Japan downgrades industrial outlook for first time in 40 months

(Nikkei) The Japanese government on Thursday downgraded its monthly assessment of industrial output for the first time in more than three years. The Cabinet Office’s economic report for February says “weakness can be seen in some areas” of production, qualifying a view of moderate growth that had been kept unchanged since October 2015. February’s report also downgraded the assessment on corporate profits. It follows January’s downward revision on exports, which are now described as “almost flat,” and raises doubts about the durability is poised to become Japan’s longest postwar economic expansion.

Rail Week Ending 16 February 2019: Economically Intuitive Sectors In Contraction

Week 7 of 2019 shows same week total rail traffic (from same week one year ago) contracted according to the Association of American Railroads (AAR) traffic data. The economically intuitive sectors rolling averages are now in contraction.

Highlights

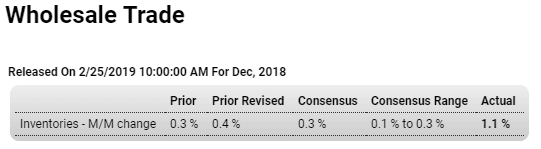

Volatility is increasingly the theme of recent economic data, including wholesale inventories which bloated by 1.1 percent in December against a 1.0 percent decline in wholesale sales. The inventory rise is not the result of price swings in nondurable goods as durables lead the build at a very heavy plus 1.5 percent including large builds for metals, furniture, electrical goods, and lumber.

The relationship between inventories and sales in the wholesale sector began to look unfavorable in November and really points to overhang in this report. Year-on-year, inventories are up 7.3 percent while sales are down 1.5 percent. The stocks-to-sales ratio spiked through the second of last year, to 1.33 in December from 1.30 and 1.28 the prior two months and from as lean as 1.26 in August.

The jump in wholesale inventories will provide a technical boost to fourth-quarter GDP but not a healthy one. Wholesalers may very well be looking to make their inventories more lean this year which would not be a plus for the sector’s employment. In an offset, comparable data on retail and manufacturing inventories, still not updated for December, showed less upward pressure in prior reports.