COMMENTS ON MYSELF IN CAPS:

Karim on Jobless Claims Data and Year End Comments

Posted by WARREN MOSLER on 30th December 2010

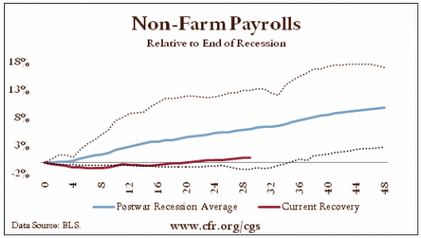

Agreed with Karim, the relatively modest recovery remains on track.

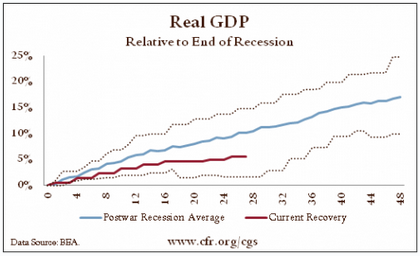

Left alone, I see GDP in the 3.5%-5.5% range for next year, and possibly more.

***WRONG ON THAT! THOUGH FOR REASONS SUBSEQUENTLY DISCUSSED IN THE SAME POST.

AND THE SURPRISE EARTHQUAKE NOT HELPING MATTERS AFTER WHAT TURNED OUT TO BE A MUCH WEAKER FIRST QUARTER

Though they didn’t add much, the latest tax adjustments did take away the down side risk of taxes going up at year end.

***TRUE, AND ON A LOOK BACK THE REMOVAL OF ‘WORK FOR PAY’ MAY HAVE BEEN A FAR STRONGER NEGATIVE THAN THE POSITIVE OF THE PARTIAL CUT IN FICA

I do, however, see several negatives with maybe up to 25% possibilities each, meaning collectively the odds of any one of them happening are a lot higher than that.

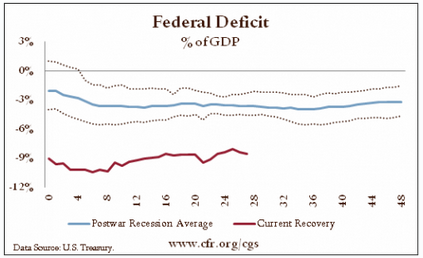

The new Congress is serious about deficit reduction. The risk is they will be successful, and it seems they even have the votes to get a balanced budget amendment passed.

***THOUGH NOT A LOT OF ACTUAL TIGHTENING YET, THIS HAS BEEN A STRONG INFLUENCE.

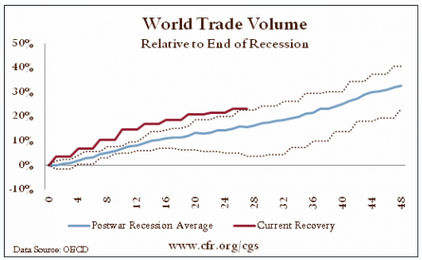

China could get it wrong in their fight against inflation and cause a pretty severe slump. In fact, I can’t recall any nation that didn’t cause a widening of their output gap in their various fights against inflation.

***THIS IS HAPPENING AS WELL.

LAST NIGHT’S NEGATIVE MANUFACTURING NUMBER CONTINUES THE PATTERN OF WEAKNESS

The ECB’s imposed austerity in return for funding at some point reverses the current modest growth of that region. Not to mention the small but real risk the ECB decides to not buy any more member nation debt in the secondary markets.

***THIS HAS ALSO TURNED OUT TO BE THE CASE WITH AUSTERITY NOW TAKING OVERALL GDP GROWTH TO NEAR 0, AND THE ECB COMING IN ONLY AS COLLAPSE IS THREATENED.

While a less important economy for the world, the UK austerity looks ill timed as well.

***ALSO CAUSING SERIOUS DOMESTIC WEAKNESS.

The Saudis could continue to hike their posted prices which could reduce US demand for domestic output. The spike to the 150 level in 08 was a significant contributor to the severity of the financial collapse that followed.

***THIS DIDN’T HAPPEN, AS THE SAUDIS INSTEAD ANNOUNCED A RANGE OF $80-90 WHICH WAS ACHIEVED FOR WEST TEXAS DUE TO LOCAL SUPPLY ISSUES, BUT WITH BRENT AND THE REST OF THE WORLD HOVERING AROUND THE $110-115/BARREL RANGE THAT PRICE IS A HIGHER TAX ON GLOBAL CONSUMERS.

There are also several lesser factors I’ve been listing the last few weeks that could cause aggregate demand to disappoint.

*INTERESTINGLY, MOST QUARTERLY FORECASTS FOR 2011 STARTED OUT AT AROUND 4%, ONLY TO BE REVISED DOWN UNTIL THE ACTUAL RESULTS CAME IN ABOUT HALF THAT.

THEN, IN LATE JULY IF I RECALL CORRECTLY, THE GOVT. REVISED DOWN THE ALREADY REVISED DOWN RESULTS SUBSTANTIALLY FURTHER, WITH Q1 NOW REPORTED AT ONLY .5%, Q2 1%, AND Q3 NOW FORECAST FOR ABOUT 1-1.5%.

On the positive side is always the possibility of a private sector credit expansion taking hold.

***SO FAR ONLY A MODEST INCREASE IN CONSUMER CREDIT EXPANSION.

Traditionally that would be borrowing to spend on housing and cars.

***CAR SALES WERE GROWING REASONABLY WELL UNTIL THE EARTHQUAKE SET THEM BACK, AND THEN POLICY RESPONSE TO THE EARTHQUAKE WAS TOO WEAK TO SUSTAIN AGGREGATE DEMAND.

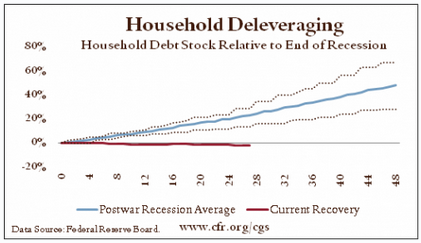

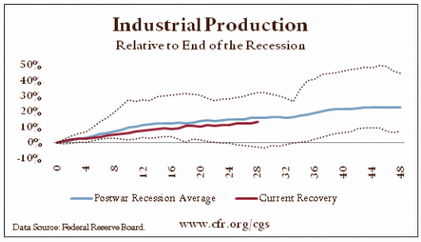

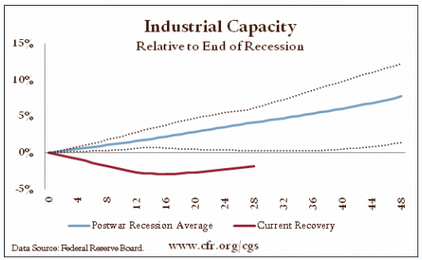

Federal deficit spending has done its job of restoring incomes and monetary savings, and will continue to do so.

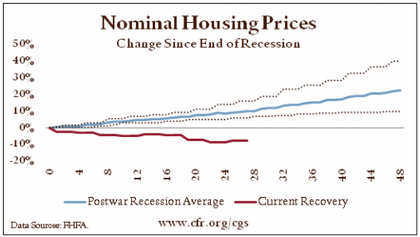

Financial burdens ratios are down, car sales are showing some modest growth, and housing looks to have at least bottomed. And both are at low enough levels where there could be a lot of growth and they’d still be very low, especially housing.

*FEDERAL DEFICIT SPENDING DOES CONTINUE TO BE SUFFICIENT TO KEEP GROWTH MODESTLY ABOVE 0, AND UNEMPLOYMENT, THOUGH FAR TOO HIGH, HAS AT LEAST STOPPED RISING.

I don’t see inflation as a risk (unless crude spikes a lot higher), nor deflation (unless one of the above shocks kicks in).

And I do see the ‘because we think we could be the next Greece we’re turning ourselves into the next Japan’ theme continuing, as it seems highly unlikely to me we will get back to, say, the 4% unemployment level for a very long time, if ever, until there’s a paradigm change regarding fiscal policy.

*THE TERM STRUCTURE OF RATES IS FALLING IN A JAPAN LIKE WAY, REAL ESTATE CONTINUE TO BEHAVE VERY JAPAN LIKE, AND STOCKS SEEM TO BE IN AN UGLY, JAPAN LIKE TYPE OF TRADING RANGE.

The full employment budget deficit might be up to 4% of GDP or higher, and our current tax structure probably still delivers a cycle ending surplus at full employment.

*THOUGH AT THIS RATE IT WILL BE A LONG TIME BEFORE THAT GETS TESTED.

BUT, MORE IMPORTANT, IT MEANS A FULL FICA SUSPENSION WOULD BE LIKELY TO BE PERMANENT.

In other words, with our current tax structure and size of govt, full employment remains unsustainable.

Lastly, my feel is that there’s about a better than even chance of an equity and commodity sell off. Stocks as well as commodities look like they are pretty much pricing in all the good economic news, some of which is bogus, like QE being inflationary, as previously discussed. There could also be dollar strength which would contribute to equity and commodity weakness. And the stock and commodity weakness would also work to bring the term structure of rates lower as well, particularly as rates seem to have gone higher recently more due to supply factors during a holiday week and maybe year end selling than anything else. The forwards ED forwards don’t look to me to be at all low with respect to mainstream expectations of future fed rate settings. And it also looks like the annual portfolio rebalancing will be that of selling stocks which went up last year and buying bonds which went down, to get all the portfolio ratios back in line with marching orders from higher ups.

*THIS WAS ALSO DISCUSSED IN MY POST ON THE QE BUBBLE, WHERE I SUGGESTED ALL THAT MOVED BASED ON QE HAD DONE SO OUT BY ‘MISTAKE’ AS MARKET PARTICIPANTS BELIEVED QE ACTUALLY WORKS TO INFLATE, ETC, WHEN IN REALITY QE IS AT BEST A DEFLATIONARY TAX.

THAT ‘UNWIND’ CONTINUES TO PLAY OUT WITH GOLD PERHAPS BEING THE LAST OBJECT OF INVESTORS HEDGING AGAINST ‘INFLATION’ TURNING SOUTH SOON AFTER IT WAS REALIZED THAT CHAVEZ’S GOLD DID EXIST AND WAS BEING SHIPPED BACK TO HIM.

DEFLATIONARY FISCAL POLICIES TEND TO TAKE AWAY SPENDING POWER TO THE POINT WHERE SPECULATION IN GENERAL LOSES ITS FUNDING AND ECONOMIC FORCES OF SUPPLY AND DEMAND TEND TO DRIVE PRICES TO AND BELOW MARGINAL COSTS OF PRODUCTION IN A VERY TEXT BOOK LIKE MANNER.