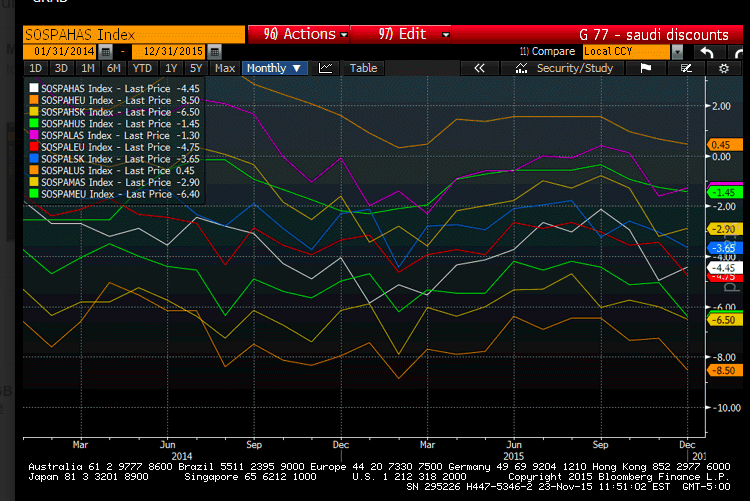

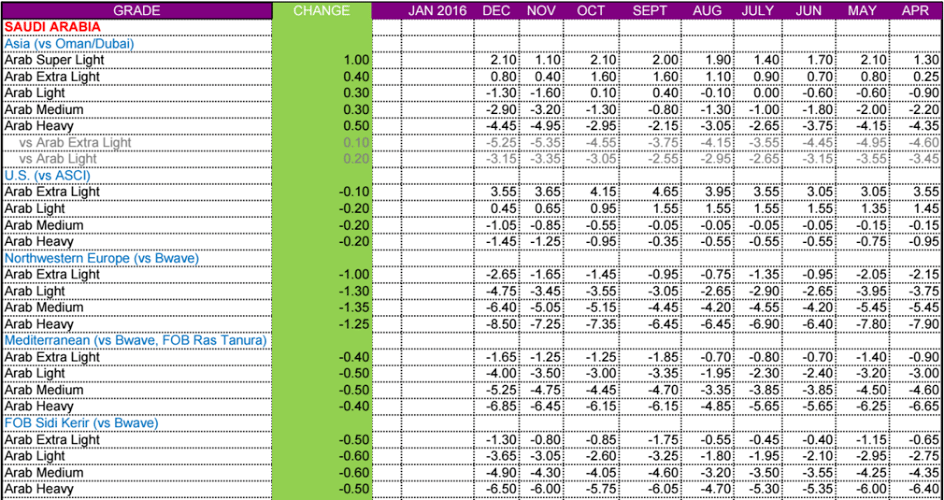

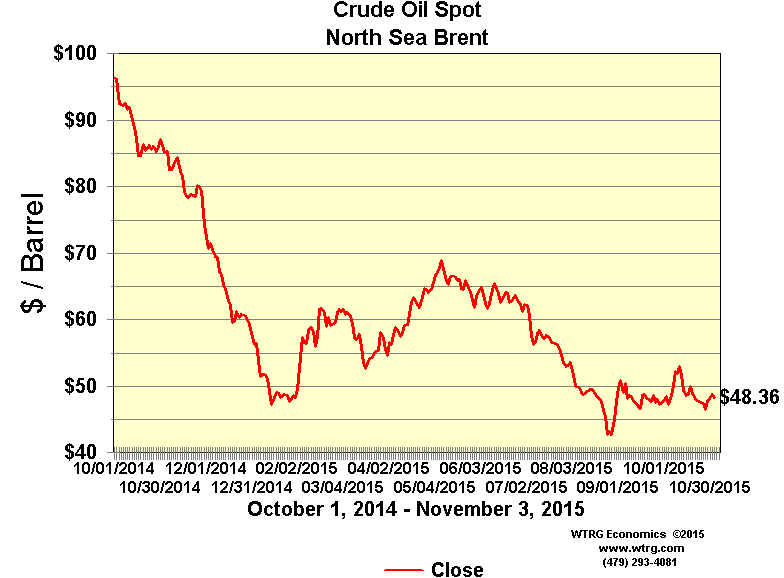

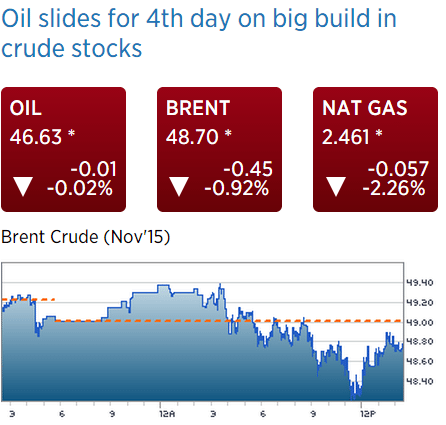

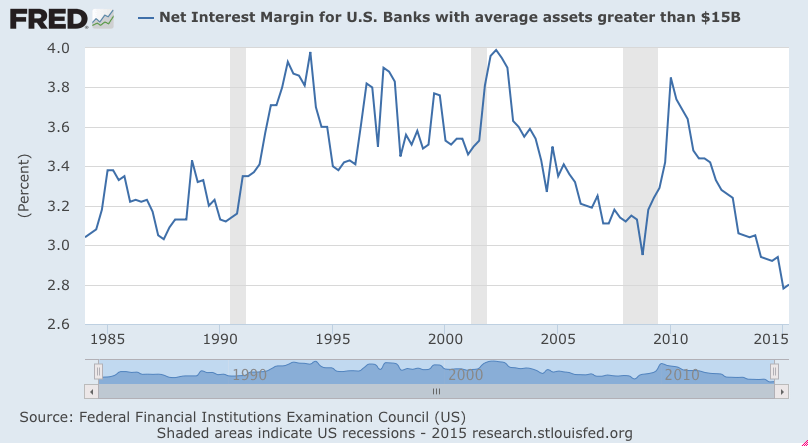

While demand for Saudi crude is up a bit, seems it’s still far below their presumed 12 million or so bpd capacity, and their strategy has been to lower their prices to the point where they are selling their full capacity:

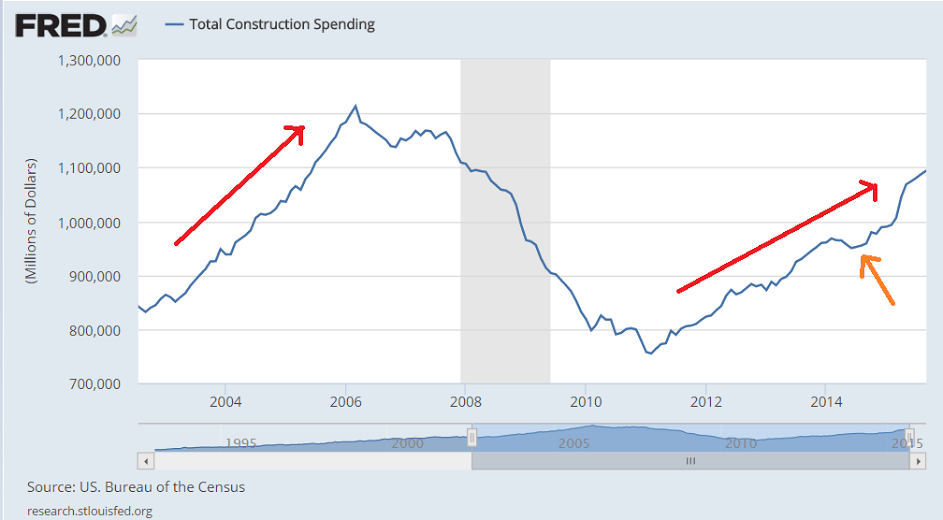

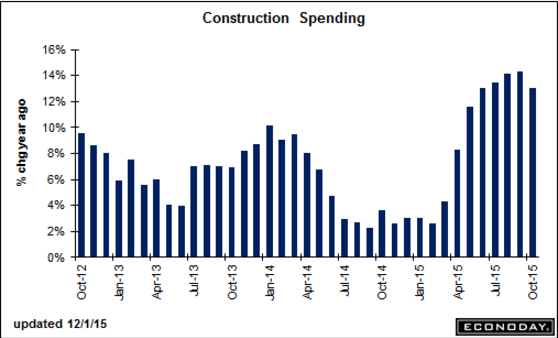

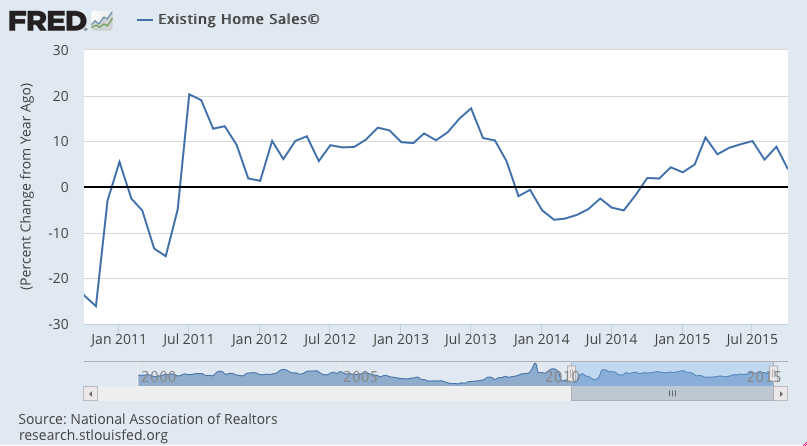

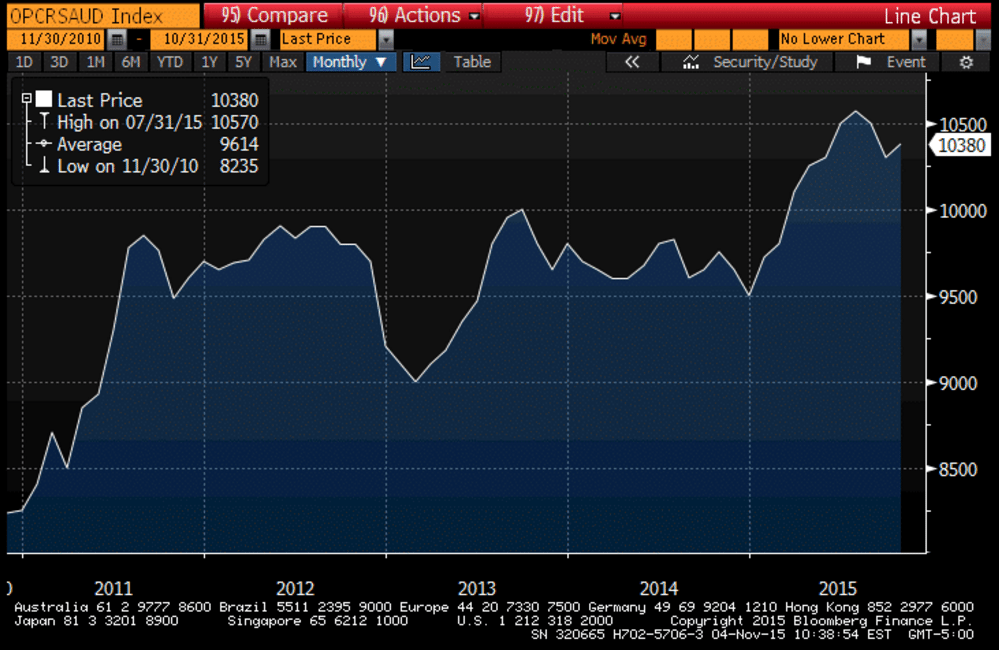

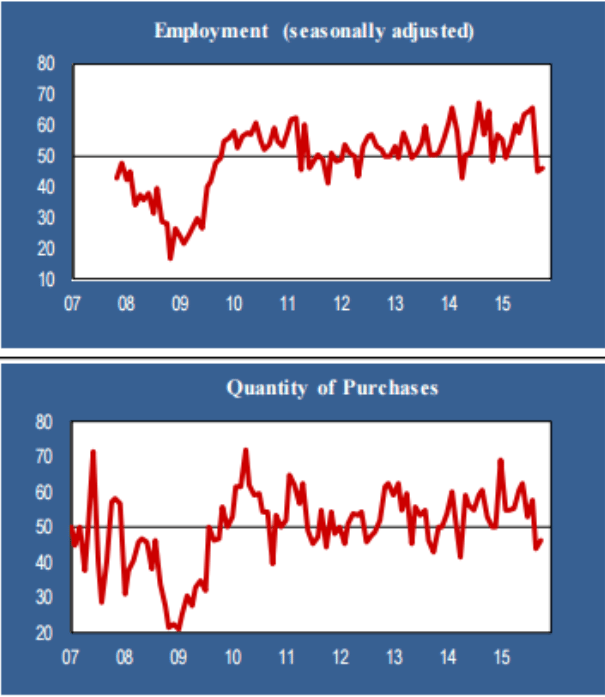

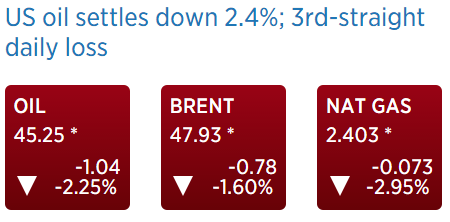

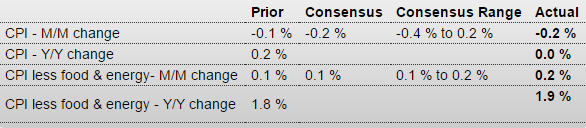

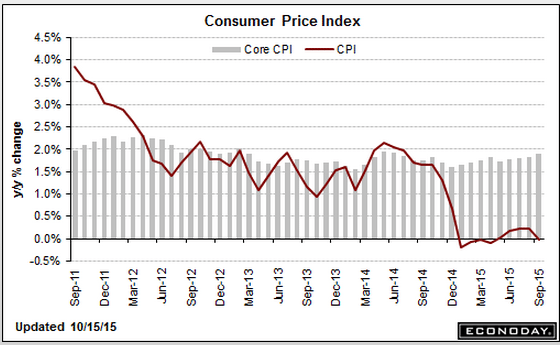

Nice bounce here, as the year over year comparisons get ‘easier’:

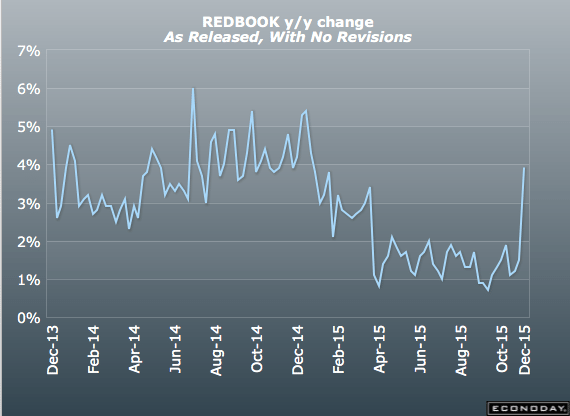

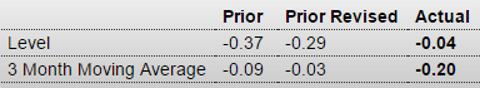

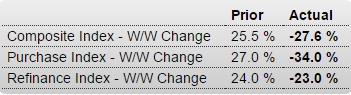

Redbook

Highlights

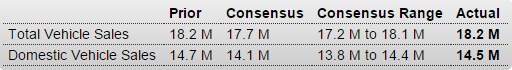

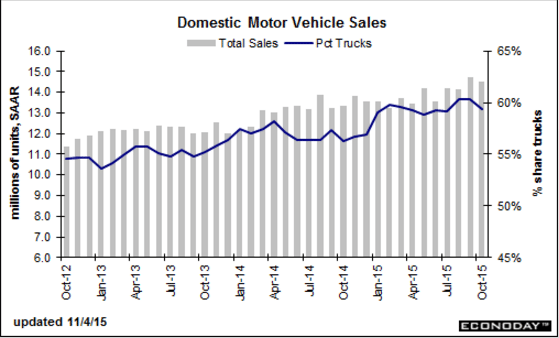

Store sales surged in the November 28 week, the week that includes Black Friday. Redbook’s same-store year-on-year sales tally jumped to plus 3.9 percent, more than doubling the pace of prior weeks and the strongest pace since the very beginning of the year. Yet the report is not upbeat, saying shoppers were drawn in by deep discounting. Other commentary on Black Friday notes that shoppers tend to shop for themselves, seeking big ticket items at a discount in buying that is not predictive of holiday sales. Still, the gain in this report offers positive evidence of consumer strength. Watch for motor vehicle sales later today for further evidence of consumer strength.

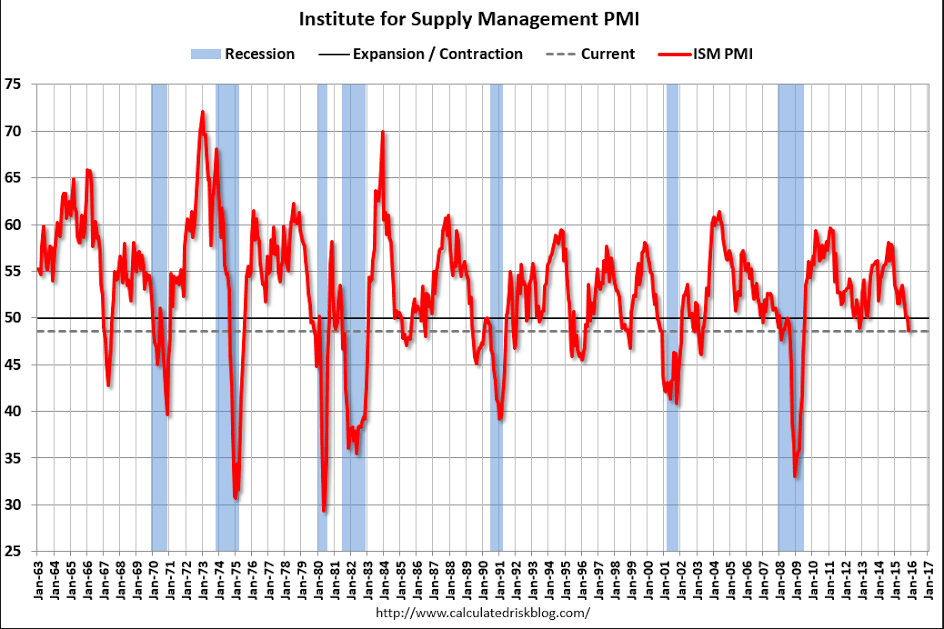

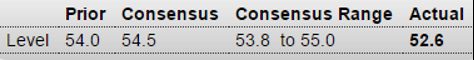

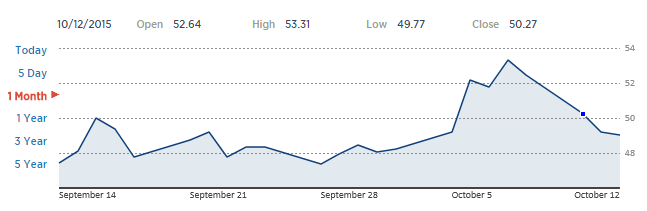

PMI Manufacturing Index

Highlights

Markit’s U.S. manufacturing sample, which has been reporting much stronger levels of activity than others, reports slower rates of growth in November. The final index for the month is 52.8 for a 2 tenths improvement from the flash but down a tangible 1.3 points from October.

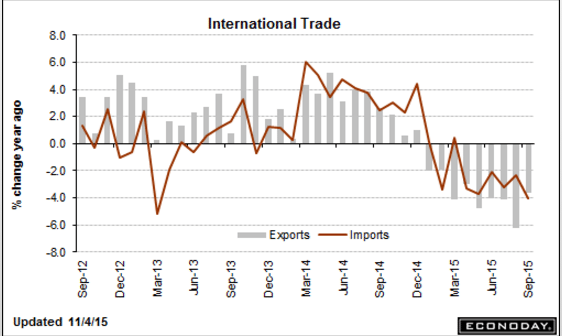

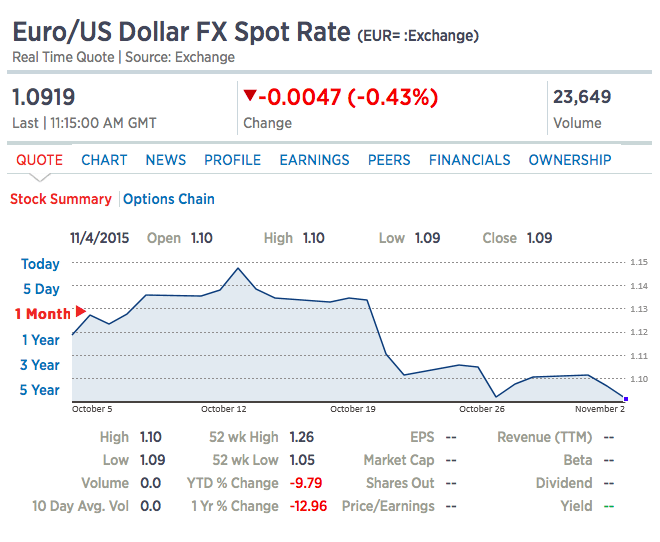

Softness in new orders, rising at their slowest pace in just over two years, is the chief reason for the dip. Export orders are in contraction, once again the result of weak foreign demand made weaker for U.S. goods by the strength of the dollar. Weakness in new orders is compounded by the first contraction in backlog orders since November last year. With orders down, output moderated in the month and manufacturers cut back inventories of finished goods.

Hiring is slowing and supply deliveries are improving, both indicative of weakness. Price readings remain mute.

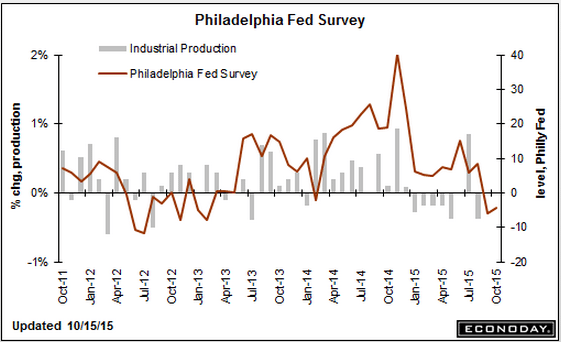

Though levels in this report are still pointing to growth, their weakness relative to prior months points perhaps to contraction in November for the factory sector which, however, bounced back in October, at least based on the industrial production and factory order reports. Watch for the ISM report coming up at 10:00 a.m. ET.

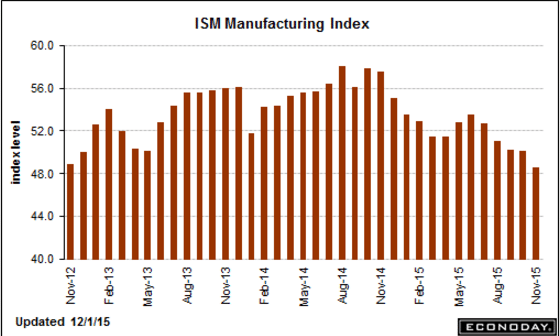

Particularly bad:

Highlights

After skirting right at the breakeven 50 line since September, ISM’s manufacturing index broke below in November to 48.6 which is more than 1 point below Econoday’s low-end estimate the lowest reading since June 2009. The decline includes a significant dip for new orders which are down 4.0 points to 48.9 and the lowest reading since August 2012. At 43.0, backlog orders are in a six-month streak of contraction. With orders down, ISM’s sample cut back on production, down nearly 4 points to 49.2, and cut back on inventories, down 3.5 points to 43.0. Employment firmed but remains soft at 51.3. This report is closely watched and will raise expectations for a quick reversal in the factory sector which, in October at least, showed glimpses of strength.

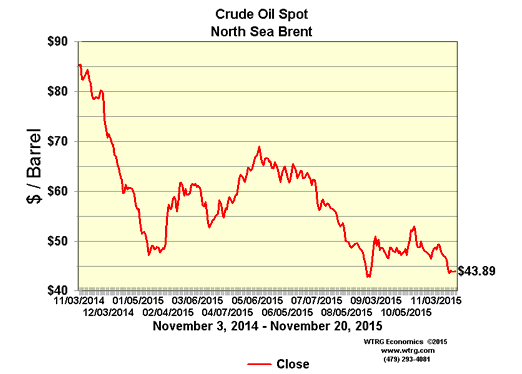

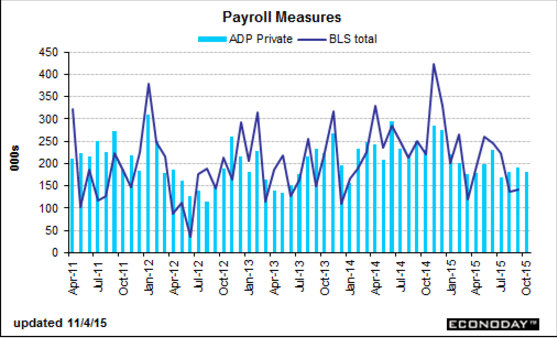

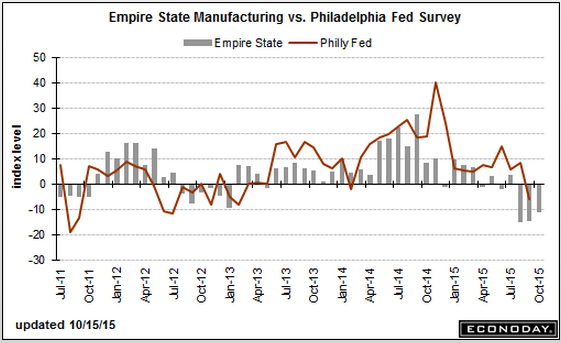

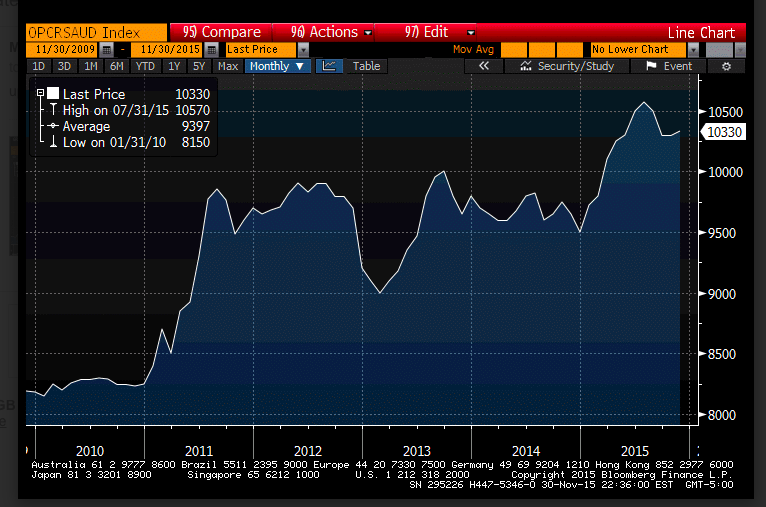

Note the deceleration since oil related capital expenditures collapsed about a year ago:

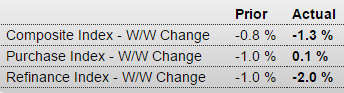

Not bad vs last month, but still depressed historically and as a % of GDP.

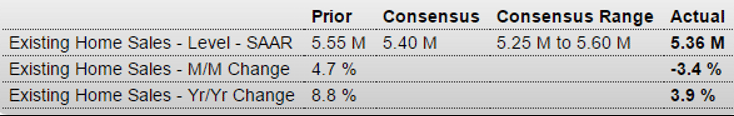

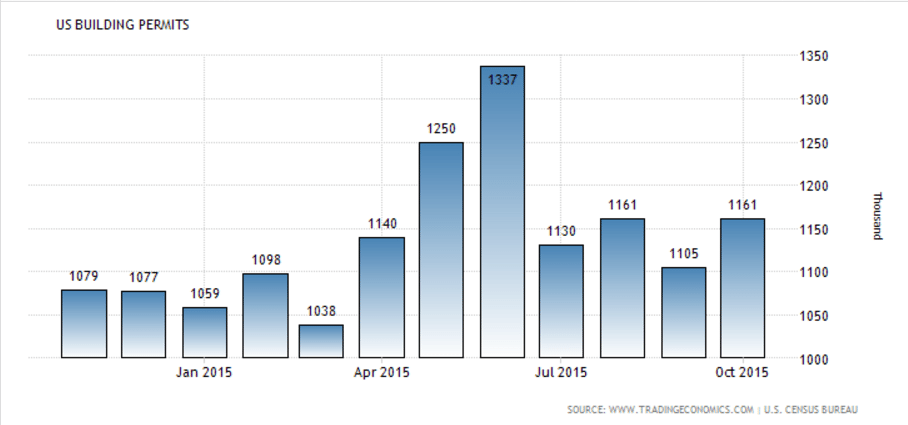

And in general it’s been softening since the surge in front of the NY tax breaks expired in June.

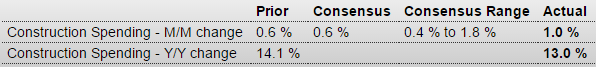

Highlights

Construction is one of the highlights of the 2015 economy with spending up a solid 1.0 percent in October for the best rate since May. Despite mixed signals from the housing sector, spending on residential construction is very solid, up 1.0 percent in October for a seventh straight gain and all of them convincing. Year-on-year, residential construction is up 16.6 percent vs 13.0 percent for total spending. Private non-residential spending rose 0.6 percent in October with the year-on-year rate at plus 15.3 percent. Public spending is holding down totals with the educational component unchanged in the month though Federal spending did jump, up 19.2 percent for a year-on-year rate of plus 10.7 percent which leads the public components. This report points to solid fourth-quarter contribution from construction.

From a previous report:

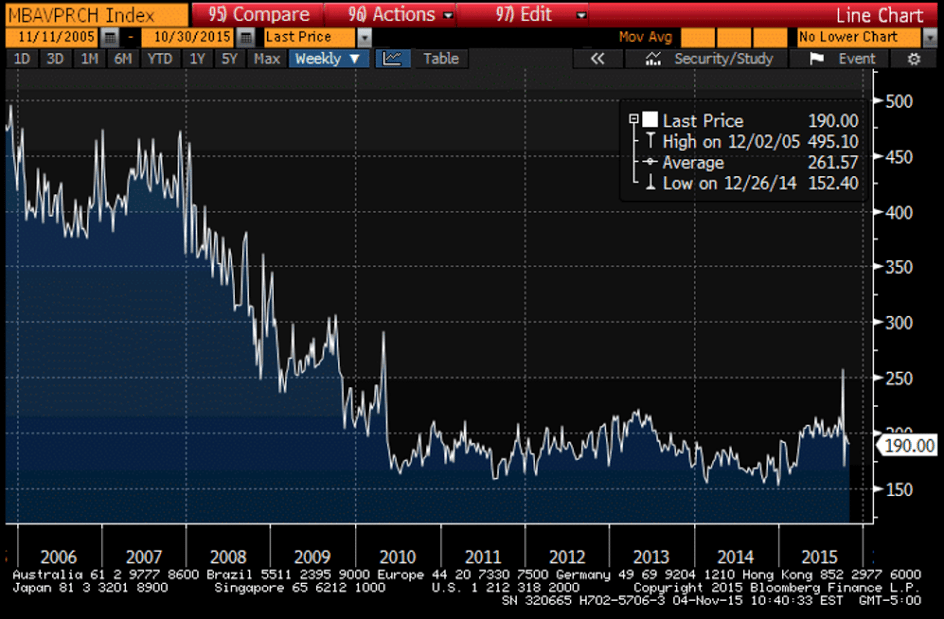

This chart hasn’t updated yet, and so is only through September, but you can see how the growth rate this cycle is well below last cycle, and how year over year comparisons will be a bit misleading for a while due to the dip last year: