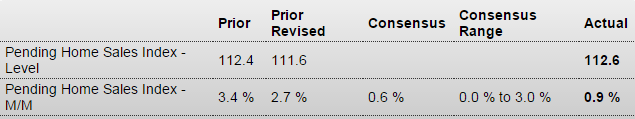

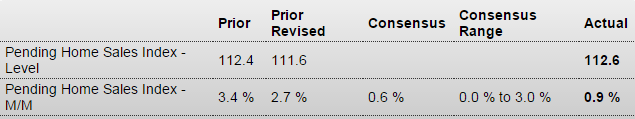

So after cheering the big jump last month to 112.4, it gets revised down to only 111.6, so the lower than expected print of 112.6 vs 113 expected is now hailed as a larger than expected increase from last month, as the shameless cheer leading continues:

United States : Pending Home Sales Index

Highlights

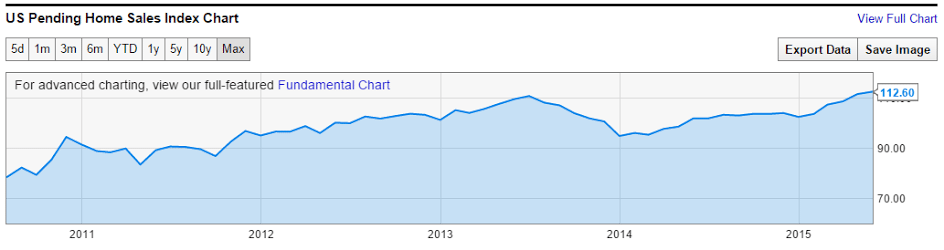

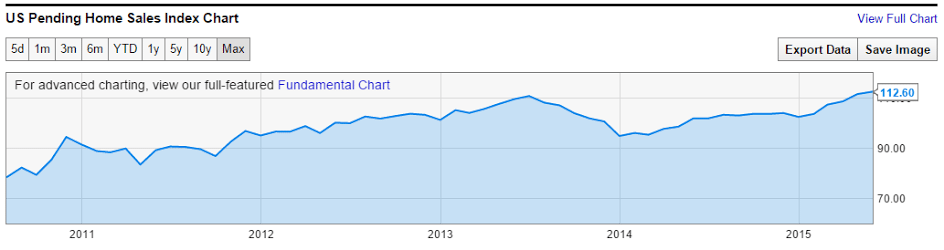

Solid momentum is building inside the housing market based on the ongoing run of very strong data including today’s pending home sales index which is up a better-than-expected 0.9 percent in the May report which tops Econoday expectations for a 0.6 percent gain. The index level, at 112.6, is as high as it’s been since the bubble days of 2006.

Sales have been very strong in the West where pending sales rose 2.2 percent in May for a 13.0 percent year-on-year gain. Pending sales in the South, up 10.6 percent year-on-year, have also been strong though the region did dip 0.8 percent in the latest month. Sales also dipped in the Midwest, down 0.6 percent for a year-on-year plus 7.8 percent, but they rose sharply in the Northeast where housing after a heavy winter is bouncing back strongly, up 6.3 percent in this report for a year-on-year again of 10.6 percent.

Today’s report points to further strength for the existing home sales report which surged in data posted last week. Housing is getting a boost from the strong jobs market together perhaps with the prospect of rising mortgage rates which may be pushing buyers into the market. Watch for Case-Shiller home price data on tomorrow’s calendar.

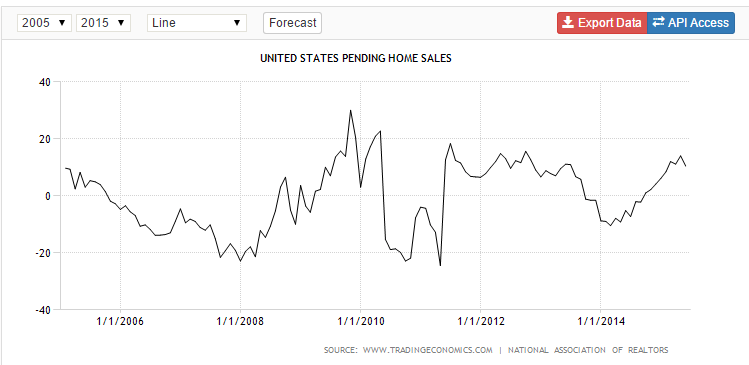

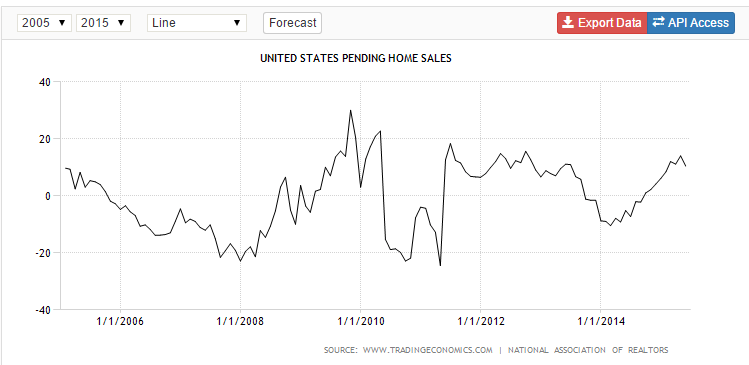

Year over year % change, as the absolute number remains depressed:

Pending home sales index- only back to previous highs of what was also a depressed market:

By Bill McBride

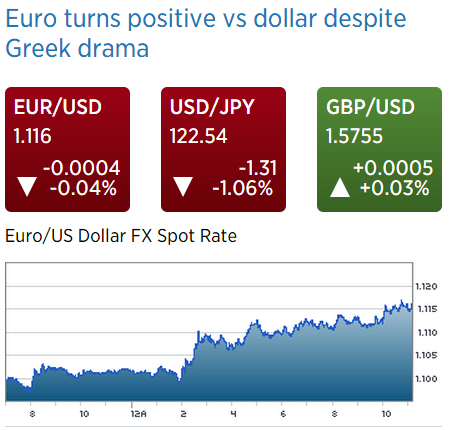

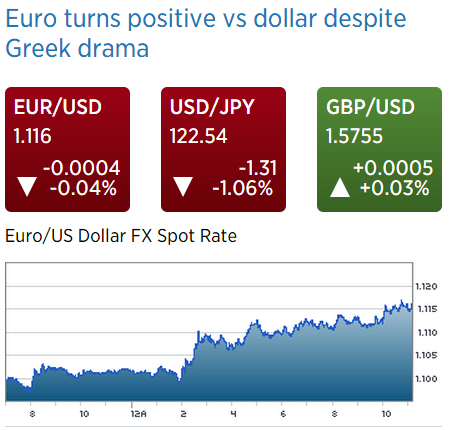

So after reading this and a few other articles it seems they think a ‘run on the banks’ somehow removes euro that could otherwise be used to pay creditors. This implies either some kind of plan to tax bank deposits to pay creditors or just the continued evidence of gross ignorance of their own monetary system. In any case seems the most likely outcome is a yes vote for the troika plan which gives the leadership the desired political cover to go ahead and sign it and move on and remain the European citizens in good standing they’ve always been…

And this would also be yet another victory for the ongoing deflationary policies, this time being spun as explicit support from the people, proving once again that populations dislike inflation even more than they dislike unemployment. This means the focused pursuit of a trade surplus is intact, and I’ve yet to see a currency with a persistent trade surplus and a weak currency:

Greece Bailout: Eurozone Ministers to Explore ‘Plan B’ (WSJ) The first step in what has commonly been referred to as “Plan B” among Greece’s creditors would likely be the introduction of capital controls to avoid a run on the country’s banks. But in comparison to Cyprus, which implemented capital controls as part of a €10 billion bailout package from the eurozone and the International Monetary Fund, the financial situation of the Greek government is much more precarious. The eurozone portion of Greece’s €245 billion rescue package runs out on Tuesday, the same day the government has to pay €1.55 billion to the IMF.

Doing the same thing over and over again and expecting different results…

China cuts reserve ratio, interest rates to bolster growth (Xinhua) The central bank cut the RRR for commercial banks serving rural areas, agriculture and small businesses by 50 basis points (bps). The RRR for finance companies, or non-bank financial institutions, will be lowered by 300 bps, the PBOC announced. Benchmark interest rates have also been cut. Interest rates for one-year lending and deposits are cut by 25 bps to 4.85 percent and 2 percent respectively. Lending of other terms and kinds will also be lowered by the same margin, the announcement said. It is the third RRR reduction in nearly five months, while the fourth round of interest cuts in nearly seven months.