Highlights

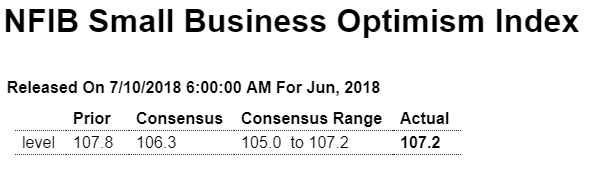

The Small Business Optimism Index retreated by 0.6 points in June to 107.2, the sixth highest reading in the NFIB survey’s 45 years history. Beating the consensus forecast calling for a more substantial decline after May’s upward surge to the second highest level in the history of the survey, the optimism index remained exceptionally strong in June mainly thanks to improvement in the employment and inventory components. Gains of 2 points to a net 20 percent in plans to increase employment and in plans to increase inventories to a net 6 percent were accompanied by a 4-point gain to a net 0 percent of business owners viewing current inventory levels as too low and a 3-point gain to a net 36 percent in current job openings. Expected credit conditions were the last among the gainer components in June, rising 1 point to a net minus 4 percent.

Despite the stronger than expected index reading for the month, half of the 10 survey components posted declines, most of which were sizable, though mostly from very strong levels, led by expectations of higher real sales, which fell 5 points in June to a still very solid net 26 percent. A drop of 5 points to a net 29 percent was also seen in the view that now is a good time to expand, while expectations that the economy will improve fell 4 points to a net 33 percent and earnings trends also shed 4 points to a net minus 1 percent. Plans to make capital outlays fell 1 point to a net 29 percent.

Business owners surveyed continued to point to difficulties in finding qualified workers and identified this as the single most important business problem, as 36 percent reported job openings they could not fill in the current period, up 3 points and matching the survey record high set in November 2000. Openings for skilled workers were reported by 31 percent of small firms while 13 percent have openings for unskilled labor, both ahead of the May readings.

The survey also showed the threat of inflation as subdued in the current environment, with the net percent of owners raising average selling prices falling 5 points to a seasonally adjusted net 14 percent, and a net 24 percent planning price hikes, down 2 points from the prior month. Perhaps surprising given the tightening on the jobs front, reports of higher compensation were down 4 points from May’s record reading to a net 31 percent, though plans to raise compensation did rise by 1 point to net 21 percent.

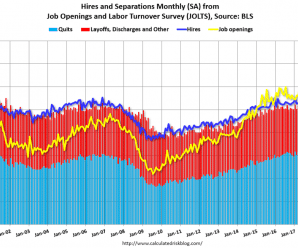

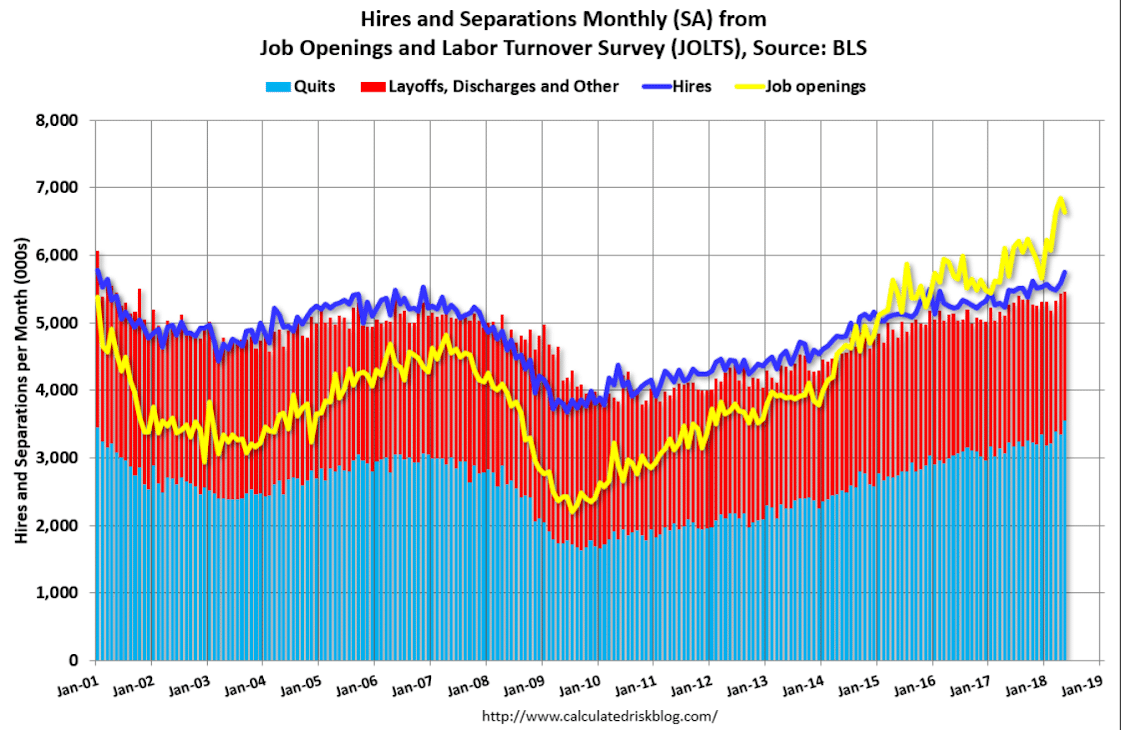

Lots of job openings at lower wages as companies work to replace higher wage employees:

Highlights

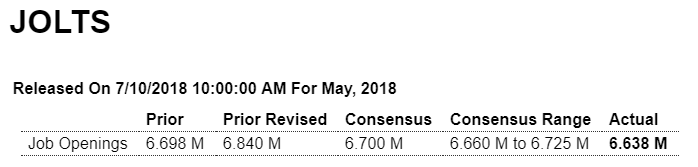

Job openings slipped back but still remain very abundant, at 6.638 million in May vs an upward revised and record 6.840 million in April. Openings are up 16.7 percent compared to May last year and are far above hiring, at 5.754 million in May for comparatively distant 4.9 percent year-on-year gain.

Openings are not only above hirings but they are also above the 6.564 million unemployed who are actively looking for work. This inversion — which strongly underscores lack of available capacity in the labor market — first appeared in April and marks a first in data going back 20 years. It’s the abundance of openings that are pulling in discouraged workers back into the workforce looking for jobs.

Of special note in today’s report is another rise in the quits rate, up 1 tenth to 2.4 percent. Jerome Powell, at his FOMC press conference last month, characterized the quits rate as elevated, a sign that workers are looking for other employers and higher pay.

Job openings represent labor demand and are a complementary statistic to unemployment which represents labor supply. And their relationship is a hot topic among Federal Reserve policy makers who are raising rates to head off potential imbalances, specifically inflationary imbalances, in the labor market.

Automotive News

DETROIT — General Motors has expanded its use of lower-paid workers in a suburban Detroit assembly plant to help defray the cost of making self-driving electric vehicle prototypes, through a deal that has raised tensions within the UAW. GM and the UAW this year reached an Autonomous Vehicle Memorandum of Understanding that lets the automaker offer reduced wages and benefits for some jobs at its plant in Orion Township, Mich. The plant makes Chevrolet Bolt EVs and its self-driving variant, the Cruise AV, as well as the Chevrolet Sonic. The agreement could be used as a template for lowering costs at other car plants that have experienced production declines because of slow-selling products. GM is analyzing the future of its car plants as its production shifts toward more crossovers, SUVs and EVs, according to the union. But the arrangement aggravates a sore spot with the UAW. The workers are typically paid less than employees of the Detroit automakers, and union leaders worry that their presence in an otherwise underused plant effectively takes work from higher-paid employees covered by the UAW’s main contracts. “Everyone agrees that this situation sucks,” Cindy Estrada, a UAW vice president, wrote in an April 19 letter to members. “But what would suck even more would be to have GM shut down any of our plants.”

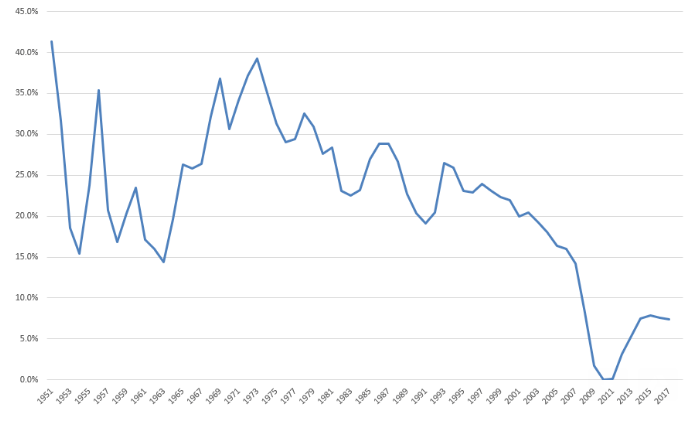

This is the employment growth rate for each year compared to the same date 10 years prior. You can see how we dipped further and recovered more slowly in this latest cycle. It also gives the appearance that we haven’t yet recovered from the damage to aggregate demand from the surplus years of the late 1990’s: