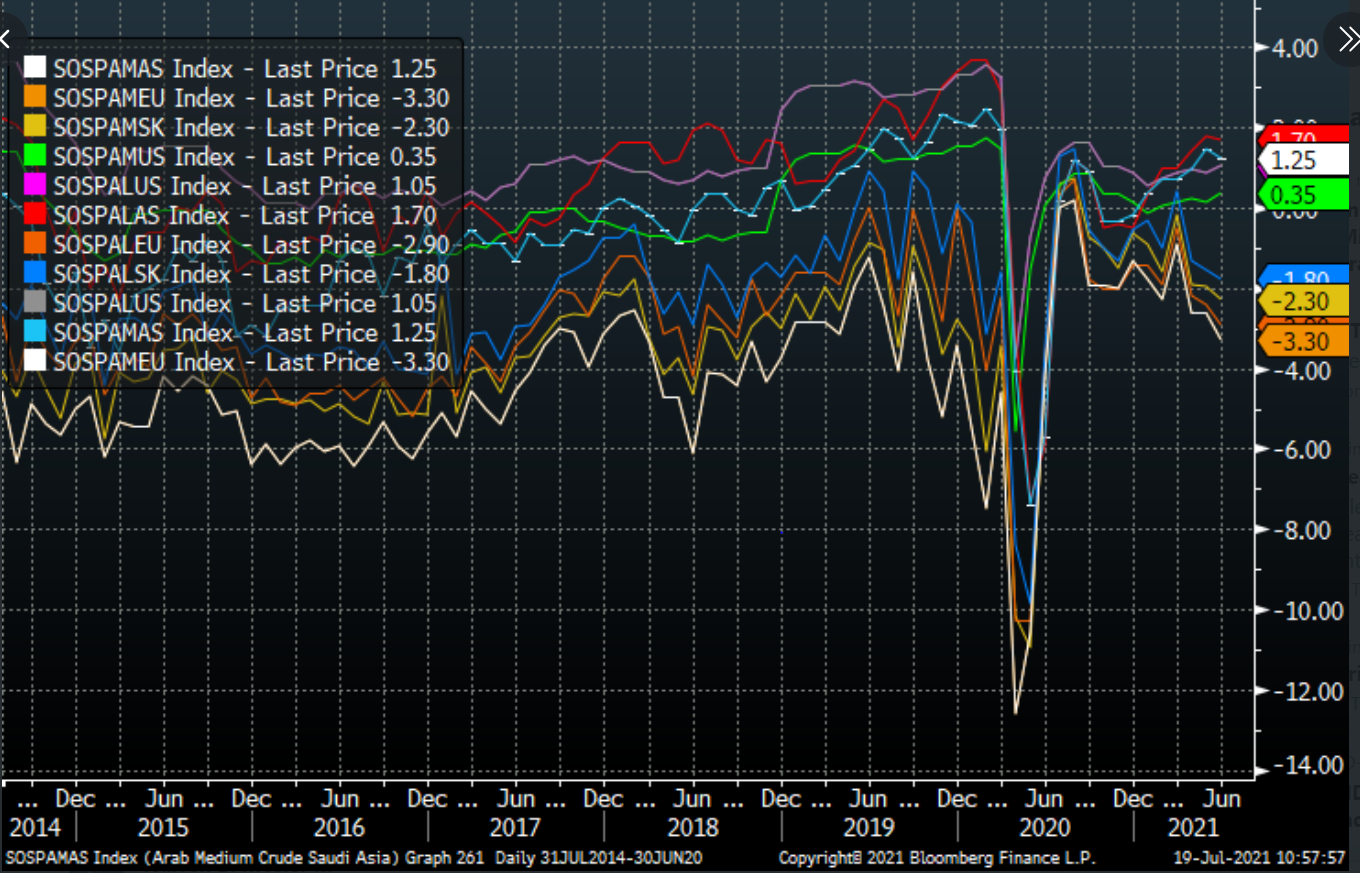

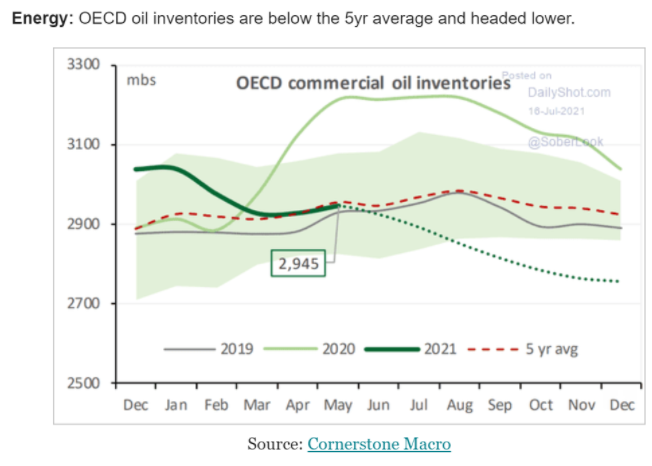

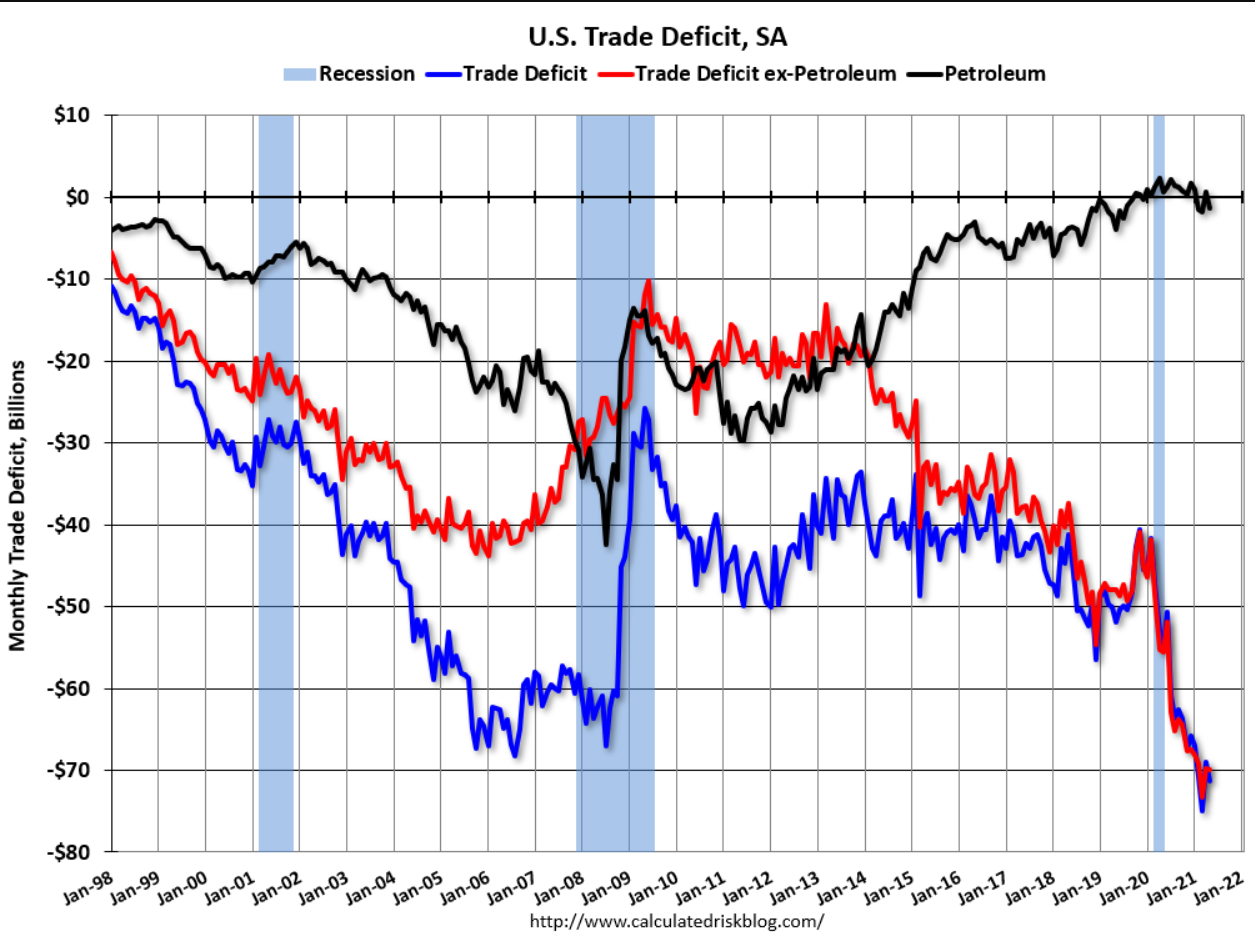

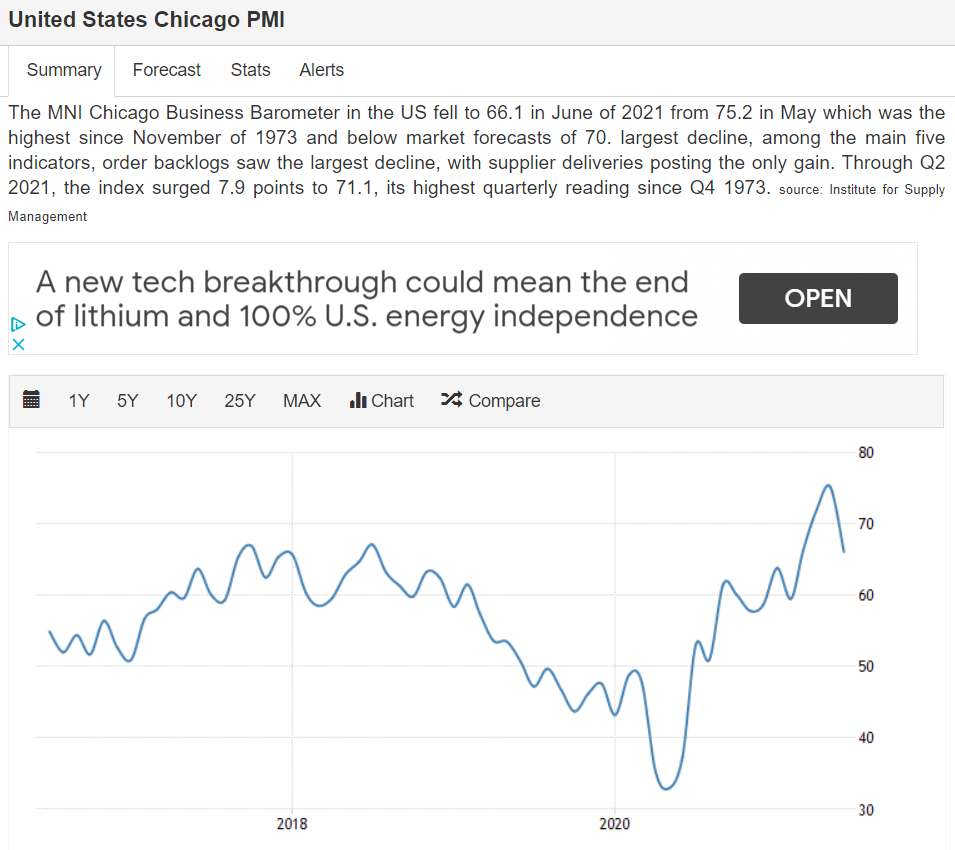

Saudis have set in process a continuous increase in the price of oil.

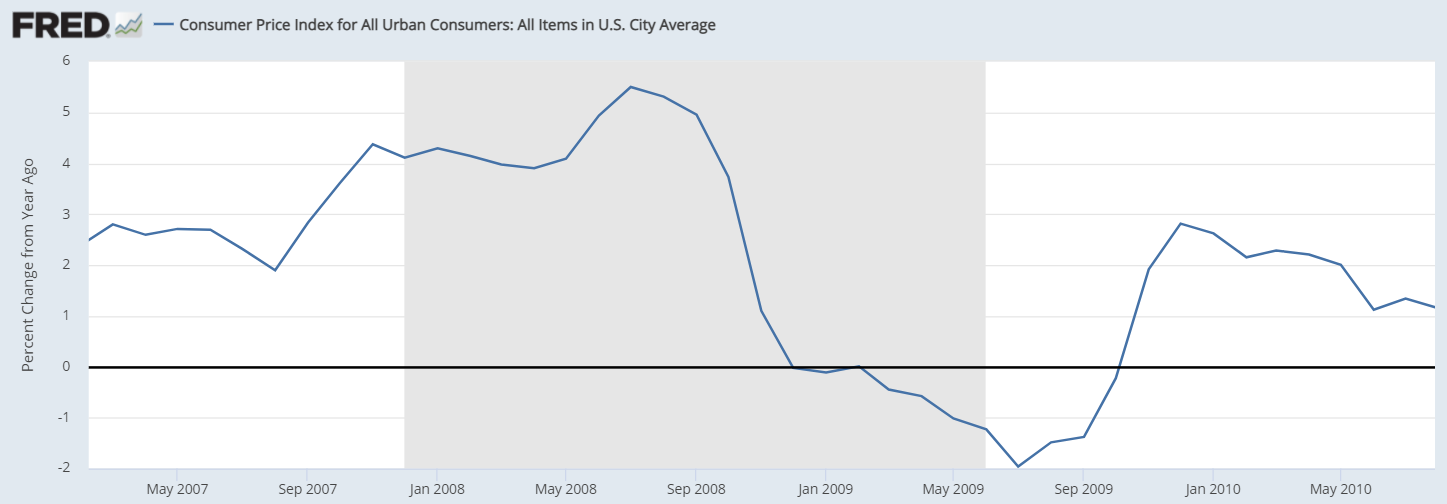

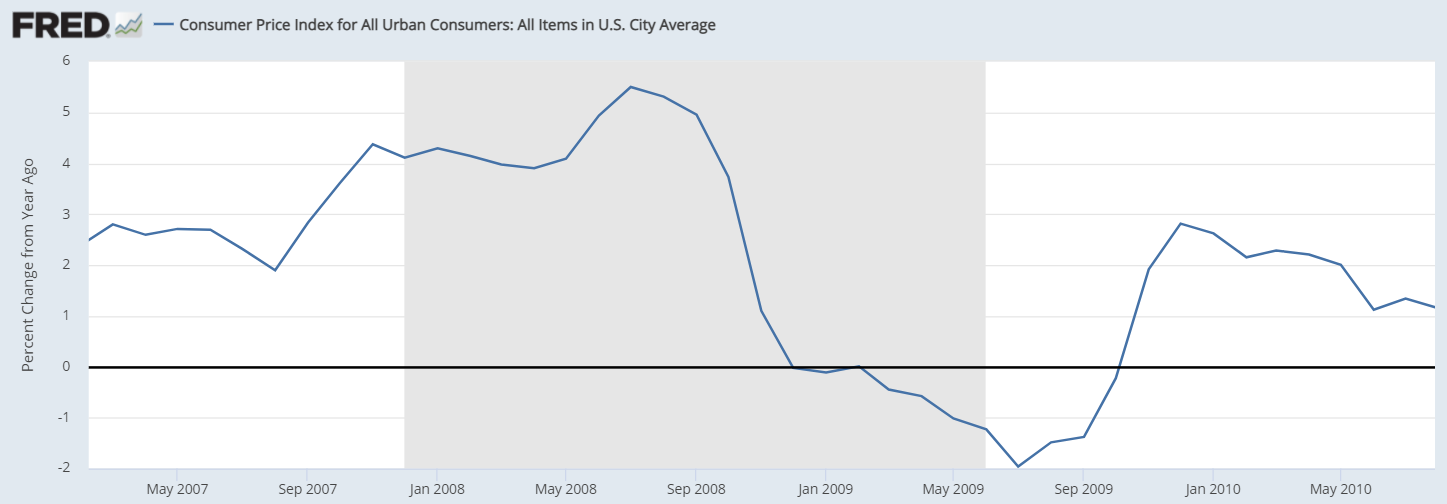

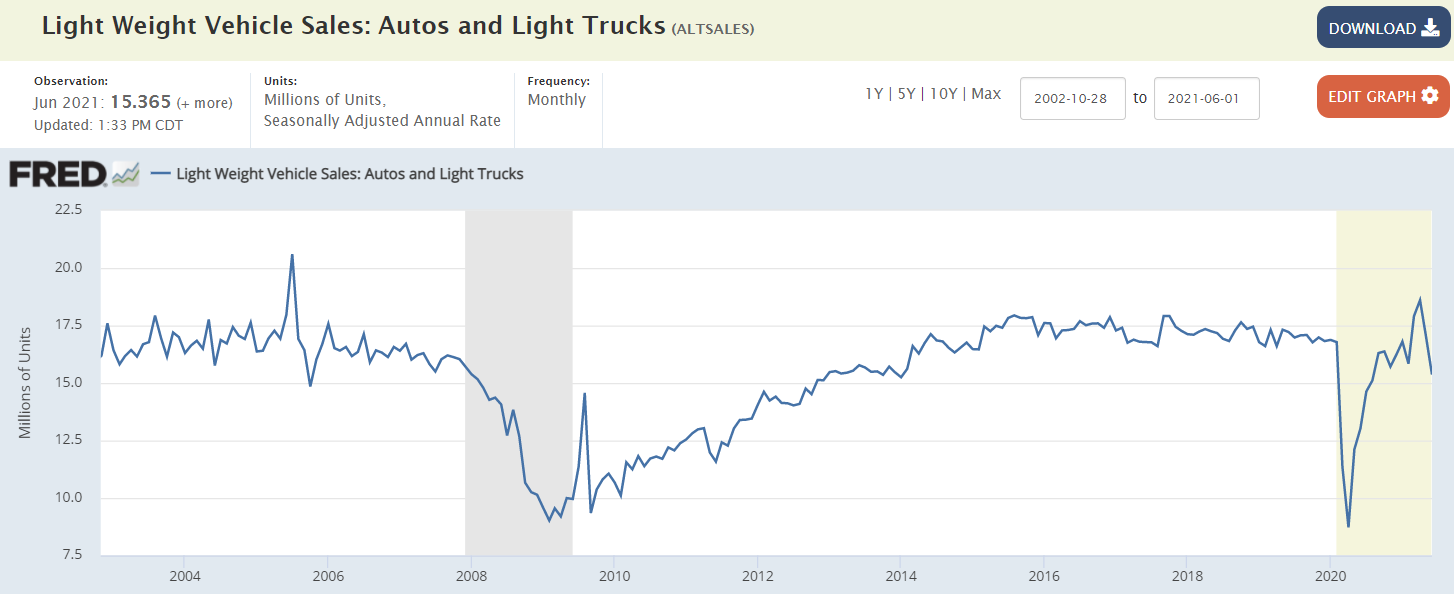

This is exactly what happened in 2008.

The Fed’s reaction was to hike rates which only made the inflationary impact worse

all triggering the financial panic and crash, with no fiscal relief from a panicked Congress

relying on the Fed until March 09.

Only a change in Saudi pricing reverses this:

SINGAPORE – Top oil exporter Saudi Arabia has raised the August official selling prices (OSPs) of all crude grades it sells to Asia, a pricing document seen by Reuters showed on Tuesday.

It set the August OSP for the flagship Arab light crude at $2.70 a barrel above the Oman/Dubai average for Asia, up 80 cents from July.

Saudi term crude supplies to Asia are priced as a differential to the Oman/Dubai average:

ASIA

AUGUST JULY CHANGE

SUPER LIGHT +3.85 +2.85 +1.00

EXTRA LIGHT +2.70 +1.90 +0.80

LIGHT +2.70 +1.90 +0.80

MEDIUM +2.15 +1.35 +0.80

HEAVY +1.20 +0.40 +0.80