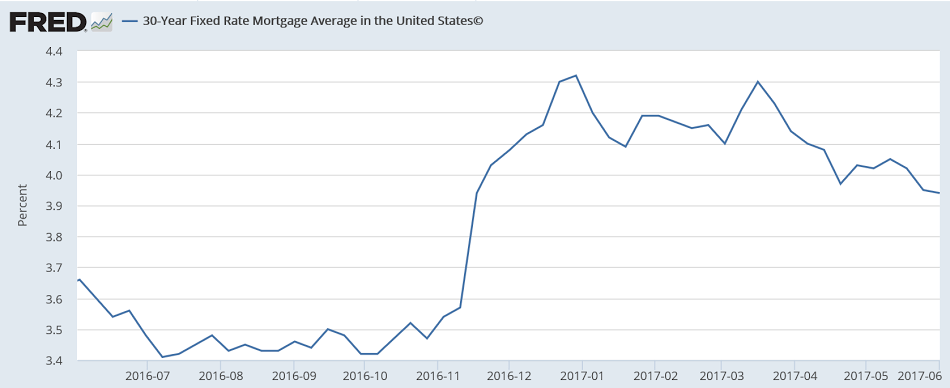

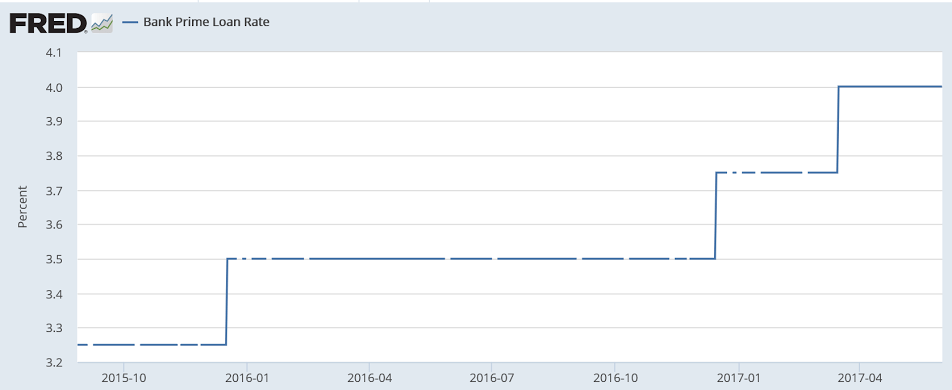

So I was reminded that I did write and post in November about what might happen if rates went up in anticipation of Fed hiking in a weak loan demand environment. (Thanks David for reminding me!) I was thinking that some portion of whatever borrowing interest there was might no longer qualify, causing a decline in the growth of borrowing to spend by businesses as well as consumers.

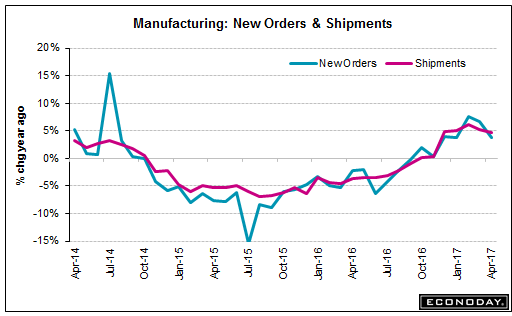

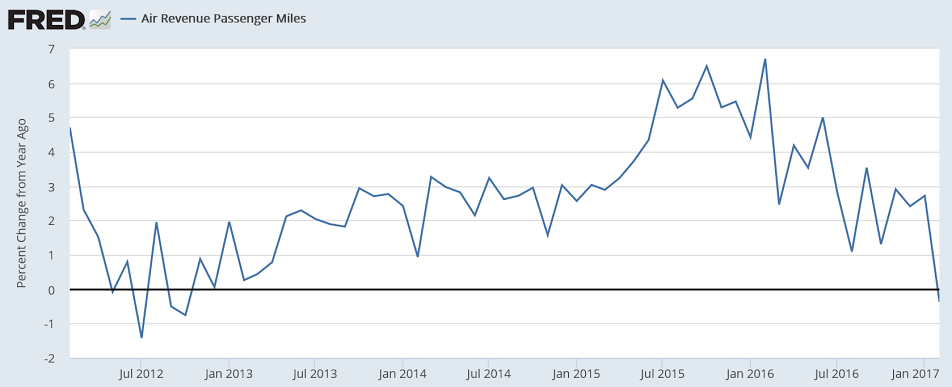

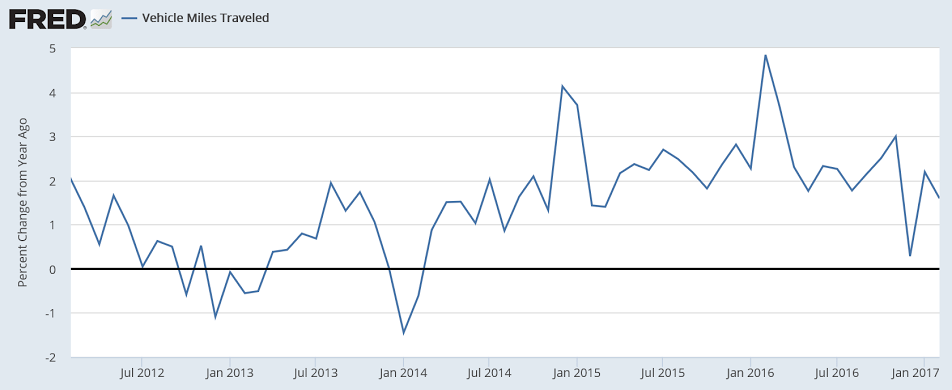

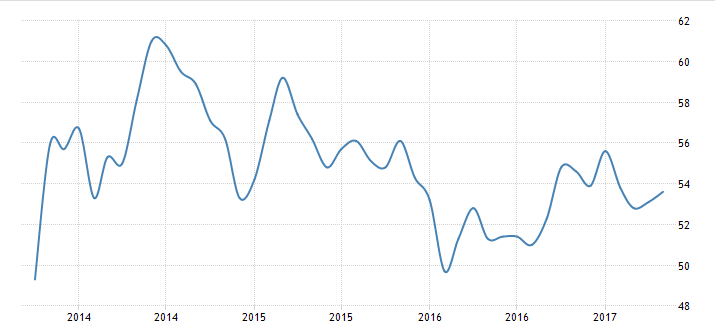

If rates go up when loan demand is strong enough so the borrowing continues, the added loan payments flow back to earnings for the lender, and govt. pays more interest, so it can all not only keep going but accelerate. However, if demand is weak, and rates go up as they did late last year due to anticipation of Fed hikes, borrowing and spending can decelerate, as per the charts:

A couple of other indicators that started sagging in November:

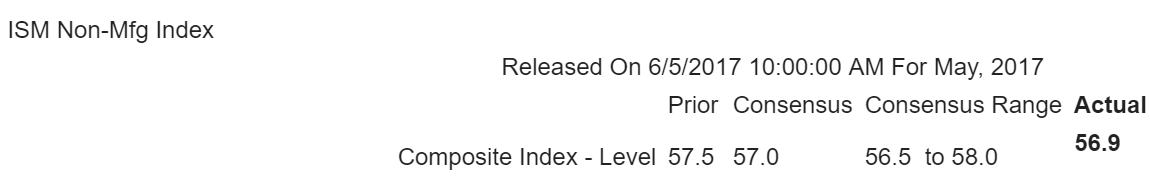

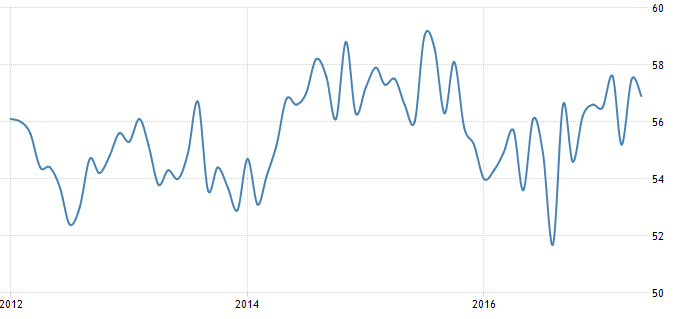

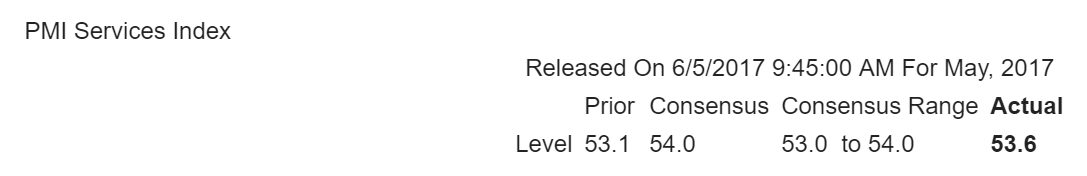

Highlights

Moderate is the message from the PMI services index which finishes May at a lower-than-expected 53.6, down 4 tenths from the mid-month flash but up a solid 1.1 points from final April and up 5 tenths from April’s flash. Most readings rose back to strength early in the year including new orders with backlog orders showing their first build since January. Employment is at a 3-month high with optimism on the general outlook, however, remaining subdued. There are badly needed signs of inflation in the report with input costs on the rise and selling prices also moving higher. This is a positive though far from robust report. Up next is the ISM non-manufacturing report which has been running much stronger than the services PMI with the Econoday’s consensus at 57.0.

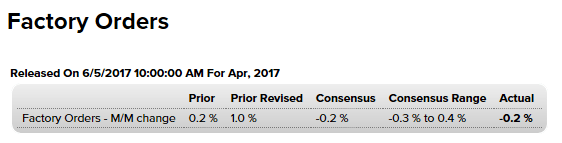

Highlights

The weak run of second-quarter data continues with April’s 0.2 percent decline in factory orders. The durable goods component fell 0.8 percent in the month reflecting a give back in aircraft orders and wide weakness for most readings. Orders for non-durable goods rose 0.4 percent reflecting moderate gains for food and energy.

The ex-transportation reading, which excludes aircraft, managed only a 0.1 percent gain in the month with core capital goods orders (nondefense ex-aircraft) also up only 0.1 percent. April’s shipments of core capital goods, which are an input into second-quarter GDP, also rose only 0.1 percent which is another negative in this report. And only a marginal positive for GDP is a 0.1 percent rise in total inventories. Total shipments were unchanged in the month keeping the inventory-to-shipments ratio unchanged at 1.38.

Positives in the report include a 0.6 percent rise for motor vehicle orders and a 1.6 percent rise for computers. Also total unfilled orders, which contracted through most of last year, are up 0.2 percent for a second straight small gain.

Another positive in the report is an upward revision to March factory orders which now stand at 1.0 percent following February’s 0.8 percent gain. But the prior gains were driven by aircraft as the ex-transportation reading could move only modestly higher. The factory sector is not living up to the promise of the high-flying regional reports and, instead of accelerating this year, now appears to be struggling.