain both full employment and price stability over the short and long run. It will be shown that:

1) Unemployment equates to the Federal budget deficit being too small, and

2) The value of a currency is determined by the prices paid by that government.

The government has embraced two primary economic objectives: price stability and full employment. Ironically, it has chosen a monetary and fiscal policy that utilizes excess capacity, including unemployment, to maintain price stability, obviating the possibility of simultaneous achievement of both objectives. The focus of this analysis is on an entirely different option in which the government assumes the role of employer of last resort (ELR), eliminating involuntary unemployment, and price stability is maintained by the government restraining the price it pays for the proposed supplementary ELR labor pool.

The Employer of Last Resort (ELR) Alternative

The U.S. Government can proceed directly to zero unemployment by offering a public service job to anyone who wants one as a supplement to the current budget. Furthermore, by fixing the wage paid under this ELR program at a level that does not disrupt existing labor markets, i.e., a wage level close to the existing minimum wage, substantive price stability can be expected.

The ELR program allows for the elimination of many existing government welfare payments for anyone not specifically targeted for exemption, as desired by the electorate. Minimum wage legislation would no longer be needed. Labor would welcome the safety net of a guaranteed job, and business would recognize the benefit of a pool of available labor it could draw from at some spread to the government wage paid to ELR employees. Additionally, the guaranteed public service job would be a counter- cyclical influence, automatically increasing government employment and spending as jobs were lost in the private sector, and decreasing government jobs and spending as the private sector expanded.

This ELR proposal at one level resembles workfare, which has been rejected by Congress, though some state welfare reform programs are not unlike workfare. However, unlike this ELR proposal, the state programs may be serving to create a new class of sub-minimum wage employees who are replacing regular public employees.

The ELR proposal also has characteristics similar to the current Federal unemployment compensation policy. There are, however, significant differences as unemployment is 1) compensation is payment for not working, 2) temporary, 3) does not cover everyone, and, 4) is less than the proposed ELR wage.

In addition to zero unemployment, it will be shown that this ELR policy establishes price stability not entirely unlike many proposed income policies have been designed to do. However, an ELR program would, nonetheless, face stiff opposition as it allows the federal budget deficit to float, with a high probability of permanent and growing deficits. For example, using rough estimates, if the government employed 8 million new public servants at, say, $12,500 per year, that would be a new expense of $100 billion. Subtract from this some portion of approximately $50 billion currently spent on unemployment compensation, $15 billion spent on AFDC, and over $20 billion spent on food stamps that may be reduced, and the net may be an additional $50 billion of annual deficit spending. Therefore, this study will first focus on why the fear of deficits per se is unwarranted.

Taxing, Spending, and Borrowing with a Non-Convertible Currency

The U.S. dollar is not legally convertible into anything by the government on demand. It is, however, designated by the government as the only means of discharging federal tax liabilities. Tax liabilities are an ongoing debt the private sector owes the government, and they create a continuous need for dollars. The private sector obtains the needed dollars primarily as payment for the transfer of real goods and services to the government, and it is government spending or lending that provides the dollars needed to pay taxes. For purposes of this analysis, government spending includes spending by the government or any of its agents. For example, when the central bank buys foreign currency, it is the same, for cash flow analysis, as the treasury buying military equipment. This is commonly referred to as viewing the treasury and central bank on a consolidated basis.

The imperative of taxation is to create sellers of real goods and services willing to exchange them for the unit of account selected by the government. Dollar denominated tax liabilities function to create sellers of real goods and services who must have dollars to extinguish their tax liabilities. Raising revenue, per se, is of no consequence to the government, as dollars are not a limited government resource, but a liability, or tax credit, that can be issued at will. The government’s ability to raise revenue does not limit what it is able to purchase. The purchasing power of the government is limited only by what is offered for sale in exchange for dollars.

Adam Smith (page 312, Cannan Edition) recognized this Chartalist view:

“A prince, who should enact that a certain proportion of his taxes should be paid in a paper money of a certain kind, might thereby give a certain value to this paper money; even though the term of its final discharge and redemption should depend altogether upon the will of the prince.”

Cannan’s summary of this paragraph reads:

“A requirement that certain taxes should be paid in particular paper money might give that paper a certain value even if it was irredeemable.”

This was also well understood by British colonial governors:

“In those parts of Africa where land was still in African hands, colonial governments forced Africans to produce cash-crops no matter how low the prices were. The favorite technique was taxation. Money taxes were introduced on numerous items: cattle, land, houses, and the people themselves. Money to pay taxes was got by growing cash crops or working on European farms or in their mines.” (Rodney, 1972, page 165, original emphasis)

In his Treatise on Money, volume 1, page 4, John Maynard Keynes wrote “…and in addition the State claims the right what thing corresponds to that which discharges obligations.”

There is little evidence that this once common understanding of non-convertible money has survived the era of convertible commodity money.

Treasury Securities and Interest Rate Maintenance

In the commercial banking system loans create deposits as an accounting entry. Commercial bank reserve accounts at the Fed can be thought of as non-interest bearing checking accounts at the Fed, and reserve requirements can be thought of as minimum balance requirements. Reserve balances are assets of the member bank, and bank liabilities are assets of the Fed.

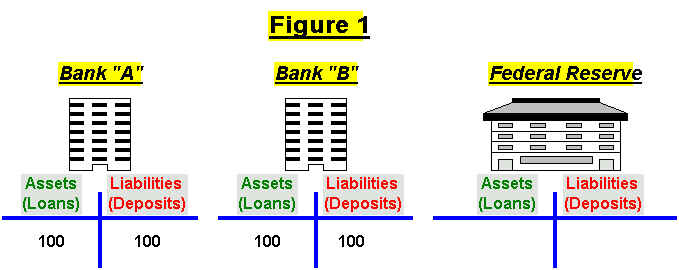

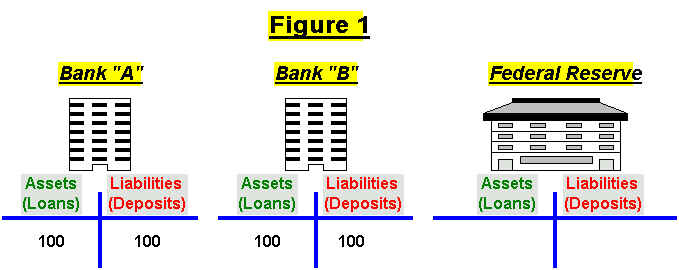

The consolidated ledger for the entire banking system is always in balance, with the exception of a few operating factors, such as checks in the process of clearing. When any bank transfers money to another bank, the first bank’s deposits are reduced and the second bank’s deposits are increased. Total deposits in the commercial banking system remain unchanged:

Bank A and Bank B are in balance. They have each originated 100 in loans and credited the proceeds to the borrower’s checking account.

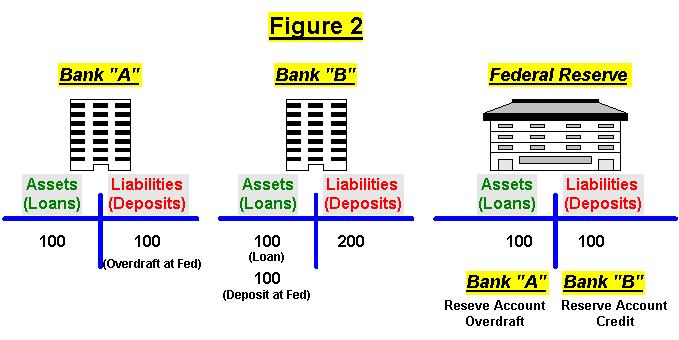

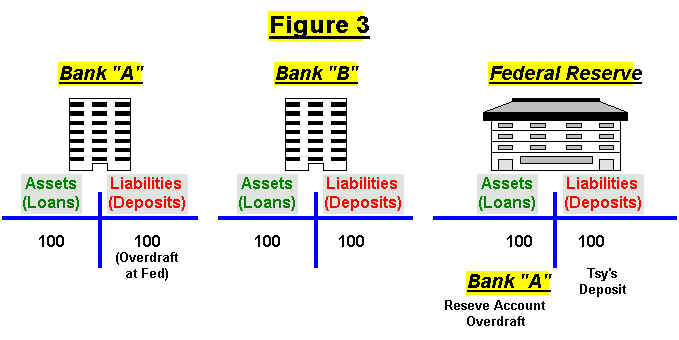

Bank A has lost its deposit to Bank B. The banking system in aggregate is still in balance, though Bank A’s reserve account at the Fed is overdrawn by 100 and Bank B’s reserve account has a positive balance of 100. In this case, Bank A can borrow from Bank B. It is possible to restore balance without intervention by the Fed.

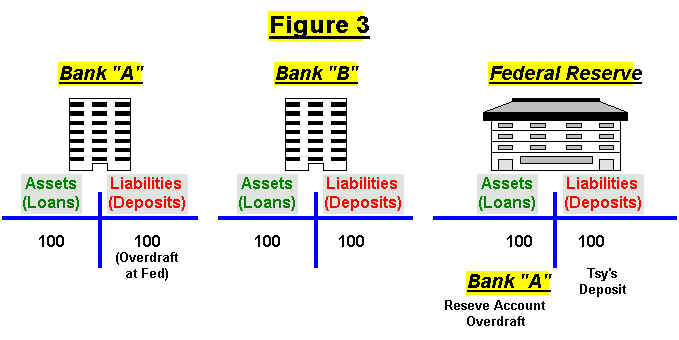

If, however, commercial bank A’s depositor writes a check to the U.S. Treasury payment of taxes, the Fed debits the reserve account of Bank A and credits the Treasury’s account at the Fed. Total bank deposits in the commercial banking system are reduced while total loans remain unchanged:

Bank A and Bank B are in balance. They have each originated 100 in loans and credited the proceeds to the borrower’s checking account.

Bank A’s depositor has made a payment to the Treasury’s account at the Federal Reserve. The Fed debits the reserve account of Bank A, and credits the Treasury’s account at the Fed. The banking system now has an overdraft at the Fed, known as a reserve deficiency, of 100. In this case, Bank A’s reserve account is overdrawn. If Bank A borrows from Bank B, the deficiency moves to Bank B and Bank B’s reserve account is overdrawn. If either bank originates a new loan and creates a new deposit, assets and liabilities will increase equally, leaving the size of the deficiency unchanged. Nor will repayment of existing loans modify the deficiency.

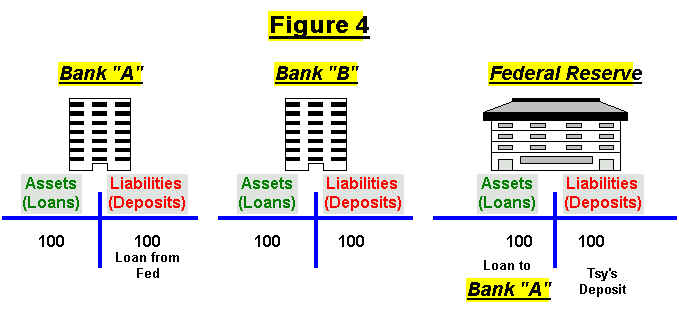

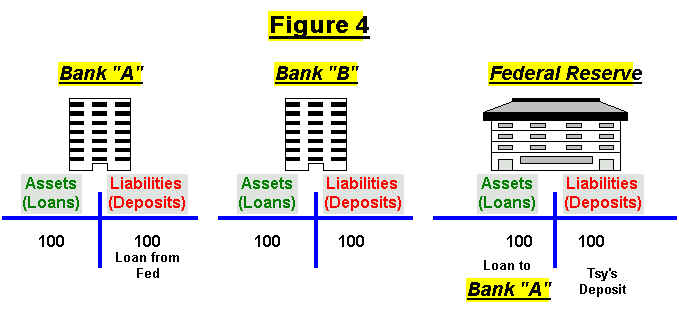

For all practical purposes, a system wide deficiency in the commercial banking system can only be alleviated by a transfer of funds from the Fed to the reserve account of a member commercial bank. When the Fed credits a member bank’s reserve account and debits its own account, total reserves in the commercial banking system are increased. In this simple case, if the Federal Reserve loans 100 back to Bank A, the banking system regains balance. Beginning with the deficiency condition:

The Fed replaces an overdraft with a loan:

Even if Bank A did not cover the deficiency, the Fed will book the overdraft as a loan and charge an appropriate penalty. In that way, a deficiency is always covered by a loan from the Fed. The variable is the rate, and possibly the collateral demanded by the Fed to secure the mandatory loan.

Should government spending exceed tax receipts, there is a budget deficit as defined for accounting purposes. Government spending is generally done via a credit to a commercial bank’s reserve account at the Fed, and an offsetting debit of the Treasury’s account at the Fed. The credit to the member bank’s reserve account is all that affects the private sector, as any offsetting transactions between the Fed and the Treasury’s account at the Fed are entirely outside the commercial banking system, and are offsetting entries on the government’s consolidated balance sheet of the Treasury and the Fed.

Let us assume the commercial banking system is in balance with all banks satisfied with their current reserve balances as in figure 4:

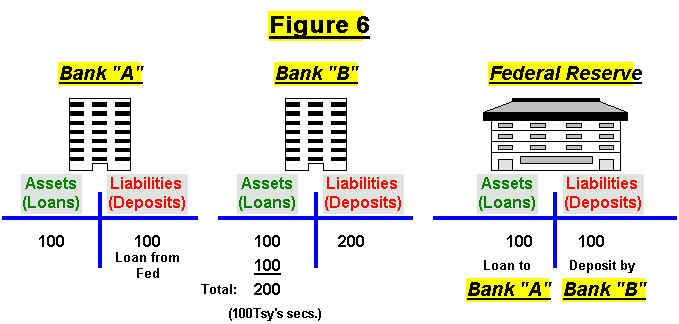

A 100 payment from the Treasury to Bank B’s customer is facilitated by the Fed debiting the Treasury’s Fed account and crediting Bank B’s reserve account:

Assuming for simplicity there are no reserve requirements, this creates an imbalance in the commercial banking system known as a system wide reserve excess. Since reserve accounts are not interest bearing, a bank with a reserve excess will attempt to loan those funds to another bank. With no other banks in deficit at the Fed, the overnight rate, known as the fed funds rate, would fall to 0 bid. Banks would be unwilling to pay interest to attract overnight deposits that don’t earn interest.

Excess reserves do have value if they can be utilized to repay loans from the Fed, to purchase new Treasury securities from the Treasury, or to purchasing existing Treasury securities from the Fed’s current portfolio. All of these constitute the transfer of funds to the Fed. Only a transfer of funds from the commercial banking system to the Fed can diminish a reserve excess.

Purchases and sales of securities by the Fed are called open market operations. The normal operating procedure is for the Fed to offset factors that cause reserve imbalances, called operating factors, with open market operations. Operating factors include any transfers between commercial banks and the Fed, and other items that effect reserve balance including changes in uncleared checks, known as “float”, and changes in cash in circulation.

The sale of newly issued government securities by Treasury affects the private sector in exactly the same way as the sale of securities by the Fed from its portfolio of existing government securities. In either case, funds held by the private sector are transferred to the Fed, the government securities are credited to a member bank’s account, and a reserve drain equal to the proceeds of the securities sale results.

Beginning with a reserve excess of 100:

The Fed sells 100 Treasury securities to Bank B:

Now, Bank B is willing to pay interest to keep its deposits as it has 100 of interest bearing loans and 100 of interest bearing Treasury securities to fund.

A system wide reserve excess or shortage can only be offset by transfers of funds to and from the Fed. If the government wishes to maintain an interest rate between “0 bid”, the condition coincident with a reserve excess, and “no offers”, the result of a reserve deficiency, it must offset operating factors that cause these conditions. Some form of interest bearing deposits, such as Treasury securities, must be offered in the case of a reserve excess. Funds are loaned, either directly (including overdrafts) or via open market purchases of securities, in the case of a reserve deficiency.

The Fed requires member banks to maintain minimum reserve balances known as required reserves. These do not pay interest, and therefore reserve requirements constitute a bank tax equal to the rate of interest banks must pay the Fed to borrow the required reserves, or, from another point of view, the interest foregone by leaving money in non-interest bearing reserve accounts. Currently the Fed enforces certain minimum reserve requirements. A reserve excess or deficiency is defined as the banks having either an excess of reserves above the required level or a reserve total that is below the required level.

Technically, the concept of the Fed being the only source of net reserves follows directly from a lag reserve accounting system wherein reserve requirements are based on deposits from a previous time period. Since reserve requirements are determined by a deposit count from a previous time period, and reserve accounts do not pay interest, demand for reserves is inelastic. Increasing or decreasing loans, and thereby deposits, for example, does change future reserve requirements, but cannot alleviate a current imbalance.

Even with a lead system, as the U.S. had in the 1960’s, practical considerations of short term inelasticities of bank loan portfolios result in the same Fed policy of acting only defensively in the money markets (Basil Moore, Horizontalists and Verticalists, 1988). In other words, the Fed can only react to imbalances by offsetting them. The Fed does not have the option to act proactively to add or drain reserves to directly alter the monetary base unless it is prepared to accept either a 0 bid interest rate, or an interest rate coincident with a reserve deficiency at one or more member banks. However, as a reserve deficiency is automatically booked as a loan, the Fed’s only real option is to set the price its loan of needed reserves to the commercial banking system. This is the basis of the concept of endogenous money, the major theme of Post Keynesian monetary thought. (Pkmt survey, Cottrell, pkt archives)

Treasury securities, therefore, function not to fund expenditures, but to provide an interest bearing deposit for non-interest bearing excess reserve deposits. The sale of Treasury securities supports the overnight interest rate determined exogenously by the Fed. Deficit spending without security sales from the Treasury or the Fed would create a reserve excess and result in a “0 bid” for overnight deposits. The economic difference between the government issuing securities and not issuing securities is the economic difference between a ‘0 bid” short term interest rate and some positive short-term rate of interest. Consequently, the offering of government debt to the private sector coincident with deficit spending is a necessary condition for the government to maintain a positive overnight interest rate.

The same logic applies to the physical printing of money. If currency is printed and spent by the government in excess of the private sector’s desire to hold cash, the holders of this excess cash will be unable to find any interest paying depositories for their cash if the government does not sell securities or offer other interest bearing deposits. A “0 bid” short-term interest rate would prevail.

Without the understanding that the dollars used to purchase government securities would otherwise reside overnight in non-interest bearing reserve accounts, fears such as ‘roll over risk’ (problems relating to possibility of the government issuing new bonds to replace maturing bonds, and not finding any borrowers) and financial ‘crowding out’ (the notion that sales of government bonds use up money that would have been available for other borrowers) can surface and block fiscal policy options that include increased deficit spending.

Exogenous Pricing: A Basic Case of Monopoly

The current monetary system is a classic monopoly with the traditional analysis of monopoly sufficient to describe all aspects. The government is the monopoly issuer of the dollars needed by the private sector to pay taxes. Spending by the Treasury and spending by the Fed when it performs offsetting open market operations, as well as direct lending by the Fed supply the private sector with the needed dollars. In all cases, the private sector exchanges assets, goods, or services to the govt., the monopoly supplier, in exchange for dollars ultimately needed for payment of taxes.

The government has the same pricing options with its money of any monopoly supplier of an absolute necessity. An analogy can be drawn, for example, with an electric utility monopoly although taxes give the currency monopolist a tool to regulate demand that the electric utility monopolist does not have.

How does the monopolist price his product? There are two options:

- Set price, p, and let quantity, q, float, or

- Set q and let p float.

The first option is generally preferred, with a gold standard or the proposed ELR program two examples of using the first option.

However, the government is currently employing the second option. It sets a budget that determines q (spending), and lets the market determine p (price level) as all purchases are made at market prices. If the monopolist decides to set q, and let the market decide p, it must constrain q so that demand exceeds q, or, for all practical purposes, the price of its product will fall towards 0. Government constraint of q to control p means using continuous unemployment and excess capacity to maintain price stability. Surely this would never be considered a viable option in running an electric utility monopoly, for example.

A gold standard uses the monopolist’s alternative of setting p, in this case the price of gold, and letting q, the quantity of government spending and lending, float. Taxes create demand for the currency. The government sets a price at which it will buy and sell gold, and makes all other purchases at market prices. It is then fiscally and monetarily constrained to a policy that spends little enough on non-gold items, and adjusts interest rates, to maintain a desired buffer stock of gold. The government must limit its non-gold spending to less than the demand for the currency created by taxation, so the excess demand for the currency is evidenced by gold sales to the government. Excessive non-gold spending results in gold sales to the private sector. As long as the buffer stock and legal convertibility are in place, the price of gold set by the government is the currency’s value. All other prices float at market levels and reflect nominal value relative to the set price of gold.

Microeconomic theory details the logic, which concludes that a monopolist, controlling an absolute necessity, sets price, one way or another. The ELR proposal uses the option of setting one price, the ELR wage, paying market prices for other purchases, and letting the total quantity of government spending be market determined.

With a gold standard, gold can always be considered fully employed as gold can always be sold to the government at the fixed price. Likewise, with an ELR policy, labor can always find a buyer.

The Paradigm Constraint

In no case must the government fund itself in dollars. Spending is limited by what is offered for sale, not by revenues. Taxes function to create a need for dollars, so the government can use dollars to purchase real goods and services. Borrowing functions to allow excess dollars created by deficit spending to earn a positive rate of interest. Deficits pose no funding risk since borrowing need take place only after spending, and only to support and maintain a desired interest rate. Interest rates and prices are subject to exogenous control by the issuer of the currency.

There is no evidence that government understands this paradigm. Government budgeting assumes the paradigm that dollars must be raised through taxing or borrowing to fund expenditures at market prices. The monopolist (the government) has decided to let market forces price its product (dollars). Therefore it must constrain the quantity of spending to maintain sufficient unemployment and excess capacity to prevent a decline in the value of its product (inflation).

Unemployment

Unemployment is defined as idle labor offered for sale with no buyers at that price. It will occur when the private sector, in aggregate, desires to work and earn the monetary unit of account, but doesn’t desire to spend all it would earn if fully employed.

Post-Keynesian monetary theory reveals the essence of involuntary unemployment. Its term ‘radical endogeneity’ asserts all deposits are the accounting records of loans, and deposit money exists only in conjunction with outstanding bank loans. If, therefore, in the private sector one agent wishes to increase his holdings of net financial assets, H(nfa), this desire can only be satisfied by the reduction of another agent’s holdings of H(nfa). An agent’s net financial assets are reduced whenever either the agent increases its outstanding debt, or reduces its stock of financial assets. Net financial assets are increased by paying down debt or by increasing the current stock. In the absence of financial intervention by the government, if one agent desires employment in order to increase his holdings of financial assets, another must decide to reduce his net financial assets for a transaction to take place. If no agent is willing to reduce his net financial assets, the desired sale of labor does not occur. This is defined as involuntary unemployment.

The national accounting double entry bookkeeping system is always in balance. Entries on one side of the ledger must be accounted for with offsetting entries on the other. Investment, for example, is accounted for as savings in national income accounting, so, by definition, total investment will always equal total savings. Government deficit spending is classified as government dissaving, and the offsetting accounting entry is an increase in net private sector nominal savings. Thus, whenever the government engages in deficit spending, aggregate private sector H(nfa) is increased, with H(nfa) including offshore holdings of dollar denominated assets. Furthermore, the level of government deficit spending determines private sector H(nfa). Should the private sector desire to increase its H(nfa), this desire can be satisfied only by an increase in government deficit spending.

Unemployment can therefore be summarized as follows:

Involuntary unemployment is evidence that the desired H(nfa) of the private sector exceeds the actual H(nfa) allowed by government fiscal policy.

To be blunt, involuntary unemployment exists because the federal budget deficit is too small.

Furthermore, if an agent wants to sell any real goods, and thereby increase his H(nfa), this too can only be accommodated by another agent decreasing his H(nfa). If the desired H(nfa) is greater than the actual H(nfa), the evidence is involuntary inventory accumulation and a contractionary bias.

H(nfa), Aggregate Demand, and Aggregate Supply

The understanding that unemployment is evidence of the government deficit being too small is consistent with the standard concept of aggregate supply and demand. Aggregate demand is the sum of all expenditures, and aggregate supply is the sum of all goods and services offered for sale. It can then be stated that if the private sector wanted to use some of its full employment income obtained by selling real goods and services to be held as H(nfa), the evidence is some combination of involuntary inventory accumulation and involuntary unemployment. Involuntary unemployment is thus traced to a desired H(nfa) that exceeds actual H(nfa).

The aggregate supply and demand approach allows changes of desired H(nfa) to be expressed either as a change in aggregate demand or a change in aggregate supply. The H(nfa) approach focuses only on the control variable-desired H(nfa)- regardless of whether it is aggregate supply or aggregate demand that is excessive or deficient. In fact, it may always be impossible to distinguish a shortfall in aggregate demand from an excess aggregate supply, rendering the distinction unnecessary.

The $12,500 Price Constrained Incomes Policy

The proposed ELR policy and its version of full employment and price stability are a logical extension of the correct paradigm of a tax driven currency. Since the private sector needs the government’s spending to pay taxes, government constraint of the size of the ELR wage, rather than constraint of the quantity of dollars it spends, results in a form of price stability. H(nfa) can be determined directly by the private sector as it decides the total quantity of ELR labor it sells to the public sector. The government sets the ELR wage and lets the market allocate all other resources accordingly. This is the same process that determines relative value under a gold standard. Under the ELR proposal, the government adjusts fiscal and monetary policy to maintain the ELR pool much the same way that a government adjusts fiscal and monetary policy to maintain a buffer stock of gold with a gold standard.

Price stability under an ELR policy is similar to that under an incomes policy. With an incomes policy, however, a budget is still targeted, so it is unlikely that actual H(nfa) will match desired H(nfa). Too small a deficit will result in unemployment. Too large a deficit will be inflationary and 1) reduce the relative standard of living of those subject to the incomes policy, 2) introduce incentives for violating the wage and productivity laws, and 3) in general, create an emotionally charged social debate that results in a series of politically determined solutions.

The ELR proposal establishes a minimum wage standard, as the government is willing to employ anyone at the ELR wage. It also provides a brake on private sector wage increases that are not related to productivity increases, as employers have a pool of government ELR workers from which they can draw. Also, employees recognize that ELR workers may replace them, though the cost to the employer will depend on the qualifications and training necessary to perform the task the employer desires. In this way, a nominal wage scale emerges. The value of the currency is the ELR wage, since that is what the government, the monopoly supplier of its money, has decided it will pay. Other wages are subject to market forces.

The initial ELR wage can be set at any level as market forces will align all other wages and prices. To minimize disruption, an initial ELR wage should be one that is not so high as to draw workers away from the private sector, and not so low as to require a general deflation to bring actual H(nfa) in line with desired H(nfa). For example, if the ELR wage were set high enough to attract workers from the private sector, a one-time adjustment would take place. Net government spending would rise as the ELR workers were added to the government payroll. Private sector output would decline as workers left their jobs, and private sector income would rise from the higher paying ELR jobs. Businesses would then have to pay more, both to replace lost workers and to retain their other workers. Prices would rise as both costs and incomes were being pushed up. The converse holds if the ELR wage is set too low. This would be evidenced by a slowdown in sales as private sector income was insufficient to realize a desired H(nfa) and purchase the output of business. Increasing inventories would lead to layoffs and downward pressure on the price of labor. Eventually, more workers would find their way to ELR jobs and government spending would rise. At some point prices would stabilize in line with the ELR wage. $12,500 per year was selected as the ELR wage for this proposal. This is a bit higher than the current minimum wage and might result in a small one time upward adjustment in the price level. My bias was to err slightly on the high side, rather than risk an initial deflation.

Under the ELR program, changes in desired H(nfa) result in, and are evidenced by, equal changes in actual H(nfa). For example, if the private sector desire for H(nfa) increases, involuntary unemployment that would occur in the absence of an ELR policy will, instead, result in additional labor being sold to the government for $12,500 per year. This increases government spending and the deficit, allowing actual H(nfa) to increase to the level desired by the private sector. In other words, if the deficit increases by $50 billion, that number, by definition, matches the private sector’s desire to net save financial assets. The currency, meanwhile, remains defined by the labor that can be purchased for $12,500. Furthermore, not providing the desired H(nfa), and letting unemployment remain at current levels, would define a deflationary and contractionary bias.

Conversely, if desired H(nfa) decreases, perhaps due to increased non-ELR government spending or behavioral changes in the private sector, an opposite bias is introduced. The government will begin to lose its $12,500 workers to higher paying jobs in the private sector. This reduces government spending. It could also increase tax liabilities, further reducing net spending. H(nfa) is thereby reduced, until it matches the H(nfa) desired by the private sector. If fiscal policy is such that all of the $12,500 government workers are hired by the private sector, then the market price of ELR labor has risen beyond $12,500, and the currency has been redefined downward accordingly. It is the equivalent of the government losing its buffer stock of gold under a gold standard. Additionally, unlike gold, non-homogeneous labor means that as the pool of ELR workers shrinks, the remaining ELR workers would be increasingly less valuable to the private sector, and the currency may begin to get redefined downward at an increasing rate. Indeed, if the remaining ELR workers have no value to the private sector, continued shrinkage of the ELR pool may be impossible, and government spending increases or tax cuts designed to reduce the size of the ELR pool might result only in a devaluation of the currency. To regain control of prices, the government could act to offset the reduced desired private sector H(nfa) directly and restore the ELR pool to a desired level by cutting spending or raising taxes. It could also attempt to indirectly raise desired H(nfa), by changing interest rates; introducing tax advantaged savings plans, etc. Such efforts would be designed to trigger a deflationary private sector slowdown that would result in a reduced demand for private sector workers above the $12,500 ELR wage, and workers finding their way back to the $12,500 ELR payroll. If this were deemed too disruptive, the same fiscal constraint could be matched with an increase of the ELR wage, say, to $15,000 per year. This would redefine the currency downward to that level- presumably the perceived market level that wages had gone to at that time. Prices would stabilize around the new benchmark as desired H(nfa) and actual H(nfa) correspond to a desired buffer stock of $15,000 ELR workers. The question of the appropriate size of this pool of workers would be somewhat analogous to the current debate over the current natural rate of unemployment.

The ELR can be considered a labor standard policy that continuously defines the value of a dollar by the quality of ELR labor that can be hired at a given price. Since labor is not homogeneous, the value of the dollar will, by definition, fluctuate with the quality of the labor that $12,500 purchases. This carries an implied cyclical tendency towards increasing money value during periods of private sector increases in desired H(nfa), and vice versa. For example, layoffs in the private sector would result in additional $12,500 government workers of higher quality than the existing pool. This would enhance the investment environment for foreigners as well as domestics, as better workers could be hired for the same nominal wage. Also, any increase in the attractiveness of the ELR pool, such as a higher level of education, would both increase the purchasing power of the currency and increase the value of the currency in the foreign exchange markets. A well thought out ELR plan would include a well-organized program to educate, upgrade skills, and make productive use of ELR workers.

This type of fluctuation of the quality of the labor available for $12,500 technically constitutes price instability, as the currency is being constantly redefined at the margin by the quality of the best worker in the pool. This does not, however, necessarily represent an increase in price volatility of goods and services over the current system which uses a pool of unemployed, i.e., the concept of a natural rate of unemployment, to stabilize prices. Nor does it imply that the resulting price instability due, for example, to an increase in the general level of education, is undesirable.

Defining the dollar by the ELR labor that can be purchased at the margin does not mean all prices will be constant forever. To the contrary, all other prices, including asset prices, will be constantly changing as the market allocates via price. Only one price, the ELR wage, has been used to define the currency. All other prices result as the forces of supply and demand settle on nominal prices that reflect a value relative to the ELR wage and continuous full employment.

Most proposed incomes policies extend government regulation into the private sector, requiring, for example, documentation that wage increases not exceed productivity increases. The proposed ELR program, however, recognizes that it is only necessary to constrain the prices the government, itself, pays. By allowing the private sector to realize desired H(nfa) through the market process, market forces will link wages to productivity. For example, an available-for-hire pool of ELR workers means private sector employers will not be forced by shortages of unskilled labor to increase wages. More productive employees will be able to command a higher wage, though general productivity increases by business will not result in higher wages if a given job can be performed equally well by a $12,500 ELR worker.

This program does not necessarily defeat the real business or inventory cycle. It does use the proposed $12,500 public service job to absorb fluctuations of private sector employment, allowing the private sector to achieve its desired H(nfa) on a continuous basis. This neutralizes any monetary system bias implied currently by a government policy that does not allow actual H(nfa) to match desired H(nfa).

ELR V.S. Unemployment Compensation

The value of a currency is determined by what the government demands the private sector must do or sell to obtain it. Unemployment compensation is payment for not working. If everyone could simply stay home and collect a government check, not be stigmatized, and thereby obtain all currency necessary to pay all taxes due, the currency would have no value. Therefore, under current policy unemployment compensation must be limited, temporary, and an insufficient source of revenue for the private sector to meet its tax obligations and desired H(nfa).

The ELR program, on the other hand, requires the employee, at a minimum, to sell his time. The ELR program therefore need not be limited, as the currency will maintain its value regardless of the quantity of ELR spending. The value of the currency will equal the effort necessary to earn the ELR wage.

Past Attempts at Government Sponsored Full Employment

With a private sector desire for H(nfa), and a government that fails to run a deficit large enough to accommodate that desire, the corresponding unemployment can be severe. It may eventually be reduced by a reduction in desired H(nfa) because of lower interest rates, or, as some contend, by falling wages. However, the time necessary to test this hypothesis is usually beyond human tolerance, and the pragmatic view of government employment arises.

For example, from 1931 to 1941 unemployment averaged well over 10% – the definition of a depression. It hit a high of 24.9% in 1933, and was still 14.6% as late as 1940. GNP reached a high of $203.6 (billions of 1958 dollars) in 1929; fell to a low of $141.5 in 1933, and by 1939, had crept up only to $209.4. Low interest rates were not enough to decrease desired H(nfa). Short term Treasury securities reached a high of just over 5% in May of 1929, were cut to the mid 3% range in November 1929 following the stock market crash, and were as low as about 0.5% by September 1931. Rates were increased to about 2.5% until May of 1932, and then remained well under 1% until 1948. Continuous low interest rates also did not seem to result in run-away asset prices. The Dow equity index price did not recover to its 1929 highs until 1958, the 1927 highs were not reached until 1946, and the low of 1930 was not surpassed until 1936.

In 1933, after several years of undesirable unemployment and depressed GNP, the Public Works Administration, the first public works program, was enacted. It was followed by the WPA in 1935. It is noteworthy that these programs did not come about until after several years of troubling unemployment, and fell short of solving the unemployment crisis and ending the depression. Work relief never reached more than 40% of the unemployed, and only 3 million of the 9 million unemployed participated in the WPA. The reason these programs were constrained was the reluctance to engage in government deficit spending. During the 1930’s, in spite of the high unemployment and depressed growth, budget balancing was never far from the forefront of political purpose. Belief in a balanced budget prevented government relief programs from ending the depression, and when Roosevelt honored his 1936 campaign pledge to balance the budget in 1937, the economy suffered a major setback with unemployment jumping back to 19.1% from a seven year low of 14.3%. Public works programs that were ‘paid for’ by other spending cuts or by tax increases could not reduce unemployment as there was never enough net government spending to accommodate desired H(nfa). The largest deficit of the 1930’s was 5.9% of GNP in 1934, and it was down to 0.1% of GNP by 1938. The U.S. was on a gold standard, and policy had to include managing the national gold supply. This led to various extremes such as suspending domestic convertibility in 1934, and making it illegal for domestics to own gold, as well as strong support for balancing the federal budget.

During WWII, a radically different approach was initiated. Government spending exceeded tax collections in 1942, 1943,1944, and 1945 by 14.5%, 31.1%, 23.6%, and 22.4% of GNP respectively. Unemployment was under 2% by 1943, and output increased from $209.4 (billions of 1958 dollars) to $337.1 by 1943. Prices were fixed, and government planning agents from the Office of Price Administration enacted rationing. Great effort was taken to ensure that rationing was perceived as equitable ensuring public support for the program. Patriotism kept Americans from black markets that may have otherwise drained resources needed for the war effort, and patriotism also became associated with nominal savings. The idea was to get desired H(nfa) up to the level of deficit spending in a low interest rate environment. In other words, hoarding of dollar denominated financial assets via government bond purchases was encouraged, allowing the government to purchase up to 60% of the real output without price competition from consumers. The desire of the American public to earn money and not spend it, which caused the unemployment of the previous decade, now dovetailed well with the public sector demands for war production, and unemployment was, for all practical purposes, eliminated.

Foreign Trade

Transactions of real goods and services between those within the geographical confines of the U.S. and anyone outside the U.S. are generally defined as foreign trade. Exports are real goods and services leaving the country, and imports are real goods and services entering the country. By standard definition, exports are a real cost, and imports are a real benefit. Exports can be considered the cost of imports. Financial transactions are accounting information, and not considered as imports or exports.

The chronic U.S. trade deficit, for example, means the dollar price of imports continually exceeds the dollar price of exports. This puts increasing numbers of dollars in the hands of non-U.S. residents who have decided to hold dollar denominated financial assets rather than use their dollars to buy U.S. goods. This is an identity, for, if they did buy U.S. goods, there would not be a trade deficit. As holders of dollar denominated financial assets, they are net nominal savers, much like any domestic holder of dollar denominated financial assets. For purposes of this analysis, foreign dollar denominated financial holdings are considered part of H(nfa).

Currently, most of the world allows currencies to trade freely. Occasionally the major central banks will intervene in the foreign exchange markets, and buy or sell one currency versus another for a variety of reasons and motivations. However, most central banks are not legally bound to guarantee convertibility of their home currency to another currency at predetermined rates. Exceptions include a few currency board systems as Argentina and Hong Kong. Should a foreign holder of dollar denominated financial assets desire to switch to another currency, he must find, in the market place, another agent who wishes to be his counter party. If a transaction does occur, the dollar denominated financial assets will change hands but not increase or diminish. The exchange rate will likely fluctuate, but the quantity of dollar denominated financial assets remains unchanged. Dollar H(nfa) is not changed by foreign exchange transactions that do not involve the Federal Reserve acting for its own account.

The desired H(nfa) of the foreign sector is a factor since it is part of the total desired H(nfa). A declining dollar in the foreign exchange markets becomes indicative, again by definition, of decreasing desired H(nfa) of the foreign sector agents, and vice versa. The number of $12,500 public service employees under the ELR employment proposal will fluctuate with changes in the desired H(nfa) of the foreign sector as well as the domestic sector. It is total desired H(nfa) that controls the number of these public service workers. Increased government deficits that arise when the pool of $12,500 ELR workers increases always match the desired H(nfa) of the entire non-government sector. The dollar remains defined by the available workers, so changes in the value of the dollar in the foreign exchange markets must be a function of the quality of the ELR labor available for $12,500 and the changing value of the other currency.

This understanding allows policy makers the option of taking advantage of the benefits of being a net importer. For example, an increase in net imports that results in the loss of private domestic employment will immediately result in an increase in the number of government $12,500 workers. This increases government spending (and the budget deficit) which may result in other industries hiring workers away from the government. If the pool of $12,500 ELR workers is deemed by the electorate to be too large, taxes can be cut or public spending increased until the number drops to the desired level. The public would associate higher trade deficits with an increasing standard of living, lower taxes, and other such benefits.

A fixed exchange rate would present problems similar the gold standard since the gold standard is, for all practical purposes, a fixed exchange rate system. If the Federal Reserve was committed to convert dollars to other currencies, a larger budget deficit or trade deficit could result in the rapid depletion of the Fed’s foreign currency reserves, forcing the suspension of convertibility and a return to a market system.

Interest Rates and Employment

Anyone who lives entirely on his interest income may otherwise need employment. Such rentiers have removed themselves from the labor force. To the extent that higher real rates increase the rentier population, potential output is reduced. Furthermore, those left working are, in real terms, supporting those living on interest income

The concept of scarce jobs has led to a variety of programs designed to reduce the work force to limit unemployment. These include child labor laws, education for veterans, aid for single mothers, and even social security. These programs were ultimately unsuccessful at reducing unemployment, no matter how many potential participants they eliminated, as a given percentage of unemployed became a tool to limit price and wage increases. The real result of reducing the labor force is reduced output.

Lower real interest rates will tend to keep more individuals in need of employment. Combined with a well run ELR policy, low rates should increase output dramatically with much of the increased output being investment. It may be possible, for example, to repair, rebuild, enhance and maintain the public infrastructure without a decrease in private consumption from current levels.

Conclusion

It is widely assumed that deficit spending to hire unemployed workers carries at least two risks- inflation and funding. The inflation risk comes from the failure to understand exogenous pricing. It is feared that deficit spending will cause an implied upward bias on labor costs from both the aggregate demand created by the deficit spending, and the elimination of the competition of the unemployed for available jobs. The result is an anti-inflation policy that requires excess capacity in the private sector to keep market prices from rising. This includes the need to maintain a pool of unemployed to discourage wages from rising. The second perceived risk, funding, comes from the widely held misconception that the government must be able to fund itself to carry on spending. The government is, therefore, concerned not only with how the market will receive the debt it believes it needs to sell in order to fund itself, but also concerned that there may be a market determined funding limit. Until these perceptions change, a pool of unemployed workers will be necessary to contain inflation, and deficit spending will be resisted.

The Keynesian mainstream proposes ending unemployment by increasing aggregate demand through low interest rates and increased deficit spending. To offset the inflation risk inherent in this policy many Keynesians propose various government legislated incomes policies. These require the direct government regulation of private sector wages, usually attempting to link wages with productivity. This has been rejected by the electorate, who seem to prefer the excess capacity approach to price stability.

The proposed ELR program recognizes that the government is a monopoly supplier of its currency. Price is set through the ELR wage, which defines the purchasing power of the currency. Further recognized is that deficit spending poses no financial solvency risk to the government.

The government, as employer of last resort, is not a new concept. What prevented such policies from being viable and sustainable in the past – the gold standard and other fixed exchange rate policies- are long gone. We currently have a monetary system that can accommodate both full employment and price stability on a permanent basis.

This ELR proposal is a logical extension of Keynesian and Post- Keynesian thought. Endogenous money is already deeply rooted, and the idea that an incomes policy need only be practiced by the government with its ELR wage should not pose any philosophical barriers. Nor should classical economists and their offspring be entirely against such an ELR program. If they are correct, there would eventually be an equilibrium condition with the ELR pool dwindling to 0.

Endnotes

The Author is a partner in the Investment Firm Adams, Viner and Mosler, and wishes to acknowledge the help of the following (alphabetical order):

Shannon Cox

Paul Davidson

Betty Rose Factor

Mathew Forstater

Charles Goodhart

Daniel Seymour

Pavlina Tcherneva

Frederick Thayer

L. Randall Wray