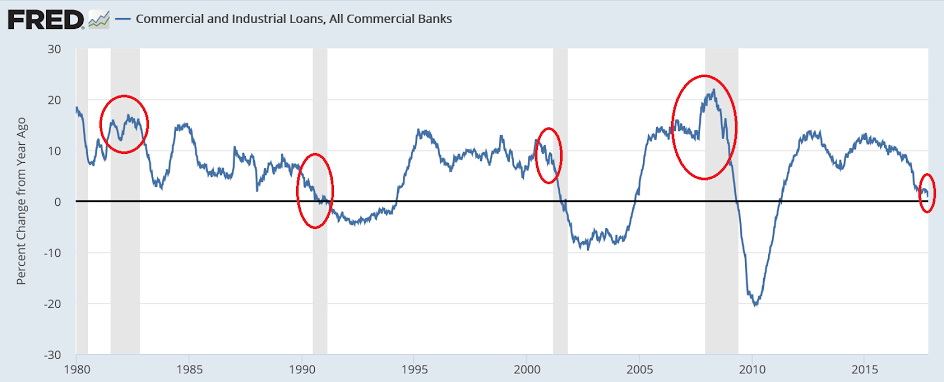

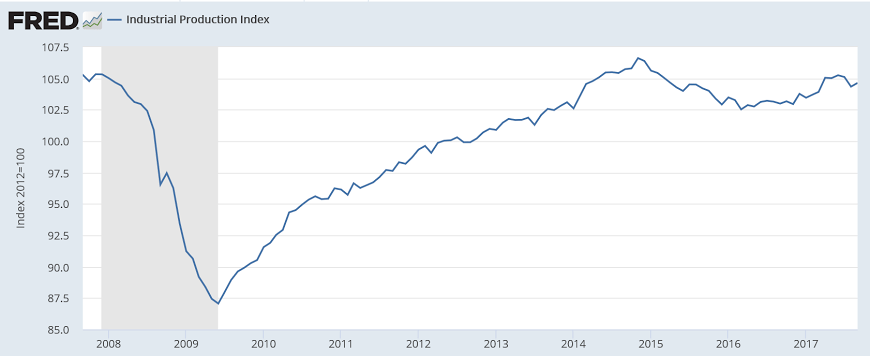

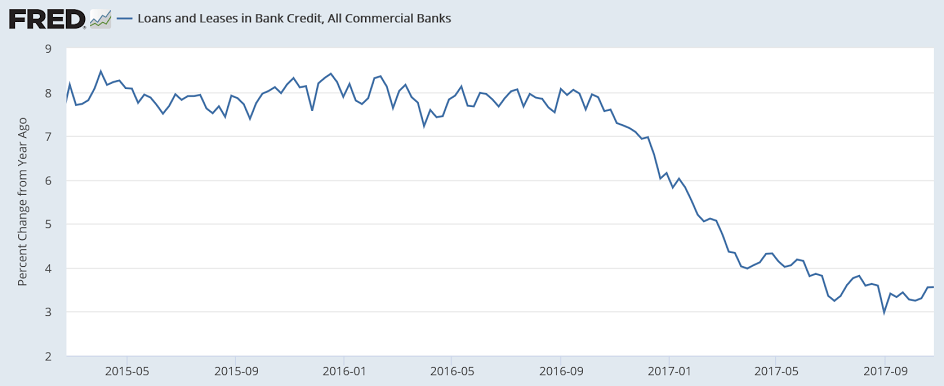

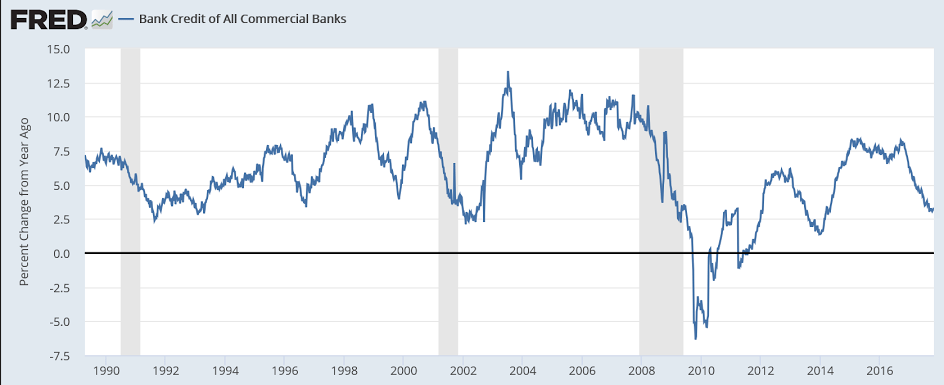

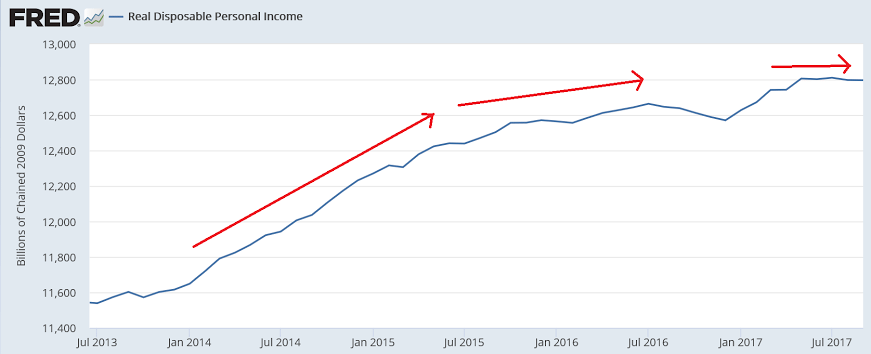

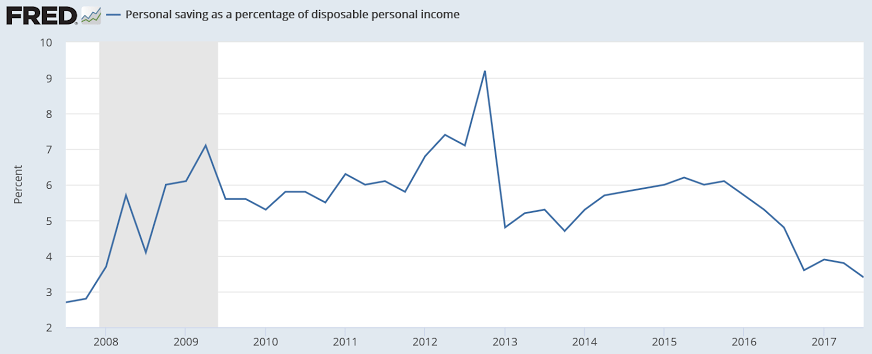

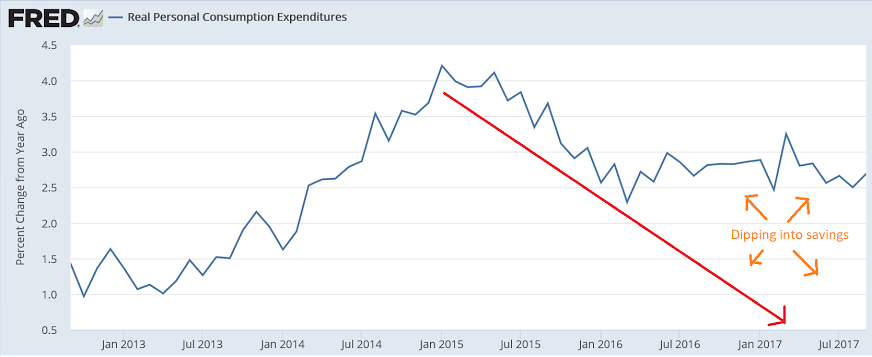

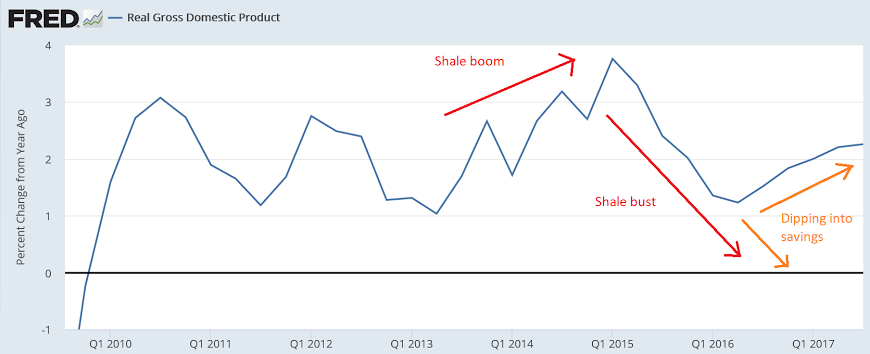

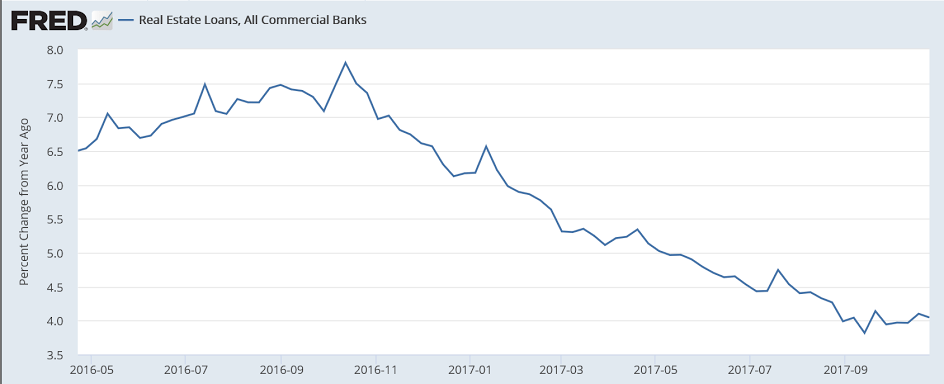

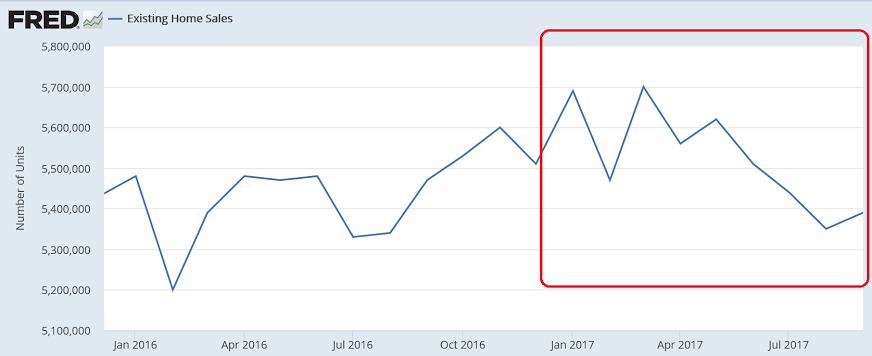

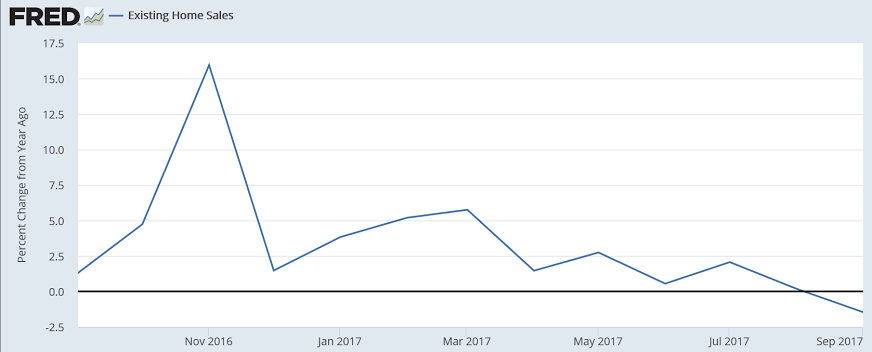

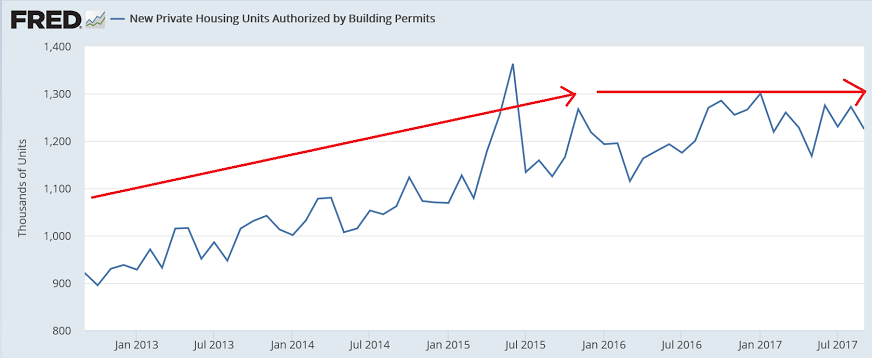

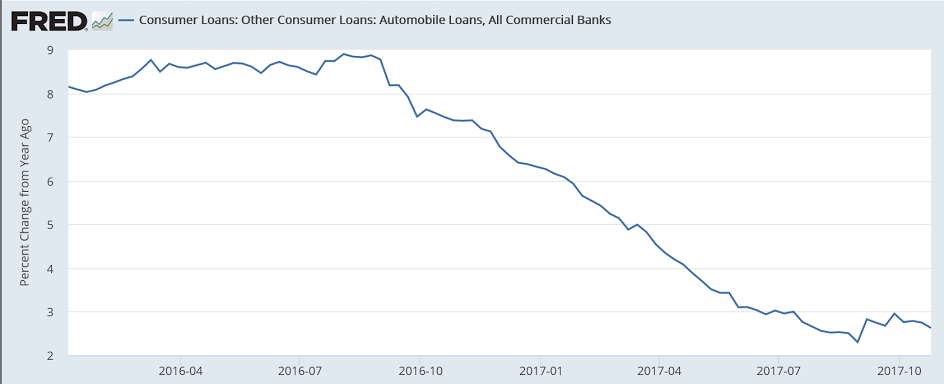

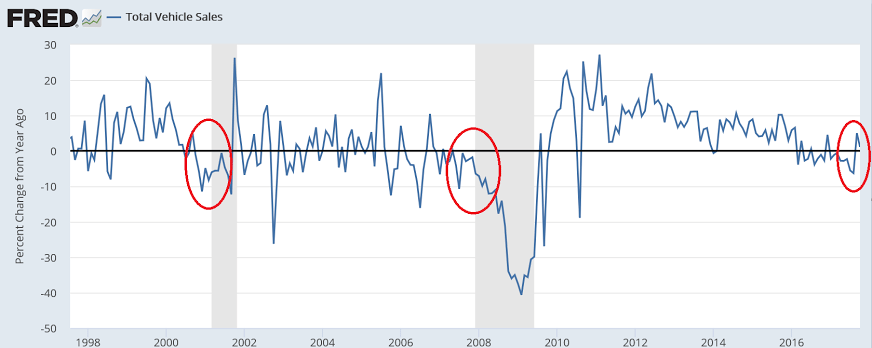

Bank credit growth continues to decelerate, to where historically, after revisions, the economy would already be in recession. Housing and vehicles look like they are already reporting negative growth, and personal income growth has decelerated to about 0% growth, with personal spending holding positive only because people are dipping into savings, which historically has always been followed by a reduction in spending:

Less borrowing to spend translates into less personal income growth:

Spending has been sustained only by dipping into savings, which is not sustainable and historically happens at he end of the cycle:

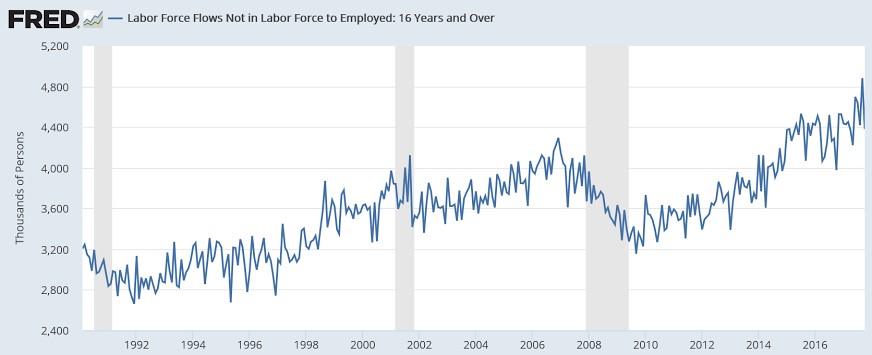

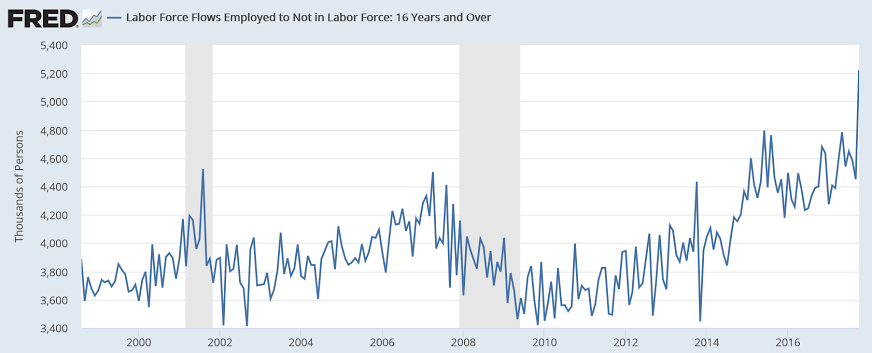

With this many jobs taken every month by people not considered to be in the labor force I suspect it’s not so easy to be counted as being in the labor force as it once was? And so there is quite a bit more slack than generally presumed?

Likewise, maybe if you leave your job it’s harder to be counted as in the labor force than it was historically?

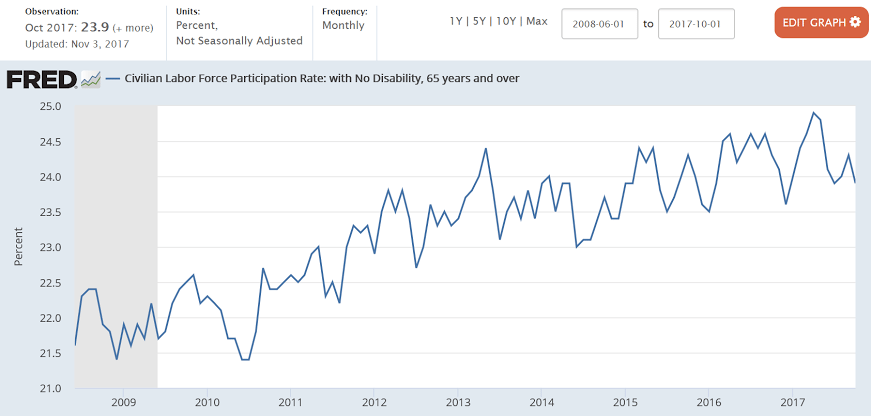

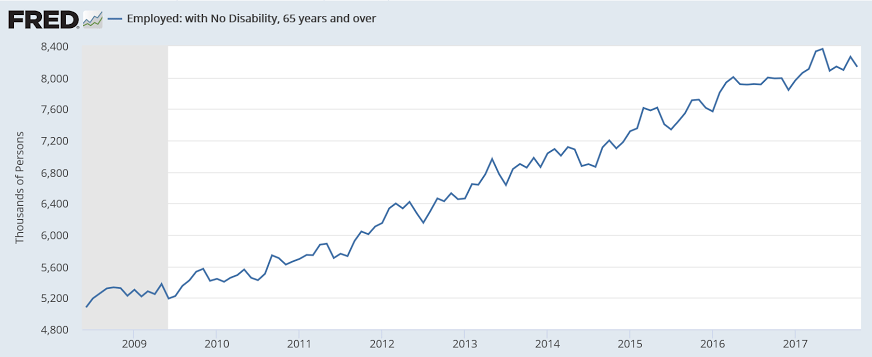

Maybe people over 65 do want to work?

The participation rate for this segment didn’t drop in 2008 and continues to increase: