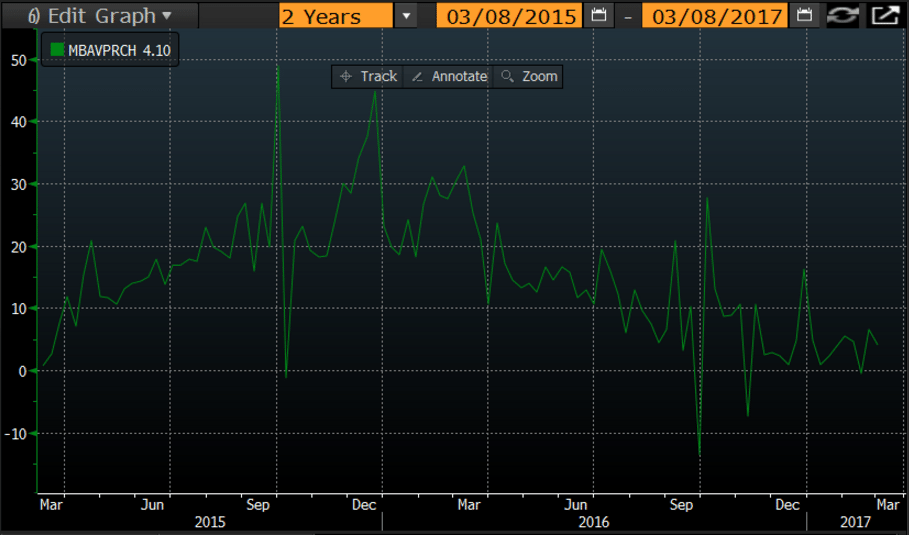

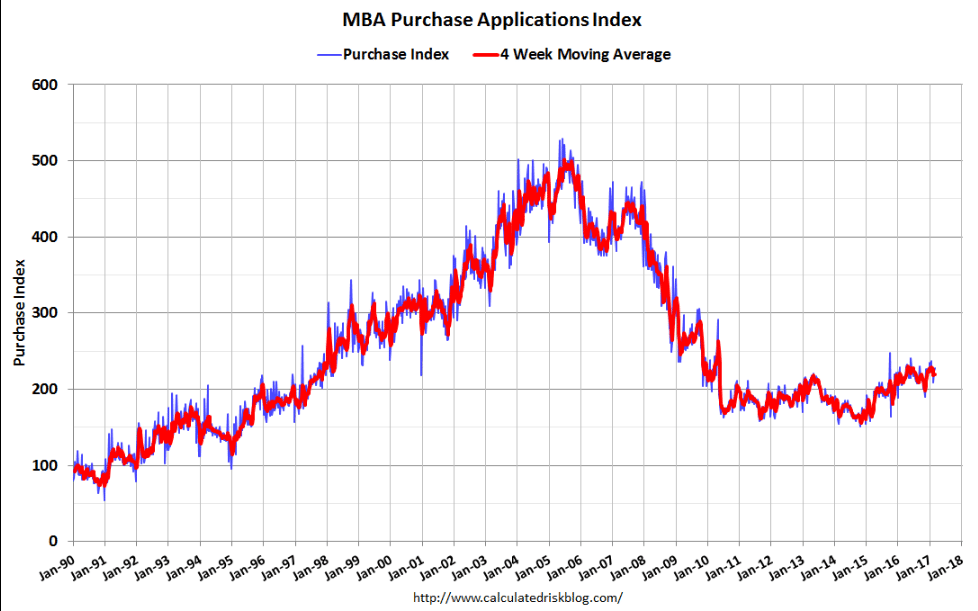

The growth rate has slowed and the level of apps remains depressed:

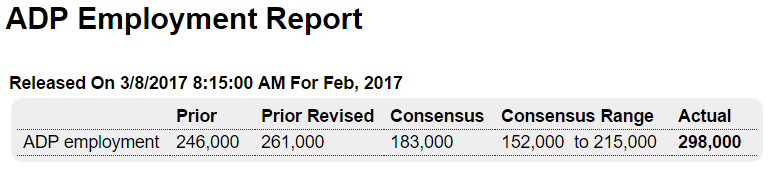

Nice move up. This is just a forecast of Friday’s number:

Highlights

The February employment report looks to be a blockbuster based on ADP’s estimate for giant growth of 298,000 in private payrolls. This would be the biggest gain since October 2015 and one of the very largest of the cycle. ADP isn’t always followed closely but its call last month for outsized growth in January payrolls did prove correct.

Mark Zandi, chief economist of Moody’s Analytics said, “February was a very good month for workers. Powering job growth were the construction, mining and manufacturing industries. Unseasonably mild winter weather undoubtedly played a role. But near record high job openings and record low layoffs underpin the entire job market.”

Read more at http://www.calculatedriskblog.com/#Gvm71i5cM1idEJoW.99

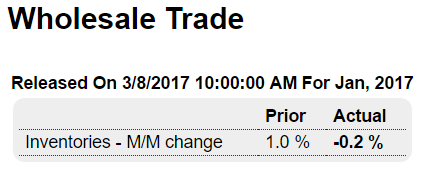

Highlights

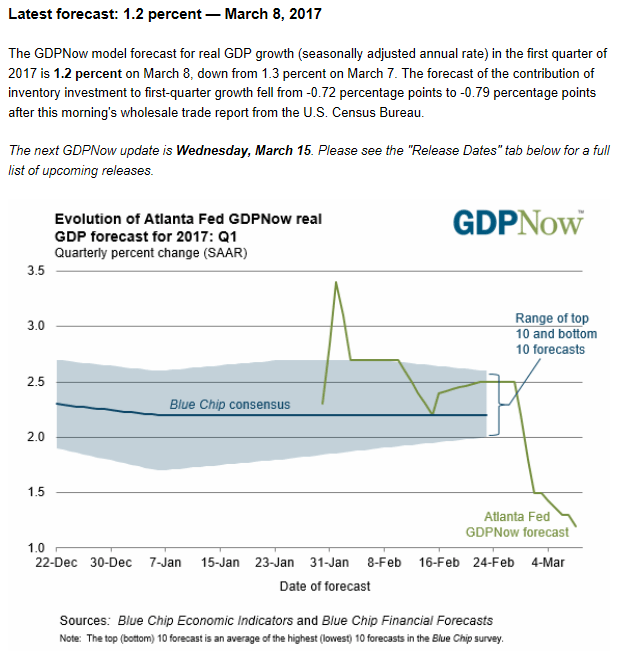

Wholesale inventories fell 0.2 percent in January while sales declined 0.1 percent, a comparison that keeps stock-to-sales at a healthy 1.29 ratio. Auto inventories at the wholesale level were depleted in the month, down 3.1 percent against a 3.2 percent rise in sales which points to restocking and a gain for auto production.

Wholesale inventories have been steady as have factory inventories, though retail inventories have been less lean. Low inventories are a plus for the economy but a negative for the GDP calculation which makes today’s report an early negative for first-quarter GDP. January data on February retail inventories will be posted next week with the business inventories report.

Trumped up surveys while the hard data continues to head way south:

Might explain the recent weakness…

A new law prevented the Internal Revenue Service from paying out refunds for tax returns claiming those credits until mid-February, and the agency warned those households not to expect access to their money until Feb. 27 due to processing and other delays.

The law, intended to prevent fraud by giving the IRS time to double-check income data, caused many refund payments to go out later than usual this year. As of Feb. 10, the IRS said it sent out 14.1 million refunds totaling $28.93 billion—down sharply from 2016, when 29.2 million refunds totaling $94 billion were sent through Feb. 12. The tax agency began to release those postponed payments around the middle of the month and by Feb. 17, the IRS said it had sent 32.9 million refunds totaling $103.24 billion.