More housing weakness:

Highlights

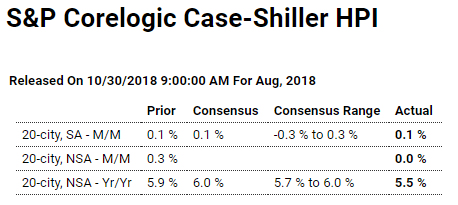

Growth in home prices, as it is for home sales, is almost at a standstill, at least on a monthly basis for Case-Shiller’s 20-city adjusted index which inched only 0.1 percent higher in August. Year-on-year, the unadjusted index is still growing at healthy rate of 5.5 percent which, however, is down from 6.8 percent as recently as March and is the lowest rate since December 2016.

Outright monthly declines were posted in two cities where price traction is clearly slipping, Seattle at minus 1.0 percent in the month for year-on-year growth still very strong at 9.6 percent, and San Diego which fell 0.3 percent in the month for a mediocre year-on-year rate of 4.8 percent.

Las Vegas is once again the big headliner in the data, posting 1.1 percent monthly growth in August following 1.2 and 1.1 percent in the prior two months. Las Vegas leads the year-on-year growth rates at 13.9 percent. At the bottom, however, remain Washington DC and New York City at only 2.8 percent growth with Chicago little better at only 2.9 percent.

These results and trends are consistent with weakness seen in last week’s FHFA house price index as well price data in the existing home sales report. However strong the 2018 economy is, it doesn’t include home prices which are a central source of household wealth.

Confidence remains high:

Highlights

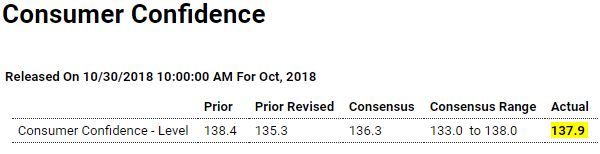

The consumer confidence index continues to hold near 18-year highs, at 137.9 in October vs a revised 135.3 in September. The index remains within striking distance of the all-time high at 144.7 reached in 2000.

A closely watched reading in this report, one used by forecasters to track the monthly employment report, is pointing to increasing strength for the labor market. Those saying jobs are currently hard-to-get fell nearly 1 percentage point to 13.2 percent. Strength in the labor market is also indicated by a 1.8 percentage rise in a less closely watched reading: those who say jobs are currently plentiful which is now at 45.9 percent.

Hiring and investment are largely functions of sales, not marginal income tax rates per se. So only to the extent that the lower tax rates somehow increase top line growth would hiring and investment tend to increase;

Most firms haven’t accelerated hiring or investments as a result of GOP tax cuts

(The Hill) Most firms haven’t accelerated hiring or investments as a result of the tax-cut law enacted by Republicans last year, according to a new survey by the National Association for Business Economics (NABE). Eighty-one percent of NABE members surveyed said the 2017 law, known as the Tax Cuts and Jobs Act, hasn’t led their firms to make changes to hiring or investment plans. More than three quarters of respondents said trade-policy changes haven’t affected their hiring, investment or pricing plans. NABE members work for private sector companies or industry trade associations.