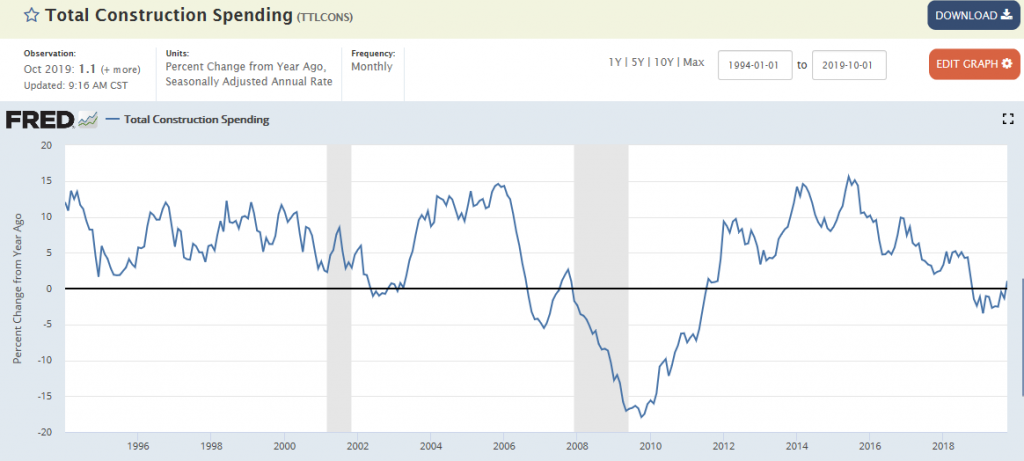

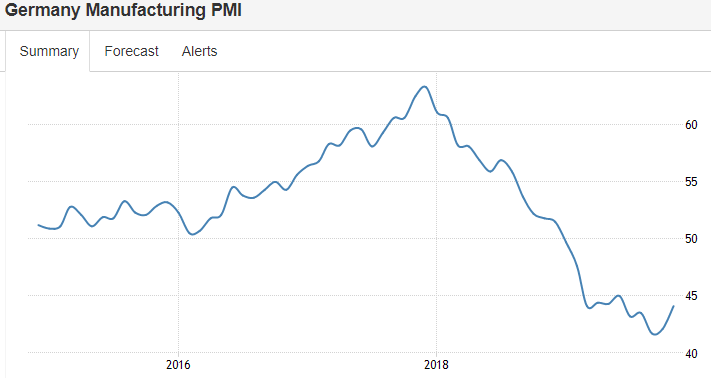

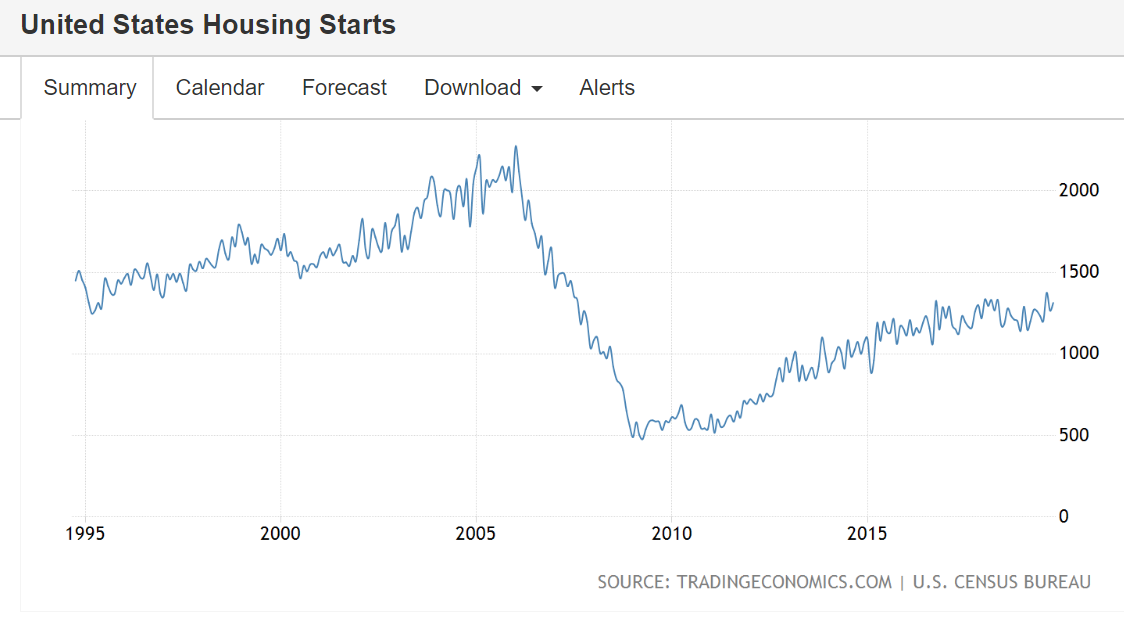

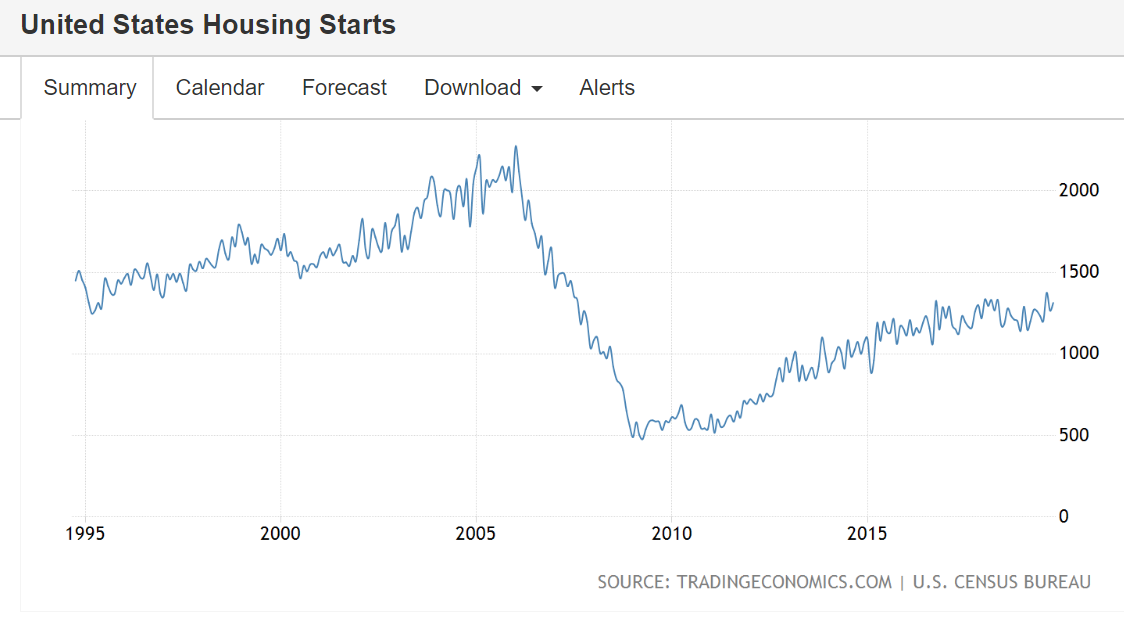

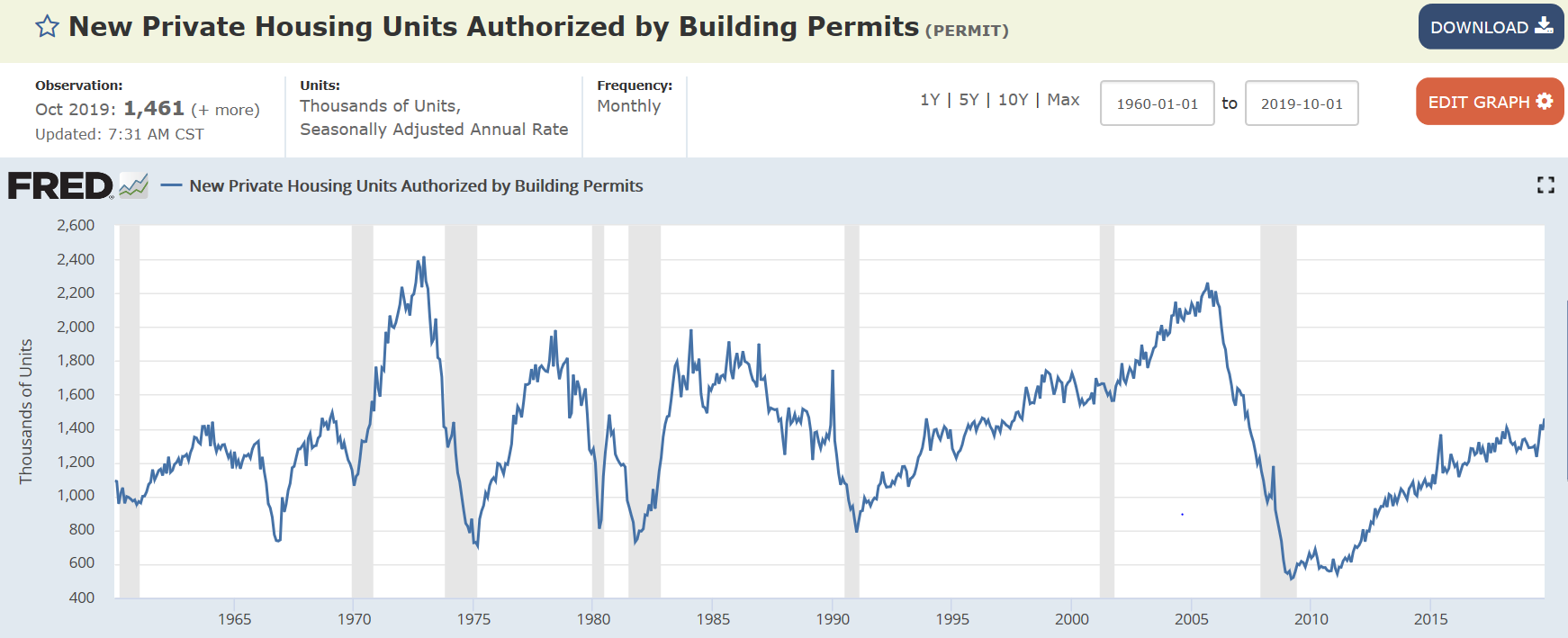

You can see from the charts how depressed this cycle has been, and how housing has stalled out overall for the last few years, and all with ultra low mortgage rates:

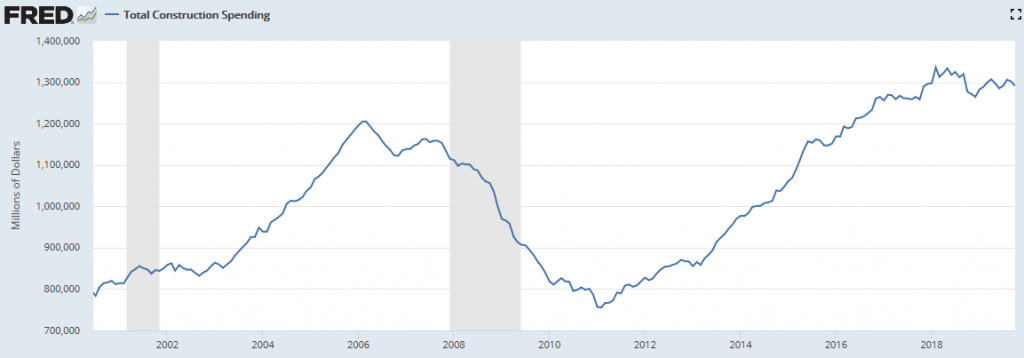

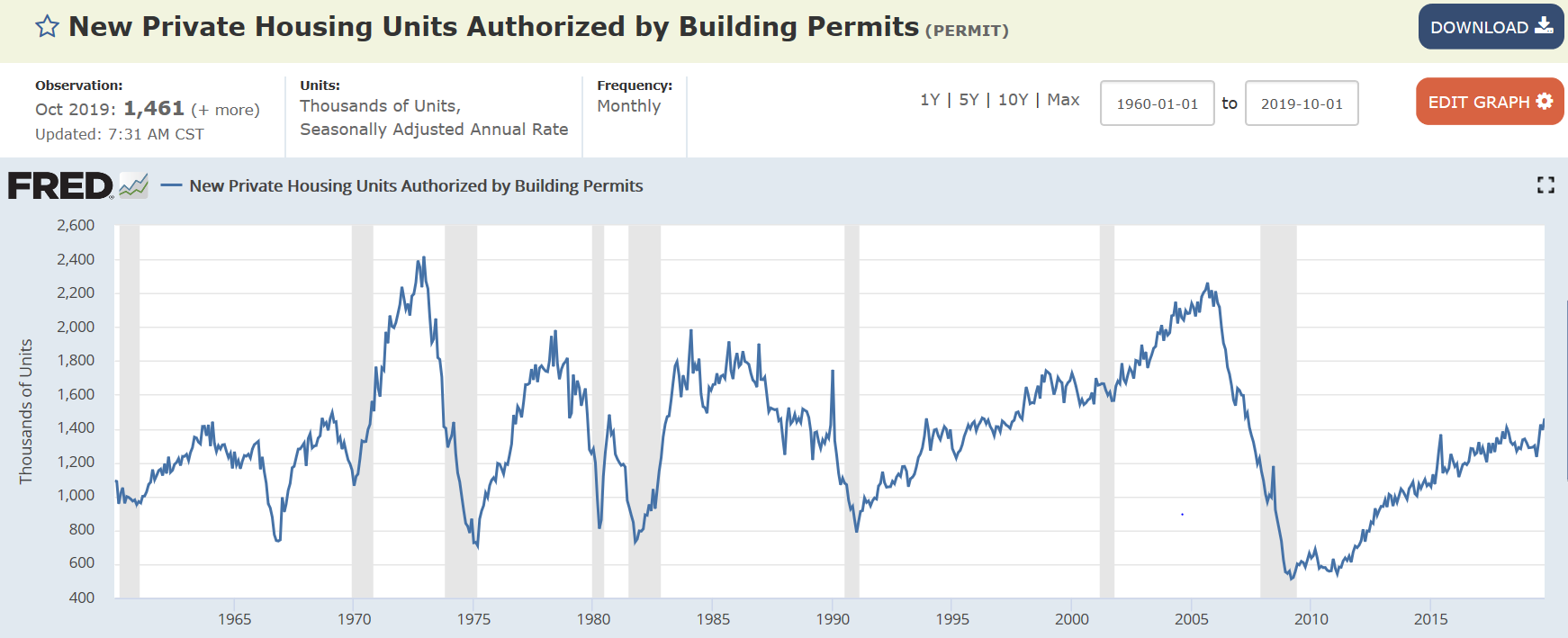

Permits which are more volatile have ‘spiked’ back to 1965 levels when the population was about half:

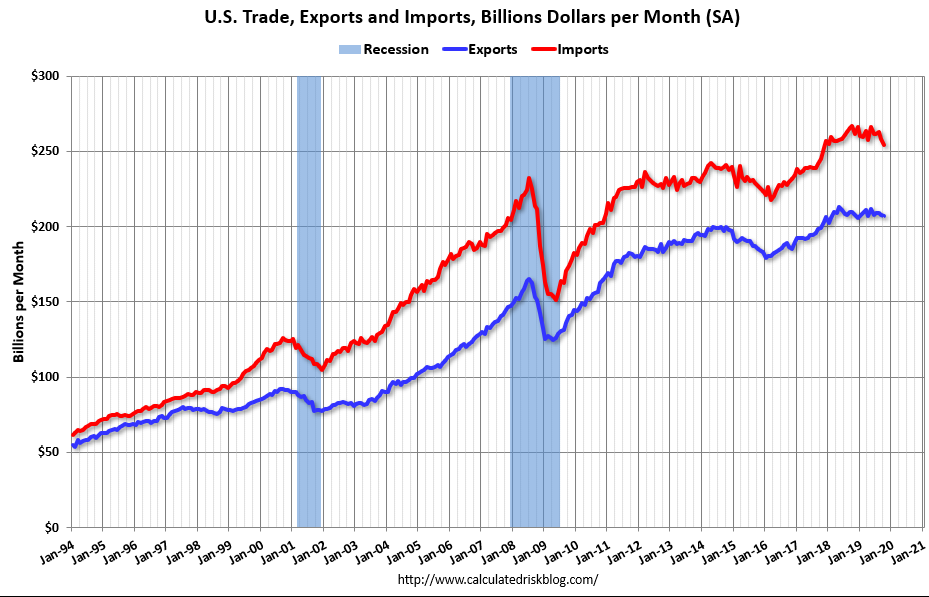

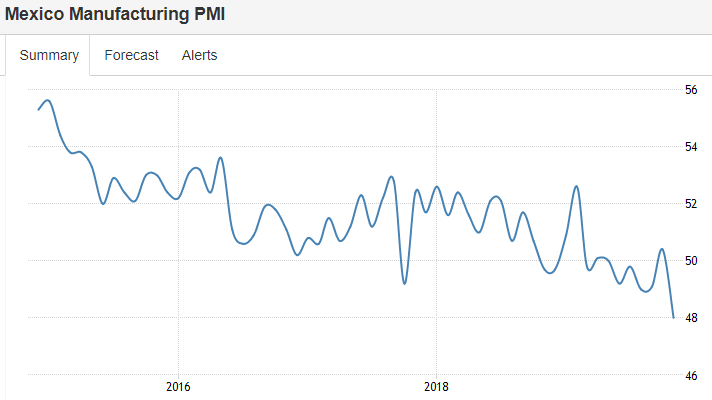

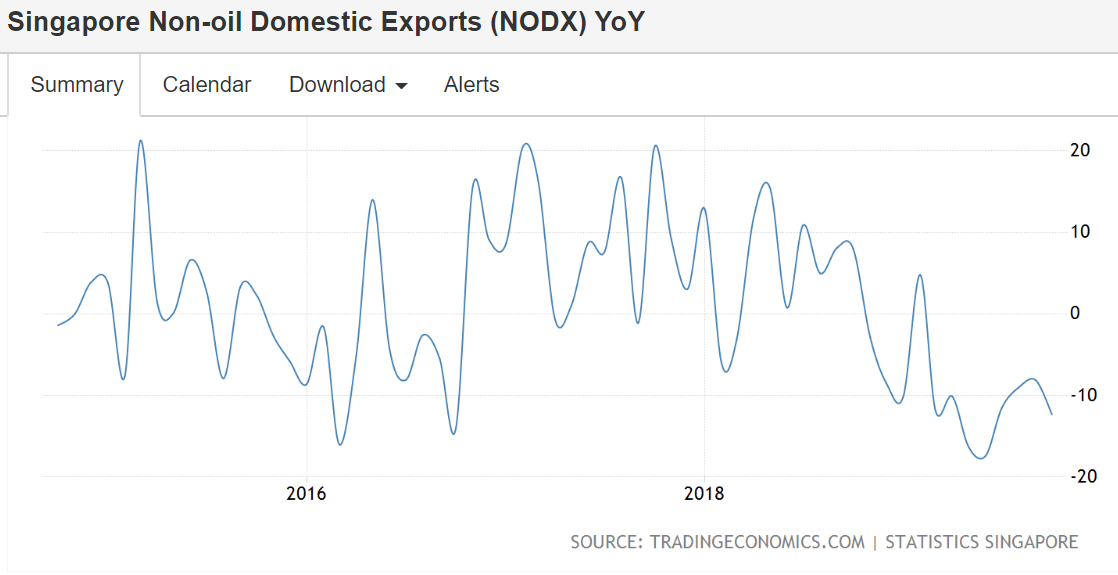

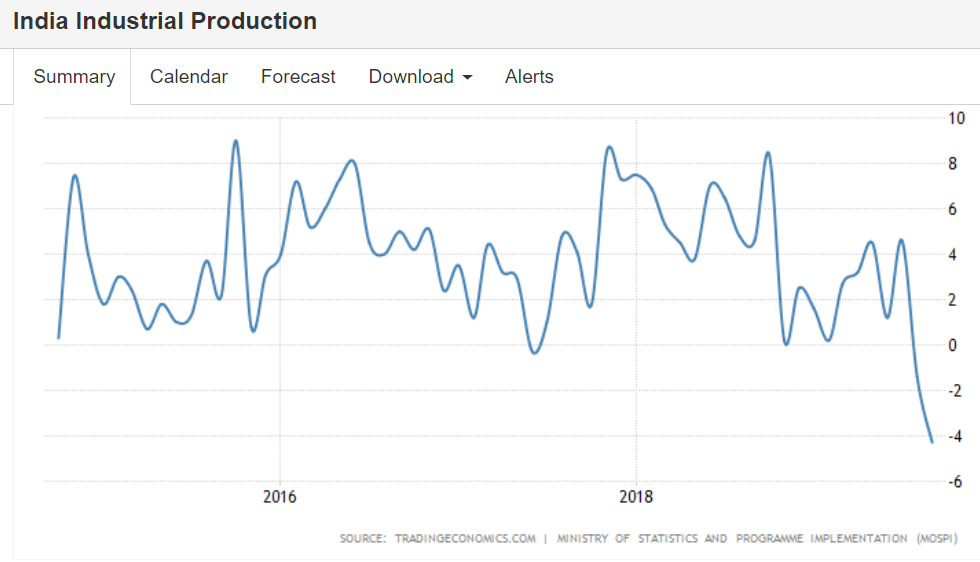

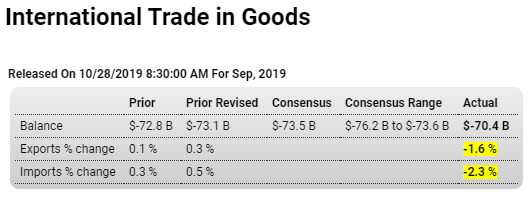

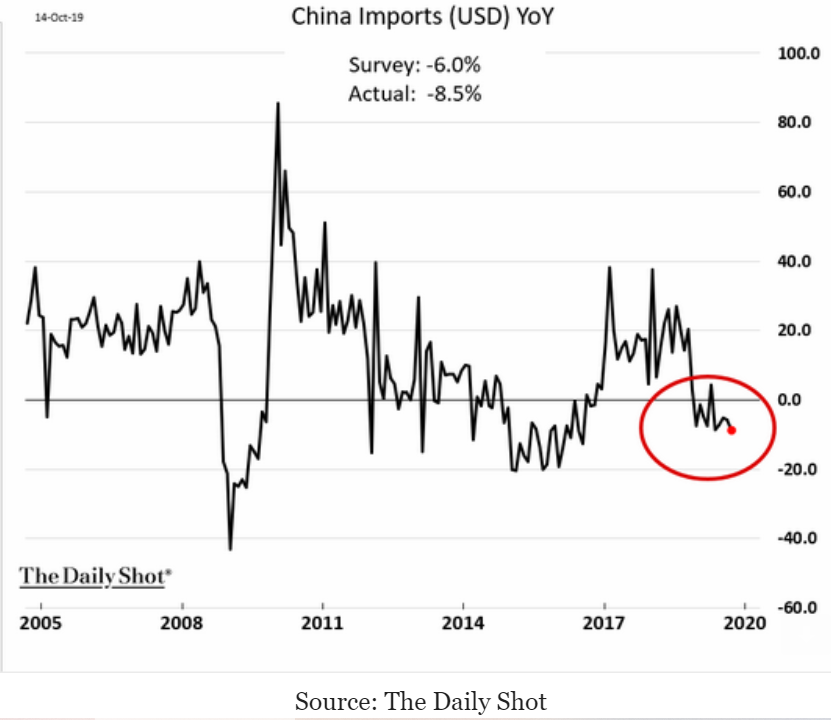

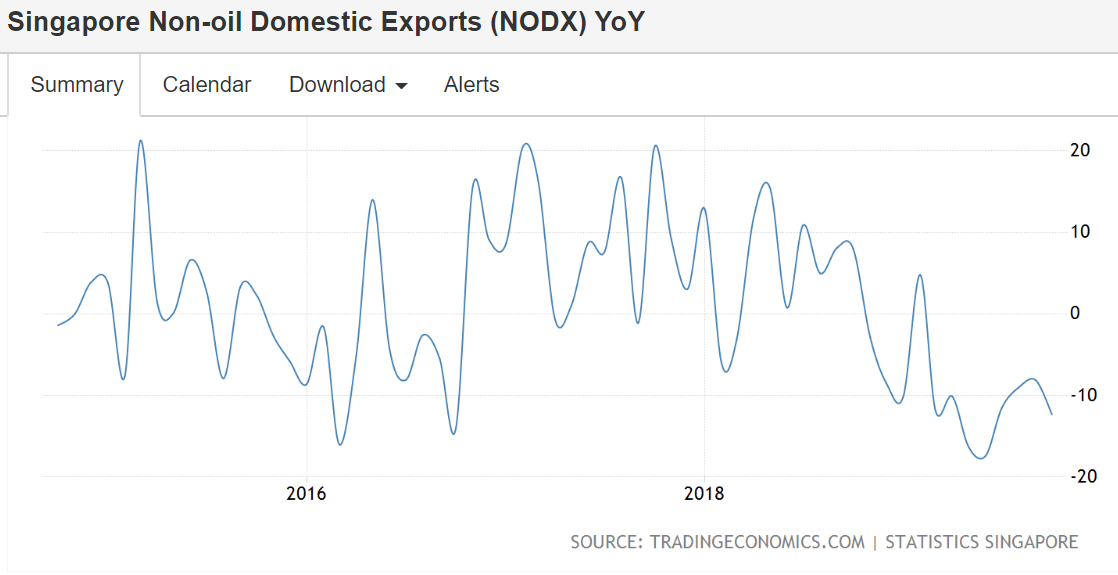

A relatively small economy but the drop in exports is telling:

Singapore’s non-oil domestic exports (NODX) tumbled 12.30 percent year-on-year in October 2019, following an 8.1 percent drop in September and compared with market consensus of a 10.40 percent decrease. It was the eighth straight month decline in NODX and the steepest drop since June, as sales of non-electronics products fell faster (-11.0 vs -2.3% in September), of which primary chemicals (-47.3%); pharmaceuticals (-36.0%), and petrochemicals (-19.2%). Meantime, sales of sales of electronics continued to declined (-16.4 vs -24.8%), including ICs (-17.2%), parts of ICs (-31.3%), and telecommunications equipment (-15.7%).Meanwhile, sales of. Among major trading partners, exports dropped to China (-21.3%); Taiwan (-23.8%); Hong Kong (-13.6%); Japan (-30.3%); Indonesia (-7.3%); Malaysia (-3.6%); the US (-3.1%); South Korea (-12.6%), and the EU (-39.6%), while increased to Thailand (1.5%). Domestic Exports of Non Oil (nodx) (%yoy) in Singapore averaged 9.90 percent from 1977 until 2019, reaching an all time high of 70 percent in February of 1980 and a record low of -34.90 percent in January of 2009.

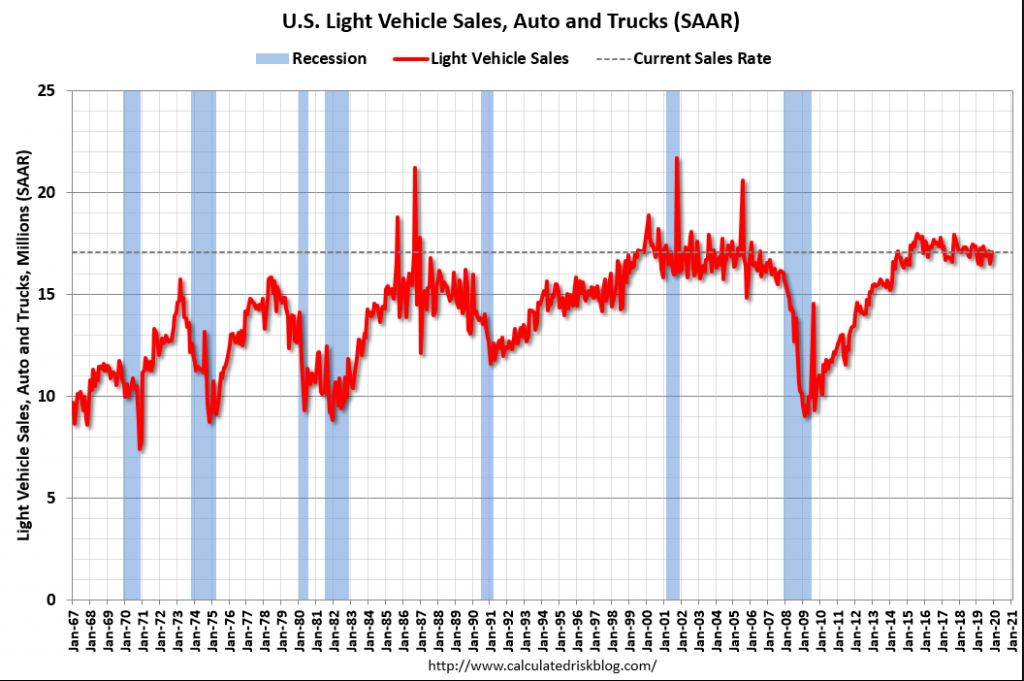

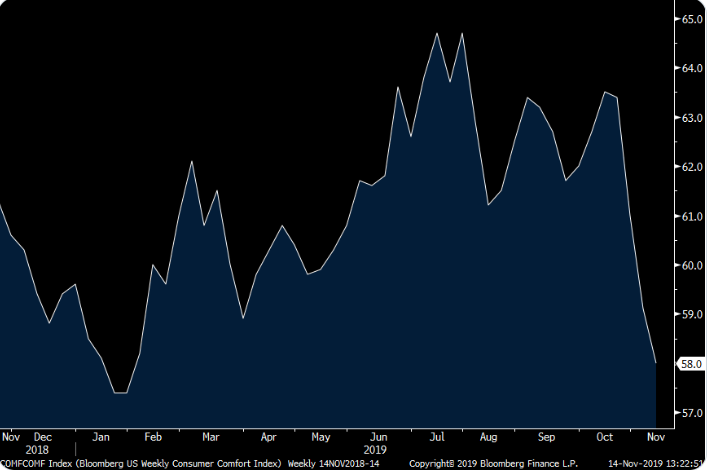

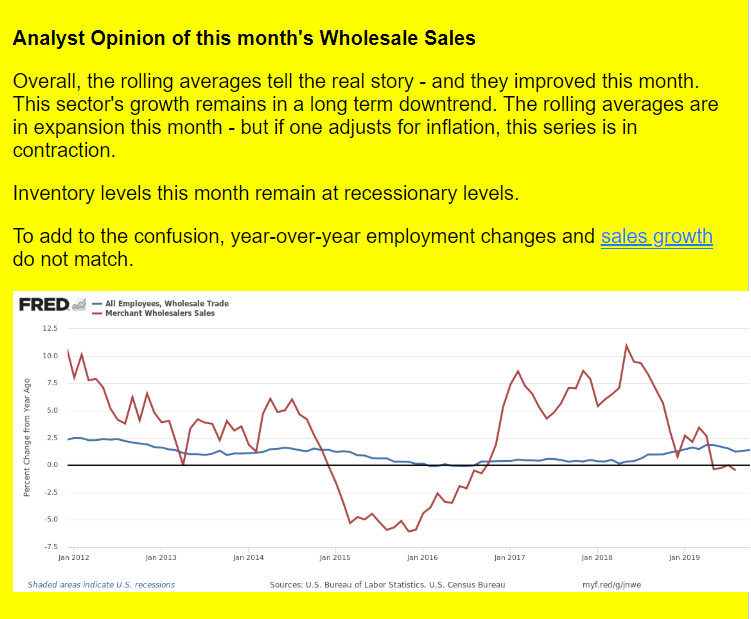

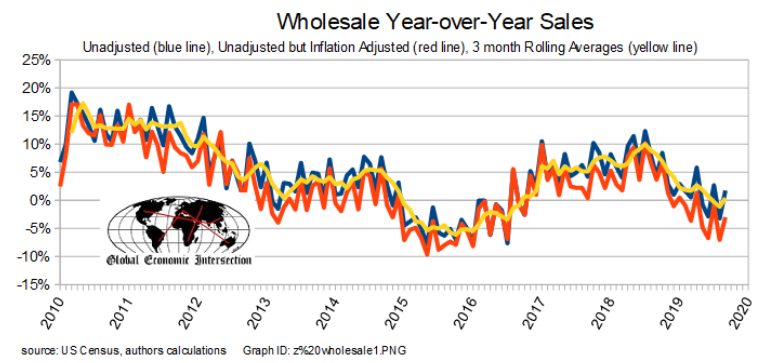

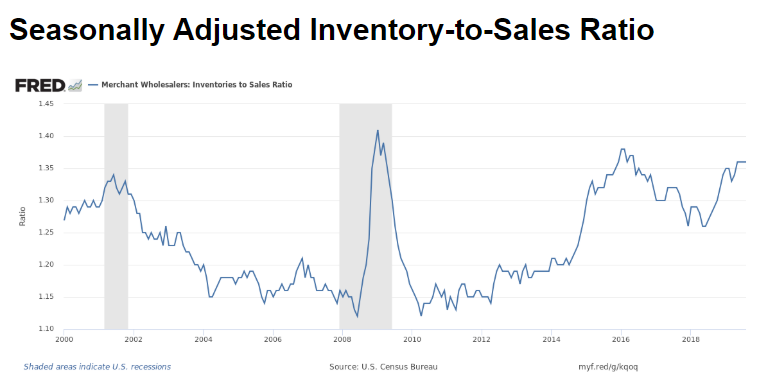

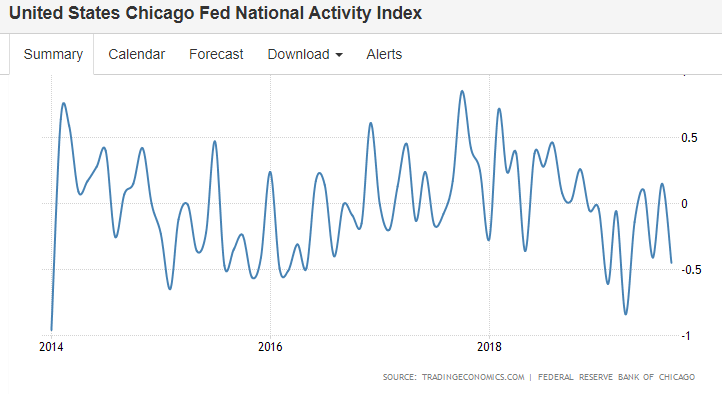

Largest 3 month drop in 8 years: