Softening if anything.

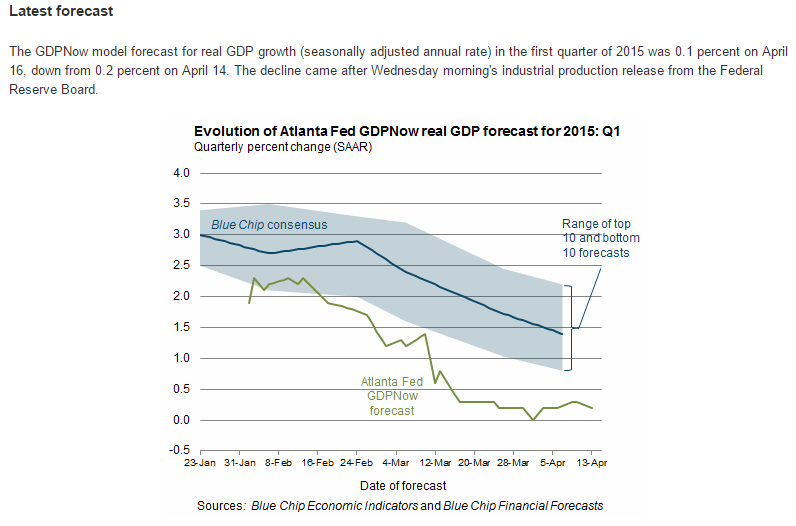

Still no sign of any Q2 bounce:

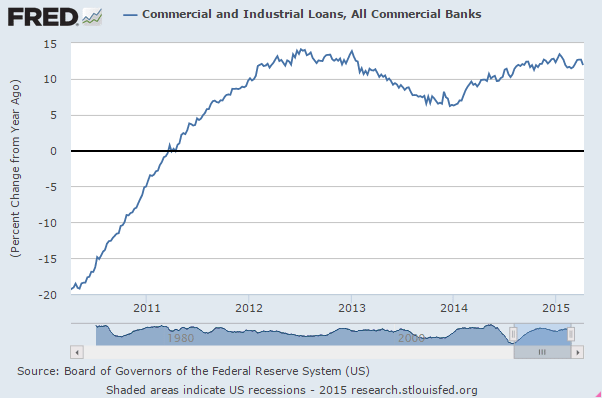

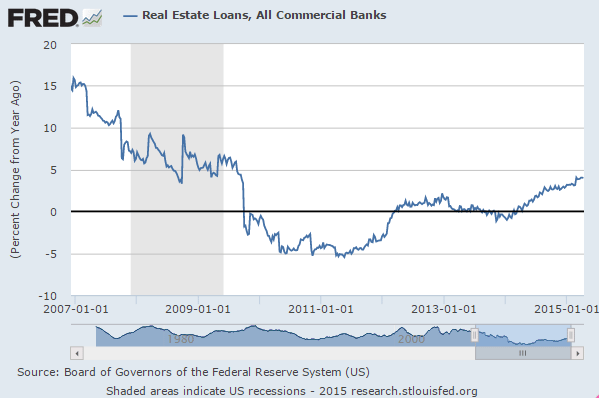

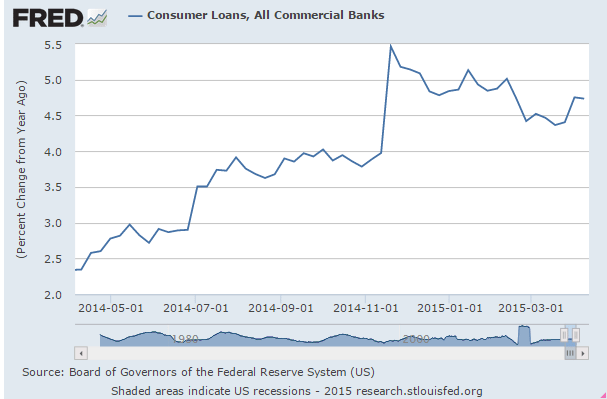

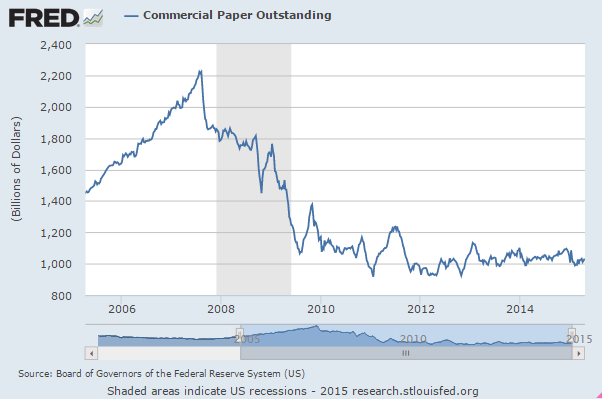

No sign of any kind of increase in bank credit expansion to offset lost oil and gas bond issuance, etc:

About this time last year I was looking to find signs of the credit expansion needed to ‘replace’ the cuts in Federal deficit spending and couldn’t find anything. Turns out it was the expanded investment chasing high priced oil that supported GDP growth of a bit over 2%. With that now behind us, and most every indicator in decline and with many GDP estimates now below 1%, I’m again looking for signs of a credit expansion capable of supporting positive growth, and so far, if anything, it looks to be going the other way.

And the latest from the Atlanta Fed isn’t encouraging

This gives you a pretty good idea of the magnitude of euro selling by central banks. The question is when are they finished, and perhaps, when foreign exporters again pressure their cb’s to increase holdings to target the euro zone for exports, which is the reason the cb’s originally bought the euro.

And note that the current account surpluses indicate the EU may be through the ‘j curve’ as net exports continue to move higher with the foreign cb induced currency depreciation.

Of course QE and negative rates continue to work to strengthen the euro, as the does the current account surplus, so it’s just a matter of time before the fundamentals overtake CB selling. The problem is timing… ;)

Euro’s Reserve Status Jeopardized as Central Banks Dump Holdings

By Kevin Buckland David Goodman

April 10 (Bloomberg) — Quantitative easing may be helping Europe achieve its economic targets, but it’s also undermining the long-term viability of the euro by tarnishing its allure as a global reserve currency.

Central banks cut their euro holdings by the most on record last year in anticipation of losses tied to unprecedented stimulus. The euro now accounts for just 22 percent of worldwide reserves, down from 28 percent before the region’s debt crisis five years ago, while dollar and yen holdings have both climbed, the latest data from the International Monetary Fund show.

“As a reserve currency, the euro is falling apart,” said Daniel Fermon, a strategist at Societe Generale SA in Paris. “As long as you have full quantitative easing, there’s no need to invest. The problem for the moment is we don’t see a floor for the currency. Money’s flowing out.”

European Central Bank President Mario Draghi has in the past welcomed the drop-off in reserve managers’ holdings because a weaker exchange rate makes the continent more competitive. Yet firms including Mizuho Bank Ltd. warn the currency’s waning popularity reflects a more lasting loss of confidence in an economy that shrank in two of the past three years.

Sinking Economically

The decline in euro reserves suggests other central banks consider the ECB’s 1.1 trillion euros ($1.2 trillion) of QE bond purchases, which started a month ago, to be the biggest threat to the currency’s global status since its 1999 debut.

Greece’s debt woes aren’t helping, either. The ECB ramped up the emergency funding available to Greek banks Thursday to alleviate the country’s worsening liquidity issues amid drawn-out negotiations over its bailout.

Outright Sales

National Australia Bank Ltd. estimates reserve managers sold at least $100 billion-worth of euros in the fourth quarter of 2014.

“Most of the fall in the euro share represented outright selling of euros” rather than simply reflecting declines in the exchange rate, said Ray Attrill, the bank’s global co-head of currency strategy in Sydney.

Of the $6.1 trillion of reserves for which central banks specify a currency, the proportion of euros fell in every quarter of 2014, IMF data show. Last year was also the first time euro holdings fell in cash terms.

Euro Weakening

Yen holdings increased in three of the four quarters and make up 4 percent of the total, up from as low as 2.8 percent in early 2009. Dollars account for the biggest proportion at 63 percent after reserve managers increased their holdings in the final six months of last year. That’s down from as much as 73 percent in 2001.

The changes came as the yen and euro each sank 12 percent versus the greenback last year. The euro has tumbled about the same amount since then, which should further shrink its presence in central banks’ war chests.

The euro’s also falling against its broader peers, dropping more than 7 percent this year among a basket of its Group of 10 nations tracked by Bloomberg Correlation-Weighted Indexes, the biggest decline in the group. The dollar climbed almost 7 percent on the prospect of higher U.S. interest rates, beating a gain of about 6 percent in the yen.

NACM’s Credit Managers Index Drops Even Further in March

The March report of the Credit Managers’ Index (CMI) from the National Association of Credit Management (NACM) fell further this month indicating that some serious financial stress is manifesting in the data.

“We now know that the readings of last month were not a fluke or some temporary aberration that could be marked off as something related to the weather,” said NACM Economist Chris Kuehl. “These readings are as low as they have been since the recession started and to see everything start to get back on track would take a substantial reversal at this stage.”

The combined score of 51.2 is moving dangerously close to contraction zone. The index of favorable factors dropped to 55.4 while the unfavorable factors drastically fell to 48.5–a place this index has not seen since after the end of the recession. “The signal this sends is that many companies are not nearly as healthy as it has been assumed and that there is considerably less resilience in the business sector than assumed,” said Kuehl.

Most categories showed decreases this month, but the real damage occurred in the unfavorable changes categories. According to Kuehl, the most disturbing drop happened in the rejection of credit applications category, which fell from 48.1 to an even weaker 42.9. The accounts placed for collection fell to 49.8, disputes improved slightly to 49, dollar amount beyond terms fell to 45.5, and dollar amount of customer deductions dropped to 48.7.

Rail Week Ending 04 April 2015: Weakness Continues

(Econintersect) — Week 13 of 2015 shows same week total rail traffic (from same week one year ago) again declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic, which accounts for half of movements, is growing year-over-year – but weekly railcar counts remain in contraction. Rail traffic remains surprisingly weak.

Baltic Dry Index is Now Below the Great Recession Low

By: John O’Donnell

April 11 (Econintersect) — The Baltic Dry Index is considered a coincident and leading indicator for global economic growth. It tracks the cost of shipping bulk commodities around the world. The BDI is now below the level reached during the Great Recession.

the BIG stupid…

Conservative lawmakers weigh bid to call for constitutional convention

Consumer Credit

Highlights

Consumer credit rose a solid looking $15.5 billion in February but a closer look shows an unwanted $3.7 billion decline in revolving credit. This is the 4th decline in 5 months for the revolving component which reflects consumer reluctance to finance purchases with credit-card debt. This reluctance may be a plus for consumer wealth, given the extremely high rates of interest credit-card companies often charge, but it is a definite negative for consumer spending which has been very soft in recent months.In contrast to revolving credit, non-revolving credit rose $19.2 billion which is the strongest gain since July 2011. The gain does reflect financing for autos but also an item not associated with consumer spending, and that’s the government’s ongoing and heavy acquisition of student loans.

Year over year showing a (modest) decline in growth:

This is mainly student loans and the growth rate continues to decline:

Not much of an Easter boost in retail showing in this chart:

This was for Feb and inline with Feb payrolls:

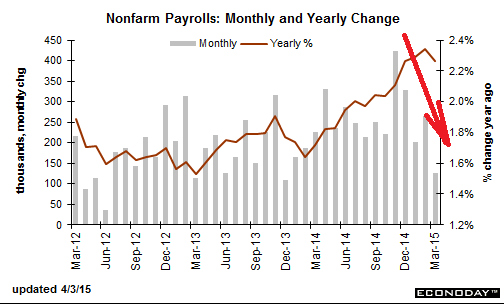

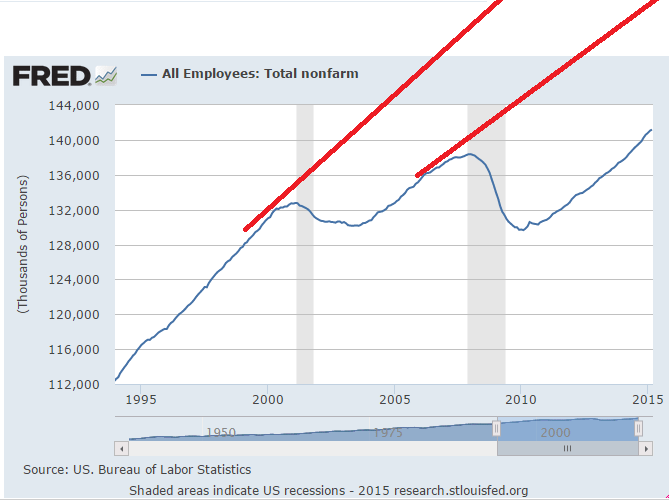

As suspected, last month’s print was revised lower and now with this month’s even lower print the spike reported in November has completely reversed and the payroll number is back in sync with ADP and the rapid declines in most other series.

Employment Situation

Highlights

The labor market has softened in several aspects. Payroll jobs increased a mere 126,000 in March after increases of 264,000 in February and 201,000 in January. January and February were revised down a net 69,000. Market expectations for March were for a 247,000 increase.

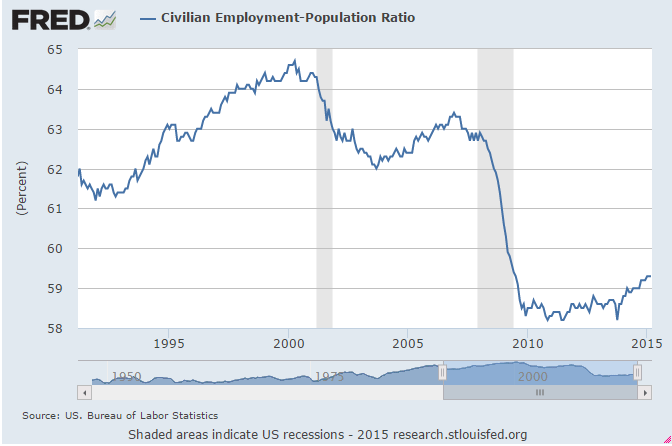

The unemployment rate held steady at 5.5 percent and matched expectations. The labor force participation rate edged down marginally to 62.7 percent from 62.8 percent in February.

Turning back to the establishment survey, private payrolls increased 129,000 in March after a 264,000 boost the month before. Analysts forecast 240,000. In March, employment continued to trend up in professional and business services, health care, and retail trade, while employment in mining declined.

Employment in other major industries, including construction, manufacturing, wholesale trade, transportation and warehousing, information, financial activities, and government, showed little change over the month.

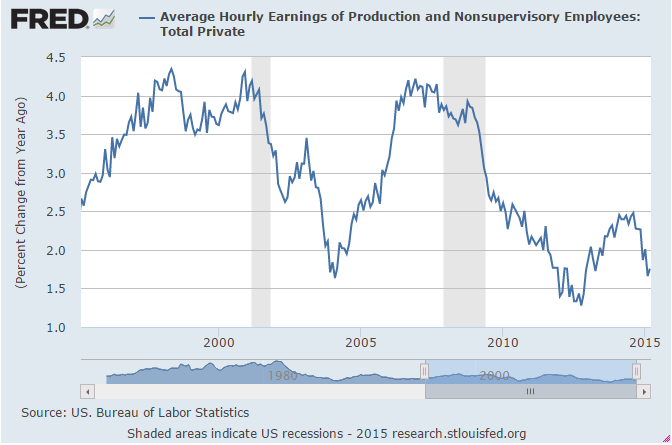

Average hourly earnings rose 0.3 percent, topping expectations for 0.2 percent. The average workweek slipped to 34.5 hours versus 34.6 in February and coming in below forecasts for 34.6 hours

The latest employment report clearly is soft and will add to arguments by Fed doves to delay rate hikes.

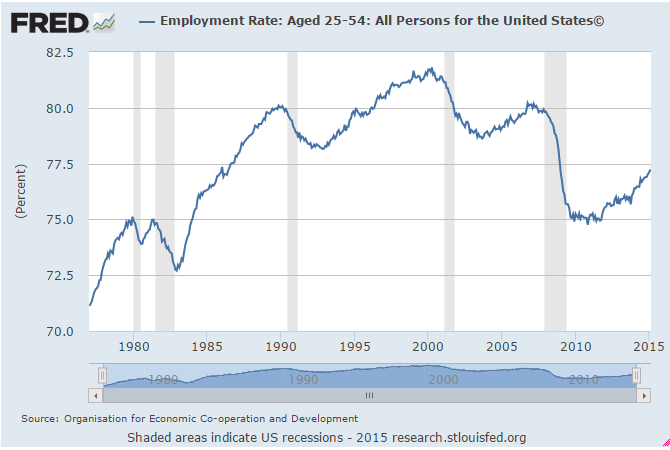

And no ‘structural issues’ here, just an obvious lack of demand:

BLS Jobs Situation Surprisingly Bad in March 2015

By Steven Hansen

The BLS jobs report headlines from the establishment survey was weak and well below expectations. The unadjusted data shows relatively weak jobs growth. The real story this month is the ALL the establishment survey jobs growth for 2015 was re-estimated lower. This is such a soft jobs report that the Federal Reserve will be reluctant to raise their interest rates.