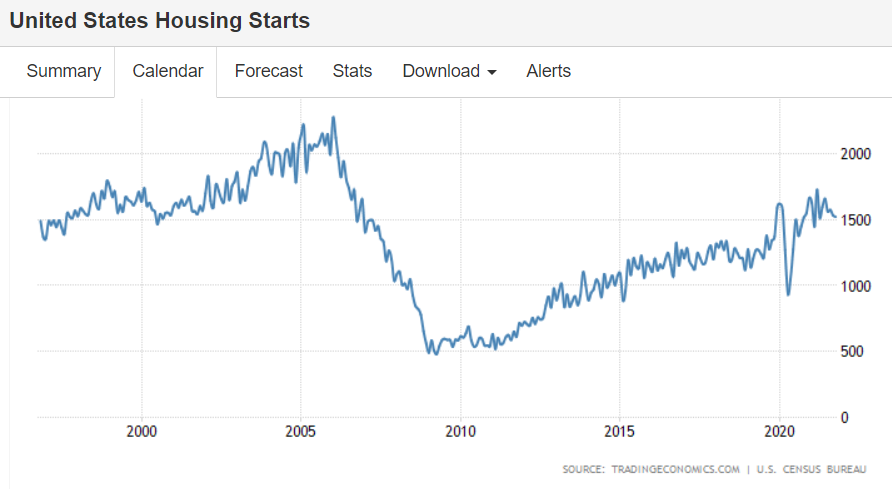

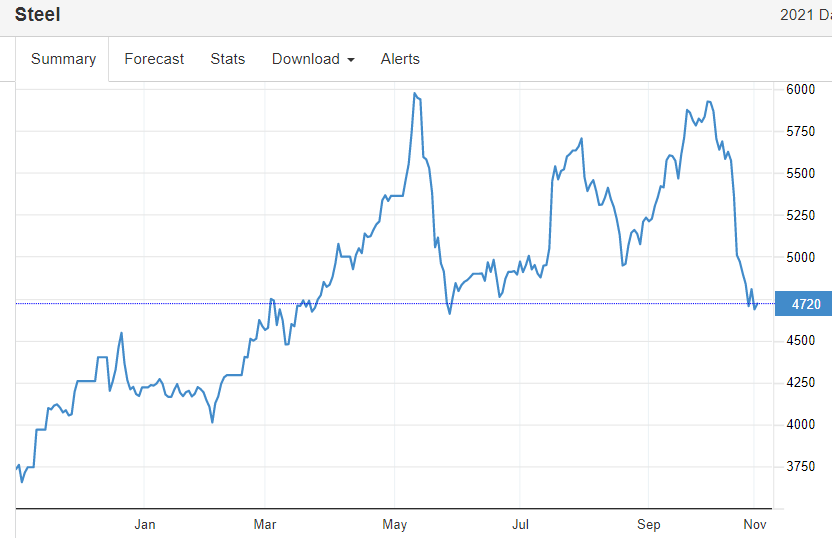

Softening from historically low levels:

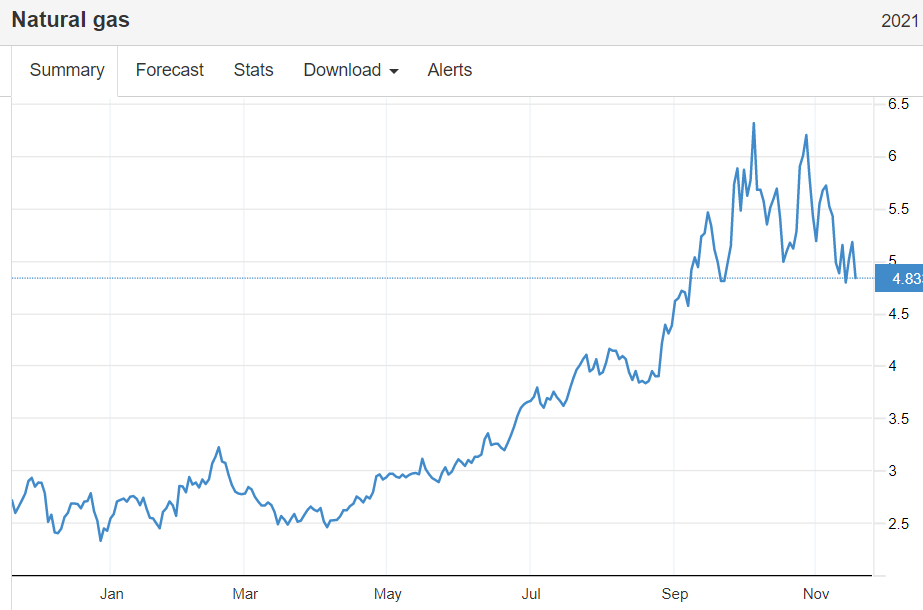

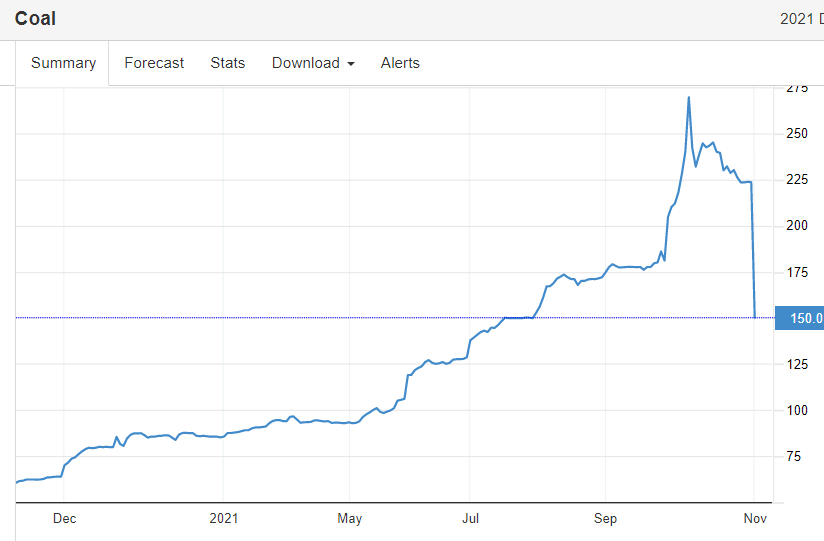

Another commodity that seems to have had a spike that’s ending:

Retirees are ‘unretiring’ — and that’s good for the labor market

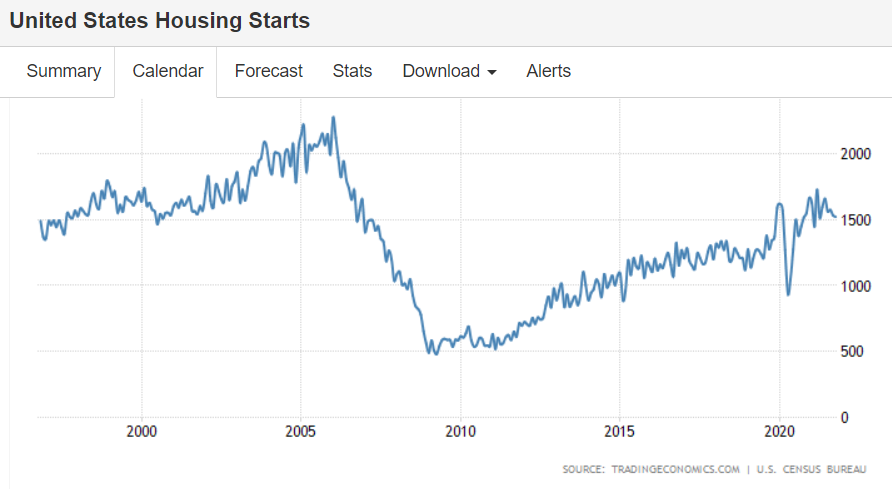

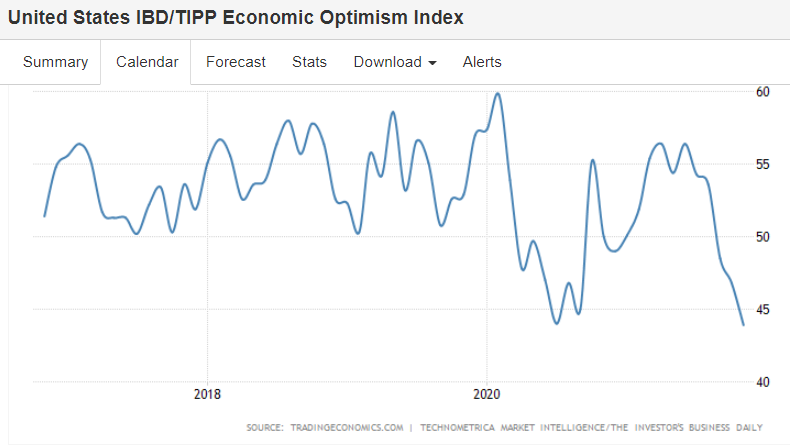

Softening from historically low levels:

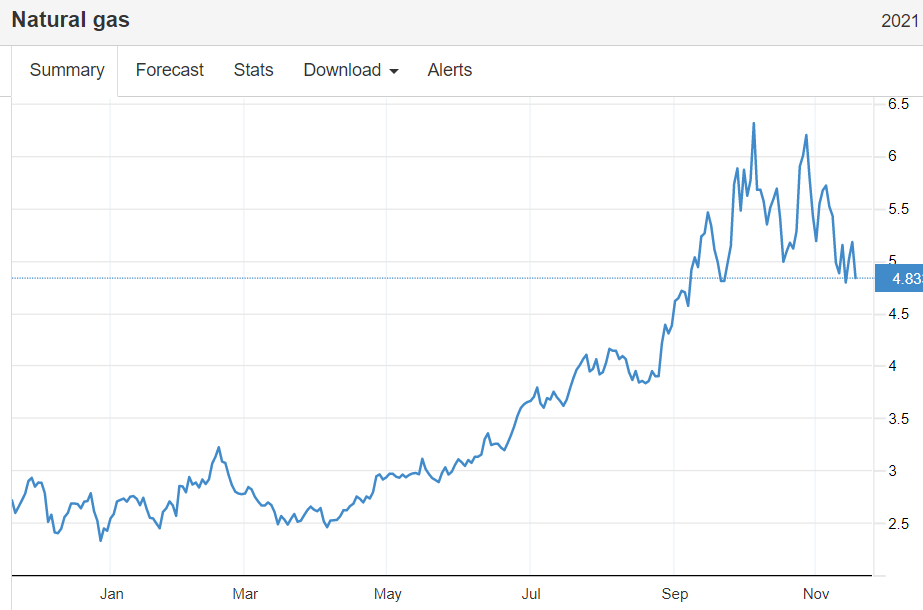

Another commodity that seems to have had a spike that’s ending:

Retirees are ‘unretiring’ — and that’s good for the labor market

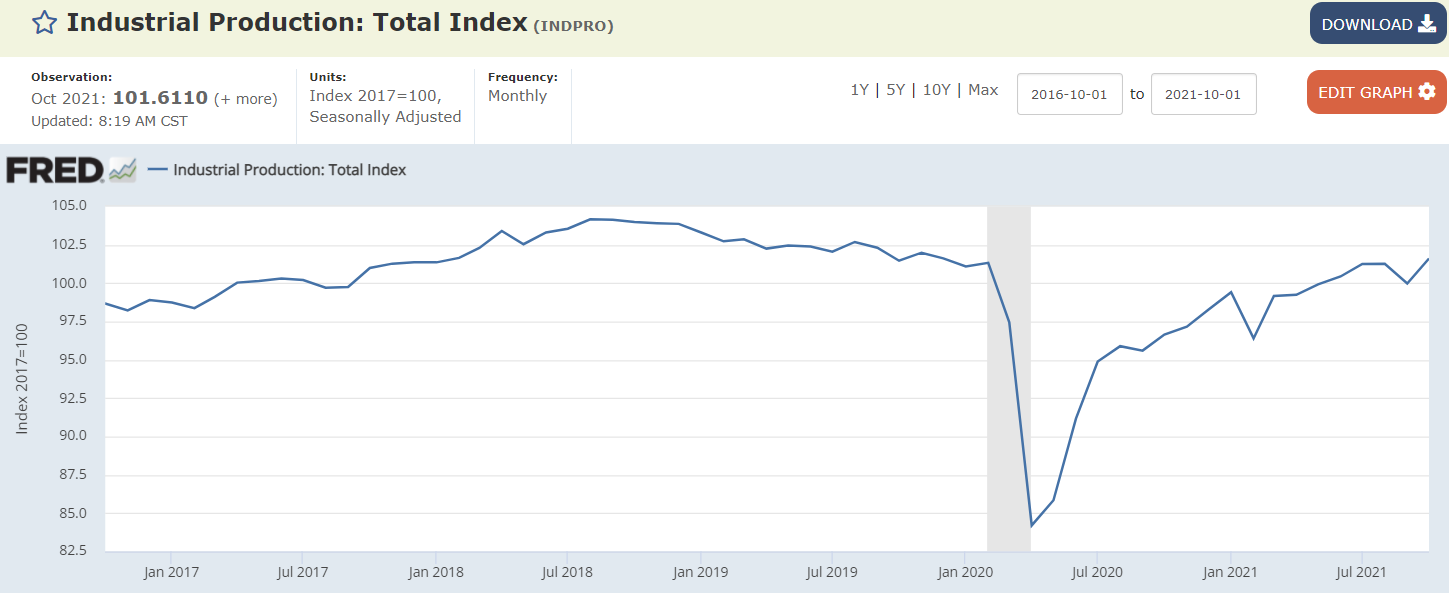

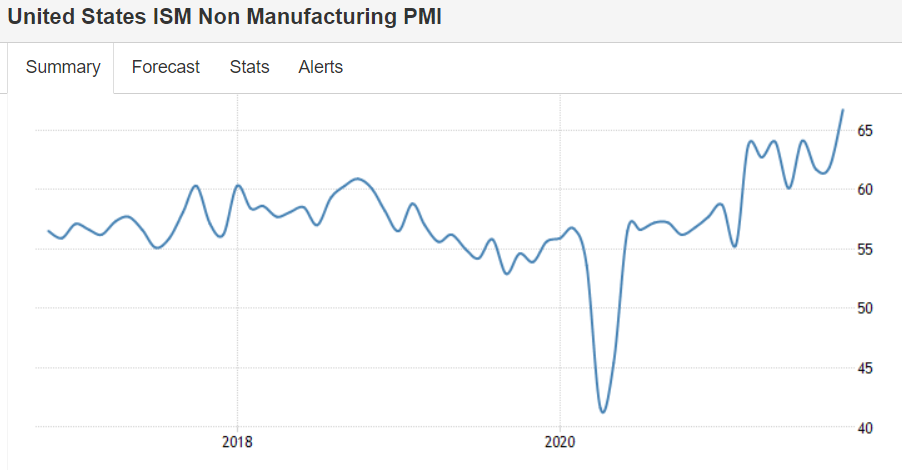

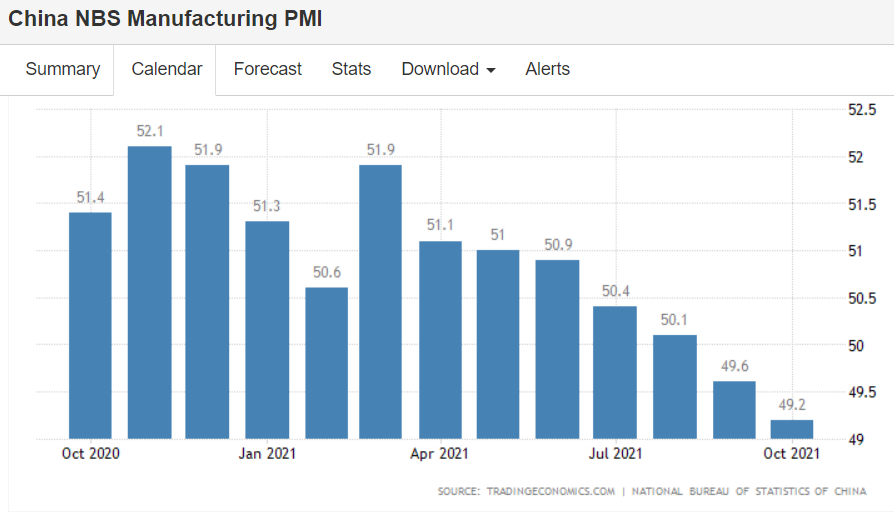

Just muddling along:

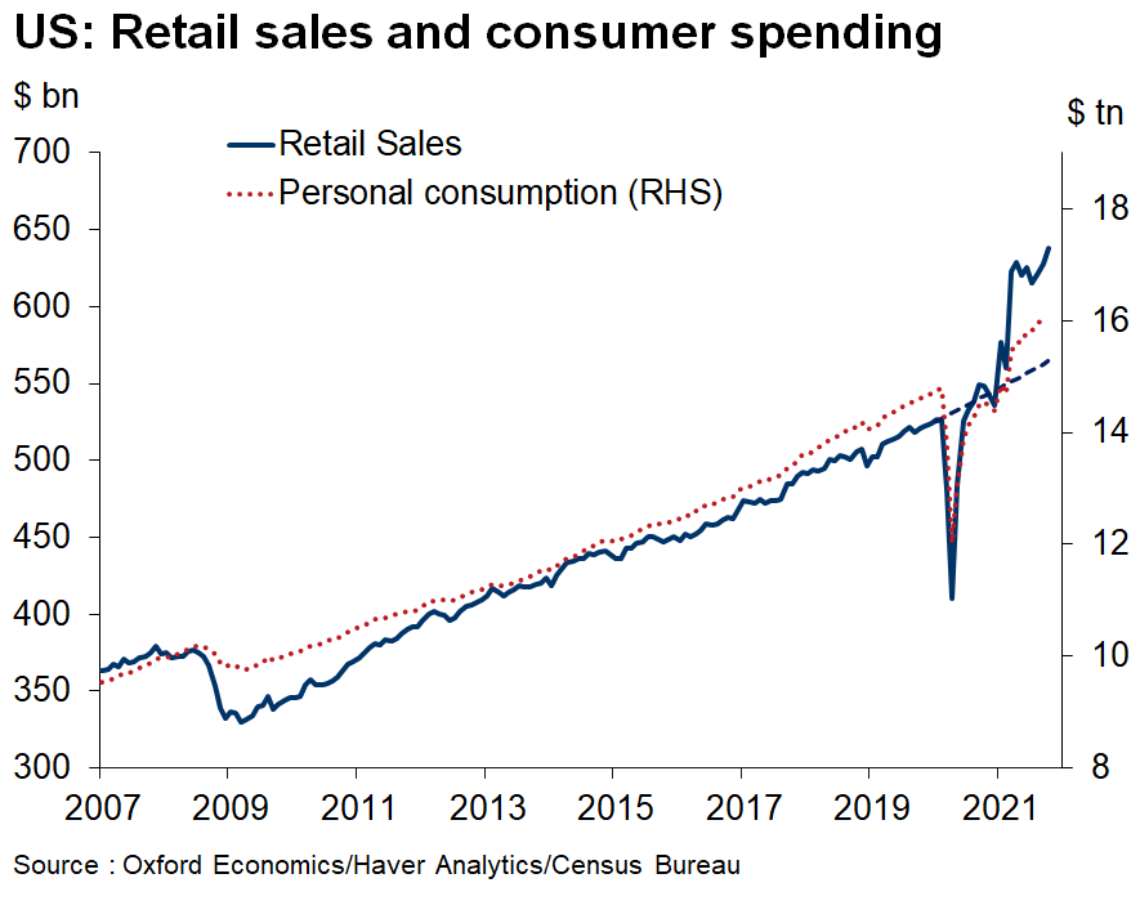

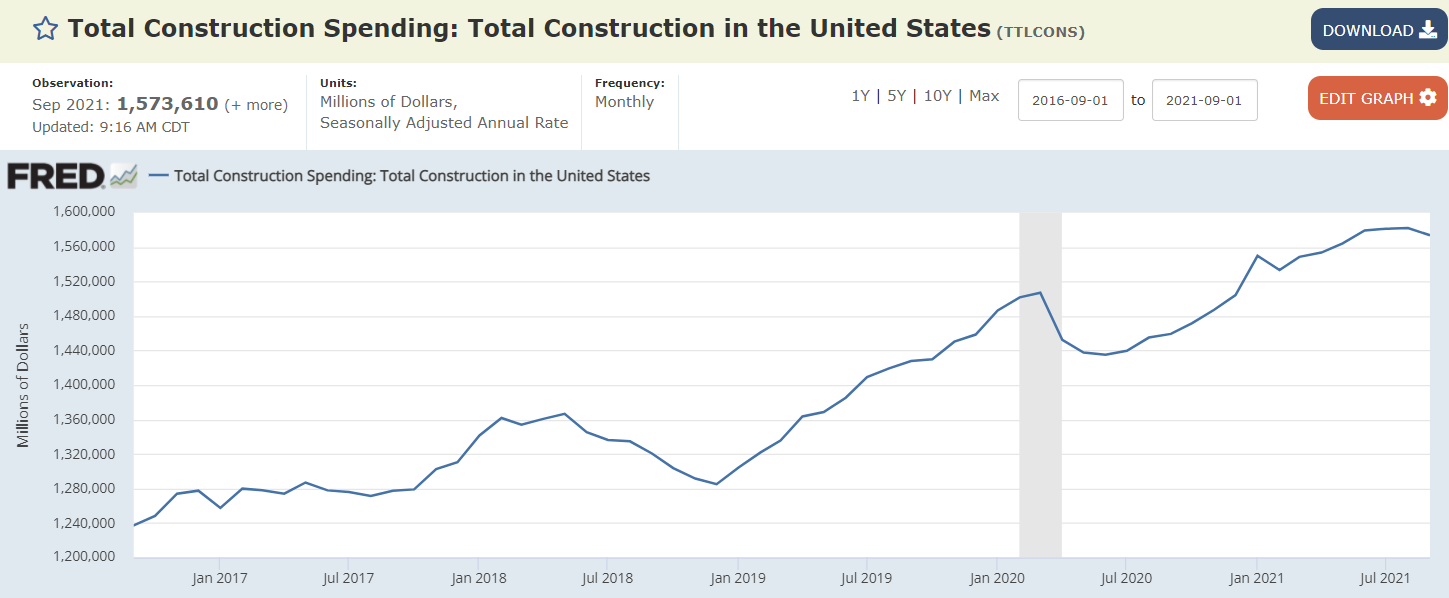

Sales dropped when covid hit, and have subsequently recovered and the total now appears to be about what it would have been without the covid interruption:

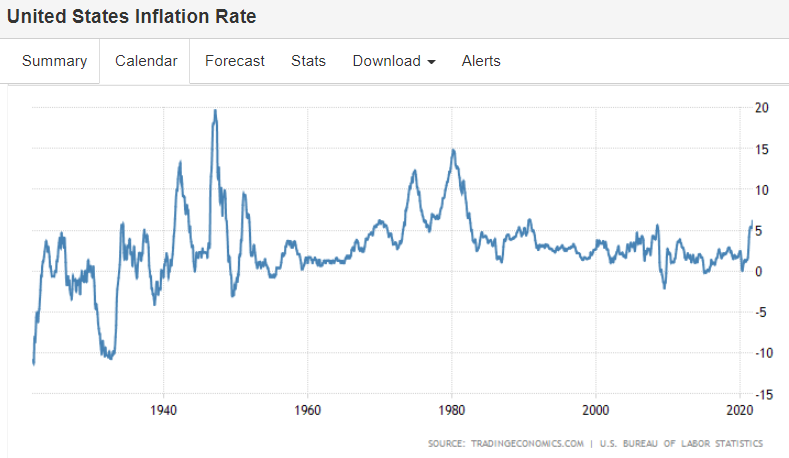

Quite a few price increases, which the media now calls ‘inflation’ even though inflation is a continuous increase in the price level:

The annual inflation rate in the US surged to 6.2% in October of 2021, the highest since November of 1990 and above forecasts of 5.8%. Upward pressure was broad-based, with energy costs recording the biggest gain (30% vs 24.8% in September), namely gasoline (49.6%). Inflation also increased for shelter (3.5% vs 3.2%); food (5.3% vs 4.6%, the highest since January of 2009), namely food at home (5.4% vs 4.5%); new vehicles (9.8% vs 8.7%); used cars and trucks (26.4% percent vs 24.4%); transportation services (4.5% vs 4.4%); apparel (4.3% vs 3.4%); and medical care services (1.7% vs 0.9%). The monthly rate increased to 0.9% from 0.4% in September, also higher than forecasts of 0.6%, boosted by higher cost of energy, shelter, food, used cars and trucks, and new vehicles. source: U.S. Bureau of Labor Statistics

The longer term chart show how so far it’s just a one time blip up:

Quite a few commodities are also looking like it’s been a one time blip up:

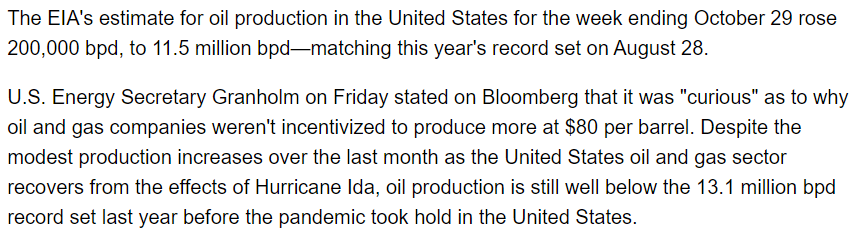

Oil prices, however are set by Saudi Arabia working closely with Russia,

so at least for the medium term the price is an entirely political decision:

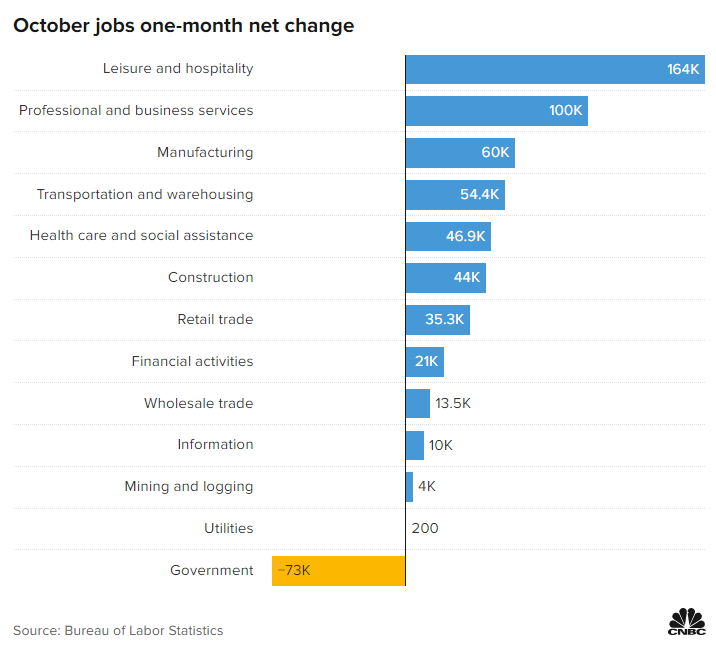

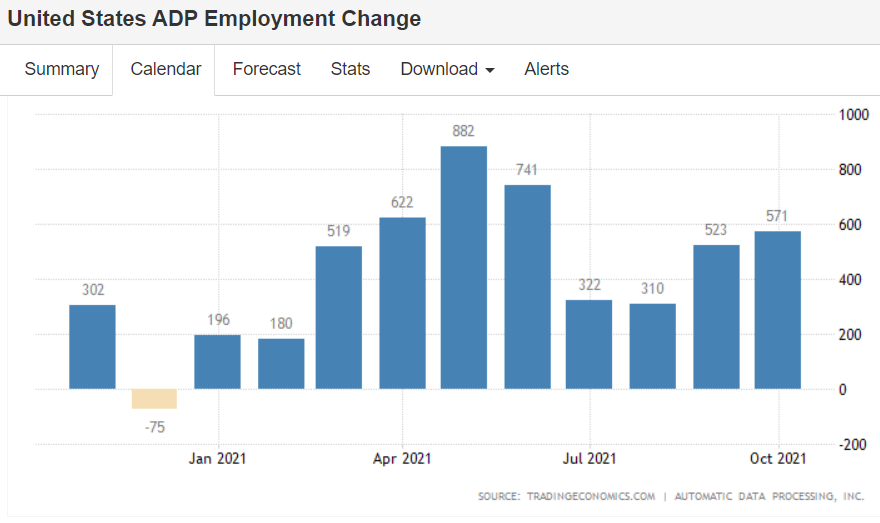

Progress, but at a decelerating rate:

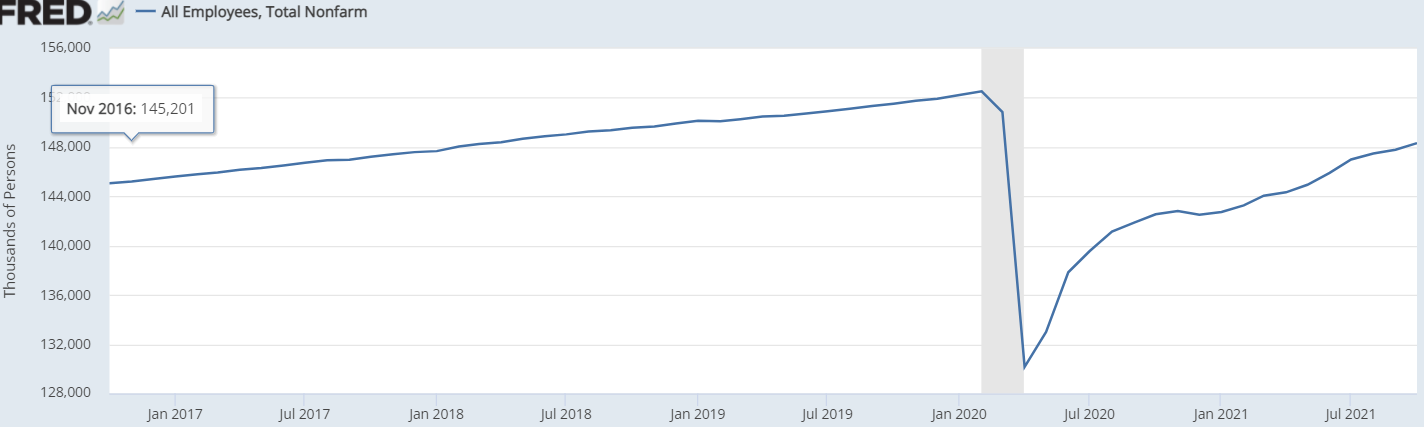

The US economy added 531K jobs in October of 2021, the most in 3 months and above market forecasts of 450K as Covid-19 cases dropped and employers offered higher wages and more flexible hours. The biggest job gains occurred in leisure and hospitality (164K), in professional and business services (100K), in manufacturing (60K), and in transportation and warehousing (54K) while employment in public education declined (-65K). So far this year, monthly job growth has averaged 582K. Nonfarm employment has increased by 18.2 million since a recent trough in April 2020 but is down by 4.2 million from its pre-pandemic level. Labour shortages continue to weigh even after federal government-funded unemployment benefits have expired and schools reopened. Some investors believe such shortages could get worse due to the White House’s vaccine mandate. source: U.S. Bureau of Labor Statistics

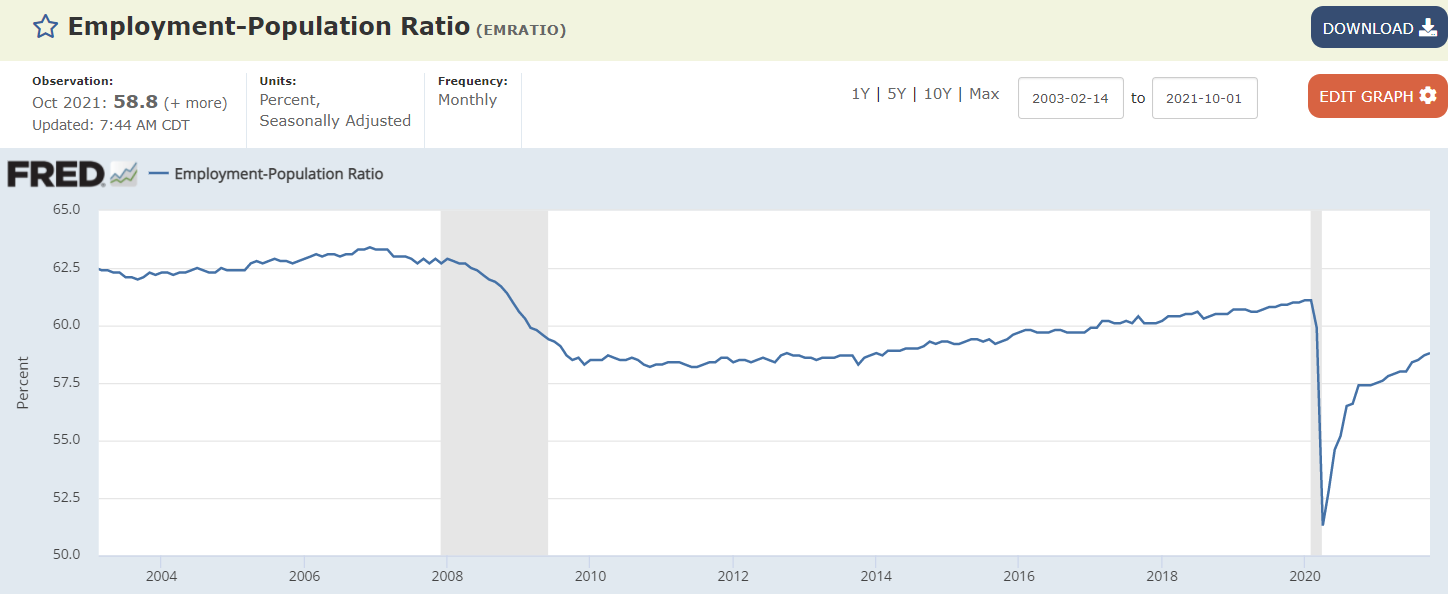

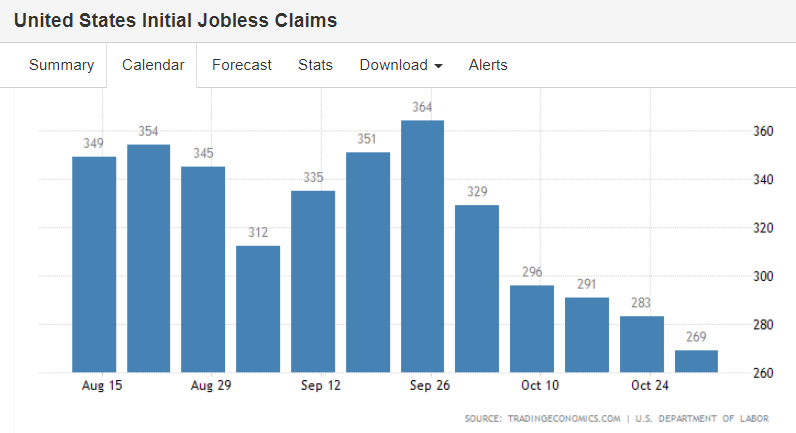

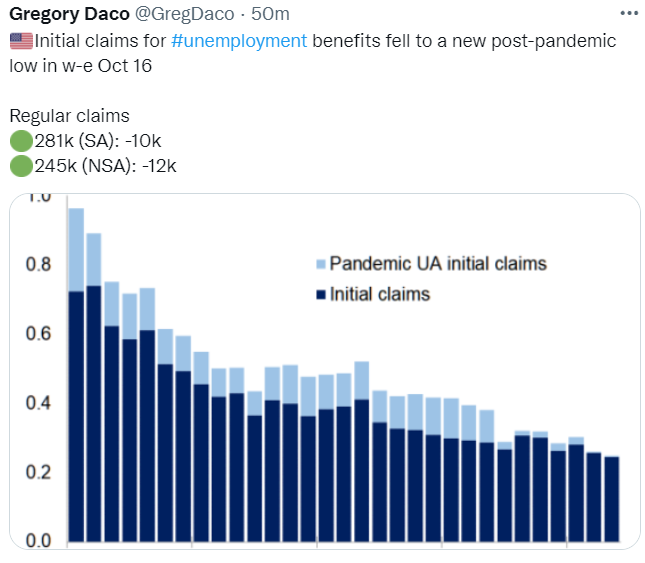

Keeps ratcheting down, telling me it’s not about demographics:

Good news here. The back to work story may be happening:

Same here, if it’s any indication of the Friday employment report:

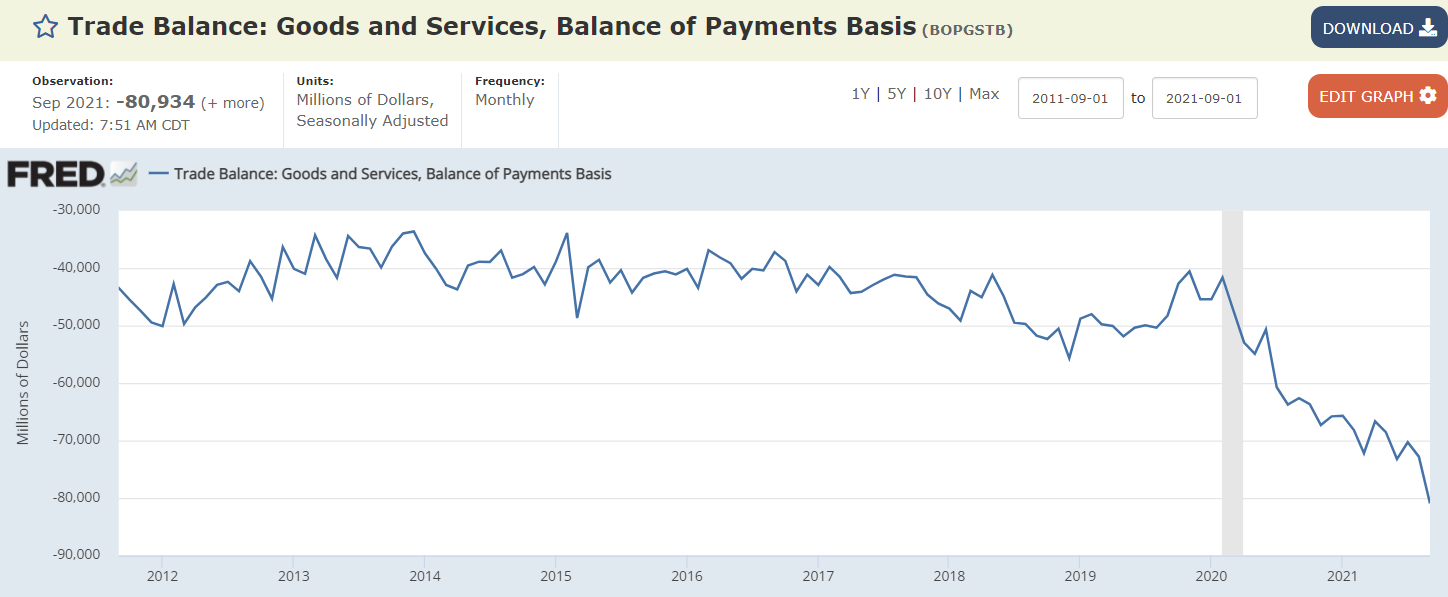

This would be a good thing if the government understood it meant lower taxes or more public services. Instead, it’s simply incomes not being spent on domestic goods and services:

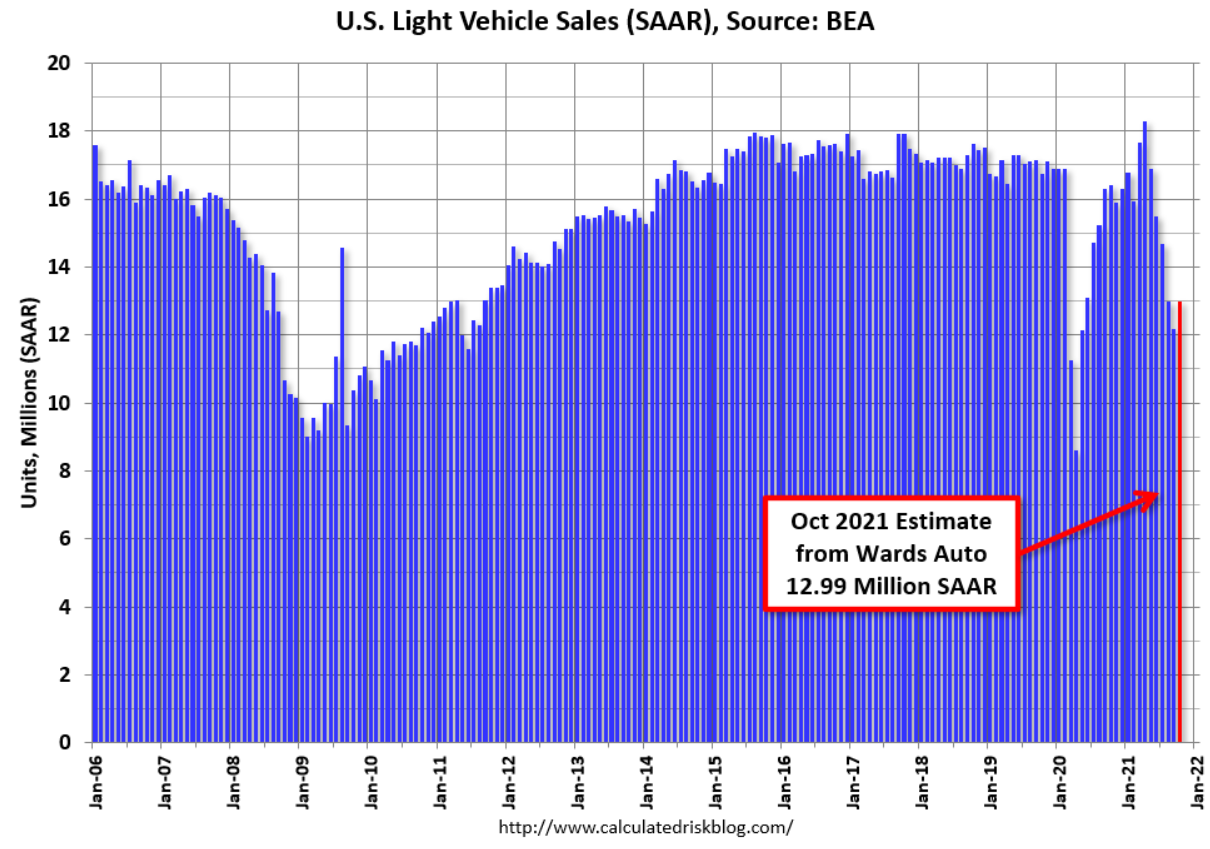

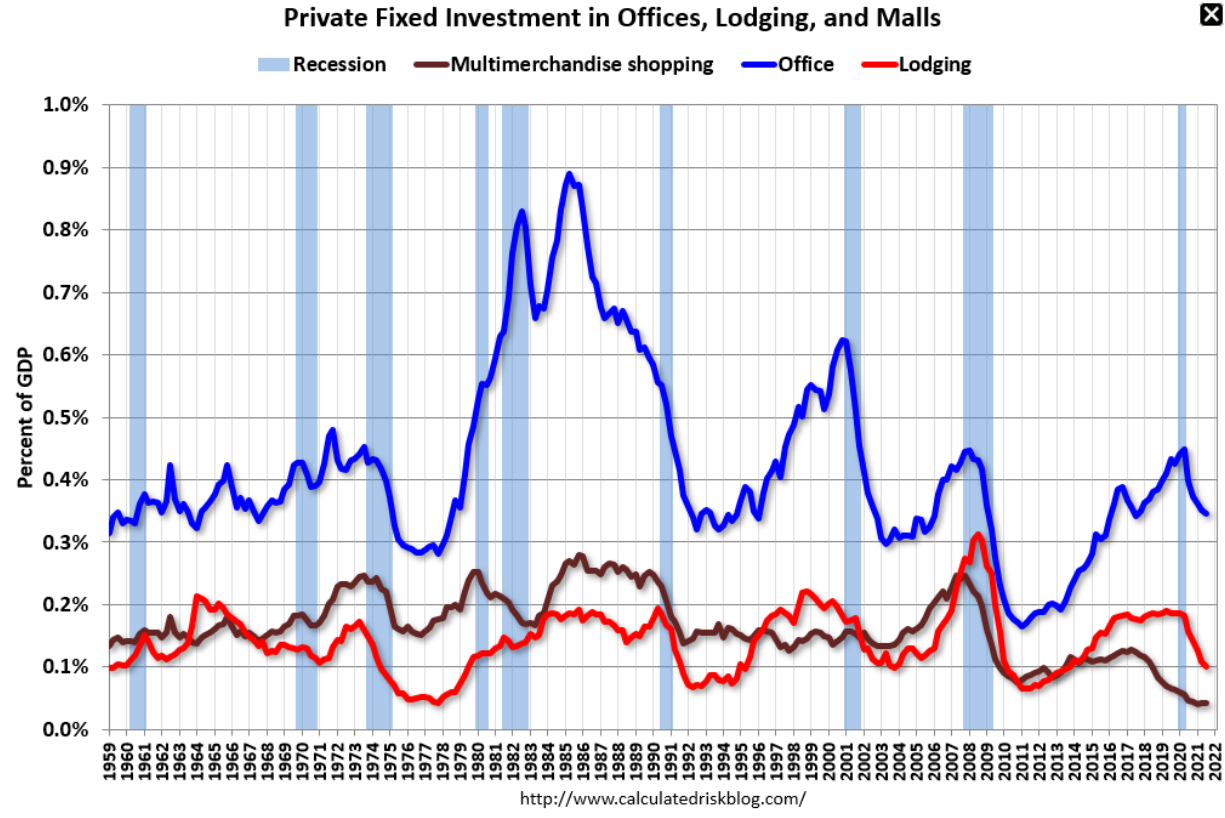

Still way down:

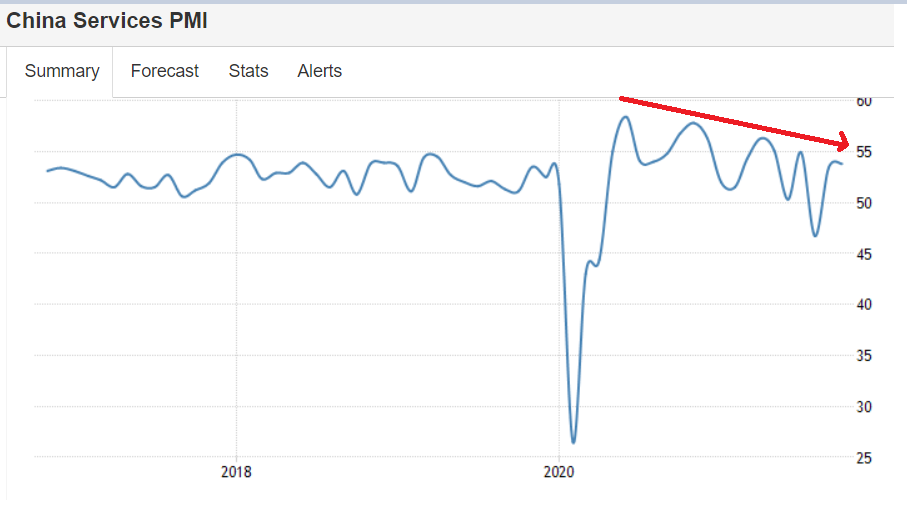

I like the headline but the chart not so much:

China Services PMI Rises to 3-Month High

The Caixin China General Services PMI increased to 53.8 in October 2021 from 53.4 in the prior month, pointing to the second straight month of expansion in the service sector and the steepest pace since July as COVID-19 outbreaks eased. New orders expanded the most in three months, export sales returned to growth, and employment rose for the second month in a row. Meantime, backlogs of work were unchanged following a three-month sequence of accumulation. On the cost front, input prices rose for the 16th straight month and increased at the fastest pace in three months on rising labor, and raw material costs; while output cost inflation accelerated to the quickest since July. Looking forward, sentiment weakened to a four-month low, due to concerns over rising costs and supply chain disruption.

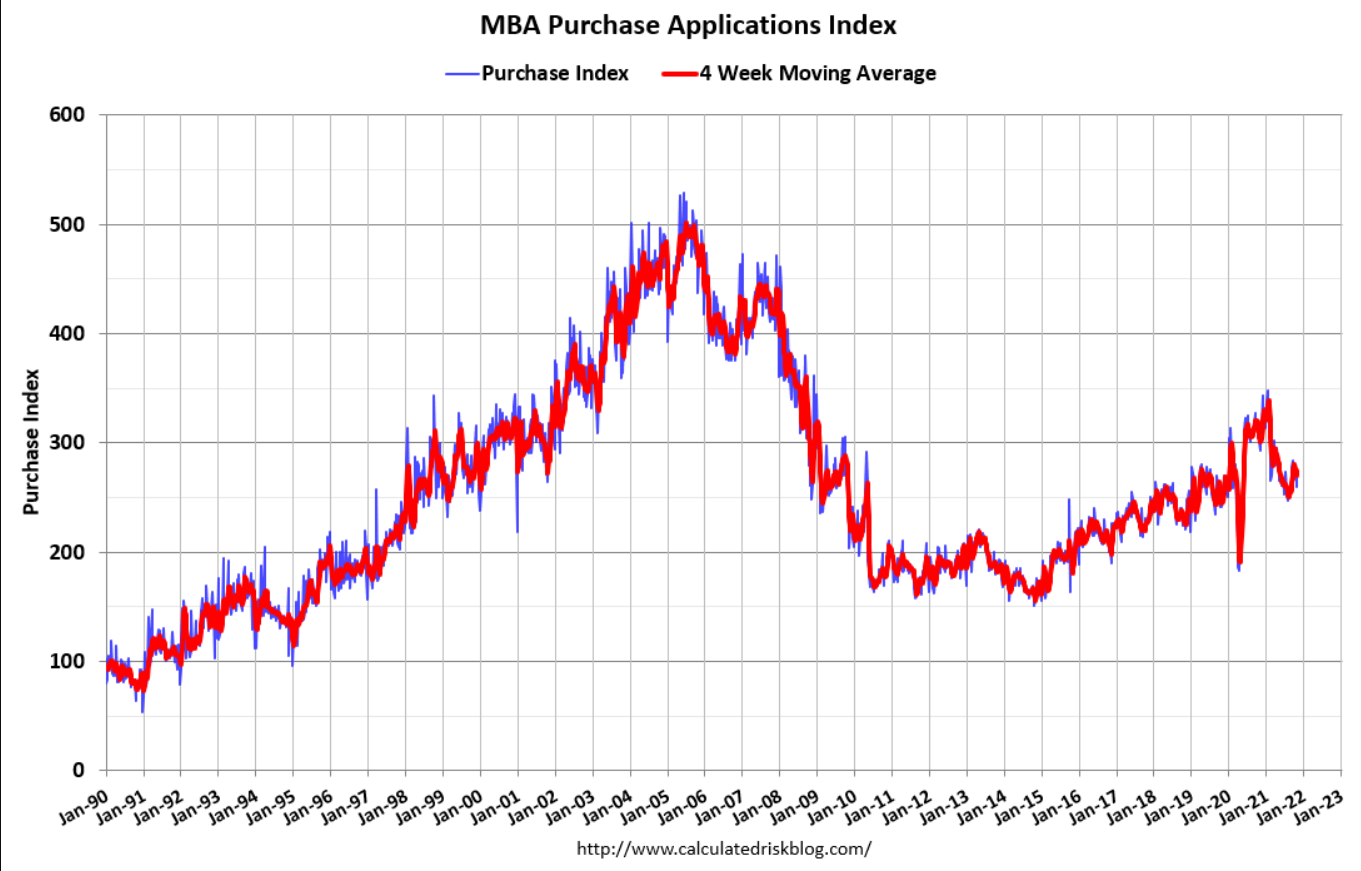

In case you thought the housing market is about interest rates:

“Mortgage applications to purchase a home fell 2% for the week and were 9% lower than the same week one year ago.”

Apparently ports are clearing:

https://www.cnbc.com/2021/11/01/commerce-secretary-gina-raimondo-sees-clear-improvements-happening-at-congested-us-ports.html

Several commodities seem to have peaked and then fallen back.

Inflation is a continuous increase in the price level, so it doesn’t seem like that’s yet the case:

Seems a global thing:

No recovery here:

Another price reversal:

GC Newcastle coal futures tumbled by over 30% to $150 per metric ton, the lowest in three months, and are more than 40% below a record high of $269.5 hit on October 5th, as China stepped up policies to boost output ahead of the winter season. China’s average daily output increased by over 1.2 million tonnes to a record at above 11.6 million tonnes on October 18th. As a result, Chinese power plants now have stocks to produce power for 16 days from less than two days’ inventories at the start of October.

Deficit spending as a % of GDP heading south fast:

The American economy expanded an annualized 2% on quarter in Q3 2021, well below market forecasts of 2.7% and slowing sharply from 6.7% in Q2. It is the weakest growth of pandemic recovery as an infusion of government stimulus continued to fade and a surge in COVID-19 cases and global supply constraints weighted on consumption and production.

Gov’s saving money as claims fall:

Transitory?