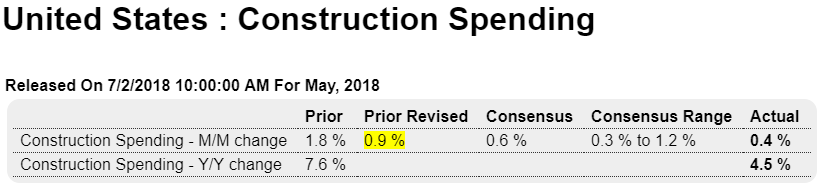

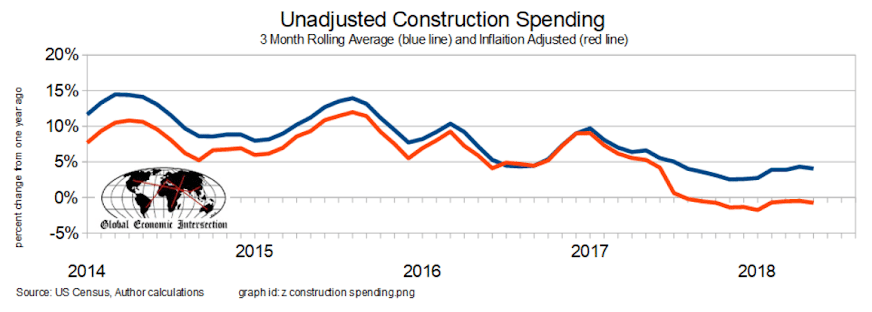

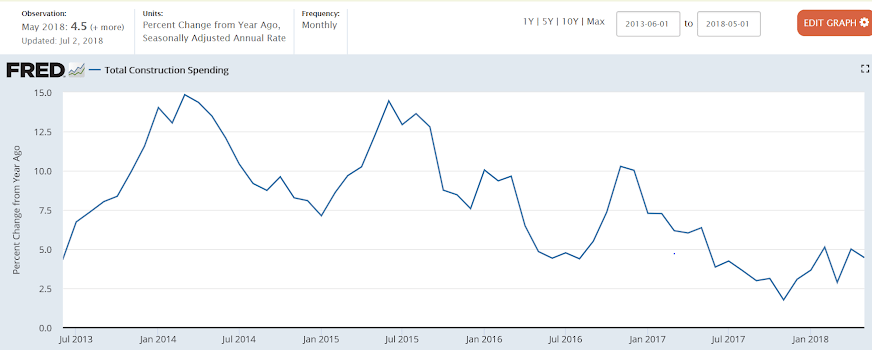

Last month revised a lot lower, and this month weak as well, as inflation-adjusted spending growth remains negative:

Note from US Census:

Notice: With this release, unadjusted data have been revised back to January 2016 and seasonally adjusted data back to January 2011. All revised estimates are available on our website. With each May release, seasonally adjusted data will now be revised for an additional five years beyond the revision period for unadjusted data. Research has shown that this revision span should produce more reliable seasonally adjusted time series.

The rolling averages declined. Also note that inflation is grabbing hold, and that inflation adjustments bring this series into contraction.

Serious weakness in Manhattan real estate:

Manhattan real estate has worst second quarter since financial crisis

The Saudis continue to set price via their posted discounts to benchmarks, and then let quantity adjust to demand. The President isn’t the only one who has no clue that’s how it’s been working for a very long time:

Trump Asks Saudi Arabia to Pump More Oil, Citing High Prices

(WSJ) Publicly, Riyadh has committed to only modest output increases, but behind the scenes the kingdom is ramping up quickly—moving from just over 10 million barrels a day a few months ago to a target of close to 11 million barrels a day by July. “I am asking that Saudi Arabia increase oil production, maybe up to 2,000,000 barrels,” Mr. Trump said in the tweet, citing a conversation with Saudi King Salman. “Prices to [sic] high! He has agreed!” the tweet said, citing “turmoil & dysfunction” in Iran and Venezuela. A senior Saudi official said the kingdom assured the U.S. of its capability to meet demand.