Category Archives: Uncategorized

Donation information and new home sales chart

Also, I’ll be in NYC Friday and Saturday if anyone wants to get together for anything, or play some tennis. Trying to stay fit on the road.

Going from there to the PMC for the annual 170 mile two day bike ride/benefit for Jimmy Fund/Dana Farber cancer research.

Click here to make donation to the PMC

Dana Farber Cancer Institute’s Website

This is the real thing- raises about $40 million.

ALL of your donated $ go to research, 0 to overheads

Dana Farber is the cutting edge of real progress that filters down to all the rest.

Please donate what you think being on this free list is worth to you.

(0 floor, so don’t ask…)

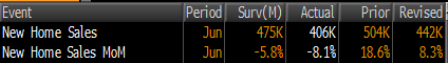

Starting to look like maybe the mortgage purchase applications is in line with home sales:

New Home Sales

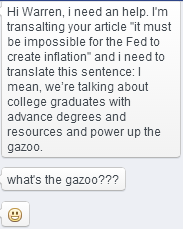

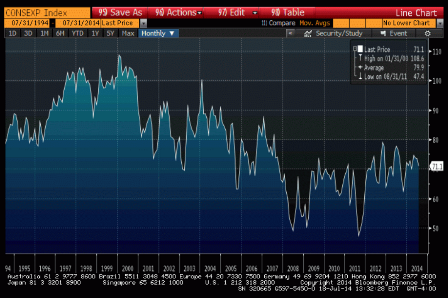

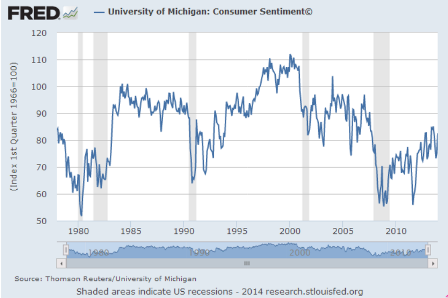

Consumer sentiment, expectations, and current conditions

This series continues to struggle to get to even the lows of prior cycles:

Expectations:

Full size image

Full size image

Current conditions:

Full size image

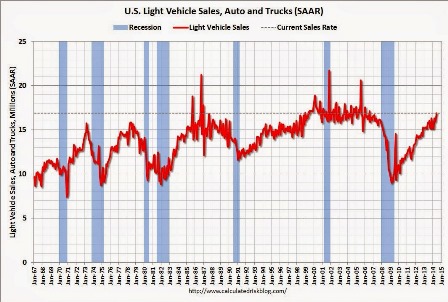

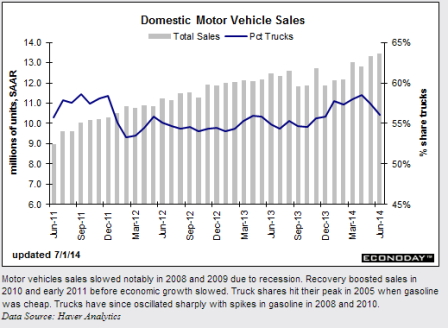

Vehicle sales hit 17 million

This is above expectations, a high for the year, and brings the 2014 average up to just over 16 million annual rate, making up for the winter slowdown.

Motor Vehicle Sales

Highlights

In an early signal of strength for June economic data, vehicle sales rose 1.2 percent in June to a 17.0 million annual rate which is the strongest rate since way back in July 2006. Sales of both North American-made and foreign-made vehicles rose in the month with domestic cars and imported trucks showing special strength. Today’s data point to yet another strong gain for the motor vehicle component of the retail sales report which rose 1.4 percent in May.

U.S. Light Vehicle Sales increase to 16.9 million annual rate in June, Highest since July 2006

By Bill McBride

Based on an WardsAuto estimate, light vehicle sales were at a 16.9 million SAAR in June. That is up 7% from June 2013, and up 1% from the 16.7 million annual sales rate last month.

This was above the consensus forecast of 16.4 million SAAR (seasonally adjusted annual rate).

Full size image

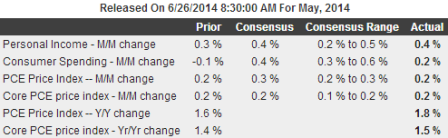

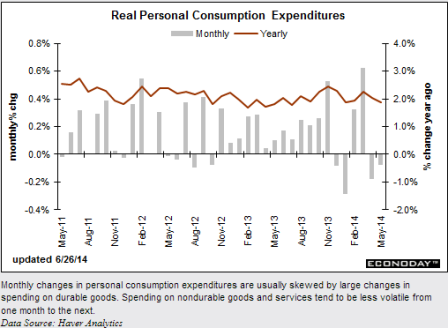

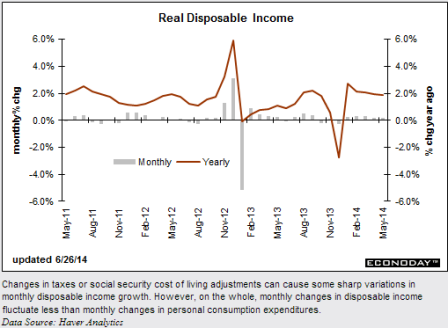

Consumer spending, personal income, PCE prices

The Commerce Department said consumer spending increased 0.2 percent after being flat in April. Spending, which accounts for more than two-thirds of U.S. economic activity, had been forecast rising 0.4 percent after a previously reported 0.1 percent dip in April.

When adjusted for inflation, consumer spending fell for a second straight month, suggesting spending this quarter could struggle to regain momentum after growing at its slowest pace in nearly five years in the first quarter.

Spending in May was probably constrained by weak healthcare spending as outlays on services barely rose for a second month.

While reports ranging from employment to manufacturing and the services industries suggest the economy has rebounded after sinking in the January-March period, the consumer spending data indicated that growth would probably fall short of the 4.0 percent annual pace that some economists are expecting in the second quarter.

Personal Income and Outlays

From Calculated Risk

Real PCE — PCE adjusted to remove price changes — decreased 0.1 percent in May, compared with a decrease of 0.2 percent in April. … The price index for PCE increased 0.2 percent in May, the same increase as in April. The PCE price index, excluding food and energy, increased 0.2 percent in May, the same increase as in April. … The May price index for PCE increased 1.8 percent from May a year ago. The May PCE price index, excluding food and energy, increased 1.5 percent from May a year ago.

Note: Usually the two-month and mid-month methods can be used to estimate PCE growth for the quarter (using the first two months and mid-month of the quarter). However this isn’t very effective if there was an “event”, and in Q1 PCE was especially weak in January and February – and then surged in March.

Still, using the two-month method to estimate Q2 PCE growth, PCE was increasing at a 2.3% annual rate in Q2 2014 (using the mid-month method, PCE was increasing less than 1.5%). Since the comparison to March will be difficult, it appears PCE growth will be below 2% in Q2 (another weak quarter).

Note the now familiar down into winter, up some, and then settling down again pattern:

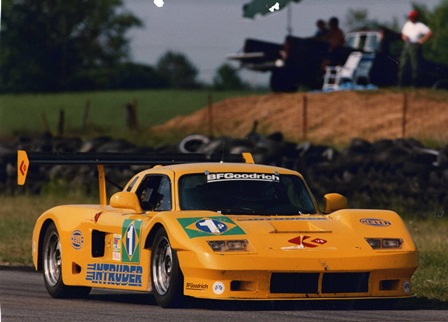

“It was 20 years ago today…”

Nelson Ledges Ohio victory 20 years ago- June 18, 1994, 3rd year of coming in 1st got my cars banned from further competition in this event.

Full size image

Full size image

Humorous question from Italy

Today’s charts

Couple of lesser indicators showing a familiar pattern- lower growth for the winter then higher growth then growth slowing some.

Goldman ICSC chain store sales index:

Full size image

Redbook retail sales, monthly, yoy:

Full size image

And looks like a spike up in wholesale sales causes recessions?

;)

Full size image

Small biz optimism now back up to prior recession lows!!!

Time to tighten up quick before the hyper inflation takes hold!!!

;)

Full size image

World Needs Record Saudi Oil Supply as OPEC Convenes

It wasn’t supposed to happen this way. All the talk last year was about new supply driving down prices. And every US ‘inflation’ of consequence I’ve seen has been oil related.

World Needs Record Saudi Oil Supply as OPEC Convenes

By Grant Smith

June 9 (Bloomberg) — OPEC ministers say they will almost certainly leave their oil-production ceiling unchanged when the group meets this week. What really matters for markets is whether Saudi Arabia will respond to global supply shortfalls by pumping a record amount of crude.

Just six months ago, energy analysts predicted output from the Organization of Petroleum Exporting Countries would climb too high and Saudi Arabia needed to cut to make room for other suppliers. They changed their minds after production from Libya, Iran and Iraq failed to rebound as anticipated, and industrialized nations’ stockpiles fell to the lowest for the time of year since 2008. Saudi Arabia may need to pump a record 11 million barrels a day by December to cover the other member nations, says Energy Aspects Ltd., a consultant.

“Now it’s not whether the Saudis will make room, but whether they’ll keep it going and maintain enough spare capacity,” said Jamie Webster, a Washington-based analyst at IHS Inc., an industry researcher. “OPEC is increasingly having a hard time just doing its job of bringing all the barrels needed.”

Even as the North American shale revolution propels U.S. production to a three-decade peak, supply in other parts of the world is faltering. A battle for political control in Libya, pipeline attacks in Iraq and prolonged sanctions against Iran are preventing those nations from reviving output. While U.S. crude inventories rose to a record in April, restrictions on exports are keeping those supplies in the country, tempering forecasts that global oil prices will decline this year.

Supply Risks

Deutsche Bank AG, Morgan Stanley, Barclays Plc and Citigroup Inc. raised their 2014 Brent price forecasts over the past three months, citing supply risks. The median estimate of the four banks climbed to $107.75 a barrel, from $100.25 as of Dec. 31. The grade has averaged $108.24 a barrel this year.

OPEC, which produces about 40 percent of the world’s oil, will meet in Vienna on June 11 to discuss its 30 million barrel daily production target. Ministers from Saudi Arabia, Angola and Kuwait said they expect no change, as did 22 of 23 analysts and traders surveyed by Bloomberg News.

OPEC’s Economic Commission Board, a panel that reviews supply and demand levels before the meeting, concluded on June 5 that the current production level is adequate, according to two OPEC delegates.

Low Inventories

The International Energy Agency, the Paris-based adviser to 29 nations, recommended on May 15 a “significant rise in OPEC production” to meet demand of 30.7 million barrels a day in the second half of the year. Oil inventories in advanced nations were at 2.62 billion barrels in April, the lowest for that month since 2008, the year Brent reached a record $147.50 a barrel, IEA data show.

Boosting output that high would be “a Herculean task for the group to surmount given that production has been below 30 million barrels a day for the last five months,” London-based Energy Aspects said in a May 27 research note.

The situation has reversed since OPEC last met in December. At that time, the IEA indicated the group would need to reduce output by about 3 percent in the first half of 2014 to make way for North America’s booming shale oil supplies.

U.S. oil production rose to 8.47 million barrels a day in the week ended May 23, the highest since 1986, according to the Energy Information Administration. The nation’s crude inventories were at 399.4 million barrels through April 25, the highest in data beginning in 1982, the EIA estimates.

December Meeting

Several OPEC nations have failed to boost output as their ministers suggested at the group’s last meeting in December. Iraq was aiming for a surge of about 30 percent in 2014 to 4 million barrels a day, Oil Minister Abdul Kareem al-Luaibi said. Libya intended to restore within 10 days full daily capacity of almost 1.6 million barrels, from less than 20 percent previously, Oil Minister Abdulbari al-Arusi said. Iran had secured six months of relief from sanctions imposed by western governments and was seeking its highest output in five years, Oil Minister Bijan Namdar Zanganeh said.

Iraq’s daily production contracted 8 percent since reaching a 35-year peak of 3.6 million barrels in February amid political disputes and pipeline bombings, according to the IEA. In Libya, output has fallen to a 10th of capacity because of protests at oilfields and strikes at export terminals. Iranian supply is little changed, while an end to sanctions relief looms in July if it cannot reach a broader deal on its nuclear program.

Expectations Fade

As a result, inventories of crude and refined oil in Europe were 86 million barrels below their five-year average at the end of March, according to the IEA. U.S. benchmark West Texas Intermediate is about $6 a barrel cheaper than North Sea Brent.

“At the start of this year, expectations around the return of Libyan, and subsequently Iranian, barrels were high,” Amrita Sen, chief oil market strategist at Energy Aspects, said by e-mail on May 20. “Today those possibilities have diminished substantially. The real question concerns how OPEC will meet higher demand for its crude in the third quarter. The onus falls on Saudi Arabia to do much of the heavy lifting.”

Saudi Oil Minister Ali Al-Naimi told reporters in Seoul on May 12 that any supply shortage in the oil market can be covered. The kingdom is capable of producing as much as 12.5 million barrels a day of crude oil and pumped 9.67 million in May, according to data compiled by Bloomberg. Media officials at Saudi Arabia’s oil ministry in Riyadh weren’t available to comment when contacted by Bloomberg on June 6 and yesterday. There was no response to an e-mail to Saudi Aramco’s media department yesterday.

Estimates vary on how much Saudi Arabia needs to produce before the end of the year. IHS projects about 10.3 million and while Societe Generale says between 10.2 million barrels and 10.5 million barres a day in the third quarter. The high of 11 million that Energy Aspects says could be needed from Saudi Arabia would be higher than the quarterly peak of 10.1 million reached in late 1980, according to OPEC data.

“At the time of the last OPEC meeting, there was a fair amount of concern about what would happen if disrupted production in key countries starts to come back in a big way,” said Mike Wittner, the head of oil market research at Societe Generale SA in New York. “It’s not all happening in a big way. It means the market needs the Saudis to produce more crude.”

Full size image

Recent credit boom…

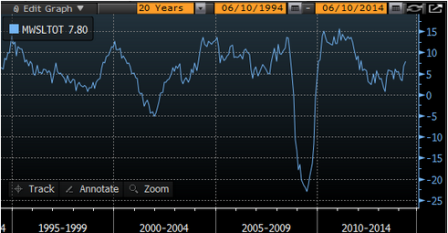

Growth of govt lending continues to slow:

Full size image

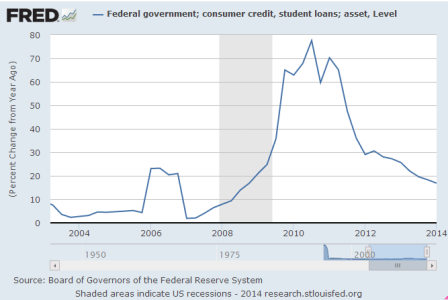

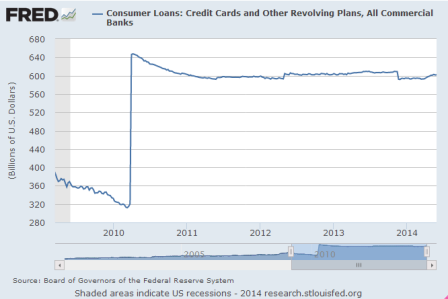

Fearsome revolving credit acceleration underway:

Full size image

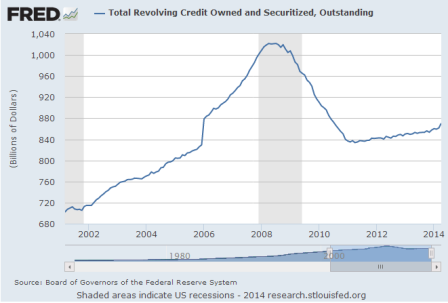

Sudden breakout here?

Full size image

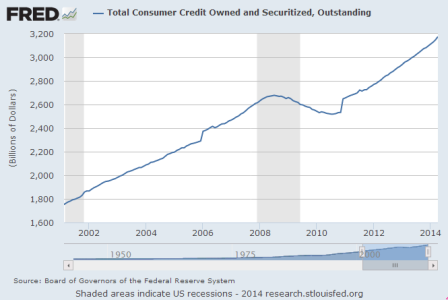

Escape velocity?

Full size image

Here it is!

Loans increased when the economy suddenly slowed due to the weather, then continued to increase at about the prior pace:

Full size image

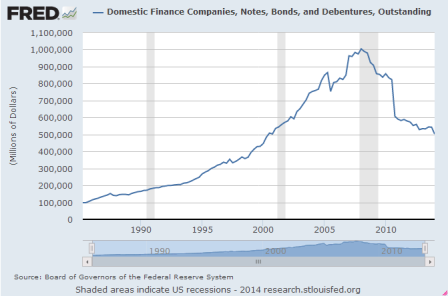

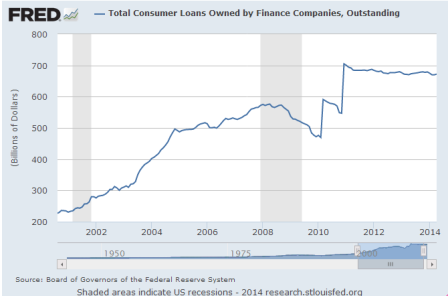

And someone’s picking up the slack from these types of lenders?

Full size image

Full size image

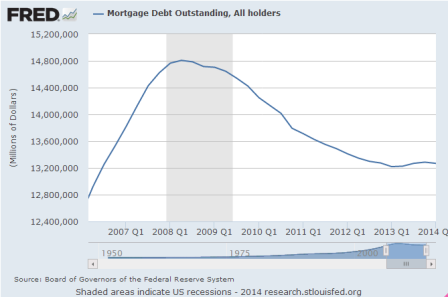

And, of course, the big guy, mortgage debt, started to move up a tad but unfortunately seems to have settled back some:

Full size image

But with the 0 rate policy, we’re sitting on a powder keg, always on the edge of hyper inflation…

:(