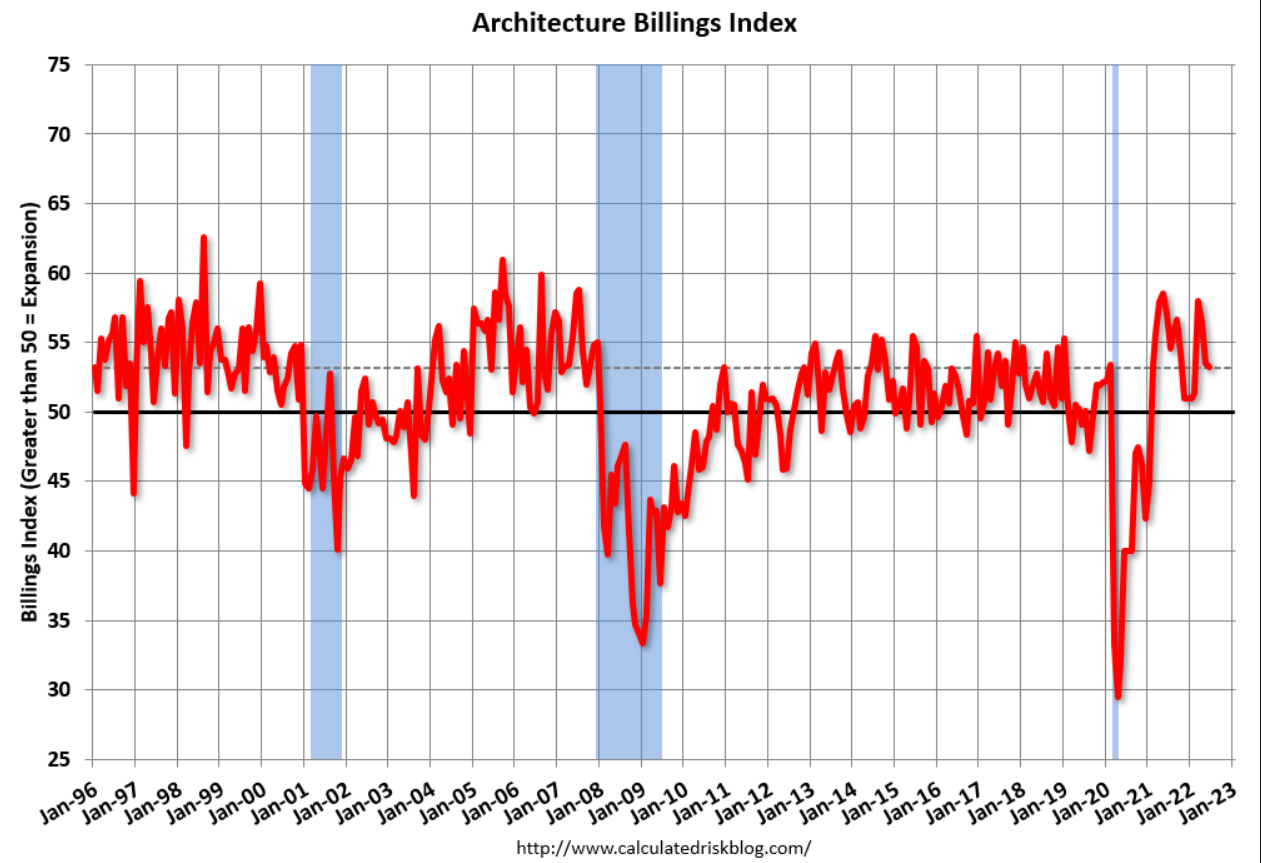

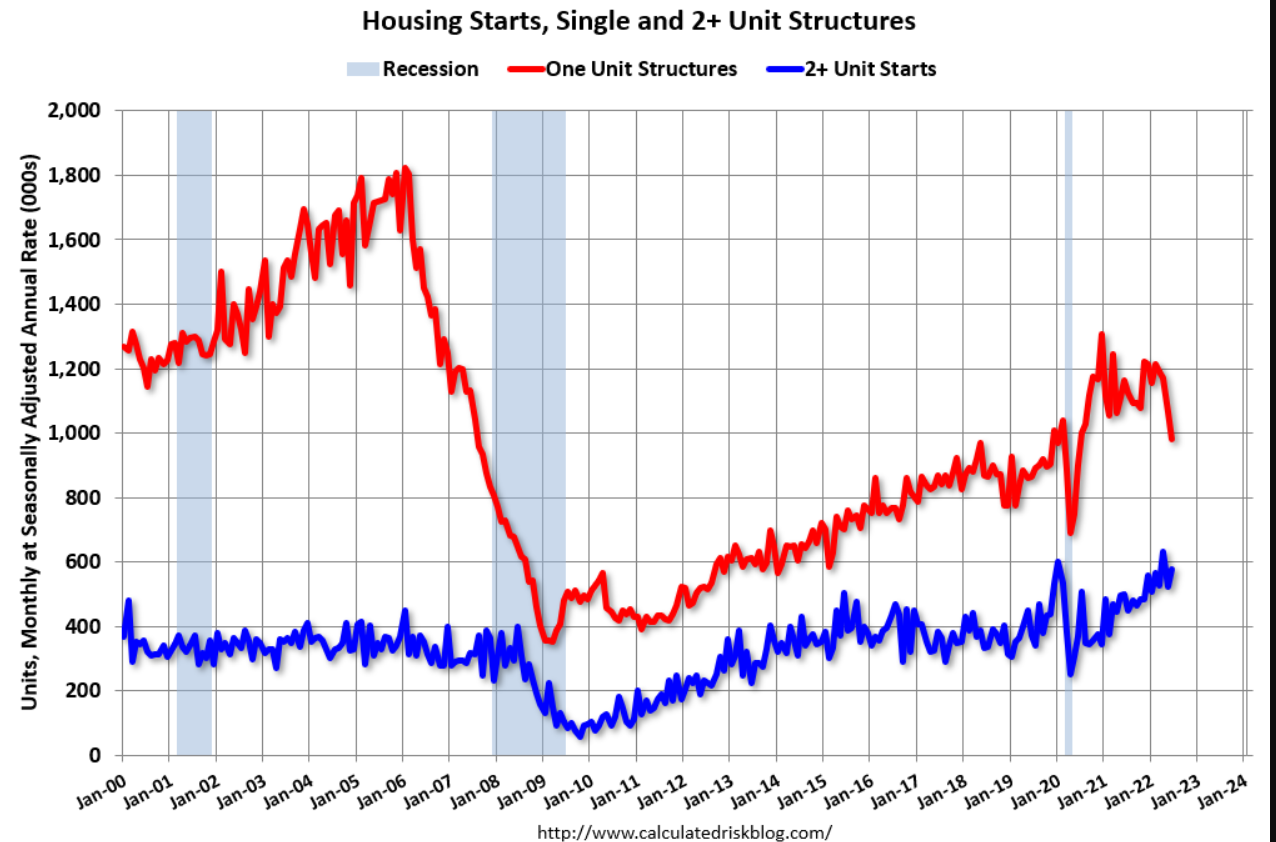

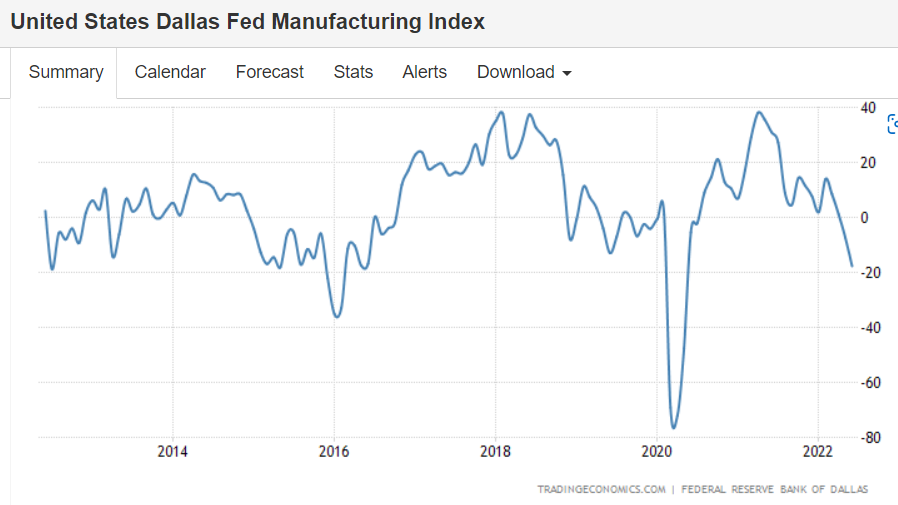

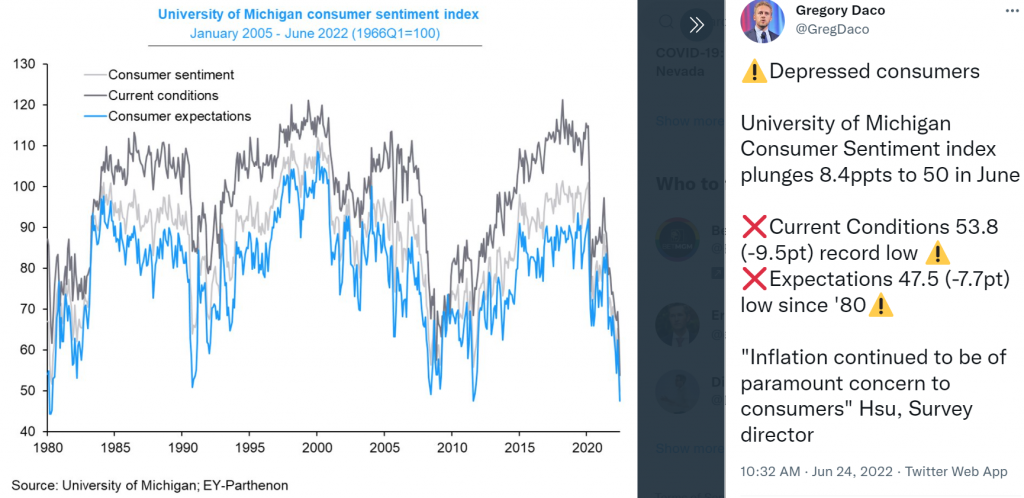

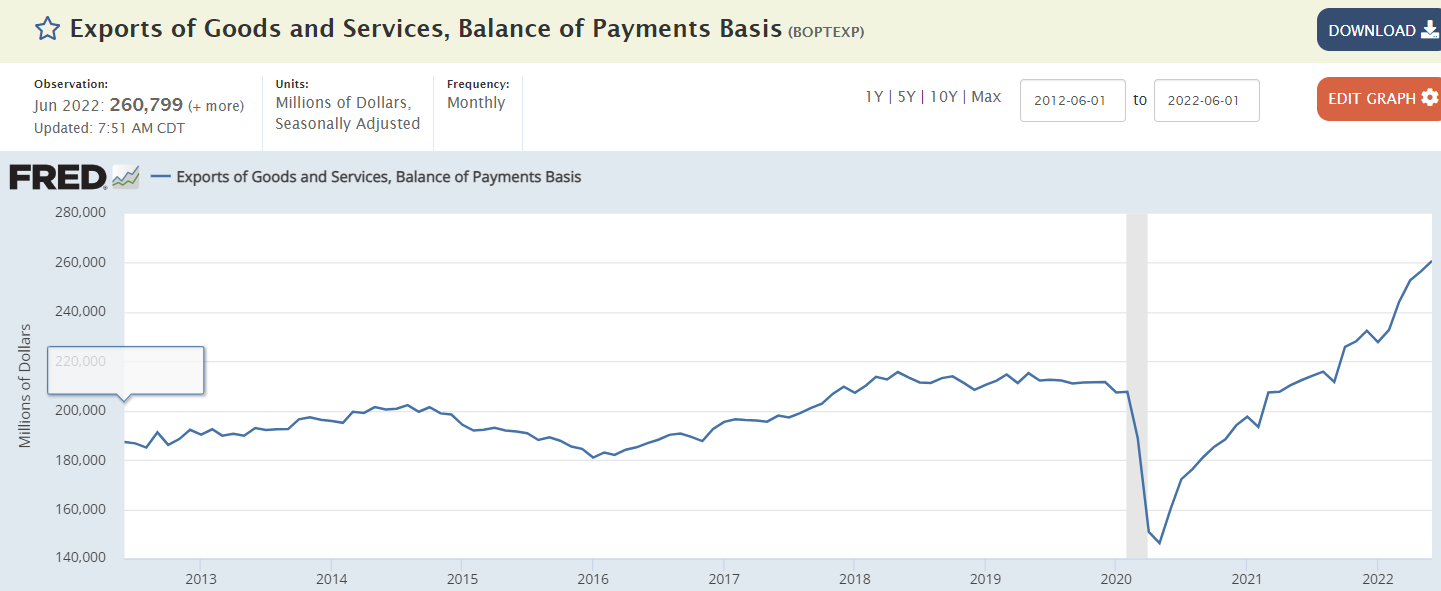

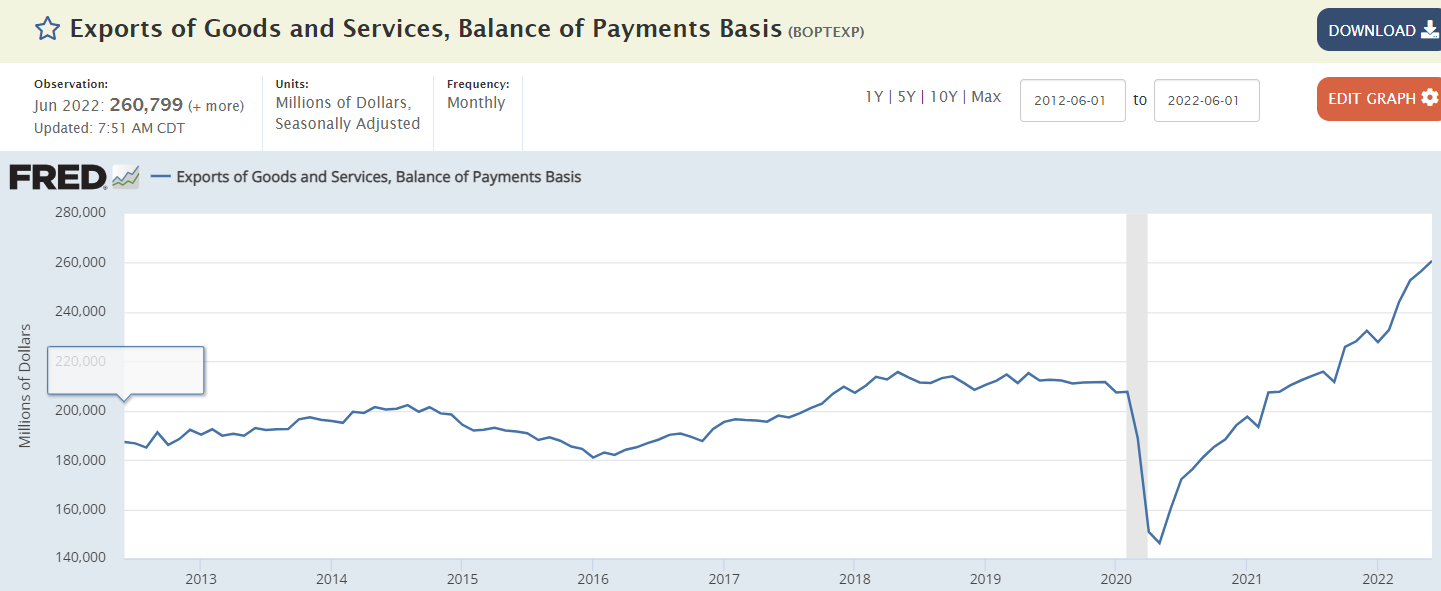

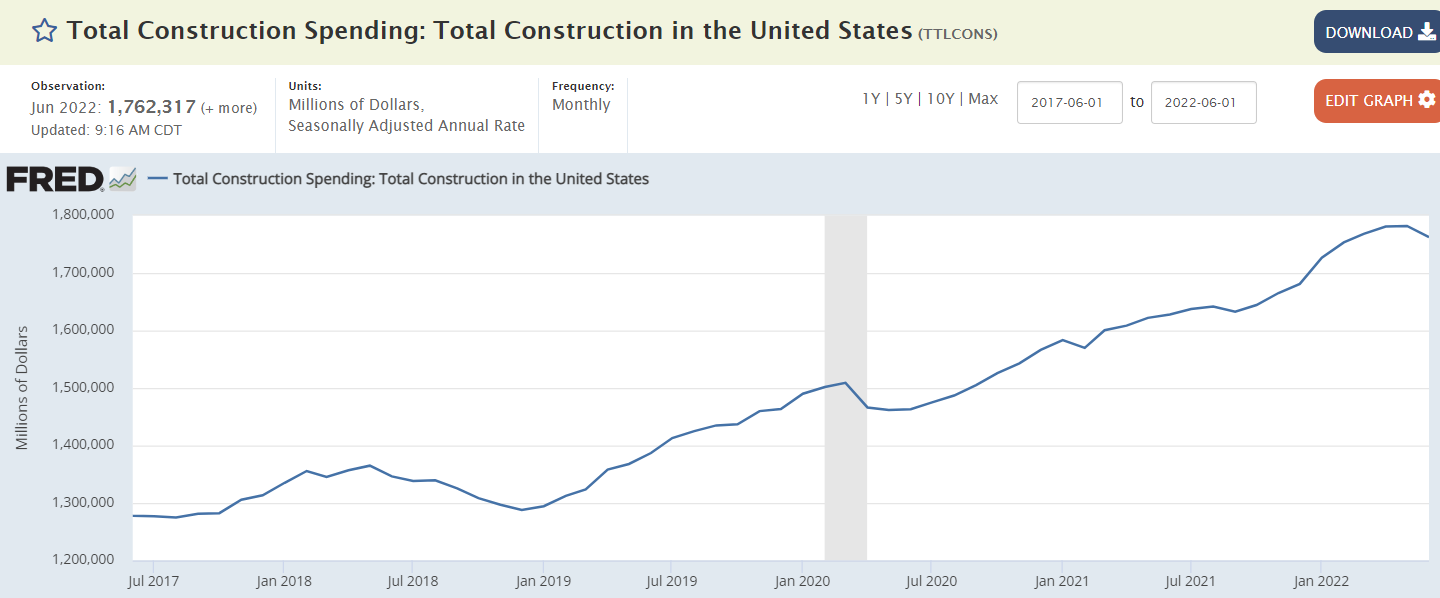

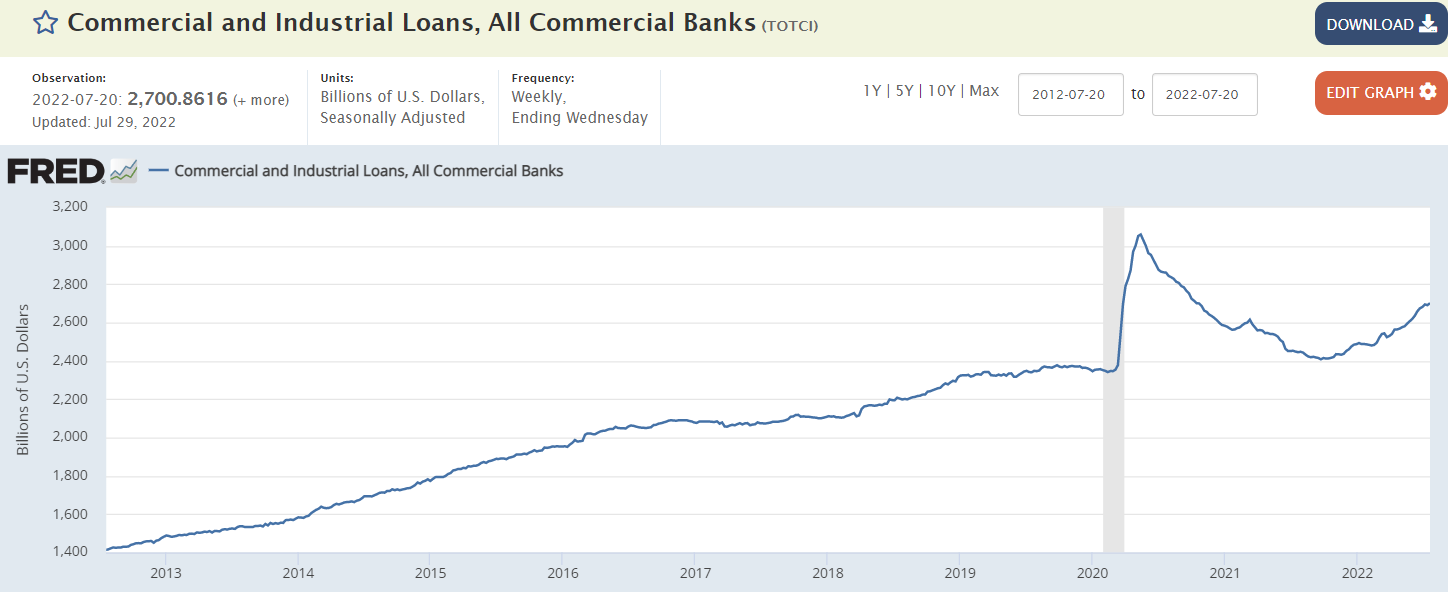

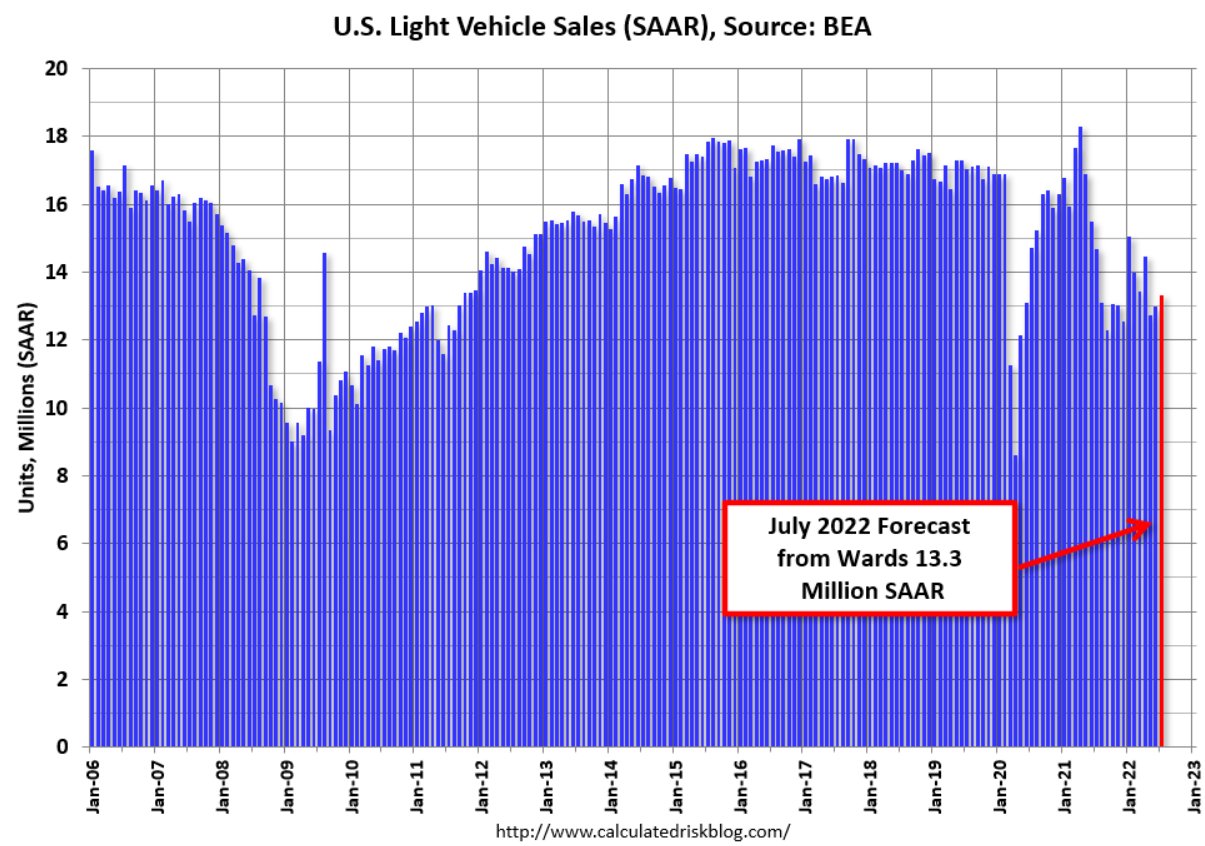

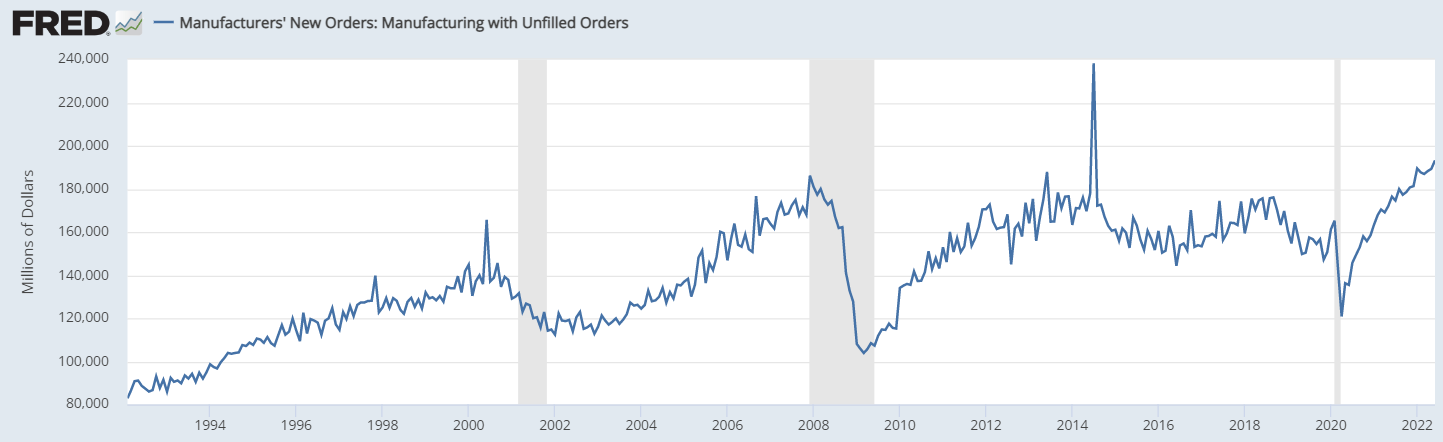

This is adding support to employment and output, even as consumption weakens. The relatively low cost of energy should keep it going for a while:

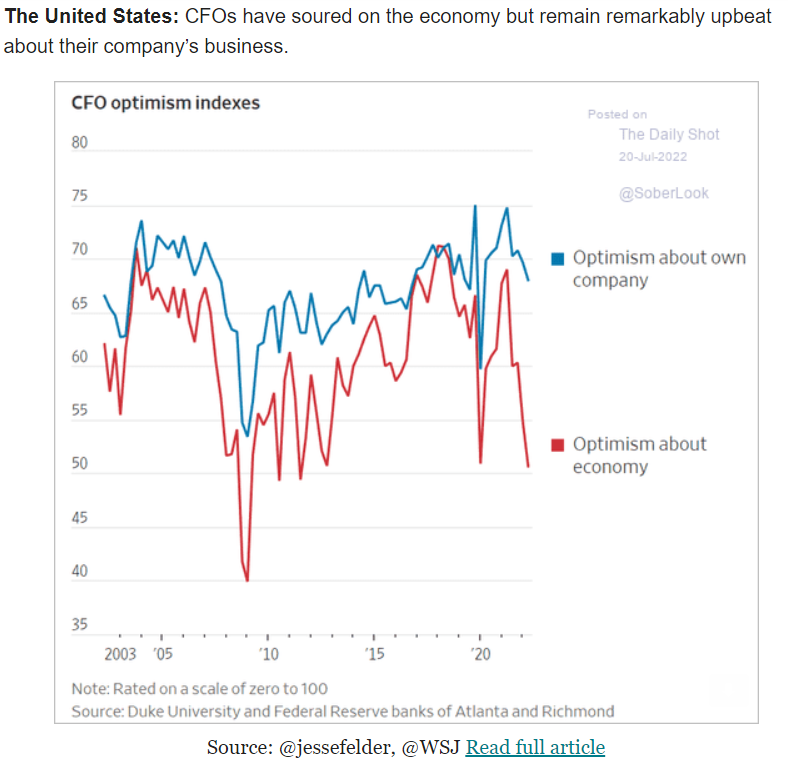

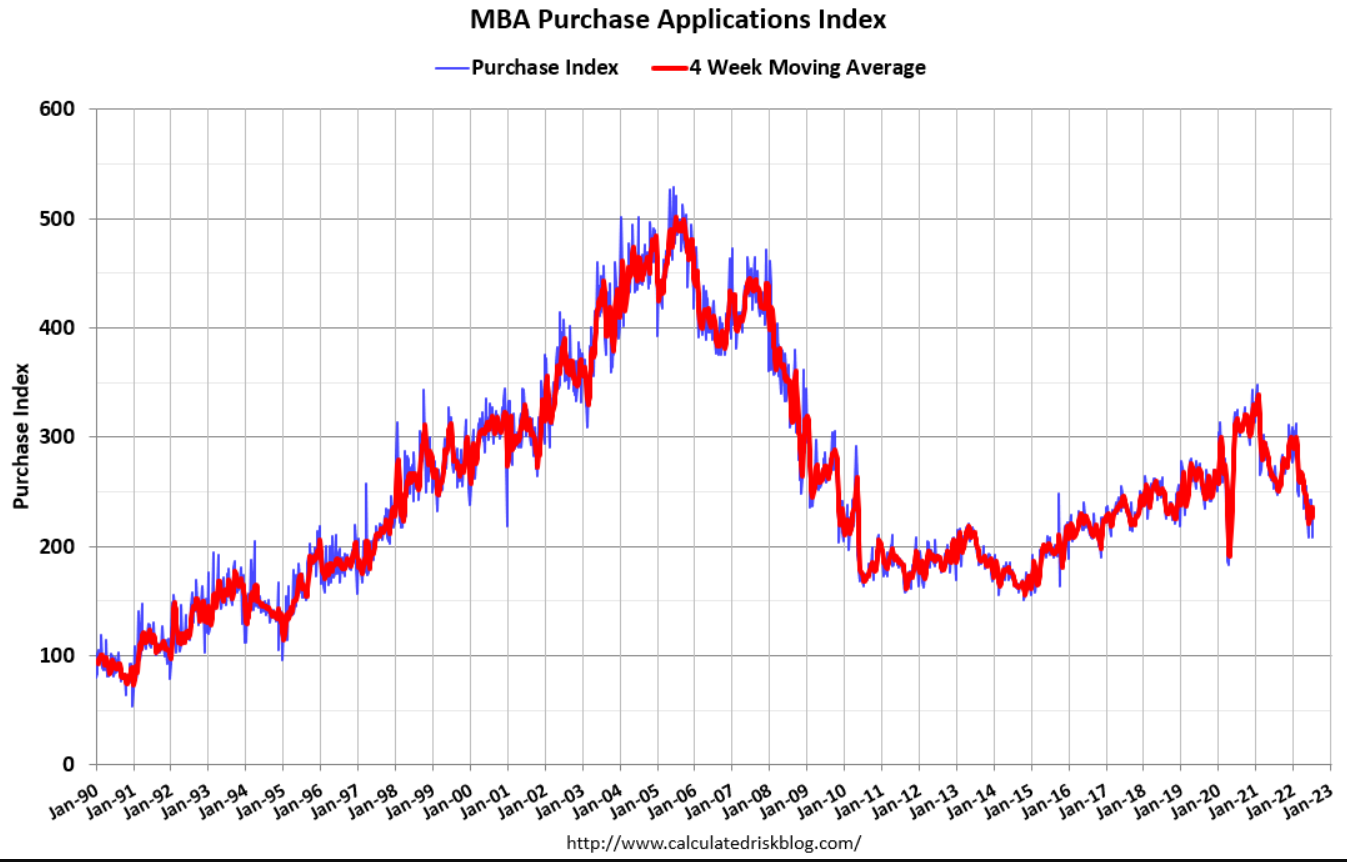

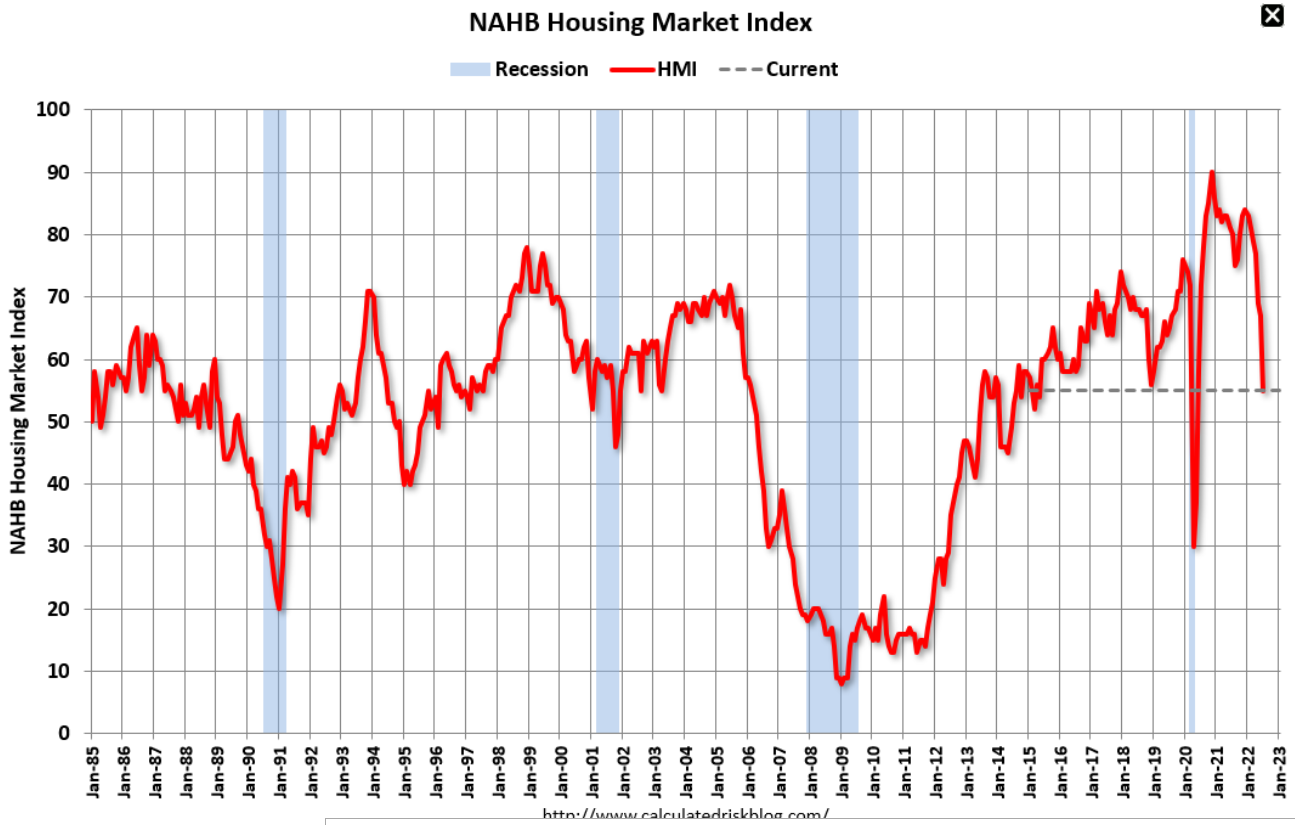

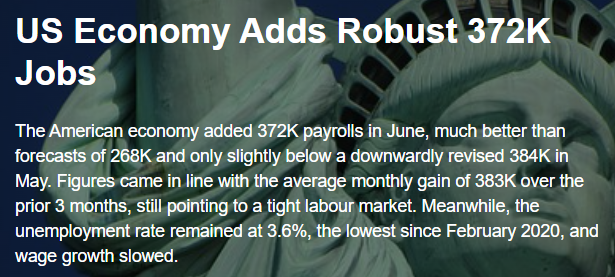

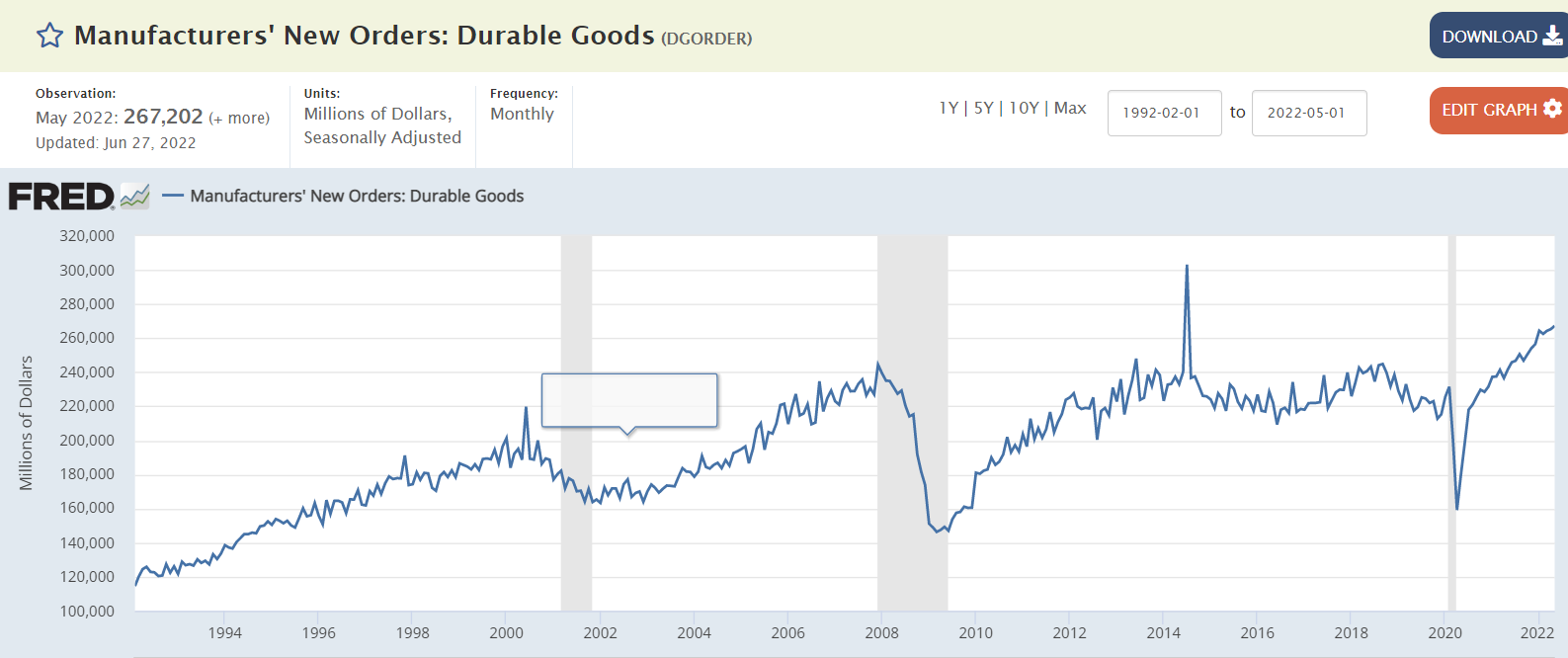

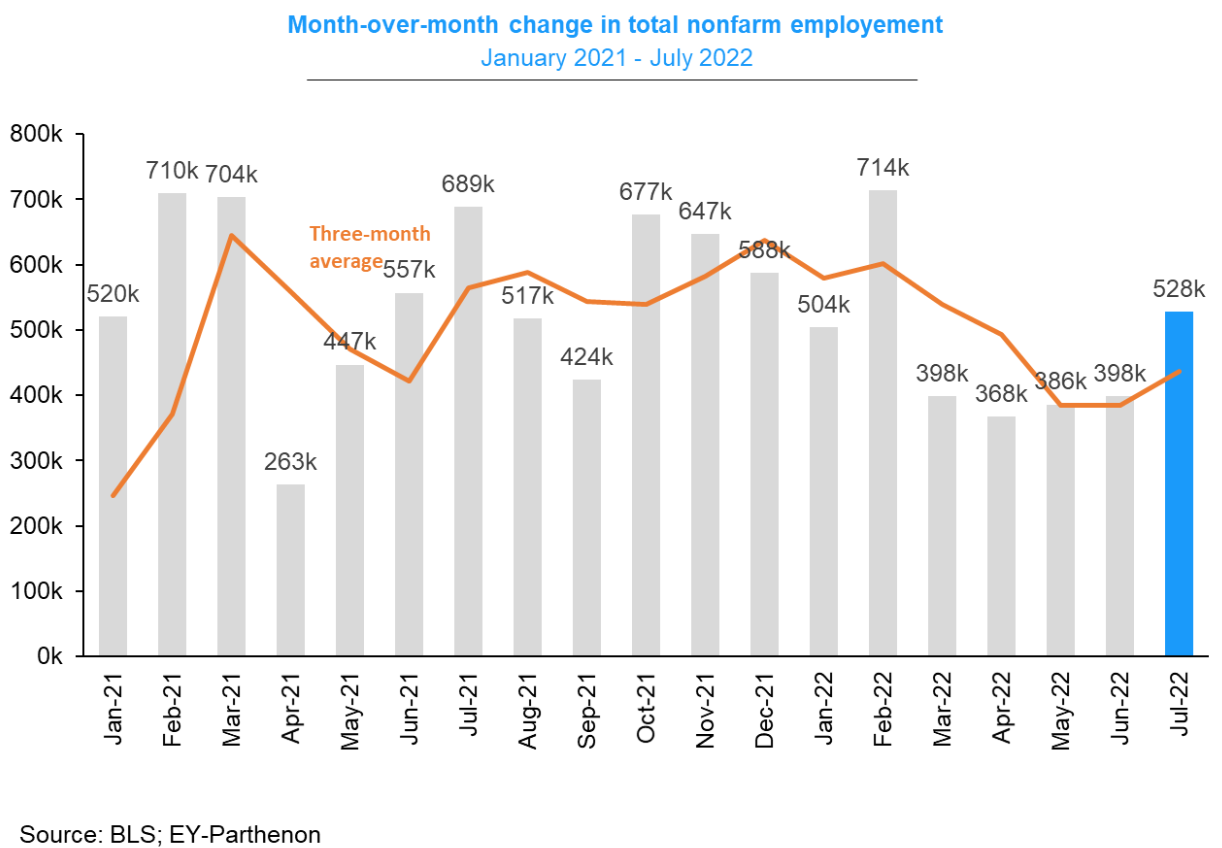

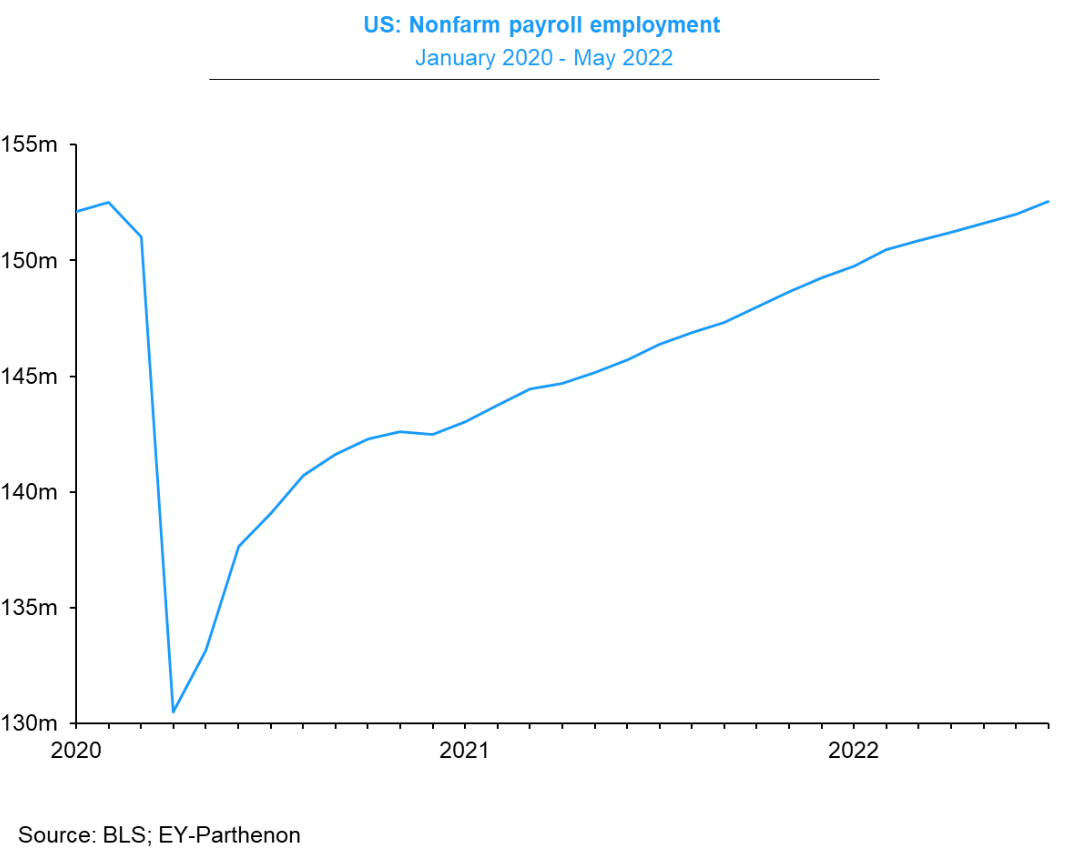

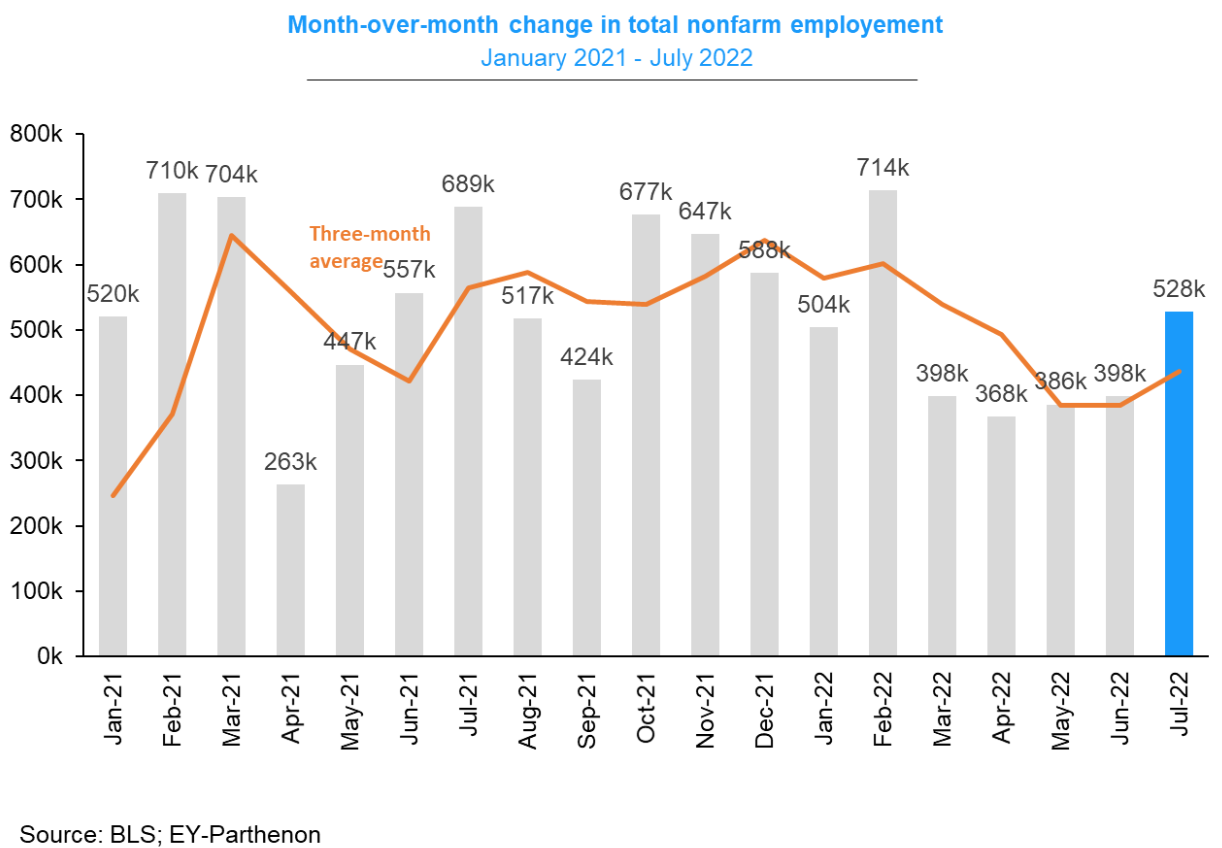

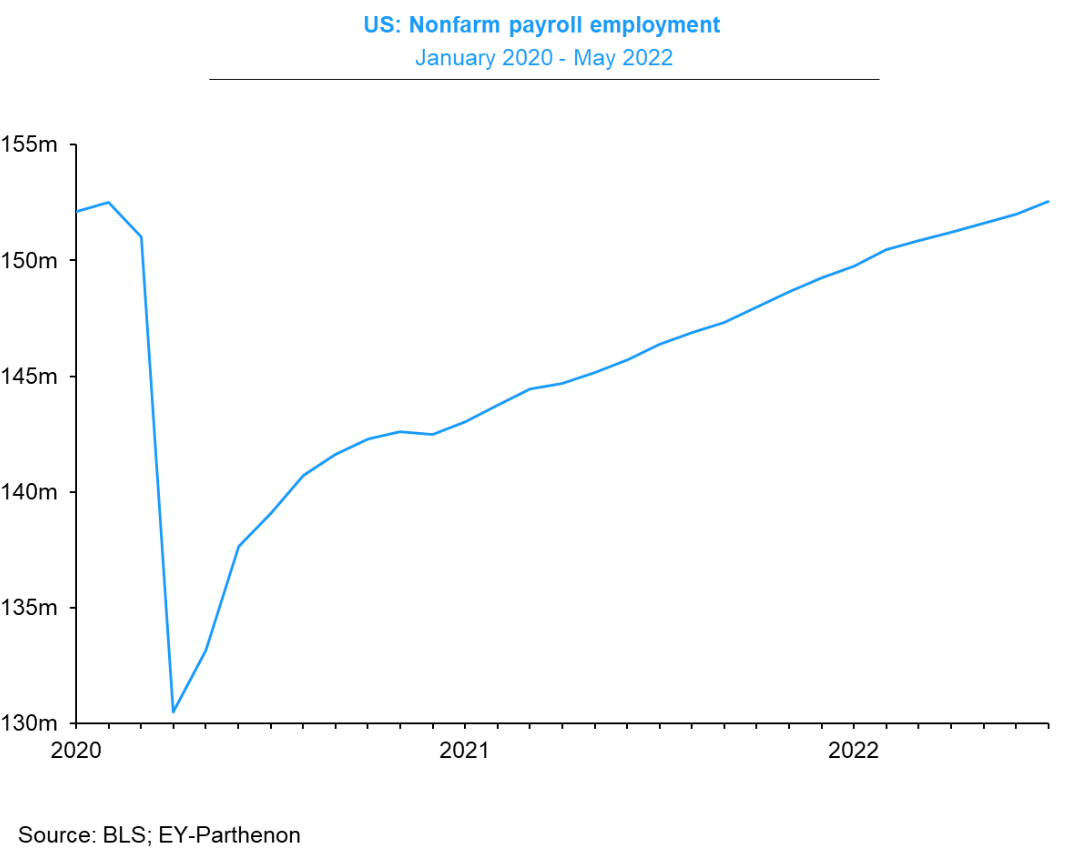

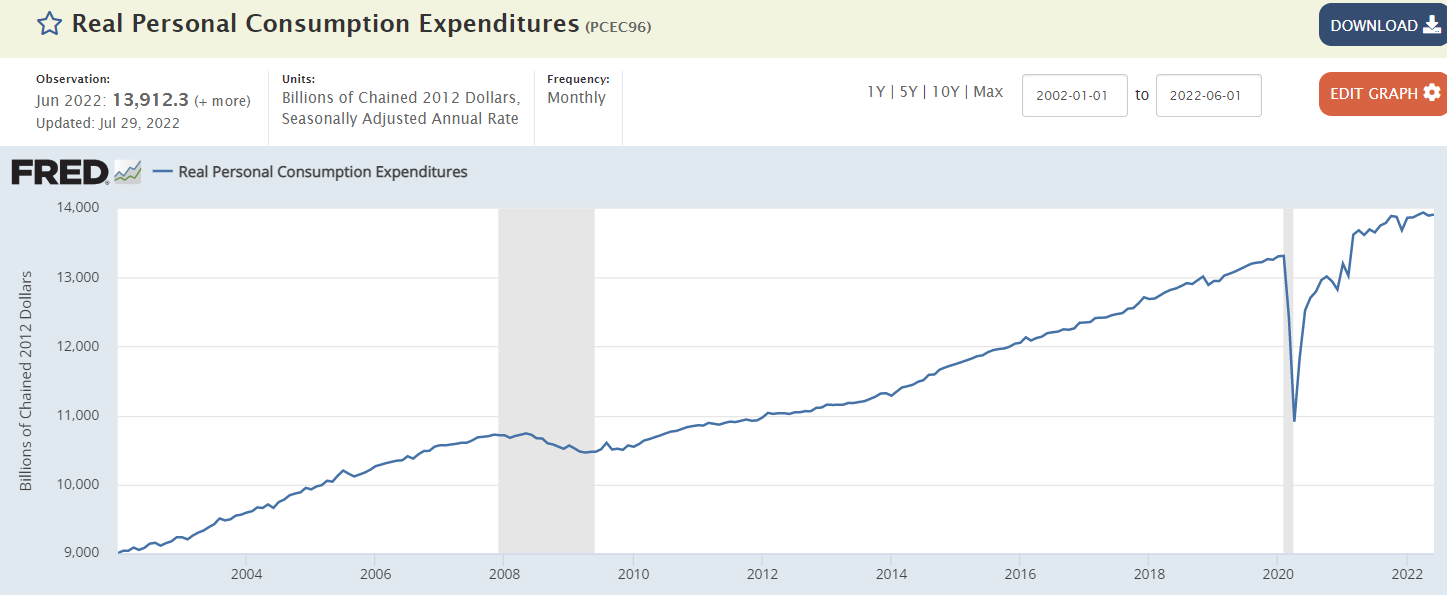

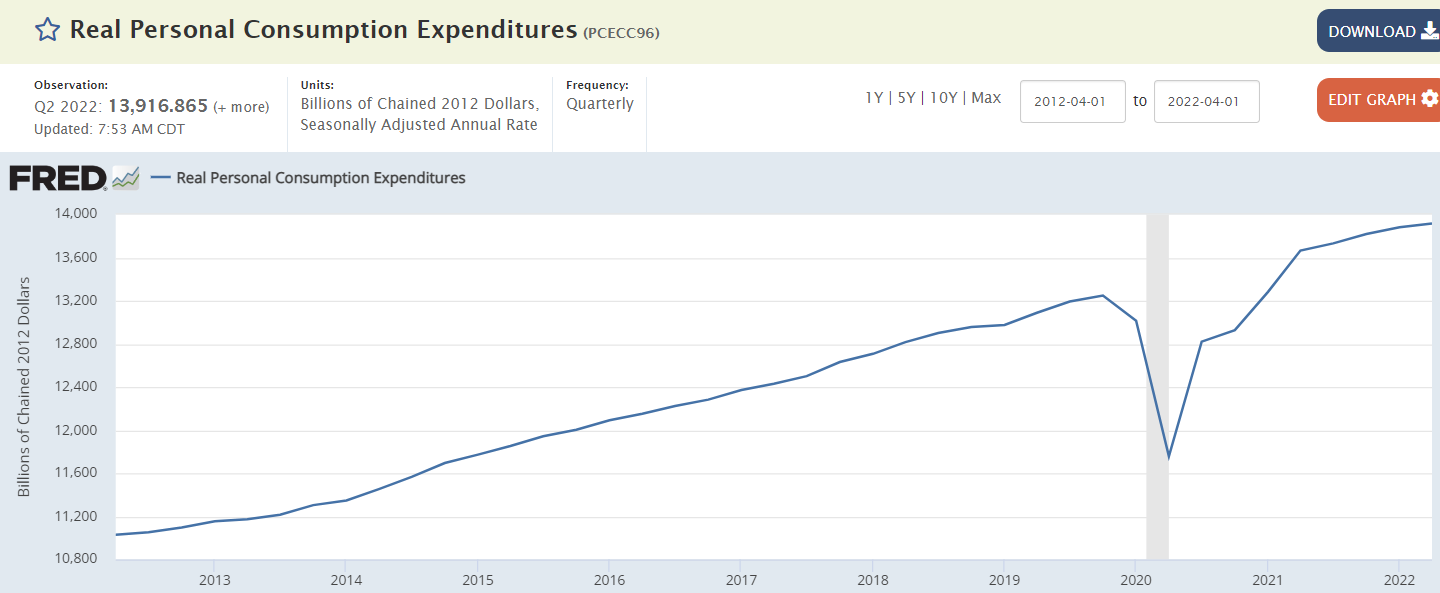

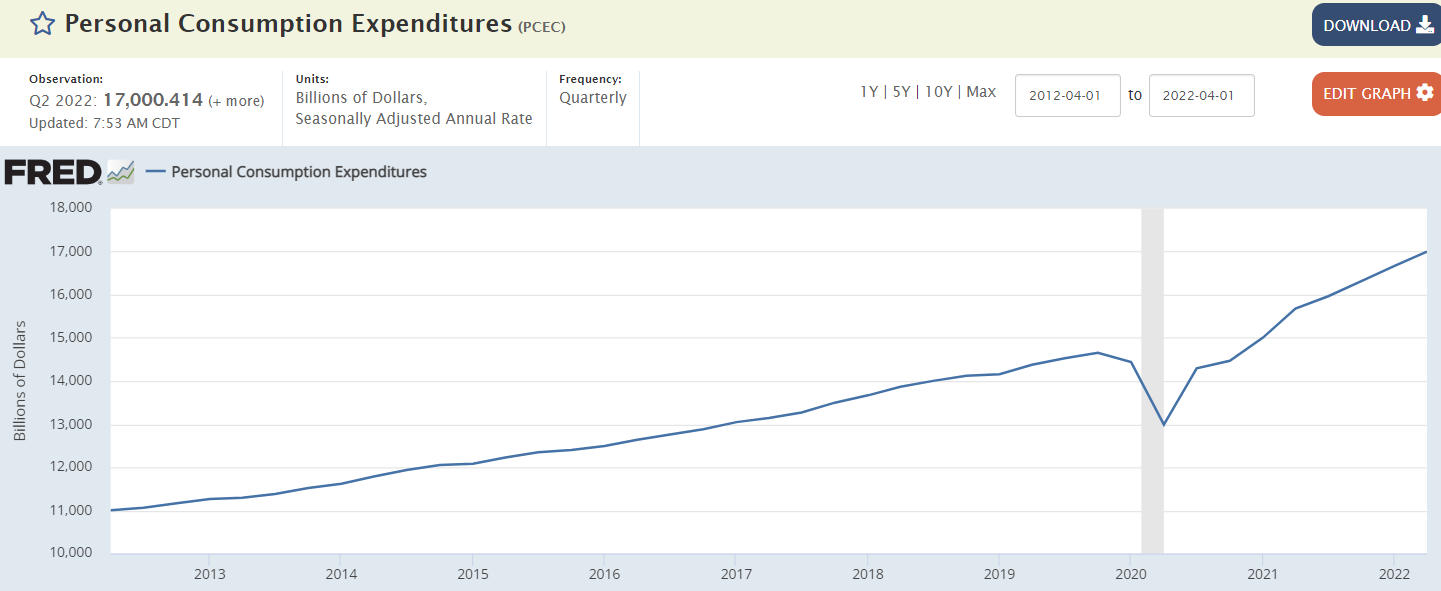

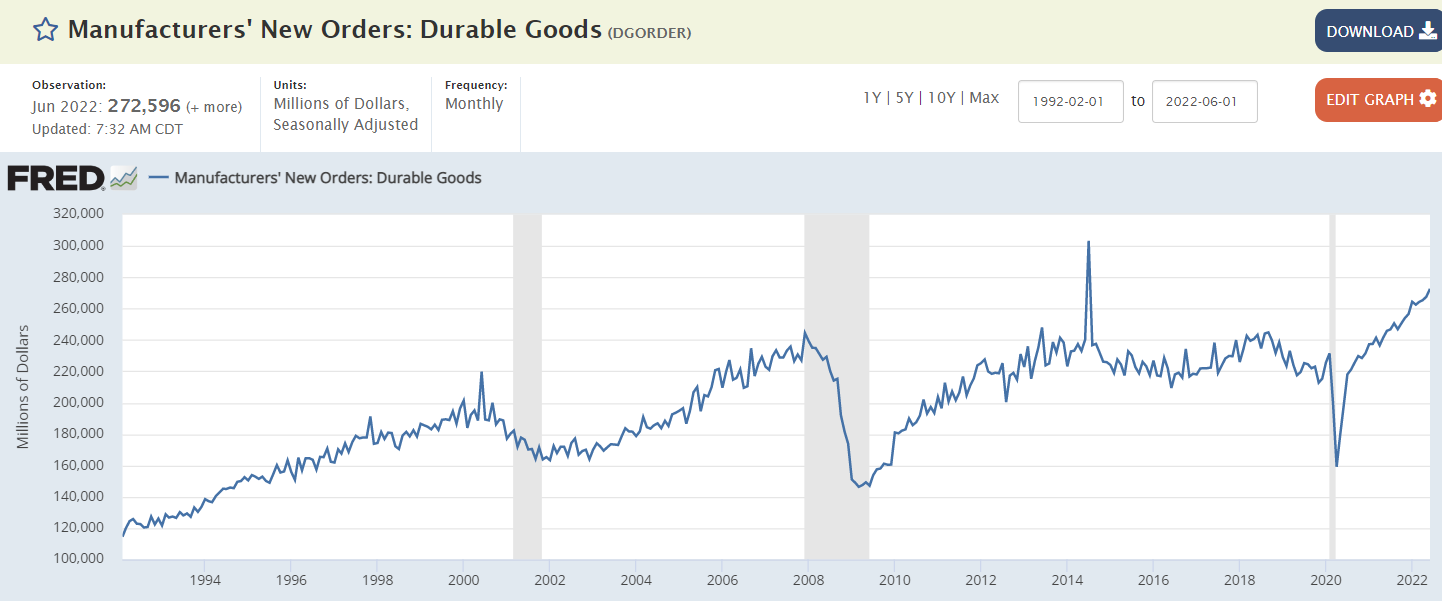

No sign of recession here:

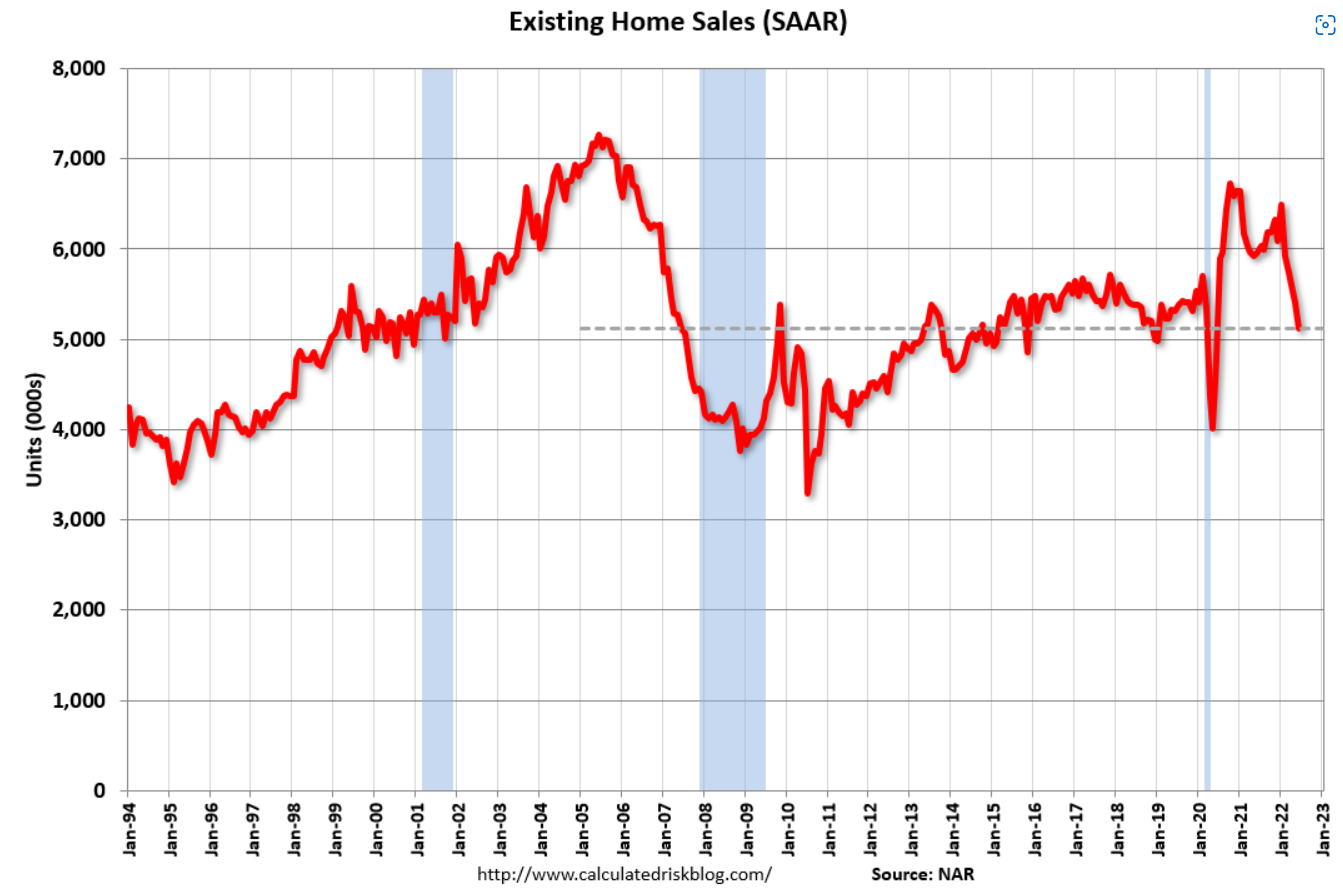

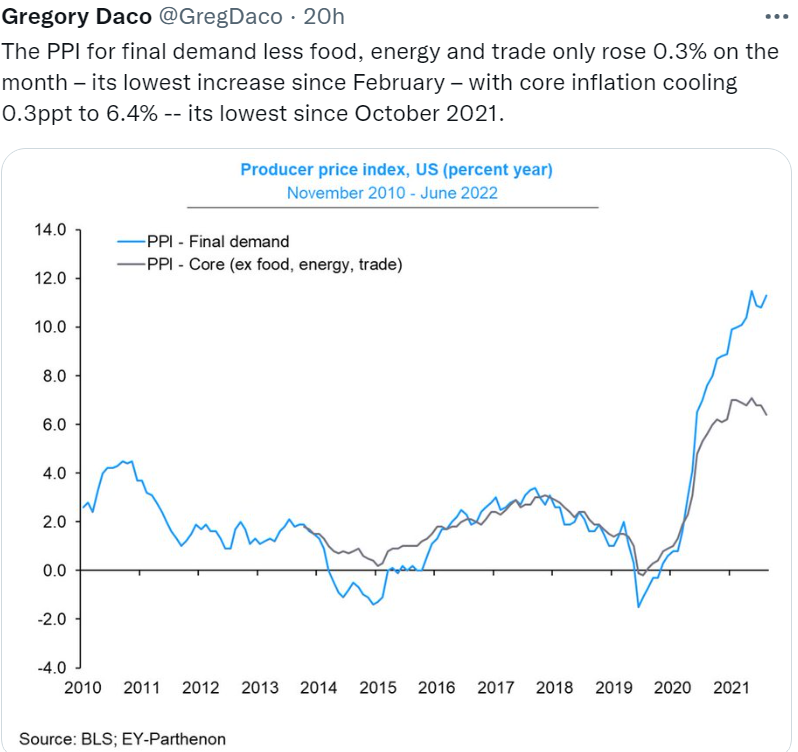

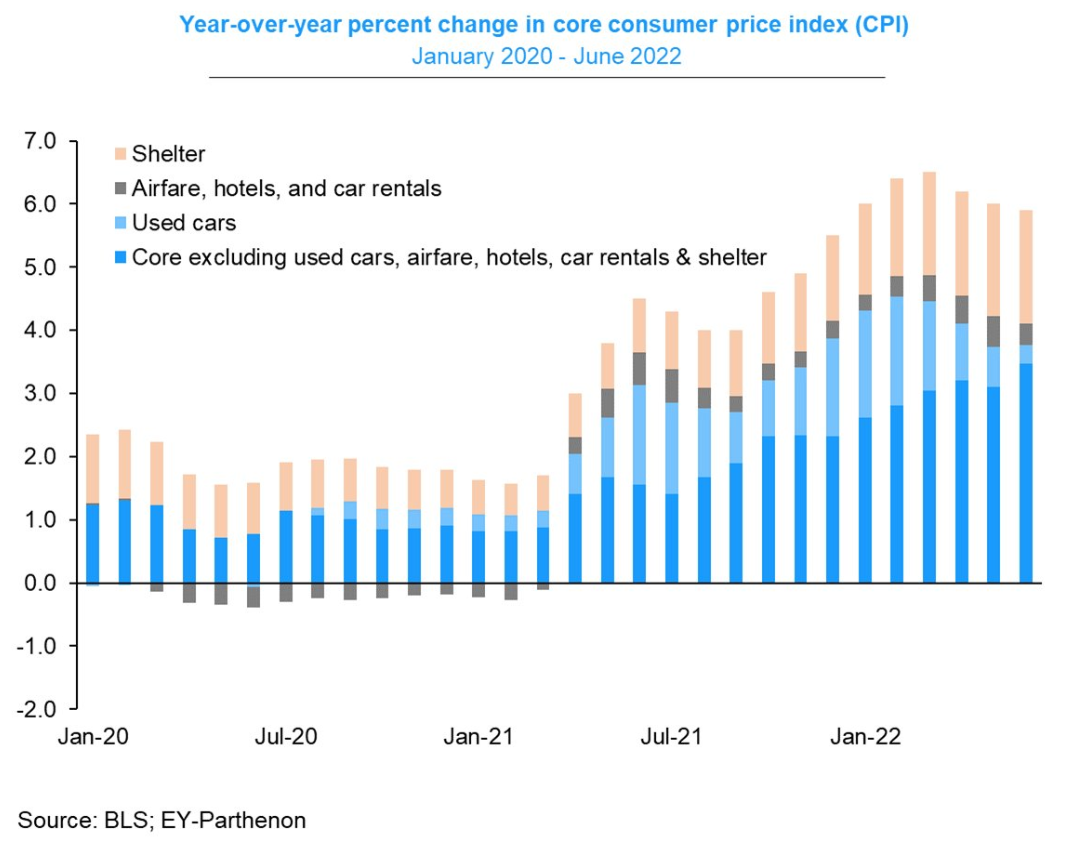

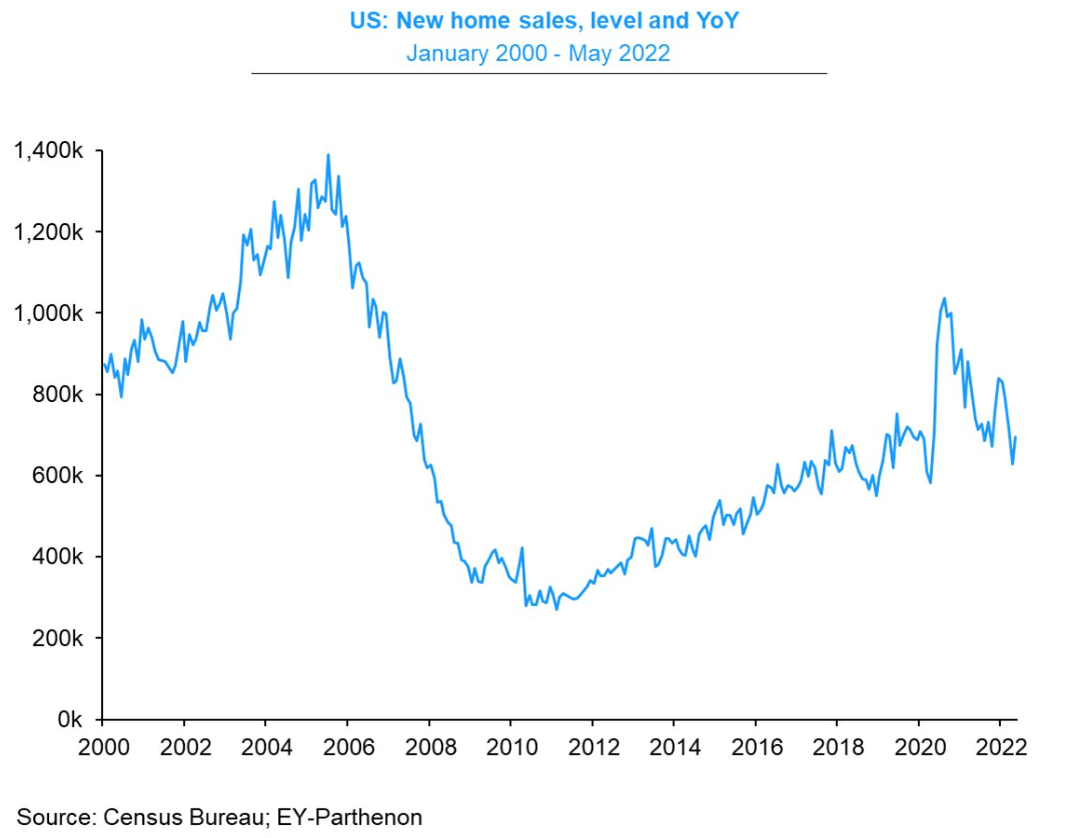

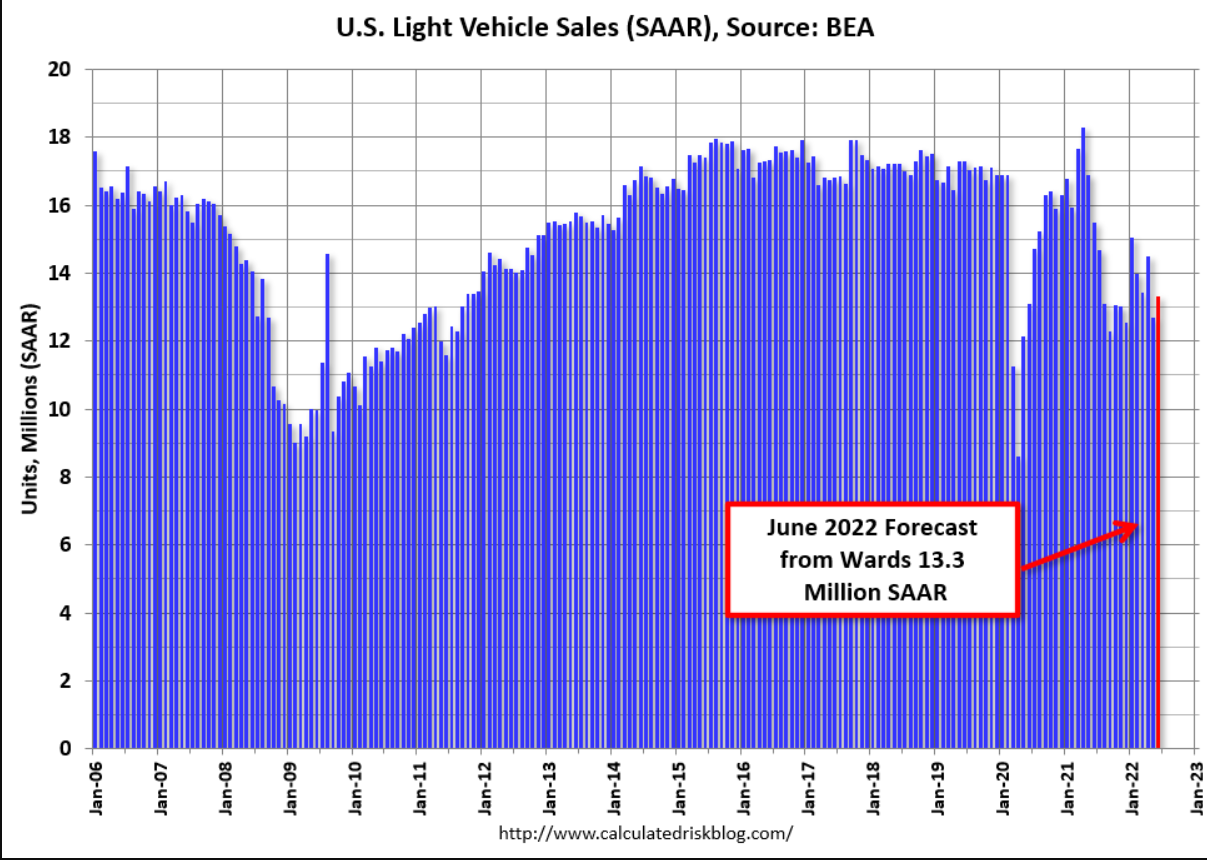

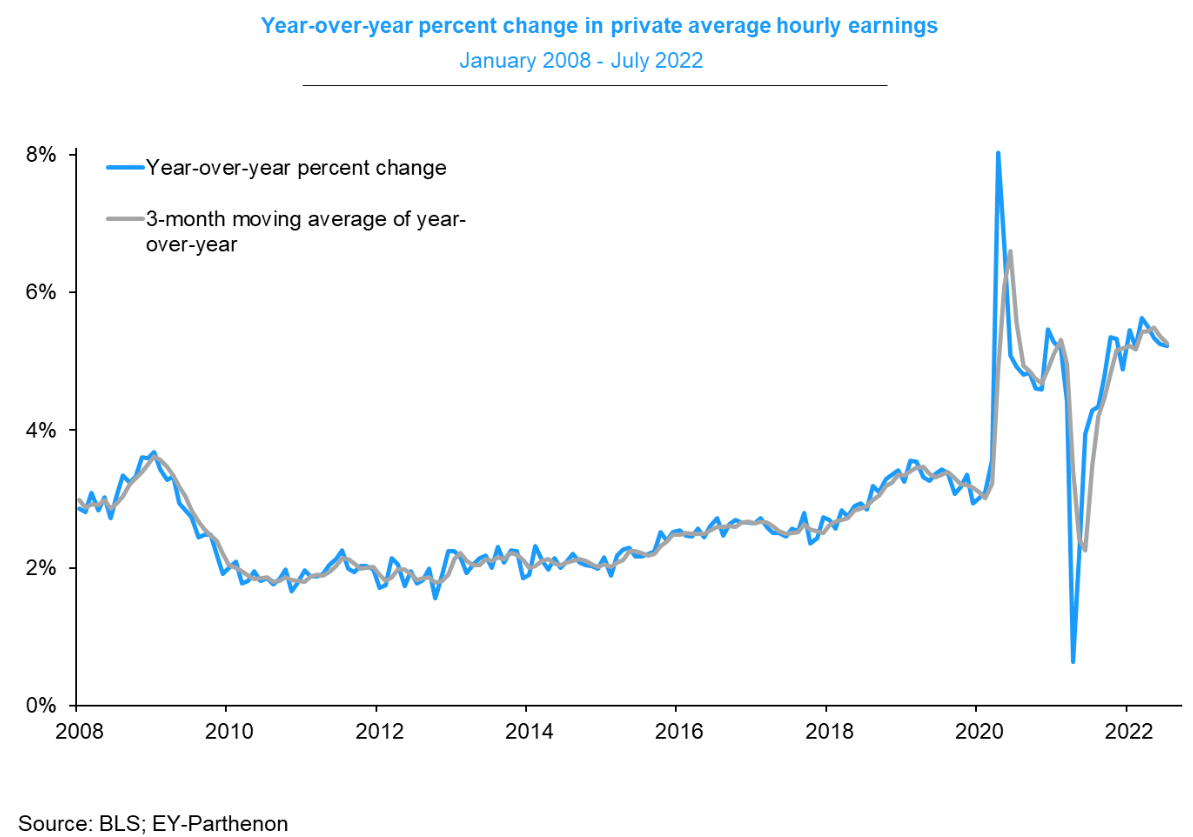

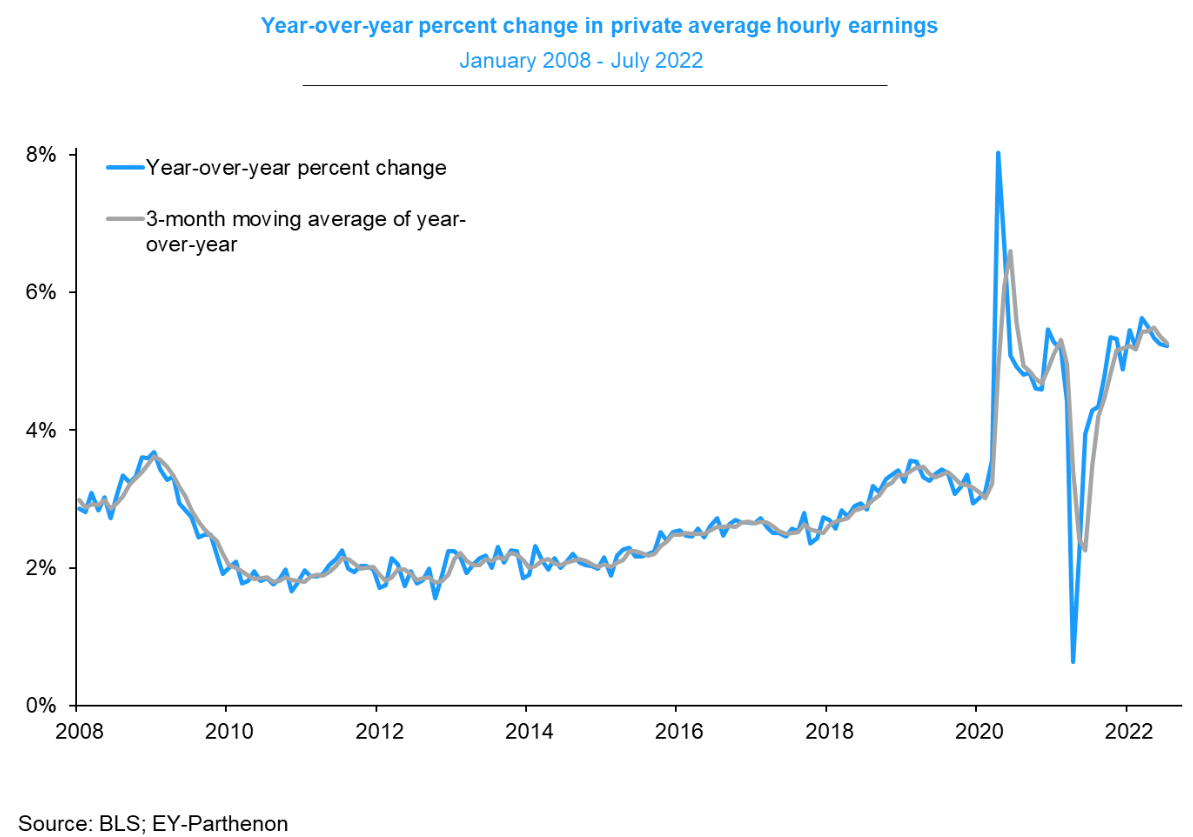

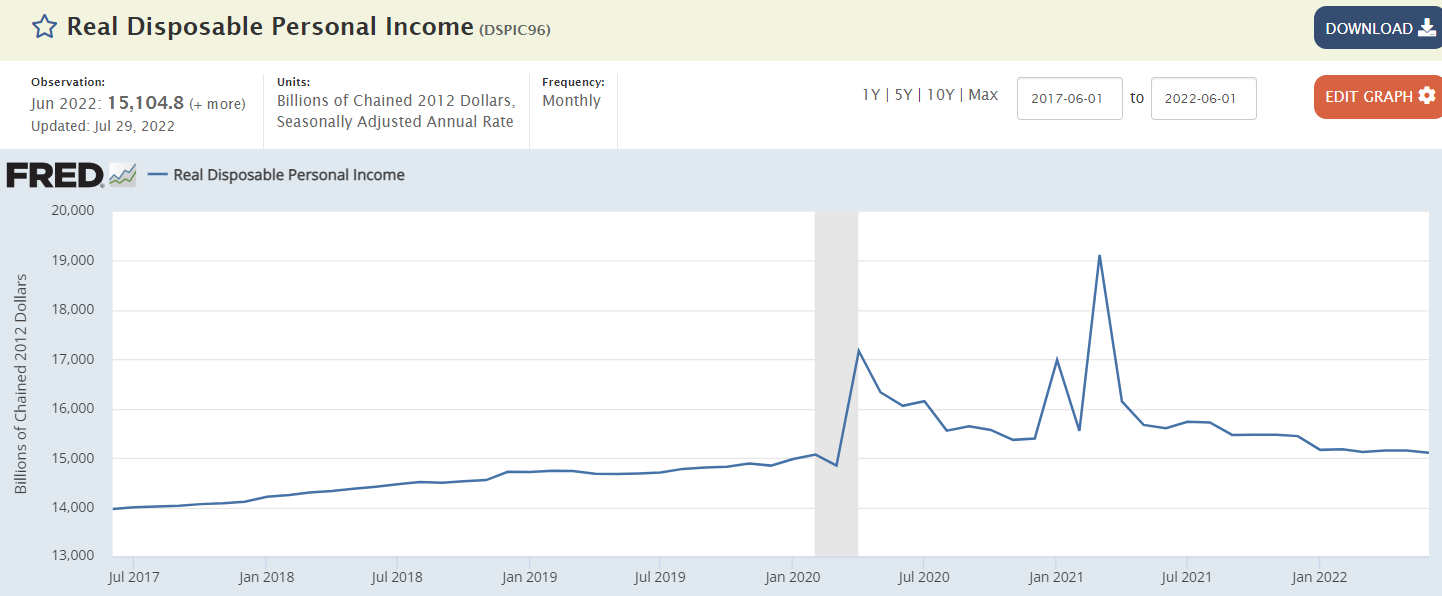

Still falling short of price increases so obviously not the cause:

Saudi Arabia sets Aug crude prices to Asia at near-record high | Reuter

Putin and MBS discuss oil less than week after Biden visit to Saudi Arabia (axios.com)