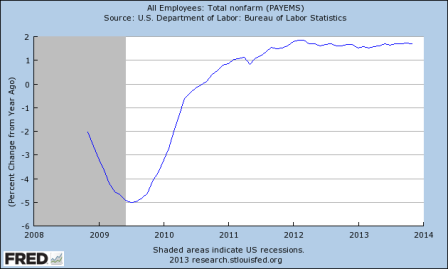

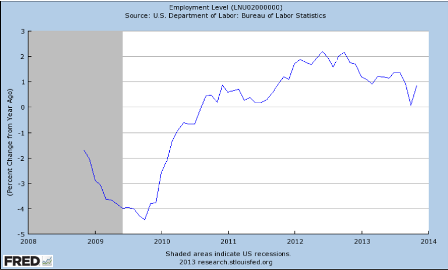

When there is a lack of aggregate demand due to high ‘savings desires’ as the unemployed take jobs when benefits expire, it just means someone else loses a job, and then some, as govt deficit spending falls as well, further reducing aggregate demand. It also serves to drive down wages, as per the latest jobs report.

By Motoko Rich

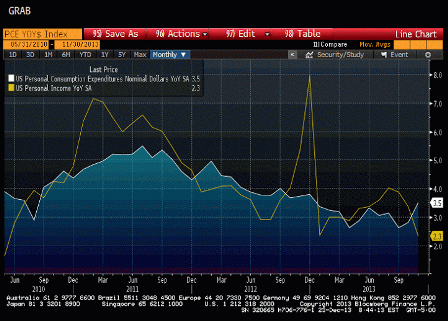

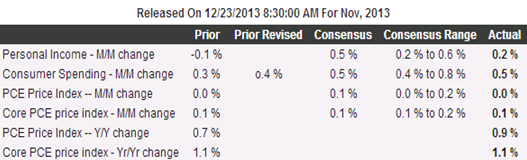

July 11 (NYT) — An extraordinary amount of personal income is coming directly from the government.

Close to $2 of every $10 that went into Americans’ wallets last year were payments like jobless benefits, food stamps, Social Security and disability, according to an analysis by Moody’s Analytics. In states hit hard by the downturn, like Arizona, Florida, Michigan and Ohio, residents derived even more of their income from the government.

By the end of this year, however, many of those dollars are going to disappear, with the expiration of extended benefits intended to help people cope with the lingering effects of the recession. Moody’s Analytics estimates $37 billion will be drained from the nation’s pocketbooks this year.

In terms of economic impact, that is slightly less than the spending cuts Congress enacted to keep the government financed through September, averting a shutdown.

Unless hiring picks up sharply to compensate, economists fear that the lost income will further crimp consumer spending and act as a drag on a recovery that is still quite fragile. Among the other supports that are slipping away are federal aid to the states, the Federal Reserve’s program to pump money into the economy and the payroll tax cut, scheduled to expire at the end of the year.

“If we don’t get more job growth and gains in wages and salaries, then consumers just aren’t going to have the firepower to spend, and the economy is going to weaken,” said Mark Zandi, chief economist of Moody’s Analytics, a macroeconomic consulting firm.

Job growth has remained elusive. There are 4.6 unemployed workers for every opening, according to the Labor Department, and Friday’s unemployment report showed that employers added an anemic 18,000 jobs in June.

In Arizona, where there are 10 job seekers for every opening, 45,000 people could lose benefits by the end of the year, according to estimates from the state Department of Economic Security. Yet employers in the state have added just 4,000 jobs over the last 12 months.

Some other states will also feel a disproportionate loss of income unless hiring revives. In Florida, where nearly 476,000 people are collecting unemployment benefits, employers have added only 11,200 jobs in the last year. In Michigan, employers have added about 40,000 jobs since May 2010, but about 267,000 people are claiming jobless benefits.

Throughout the recession and its aftermath, government benefits have helped keep money in people’s wallets and, in turn, circulating among businesses. Total government payments rose to $2.3 trillion in 2010, from $1.7 trillion in 2007, an increase of about 35 percent.

While some of that growth was in Social Security and disability benefits as the population aged, the majority resulted from payments to people continuing to suffer from the recession, said Mr. Zandi. Unemployment benefits, including emergency and extended benefits, are more than three times their prerecession level, he said. The nearly 20 percent of personal income now provided by the government is close to a record high.

Approved by Congress last December, the final extension of jobless benefits — for a maximum of 99 weeks for each unemployed person — is scheduled to conclude at the end of this year. A handful of states, like Wisconsin and Arizona, have already cut off weeks 80 through 99 for their residents. Meanwhile, more of the long-term unemployed are bumping up against the 99-week limit.

Consumers account for an estimated 60 to 70 percent of the country’s economic activity, but two years into the official recovery, businesses are still complaining that people simply are not spending enough.

“Regardless of why people have less money to spend, it affects all retailers in all industries,” said Michael Siemienas, spokesman for SuperValu, which operates grocery chains including Cub Foods, Shop ’n Save and Save-A-Lot. Mr. Siemienas said that the number of SuperValu’s customers using electronic benefit transfers to pay bills had grown over the last year.

Because benefit payments tend to be spent right away to cover basic needs like food and rent, they provide a direct boost to consumer spending. In a study for the Labor Department, Wayne Vroman, an economist at the Urban Institute, estimated that every $1 paid in jobless benefits generated as much as $2 in the economy.

For many of the nearly 7.5 million people collecting unemployment benefits, those payments are keeping them afloat. Laura Metz, 42, was laid off from a clerical job paying $15.30 an hour at a home health care provider near her home in Commerce, Mich., nearly 15 months ago. She has been collecting $362 a week in unemployment insurance and about $50 a month in food stamps.

That covers the basics. But Ms. Metz stopped making her mortgage payments last year on the modest home she shares with her 19-year-old son. A program that allowed her to make a lower monthly payment has expired, and she is waiting to see if the lender will modify her loan. She can no longer make her student loan payments for her bachelor’s degree or master’s in business administration, and she has downgraded her Internet and cable service and cut back on car trips and snacks.

Ms. Metz, who has been applying for administrative jobs, has been shocked at the dearth of opportunities. A decade ago, when she applied for clerical jobs, “as soon as I walked up, there was a sign saying ‘We’re hiring,’ but it’s not like that now,” she said. “It’s really, really difficult.”

Businesses that rely heavily on low-income shoppers worry that their customers will have little to spend. Najib Atisha, who co-owns two small grocery stores in Detroit, said people receiving government assistance made up about a third of his customers downtown and as much as 60 percent at his store on the west side of the city.

“Of course, we’re hoping that things will turn around, but it’s always easier to lose jobs than it is to gain jobs,” Mr. Atisha said. “I think it’s going to take twice as long to rebound as it took to get where we are now.”

Some business groups argue that extending unemployment benefits has had deleterious effects on employers and potential workers.

“It’s having a chilling effect on hiring,” said Wendy Block, director of health policy and human resources at the Michigan Chamber of Commerce. “At one point, our unemployment taxes were just a blip on the balance sheet, but when you’re talking over $500 a head, this is significant.” Last year, Michigan spent $6.2 billion on jobless benefits, according to the National Employment Law Center.

Some economic studies show that people who collect unemployment benefits are less likely to look for or accept work until their benefits are close to running out.

“Unemployment insurance extends the typical amount of time that people will spend off the job and not looking for work,” said Chris Edwards, an economist at the Cato Institute, a libertarian organization.

In Michigan, Ms. Metz said that if all else failed, she would have to move in with her parents, who live on a fixed income. But she is determined to find work before her benefits run out and plans to expand her search to include light industrial manufacturing. “It’s getting close to the end,” she said. “And I got to do what I got to do.”