The ‘demand destruction’ still leaves a net increase in demand, just smaller than anticipated.

While the US is using a tad less gasoline, consumption elsewhere has picked up.

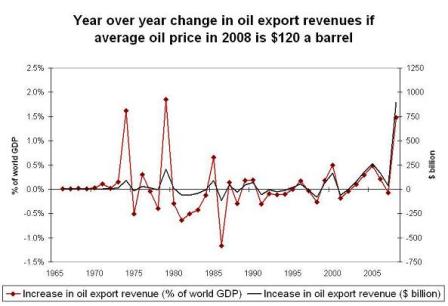

And this is with a weak world economy:

NYMEX-Oil steadies on OPEC output cut

by Rebekah Kebede

Meanwhile, the International Energy Agency lowered its 2008 world oil demand growth forecast by 100,000 barrels per day (bpd) to 690,000 bpd and also trimmed its forecast for 2009 global demand growth by 40,000 bpd to 890,000 bpd.[ID:nLA109634]

This is confirmed by Saudi production rising to 9.6 million bpd in last month’s report.

OPEC’s decision to stick to quotas gives the Saudis cover should demand for their output fall and be seen as a production cut by the rest of the world.

Oil prices had gained a dollar earlier Wednesday after OPEC ministers meeting in Vienna made the unexpected decision to cut output by around 500,000 barrels per day (bpd) from the market after high fuel prices and wider economic problems hit demand in the United States and other large consumer nations.

Any pickup in the US or Euro economies will probably increase demand for crude, and the Saudis don’t have more than maybe 1 million bpd spare capacity.

The ‘Master’s sell-off’ may have run its course, allowing the Saudis to work prices higher if they so desire.

Lower crude prices continue to support the USD.

*U.S. crude inventories down after Gustav

*OPEC makes unexpected output cut

*IEA cuts 2008, 2009 global demand forecasts

*Hurricane Ike likely to miss offshore oil, refineries

NEW YORK, Sept 10 (Reuters) – U.S. crude oil futures fell more than a dollar in volatile trading on Wednesday as a government report showed crude oil supplies building up in the nation’s primary Gulf Coast refining region after Hurricane Gustav crippled several plants last week.

The increase in crude inventories in the Gulf Coast region offset concerns over a larger-than-expected nationwide drawdown, dealers said.

NYMEX October WTI futures CLV8 CLc1 were down $1.53 at $101.73 a barrel, at 11:01 a.m. EDT (1501 GMT), trading between $101.36 and $104.97 a barrel.

“One reason that crude is selling off in the face of a seemingly supportive 5.9 million barrel (nationwide) crude draw is the fact that stocks actually built by 1.8 million barrels in the Gulf Coast region as crude supply was backed away from the downed refineries,” said Jim Ritterbusch, president, Ritterbusch & Associates, Galena, Illinois.

Weekly data from the U.S. Energy Information Administration showed refinery utilization plunged to 78.3 percent of total capacity in the week ending Sept. 5, the lowest level seen since October 2005 when hurricanes Katrina and Rita ravaged Gulf Coast refineries.

[top]