Warren, euro continue to go down vs usd. Do you think draghi goal is to reach eur/usd 1:1 ?

Good question!

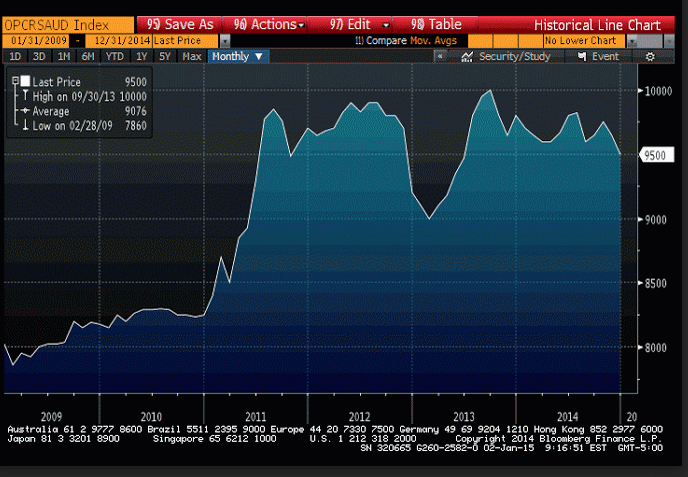

No one thinks the ECB is buying dollars so if that’s the case the world is getting short euros directly and indirectly in very large size, as per the EU trade surplus, which is a consequence of the overall increases in ‘competitiveness’ as wages are depressed by fiscal policy. It’s all part of the ‘purchasing power parity’ shift with the EU becoming the low cost producer. And these forces all work to make the euro very strong once the ‘portfolio shifting’ has run its course, which it hasn’t yet.

What’s happened with the euro is the same thing that happened with the USD- markets feared QE would be inflationary and cause currency depreciation, so they discounted that in advance of QE, depressing the dollar. And when it didn’t happen and QE ended, the dollar reversed as those caught short and those who had become underweight in dollars had to restore their dollar exposures.

So while portfolios with dollar liabilities that had reduced dollar exposure were returning to dollars, at the same time the ECB was moving towards negative rates and QE, causing portfolios to reduce euro exposures, driving the euro lower. And events surrounding Greece and Ukraine only added to euro fears, further driving portfolio managers to shift exposure away from euro.

What I can’t tell you is when the tide will turn, but looks to me that when it does, the euro goes up until the trade surplus reverses, and since the link between the rising euro and the trade balance is ‘loose’ the euro could easily get very high vs the dollar- say, over 1.5- before that happens.

To answer your question, what Draghi is doing- negative rates and QE, fundamentally makes the euro stronger, but he believes, as do market participants, that it makes the euro weaker. Same with the Fed, of course, as market participants believe higher rates are dollar friendly when in fact fundamentally they weaken it. So while Draghi may be targeting 1:1 as you suggest, and taking measures he believes and markets believe will get him there, in fact he and markets are ‘pushing on a spring’ as fundamentally net euro are being drained rather than added to the global economy.

What this also suggests is the next EU crisis could be that of the strong euro as it appreciates and starts hurting EU export industries, and the ECB just keeps doing more and more QE and cuts rate further which only makes it all worse.