Right, this is the second time they’ve said this.

It could all simply be ‘cover’ for lowering prices.

Lots of reasons why they might lower price:

Get it way down and ‘intimidate’ investors in alternatives.

Try to spur demand.

Try to support the world economy and their support their equity holdings.

Members of the royal family and/or other insiders may have established large personal shorts in fwd crude contracts, and now lower price to transfer wealth to their own personal accounts.

Supports any other scheme they may have dreamed up on their flights back and forth to London.

It’s good to be price setter.

By Amena Bakr and Reem Shamseddine

April 17 (Reuters) — Saudi Arabia’s oil minister said on Sunday the market was oversupplied and the kingdom had reduced output, sending a the strongest signal yet that OPEC may not boost output in June to quell soaring oil prices.

Consumers have urged the exporters’ group to add supply to halt the rally in oil prices that has taken crude to its highest level in 2 1/2 years amid unrest in North Africa and the Middle East, but OPEC members say there is little they can do to bring prices down.

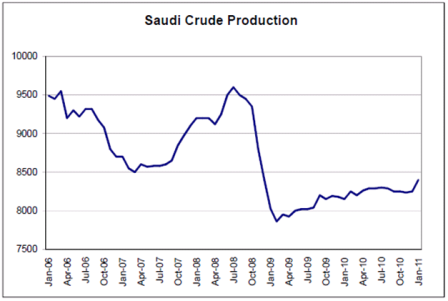

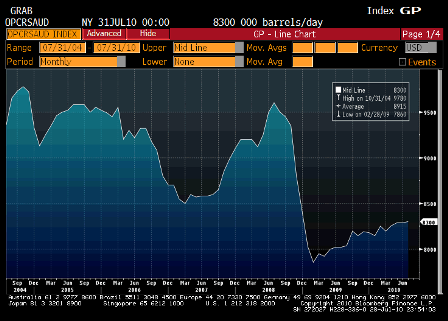

“The market is overbalanced … Our production in February was 9.125 million barrels per day (bpd), in March it was 8.292 million bpd. In April we don’t know yet, probably a little higher than March. The reason I gave you these numbers is to show you that the market is oversupplied,” Naimi told reporters.

Two Saudi-based industry sources told Reuters last week the kingdom had cut production.

Naimi’s words, echoed later on Sunday by his counterpart from the United Arab Emirates, are the clearest indications yet that the group is unconvinced there is a need for more oil despite the civil war that has slashed Libyan output and expectations Japanese oil demand will rise as it scrambles to rebuild its earthquake-shattered electricity grid.

“These statements underscore the breadth of the security premium currently in (oil) prices. Overall supplies are sufficient,” said John Kilduff of energy hedge fund Again Capital. “As we’ve seen in the past, however, a well-supplied market is not always a barrier to very high prices.”

NO COMMENT ON PRICE FROM NAIMI

Naimi declined to comment on the current price of crude.

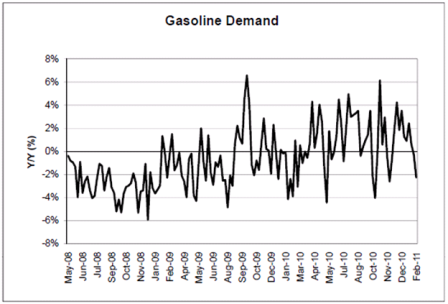

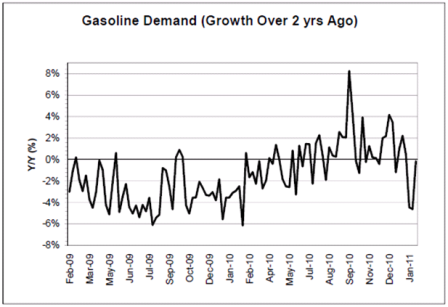

Oil prices fell early last week after Goldman Sachs warned high prices may be eroding demand, but rebounded on signs of renewed health in the U.S. economy on Friday.

Nobuo Tanaka, the head of the International Energy Agency, which represents oil importers’ interests that warned last week high prices were cutting into oil demand, stopped short of saying OPEC needed to boost output, but suggested the group be more flexible in its thinking about supply.

“The market is getting tighter and if it is tighter the price may go up, which may have a negative impact to economic growth,” Tanaka told reporters.

Unrest in North Africa and the Middle East has left Saudi Arabia and other Gulf nations nervous of political unrest. The kingdom has promised nearly $93 billion in handouts to its citizens to keep them happy, making a sharp fall in oil prices a major risk for its budget.

Saudi Arabia and some other OPEC members unilaterally boosted oil production after the March uprising against Libyan leader Muammar Gaddafi shut down the bulk of the North African OPEC member’s oil industry but weak demand for the additional production appears to have prompted the reduction in output.

Naimi said Saudi Arabia had sold 2 million barrels of a special blend of crude that tried to replicate the high quality Libyan barrels lost. Demand for the blend has been tepid, according to oil traders.