QE is a Tax

By Chris Mayer

May 2 — QE is a tax.

That’s an odd thing to say about the Fed’s bond-buying stimulus program, known as quantitative easing, or QE. But the reality of QE is different than what most people think…

To talk about this, I sought out Warren Mosler, a former hedge fund manager and now trailblazing economist. (I first introduced Mosler to you in your February letter, No. 120. See “How Fiat Money Works.”) So on one Sunday afternoon, with Mosler in Italy and me in Gaithersburg, Md., we chatted on Skype about the Fed and its doings.

Mosler was also a successful banker, and he talks about this stuff with the ease that comes from deep familiarity with the plumbing of the system. The U.S. system, importantly, is one of floating exchange rates and a nonconvertible currency. Meaning the government does not fix the price of the dollar against anything (contra what is done in Hong Kong, where they peg their currency to the dollar). And it is not convertible into anything except itself. (You can’t present your dollars to the Fed and demand gold, for instance.)

With those parameters, we started with a simple question: What would the natural rate of interest be if the government didn’t try to interfere in the interest rate market? (“Natural rate” in this context means the risk-free, nominal rate of interest.)

“In some sense, QE is undoing what the Treasury has done.”

Well, before we can answer that, think about the ways the government interferes in the interest rate market. There are two ways, Mosler points out. The first is that the government pays interest on bank reserves, which are essentially checking accounts held at the Fed. Currently, that rate is 25 basis points, or 0.25%.

The second is to offer “alternative accounts at the Fed called Treasury securities.” These are essentially savings accounts and pay higher interest than the checking accounts (or reserve accounts).

“If we eliminated these things, there would no interest paid on reserves, and there would be no securities,” Mosler says. “So the natural rate of interest would be zero.” Like in Japan for 20 years.

Note this doesn’t mean there would be no interest rates. It means absent these interventions, the market would determine interest rates based on credit risk, etc. But there would be no floor — no risk-free rate, no natural rate — put in place by the government.

“Not that you should do it that way,” Mosler says, “but that’s the way to look at it. The base case is zero. Then the Treasury comes in and offers $17 trillion in securities. And that’s a distortion, to some degree. If the Fed did QE and bought them all back, it would put you back to where you started. In some sense, QE is undoing what the Treasury has done.” When the Fed buys securities, it is as if the Treasury never issued them in the first place.

Or as Mosler puts it in a tidy, eight-page paper (more on that in a bit):

It can be argued that asset pricing under a zero interest rate policy is the “base case” and that any move away from a zero interest rate policy constitutes a (politically implemented) shift from this “base case.”

In other words, the government doesn’t have to pay 3% on a 10-year note, as it does today. It doesn’t have to issue bonds at all. It creates dollar deposits (money) in member bank reserve accounts when it spends. By issuing securities/offering alternative interest-bearing accounts, the government pays a lot of interest to the economy.

“So in that sense,” Mosler says, “issuing securities means paying higher rates than the overnight rate. It is a spending increase and has an inflationary bias by adding net financial assets to the system.”

The mainstream view says that when the government sells Treasury securities, it is taking money out of the system, that it’s a deflationary thing to do and it offsets the inflationary effect of deficit spending. “Not true at all,” Mosler says. “Selling Treasuries does not take money out.” What’s happening is akin to a shuffle between checking accounts and savings accounts.

Let’s turn back to the case of QE, where the Fed buys securities. In this case, the economy loses the interest income from those securities.

“QE takes money out of the economy,” Mosler says, “which is what a tax does.” Hence, as noted above, QE is a tax.

“The whole point of QE is to bring rates down,” Mosler says. “If it does bring rates down, that means the rest of the securities the Treasury sells pay less interest too. So it lowers government interest expense even more. Because the government is a net payer of interest, lower rates mean it pays less interest.”

But does it help the economy? Hard to see how it does. Mosler has an interesting take here. I’ll paraphrase as best I can.

Let’s say people ask why the Fed is buying securities. Well, to help the economy. So now people have to think about whether that policy will work or not. If it’s going to work, that means the Fed’s going to be raising rates, because the economy will be getting stronger. The only time QE will bring rates down is if investors think the policy won’t work. It’s a policy that works through expectations, and it works only if investors think it won’t work.

“It’s a disgrace,” he says.

“On top of that, most investors don’t understand it,” Mosler says. “You’ve got the Chinese reading about how the Fed is printing money. And they go and buy gold. There are knock-on effects all over the world, and portfolios are shifting based on perceptions.”

QE, then, because it costs the private sector interest income and doesn’t add money to the economy, is not inflationary. “The evidence is that it is not inflationary,” Mosler says.

Let’s look at it another way. The bank of Japan has been trying to create inflation for 20 years. The Fed’s been trying to create inflation as hard as it can. The European Central Bank too. “It is not so easy for a central bank to create inflation,” he says, “or you’d think one of these guys would’ve succeeded.

“People act like you have to be careful because one false move on inflation expectations and, bang, you have hyperinflation,” Mosler chuckles. “If you know what that false move is, tell Janet Yellen [the current Fed chief], because she’s trying to find it.”

Though he no longer runs a hedge fund, Mosler is still involved in financial markets. He has a portfolio he runs for himself and for other people. I asked him if he fears interest rates going up.

“It could happen,” he says. “It’s a political decision where rates go.”

And that’s a good place to leave it. Because it brings us back to the beginning. Without the government wading into the interest rate market, the base rate would be zero. And everybody would be working off that. But instead, we have the Fed trying to find monetary nirvana.

As Mosler says, it’s a disgrace.

These are challenging ideas, I know. If you want to read more, look up “The Natural Rate of Interest is Zero,” a tightly reasoned, accessible eight-page paper by Mathew Forstater and Warren Mosler. You can find it free online.

Category Archives: Hong Kong

Asia Chart Alert: The destination of Asian exports – 30 Jul 2013

We need more QE

:(

From Nomura:

Seven countries in emerging Asia – China, Hong Kong, India, Korea, Singapore, Taiwan and Thailand – have released trade data for June, and year-on-year export growth in six of these was negative, the exception being Taiwan. For the “Asian 7” in aggregate, export growth slowed from 7.6% y-o-y in April to 0.3% in May, and to -2.0% in June.

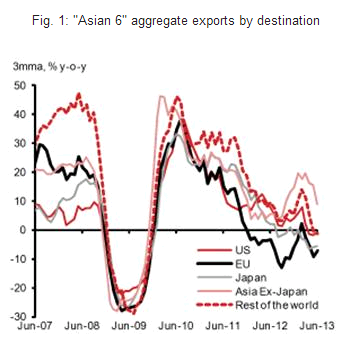

Of the Asian 7 all but India have released exports by destination, so from the remaining Asian 6 we can assess where demand for Asian exports is slackening. Earlier this year, Asian exports held up because weak shipments to Japan and the EU were offset by stronger shipments to the US, emerging Asia itself and the rest of the world.

However, in recent months there has been a broad-based weakening in Asian exports by destination. Even intra-Asian export growth has started to cool, in part due to China’s slowing economy. Much hinges on recoveries in some of the big advanced economies to counter ebbing growth in EM, but this has yet to show up in Asia’s export data.

Fitch says China credit bubble unprecedented…

Nothing that fiscal adjustment can’t keep from spilling over into the real economy.

But that’s not how the western educated offspring now in charge learned it…

Fitch says China credit bubble unprecedented in modern world history

By Ambrose Evans-Pritchard

June 16 (Telegraph) — China’s shadow banking system is out of control and under mounting stress as borrowers struggle to roll over short-term debts, Fitch Ratings has warned.

The agency said the scale of credit was so extreme that the country would find it very hard to grow its way out of the excesses as in past episodes, implying tougher times ahead.

“The credit-driven growth model is clearly falling apart. This could feed into a massive over-capacity problem, and potentially into a Japanese-style deflation,” said Charlene Chu, the agency’s senior director in Beijing.

“There is no transparency in the shadow banking system, and systemic risk is rising. We have no idea who the borrowers are, who the lenders are, and what the quality of assets is, and this undermines signalling,” she told The Daily Telegraph.

While the non-performing loan rate of the banks may look benign at just 1pc, this has become irrelevant as trusts, wealth-management funds, offshore vehicles and other forms of irregular lending make up over half of all new credit. “It means nothing if you can off-load any bad asset you want. A lot of the banking exposure to property is not booked as property,” she said.

Concerns are rising after a string of upsets in Quingdao, Ordos, Jilin and elsewhere, in so-called trust products, a $1.4 trillion (0.9 trillion) segment of the shadow banking system.

Bank Everbright defaulted on an interbank loan 10 days ago amid wild spikes in short-term “Shibor” borrowing rates, a sign that liquidity has suddenly dried up. “Typically stress starts in the periphery and moves to the core, and that is what we are already seeing with defaults in trust products,” she said.

Fitch warned that wealth products worth $2 trillion of lending are in reality a “hidden second balance sheet” for banks, allowing them to circumvent loan curbs and dodge efforts by regulators to halt the excesses.

This niche is the epicentre of risk. Half the loans must be rolled over every three months, and another 25pc in less than six months. This has echoes of Northern Rock, Lehman Brothers and others that came to grief in the West on short-term liabilities when the wholesale capital markets froze.

Mrs Chu said the banks had been forced to park over $3 trillion in reserves at the central bank, giving them a “massive savings account that can be drawn down” in a crisis, but this may not be enough to avert trouble given the sheer scale of the lending boom.

Overall credit has jumped from $9 trillion to $23 trillion since the Lehman crisis. “They have replicated the entire US commercial banking system in five years,” she said.

The ratio of credit to GDP has jumped by 75 percentage points to 200pc of GDP, compared to roughly 40 points in the US over five years leading up to the subprime bubble, or in Japan before the Nikkei bubble burst in 1990. “This is beyond anything we have ever seen before in a large economy. We don’t know how this will play out. The next six months will be crucial,” she said.

The agency downgraded China’s long-term currency rating to AA- debt in April but still thinks the government can handle any banking crisis, however bad. “The Chinese state has a lot of firepower. It is very able and very willing to support the banking sector. The real question is what this means for growth, and therefore for social and political risk,” said Mrs Chu.

“There is no way they can grow out of their asset problems as they did in the past. We think this will be very different from the banking crisis in the late 1990s. With credit at 200pc of GDP, the numerator is growing twice as fast as the denominator. You can’t grow out of that.”

The authorities have been trying to manage a soft-landing, deploying loan curbs and a high reserve ratio requirement (RRR) for banks to halt property speculation. The home price to income ratio has reached 16 to 18 in many cities, shutting workers out of the market. Shadow banking has plugged the gap for much of the last two years.

However, a new problem has emerged as the economic efficiency of credit collapses. The extra GDP growth generated by each extra yuan of loans has dropped from 0.85 to 0.15 over the last four years, a sign of exhaustion.

Wei Yao from Societe Generale says the debt service ratio of Chinese companies has reached 30pc of GDP – the typical threshold for financial crises — and many will not be able to pay interest or repay principal. She warned that the country could be on the verge of a “Minsky Moment”, when the debt pyramid collapses under its own weight. “The debt snowball is getting bigger and bigger, without contributing to real activity,” she said.

The latest twist is sudden stress in the overnight lending markets. “We believe the series of policy tightening measures in the past three months have reached critical mass, such that deleveraging in the banking sector is happening. Liquidity tightening can be very damaging to a highly leveraged economy,” said Zhiwei Zhang from Nomura.

“There is room to cut interest rates and the reserve ratio in the second half,” wrote a front-page editorial today in China Securities Journal on Friday. The article is the first sign that the authorities are preparing to change tack, shifting to a looser stance after a drizzle of bad data over recent weeks.

The journal said total credit in China’s financial system may be as high as 221pc of GDP, jumping almost eightfold over the last decade, and warned that companies will have to fork out $1 trillion in interest payments alone this year. “Chinese corporate debt burdens are much higher than those of other economies. Much of the liquidity is being used to repay debt and not to finance output,” it said.

It also flagged worries over an exodus of hot money once the US Federal Reserve starts tightening. “China will face large-scale capital outflows if there is an exit from quantitative easing and the dollar strengthens,” it wrote.

The journal said foreign withdrawals from Chinese equity funds were the highest since early 2008 in the week up to June 5, and withdrawals from Hong Kong funds were the most in a decade.

China’s Manufacturing Growth Slows as Economic Recovery Falters

More signs the new, western educated/monetarist generation is restricting credit growth at the ‘state lending’ and local govt level:

China’s Manufacturing Growth Slows as Economic Recovery Falters

April 23 (Bloomberg) — China’s manufacturing is expanding at a slower pace this month on weakness in global and domestic demand, fueling concern that the world’s second-biggest economy is faltering.

The preliminary reading of 50.5 for a Purchasing Managers’ Index (EC11CHPM) released by HSBC Holdings Plc and Markit Economics compared with a final 51.6 for March. The number was also below the median 51.5 estimate in a Bloomberg News survey of 11 analysts. A reading above 50 indicates expansion.

China’s stocks slumped as the data provided further evidence of an economic slowdown after weaker-than-estimated numbers for gross domestic product last week prompted banks including Goldman Sachs Group Inc. to cut full-year forecasts. In Washington, central bank Governor Zhou Xiaochuan said April 20 that a 7.7 percent first-quarter expansion was reasonable and “normal,” highlighting reduced expectations after 10 percent- plus rates during the past decade.

“This paints a picture of a continued painfully slow recovery for China’s manufacturing sector,” said Yao Wei, a Societe Generale SA economist based in Hong Kong. “The government needs to help translate the easy liquidity conditions into real growth.”

President Xi Jinping’s officials are grappling with constraints on export demand, property-market overheating, the risks associated with a surge in so-called shadow banking, and weakness in consumption because of a campaign to rein in official perks such as spending on banquets.

The Shanghai Composite Index fell 2.6 percent, the biggest decline in three weeks.

BOJ Shockwave Leveling Rates Sends Banks to Dollar: Japan Credit

Bad for US banks if they are coming to compete in the US market again.

This will cut into net interest margins.

BOJ Shockwave Leveling Rates Sends Banks to Dollar: Japan Credit

By Monami Yui & Emi Urabe

April 16 (Bloomberg) — Shizuoka Bank Ltd. (8355) joined Japanese national lenders in expanding U.S. dollar finance activity, anticipating monetary easing will crush margins on yen loans.

The nations second-biggest regional bank by market value raised $500 million in zero-coupon notes due 2018, the first public sale of dollar-denominated convertible bonds by a Japanese company since 2002. The average interest rate on long- term yen loans from the countrys lenders fell to 0.942 percent in February, compared with 3.348 percent companies worldwide pay on dollar facilities, according to data compiled by Bloomberg.

Mitsubishi UFJ Financial Group Inc. plans to increase energy and utility financing in the U.S., as the Bank of Japan (8301)s focus on cutting long-term borrowing costs undercuts earnings from yen loans, President Nobuyuki Hirano said. Sumitomo Mitsui (8316) Financial Group Inc. aims to sell a record amount of dollar bonds this year for overseas business, even as the BOJ policy seeks to spur domestic lending to revive the economy.

You know its a big deal when a conservative lender like Shizuoka Bank does this, a sure sign that yen debt is just not cutting it anymore, said Nozomi Kokubun, a Tokyo-based analyst at SMBC Nikko Securities Inc. Dollar-denominated loans are attractive for banks because they offer a spread you simply wont find in Japan.

Excess Cash

Prime Minister Shinzo Abes call to boost fiscal and monetary stimulus hasnt been enough to spark corporate demand for loans, leaving Japans banks with a record amount of excess cash. Customer deposits held by Japanese lenders exceeded loans by 176.3 trillion yen ($1.8 trillion) in March, central bank data show.

The BOJ decided on April 4 to double monthly bond buying to 7.5 trillion yen and lengthened the average maturity of the purchases by twofold to about seven years. The central banks previous program under Governor Masaaki Shirakawa focused on notes maturing in one to three years.

The announcement sent Japans benchmark 10-year bond yield to a record low of 0.315 percent the following day. The rate surged to almost double that level in the same session and traded 6 1/2 basis points lower at 0.575 percent as of 2:20 p.m. in Tokyo today.

Without Precedent

This round of monetary easing is without precedent and we must prepare for the interest rates to fall even further, Mitsubishi UFJs Hirano said in an interview on April 8. The decline in yen-denominated interest rates is weighing heavily on earnings from capital.

The average interest rate on long-term loans from Japans six so-called city banks, which include Mitsubishi UFJ, Sumitomo Mitsui and Mizuho Financial Group Inc., dropped below 1 percent for the first time in January and was 1.01 percent in February, according to data compiled by Bloomberg. The rate for regional banks was 1.097 percent, after matching a record low of 1.075 percent in December, the data show.

Elsewhere in Japans credit markets, Nissan Motor Co. plans to price about 60 billion yen of five- and seven-year bonds later this week, according to a person familiar with the matter. The automaker is marketing 50 billion yen of the shorter-term notes at 16 to 21 basis points more than government debt and the remainder at an 18 to 24 basis point spread, the person said, asking not to be name because the terms arent set. A basis point is 0.01 percentage point.

7-Eleven Bonds

Seven & I Holdings Co. plans to raise 60 billion yen split between three-, six- and 10-year bonds, marketing all tranches at a yield spread of 10 to 14 basis points, a separate person familiar with the matter said yesterday. The operator of 7- Eleven convenience stores last sold debt in June 2010, offering 80 billion yen of seven- and 10-year debt, according to data compiled by Bloomberg.

A Ministry of Finance sale of about 2.5 trillion yen of five-year notes today attracted bids valued at 3.09 times the amount available, showing the weakest demand since December 2011, according to ministry data. The gap between the average and low prices at the auction was 0.05, the widest since June 2008, another sign of low demand.

Shizuoka Banks offering is the first sale of convertible notes by a Japanese company in the U.S. currency since Orix Corp.s May 2002 offering, according to Hiromitsu Umehara, a Tokyo-based general manager in its banking department. The lender, headquartered in Shizuoka Prefecture west of Tokyo, home to Suzuki Motor Corp. and Yamaha Corp., will use the proceeds to fund dollar offerings to its mostly Japanese clients seeking to expand overseas, Umehara said.

Loan Demand

Domestic loan demand should gradually improve, but at this moment company spending remains at a low level, said Shigeki Makita, deputy general manager at Shizuoka Banks corporate planning department. Higher interest rates on dollar loans make overseas facilities more profitable than domestic lending, he said.

Japans corporate bonds have handed investors a 0.56 percent return this year, compared with a 1.43 percent gain for the nations sovereign notes, according to Bank of America Merrill Lynch index data. Company debt worldwide has climbed 1.54 percent.

The yen traded at 97.41 per dollar at 2:30 p.m. in Tokyo today, after falling to a four-year low of 99.95 last week. The currency has plunged 10 percent this year, the worst performance among the 10 developed-market currencies tracked by the Bloomberg Correlation Weighted Indexes.

Sovereign Risk

The cost to insure Japans sovereign notes for five years against nonpayment was at 71 basis points yesterday, after reaching 78 earlier this month, the highest since Jan. 23, according to data provider CMA, which is owned by McGraw-Hill Cos. and compiles prices quoted by dealers in the privately negotiated market. A drop in the credit-default swaps signals improving perceptions of creditworthiness.

Japanese regional lenders and megabanks alike are very keen on opportunities for dollar financing, SMBC Nikkos Kokubun said. They dont even have to use the proceeds for lending and may just accumulate overseas securities.

Sumitomo Mitsuis lending unit targets two issuances that could total as much as $4.5 billion, matching last years amount as the most in the companys 11-year history, President Koichi Miyata said in a Dec. 19 interview. The two sales would range from $1 billion to $3 billion each, he said.

Sale Ranking

The bank raised 2.15 trillion yen from dollar bond sales this year, making it the third-largest Japanese borrower in the currency after Mitsubishi UFJ with 2.25 trillion yen, according to data compiled by Bloomberg. Toyota Motor Corp. led the rankings with 3.193 trillion yen, the data show.

Mitsubishi UFJ is looking to buy a regional bank on the west coast of the U.S., President Hirano said. The Tokyo-based lender acquired San Francisco-based UnionBanCal Corp. in 2008 and Santa Barbara, California-based Pacific Capital Bancorp last year as persistent deflation inhibits loan demand at home.

The balance of outstanding loans at Japanese banks rose 0.6 percent to 404.8 trillion yen in March, the highest level since April 2009, according to data compiled by Bloomberg. Lending by city banks climbed to 199.1 trillion yen in the period, 3.7 percent short of the level three years ago, the data show.

Theres been great demand for dollar funding among Japanese banks as they increase lending overseas, said Chikako Horiuchi, a Hong Kong-based analyst at Fitch Ratings Ltd. The trend is likely to continue.

China’s Economic Data Show Weakest Start Since 2009

China’s Economic Data Show Weakest Start Since 2009

March 10 (Bloomberg) — China’s industrial output had the weakest start to a year since 2009 and lending and retail sales growth slowed, toughening challenges for a new leadership that wants to narrow the gap between rich and poor.

Production increased 9.9 percent in the first two months and retail sales rose 12.3 percent, government data showed March 9, trailing economists’ estimates. New local-currency loans in February fell to 620 billion yuan ($99.6 billion), the People’s Bank of China said yesterday, lower than the estimates of 27 out of 28 analysts in a Bloomberg News survey.

Strengthening U.S. demand after the unemployment rate fell to a four-year low may help incoming Premier Li Keqiang achieve the 7.5 percent expansion in gross domestic product sought by policy makers entering the final week of their meeting at the National People’s Congress in Beijing. China’s exports jumped 23.6 percent in the first two months of the year, the most for a January-February period since 2010.

“Exports are still an important growth driver for China so the pickup should make policy makers less concerned about the disappointment in some of the other indicators,” said Louis Kuijs, chief China economist at Royal Bank of Scotland Plc in Hong Kong. “When push comes to shove, they know the recipe to kick-start growth, so if things do slow down to a rate they aren’t comfortable with, they can encourage investment.”

At the same time, February credit data indicate the central bank may be working to contain the expansion in lending and aggregate financing that started last year, said Kuijs, who previously worked as an economist for the World Bank in Beijing.

Increasing Optimism

New local-currency loans in February trailed the 700 billion yuan median estimate in a Bloomberg survey and were lower than the 710.7 billion yuan in the same month last year and the 1.07 trillion yuan figure in January. Aggregate financing, a broader measure of credit, fell to 1.07 trillion yuan last month from a record 2.54 trillion yuan the previous month, PBOC data showed.

U.S. stocks have risen 8.8 percent this year, compared with a 2.2 percent gain in the Chinese benchmark index, as optimism increases that the world’s biggest economy is responding to an unprecedented monetary stimulus. In China, the decline in four February purchasing managers’ indexes, and official data released over the past week, are raising concerns that a recovery that started in the fourth quarter may be peaking even as house-price gains accelerate and inflation risks increase.

Spending Crackdown

The growth in January-February retail sales was below the lowest economist projection of 13.8 percent and was the smallest for that period since 2004. The moderation follows a crackdown by new Communist Party chief Xi Jinping on lavish spending by government officials and state-owned companies, part of efforts to curb corruption and waste.

Shares of Kweichow Moutai Co. (600519), maker of the eponymous high- end white spirit, have dropped 19 percent since Xi took power on Nov. 15, compared with a 14 percent gain in the Shanghai Composite Index.

The increase in factory output compared with the 10.6 percent median estimate in a Bloomberg survey. The statistics bureau doesn’t break out figures for January and February retail sales and industrial output in an attempt to smooth distortions caused by the timing of the Lunar New Year holiday.

Fixed-asset investment excluding rural areas in the first two months of the year rose 21.2 percent, against a median economist estimate of 20.7 percent and a 20.6 percent pace for the whole of 2012.

Inflation Worry

Consumer prices climbed a more-than-estimated 3.2 percent in February from a year earlier. Standard Chartered Plc estimates inflation will average 4 percent this year, compared with the government’s target of 3.5 percent.

“From a monetary policy perspective, by mid-2013, the inflation issue should begin to move up policy makers’ list of things to worry about,” Li Wei, a Shanghai-based economist with Standard Chartered, said in March 9 note. Li forecasts the central bank will raise benchmark interest rates once in the fourth quarter by 25 basis points as the CPI rises above 5 percent.

China’s economic growth slowed for seven quarters before recovering to 7.9 percent in the final three months of 2012, led by government-directed spending on infrastructure. The central bank also allowed expansion in credit in the less-regulated shadow banking sector.

The rebound may accelerate to 8.2 percent in the first quarter before slowing to 8 percent in the last three months of the year, according to median estimates in Bloomberg surveys last month.

Policy Dilemma

At the same time, the PBOC has flagged growing inflation and financial risks since December and the government stepped up efforts to curb resurgent home prices on March 1, ordering higher down payments and interest rates for some mortgages and implementation of a 20 percent capital gains tax.

“Policy makers face a dilemma as growth is weakening yet inflationary pressure keeps building,” said Zhang Zhiwei, chief China economist at Nomura Holdings Inc. in Hong Kong. “The government will eventually have to tighten policy to contain inflation but in the short term, the next several months, the government may put policy on hold to observe how growth and inflation move and fine-tune accordingly.”

China to Raise Budget Deficit by 50 Percent to Boost Demand

The elders must have overruled the western educated kids…

;)

Note on China deficit spending:

The headline deficit spending is relatively low at 2% of GDP. The heavy lifting is done by state sponsored lending which is maybe 20%+ of GDP. Don’t know what level that is at currently.

China to Raise Budget Deficit by 50 Percent to Boost Demand

March 5 (Bloomberg) — China plans to raise its budget deficit by 50 percent this year as the central government cuts taxes and boosts measures to support consumer demand in the world’s second-biggest economy.

The gap will widen to 1.2 trillion yuan ($193 billion) in 2013 from 800 billion yuan last year, amounting to about 2 percent of gross domestic product, the Ministry of Finance said in its budget report to the National People’s Congress in Beijing today. Local governments will run a combined deficit of 350 billion yuan and the Ministry of Finance will issue bonds to cover their shortfall, according to the report.

The larger fiscal deficit indicates China’s incoming leaders may step up efforts to support expansion and address income inequality, with growth forecast to fall below the annual average of 10.5 percent the country reported under President Hu Jintao and Premier Wen Jiabao. Officials have pledged to make expansion more sustainable, emphasizing quality over speed and Wen said today he’s targeting 7.5 percent economic growth this year.

“The higher fiscal gap and improved consumption will be positive for the economy,” Dariusz Kowalczyk, senior economist and strategist at Credit Agricole CIB in Hong Kong, said before the report. Boosting spending on the social safety net and education subsidies would reduce inequality and “help reverse the rising trend in the savings rate,” he said.

Except the deficit adds to non govt. savings, yuan for yuan.

China Budget Deficit Said Set to Expand 50% to $192 Billion

Ancient Chinese secret:

China Budget Gap Said Set to Widen 50% to $192 Billion

December 27 (Bloomberg) China plans to increase the budget deficit by 50 percent to 1.2 trillion yuan ($192 billion) in 2013, including the sale of 350 billion yuan of bonds to fund local governments, a person familiar with the matter said.

The central government deficit is budgeted at 850 billion yuan, according to the person, who asked not to be identified as the deliberations are not public. The nations leaders target about 8 percent trade growth, down from this years 10 percent goal, the person said.

A bigger fiscal deficit may give Chinas new leadership under Xi Jinping more room for tax cuts and measures to boost urbanization and consumer demand. The 1.2 trillion-yuan total compares with an 800 billion-yuan target this year, which included a 550 billion-yuan central government deficit and 250 billion yuan in local government bond sales.

The year 2013 is the first year for the new Chinese leadership, and urbanization will receive a big push, said Zhang Zhiwei, chief China economist at Nomura Holdings Inc. in Hong Kong. Financial support, including an expanded fiscal deficit in the budget, is needed for that.

Apart from a trial program launched in late 2011, local governments are barred from selling bonds directly and cant run deficits. China Business News reported the 1.2 trillion yuan figure today and Economic Information Daily reported an 8 percent trade target.

China News Service reported a 10 percent growth target for industrial production in 2013.

The government usually reveals specific goals at the legislatures annual meeting in March.

China Services Industry Expands at Faster Pace

Seems to be some credence to the notion that China is working to expand its service sector vs manufacturing and construction:

China Services Industry Expands at Faster Pace

June 4 (Bloomberg) — China’s services industry expanded at a faster pace in May, according to a survey of purchasing managers released by HSBC Holdings Plc and Markit Economics.

The PMI rose to a 19-month high of 54.7 in May from 54.1 in April, HSBC and Markit said today. The result contradicted a government-backed survey of services businesses released June 3 and signs from other data that a slowdown in the world’s second- biggest economy is deepening.

China’s stocks rebounded today from the biggest drop in six months on speculation the government will accelerate measures to spur consumer spending. The Ministry of Finance said yesterday it will offer consumers subsidies for purchases of energy-saving home appliances including washing machines, water heaters and refrigerators.

“This should reduce the fears of a sharp growth slowdown,” Qu Hongbin, a Hong Kong-based economist for HSBC, said of the PMI reading.

The Shanghai Composite Index rose 0.4 percent as of 10:47 a.m. local time after sliding 2.7 percent yesterday.

Japan To Buy Chinese Govt Bonds Under Bilateral Pact

This is peculiar.

This supports the yuan vs the yen,

supporting Japan’s exports to China.

Could be more evidence of China’s inflation concern?

Japan To Buy Chinese Govt Bonds Under Bilateral Pact

TOKYO (Nikkei) — Japan will likely purchase yuan-denominated bonds issued by the Chinese government under a proposed bilateral currency and financial agreement, The Nikkei learned Monday.

Japanese and Chinese officials are working out plans to have the pact signed when their leaders meet for a summit this coming Sunday. The agreement will be pillared on the purchase of Chinese government bonds using Japan’s foreign exchange fund special account, along with the joint establishment of a green investment fund.

Japan seeks to diversify its forex fund special account, which now focuses on dollar investments. It also aims to strengthen economic cooperation with China by supporting that nation’s efforts to turn the yuan into a more international currency.

The bond purchases may total up to 10 billion dollars’ worth, or roughly 780 billion yen, with buying carried out in stages through the special account.

The Chinese government counts Japanese government bonds among its foreign-currency reserves. Through cross-holding of bonds, Japan and China will be better poised to exchange information on financial developments in the bond market and elsewhere.

The Japanese government also plans to aid Chinese efforts to nurture an offshore market for yuan-denominated transactions.

The proposed joint fund for environmental investment would feature the participation of the Japan Bank for International Cooperation and private-sector companies from the Japanese side. Details of the fund’s size and investment percentages are to be fleshed out in the near future.

Thailand and Nigeria are among the countries that hold yuan-denominated government bonds through their central banks. Tokyo and Beijing believe that having a developed nation like Japan maintain a certain amount of yuan-denominated holdings may help lift the Chinese currency’s standing on the international stage.

China’s government bond offerings totaled 1.4 trillion yuan in 2009, up 55% on the year.

Such issuances have recently increased in Hong Kong. Overseas investors can acquire government bonds issued on the mainland, but regulations — including a ceiling on purchase amounts — remain strict. top

China Bond Purchases Could Help Ties: Finance Minister

Japan To Buy Chinese Govt Bonds Under Bilateral Pact

TOKYO (NQN) — Finance Minister Jun Azumi on Tuesday confirmed a report that Japan is considering buying Chinese government bonds, arguing that such purchases will offer the two countries significant advantages while strengthening bilateral economic ties.

At a news conference after a Cabinet meeting, Azumi said Japan should hold yuan-denominated bonds as a means of strengthening diplomatic relations.

Azumi said no official decisions have been made on the matter, and that Tokyo will discuss the issue at a future Japan-China summit. He also suggested that the two nations may be able to strike an agreement when Prime Minister Yoshihiko Noda visits China.