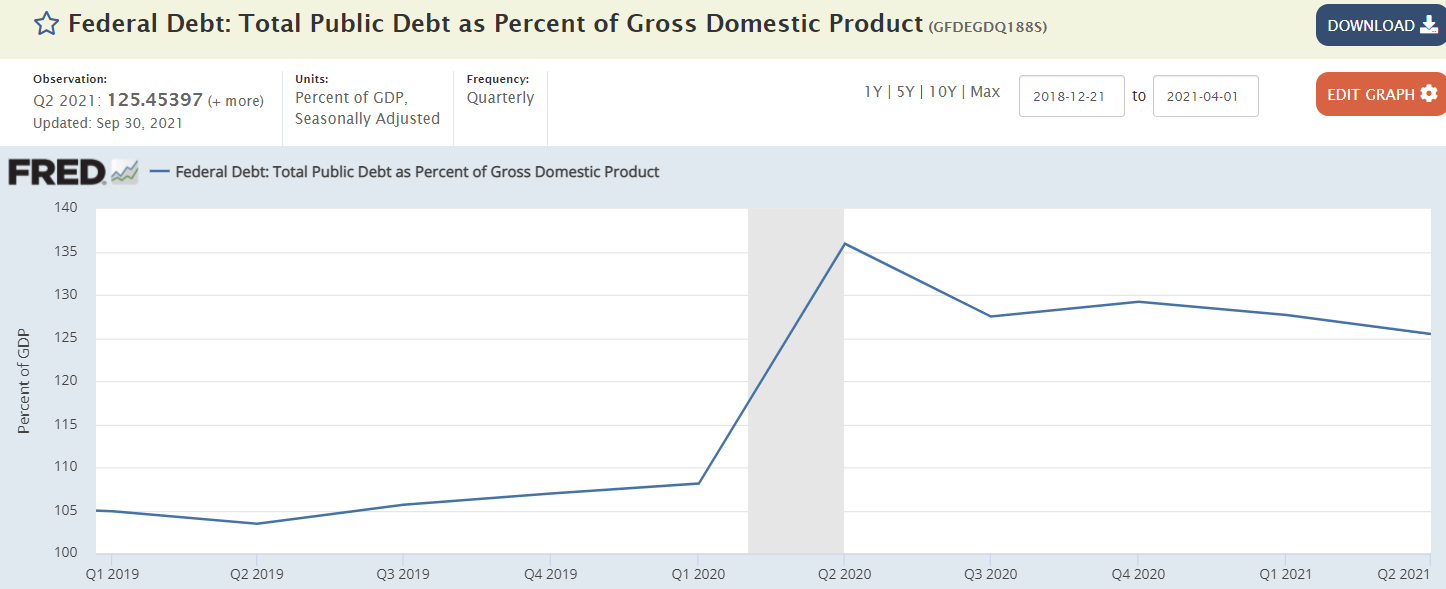

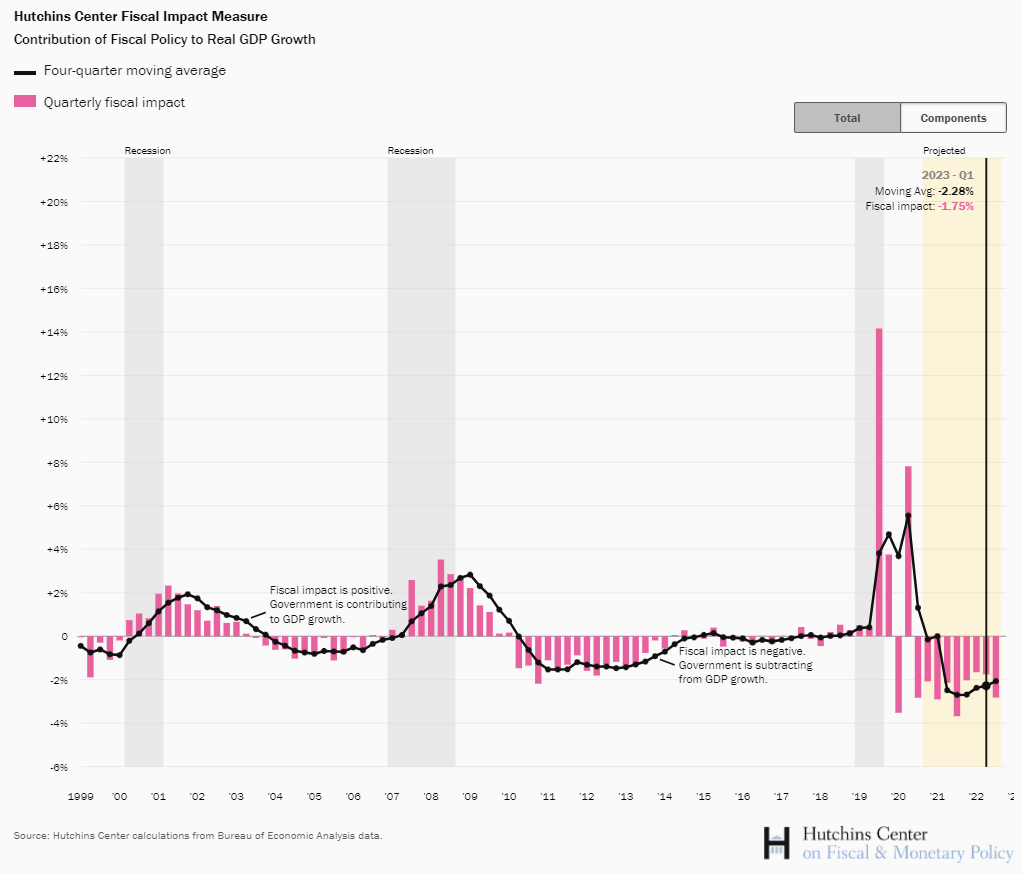

More reason for a fiscal adjustment that’s not happening:

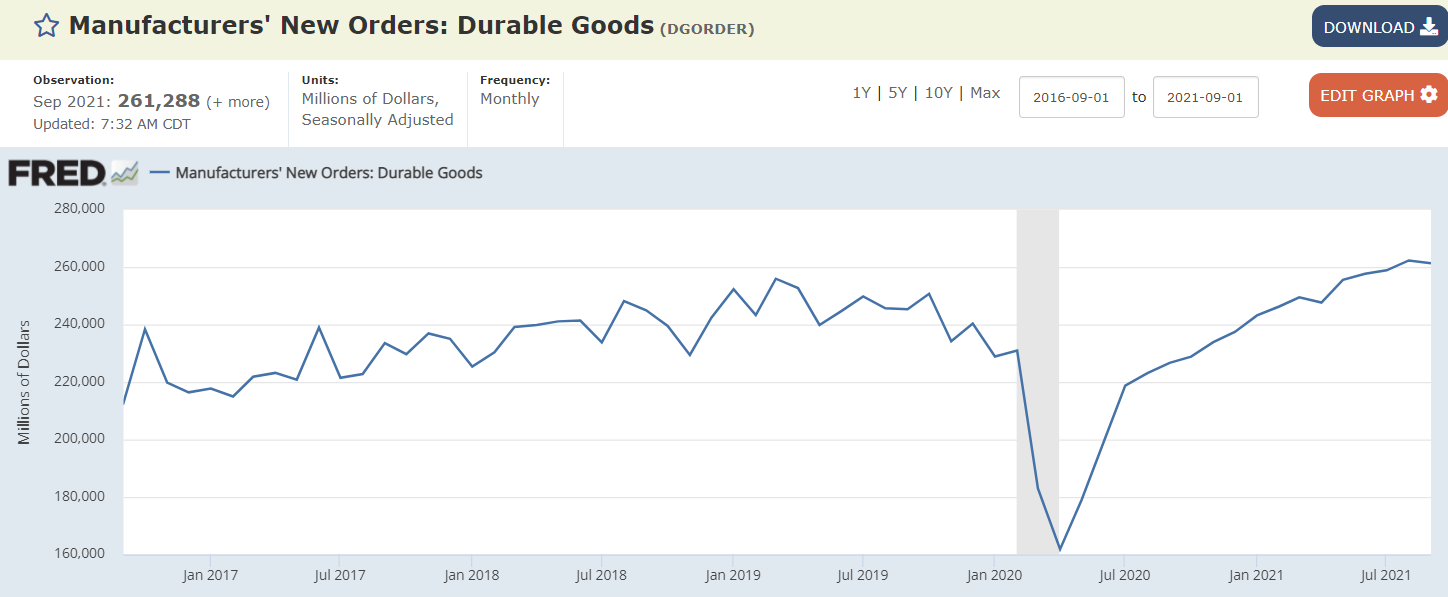

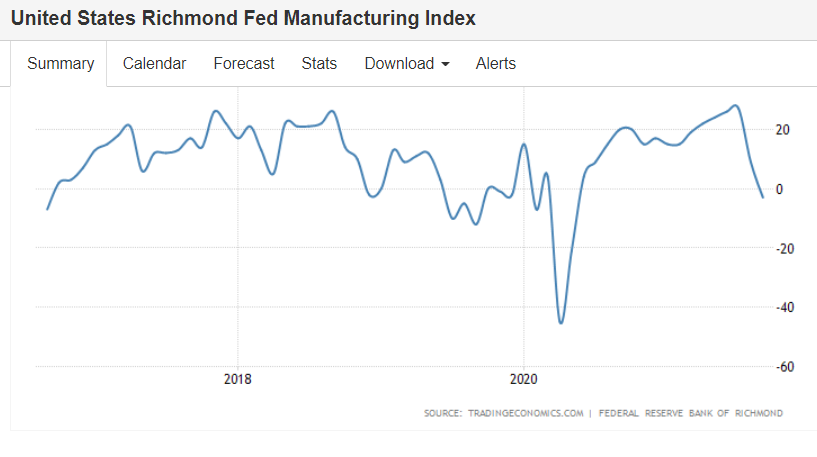

These are new orders so the slowing isn’t about supply issues:

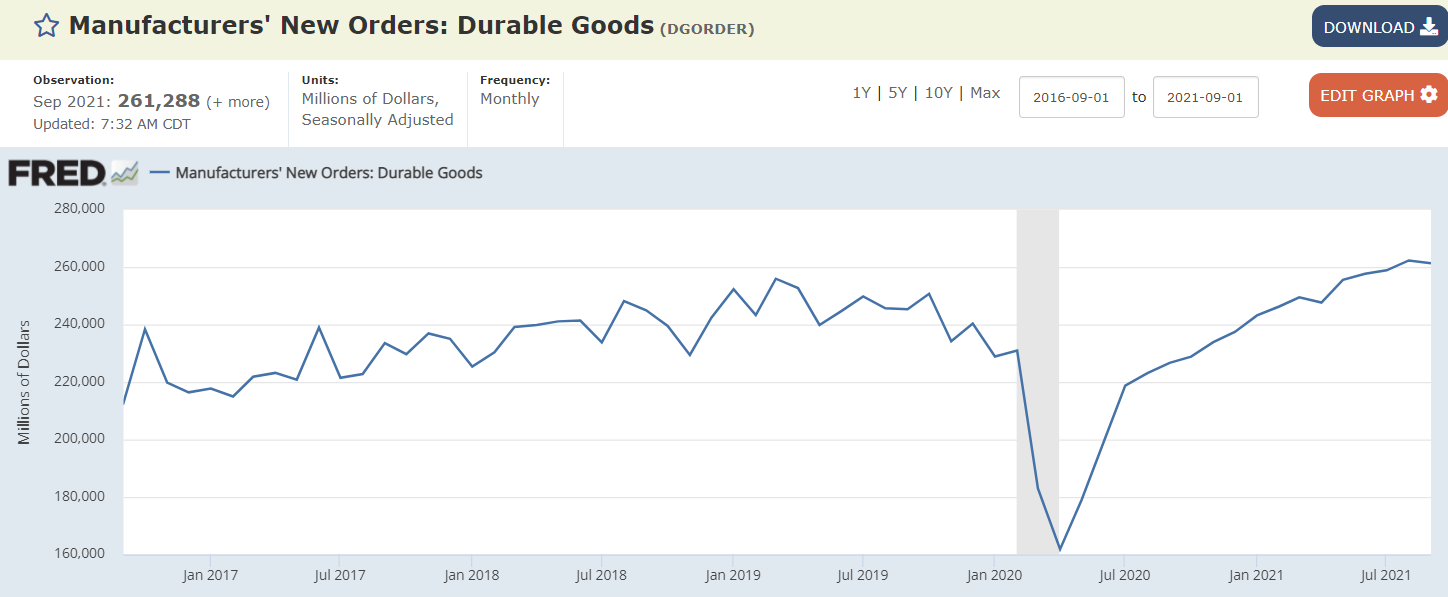

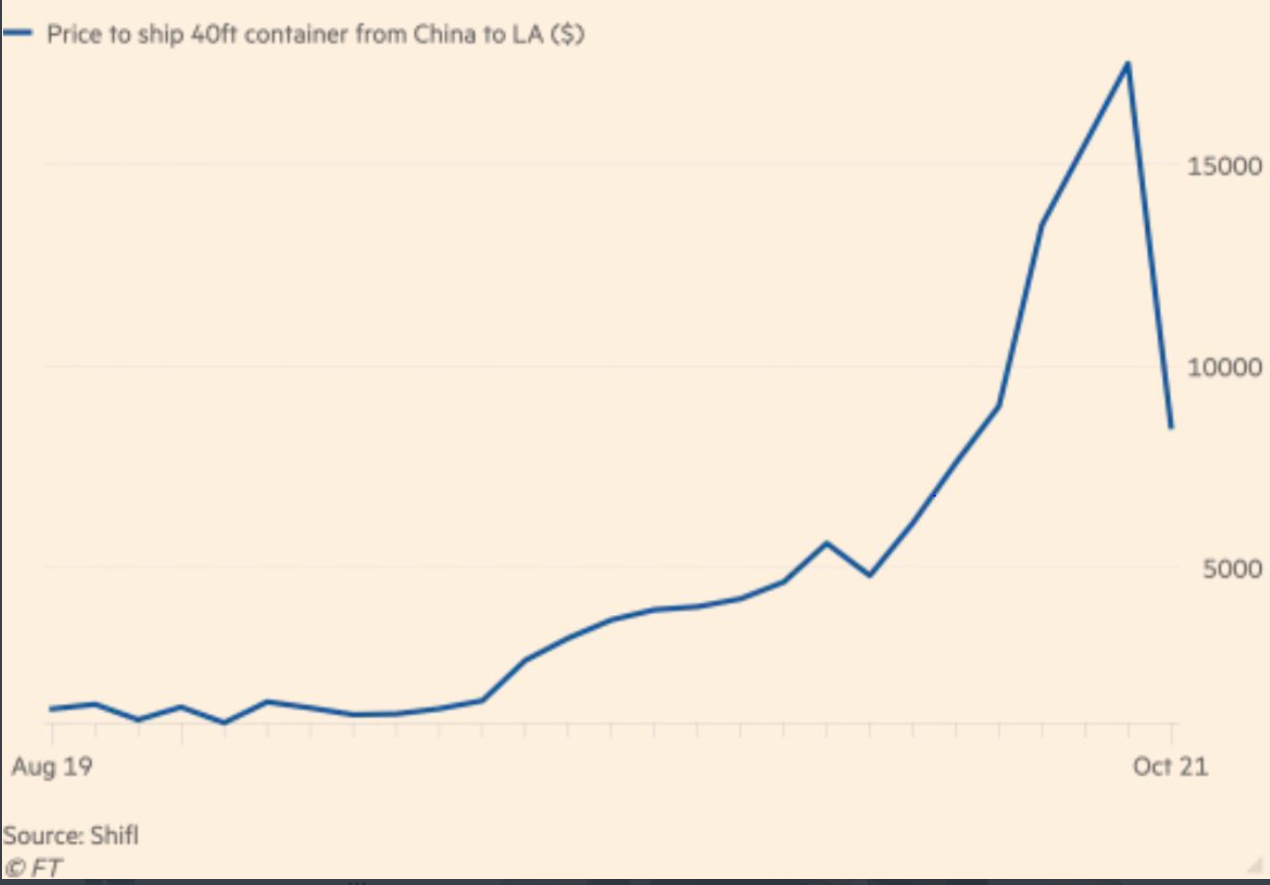

Lots of commodity charts looking something like this- post covid spikes fading most everywhere:

More reason for a fiscal adjustment that’s not happening:

These are new orders so the slowing isn’t about supply issues:

Lots of commodity charts looking something like this- post covid spikes fading most everywhere:

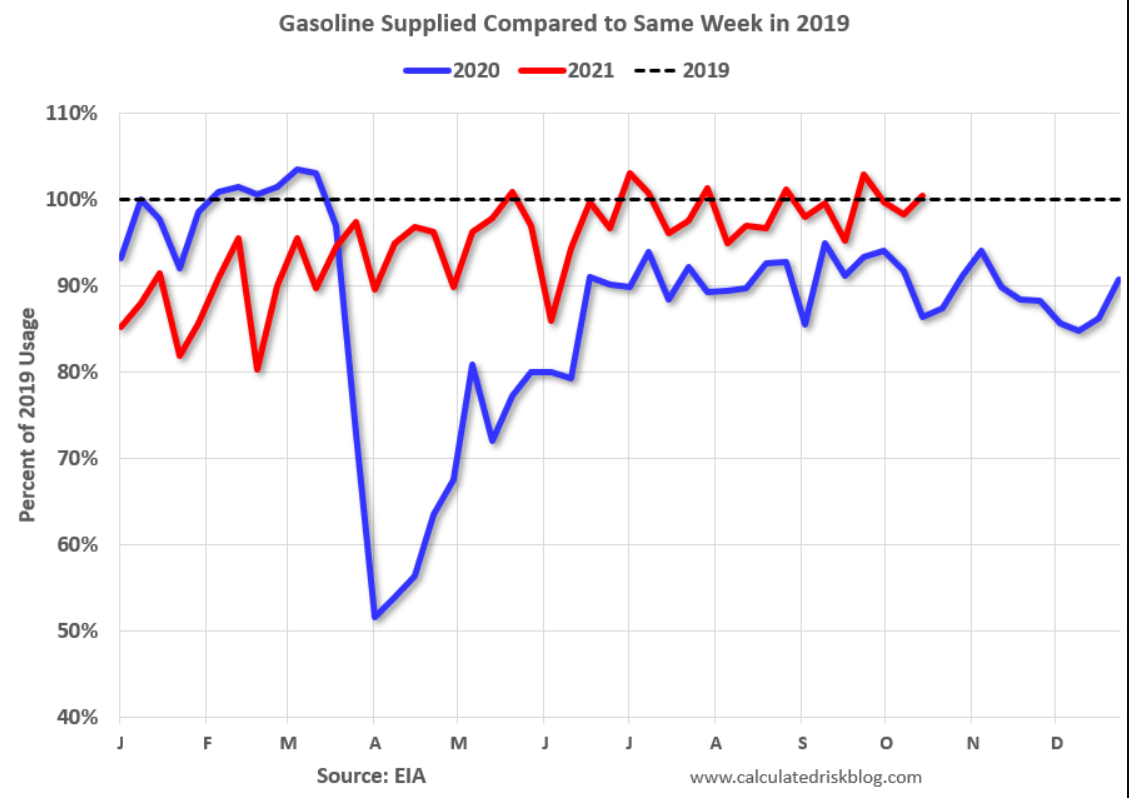

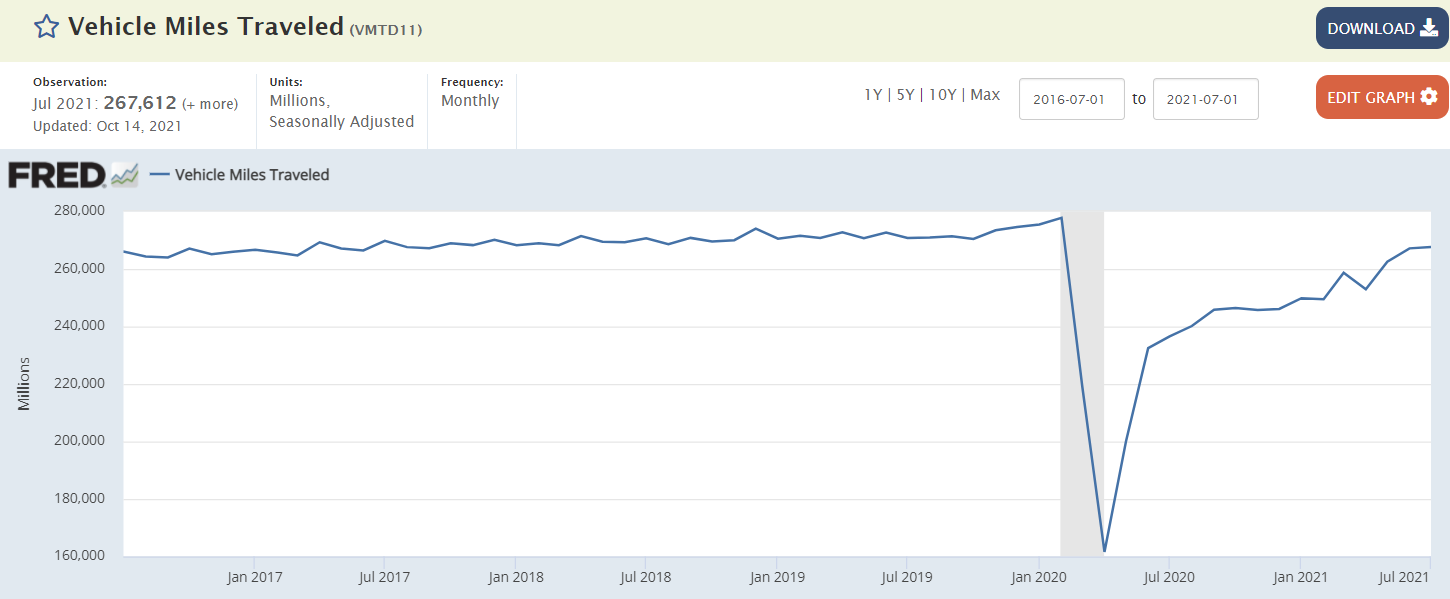

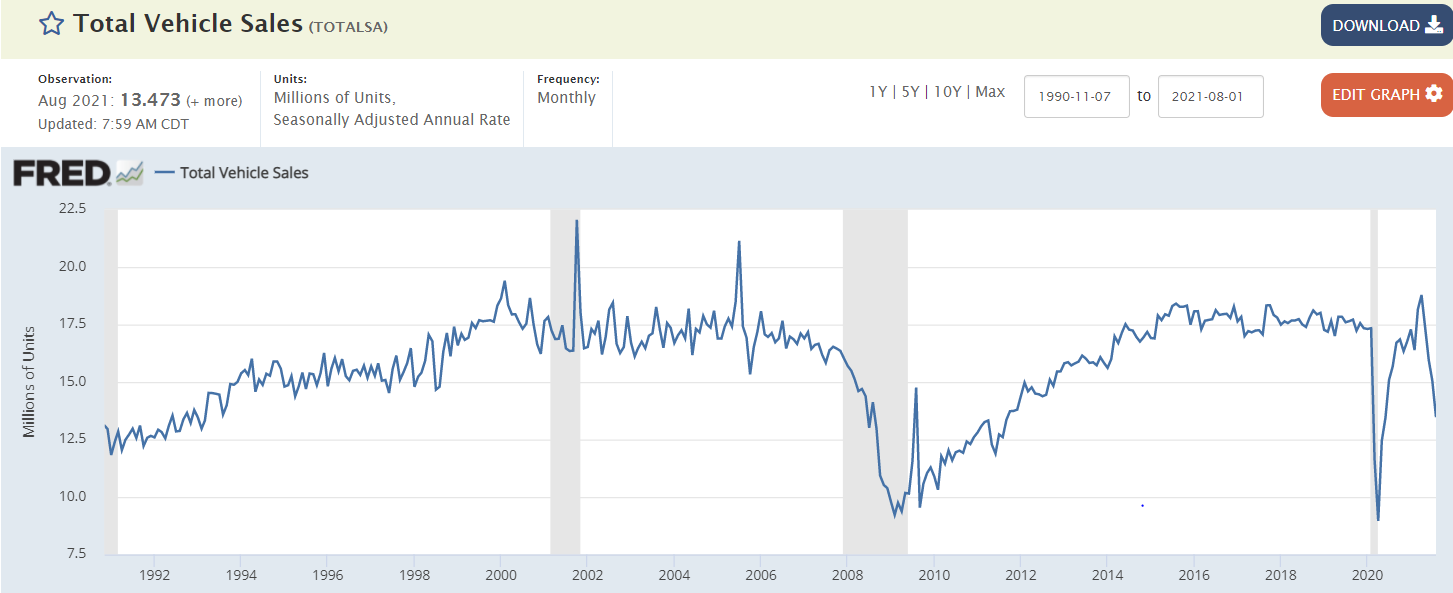

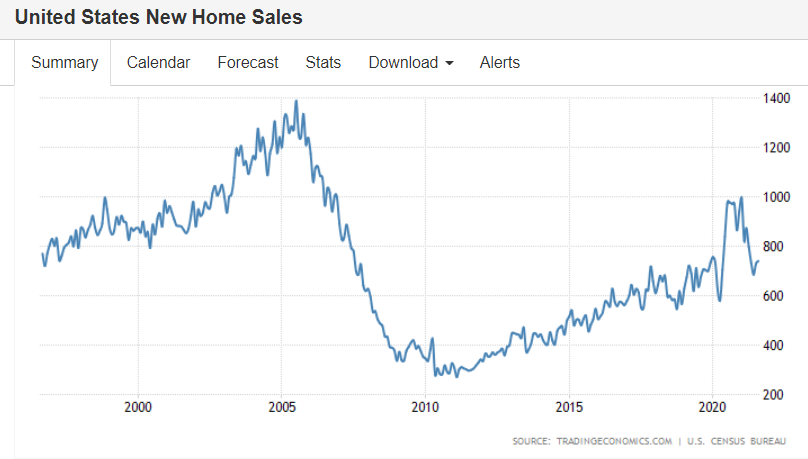

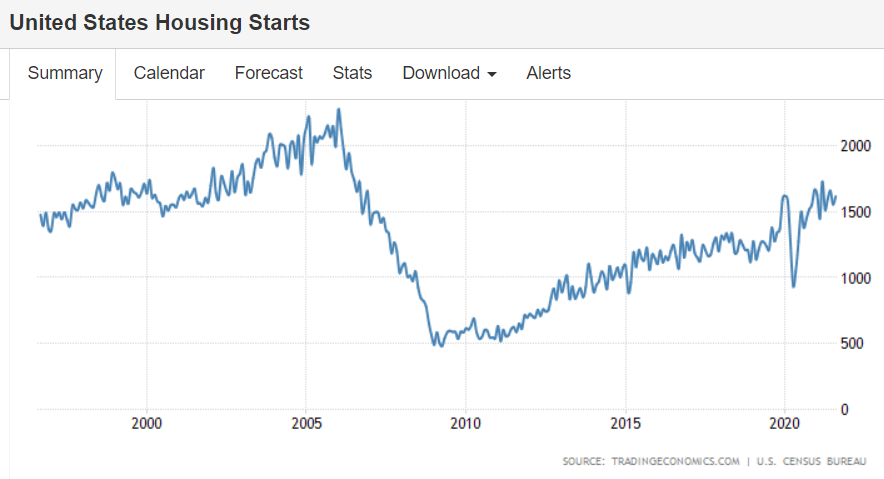

This seems to be holding up, though not yet back to pre covid levels:

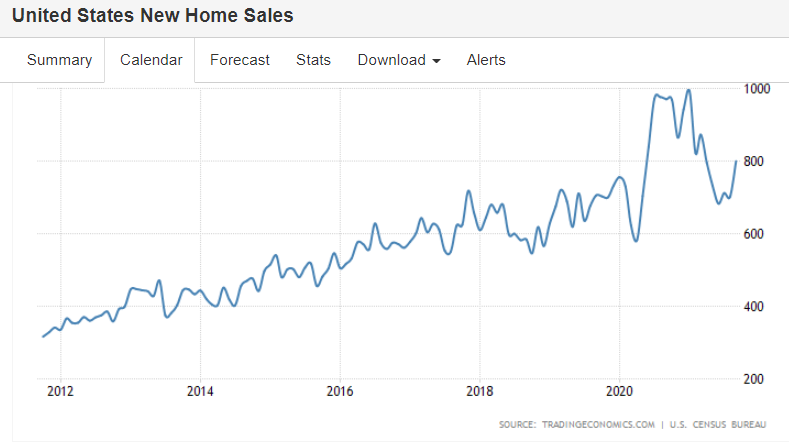

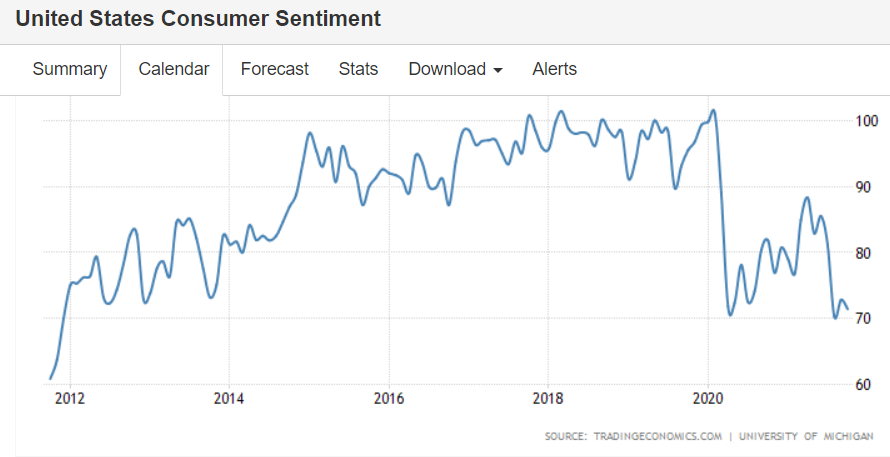

Up a bit from last month, but still looking weak:

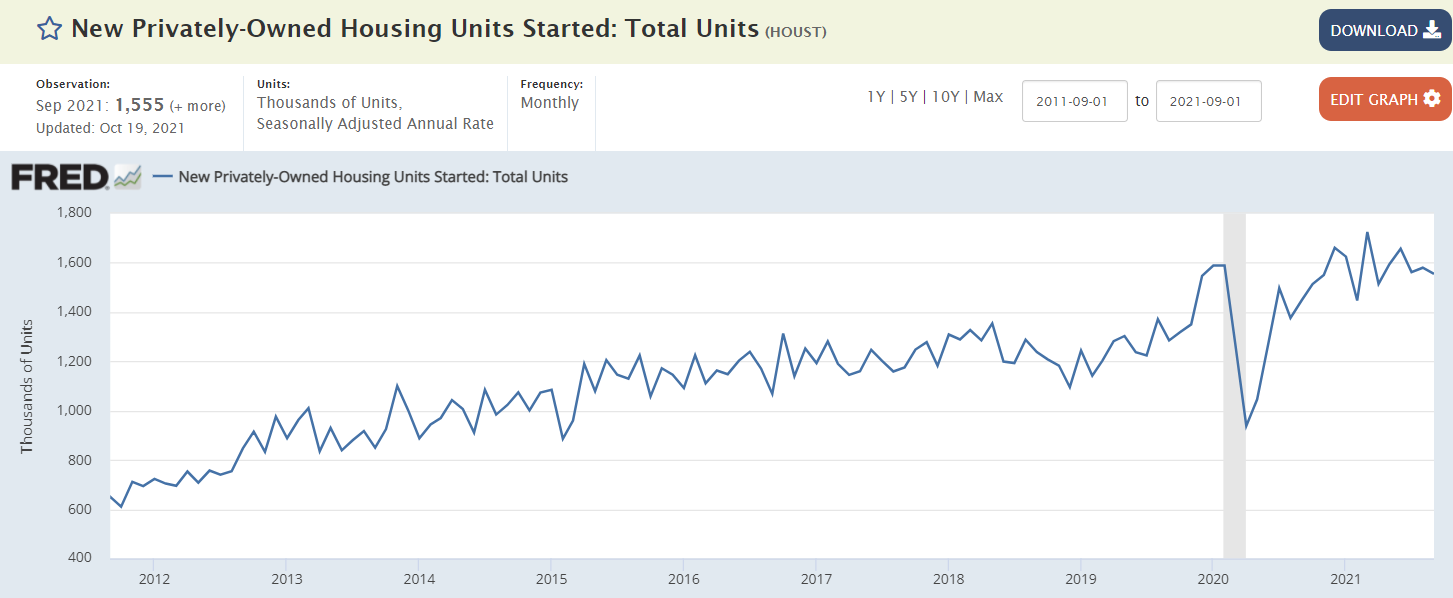

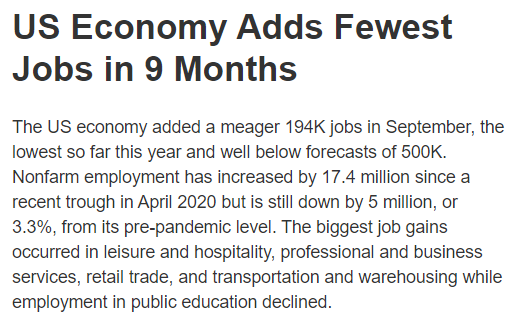

Weak again:

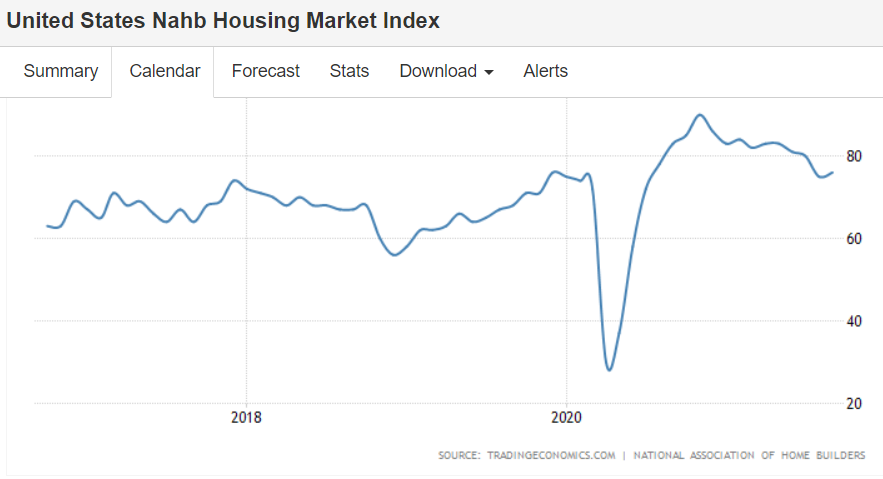

A bit of improvement but still looking weak:

No growth here:

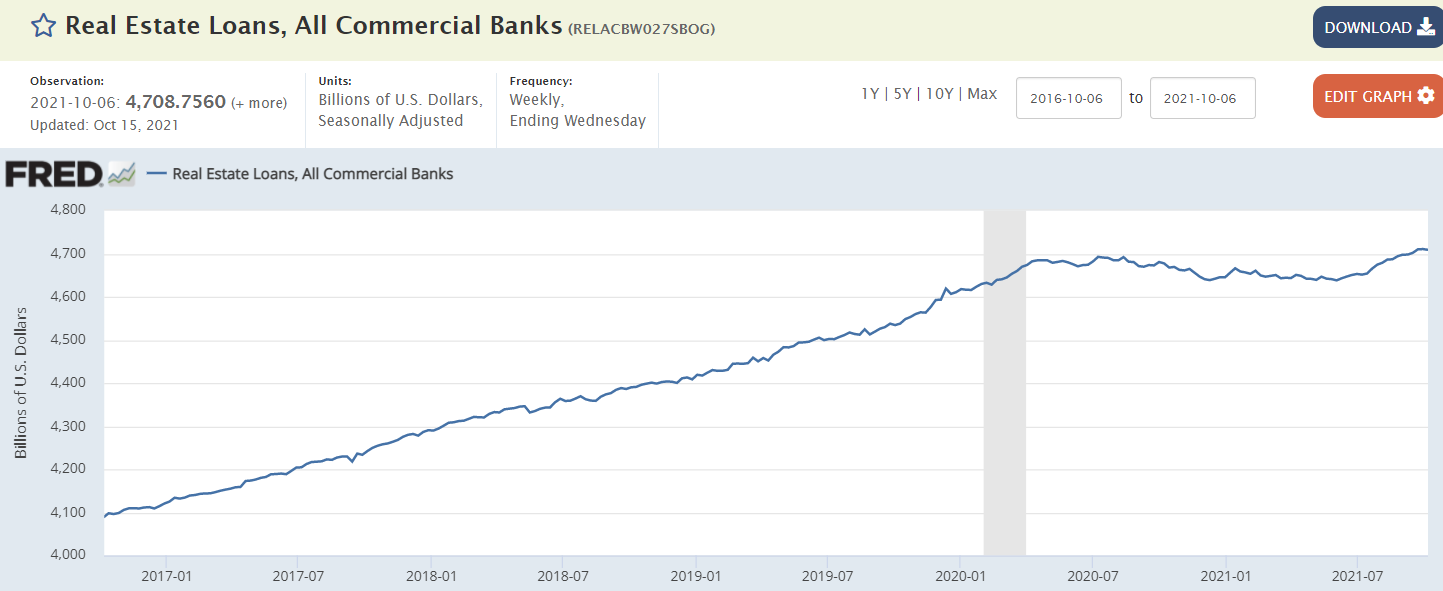

No sign that low rates have caused excess lending:

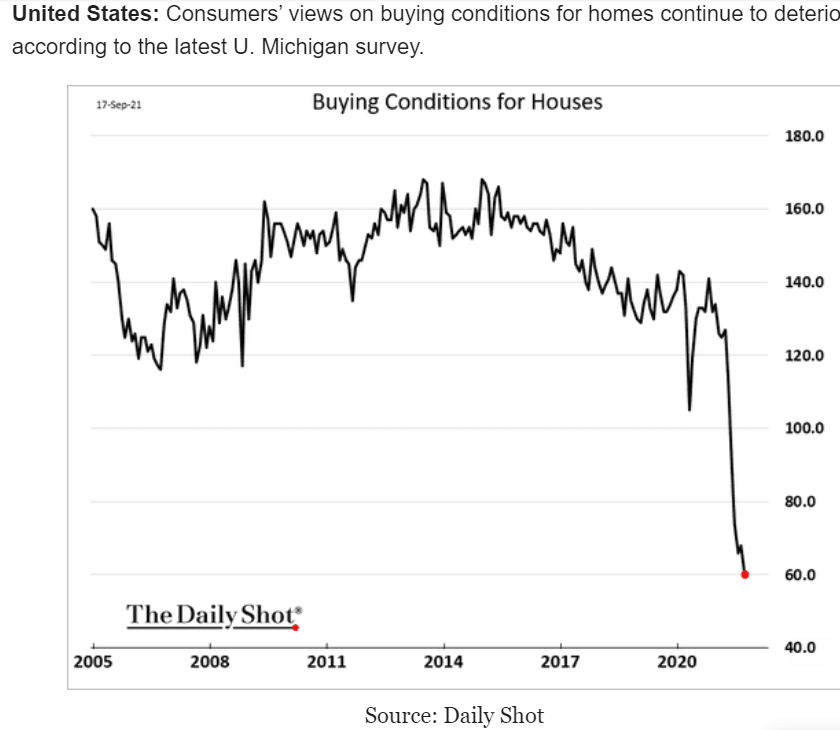

Not looking good:

Russians and Saudis now cooperating to set crude oil prices.

Not good:

Post covid fiscal contraction is underway and debt/gdp is forecast to fall a lot further.

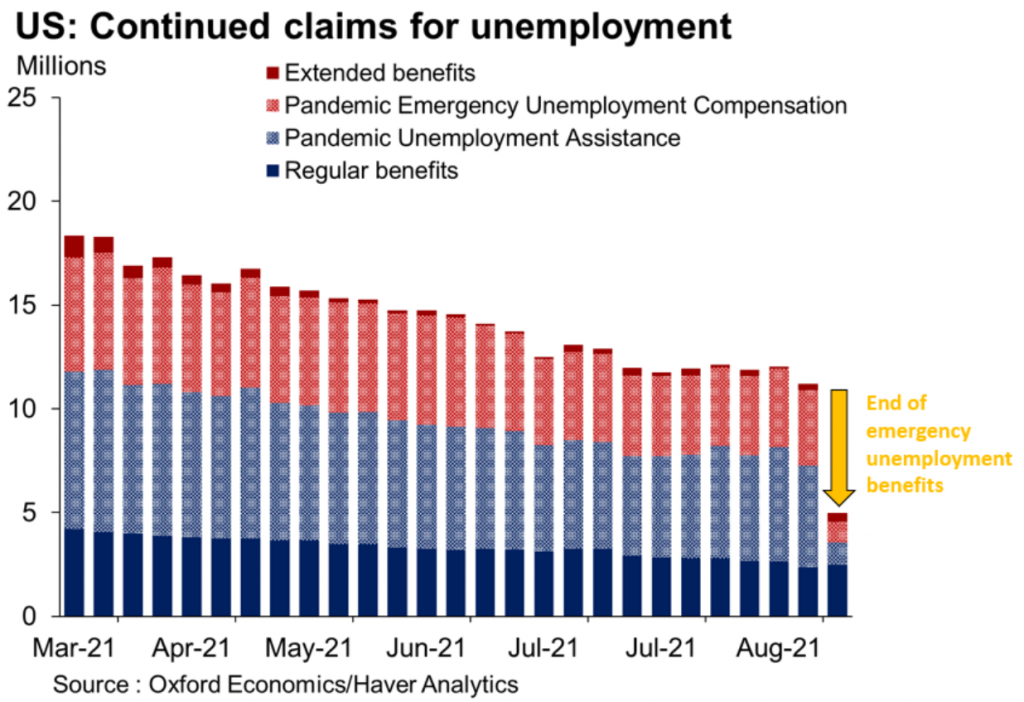

Most of the Federal assistance was the likes of unemployment benefits which have

now expired and new spending programs from Congress seem to be not happening,

at least any time soon. Also, higher prices mean the inflation adjusted value of the

outstanding public debt falls which is a drag on private sector spending as agents seek

to sustain the value of their savings:

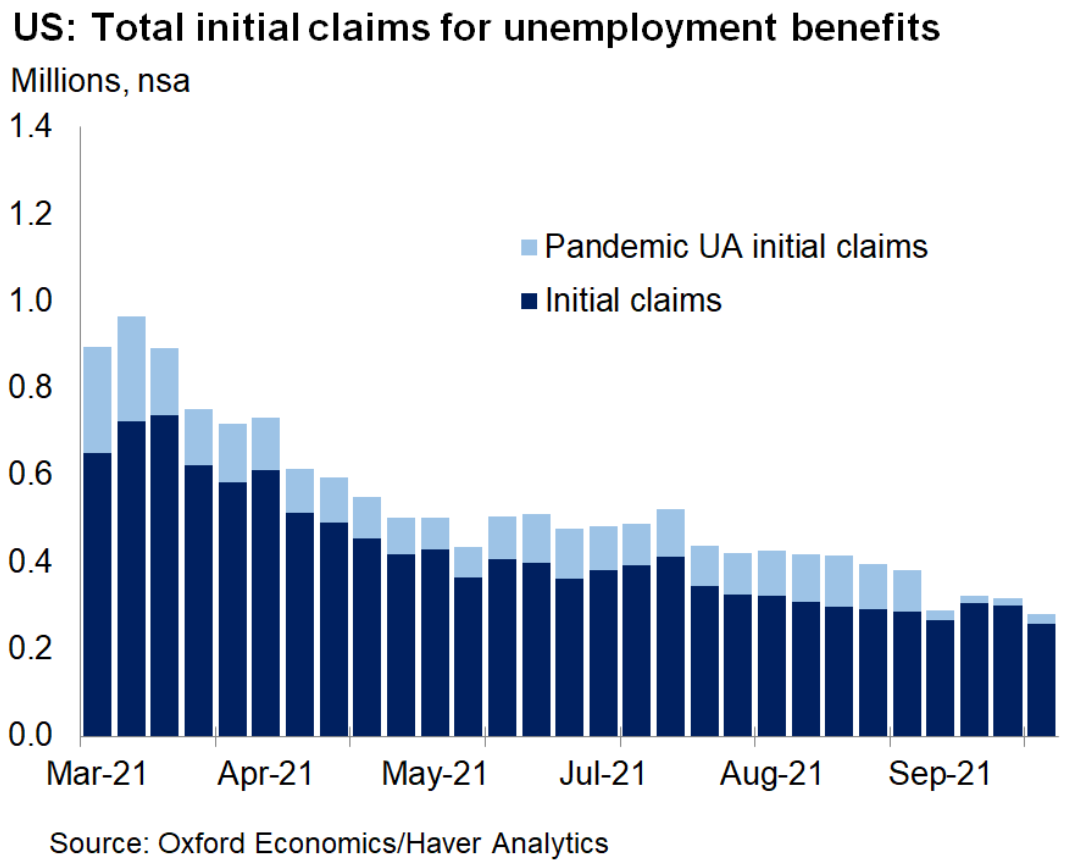

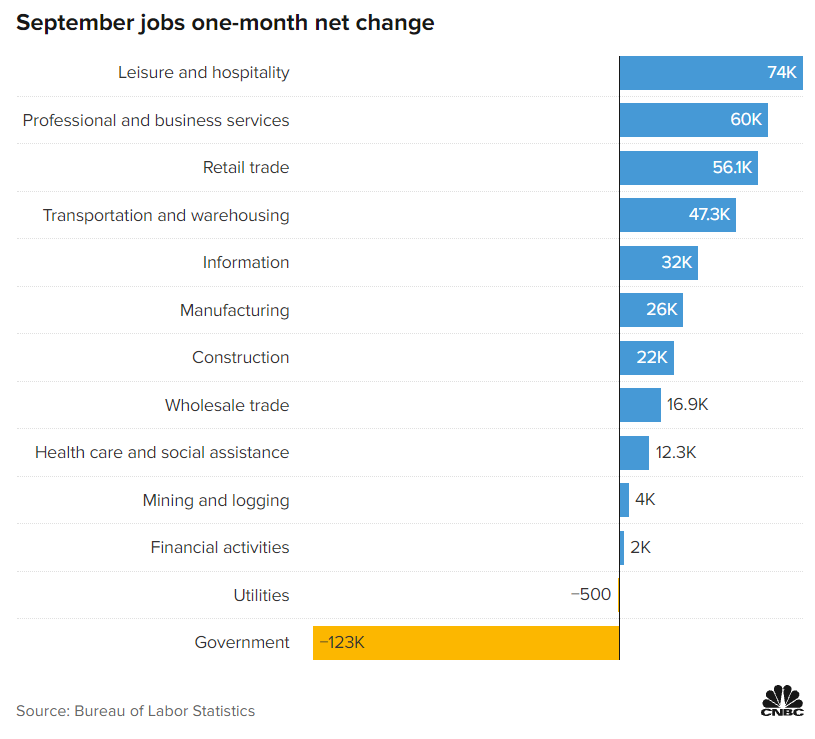

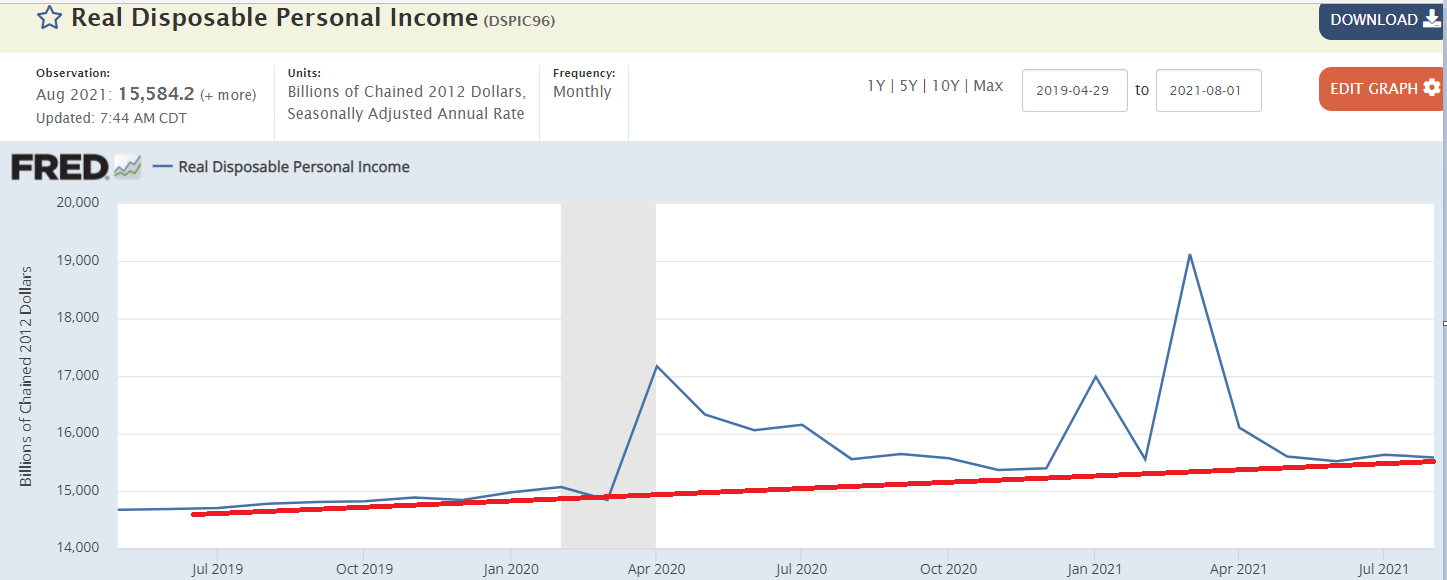

Down a bit since Federal benefits expired. This materially cuts gov. spending:

A lot worse than expected. They thought the end of Federal benefits would send people back to work.

However, a cut in Federal spending cools down aggregate demand:

Transitory comes to mind:

Saudis and Russians are working together to set price. What could go wrong???

:(

Who would have thought?

This is through August which included Federal unemployment benefits that have subsequently expired.

Income is now weaker than it was at the time of this report:

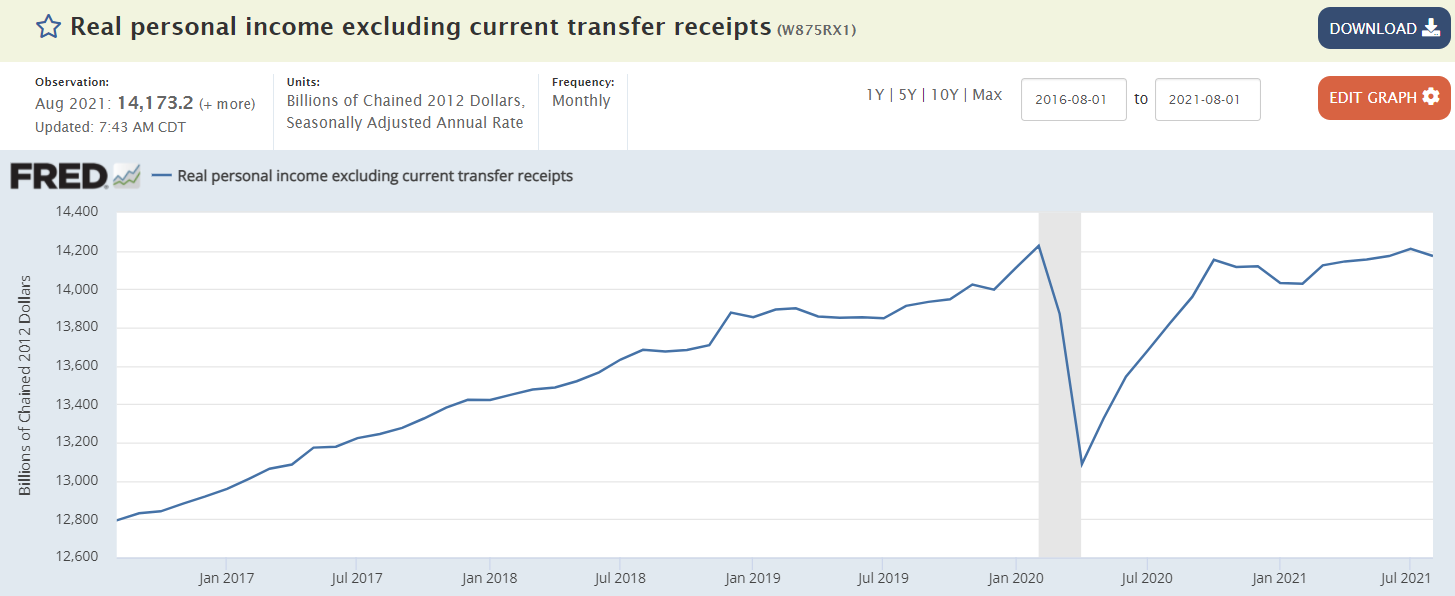

Without transfer receipts income continues to lag pre covid levels:

This is likely to go down in September with expiring Federal benefits:

Familiar pattern:

Similar pattern- covid dip, bounce, fade:

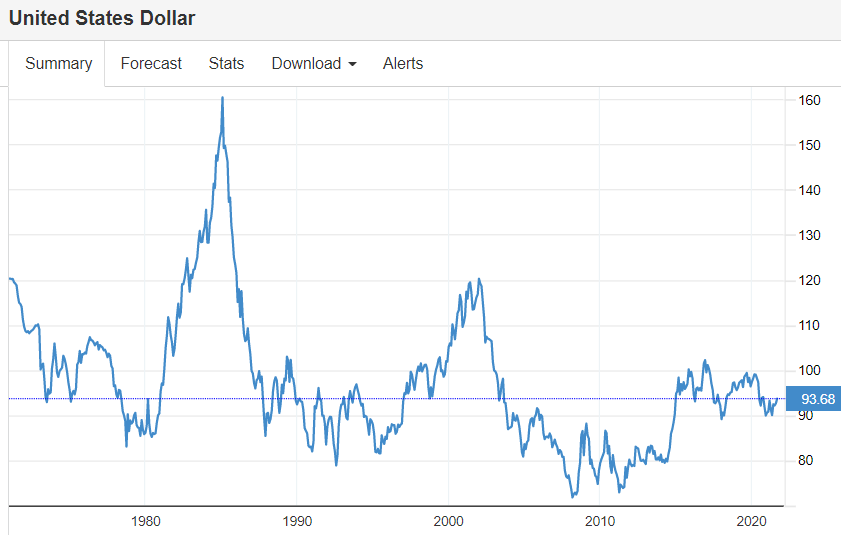

Remember all the talk about how all the money printing stuff after the crash and for covid, etc. was going to trash the $US, etc.?

It’s not that easy to forecast:

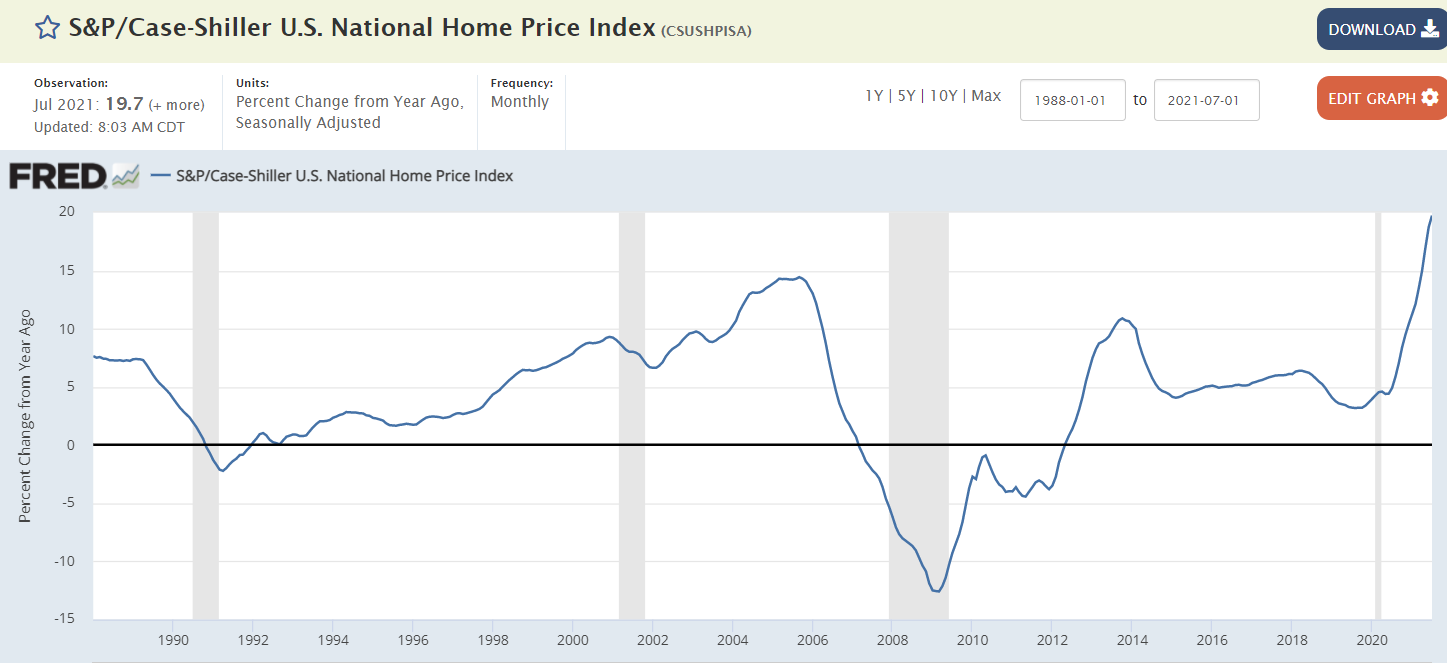

This is only through July. Seems to turn down in front of recessions, but the data

is from two months back so by the time you see the index turn down the recession

is probably already well underway:

Also, follow me on twitter

@wbmosler

I comment regularly on current events.

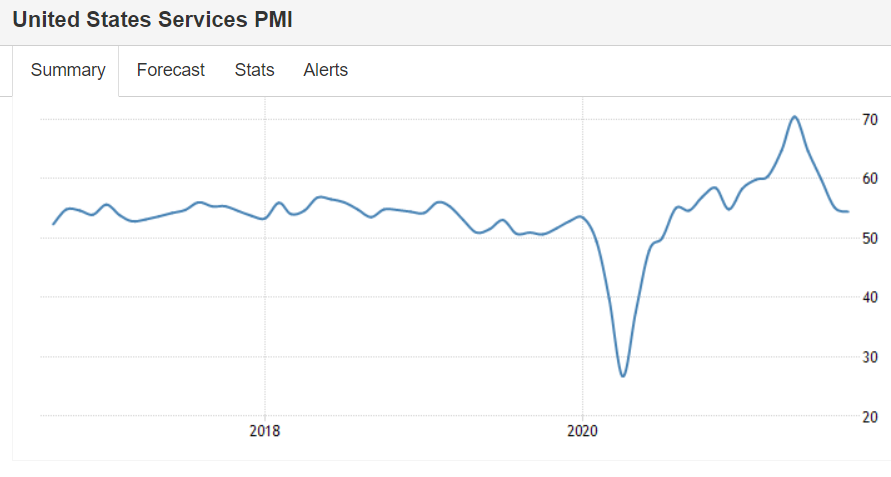

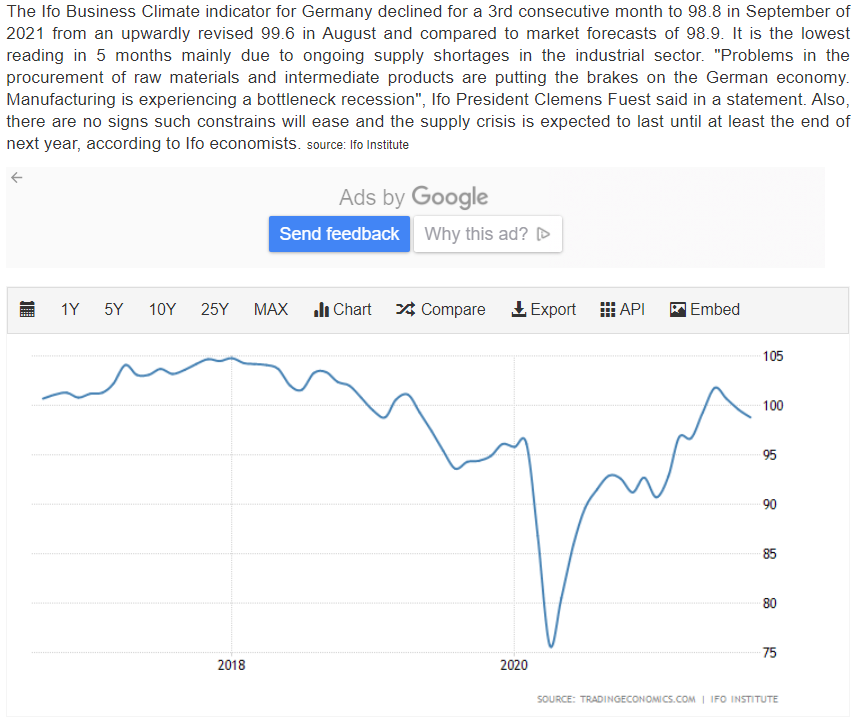

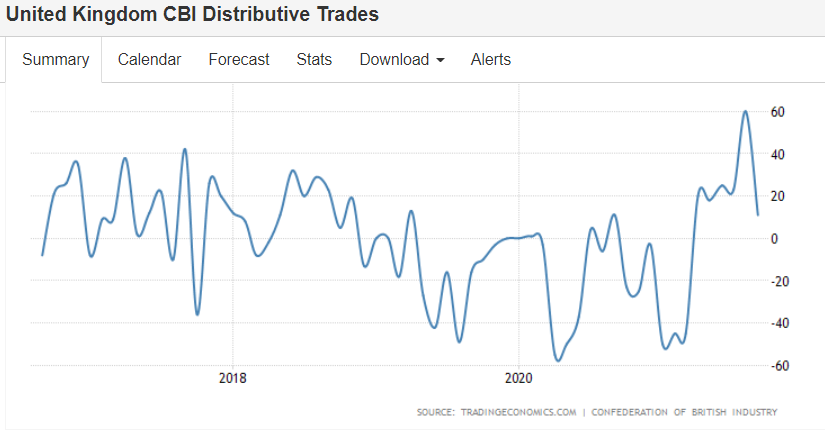

Pretty much the whole world had a covid dip, bounce, and most recently a retreat as the economy appears to be rapidly decelerating as unemployment benefits expired and what’s left of the new fiscal spending is relatively small and keeps getting pushed out:

Crude oil is another story. There was a covid dip as the drop in demand exceeded Saudi output, which caused them to lose control of output. Now that demand has recovered they are back in control of prices, and currently they are in price hike mode:

Up a bit last month but still looking depressed historically:

Up a bit but at best moving sideways:

Not looking good for gdp unless private sector deficit spending comes to the rescue:

(hat tip Patrick Rien)