Last week of federal unemployment benefits:

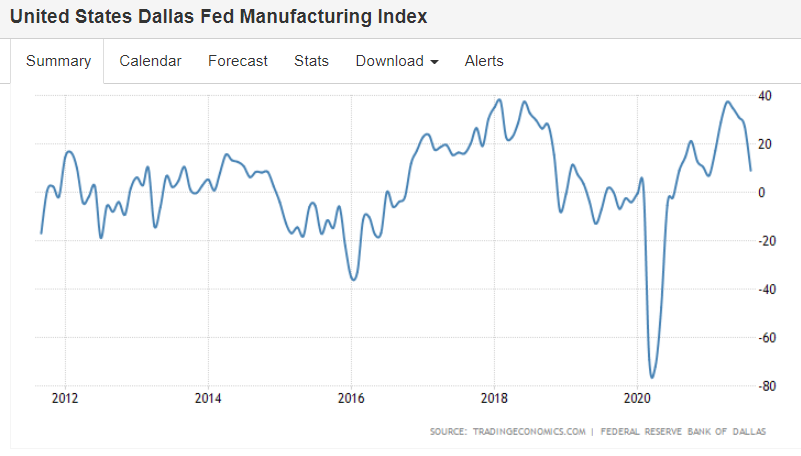

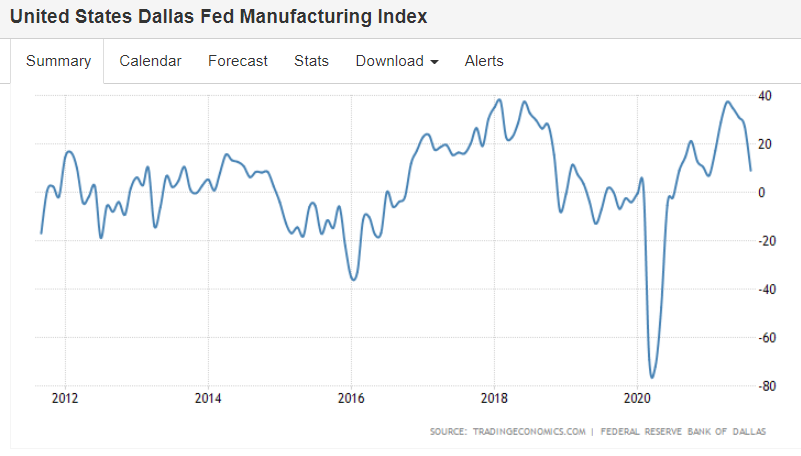

Dallas surprises on the downside, but inline with other indicators:

Last week of federal unemployment benefits:

Dallas surprises on the downside, but inline with other indicators:

And federal unemployment benefits expire in 2 weeks:

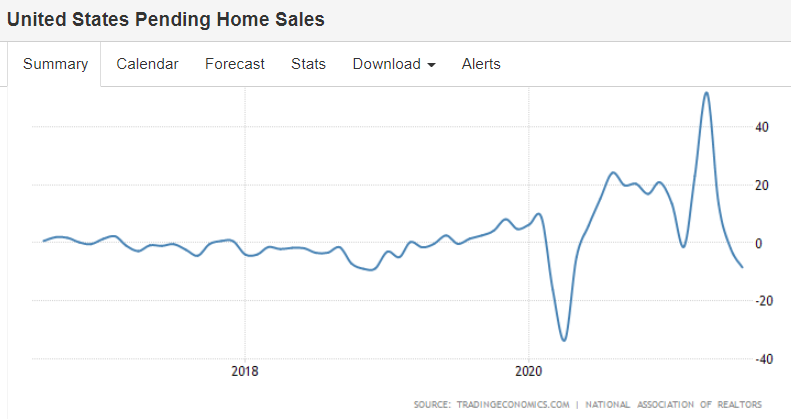

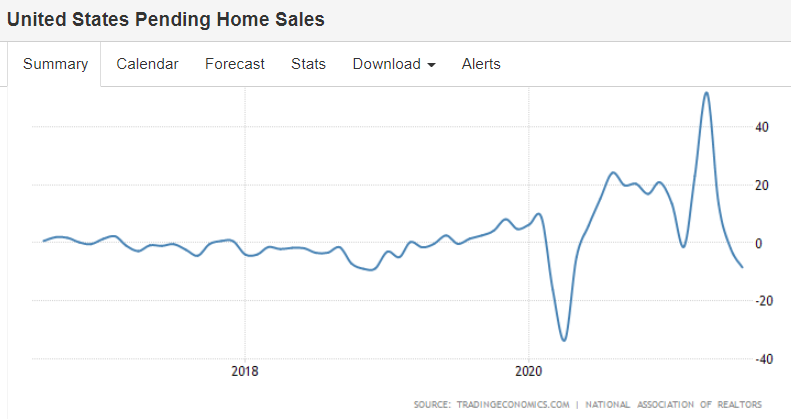

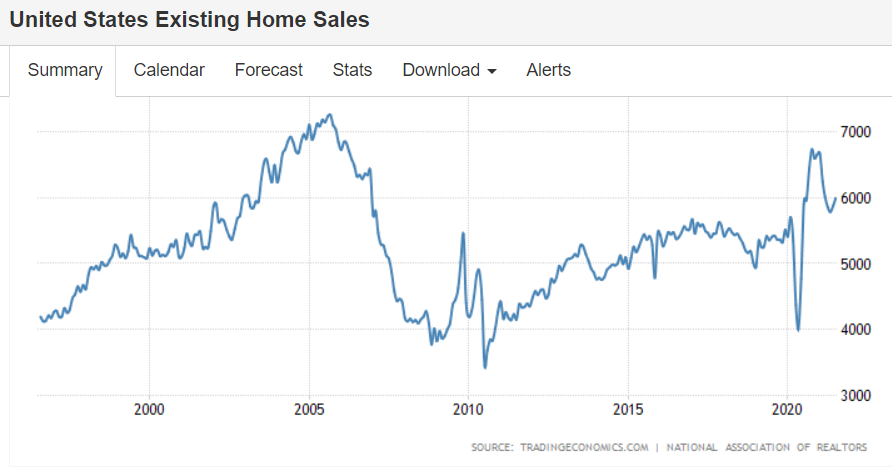

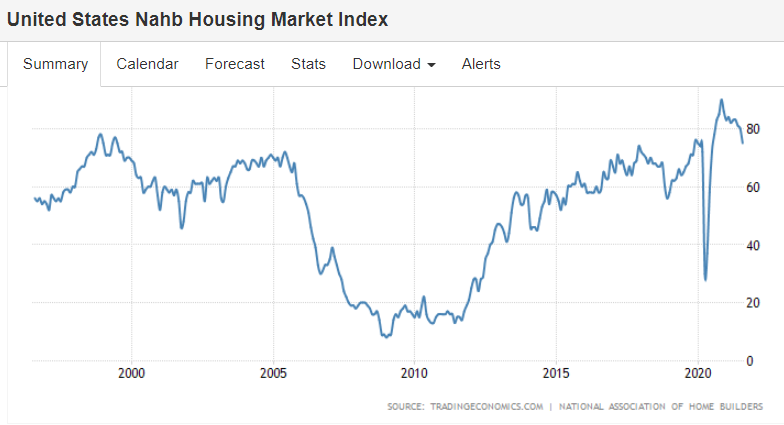

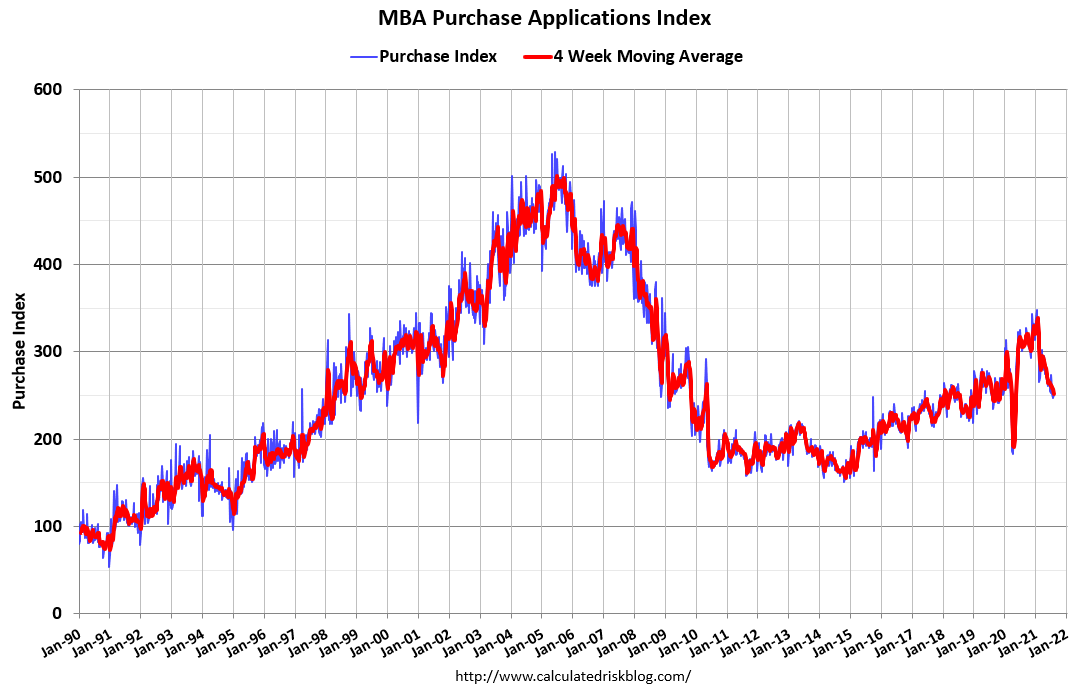

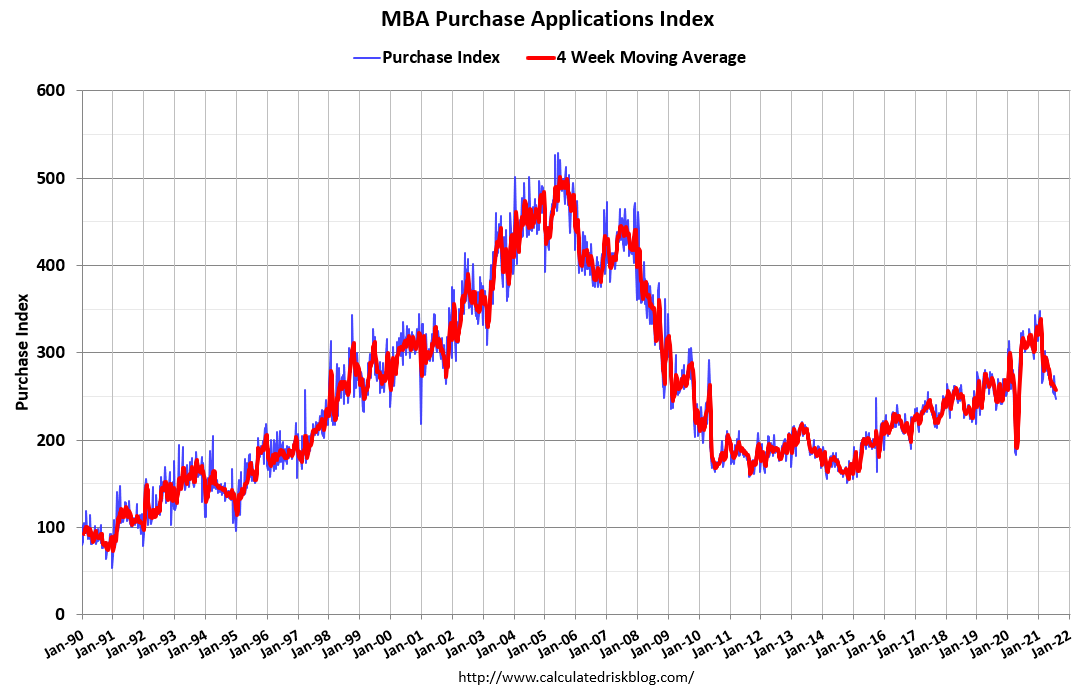

Back to about where it was heading pre covid, way below last cycle and not

where it was expected to be with record low mortgage rates:

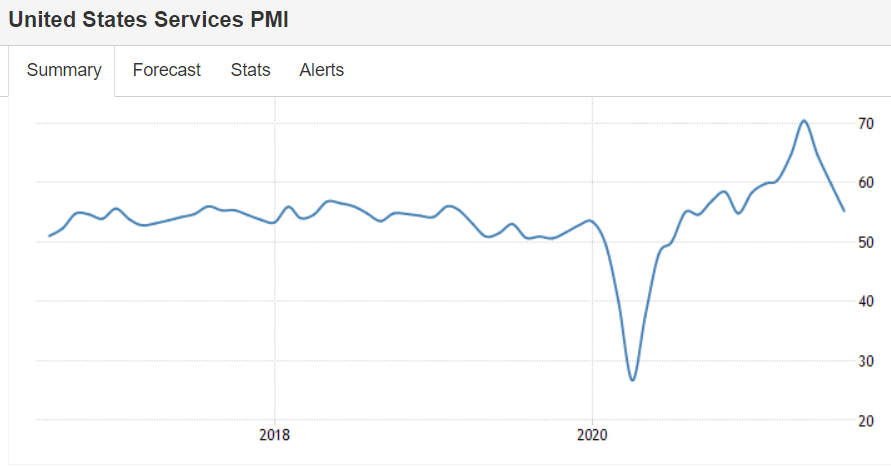

Still weak:

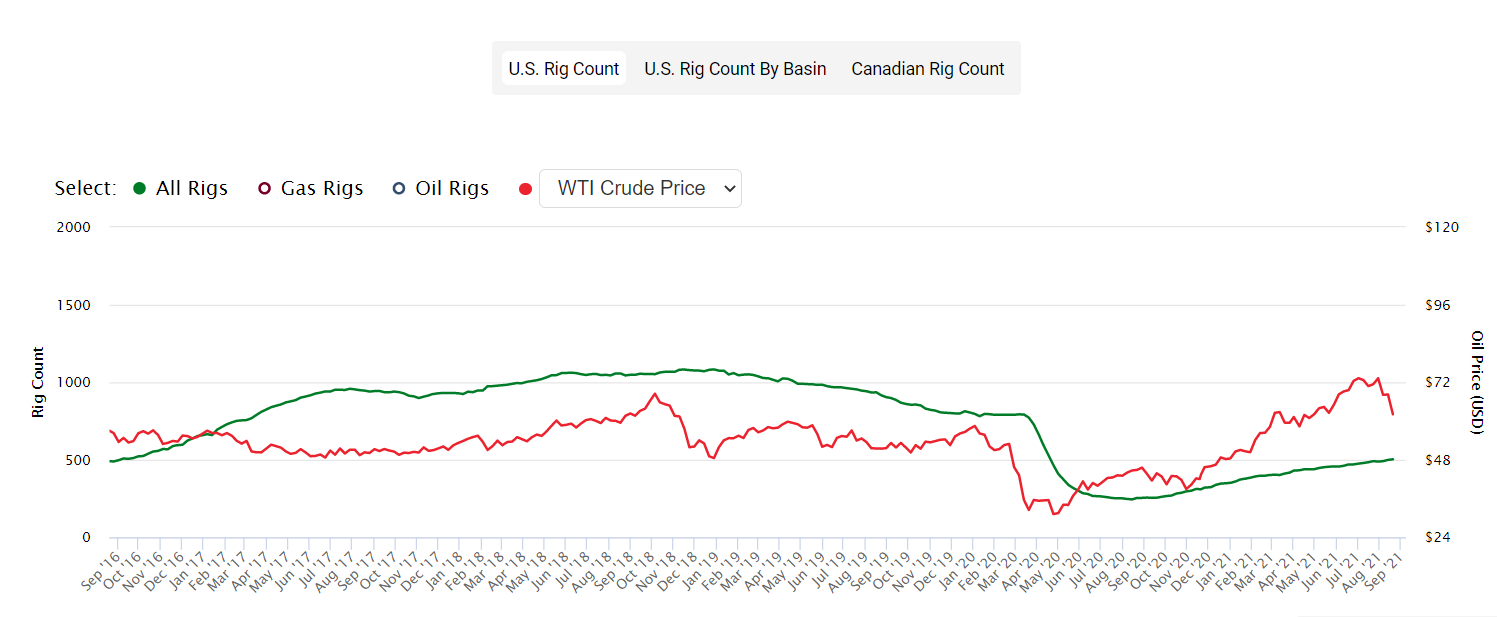

Coming back slowly, but now oil prices are lower:

Lots of spiky commodities like iron ore:

Retail sales jumped up with the Federal transfer payments and have more recently

started to decline as transfer payments subsided. And the remaining Federal unemployment comp

of $300/week expires Labor day for approximately 7 million beneficiaries:

More evidence of a housing decline, even with the lowest rates ever:

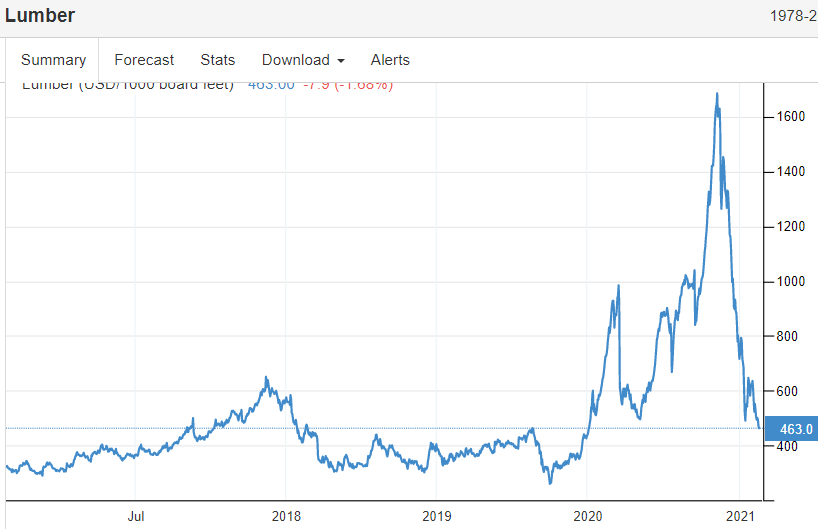

Lumber and housing often move together:

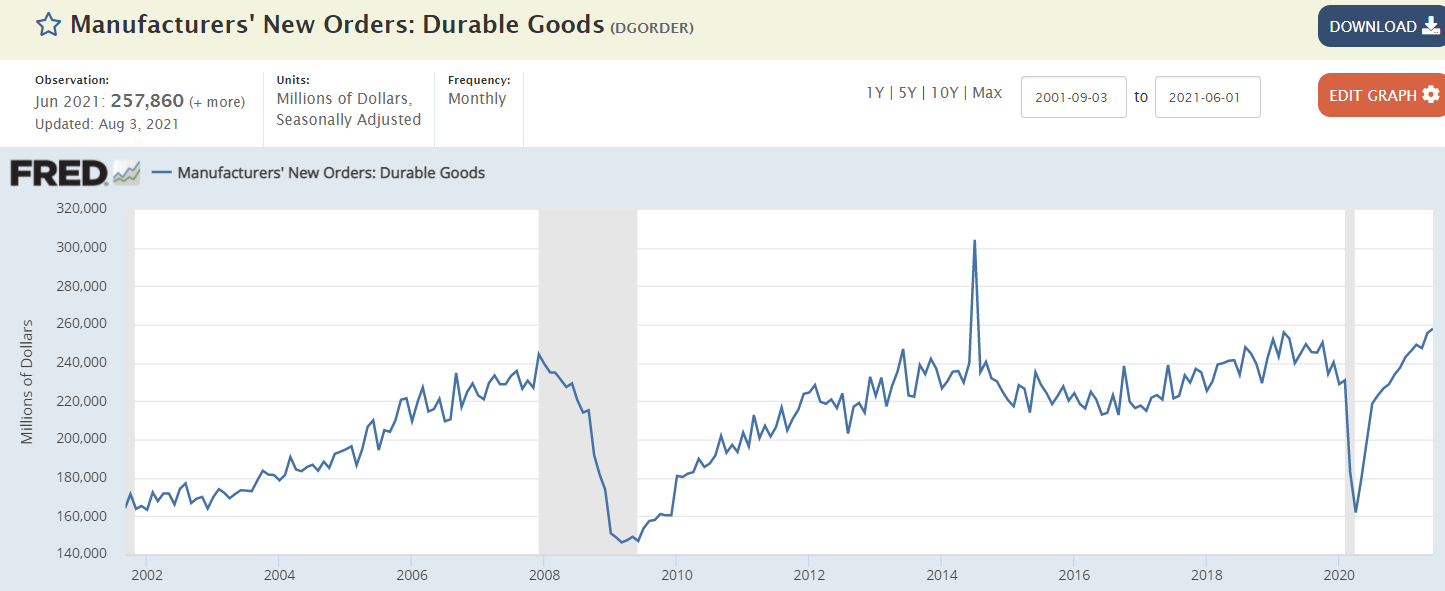

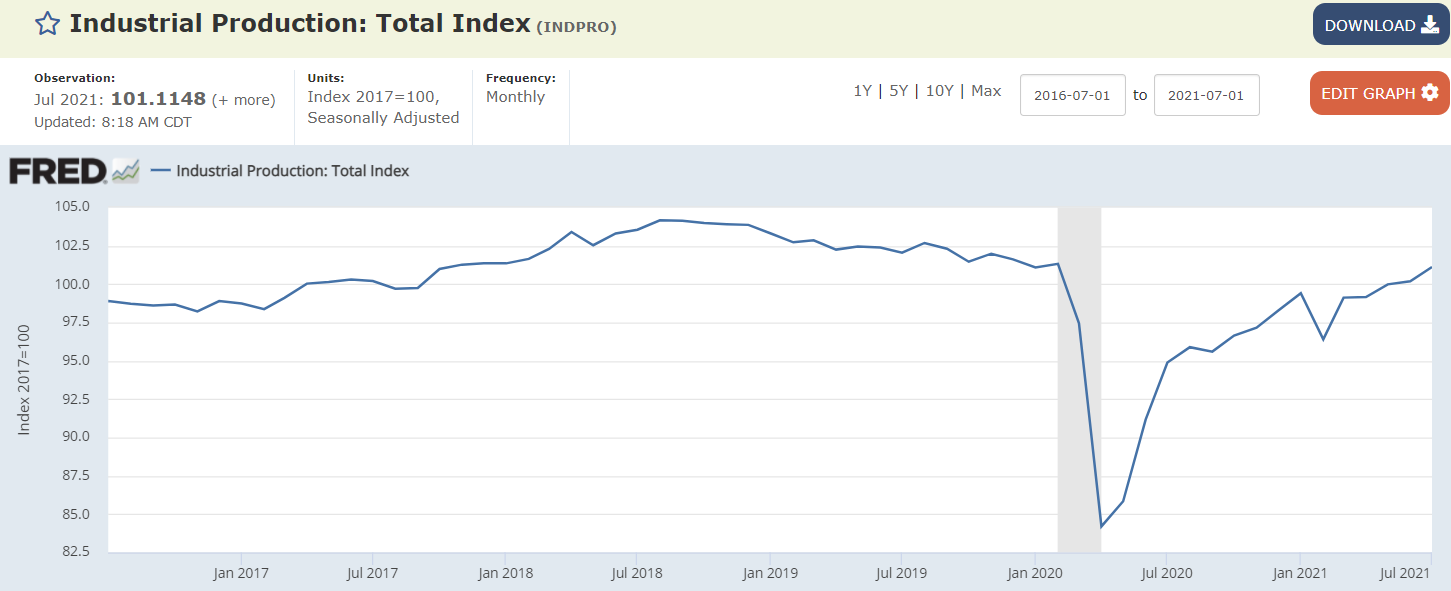

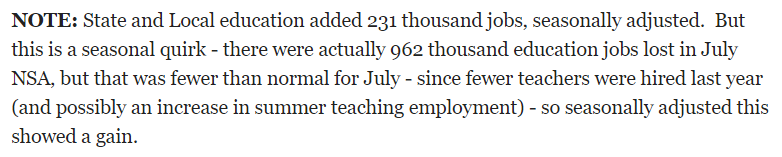

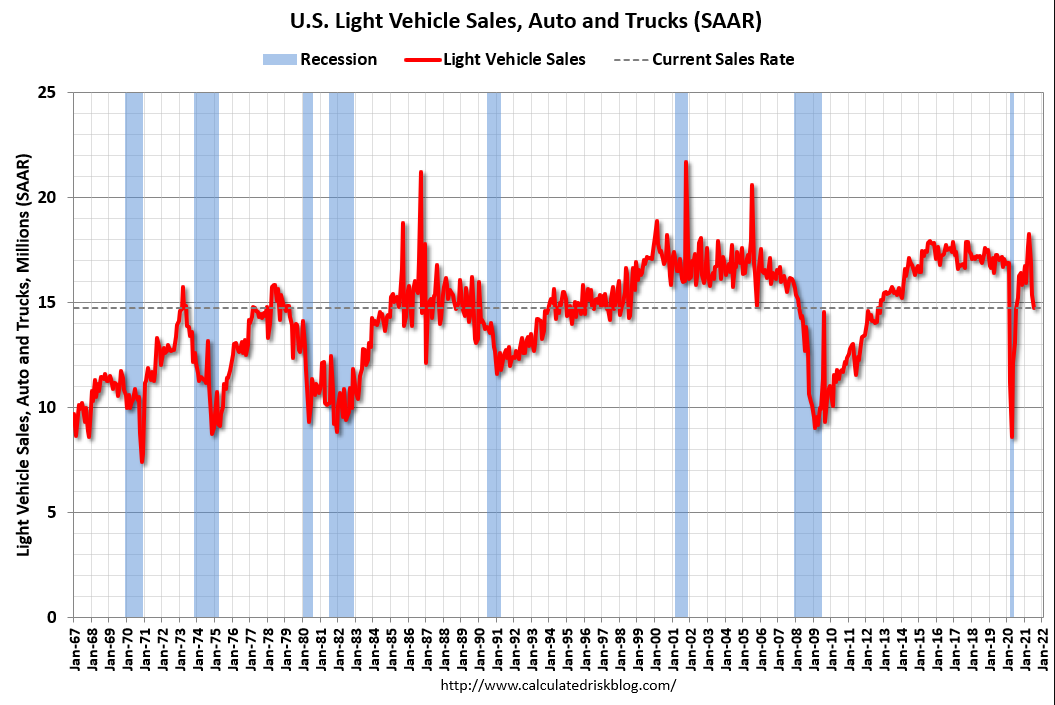

This number is seasonally adjusted, and was higher in July because auto plants typically shut down in July didn’t this year due to prior production issues:

Industrial production in the United States increased 0.9 percent in July 2021, following a downwardly revised 0.2 percent growth in June and beating market expectations of 0.5 percent. Manufacturing output rose 1.4 percent, mainly due to a jump of 11.2 percent for motor vehicles and parts, as a number of vehicle manufacturers trimmed or canceled their typical July shutdowns. Despite the large increase last month, vehicle assemblies continued to be constrained by a persistent shortage of semiconductors. The output of utilities decreased 2.1 percent in July, while the index for mining rose 1.2 percent. source: Federal Reserve

Steel and industrial production are also somewhat related:

Working its way lower:

Inflation fears may be fading?

Getting worse. I guess low rates aren’t the end all for housing…

;)

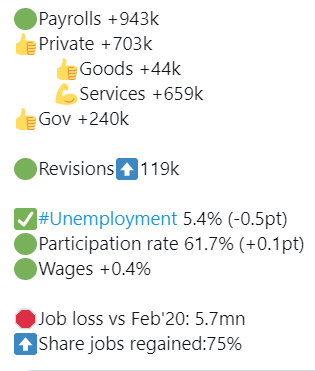

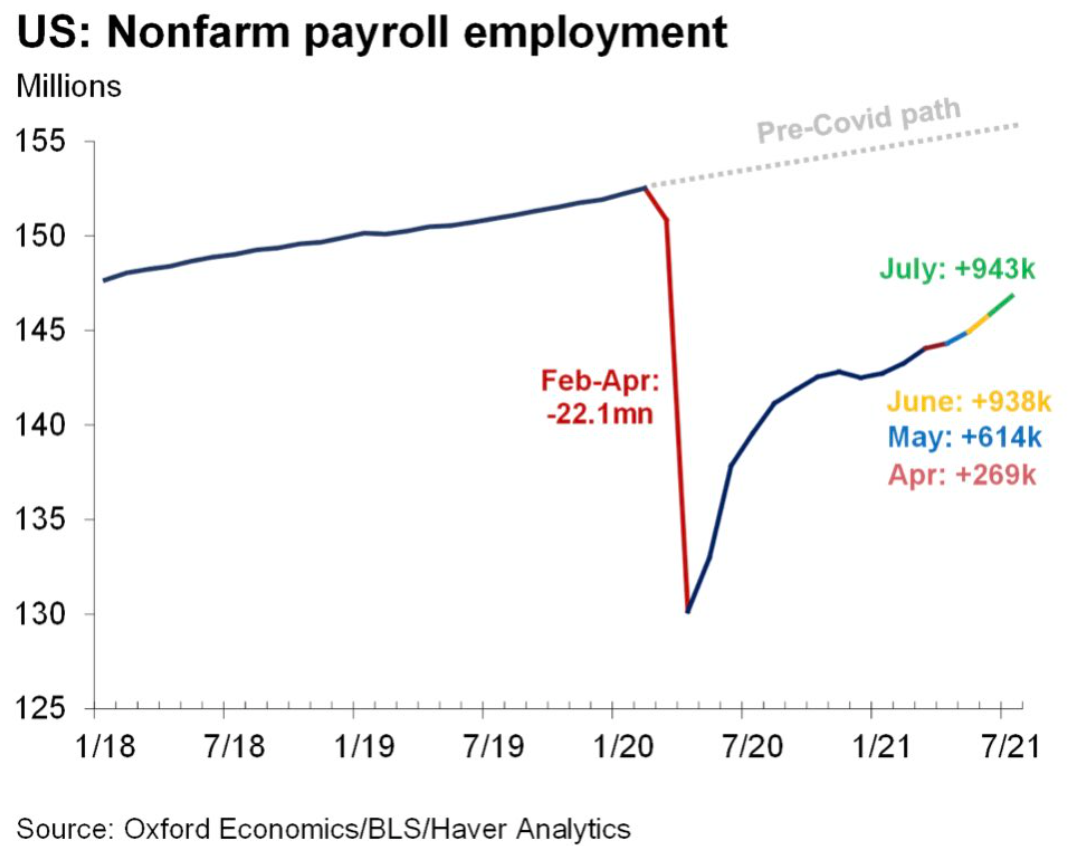

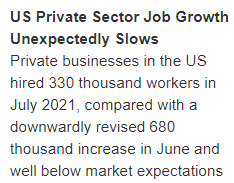

Steady improvement but still a ways to go:

And this doesn’t look good:

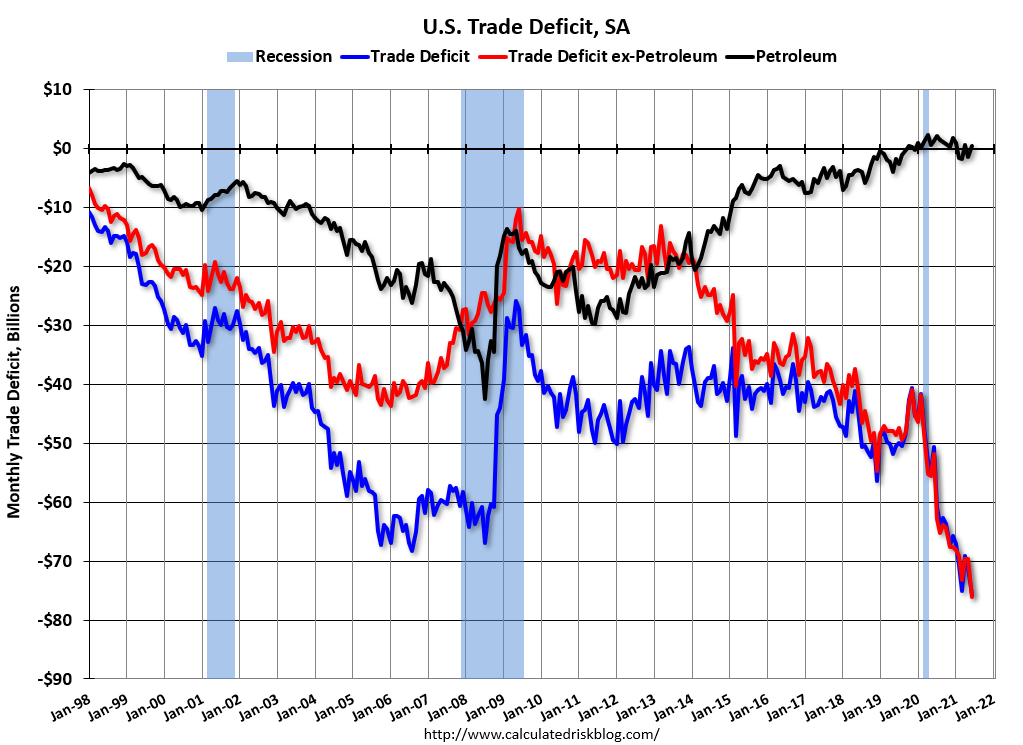

We’re spending more on net imports which is fundamentally a direct benefit for us, if only our govt. knew the appropriate policy response:

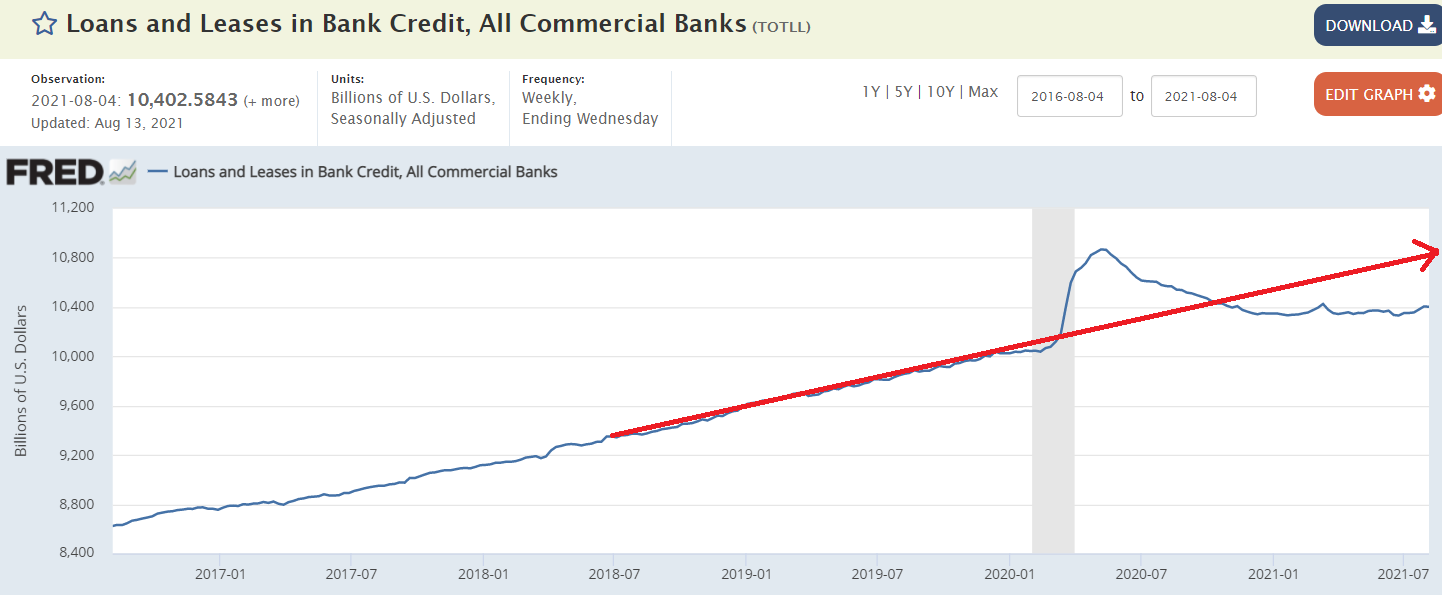

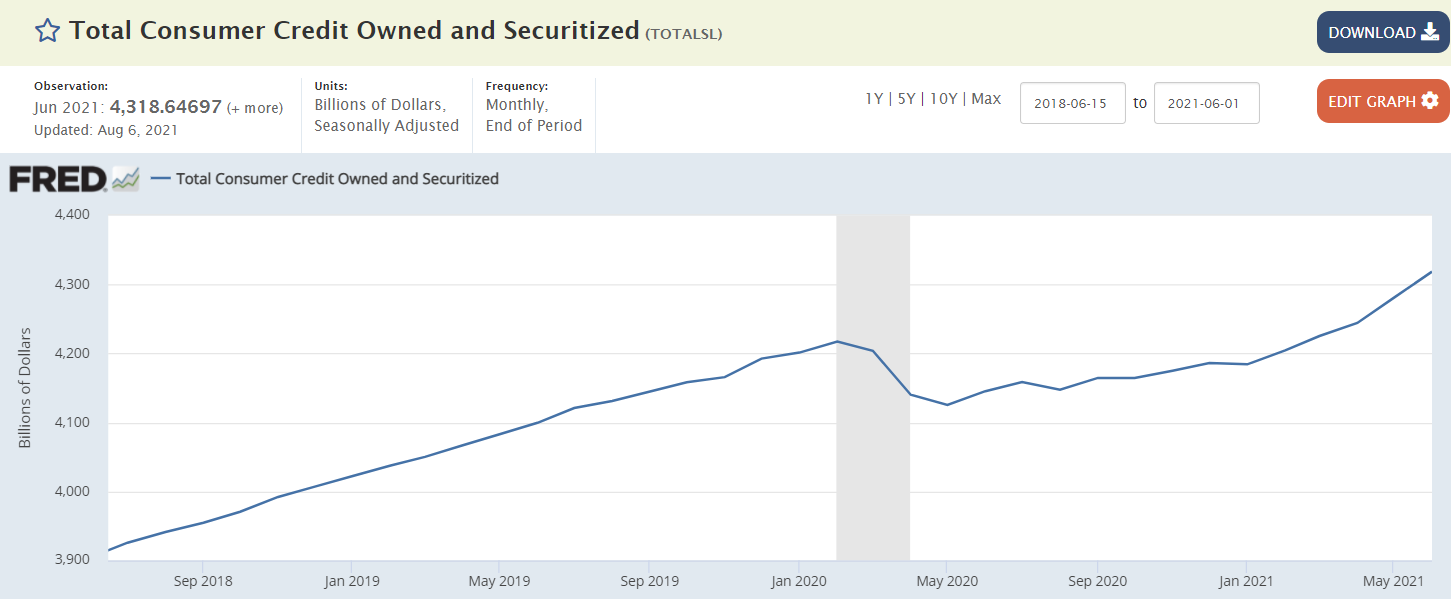

Consumer credit growth has picked up as jobs are added and as Federal unemployment benefits expire:

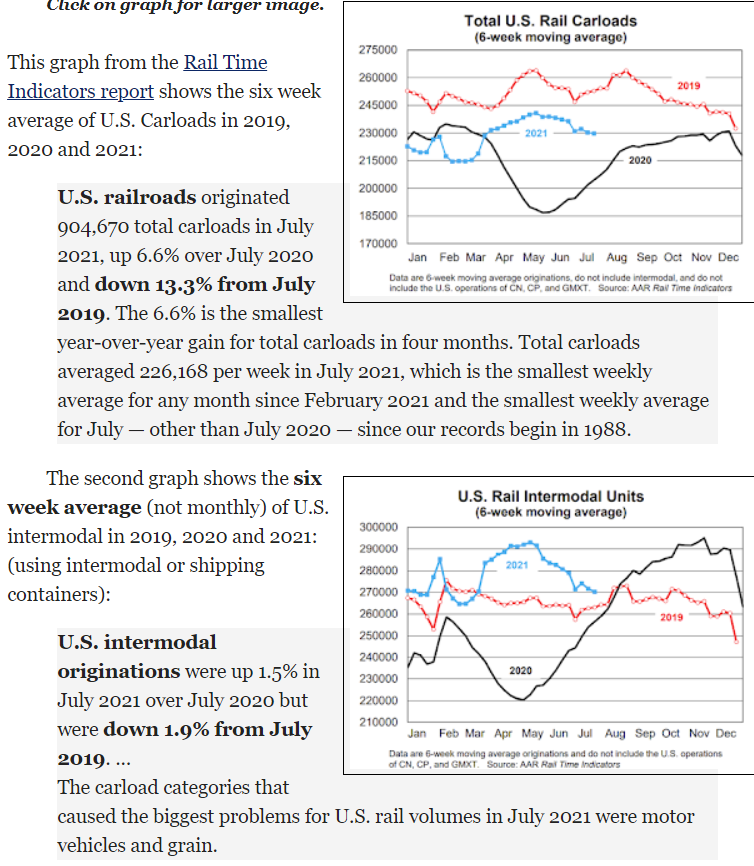

These charts have turned down:

Not good. Analysts/politicians/voters expected more gains as Federal benefits expired:

Not good:

Not good:

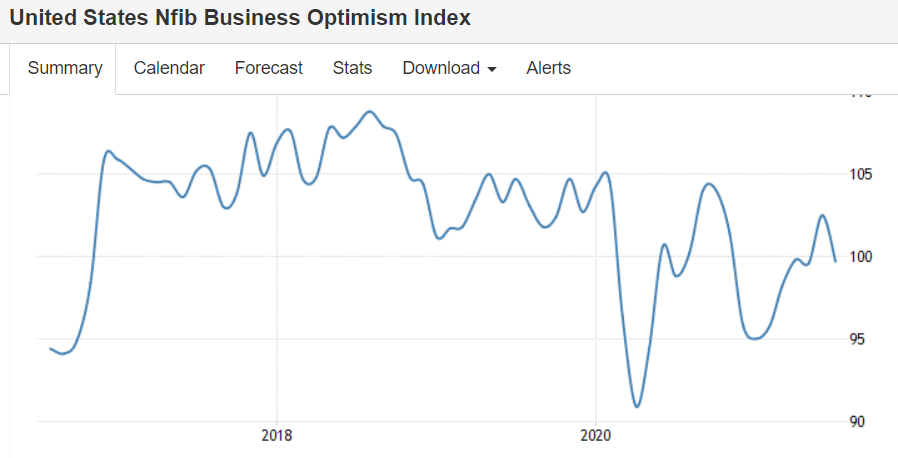

Typical bounce after the covid dip that followed the tariff decline, but so far only back to prior levels, and less when adjusted for inflation: