As previously discussed the economy is continually subject to chronic ‘unspent income’, also known as ‘demand leakages’. Many are tax advantaged, such as pension fund and retirement contributions, insurance reserves, and other corporate reserves. Some are political, such as foreign central bank fx reserve accumulation.

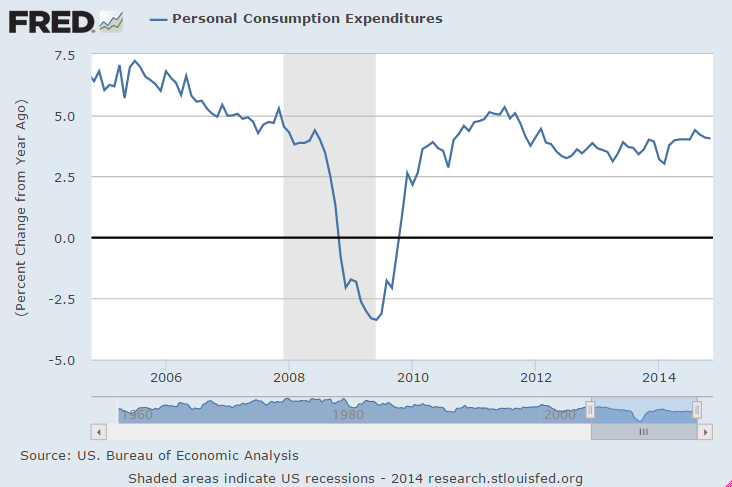

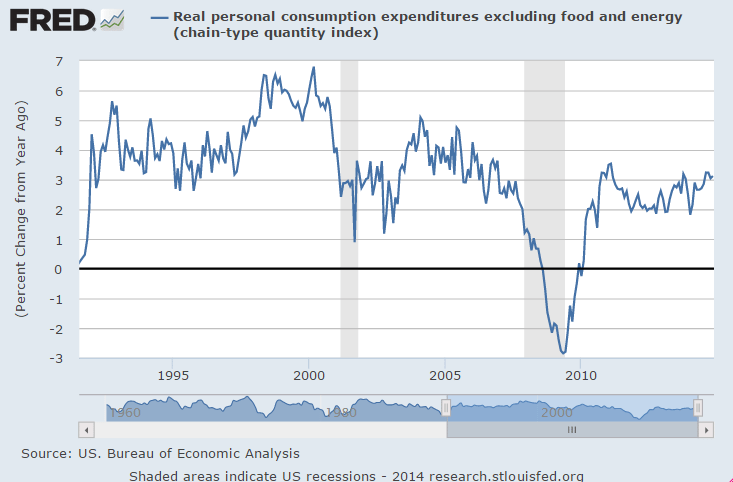

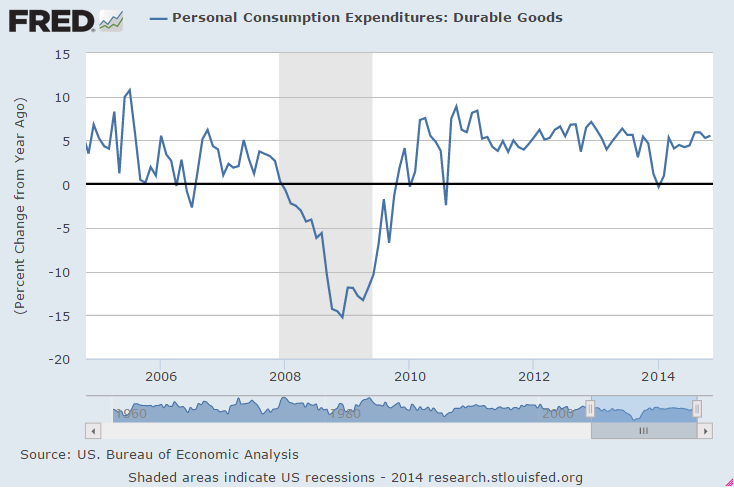

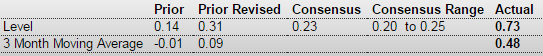

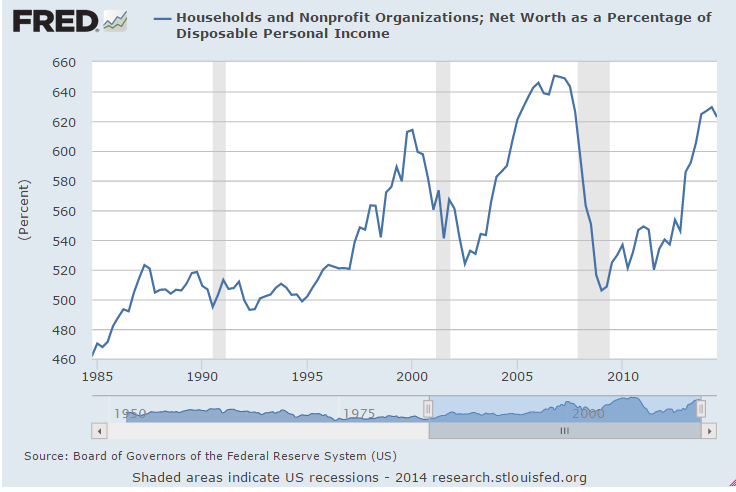

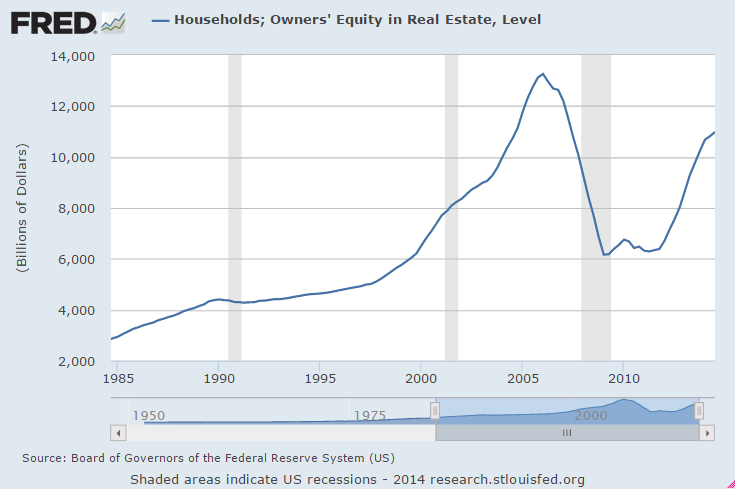

And each period of expansion has been characterized by a ‘borrowing to spend’/’credit expansion’/’spending more than income’ that has more than offset the demand leakages.

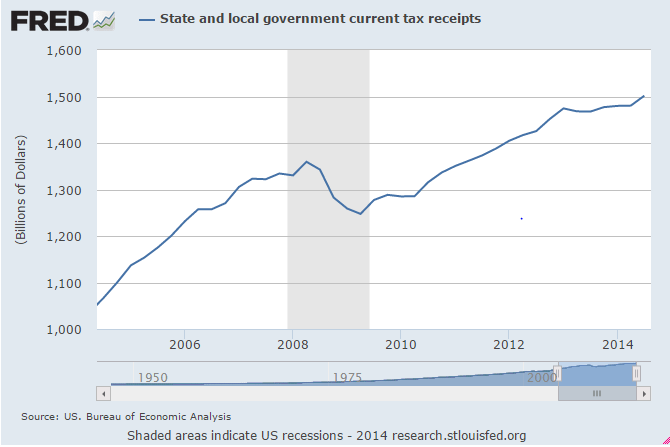

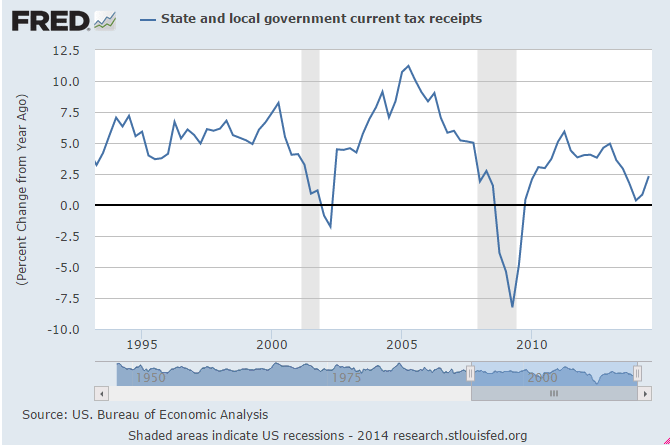

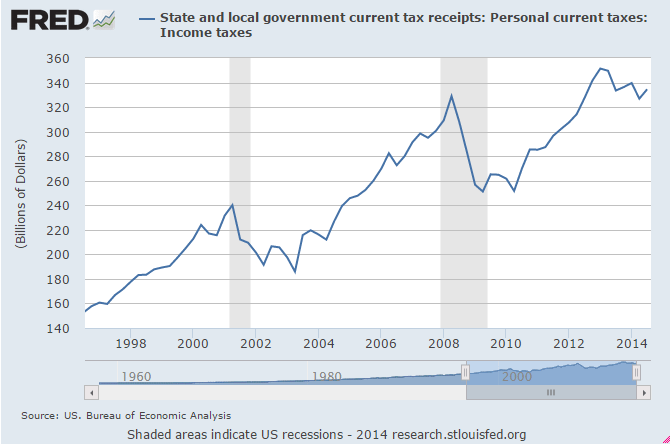

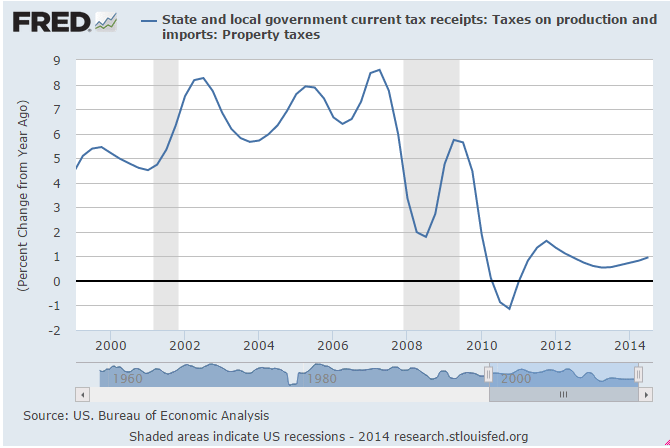

The govt spending more than its income ordinarily gets things going, but then the non govt ‘spending more than its income’ has to take over as the ‘automatic fiscal stabilizers’ of falling unemployment and other benefits and increased tax collections ‘automatically’ reduce govt deficit spending.

In the 80’s the deficit went up with the tax cuts and spending increases, but the heavy lifting was done by the savings and loan expansion phase which added about $1 trillion of ‘suspect’ loans while it lasted. In the late 90’s it was the .com and y2k ‘borrowing to spend’ further supported by a surge in mortgage credit. In the early 2000’s it was the expansion phase of the sub prime fiasco that drove growth until that ended.

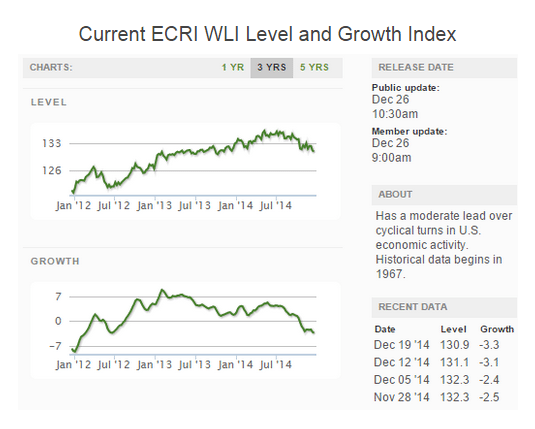

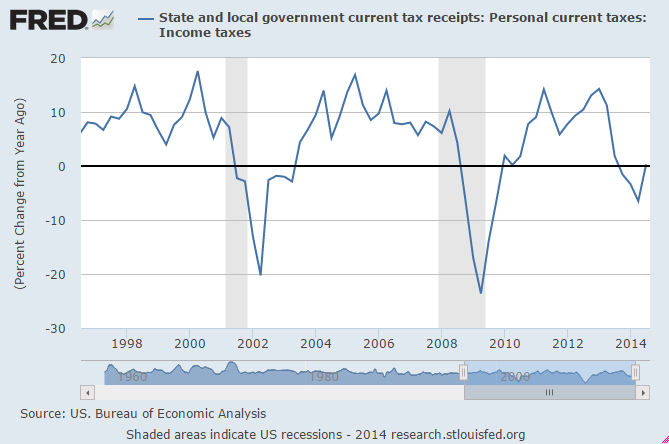

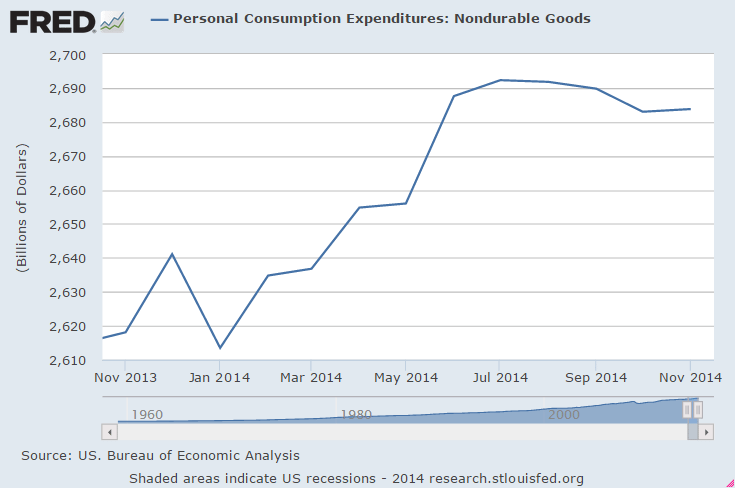

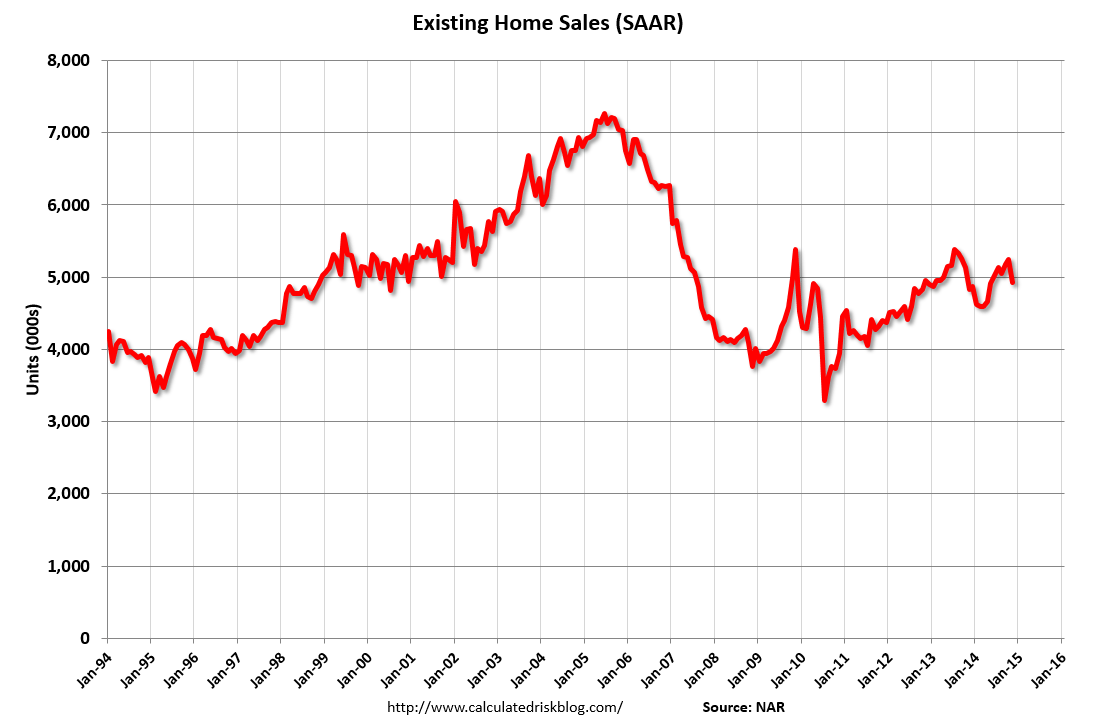

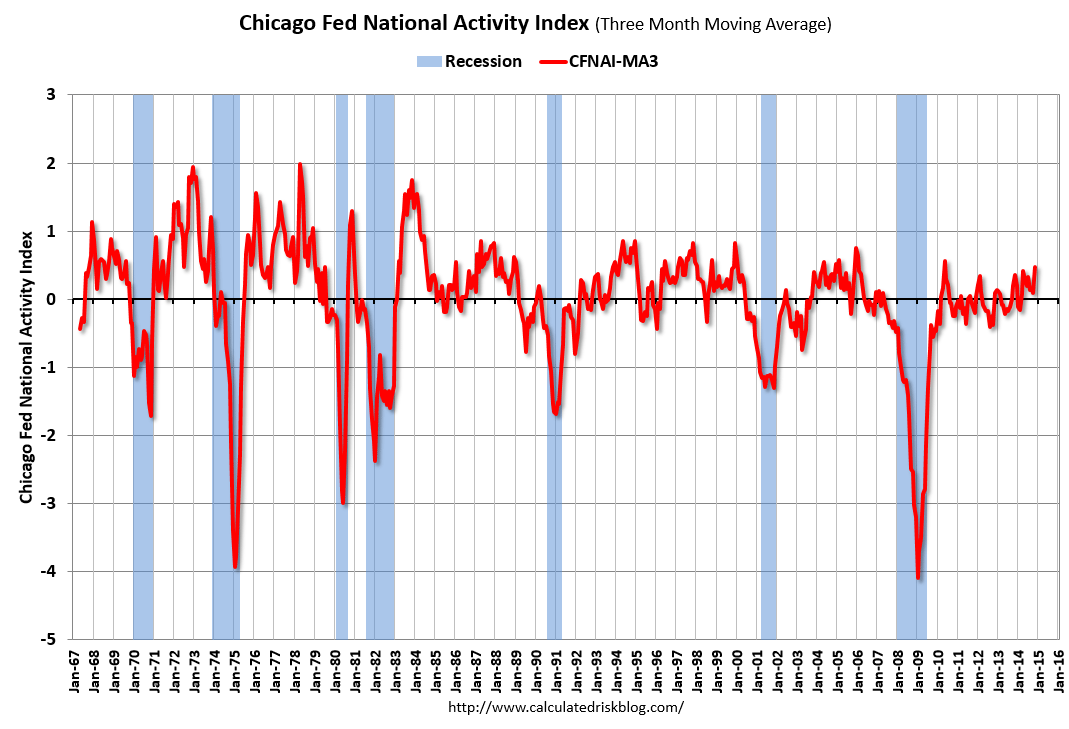

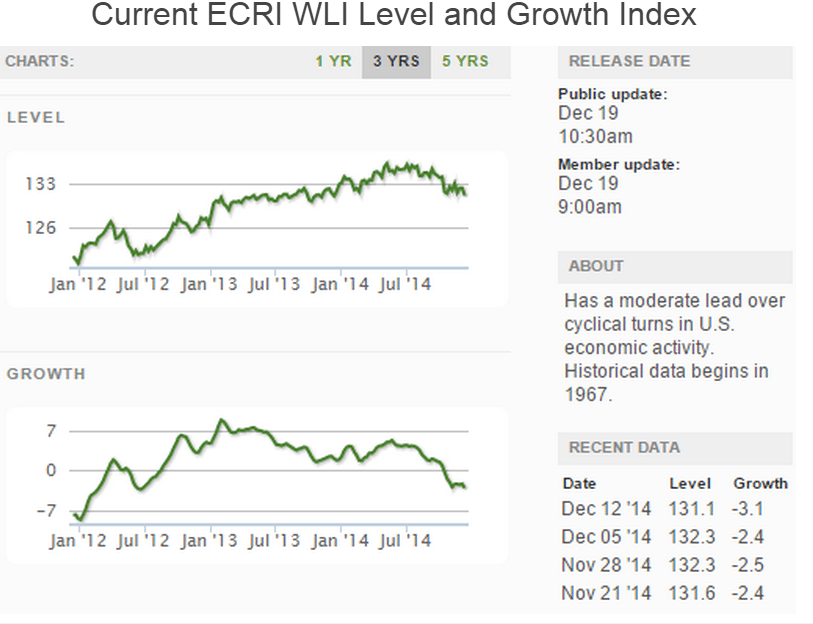

That’s why I’ve been looking for the credit expansion that’s been sustaining even the modest growth we’ve been getting in this latest cycle, particularly after the 180 billion tax hike that began Jan 1, 2013 and the 70+ billion in sequesters that followed a few months later. I couldn’t find the supporting credit expansion in the usual places- houses, C and I loans, student loans, and autos which did help some.

What I didn’t dig into was loans to the energy sector to develop what are now high priced oil. And now with that source of ‘borrowing to spend’ going into reverse, we’ll see how much support it’s been providing…