The tariff thing keeps taking its toll:

China Nov car sales fall 14%, biggest drop since 2012

(Reuters) China’s automobile sales fell 13.9 percent in November from a year earlier. The drop in sales to 2.55 million vehicles, a fifth straight decline in monthly numbers. The last time sales fell by more than this was in January 2012, when business was hurt by the timing of the Lunar New Year holiday. The November drop comes on the heels of almost 12 percent declines in each of the past two months, putting China on track for an annual sales contraction not seen since at least 1990. Sales in the country totalled 25.4 million vehicles in the first eleven months of the year, down 1.7 percent from the same period a year earlier.

Euro Area Private Sector Activity at 49-Month Low: Markit

The IHS Markit Eurozone Composite fell to 51.3 from 52.7 in the previous month and below market expectations of 52.8, a preliminary estimate showed. The reading pointed to the weakest expansion in the private sector activity since November 2014, as both manufacturing (51.4 from 51.8) and services (51.4 from 53.4) slowed. The job creation rate dropped to a two-year low; new export orders fell for the third straight month, recording the steepest decrease since series began while new business almost stalled. The slowdown was centered in France, as disruptions to business and travel were registered from the ‘gilets jaunes’ protest. On the price front, input price inflation eased to an eight month low due to lower oil and other commodity prices and fewer supply constraints regarding demand in the region. Finally, optimism deteriorated drivn by growing concerns over global trade and economic growth, rising political uncertainty, Brexit and tighter financial conditions.

German Private Sector Growth at 4-Year Low

The IHS Markit Germany Composite PMI declined to 52.2 in December 2018 from 52.3 in the previous month and below market forecasts of 52.5. The latest reading pointed to the weakest pace of expansion in the private sector since December 2014 as service sector expansion was the second-weakest seen in over two years (PMI at 52.5 vs 53.3 in November) and manufacturing growth slowed to a near three-year low (PMI at 51.5 vs 51.8 in November). Inflows of new orders edged closer to stagnation as new export business fell for the fourth month running, with a number of manufacturers highlighting a drop in sales to China. Meanwhile, employment growth picked up from November’s six-month low and remained solid overall while backlogs of work decreased for a second straight month. On the price front, input price inflation was the lowest since September 2017. Looking ahead, business confidence regarding the year-ahead outlook for activity dropped to a four-year low.

Seems a particularly silly statement, but not uncommon:

Ex-Fed’s Richard Fisher: Rates need to go higher to create enough room to cut should the economy tank

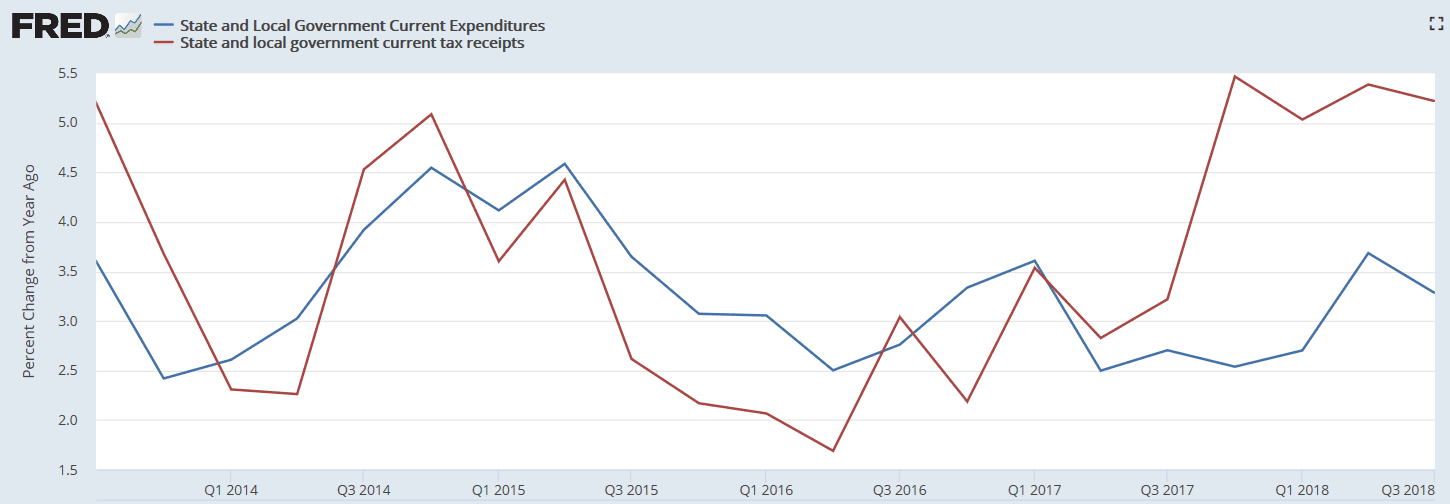

State and local tax receipts now growing faster than expenditures is a source of drag on the economy:

Many States See Strong Revenue

(WSJ) With most states nearing the midpoint of their fiscal years, which end June 30, at least 19 of them are seeing higher-than-expected general-fund revenue, according to a report from the National Association of State Budget Officers. “Clearly, from what I’ve observed, a continued, much-improved personal-income tax situation” is feeding the states’ revenues, said John Hicks, Nasbo’s executive director. “But also, we’re seeing an improved sales tax.” The states’ personal income-tax collections grew by a median 7.9% in fiscal 2018, Mr. Hicks noted. And general-fund collections from personal-income taxes outperformed forecasts by 3.6%.