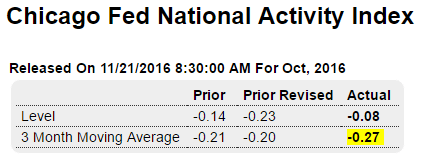

Still in the red:

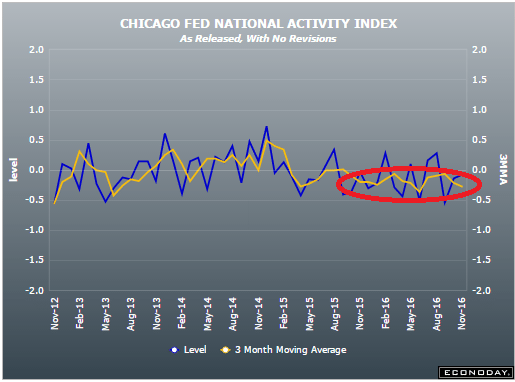

This is not a good sign for global demand. And Japan’s continuing trade surplus recently enhanced by the falling yen isn’t a positive for US GDP:

Japan’s trade surplus grows 4.7-fold in October

Nov 21 (Kyodo) — Japan’s trade surplus expanded 4.7-fold in October from a year earlier to 496.17 billion yen ($4.5 billion). The value of exports dropped 10.3 percent from a year earlier to 5.87 trillion yen while imports plunged 16.5 percent to 5.37 trillion yen. Exports to China fell 9.2 percent to 1.07 trillion yen while imports dived 17.9 percent to 1.42 trillion yen. Japan’s shipments to the United States dropped 11.2 percent to 1.20 trillion yen while imports fell 9.9 percent to 616.82 billion yen. Exports to the European Union declined 9.5 percent to 650.49 billion yen while imports shed 12.0 percent to 674.89 billion yen.

Weak foreign demand since the collapse of oil capital expenditures:

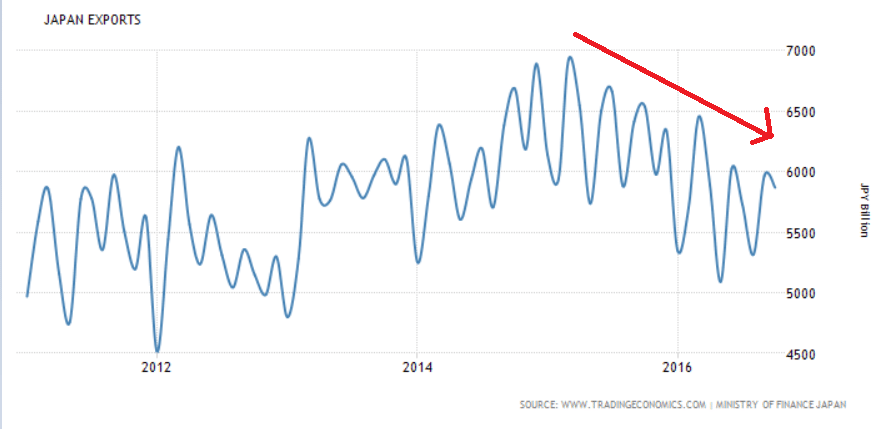

Same with China, and no word yet from President Trump on ‘currency manipulation’ and ‘competitive devaluation’:

China Devalues Yuan For Longest Streak Ever To 8 Year Lows – ZeroHedge – http://bit.ly/2fwiIMc

…(6.8985 vs. Friday at 6.8796) For the 12th consecutive day, China has weakened the official fix of the Yuan against the USD, slashing its currency by over 2.2% in that time

And no push back on this statement tells me global demand can’t go anywhere but down:

UK’s Hammond says budget options constrained by high debt – http://reut.rs/2gsIZzg

…Britain’s first budget plan since the Brexit vote will not include a big new spending push because of “eye-wateringly” high public debt levels, but will have some help for the economy and struggling families, the country’s finance minister said.

The red line, imports, remain in negative territory on a year over year basis:

As previously discussed, with govt. a large net payer of interest to the economy, rate cuts remove material levels of income from the economy, which constrains borrowing:

Negative Rates Are Failing to Halt Savings Obsession in Europe – http://bloom.bg/2g7ONK6

Why would we want to compete with billions of other consumes for real resources?

Fed’s Powell says Asian economies should boost domestic demand – http://reut.rs/2fiHF05

Consequences of the collapse in global oil capital expenditure continue:

Global dividends stumble as US growth drops to post-crisis low -Telegraph – http://bit.ly/2fwd253