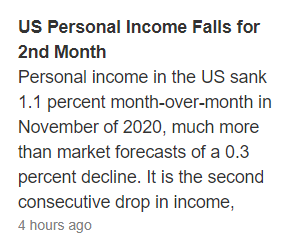

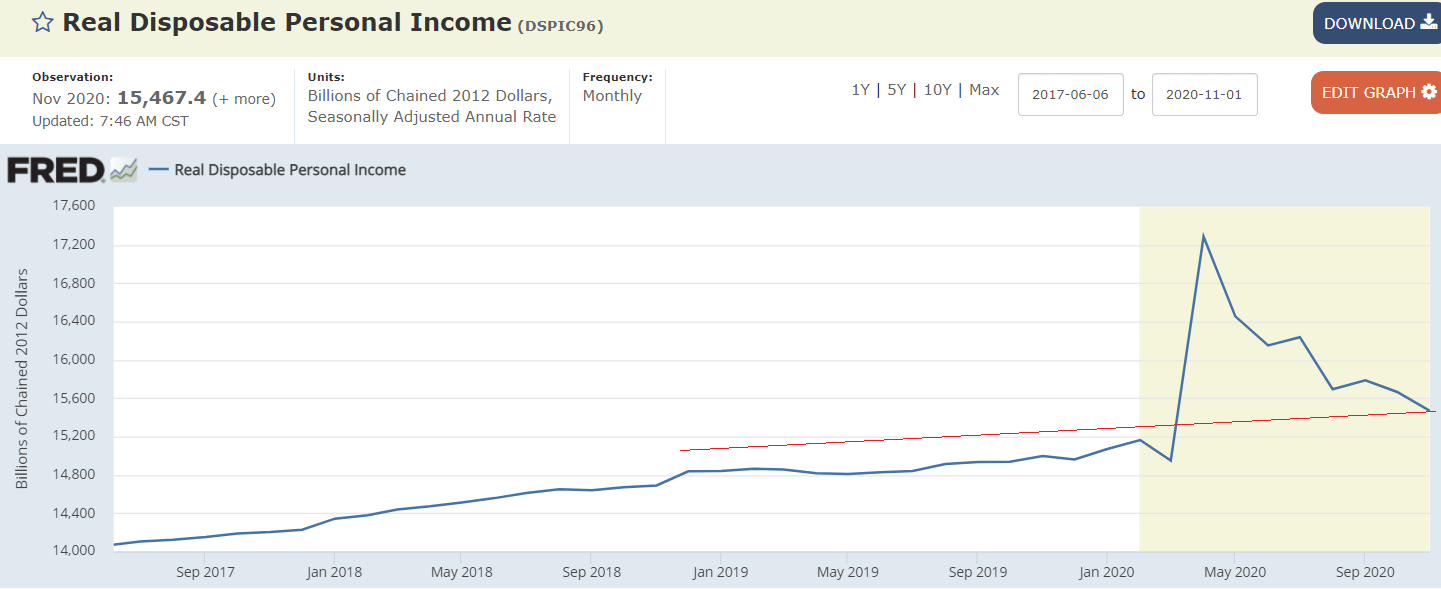

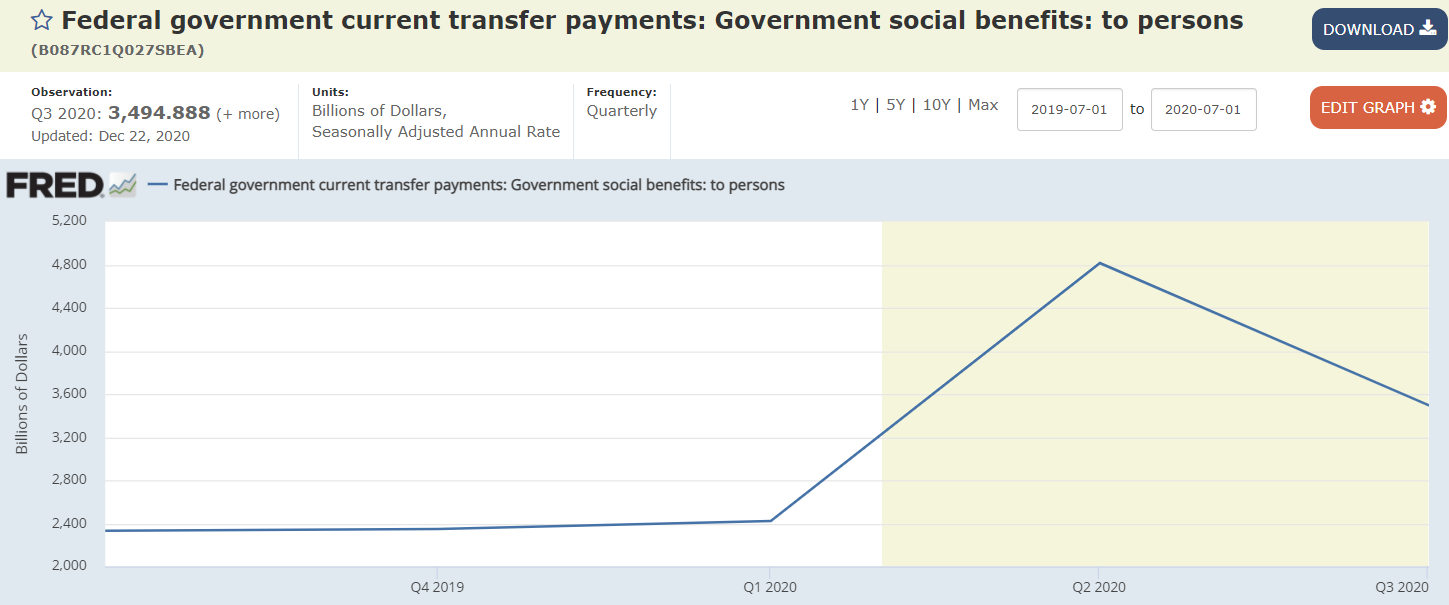

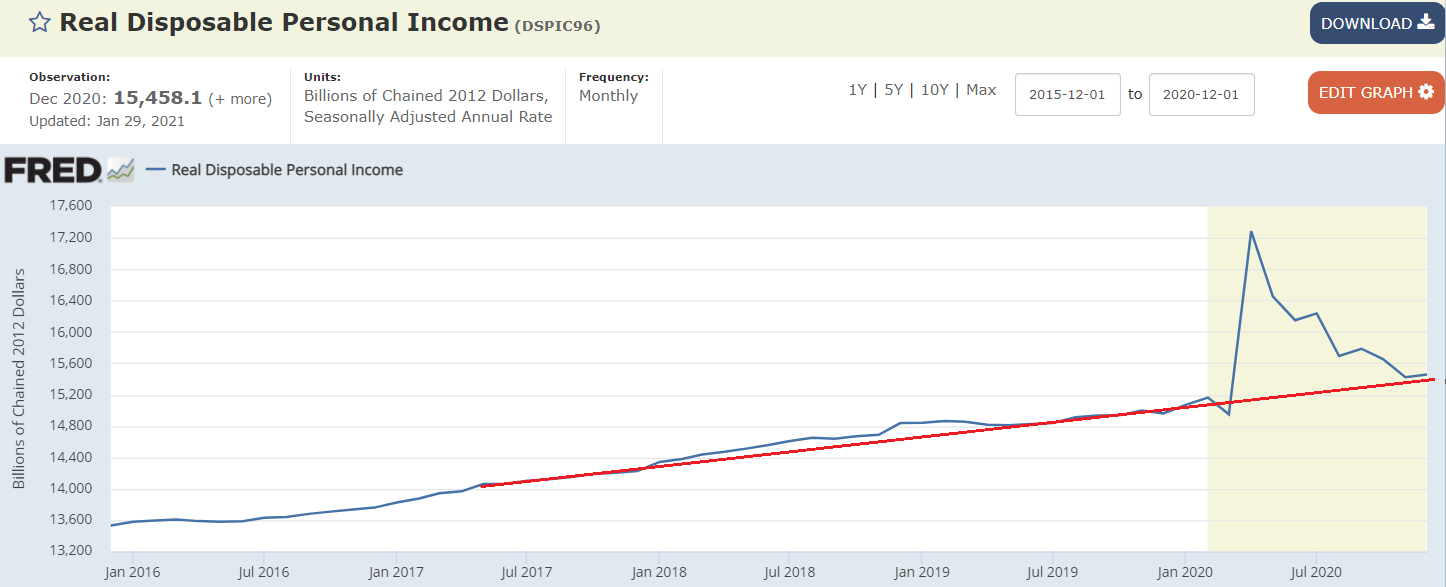

Personal income went up with the crisis due to Federal transfers of the Cares Act, which subsequently faded:

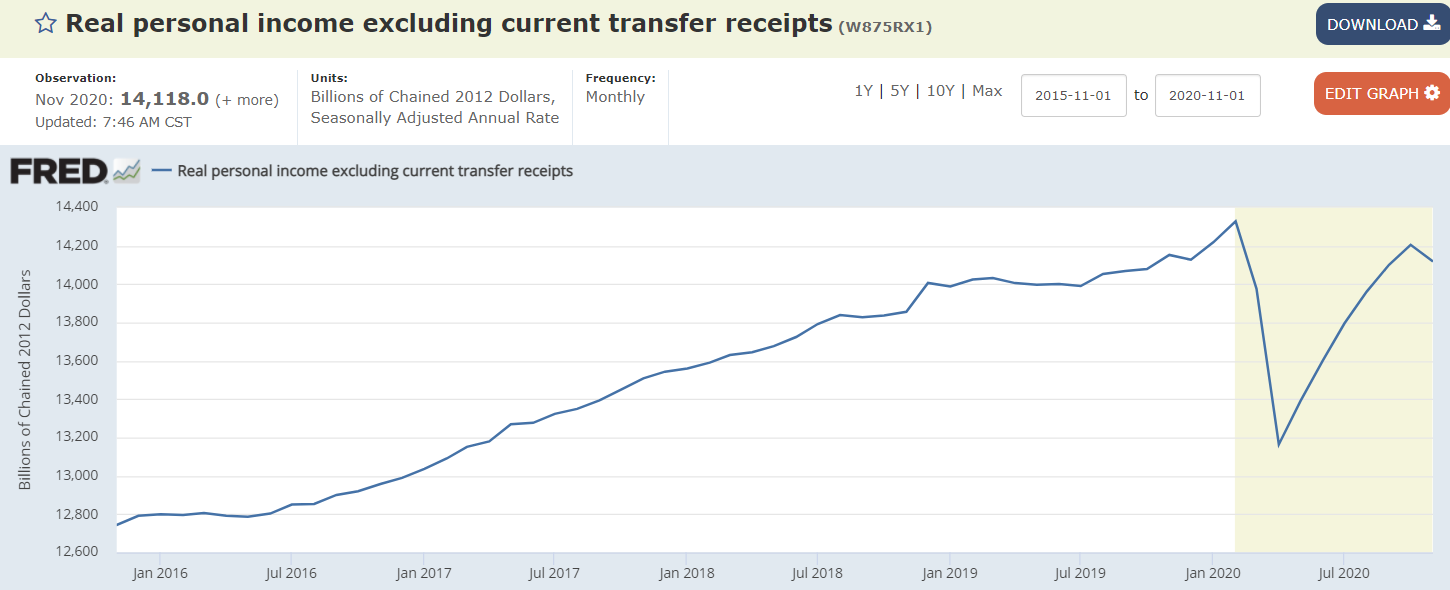

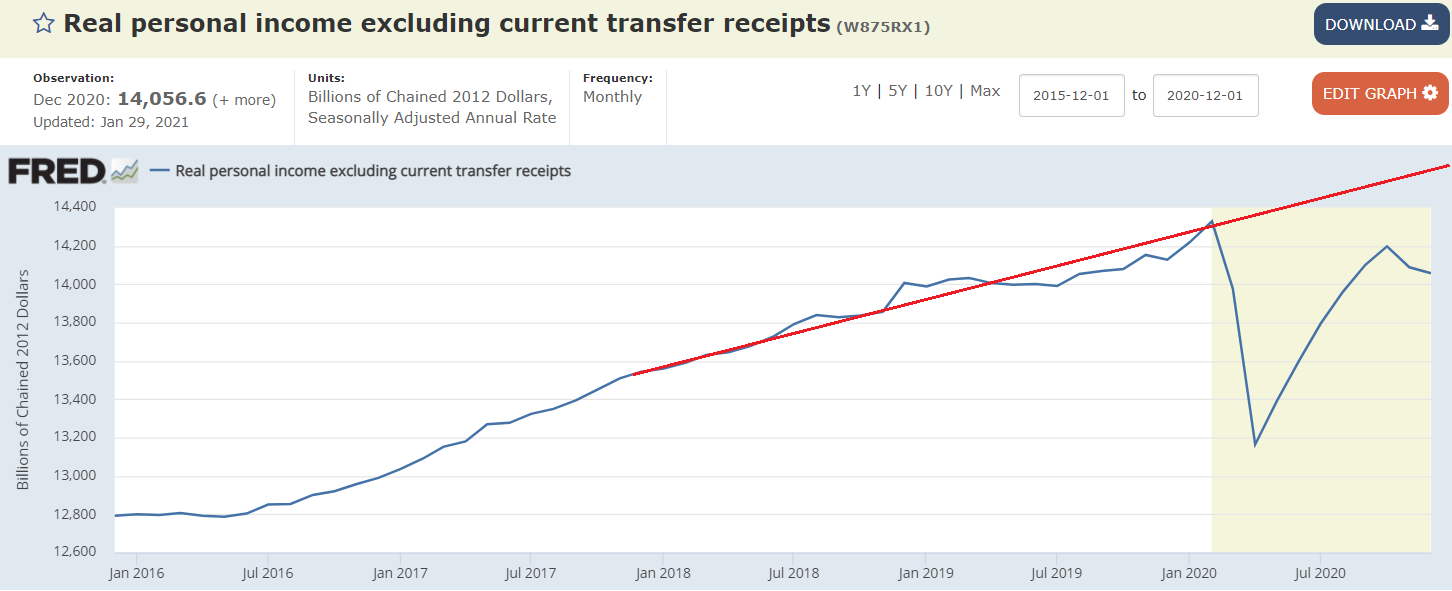

Personal income excluding government support continues to lag behind prior levels:

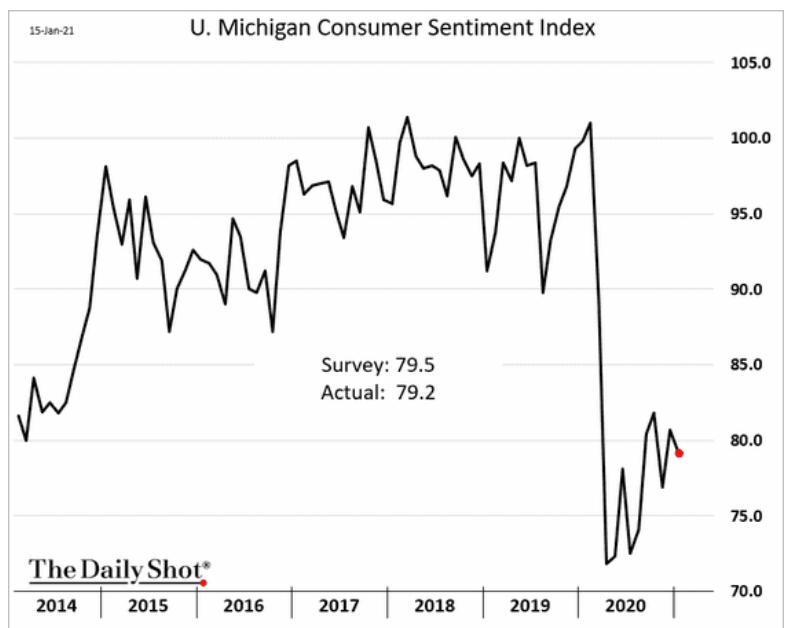

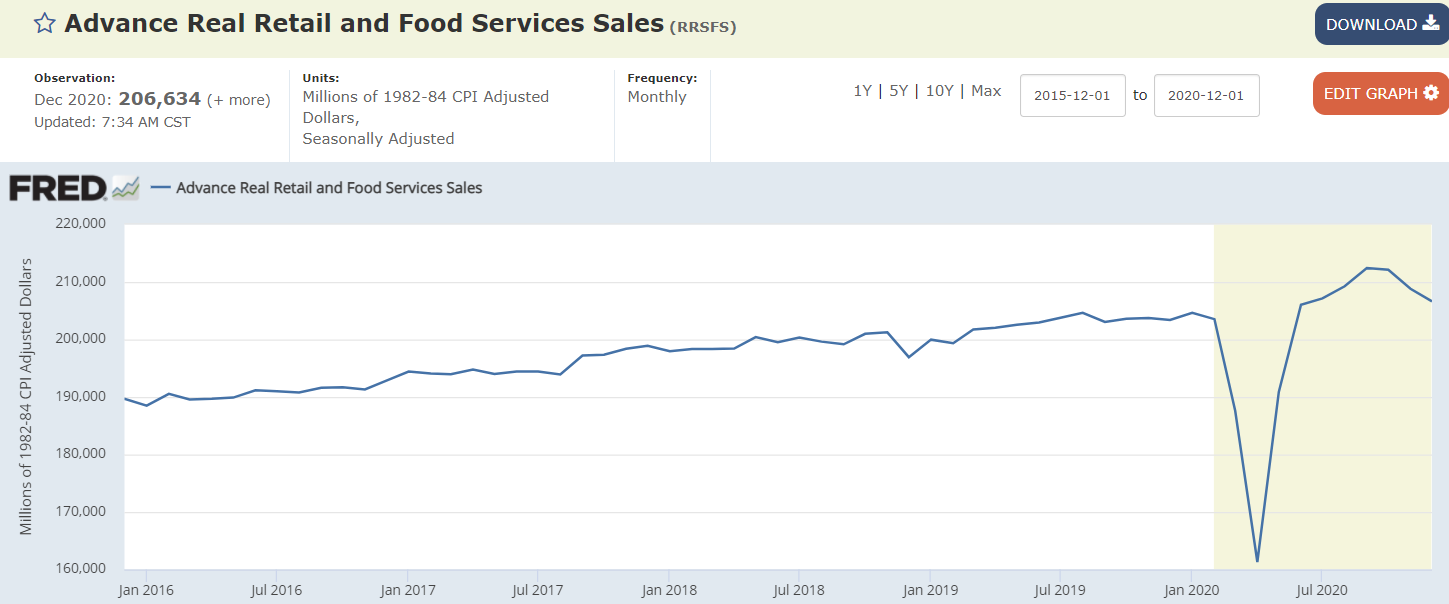

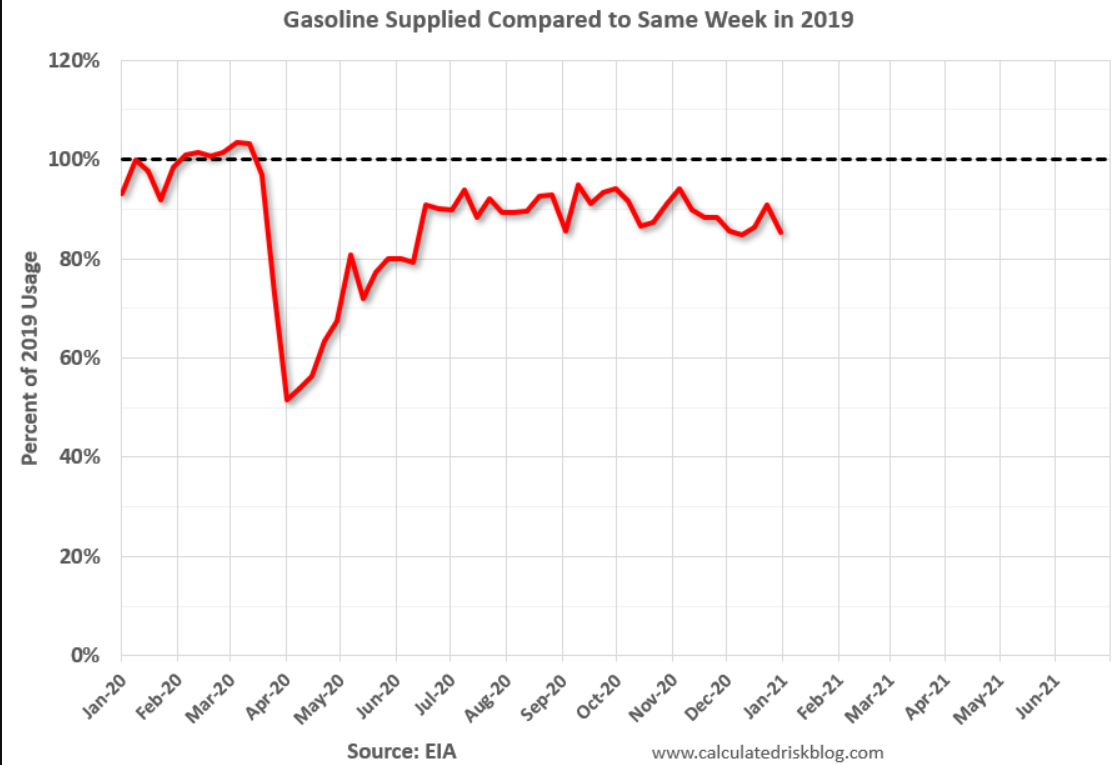

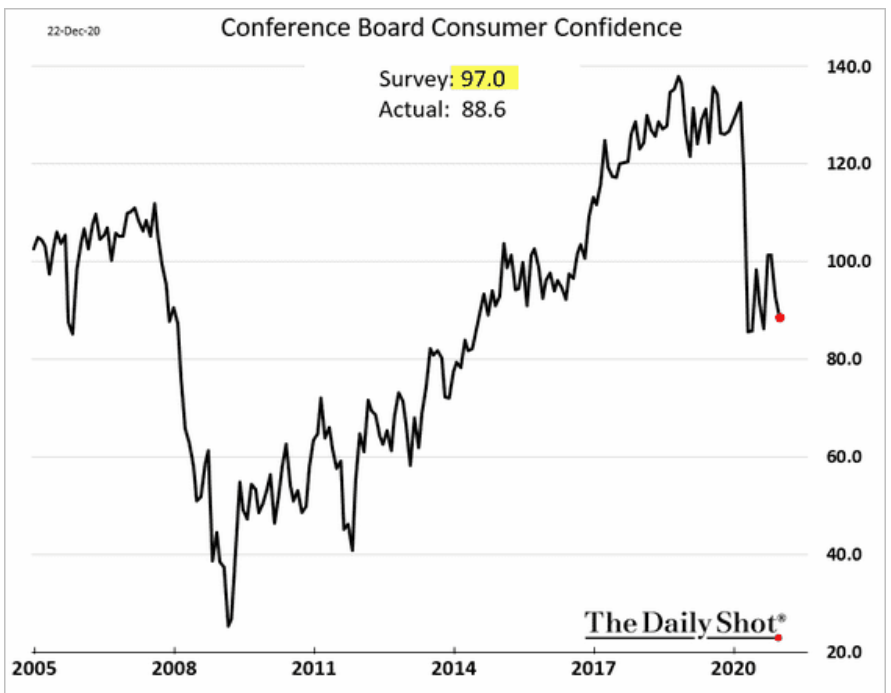

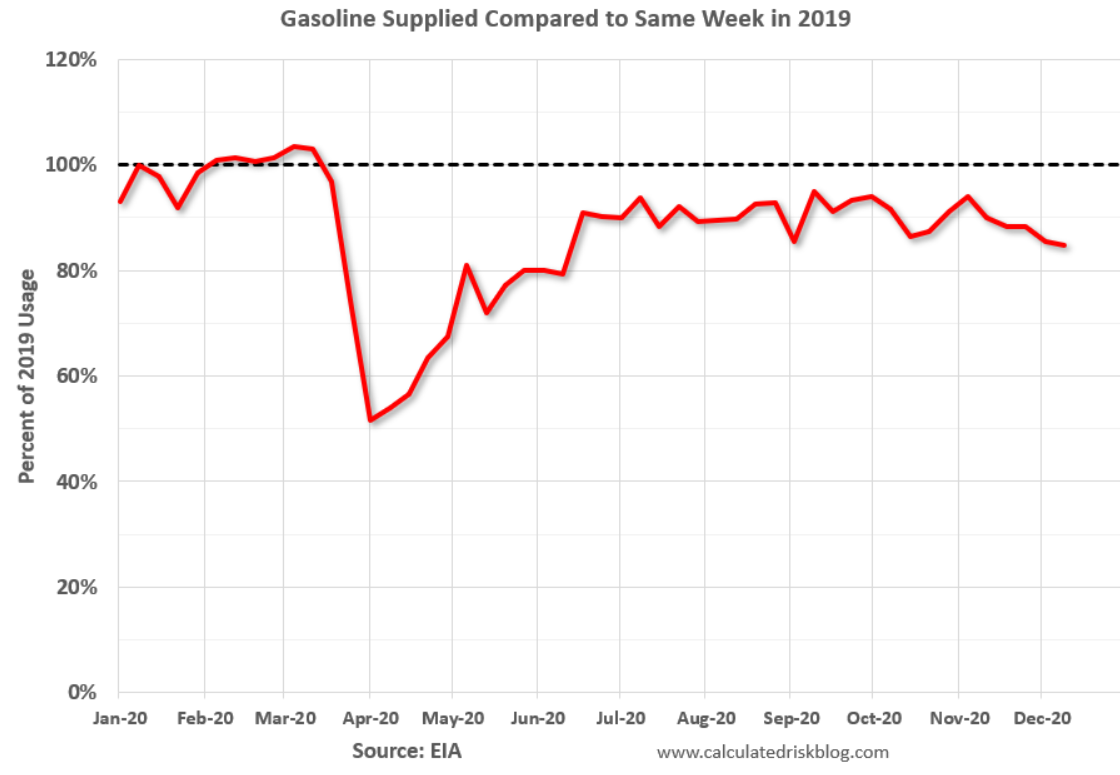

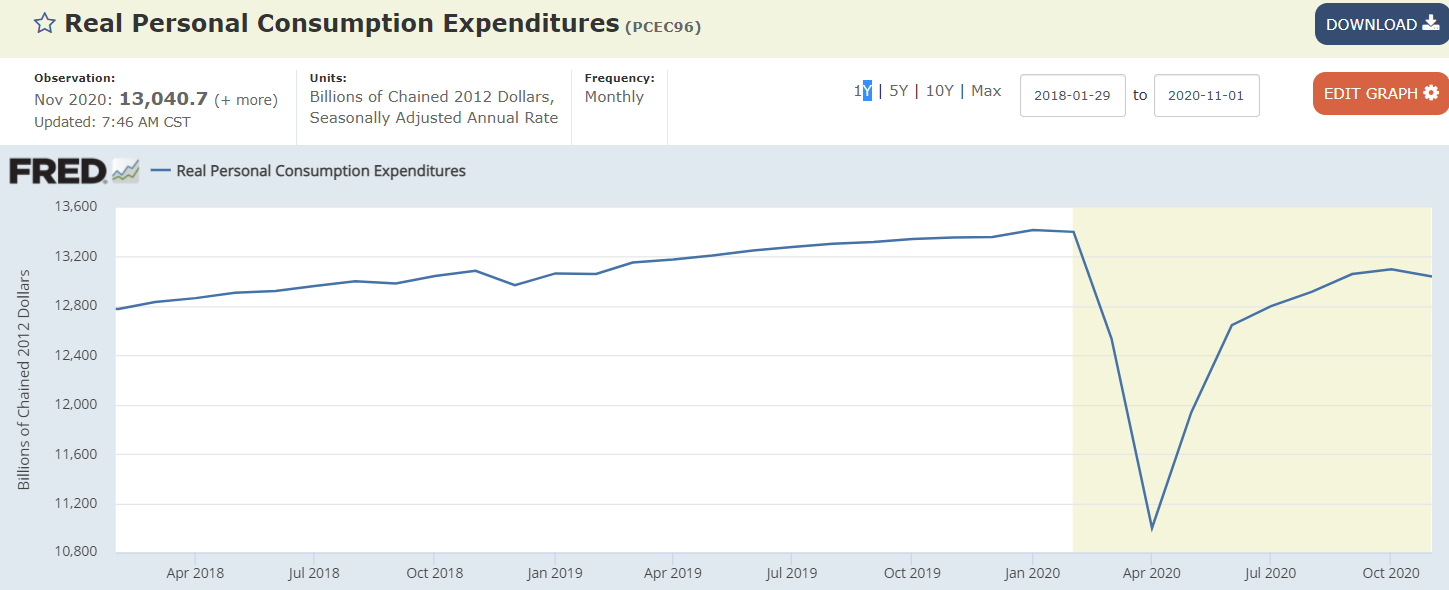

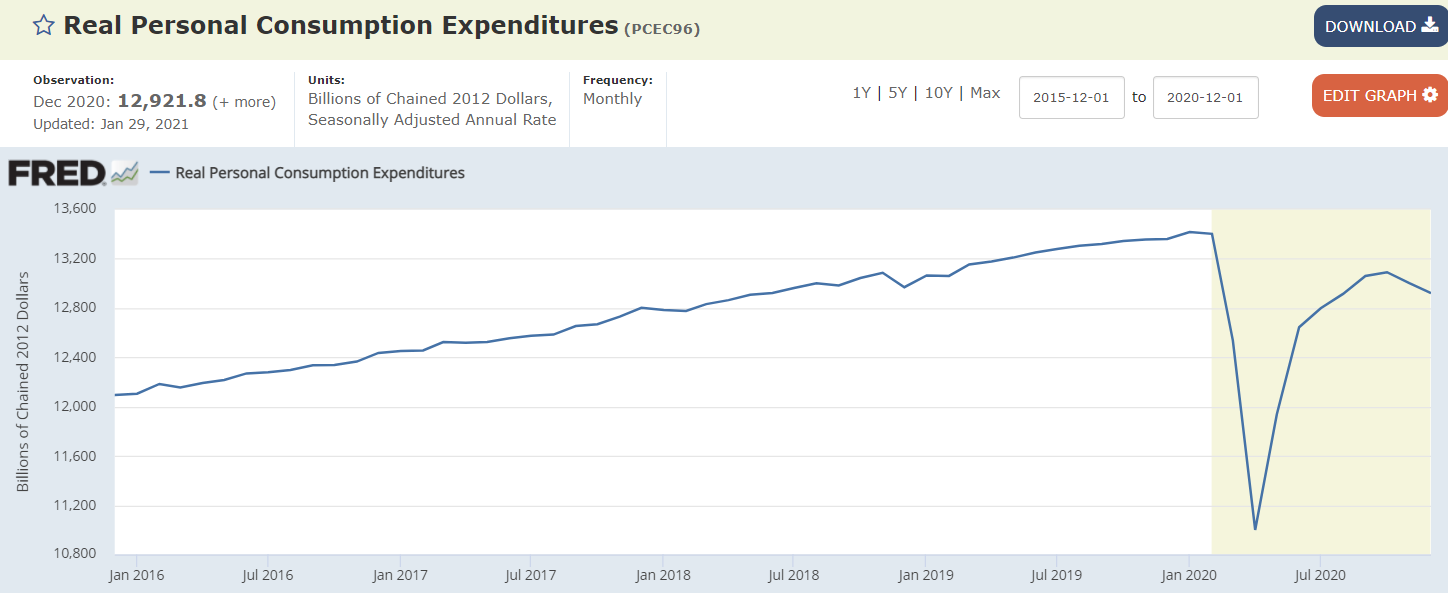

Even with the higher levels of total personal income consumption has lagged and most recently decreased as government benefits expired:

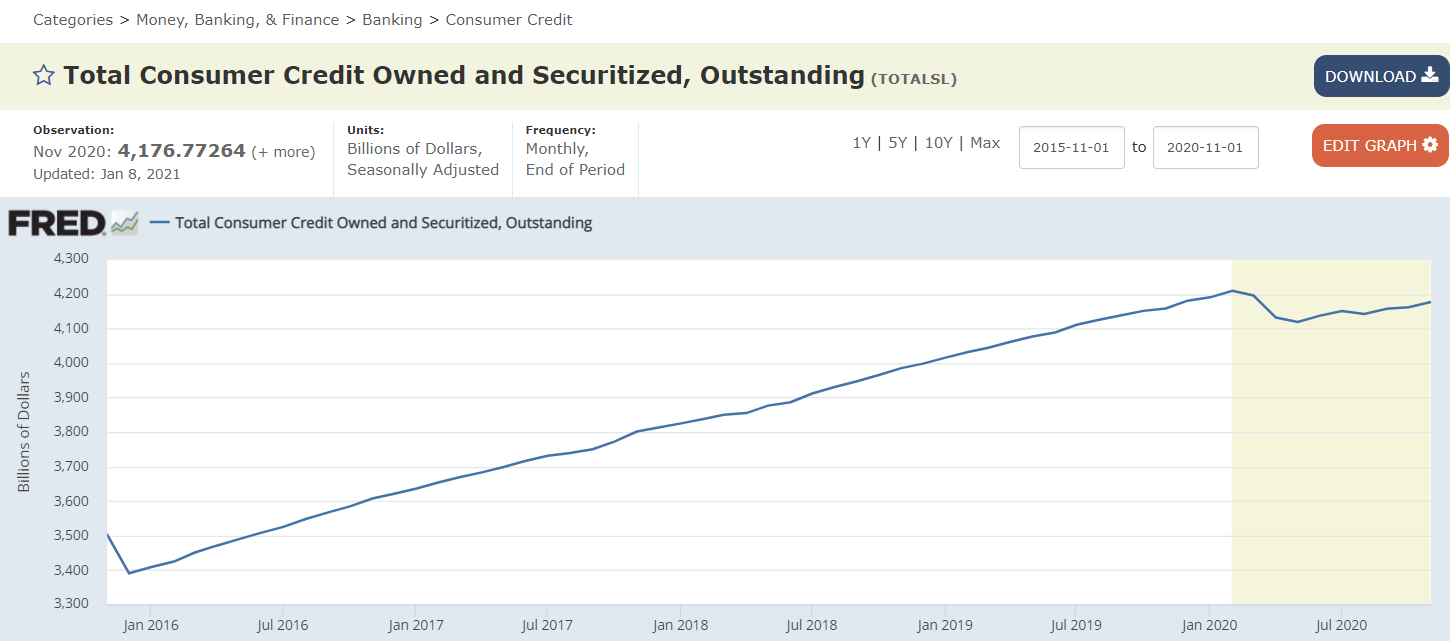

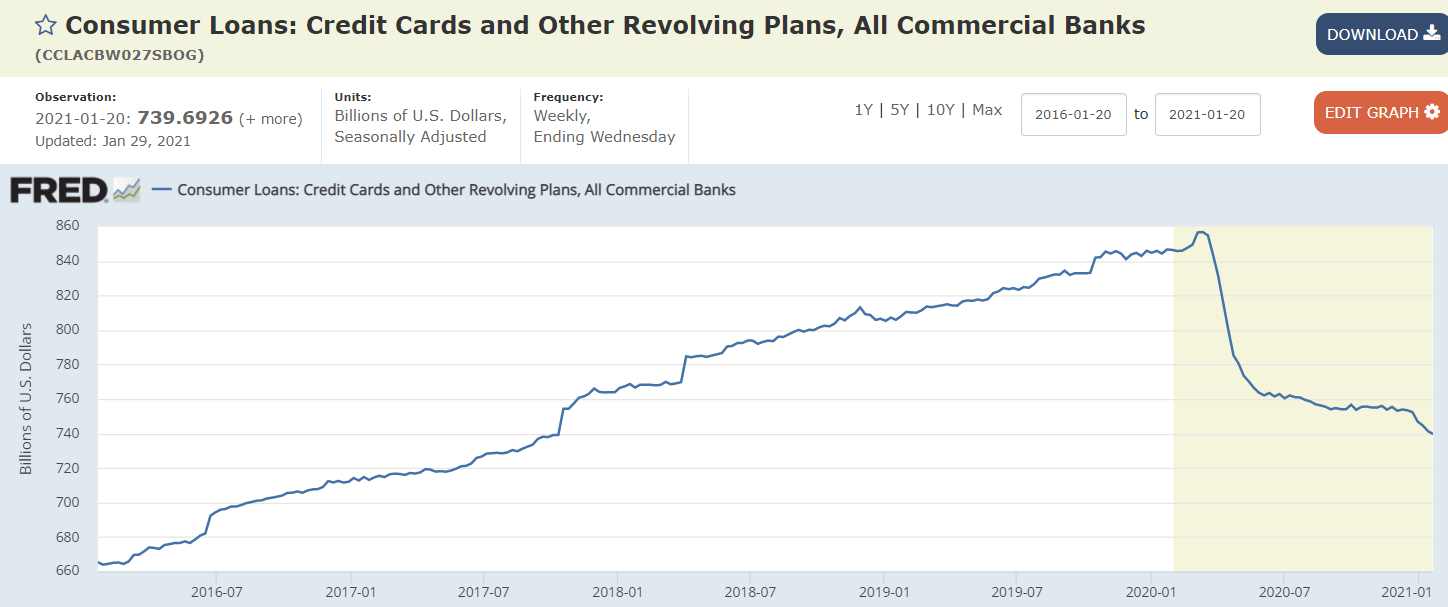

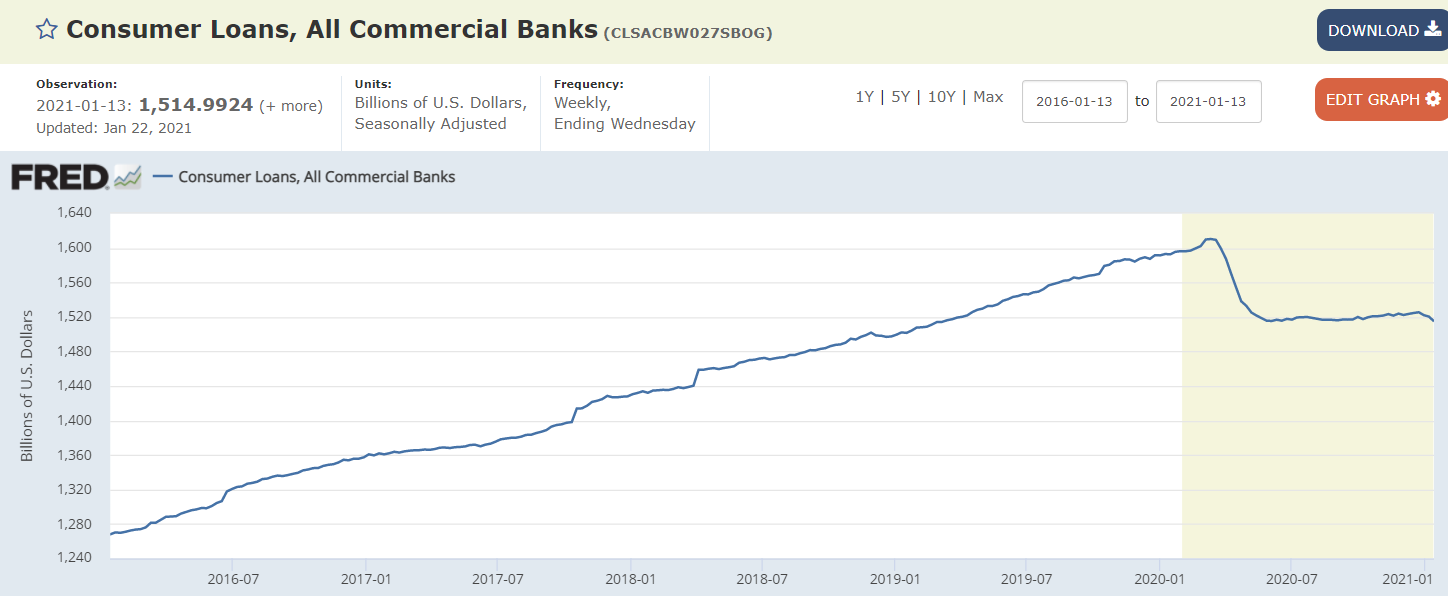

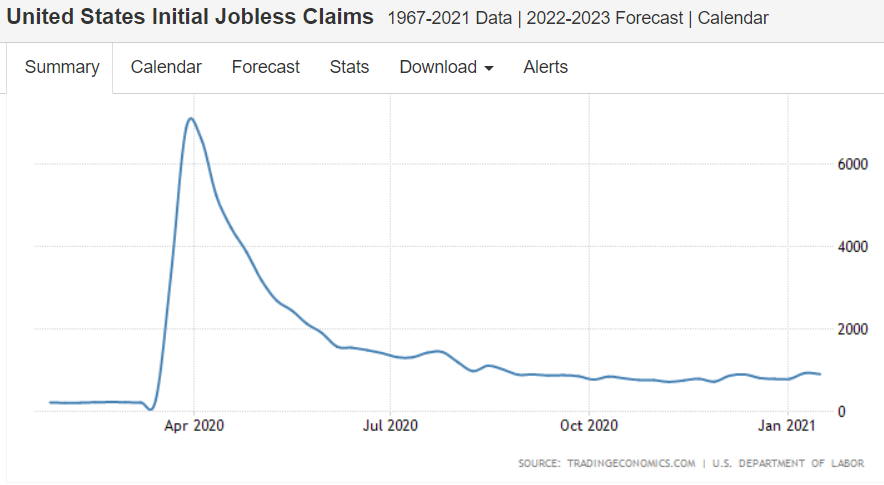

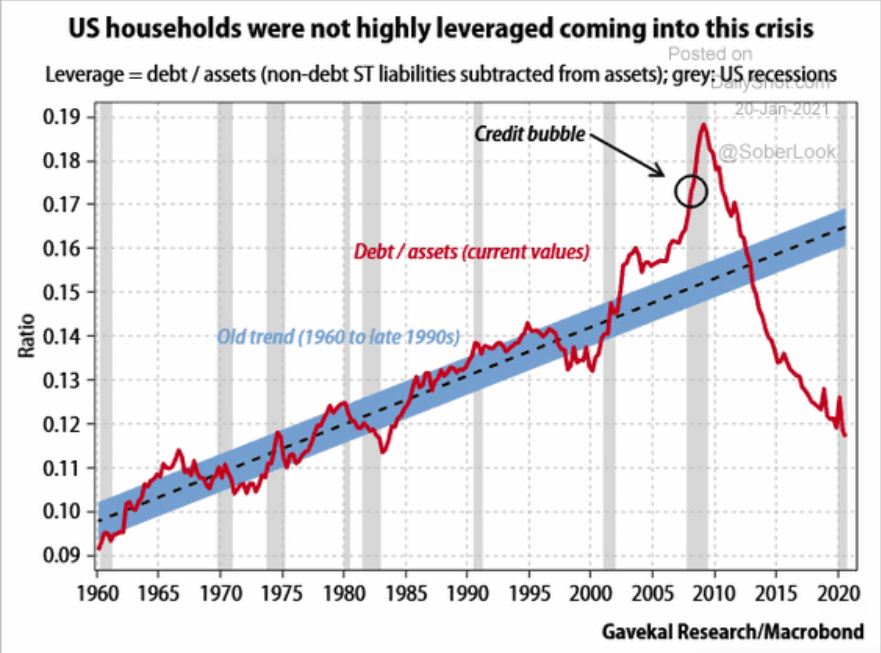

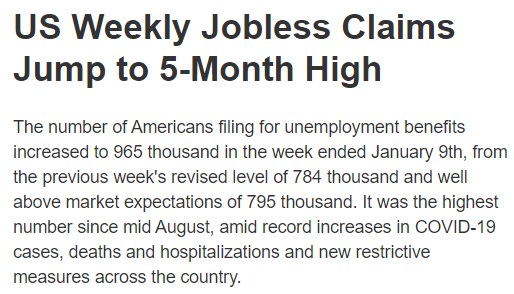

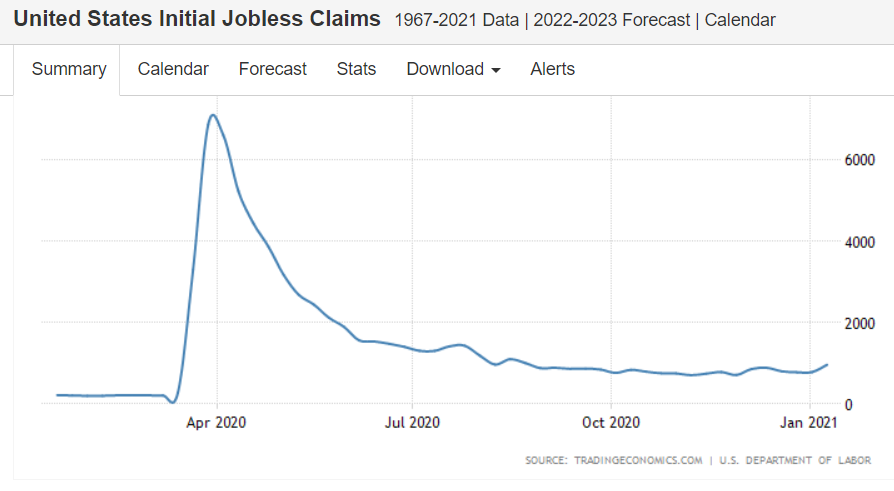

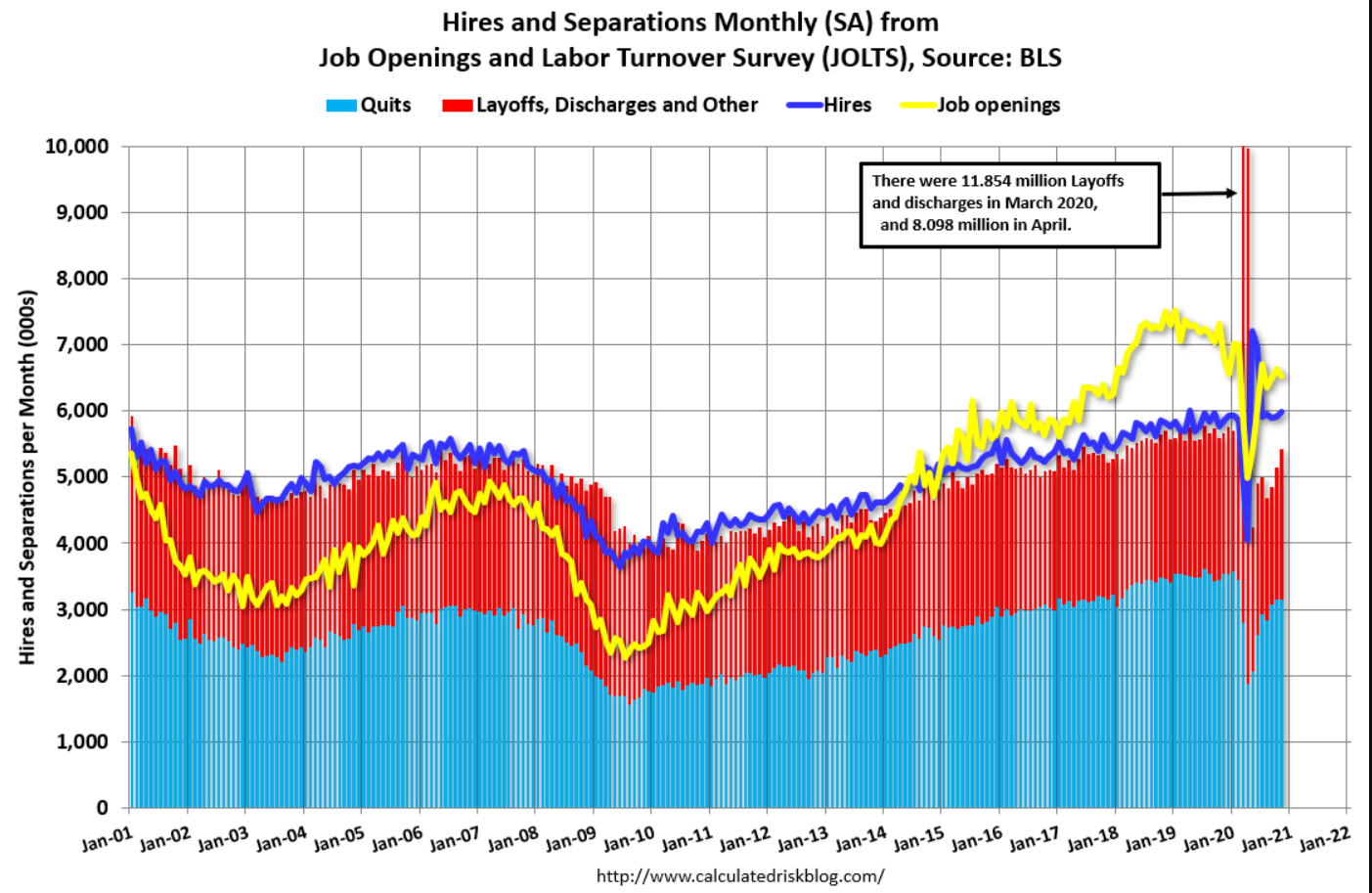

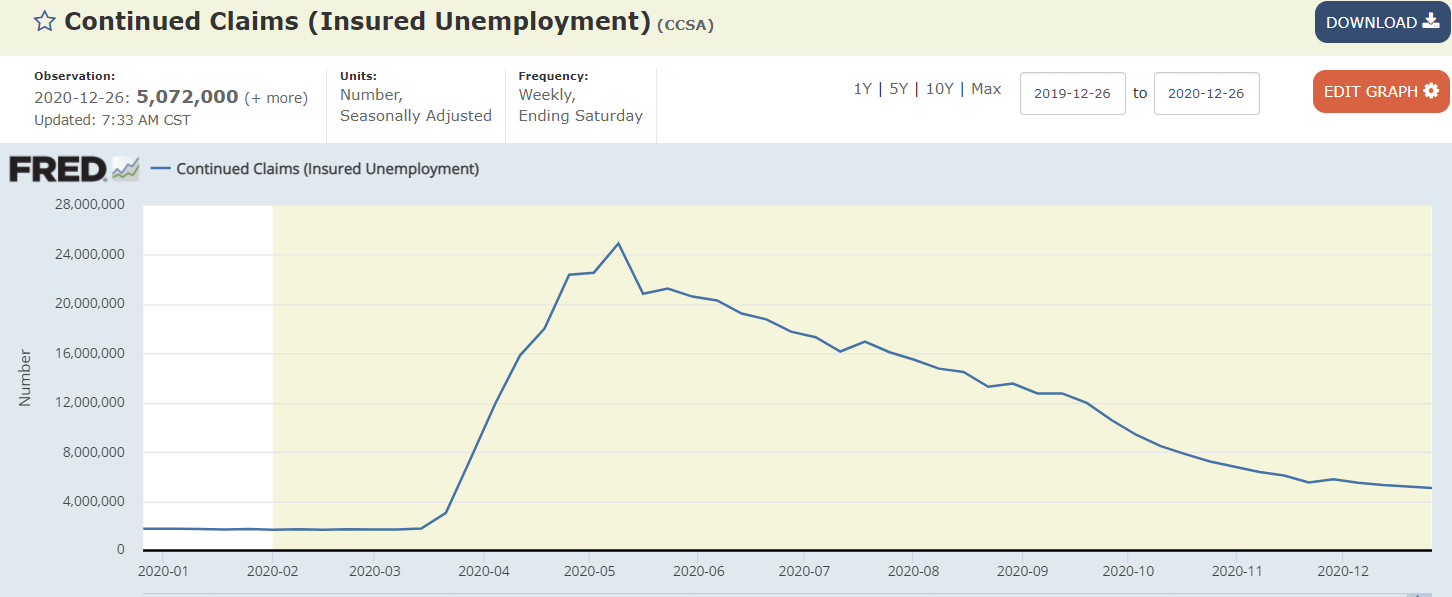

A part of consumption comes from buying on credit, and with employment down, fewer people qualify for credit. So while the additional income reduces the need for credit in order to spend, it appears the further drop in credit due to unemployment has resulted in a net drop in consumer spending: