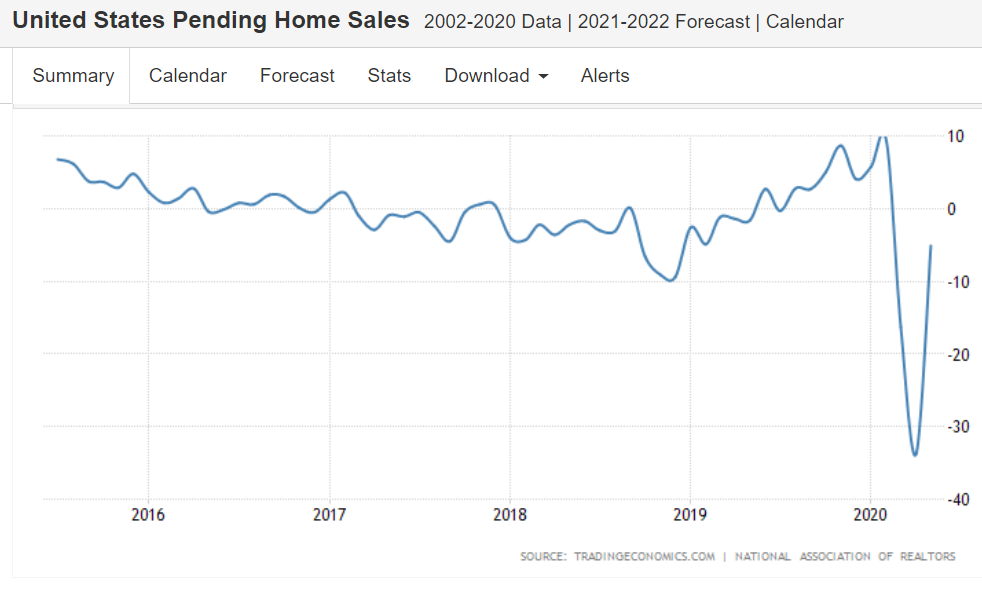

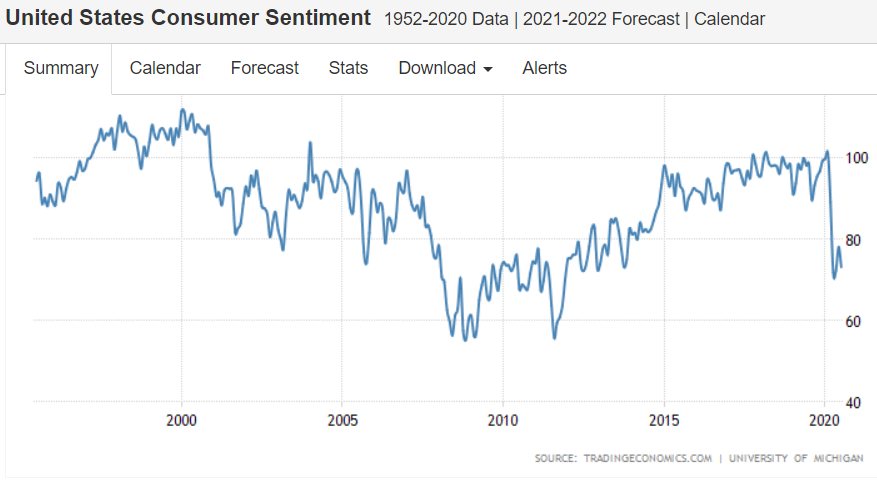

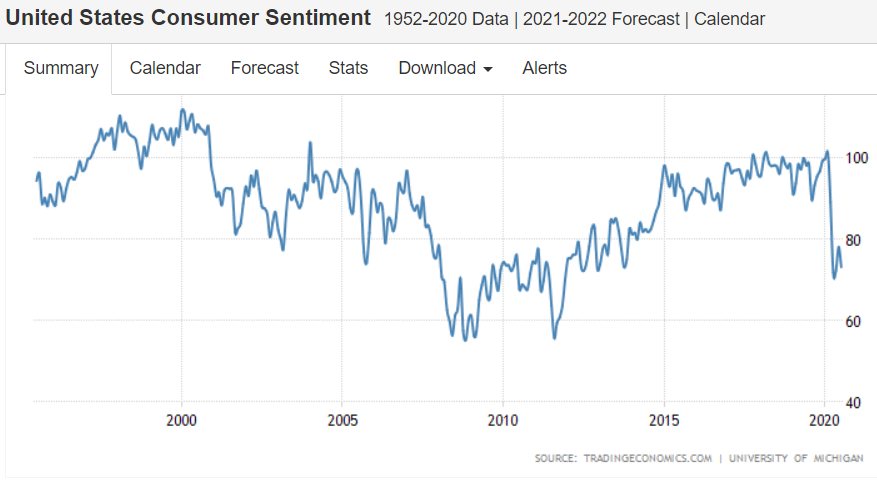

This is about consumer spending plans which remain weak:

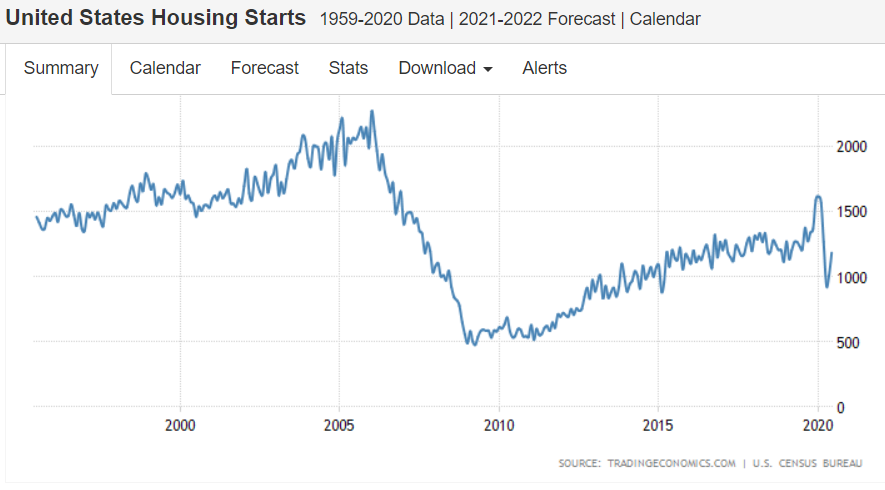

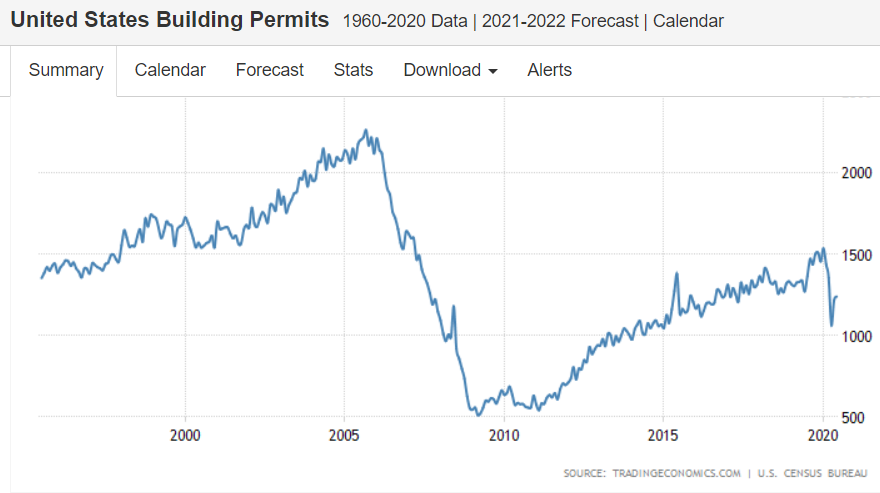

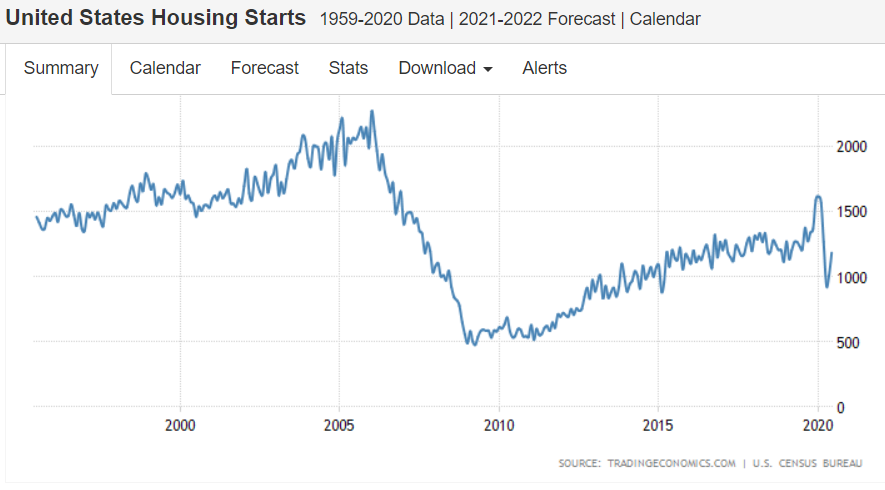

Housing starts were depressed historically and going sideways before covid, and have subsequently weakened:

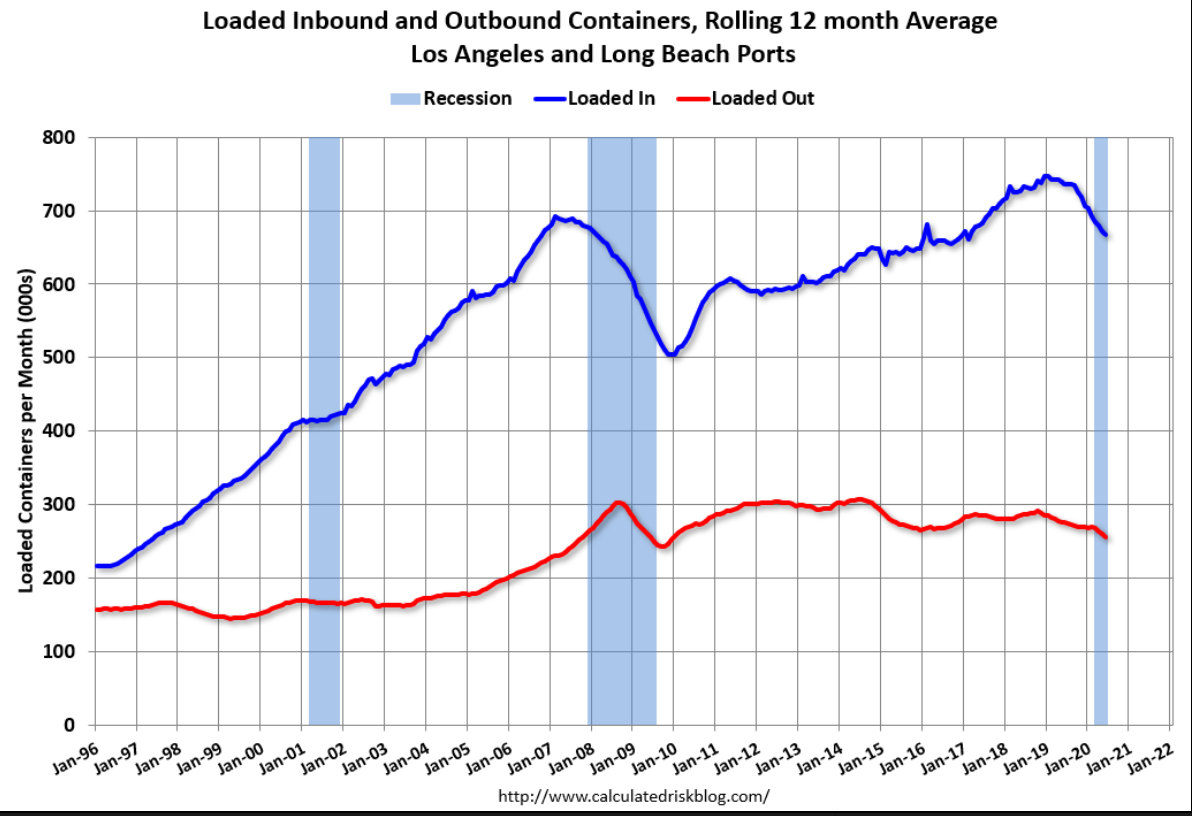

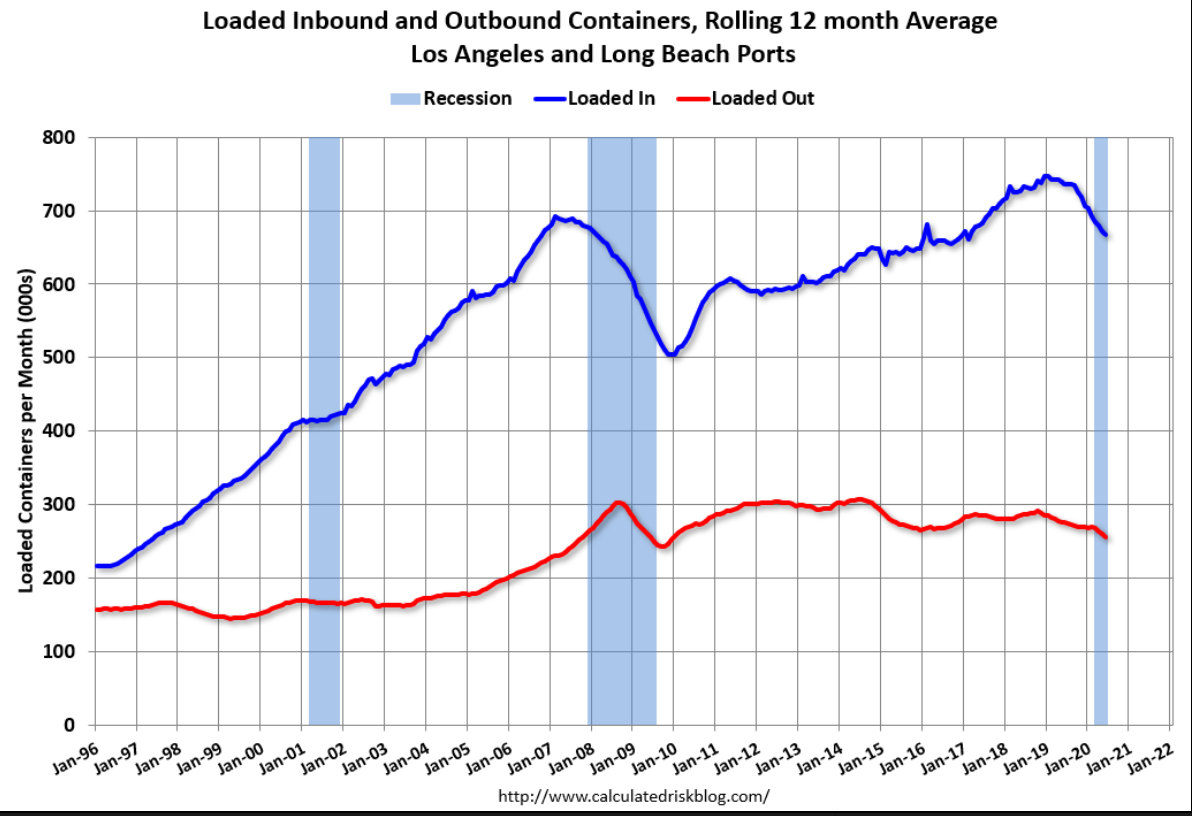

Collapse in global trade continues:

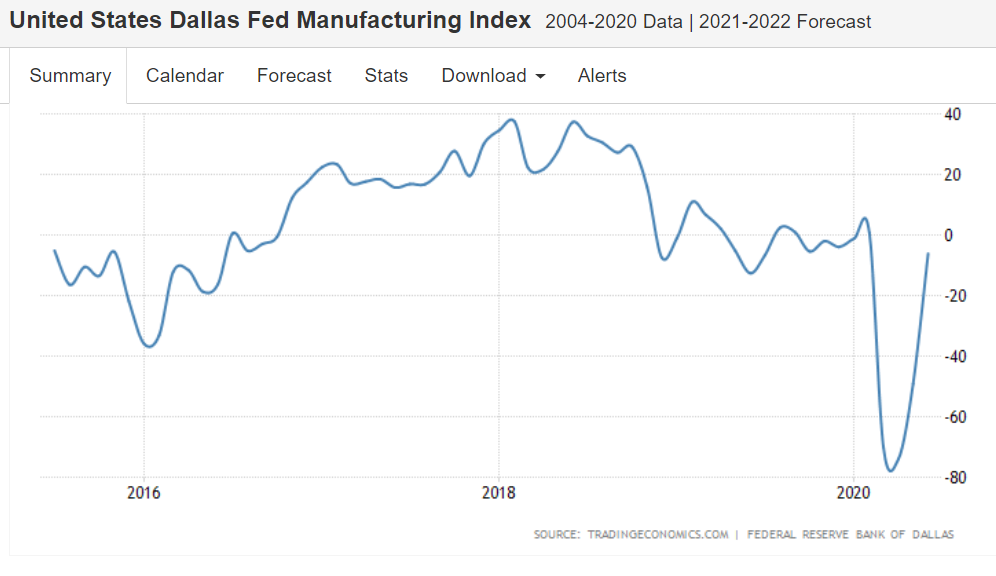

Not good:

This is about consumer spending plans which remain weak:

Housing starts were depressed historically and going sideways before covid, and have subsequently weakened:

Collapse in global trade continues:

Not good:

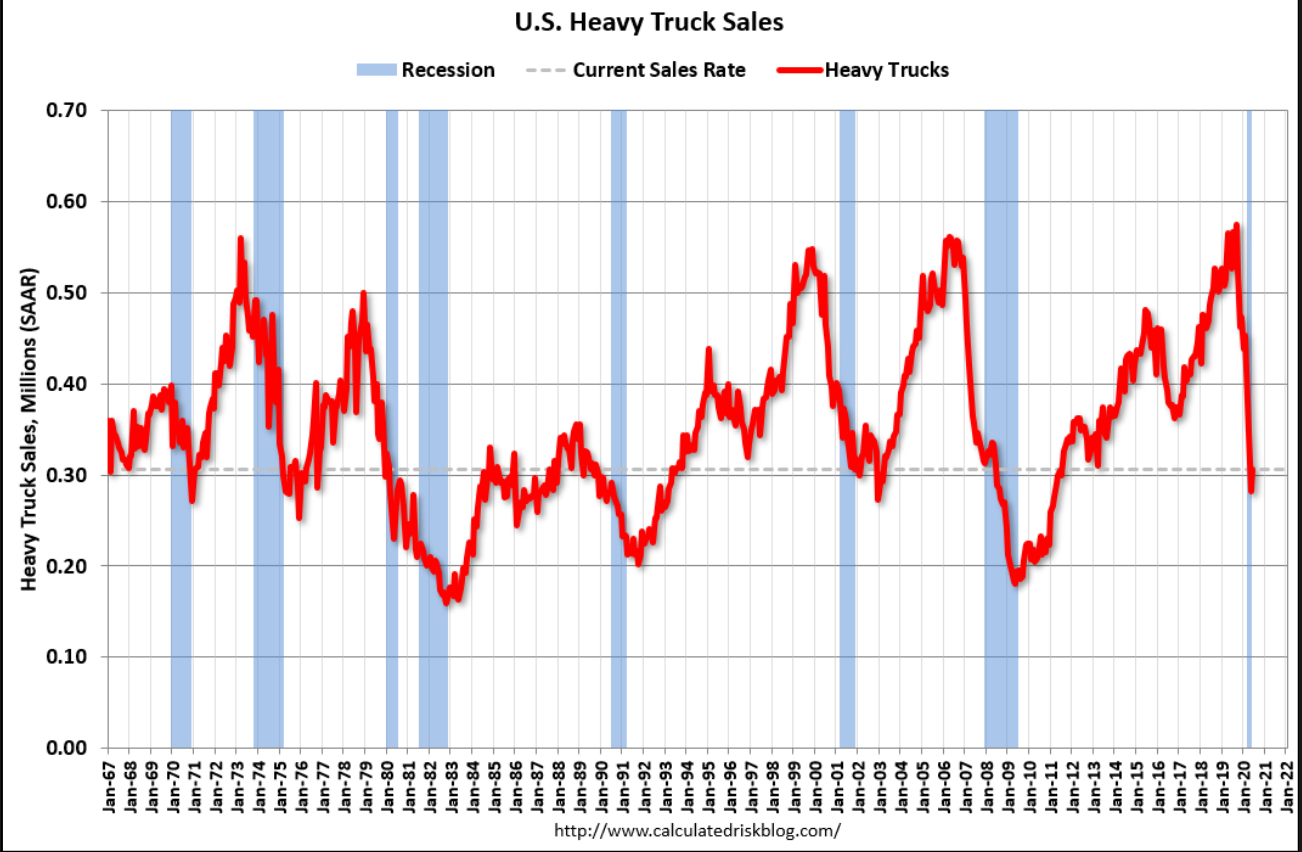

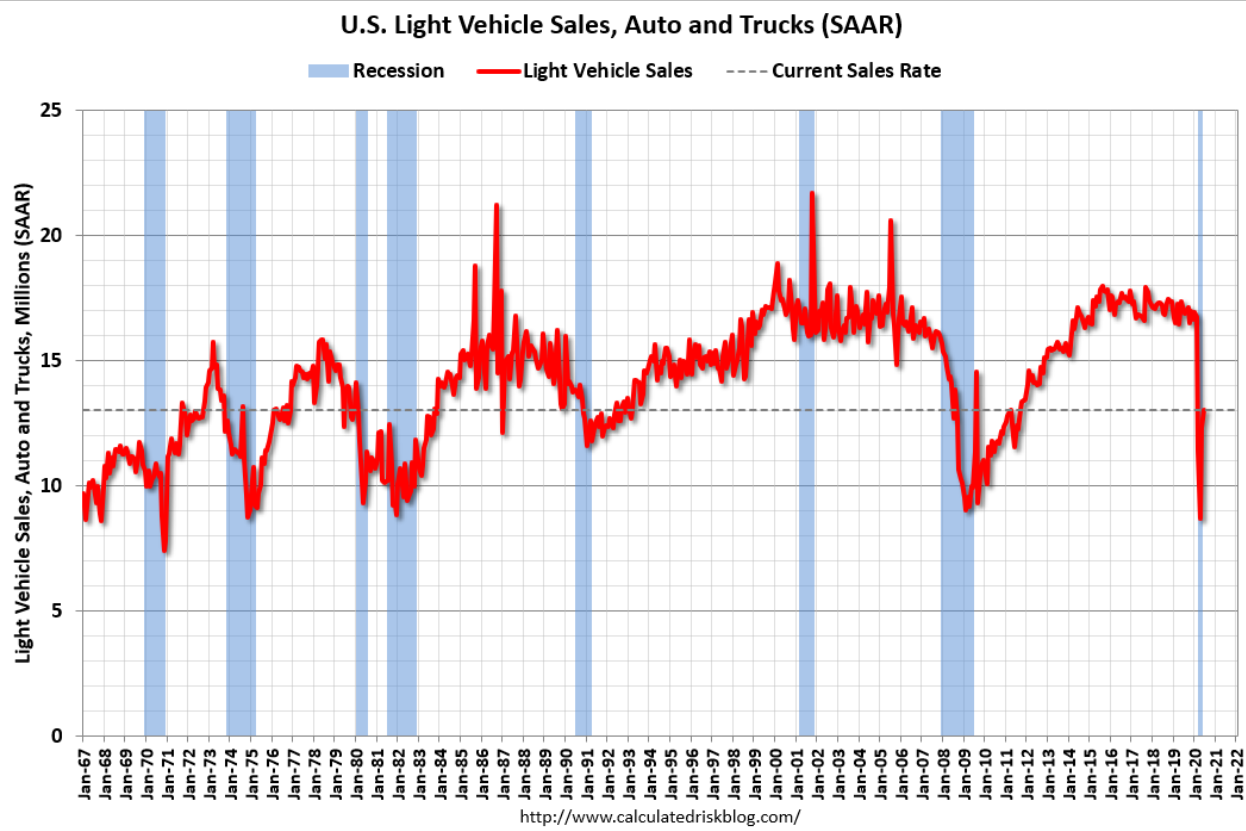

Still way down after a small uptick last month, and it had already started fading with the tariffs that continue:

https://www.instagram.com/tv/CCqgZ8xD-Ef/?igshid=1r39gp3arr6i0

The retreat continues:

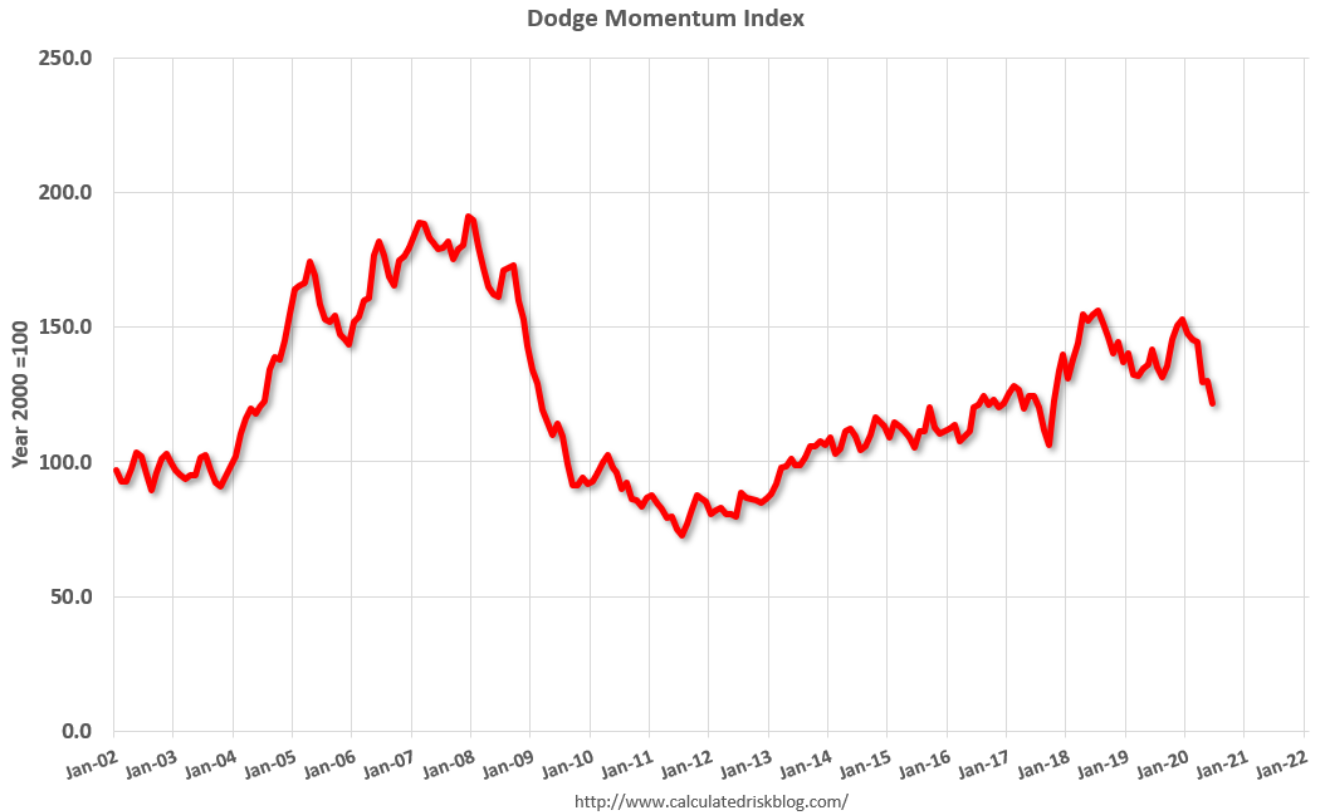

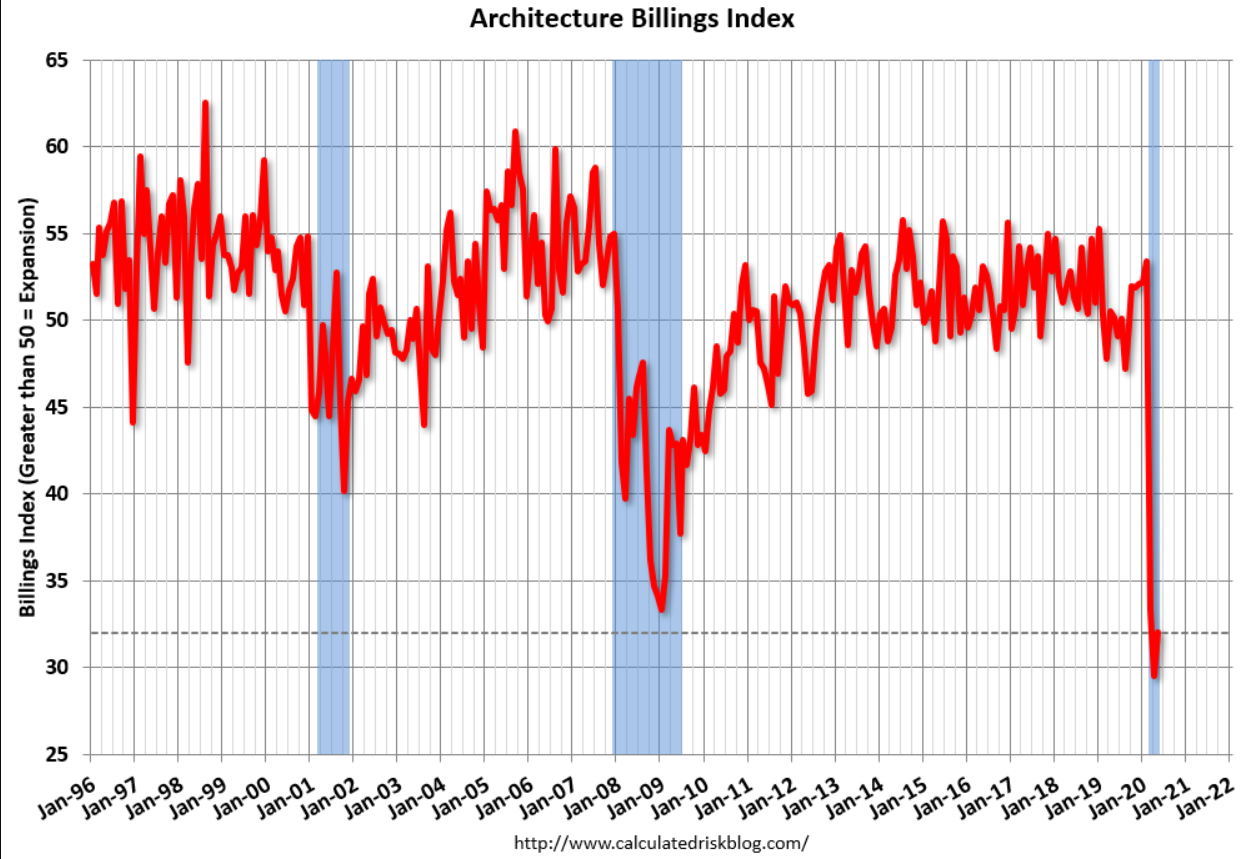

Commercial real estate leading index was down again for June:

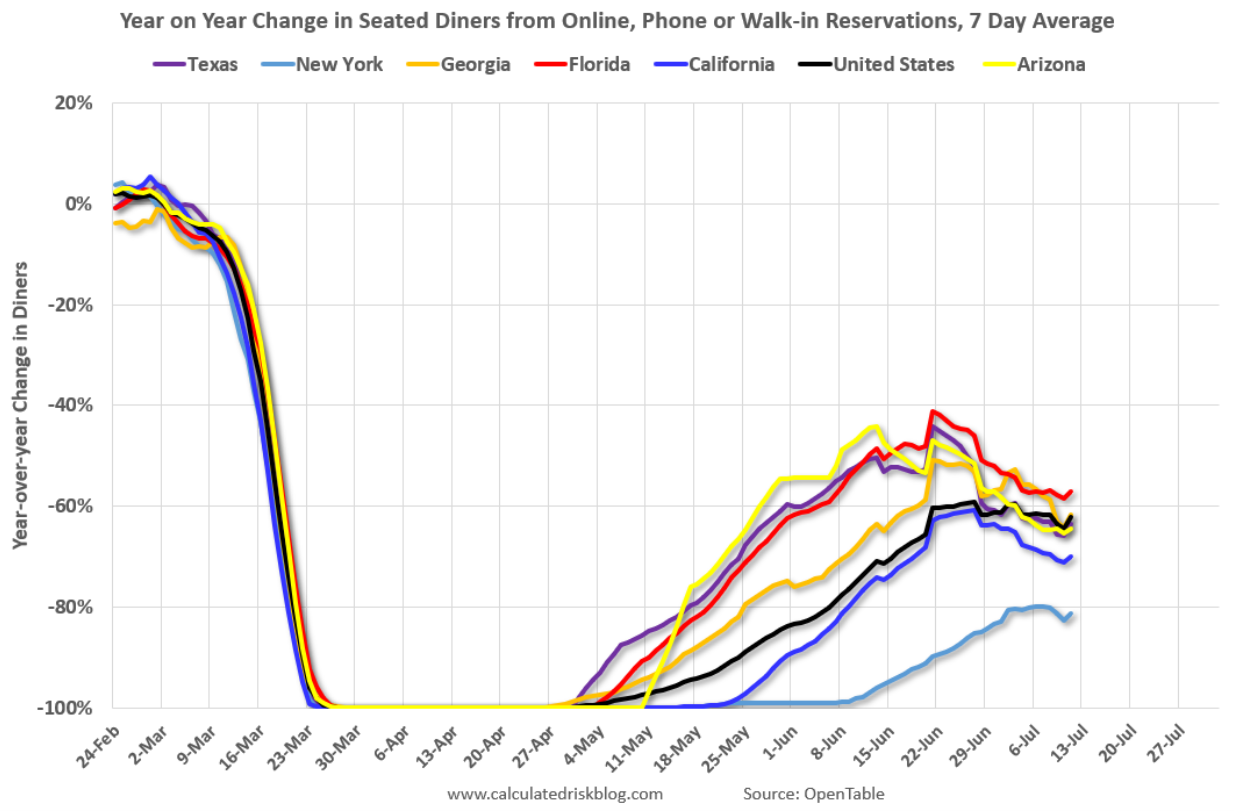

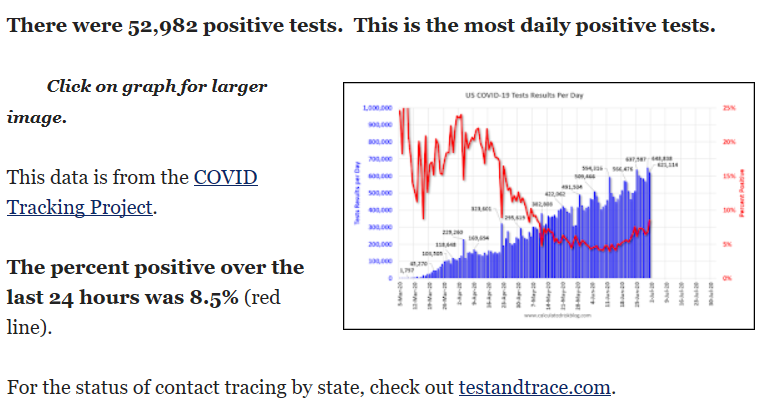

Taken a turn for the worse:

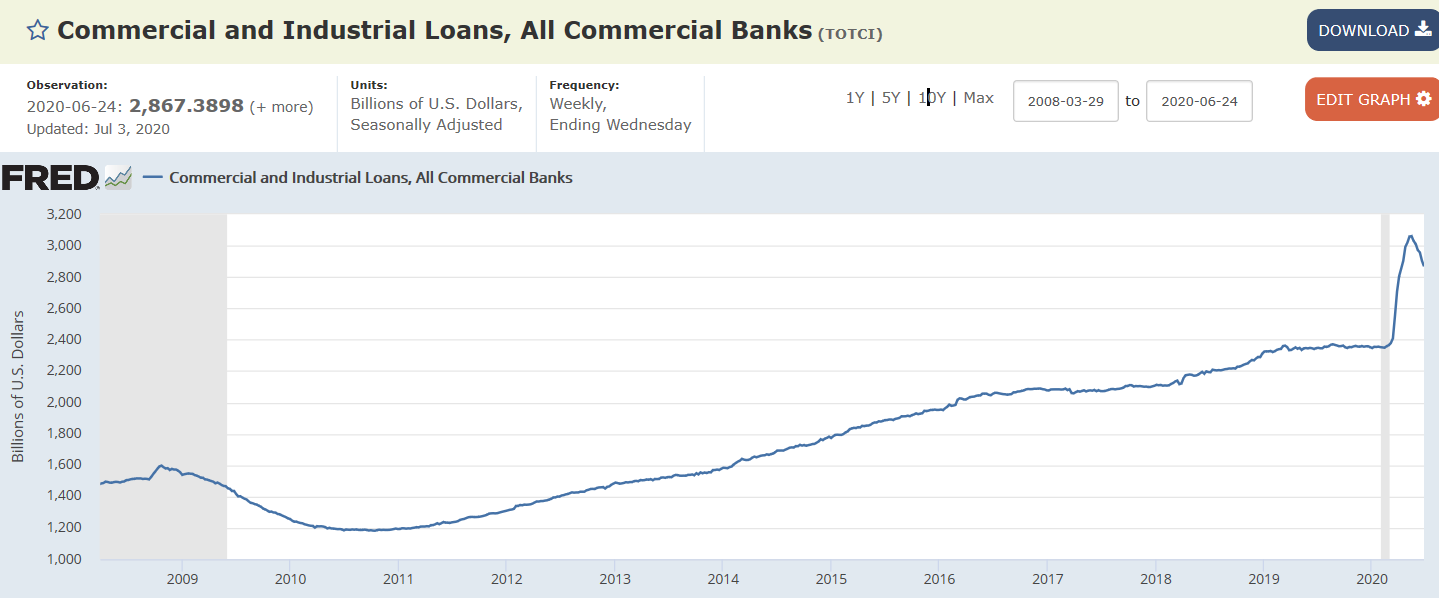

Still at very high levels:

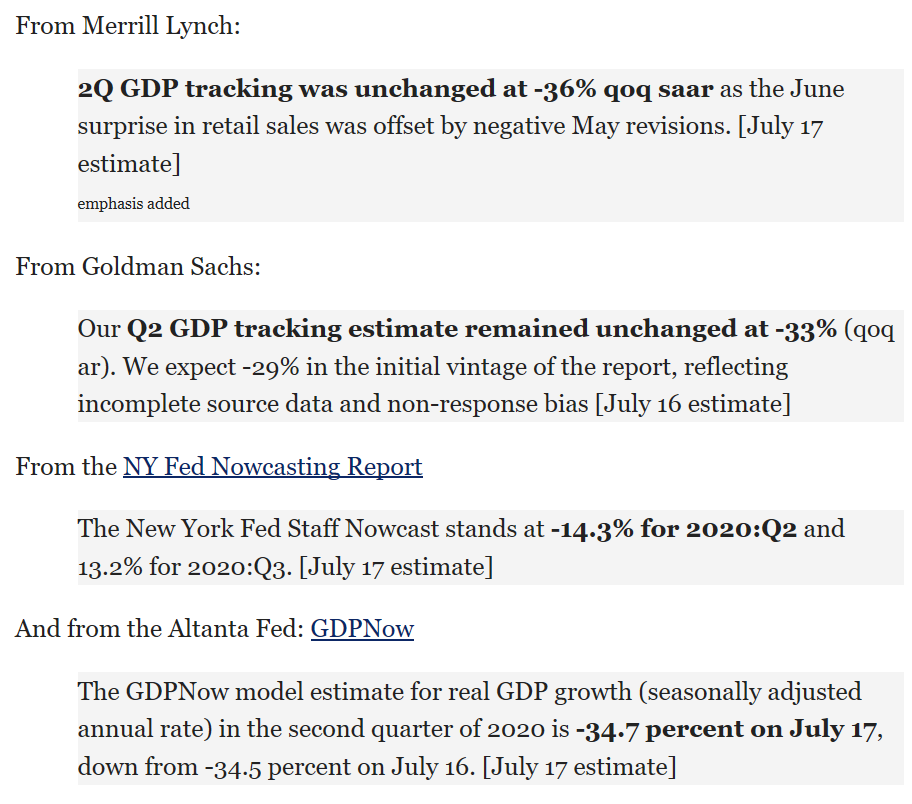

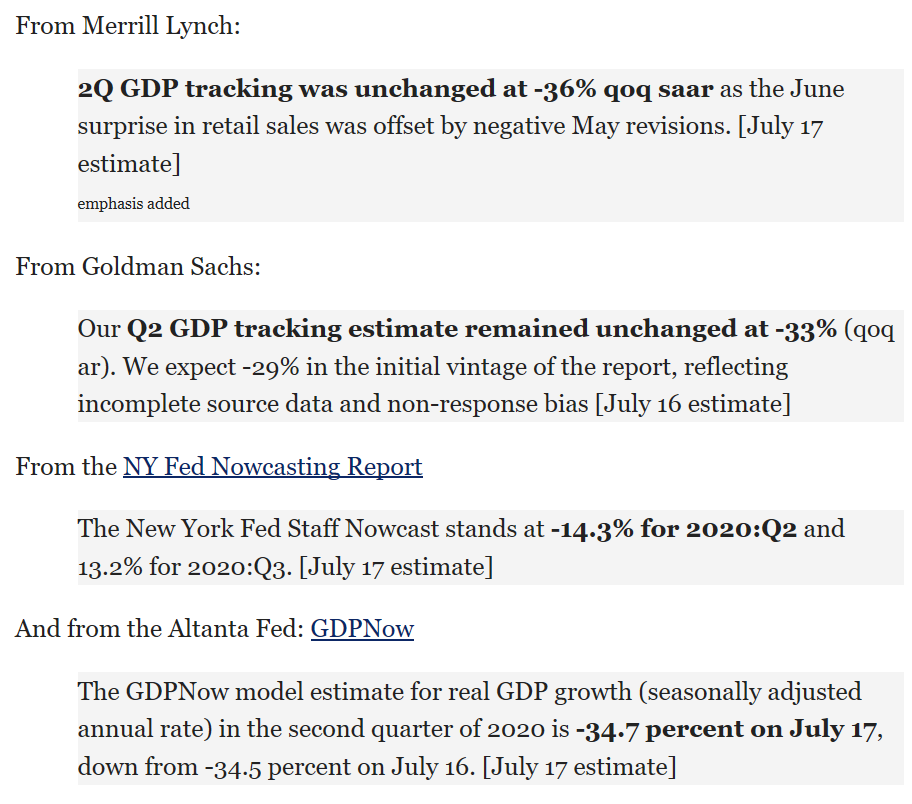

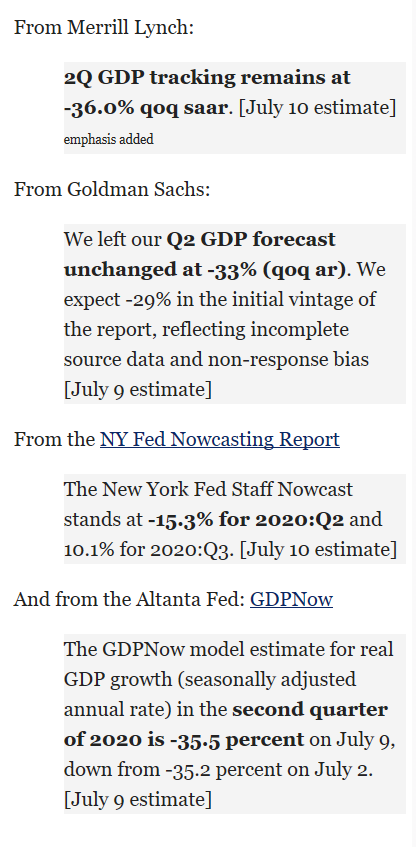

Q2 forecasts for GDP, which ended June 30 (forecasting the past). Down 35% is about a $2 trillion drop in income/sales for the economy:

Interesting:

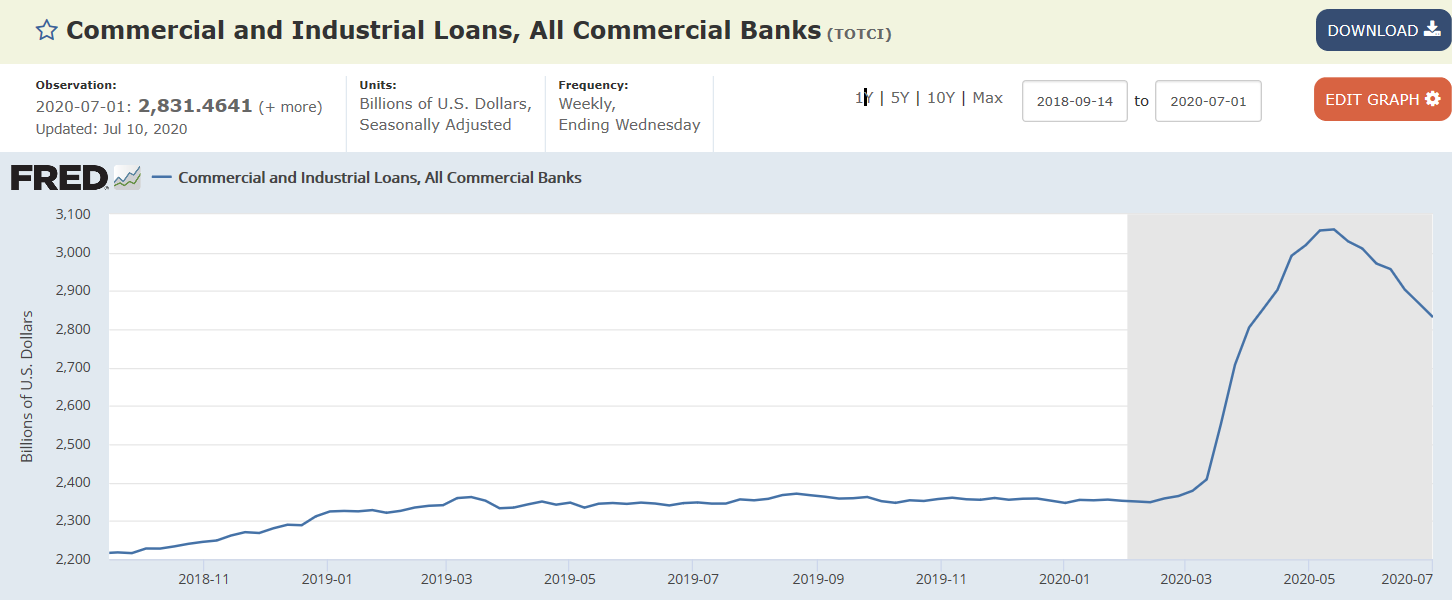

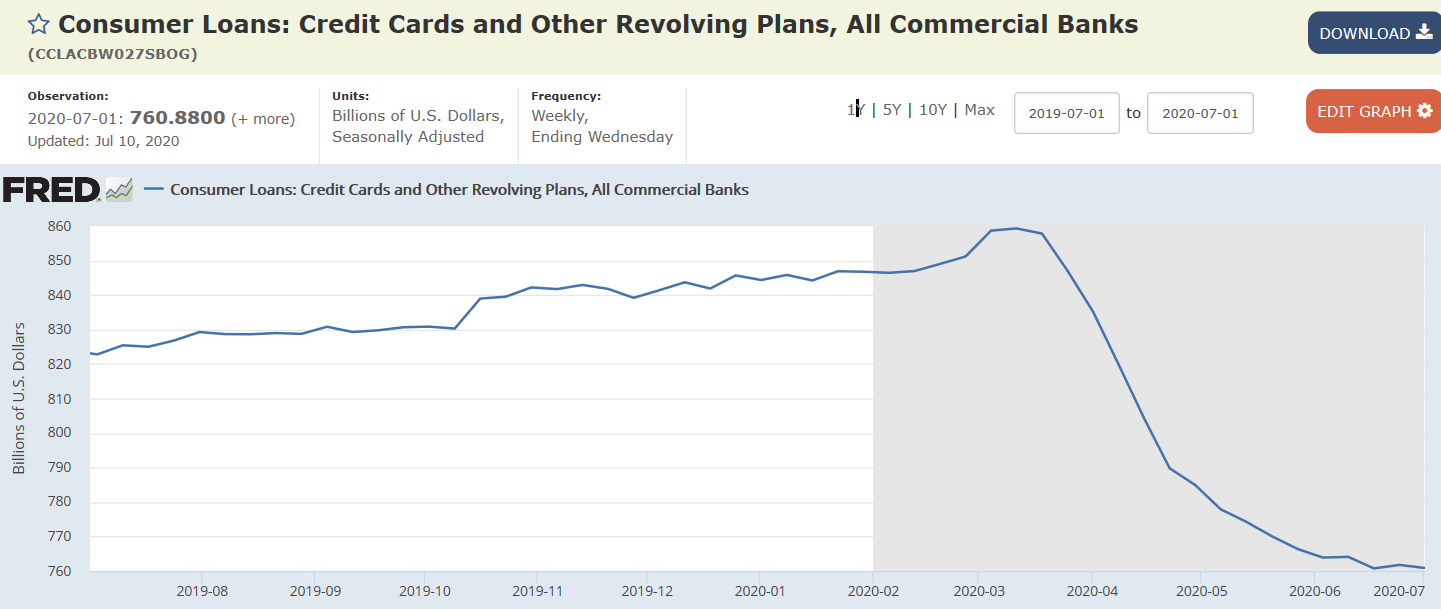

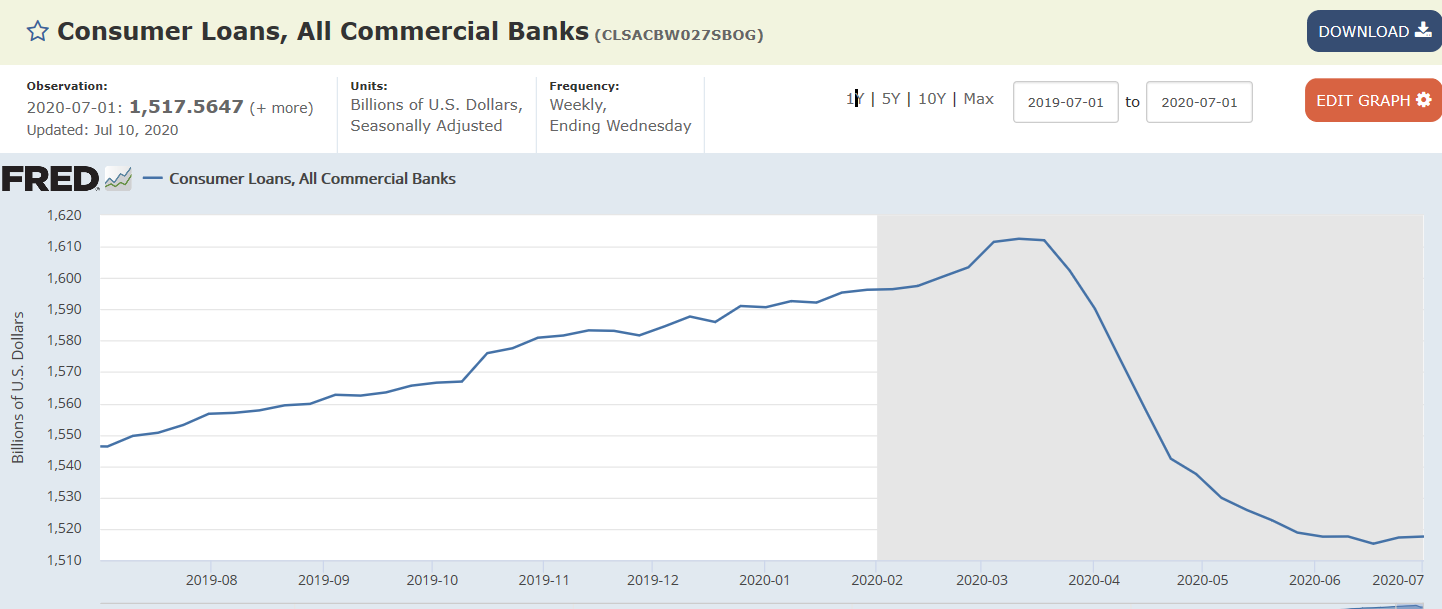

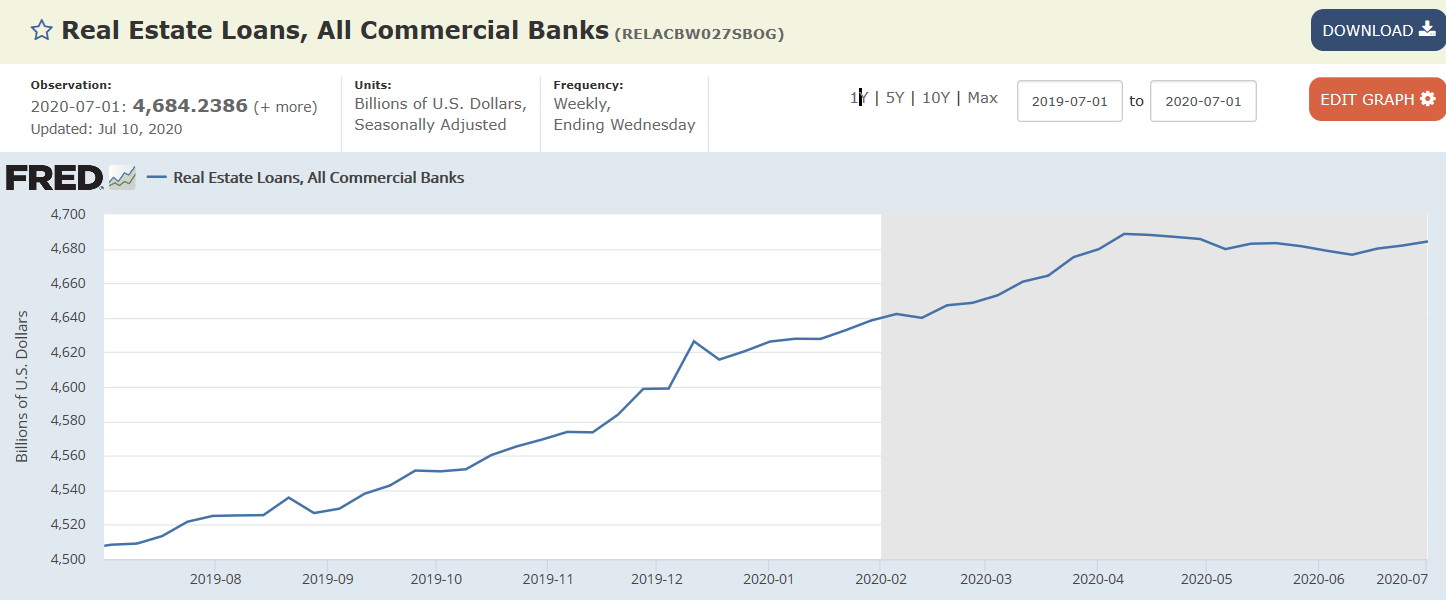

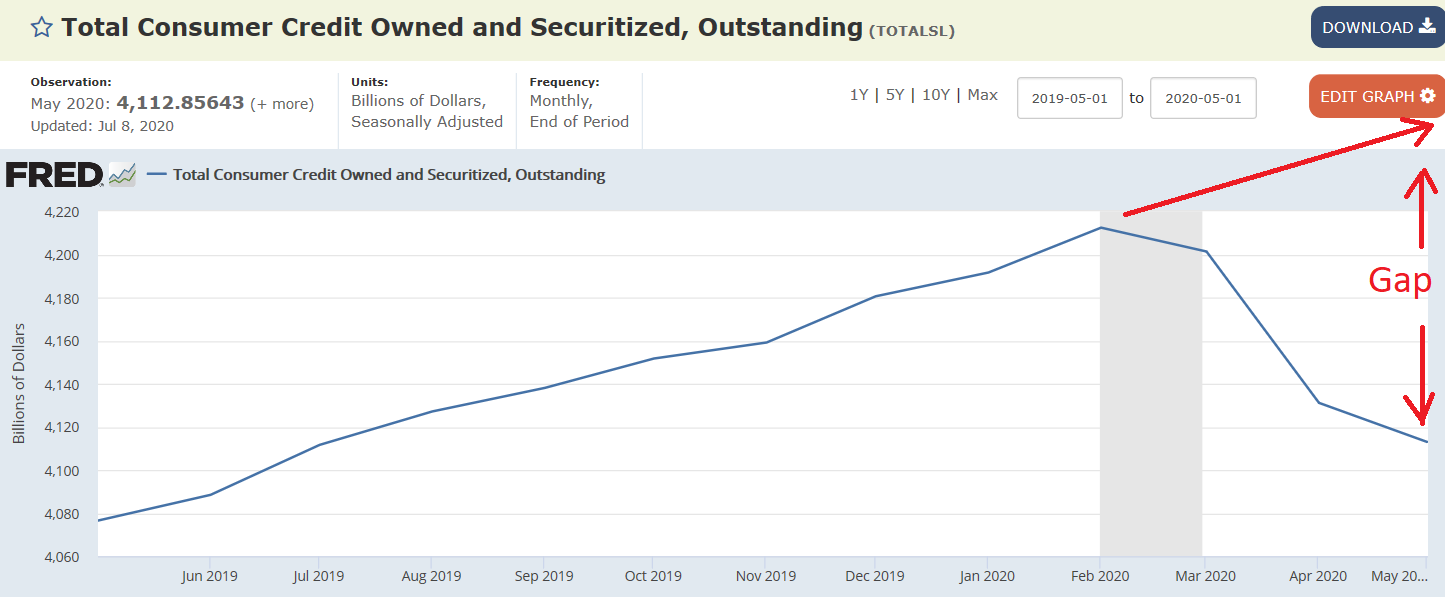

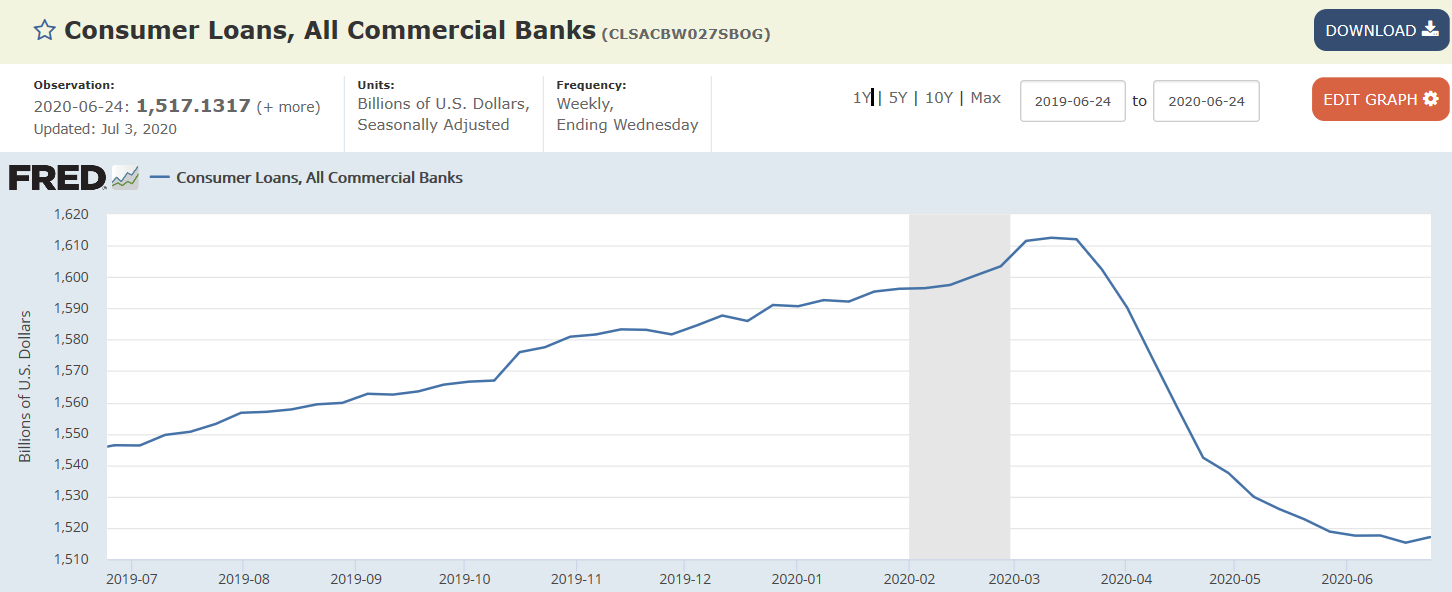

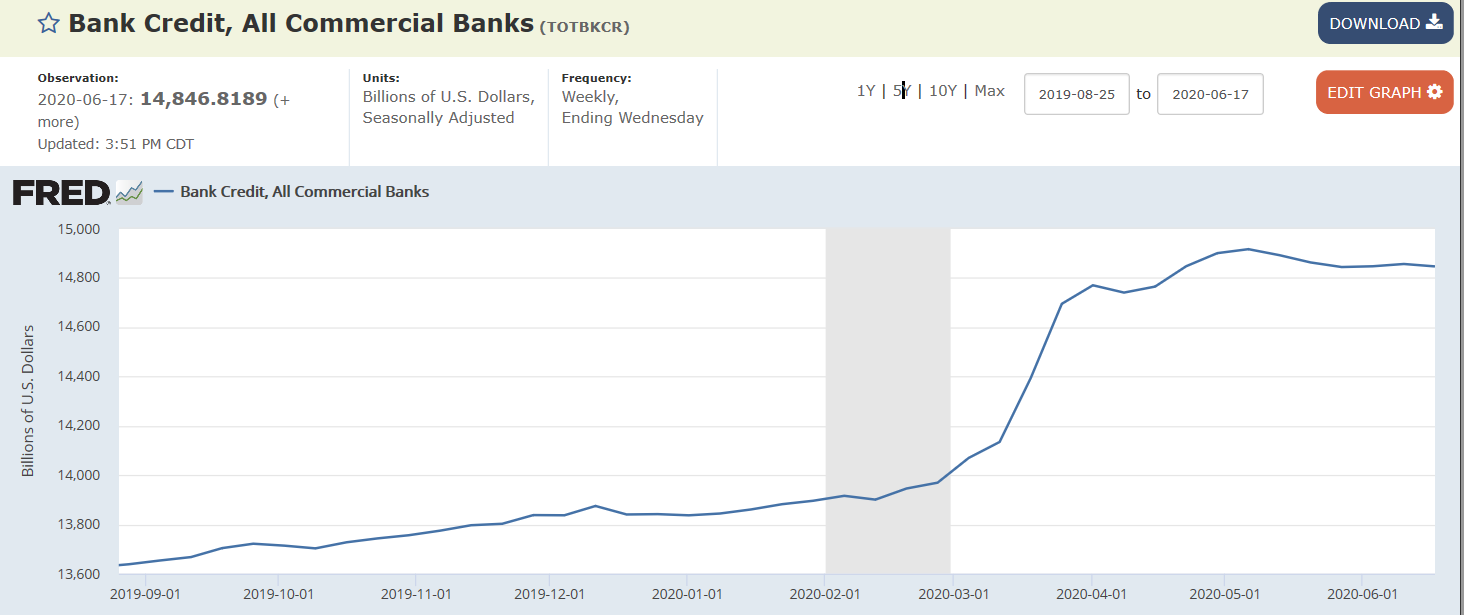

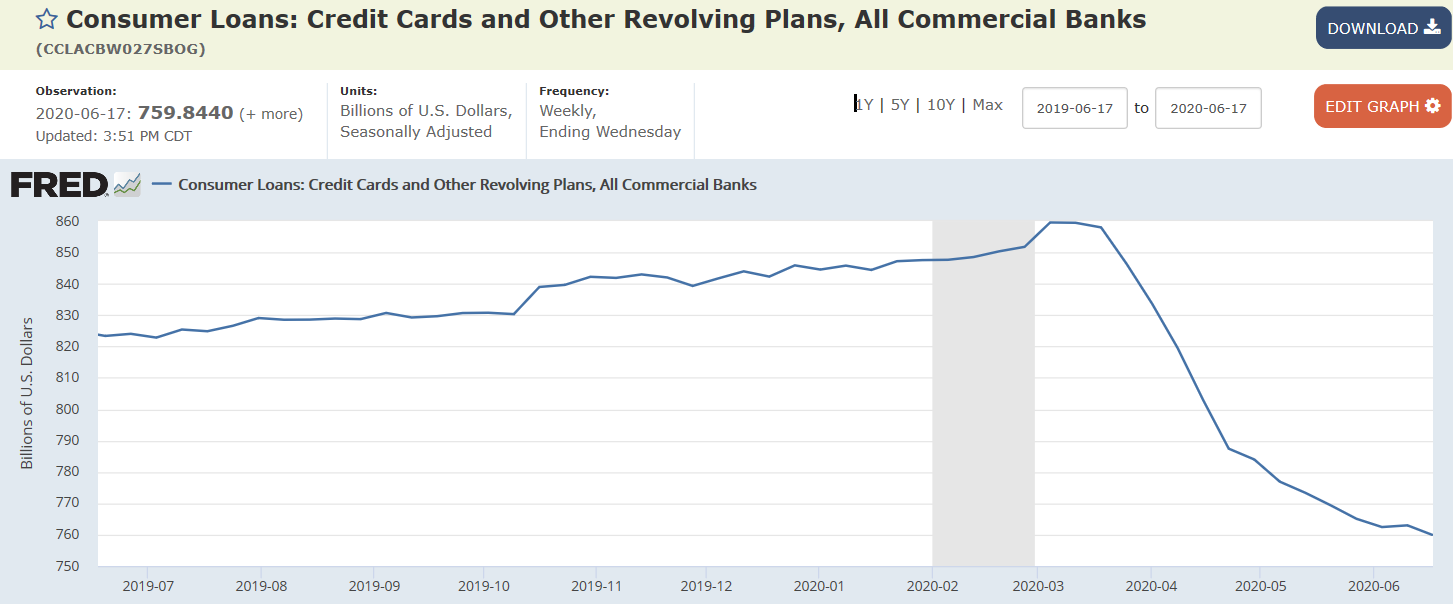

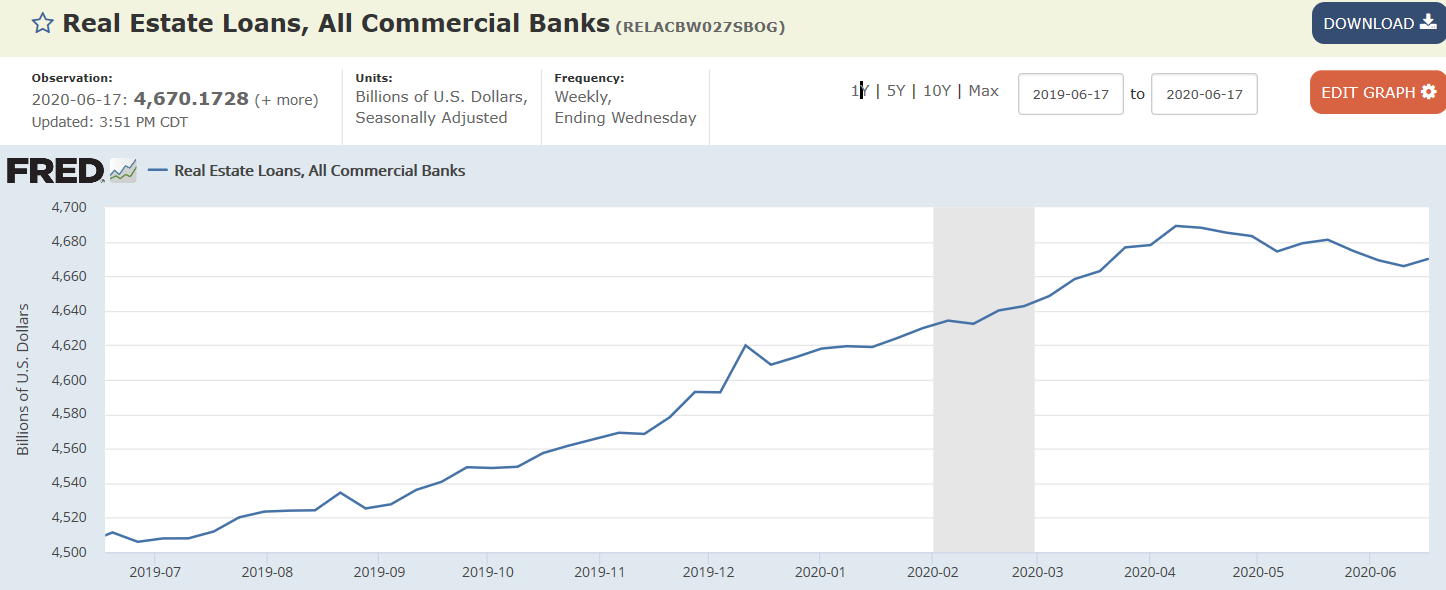

Consumer borrowing to spend is a component of private sector deficit spending that offsets unspent income to support GDP which is sales/income. Consumer borrowing is also ‘dissaving’ so a drop in borrowing is recorded as an increase in savings. The open question is to what degree the fiscal adjustment/increase in public sector deficit spending is offsetting the drop in private sector deficit spending:

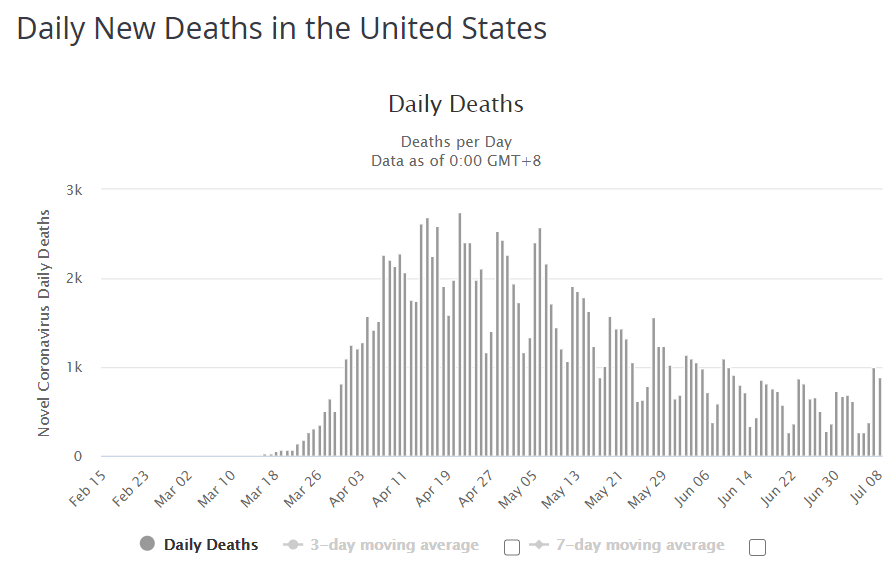

A few weeks after new cases started moving up deaths may have just begun to follow:

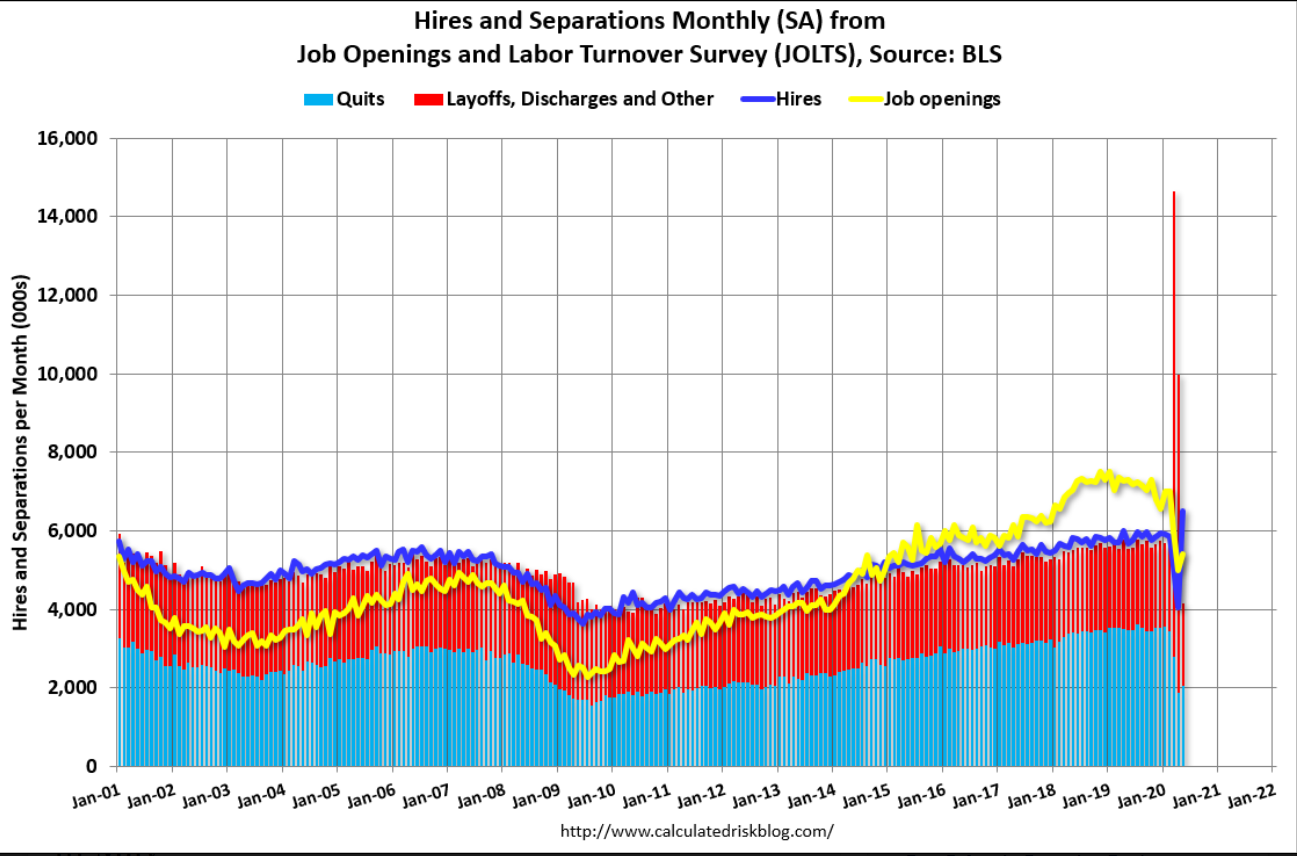

Note the yellow line, job openings, which peaked with the tariffs and then full further with covid:

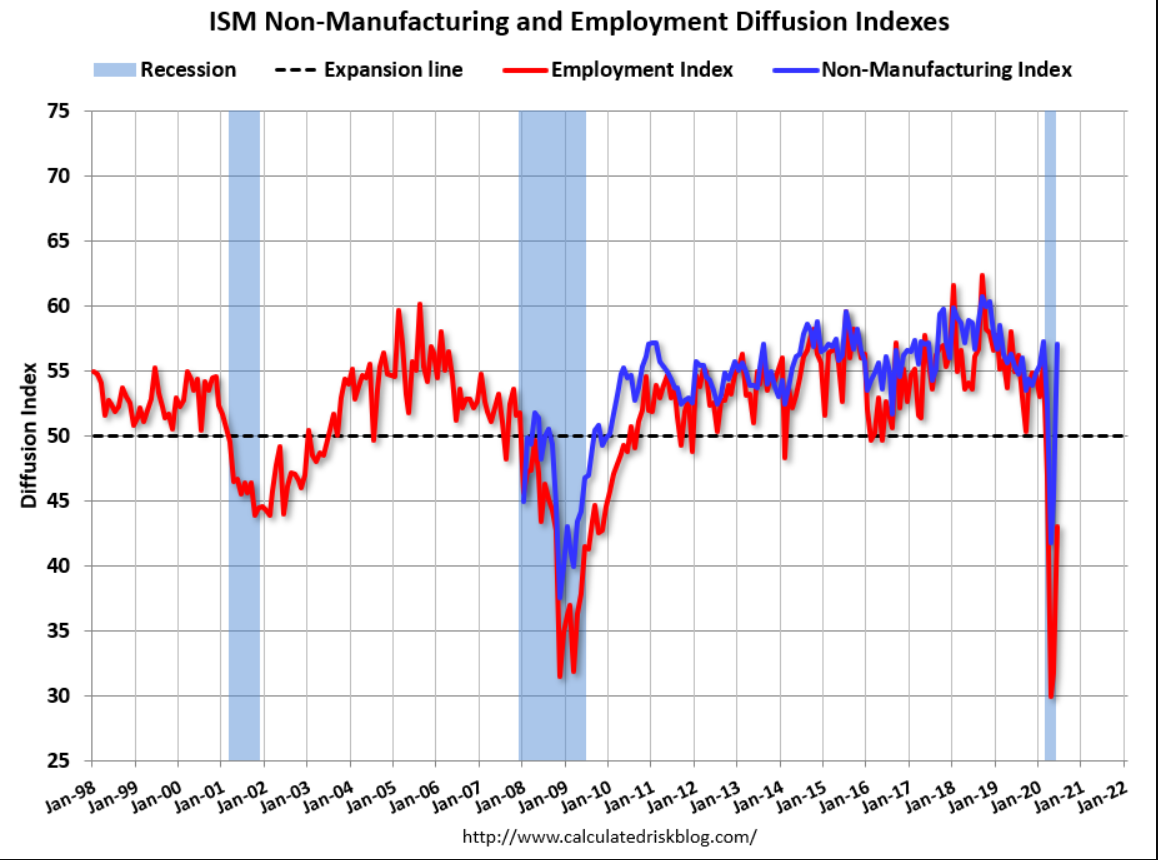

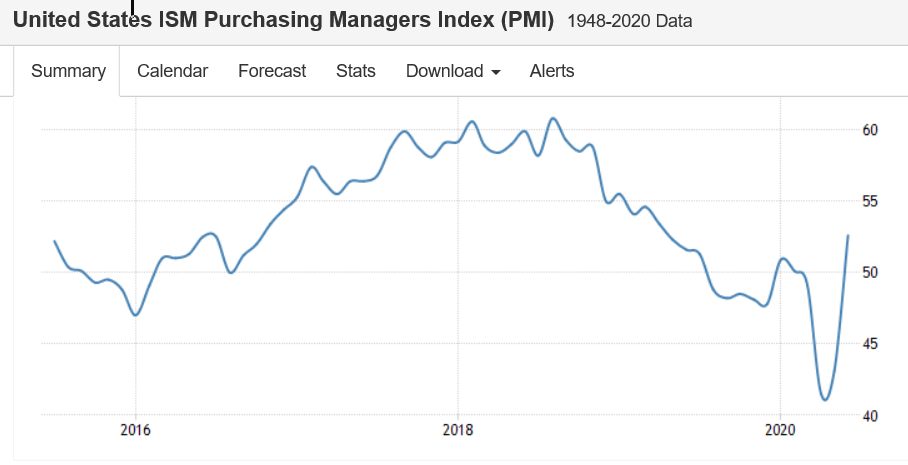

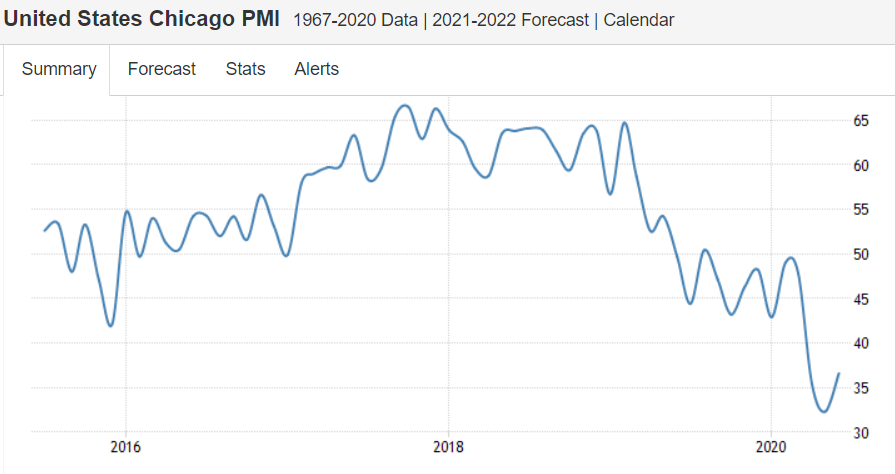

The non manufacturing index peaked with the implementation of the tariffs, well before covid hit. And employment growth is still negative:

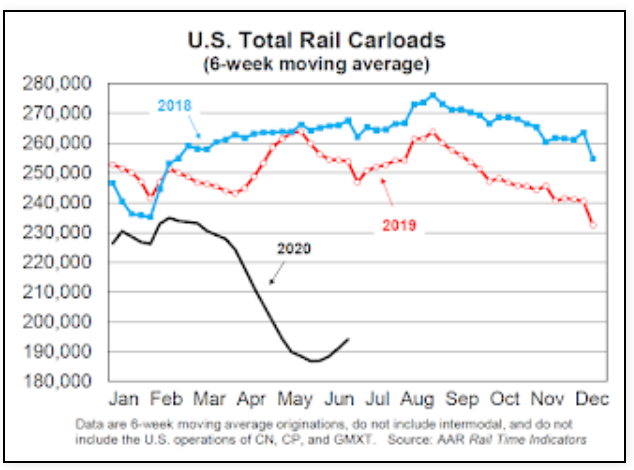

Same with rails- turned down with the tariffs well before covid, and then went lower:

“The European Commission lowered its GDP forecasts for 2020 and 2021, saying that the lifting of COVID-19 lockdown measures in some countries was proceeding less swiftly than it had initially predicted. The EU executive said the bloc would shrink by a record 8.7 percent this year, before rebounding by 6.1 percent in 2021, compared with early May estimates of a 7.7 percent contraction in 2020 and a 6.3 percent recovery next year.”

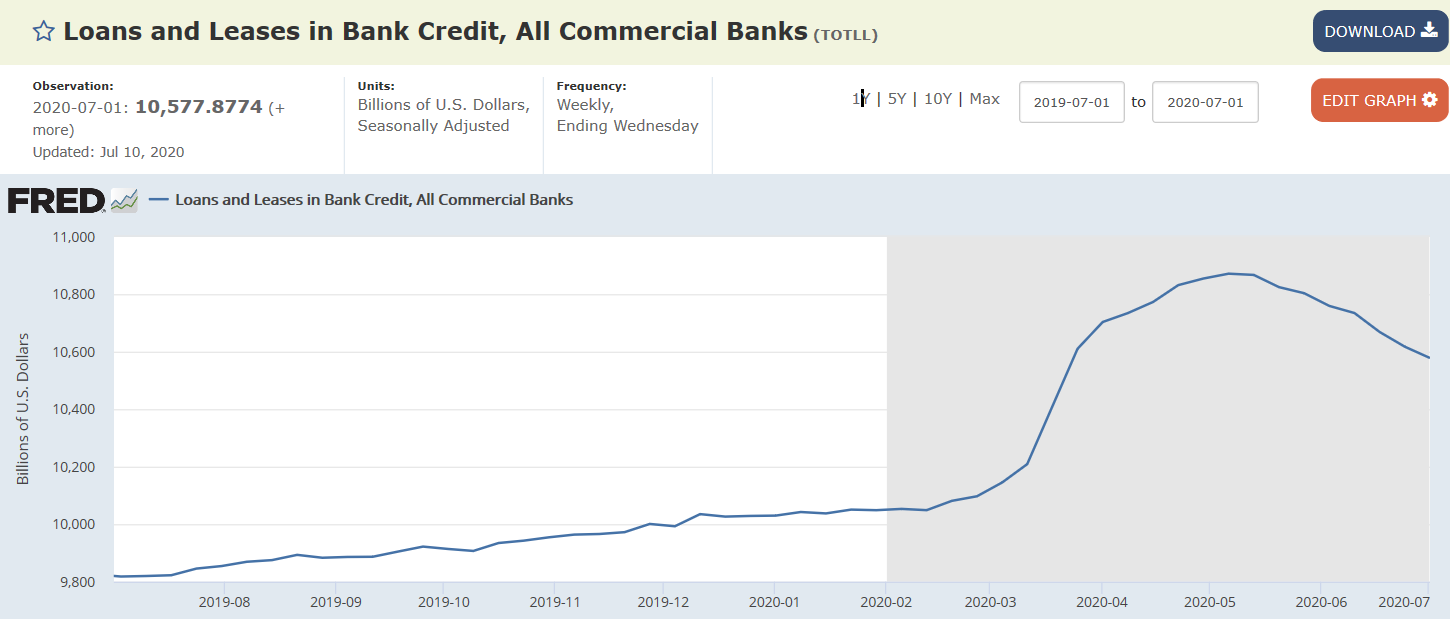

The spike continues to reverse, and the deceleration in consumer borrowing is also an increase in savings:

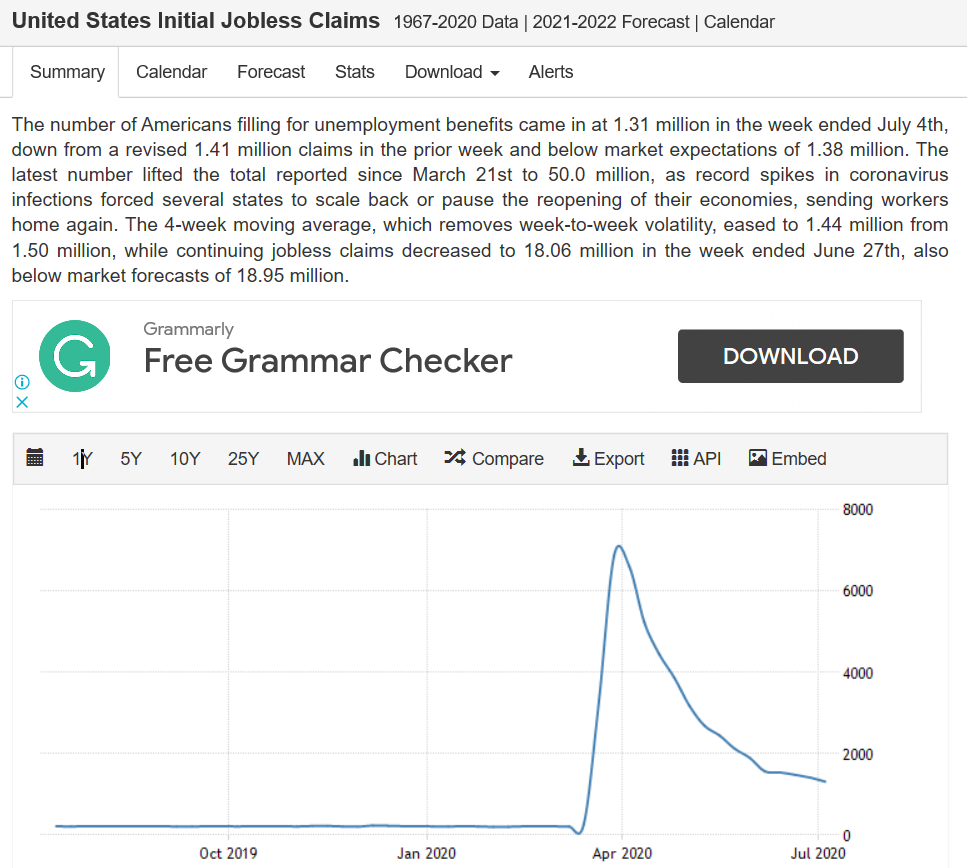

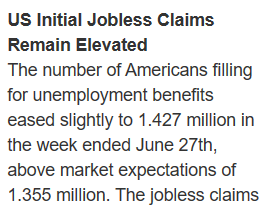

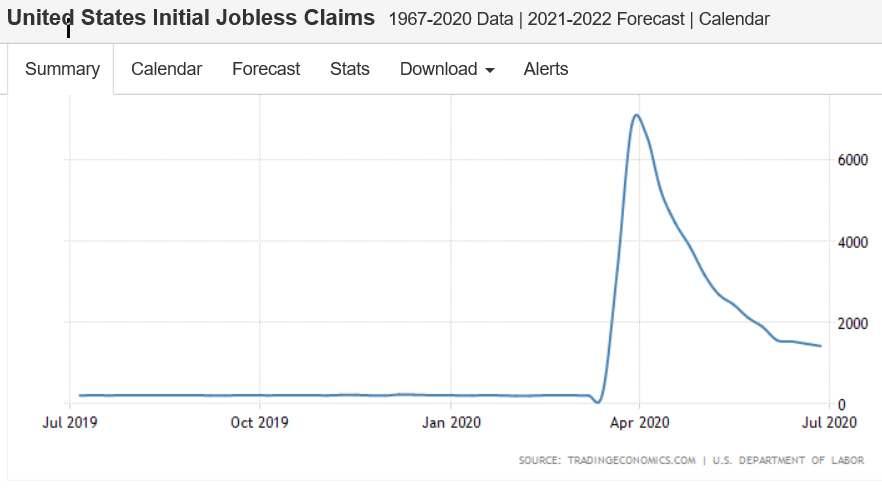

New claims for unemployment comp remain at alarmingly high levels:

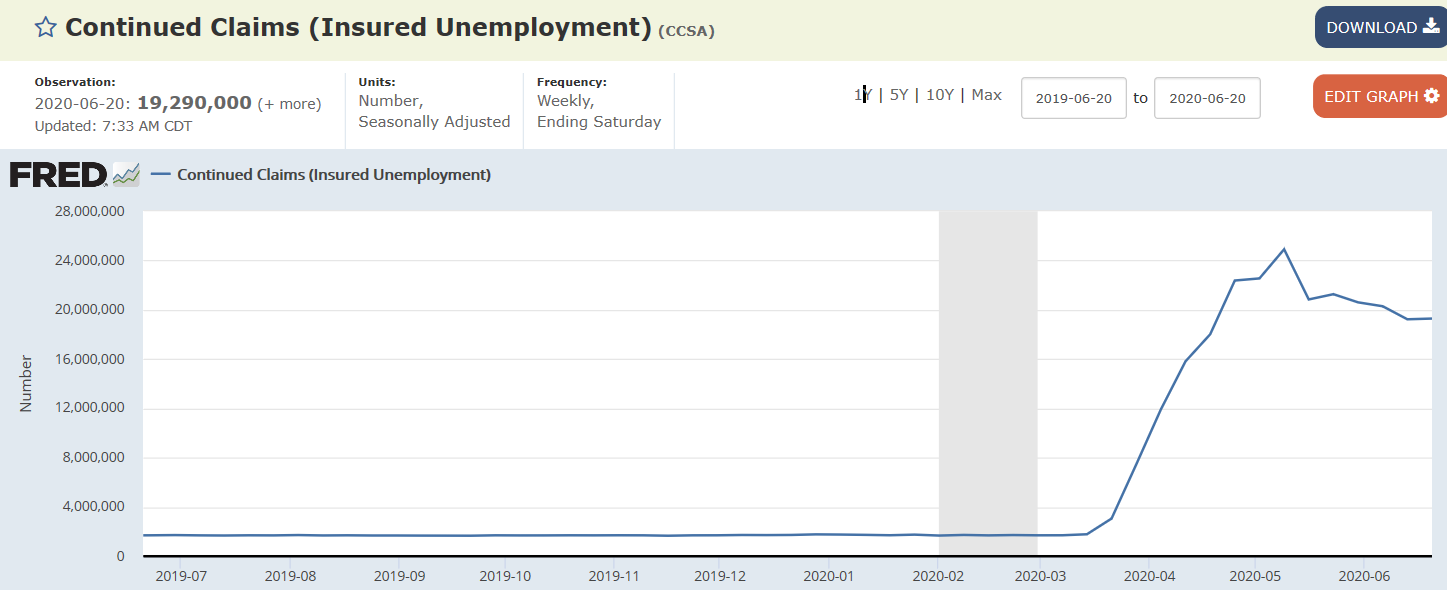

Holding too steady at just under 20 million:

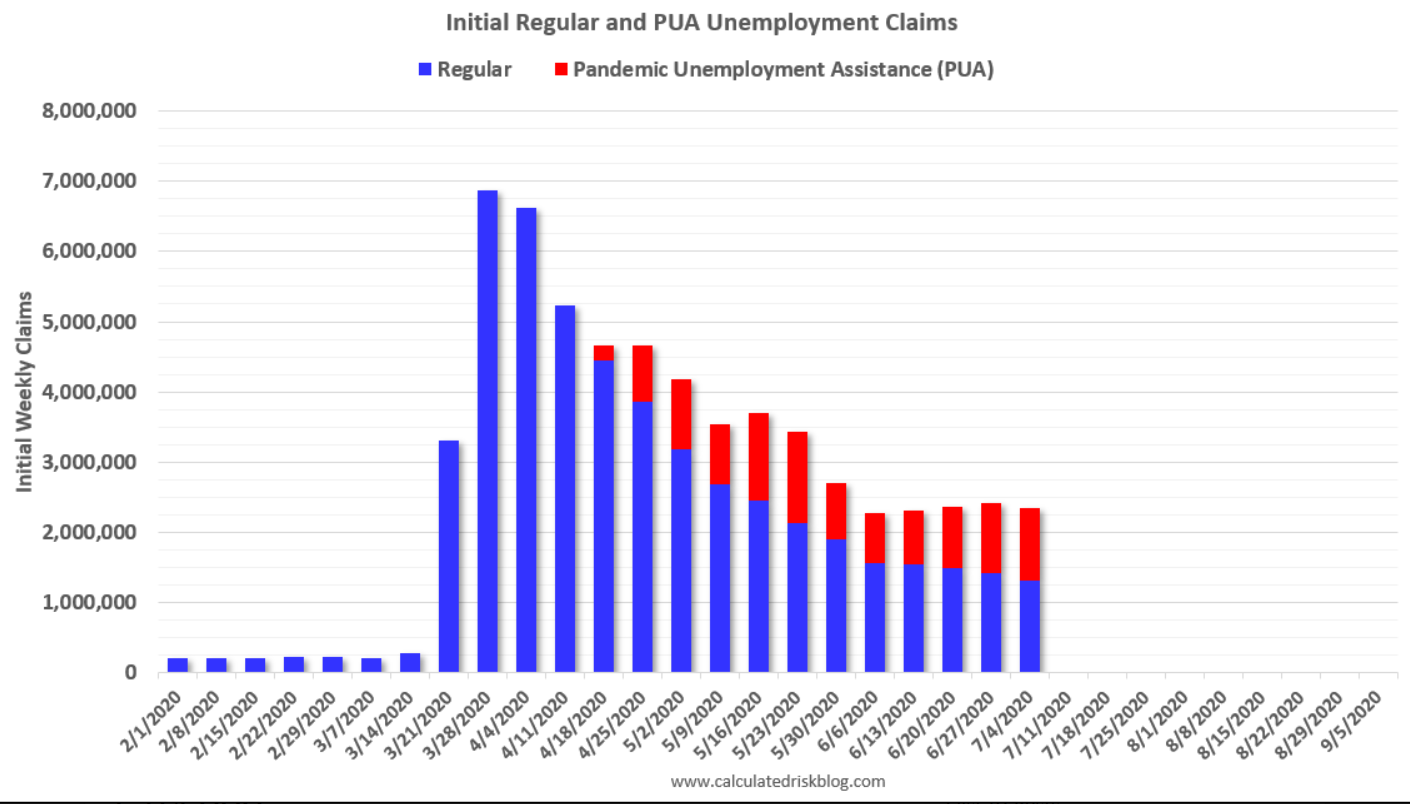

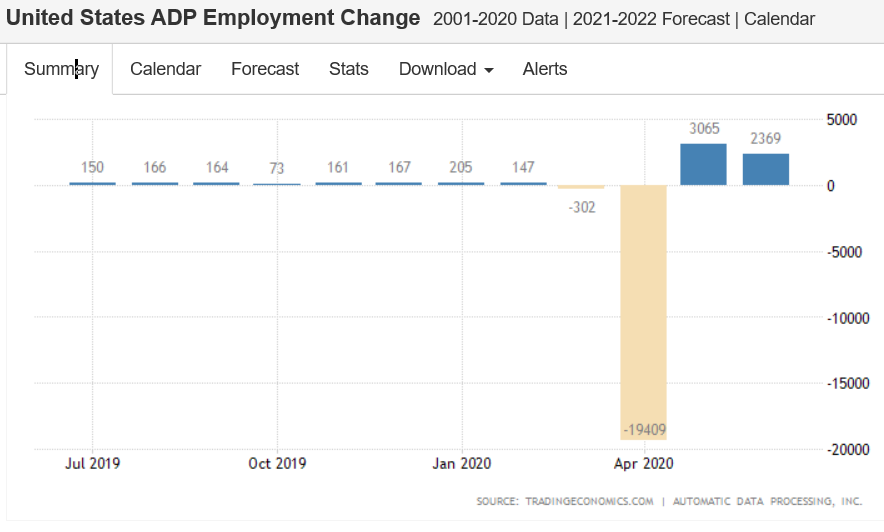

Last month I noted that the “reopenings” would be a June story, and that is what this report suggests. In addition, companies using PPP had to rehire employees to convert the loans to grants. Unfortunately, the surge in virus infections and related closures, will probably negatively impact the July report. In addition, we will probably start to see more PPP related layoffs. Calculatedriskblog.com

Employment is up for the month but still down by over 15 million, and the date of record for the report was before reopening decisions were reversed:

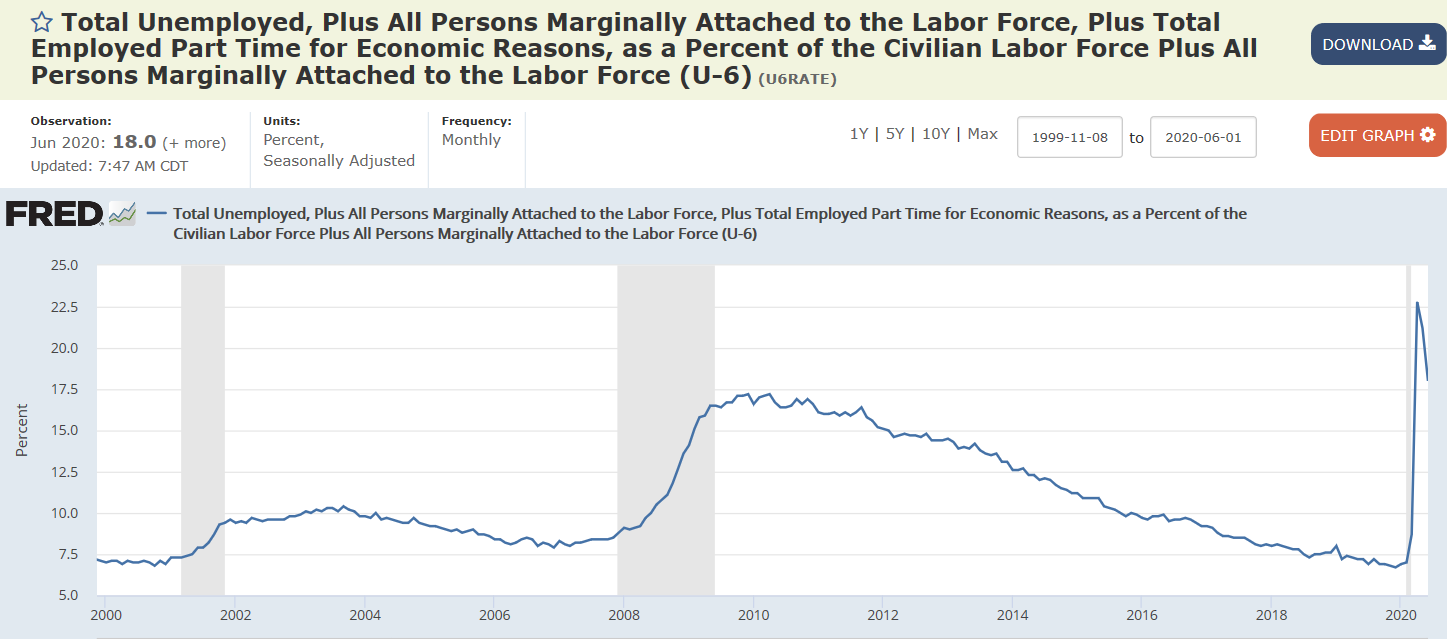

About 18%:

Interesting:

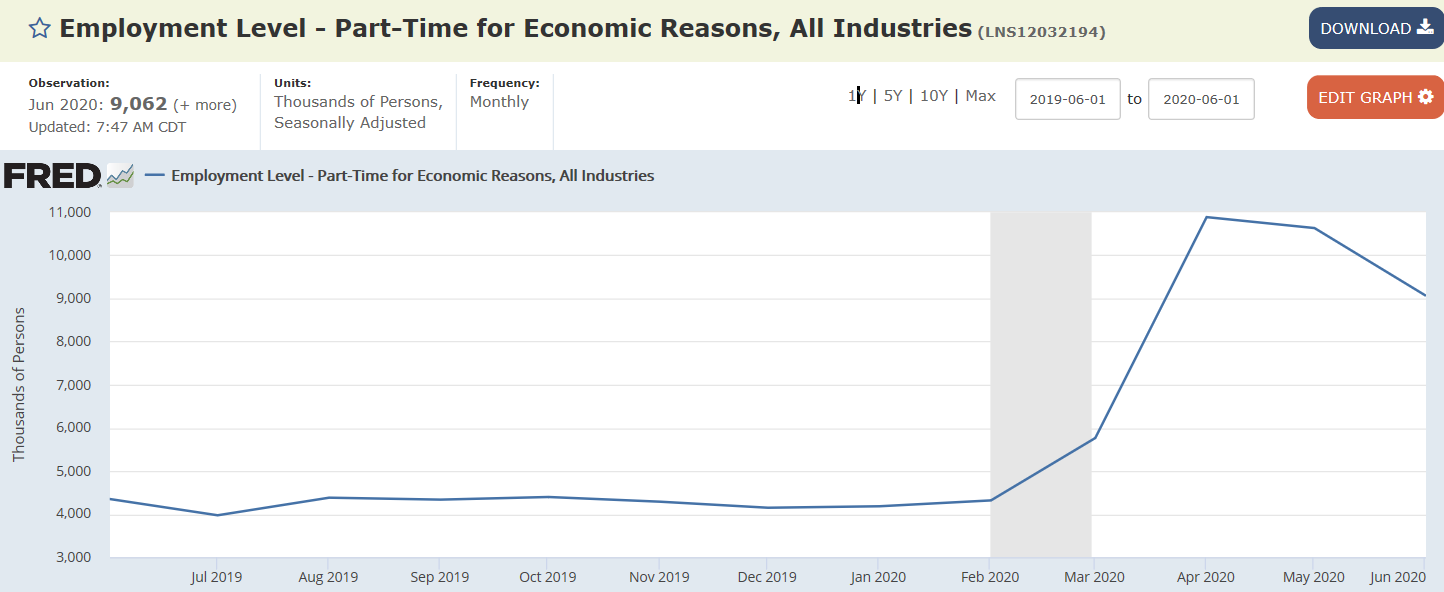

These are people looking for full time work but can only get part time work. It’s still up by nearly 5 million people:

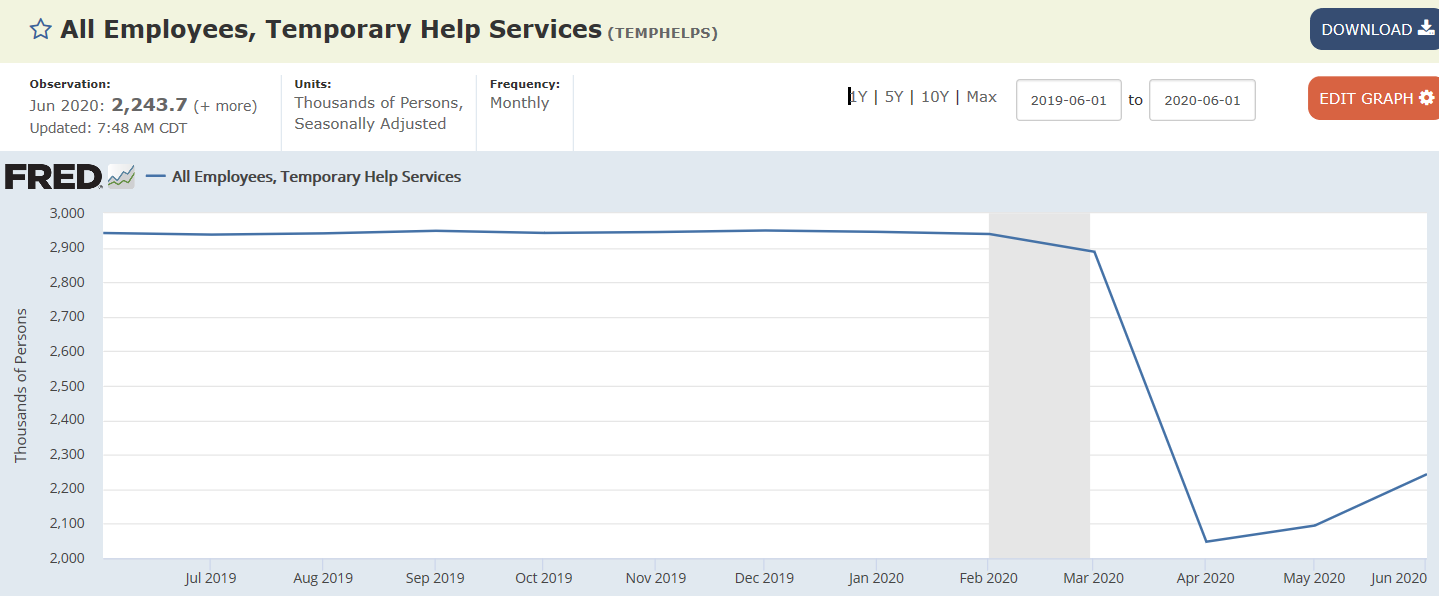

Up a bit this month but at depressed levels:

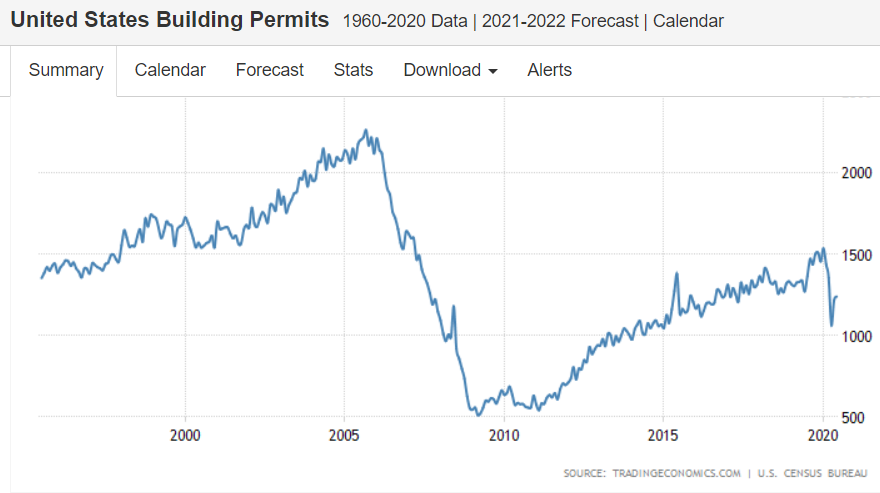

Up a bit but still way down from where they were pre covid, which wasn’t all that high in any case, has the tariffs were holding things back:

A relatively few new private sector jobs after the massive loss:

A little bit of growth from massively depressed levels:

Still in contraction:

Same story:

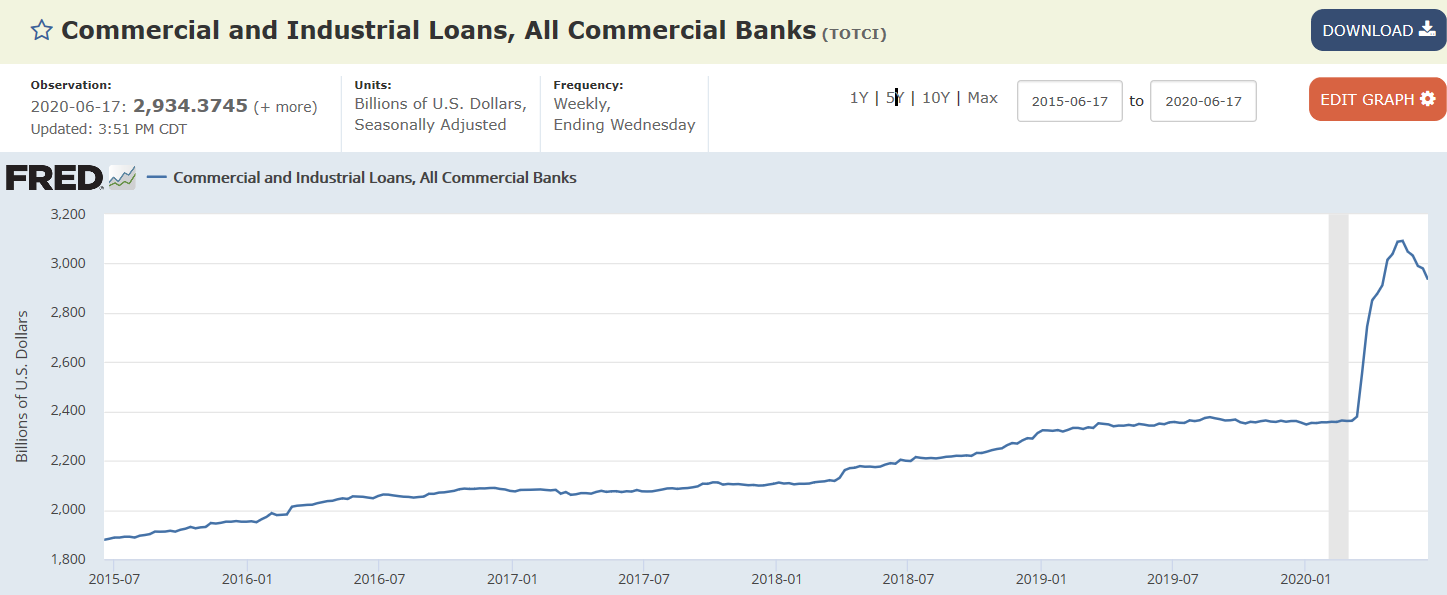

Heading steadily lower. This is the source of a large component of the money supply. It’s always growing in normal times:

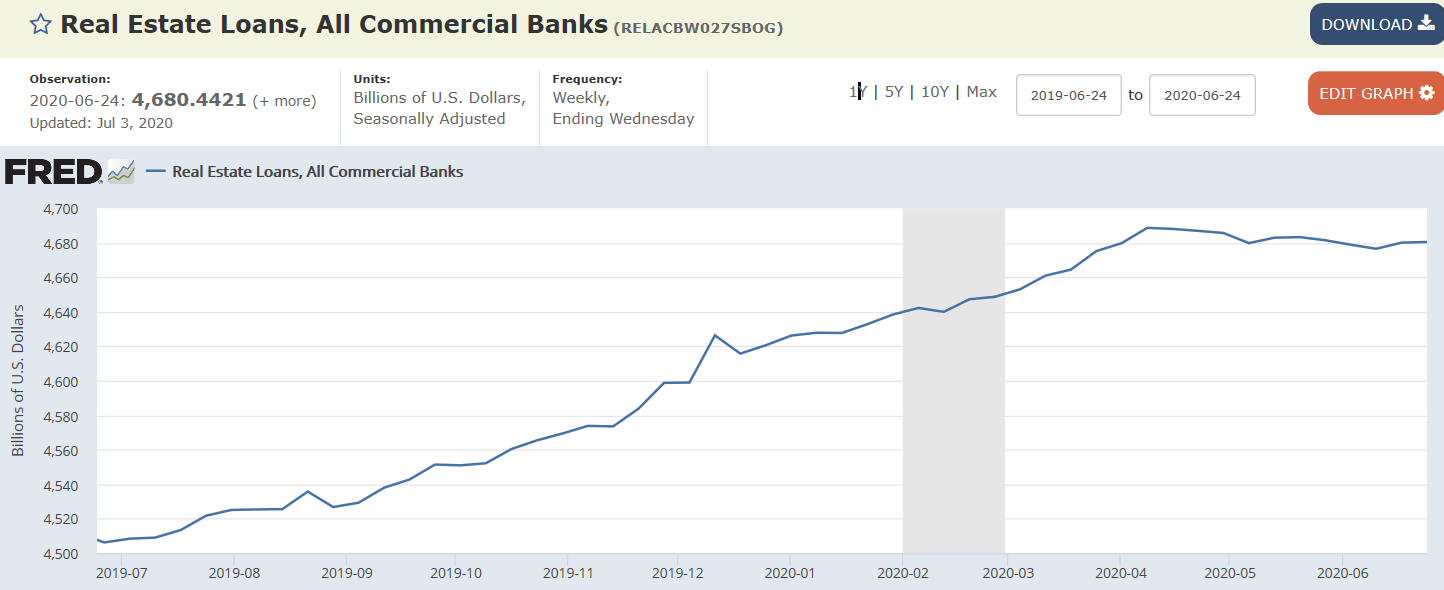

Both fell hard and still falling from the lower levels: