>

> On Tue, Jul 29, 2008 at 4:05 AM, Andrea wrote:

>

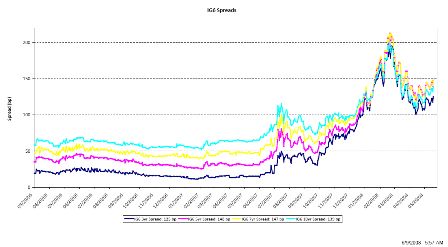

> In case you haven’t seen this yet: A Fed study that finds that

> Taf has lowered Libor.

>

> http://www.newyorkfed.org/research/staff_reports/sr335.html

>

>

right, thanks, as if they needed to fund a study to figure that out!

It’s like doing a study that shows the repo rate goes down when the fed lowers its ‘stop’ on repo.

(Too bad they didn’t use this study to show they should set a rate for the TAF and let quantity float, instead of setting a quantity and having an auction.)

It’s this kind of expense that gives govt. a govt. spending negative connotation.

all the best!

warren

[top]