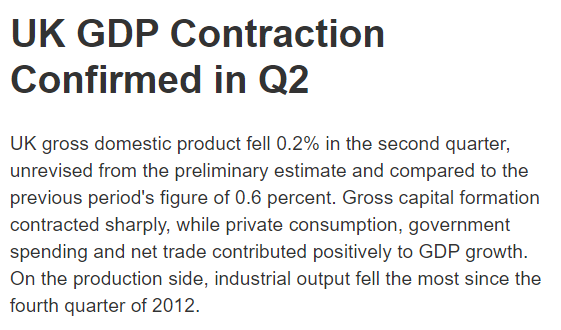

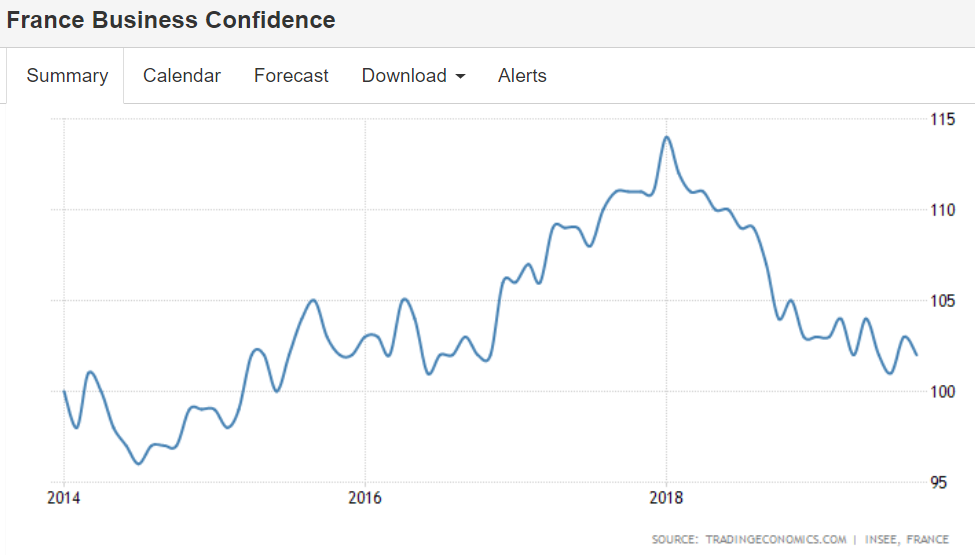

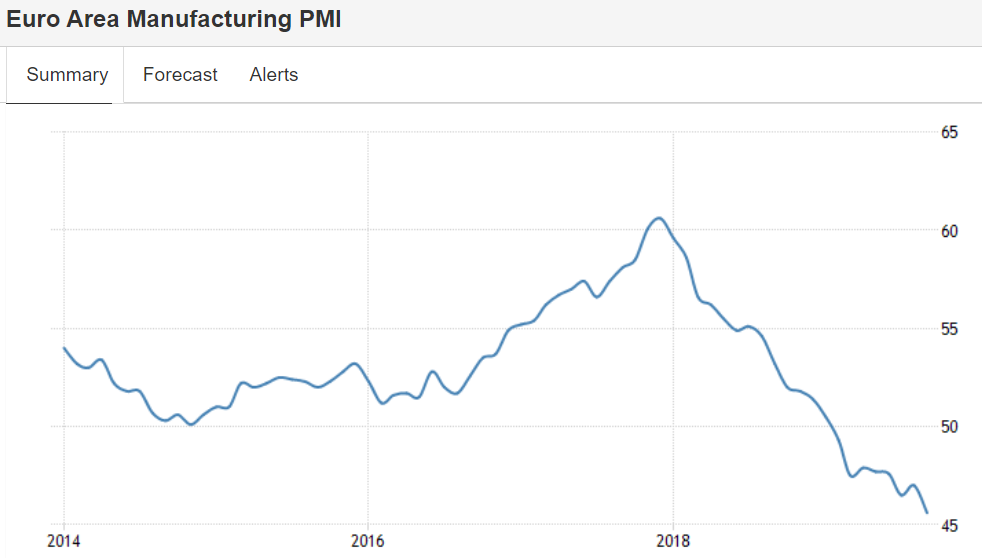

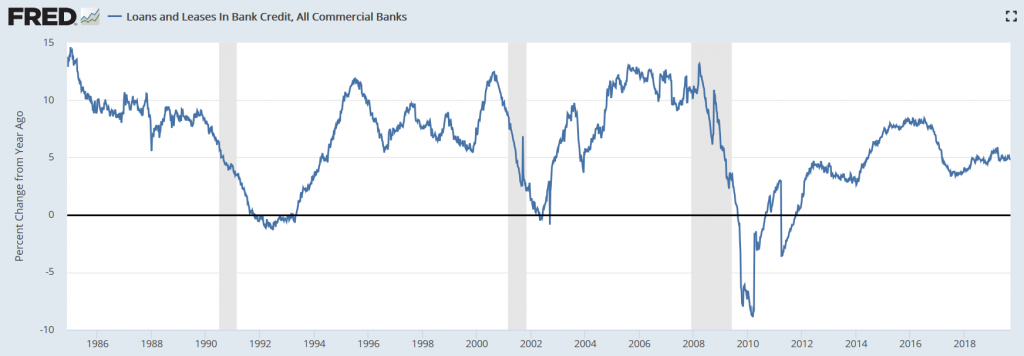

Still contracting:

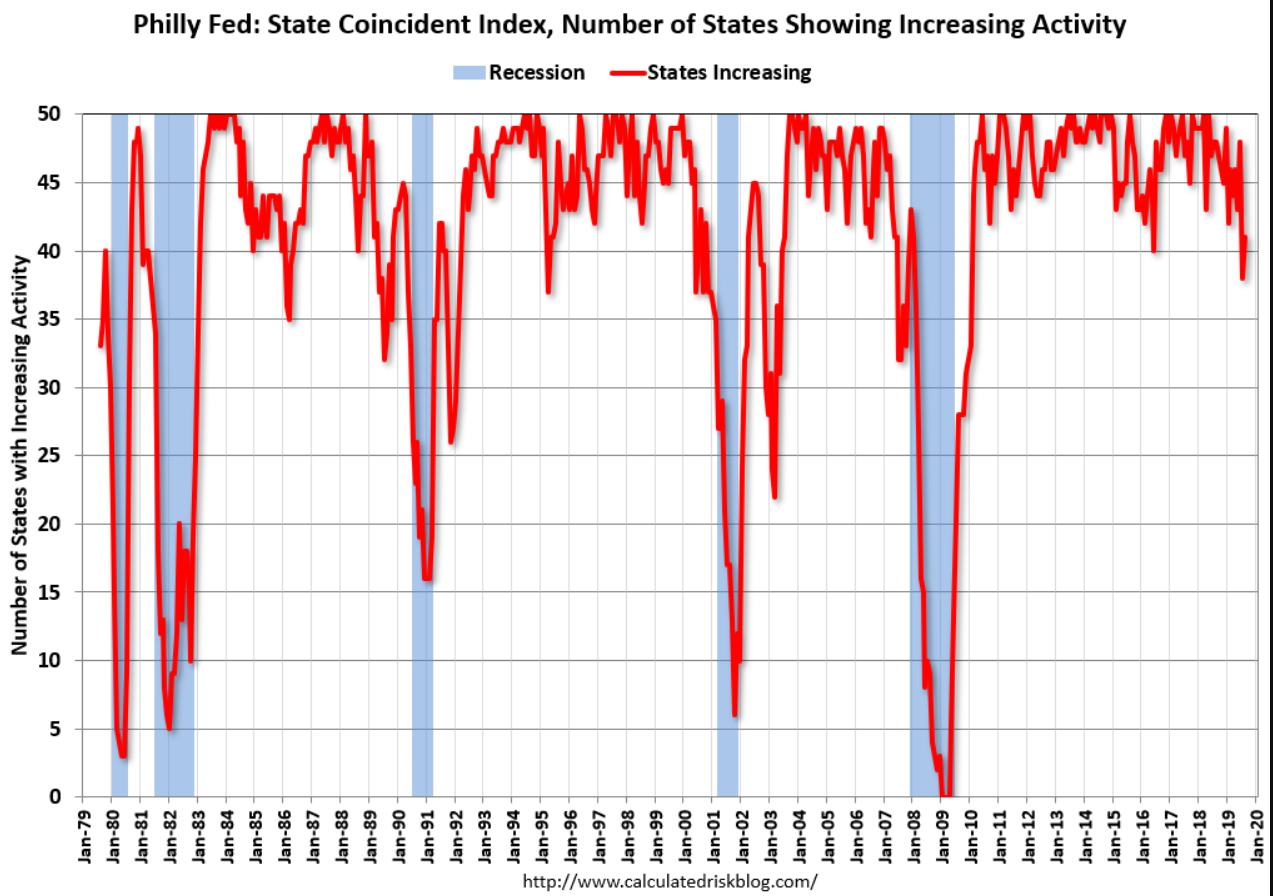

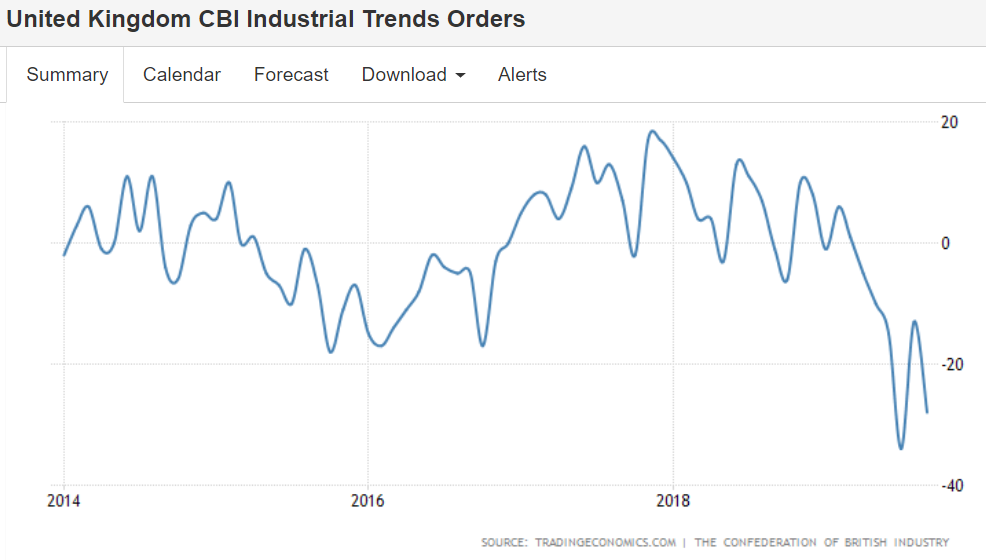

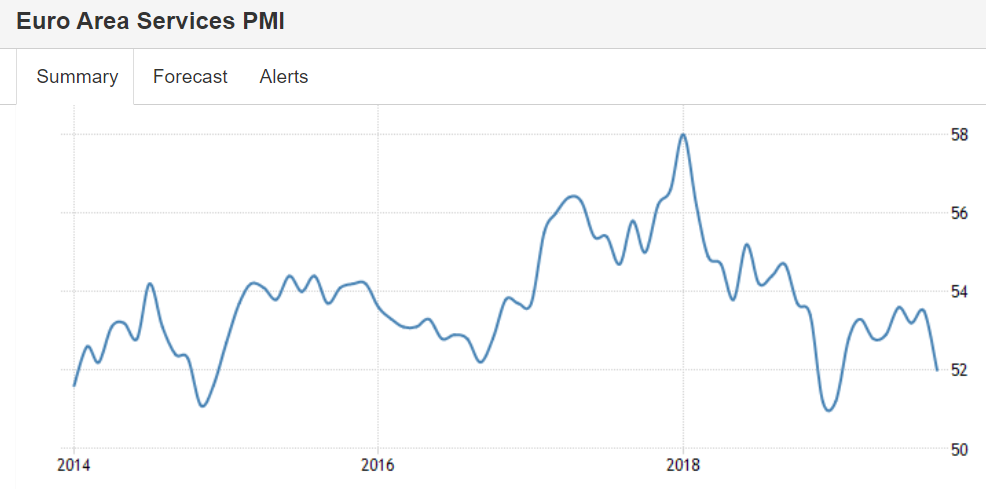

This indicator is flashing recession again. Last time this happened a few years ago the numbers were subsequently revised higher:

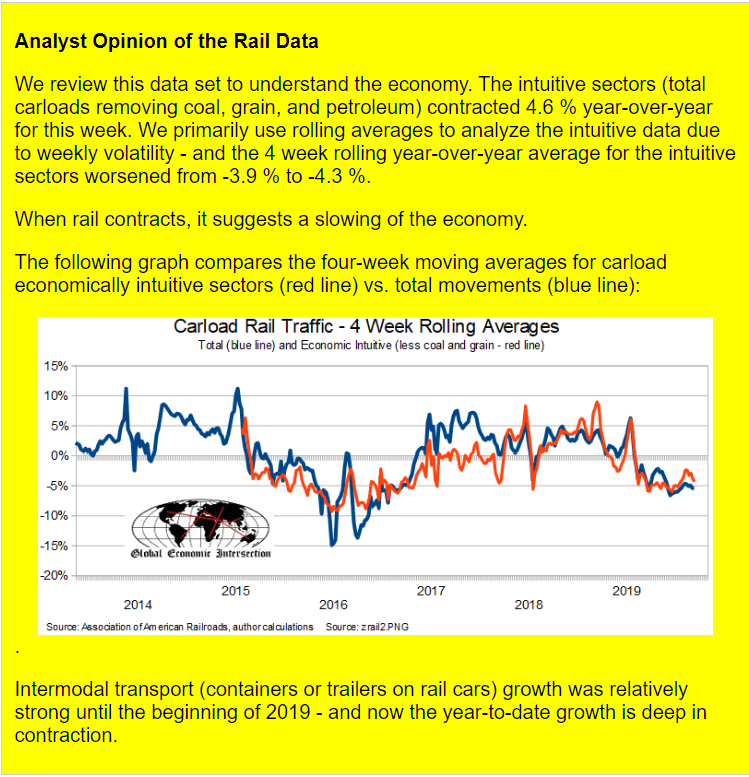

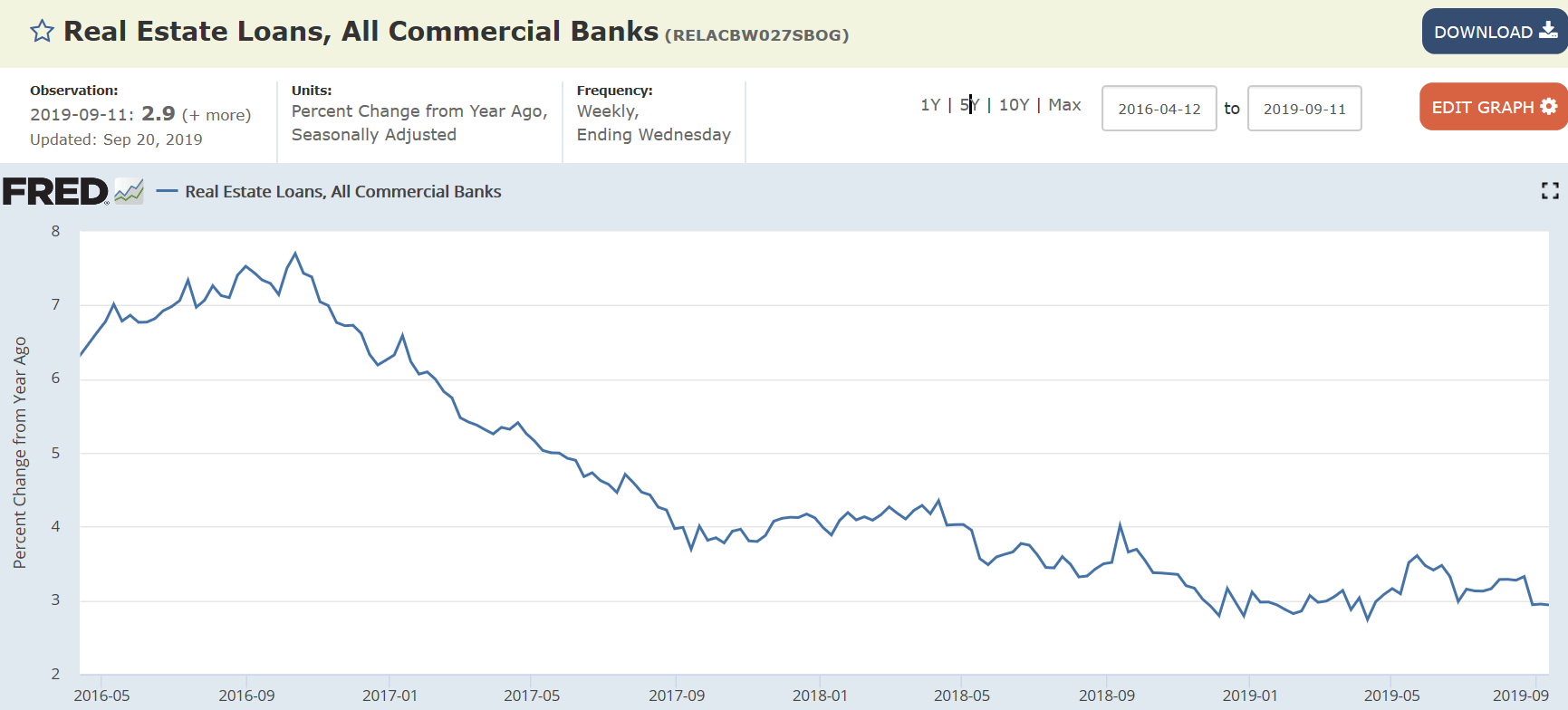

Not a good sign:

Lending to house flippers hits a 13-year high as prices and competition heat up

Still contracting:

This indicator is flashing recession again. Last time this happened a few years ago the numbers were subsequently revised higher:

Not a good sign:

Lending to house flippers hits a 13-year high as prices and competition heat up

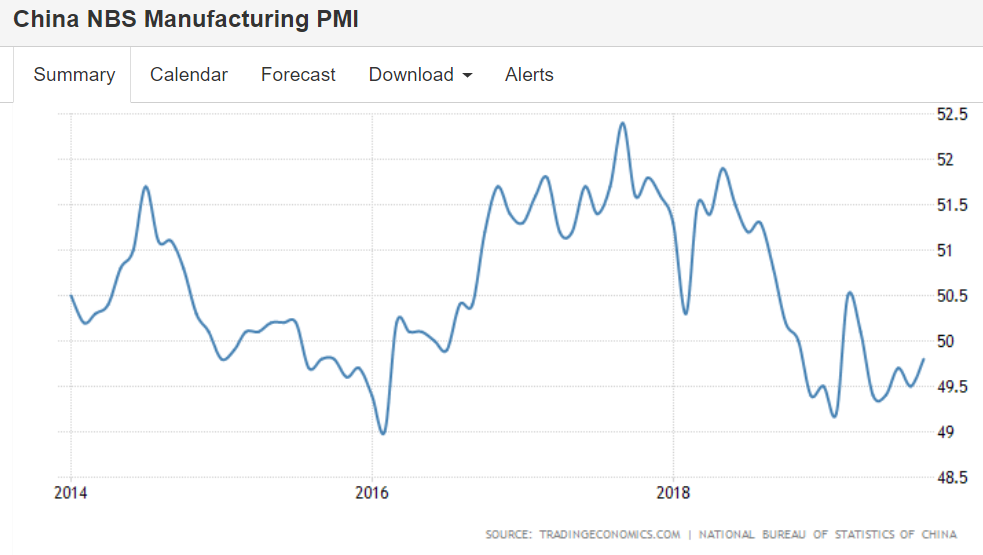

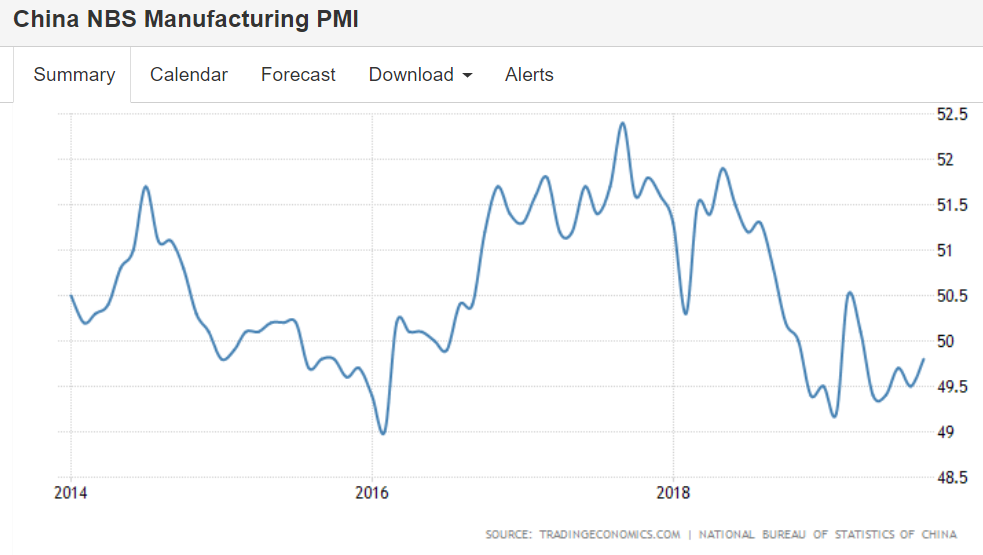

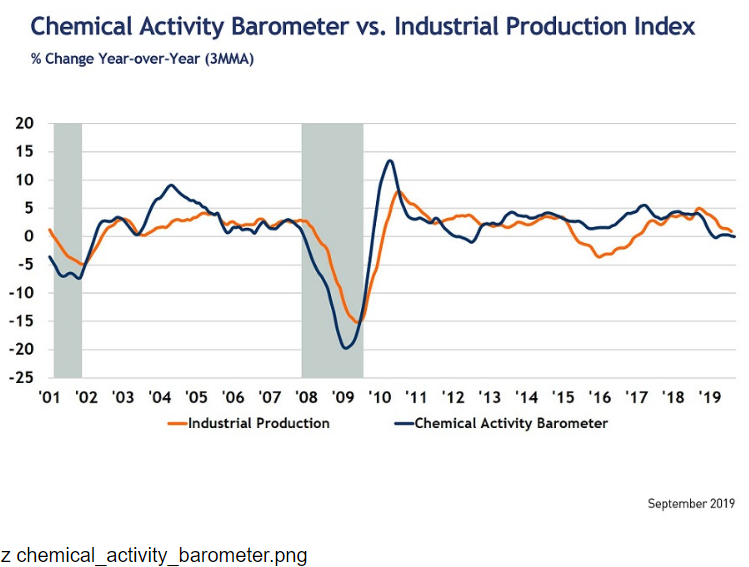

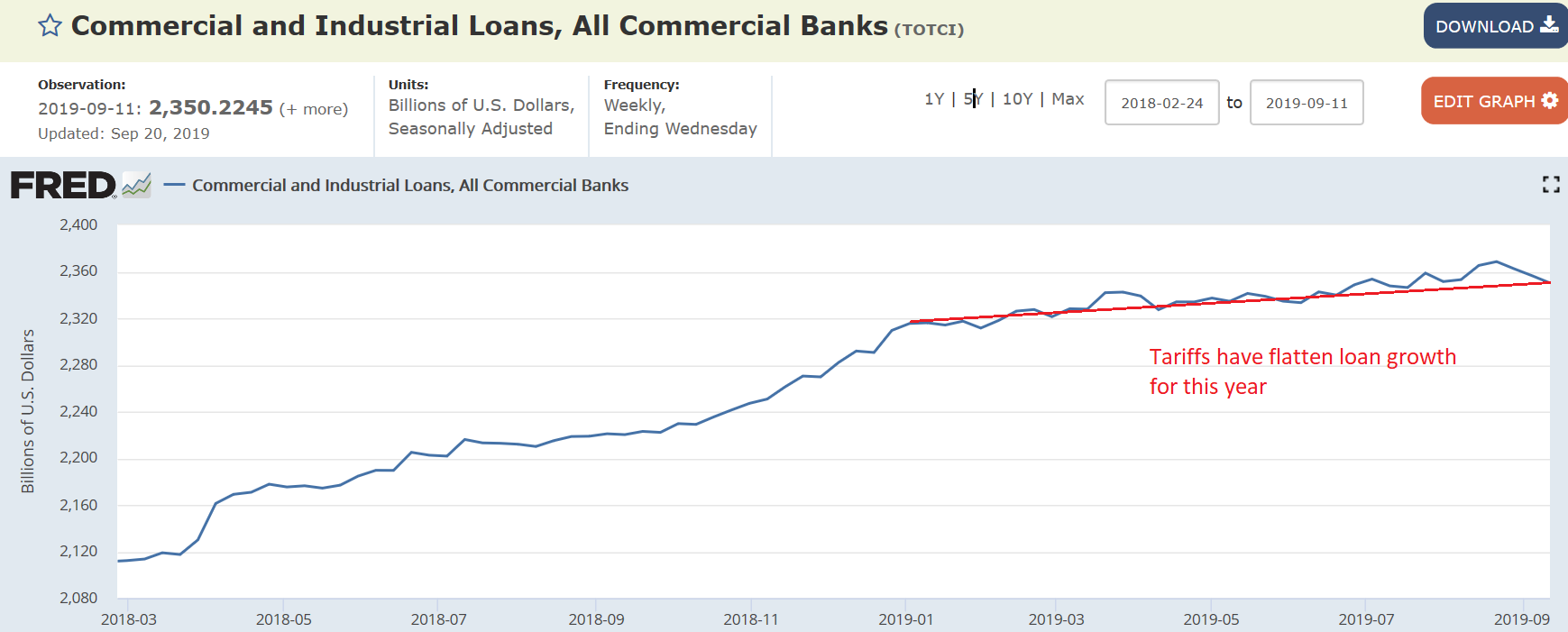

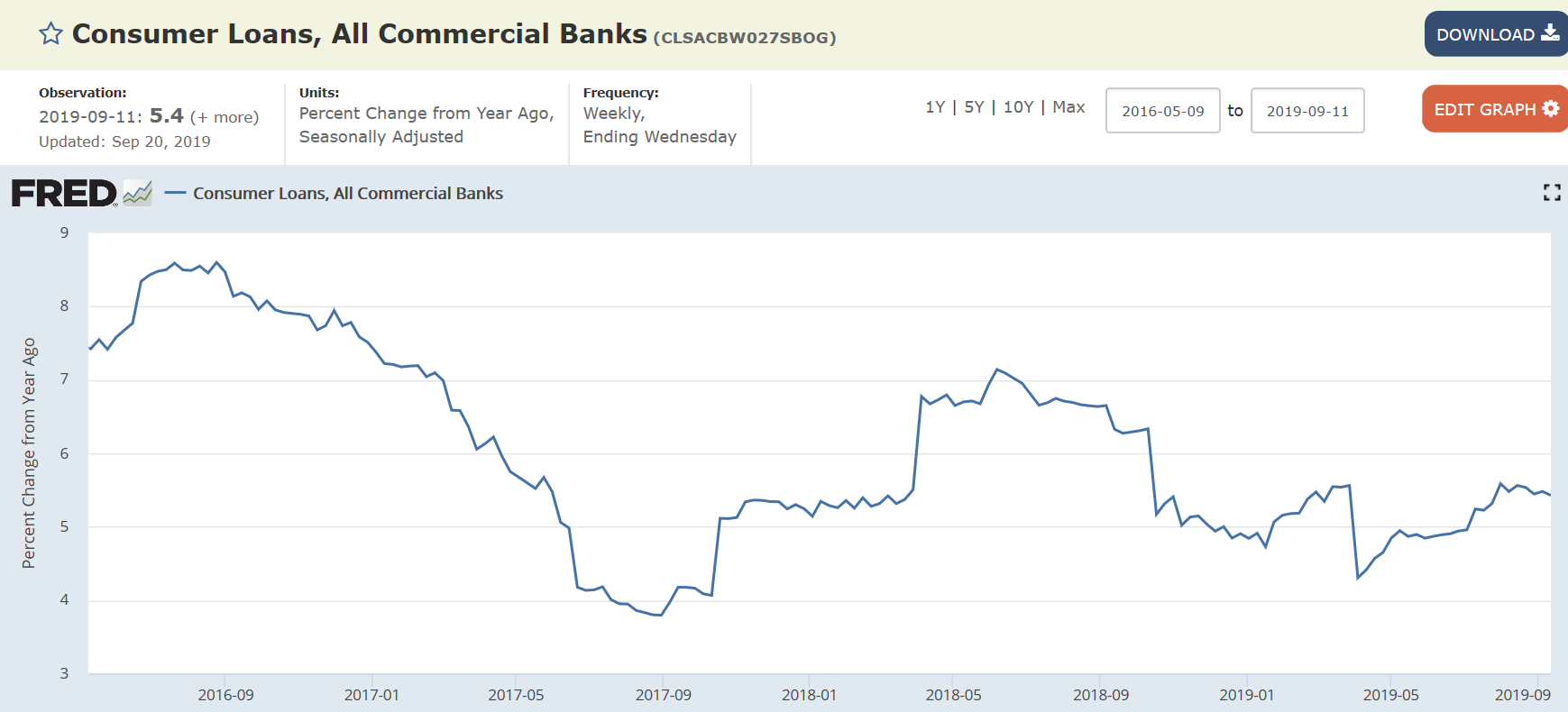

Tariffs taking a bite- deceleration in progress:

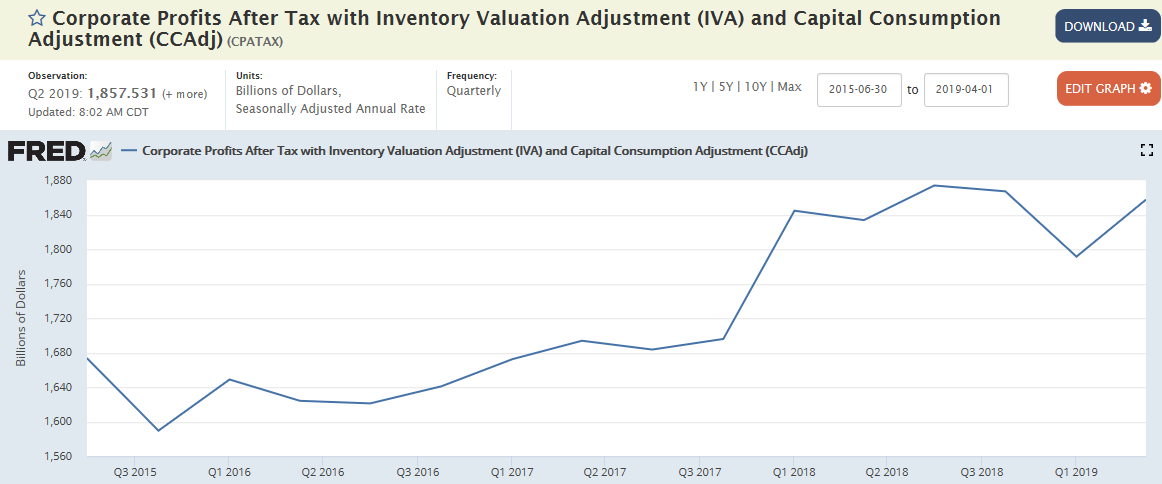

Corporate profits had been flat, got a one time boost from the tax cuts, and then flattened again:

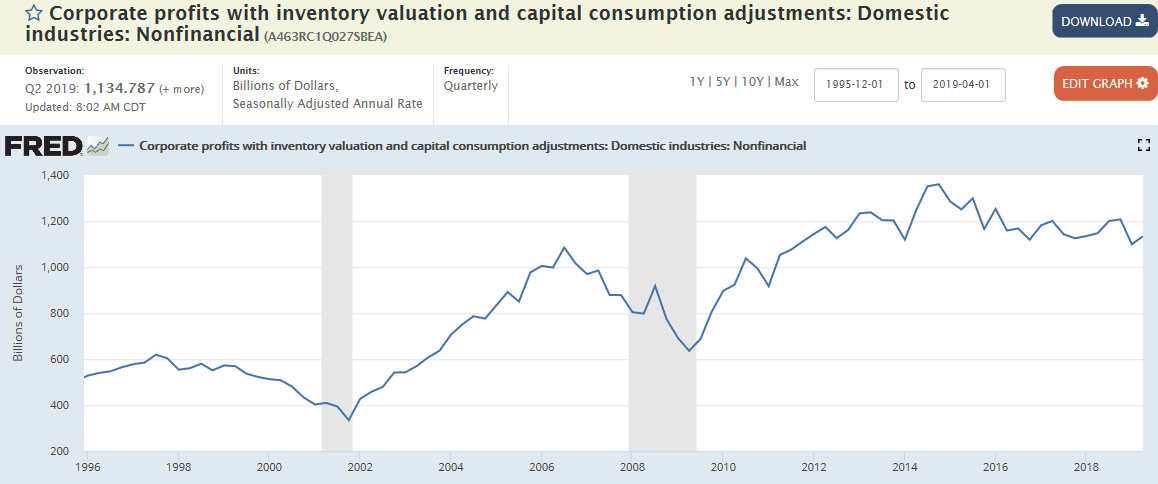

The non financial’s have done even worse:

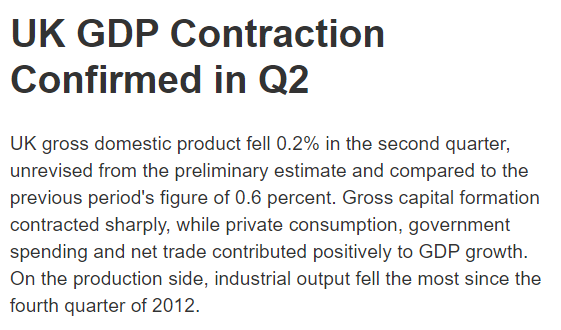

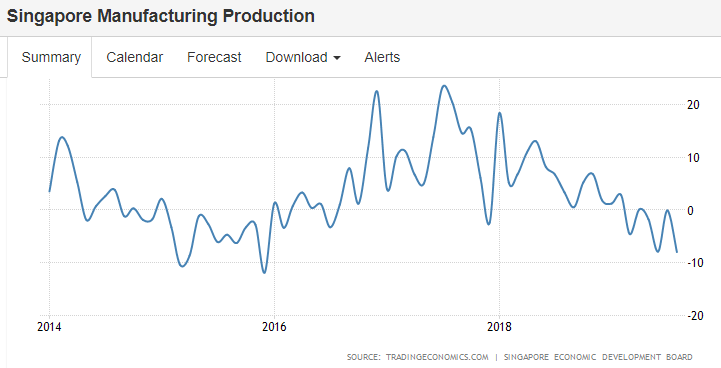

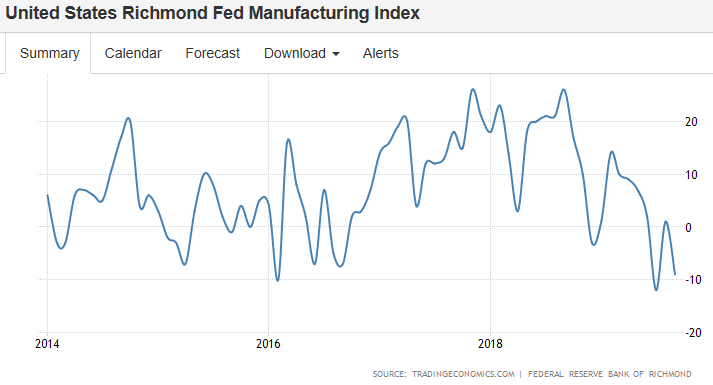

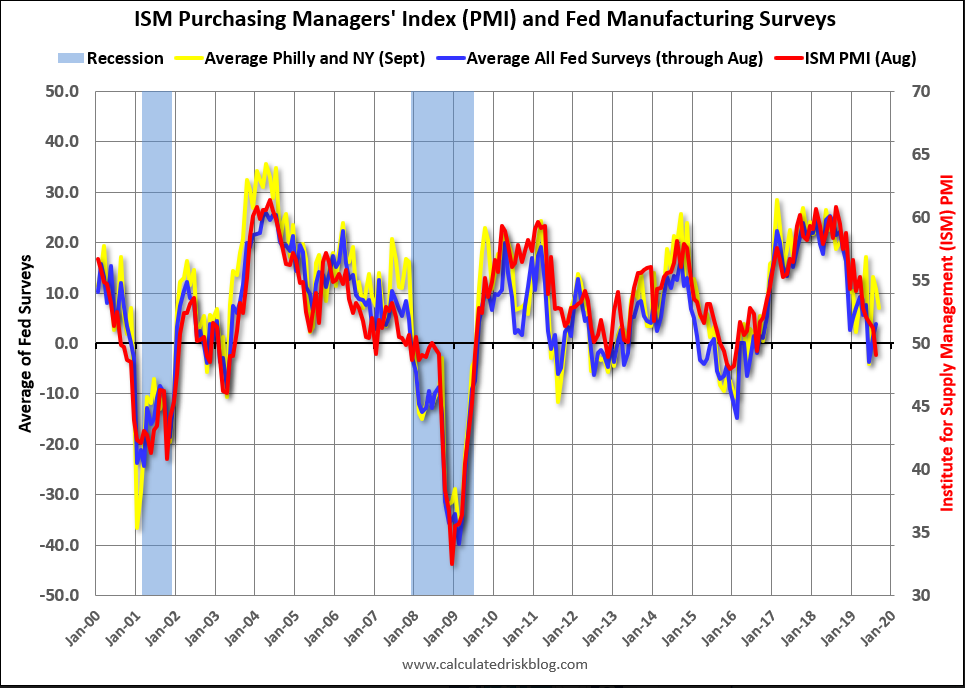

Contraction:

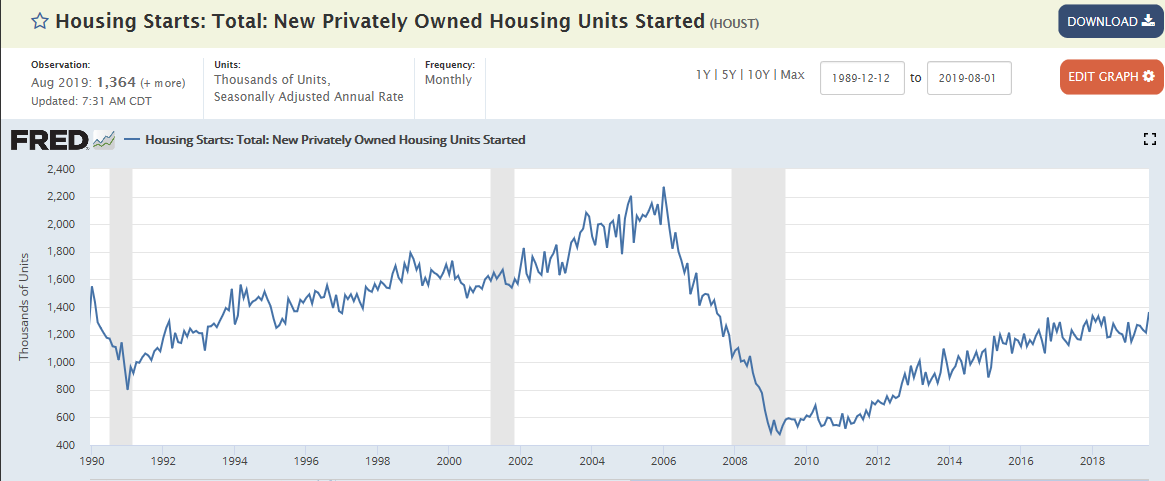

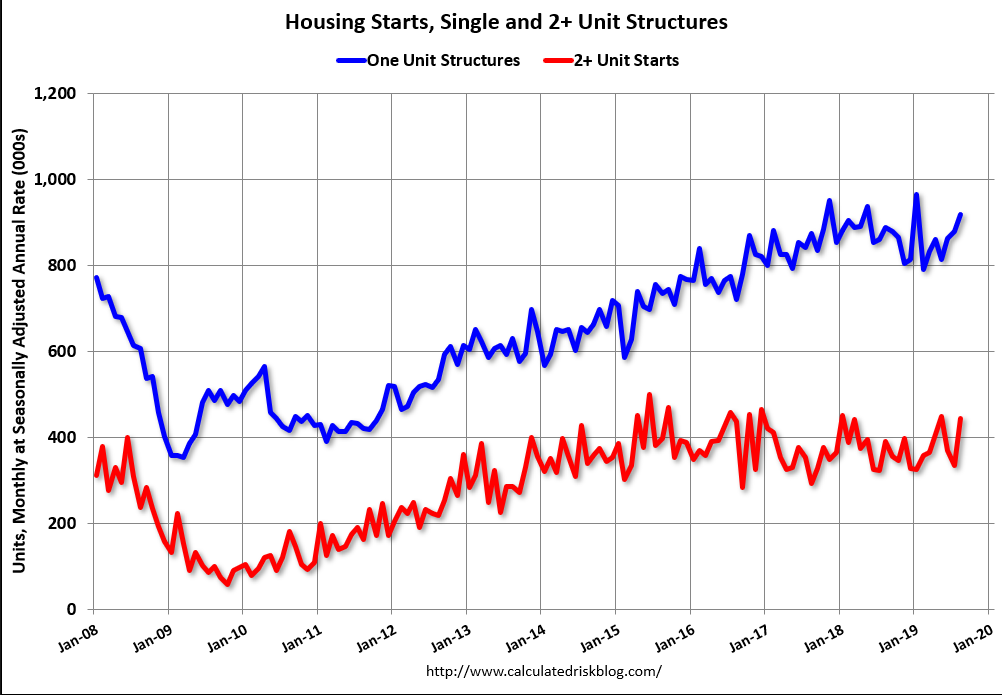

Up a bit last month, but note they are less than half of where they were the last cycle, and hovering around early 1980’s levels, when there were a lot fewer people:

Down to no annual growth:

More deceleration:

US Home Price Growth Slows to New 7-Year Low

The S&P CoreLogic Case-Shiller 20-city home price index in the US rose 2% year-on-year in July, missing market expectations of 2.2%. It was the smallest annual gain in house prices since August 2012. Phoenix recorded the biggest increase in home prices, followed by Las Vegas and Charlotte, while the smallest gains were seen in San Francisco, New York and Los Angeles. Prices in Seattle continued to drop.

Highlights

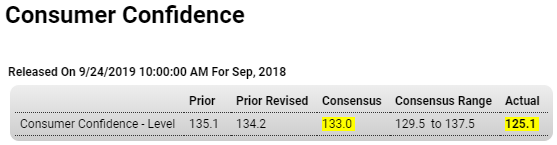

The consumer confidence index had been showing exceptional strength but did fall back unexpectedly in September to 125.1 which is down sharply from a revised 134.2 in August and 135.8 in July. Nevertheless, this index has been trending higher this year in continued contrast to the rival consumer sentiment index which has been slumping noticeably.

The difference between the two indexes is the focus on labor market factors which are central to the consumer confidence report and where today’s results are mixed. Those saying jobs are currently hard-to-get did fall 4 tenths to 11.6 percent, which is a positive indication of increasing strength, in contrast to those who say jobs are currently plentiful which fell 5.5 percentage points to 44.8 percent. The outlook for future employment strength is negative with fewer saying there will be more jobs (17.5 vs August’s 19.9 percent) and more saying there will be fewer jobs (15.7 vs 13.7 percent).

A strong negative in today’s report is a sharp decline in those who see their income improving over the next months, falling to 19.0 percent versus August’s 24.7 percent, a downturn reflecting not only caution over the jobs outlook but also a tangible drop in stock market confidence where bears, at 35.3 percent, now outnumber bulls at 31.6 percent. This is the first time since January this year that bears are on top.

Among other readings, inflation expectations are flat at 4.8 percent, down 1 tenth for this reading from August, with buying plans all noticeably lower including for autos and homes.

Today’s report offers a measure of caution and if nothing else suggests that further acceleration in consumer spending, which the Federal Reserve considers to be by far the strongest segment of the economy, may be limited.

Someone else agrees with me about the tariffs and the global trade collapse:

CNBC: The trade war is weighing ‘like a big, dark cloud’ on the global economy, says Christine Lagarde.

And this would function like a tax increase:

Bloomberg: President Trump Doubles Down on Call for Negative Interest Rates.

Today’s tariff induced bad news:

Highlights

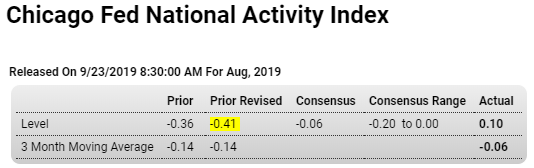

A snapback for manufacturing production led a jump into the positive column for the national activity index which at 0.10 marks the second positive score in three months. Yet the 3-month average, at minus 0.06, remains in the negative column for the seventh straight month.

Manufacturing has been the center of weakness for this indicator but posted a strong gain in August’s industrial production report. Offsetting this strength was a drop below 50 to 49.1 for the ISM manufacturing report. And speaking to broad weakness, the other three components of the index (employment, sales/orders/inventories, consumption & housing) all posted marginal declines on the month of minus 0.2 percent.

This report has been running well below GDP, offering an alternative and not very upbeat assessment of the 2019 economy. Of the 85 separate indicators that make up this report, 51 were available for August’s results.

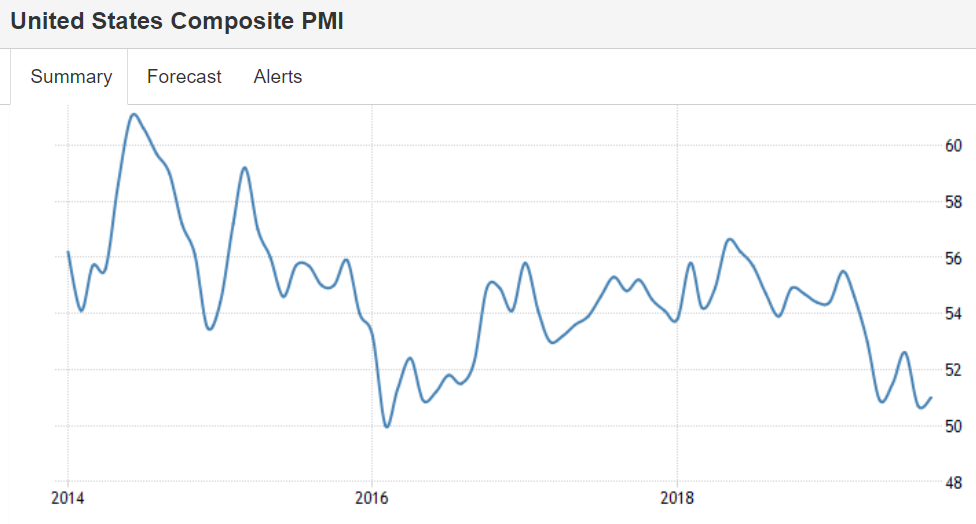

This is a composite of manufacturing and services and doesn’t look good:

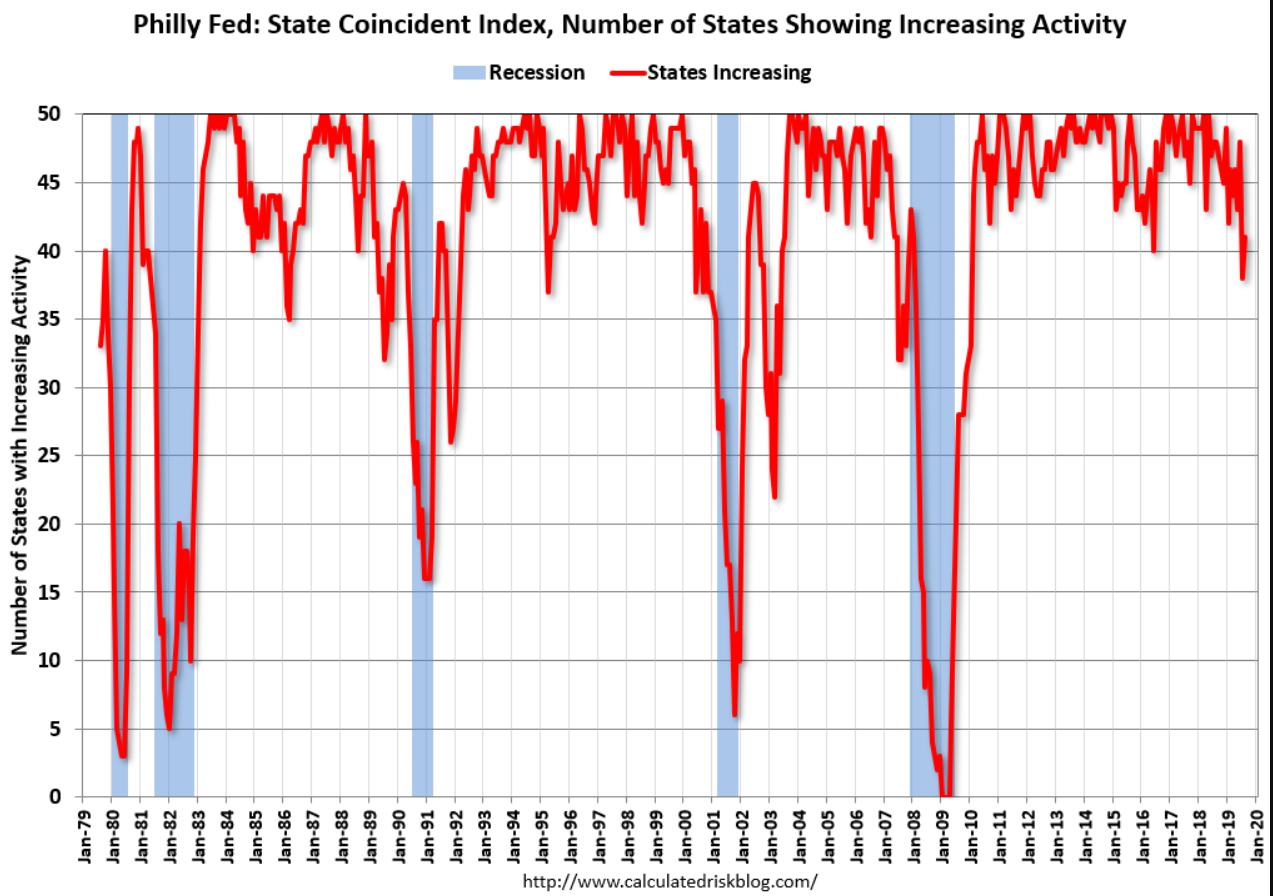

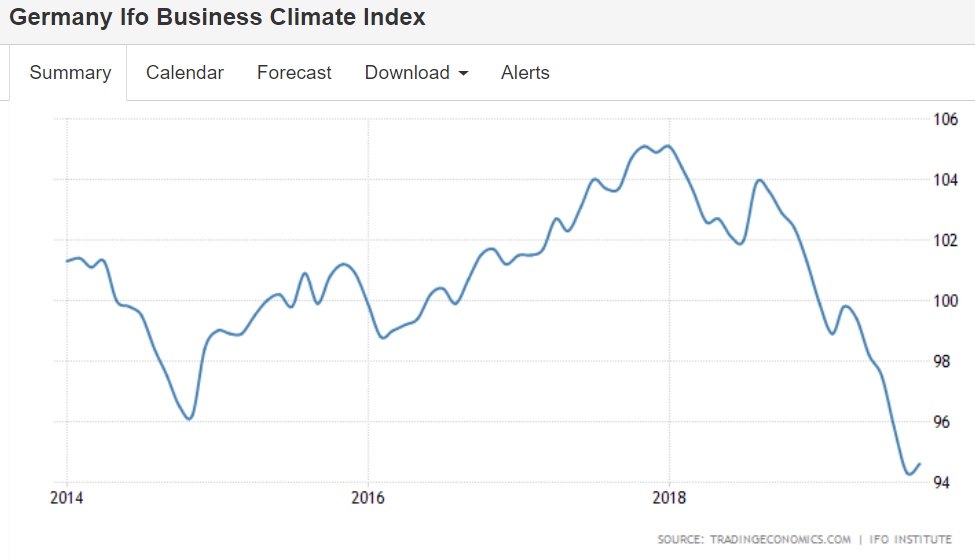

Looking like full blown recession in progress:

German Manufacturing PMI at Over 10-Year Low

The IHS Markit Germany Manufacturing PMI fell to 41.4 in September, missing market expectations of 44 and pointing to the steepest contraction in factory activity since the global financial crisis in mid-2009. Output shrank at the sharpest pace since July 2012 and new business dropped the most in more than a decade. Also, the job shedding rate accelerated to the fastest since January 2010.

Still contracting:

Commercial loan growth has flattened this year:

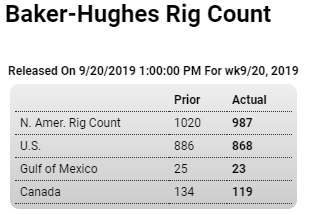

Oil capex seems to be headed south again. Might take higher prices to bring it back. And the way the decline curves work output should be peaking soon and then declining:

Highlights

The Baker Hughes North American rig count is down 33 rigs in the September 20 week to 987. The U.S. rig count is down 18 rigs from last week to 868 and is down 185 rigs from last year at this time. The Canadian count is down 15 rigs from last week to 119 and, compared to last year, is down 78 rigs.

For the U.S. count, rigs classified as drilling for oil are down 14 rigs at 719, gas rigs are down 5 at 148 and miscellaneous rigs are up 1 at 1. For the Canadian count, oil rigs are down 11 at 82 and gas rigs are down 4 at 37.

Accelerating:

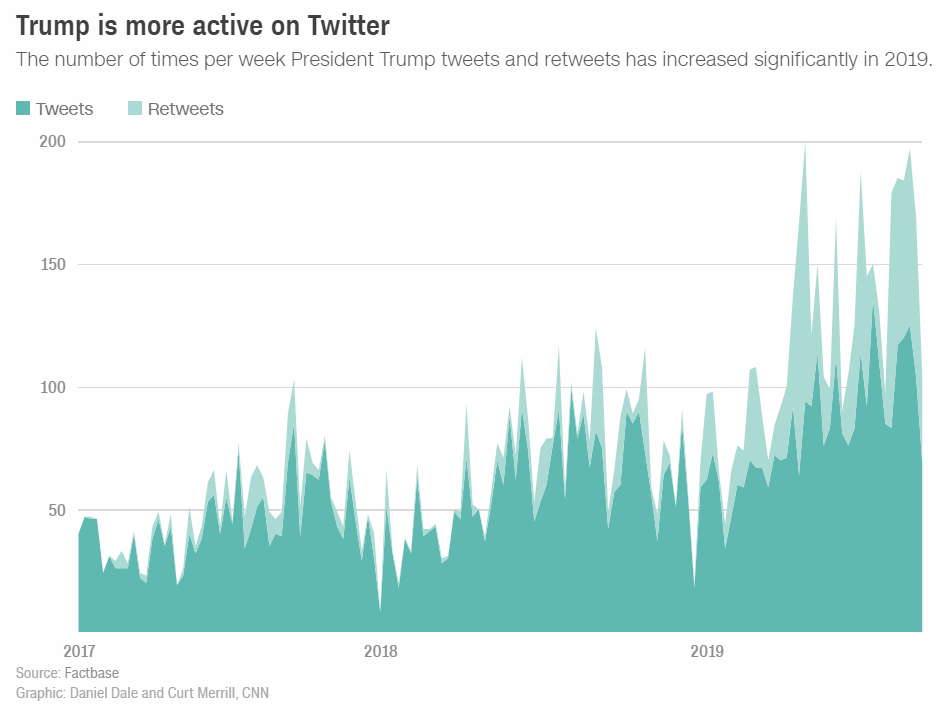

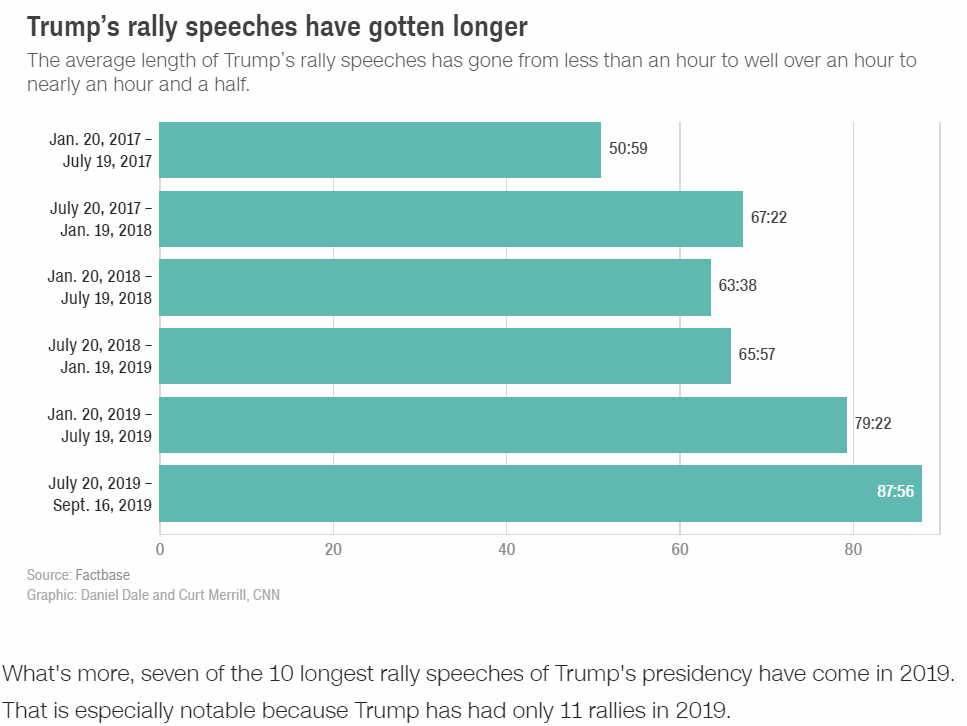

Trump unleashed: He’s talking more and tweeting more

It’s important not to mistake Trump’s own accessibility for transparency. As we documented in August, his lengthy exchanges with reporters in July and August were littered with dozens of false claims.

In general, there has been a strong correlation between how much Trump talks and how many false claims he makes. As his speaking time has increased over time, the frequency of his dishonesty has generally increased with it.

One way to visualize all this: it took Trump 343 days to make his first 1,000 false claims as president — then just 197 days to make his second 1,000, just 93 days to make his third 1,000, and just 75 days to make his fourth 1,000, Toronto Star editor Ed Tubb found when we worked for that newspaper. Trump then slowed a little after the midterms, taking 125 days to make his fifth 1,000.

Today happens to be the eco strike:

Trump grants tariff exemptions to plastic straws, dog leashes and more from China

Must be some defense agreement no one else knows about:

Trump sanctions Iran’s central bank in wake of strikes on Saudi oil facilities

No end to tariffs in sight, and no interest in helping Trump politically:

China officials have changed their travel schedule and were headed back to China earlier than planned, according to Nicole Rolf, the Montana Farm Bureau Federation’s director of national affairs.

Nebraska department of agriculture also said the Chinese team called off a visit to farms in Nebraska.

U.S. Secretary of Agriculture Sonny Perdue confirmed just Thursday the meetings were in the works as a way for China to build goodwill with American farmers.

He’s feeling the leverage China is exerting:

Trump says he doesn’t need a trade deal with China before the 2020 election

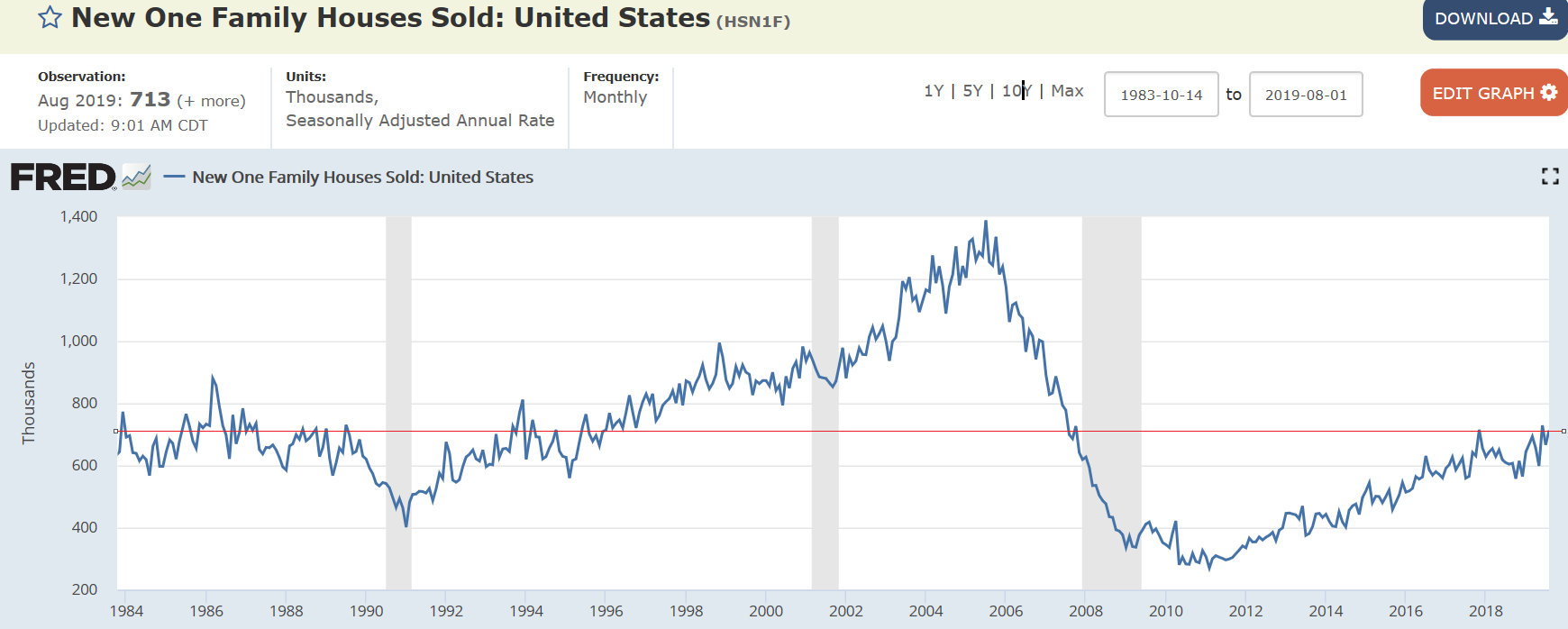

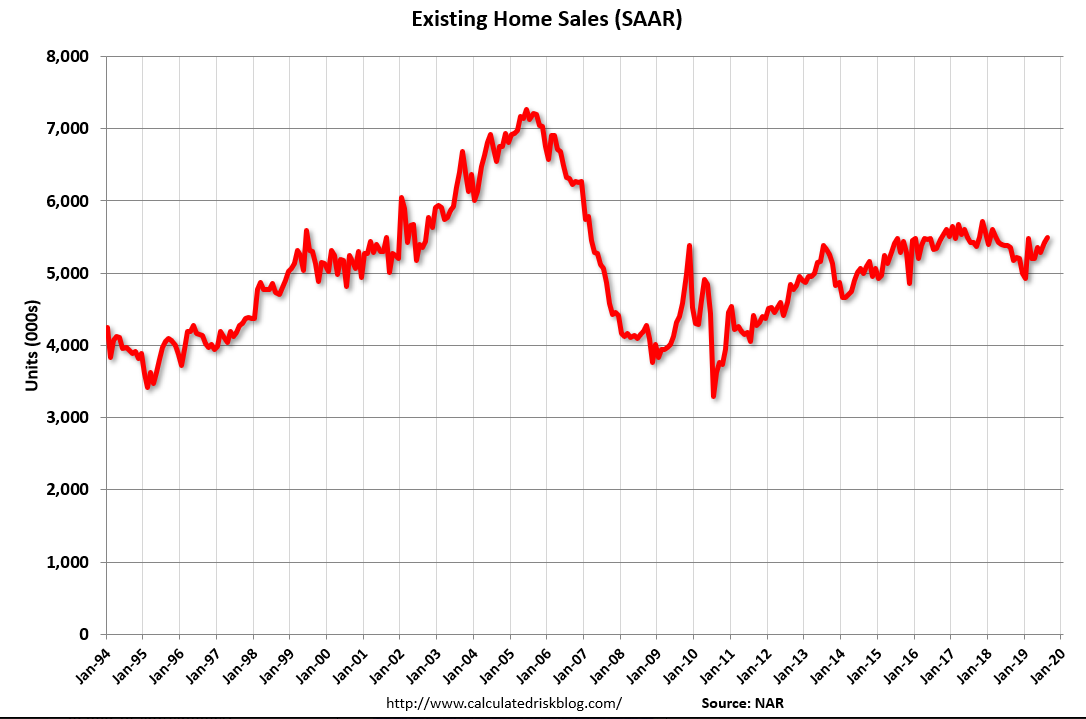

Up some for the month, but remain weak and depressed historically, especially on a per capita basis:

Manufacturing surveys continue to forecast weakness:

I think what he wants rate cuts because he (and most everyone else) believes that will make the dollar go down which he further believes will reduce the trade deficit and support economic growth:

And the VP isn’t far behind the big guy:

Pence says other countries should ‘emulate’ US economic policies to catch up

Vice President Mike Pence said Thursday that other countries should “emulate” US policies.

However, he also said the US should imitate the policy of other nations who keep their interest rates anchored near zero.

Looks to me like Turkey has got it right- inflation will fall and the currency firm as they cut rates. But I don’t expect it to help the economy, but instead the rate cuts will likely weaken it, begging a fiscal adjustment to support employment and output:

Erdogan Says Turkey to Soon Cut Interest Rates to Single Digits

President Recep Tayyip Erdogan said Turkey will lower interest rates to single digits soon and inflation will follow suit.

“We are lowering and will lower interest rates to single digits in the shortest period,” Erdogan said in a televised speech on Sunday. “After it falls to single digits, inflation will also slow to single digits.”

The drop in inflation after rate cuts is an apparent reference to Erdogan’s personal belief that price gains slow when the cost of borrowing is reduced. Most economists think the opposite is true.

The global trade collapse from tariffs continues:

They all have it backwards- it’s the 5th deadly innocent fraud- as the great global trade collapse continues:

Blackstone’s Schwarzman: China’s economic ‘miracle’ came at the expense of the US and the West

“That leads the developed world to say to China: ‘We’ve got to rebalance this. It’s working for you. It’s not working for us,’” says Blackstone CEO Stephen Schwarzman.

Up a bit this month, but levels remain historically depressed, and it’s likely some demand was moved forward by the sudden drop in rates. Also note that the chart isn’t population adjusted.