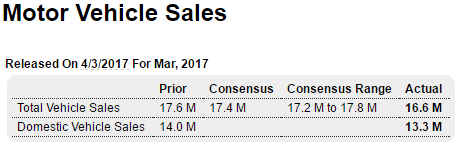

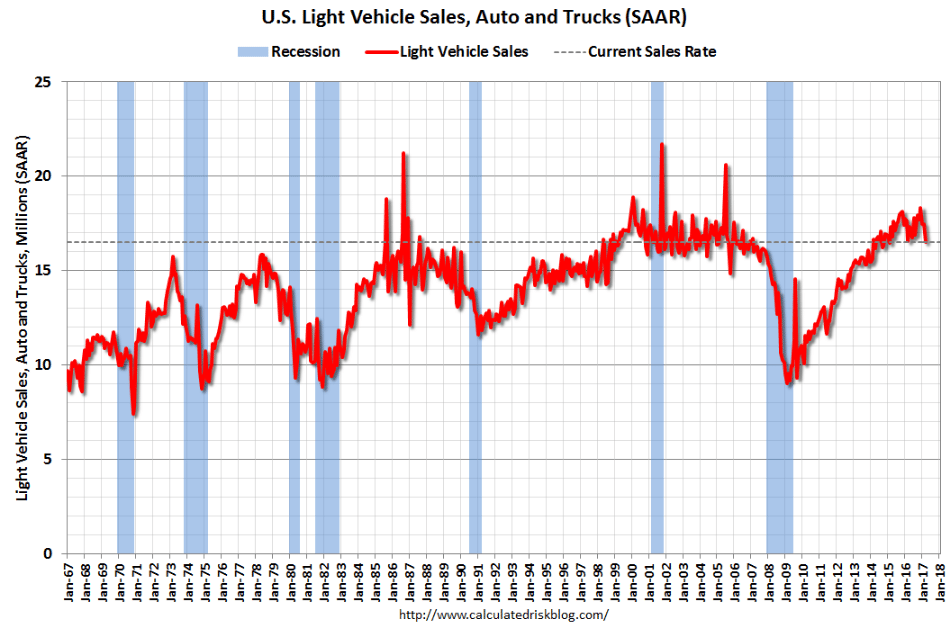

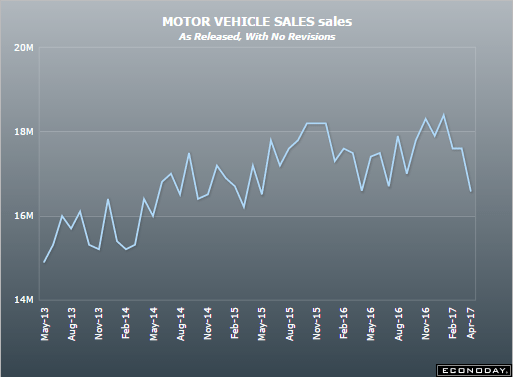

Big drop, and in line with collapsing bank loan reports:

Highlights

First-quarter GDP will take another hit, this time from March vehicle sales which like February and January proved weak. But the March data is unusually weak, down 5.7 in the month to a 16.6 million annualized rate that is a 2-year low. Sales of North American-made and imports both suffered, at 13.3 and 3.4 million rates, with light trucks and autos both down. Vehicle sales seem to have been pulled forward into December which was an unusually strong month and which helped the fourth quarter at the expense of the first quarter.

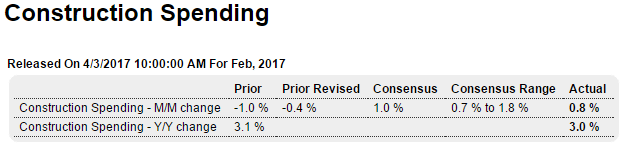

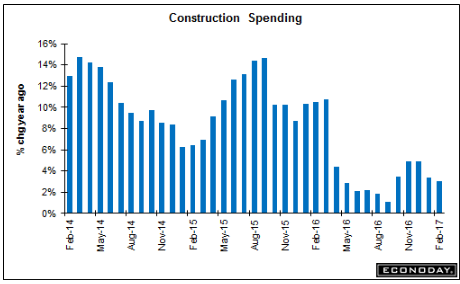

Worse than expected though last month not as bad as reported, and the already low annual growth numbers continue to weaken, as per the chart:

Highlights

Construction spending rose a very solid 0.8 percent in February and was led by residential construction where spending on single-family homes rose 1.2 percent for a second straight month and multi-family spending rose 2.0 percent following January’s 4.0 percent surge.Nonresidential construction is holding back the total, down 0.3 percent in the month and reflecting weakness in the transportation, commercial, and manufacturing components. Federal spending was also down for a second straight month, 2.8 percent lower following a 5.6 percent drop in January.

Year-on-year rates show the negative pull from government spending which was down 8.8 percent at the Federal level and down 8.0 percent at the state & local level. Total yearly spending is up a modest 3.0 percent with single-family homes up 3.4 percent and multi-family units, reflecting the high cost of housing and demand for rentals, again leading the way up 10.6 percent.

The construction sector hasn’t been on fire but continues to post passable numbers, and momentum may begin to build at least for the housing sector as permits for both single- and multi-family units are on the climb.

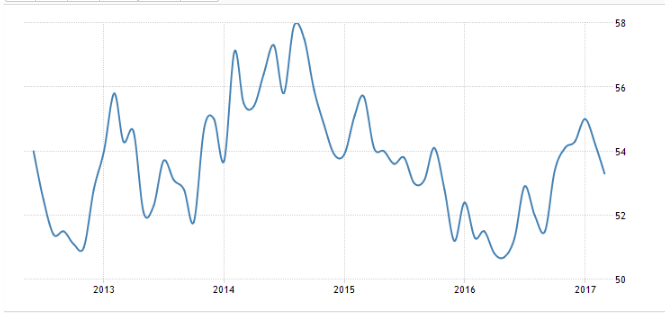

Markit purchasing managers index survey shows trumped up expectations continue to fade:

ISM survey coming off a bit as well: