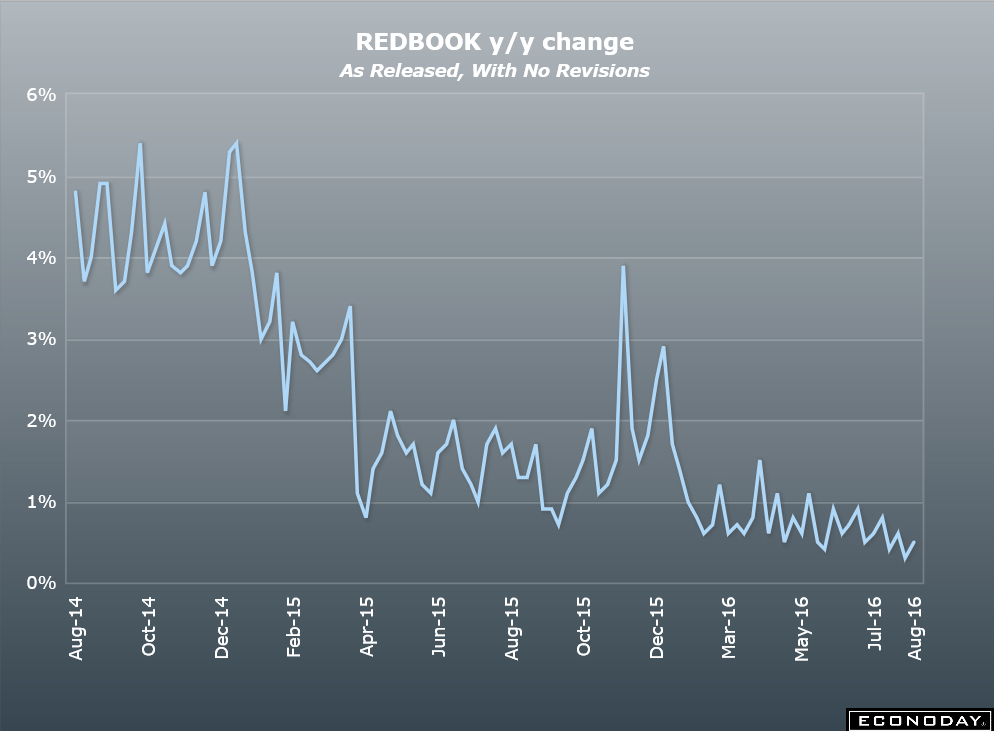

No sign of increased global demand here:

China Exports Slide on Weak Demand

By Mark Magnier

Aug 9 (WSJ) — China’s General Administration of Customs said Monday that exports fell 4.4% in July year-over-year in dollar terms after a 4.8% decline in June. July imports fell by a greater-than-expected 12.5% from a year earlier, raising concerns over weak domestic demand. This compared with an 8.4% fall in June, the customs agency said. China’s trade surplus widened more than expected in July to $52.31 billion from $48.11 billion the previous month. The economy grew at a better-than-expected 6.7% rate in the second quarter, matching its first-quarter level.

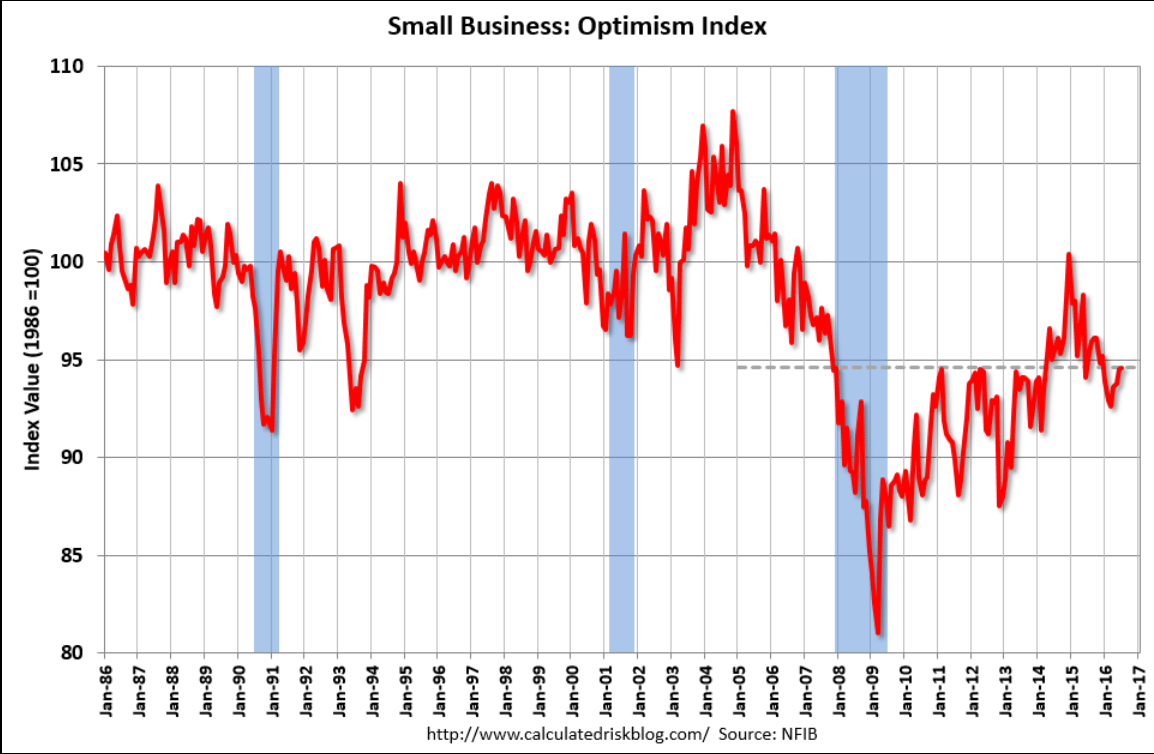

No improvement of note here as this index remains depressed:

Highlights

The small business optimism index rose 0.1 points in July to 94.6, a minute gain but nevertheless a touch higher than expectations and the fourth monthly increase in a row after falling to a 2-year low in March. Four of the 10 components of the index increased, four declined and two were unchanged.Expectations that the economy will improve led the gains again, rising 4 points as it did in May and June yet still remaining negative at minus 5, followed by plans to increase inventories, which rose 3 point to a neutral 0. Job openings hard to fill fell 3 points to 26 while maintaining its position as the strongest of the components, with the second strongest, plans to increase capital outlays, also dropping 1 point to 25. Business owners became even more pessimistic about earnings trends, with what has been the most negative component falling 1 point to minus 21.

I’m still thinking the negative productivity numbers- more employees producing less output- can be thought of as ‘human inventory building’ that increases costs and at some point reverses. That is, without increases in sales there’s generally no reason to increase employment.

At the same time, the still substantial slack in the labor market is keeping down labor costs, with the initially reported large Q1 gain revised down to a negative .2%.

Highlights

Output picked up in the second quarter but not quite as much as hours worked or compensation. Productivity fell 0.5 percent in the quarter for the third decline in a row. This is the longest negative streak in the history of this report which goes back to just after WWII.Unit labor costs rose 2.0 percent but, in a plus, were revised sharply lower in the first quarter which now shows a rare decline at minus 0.2 percent. But most readings in this report are not positive including the year-on-year rate for productivity which is down 0.4 percent for the first decline since second-quarter 2013. In an unfavorable contrast, year-on-year unit labor costs are up 2.1 percent.

Lack of business investment is unfortunately a central negative of this cycle and it results in weakening productivity for the nation. Americans are working more hours but production isn’t keeping up.

Still stone cold dead: