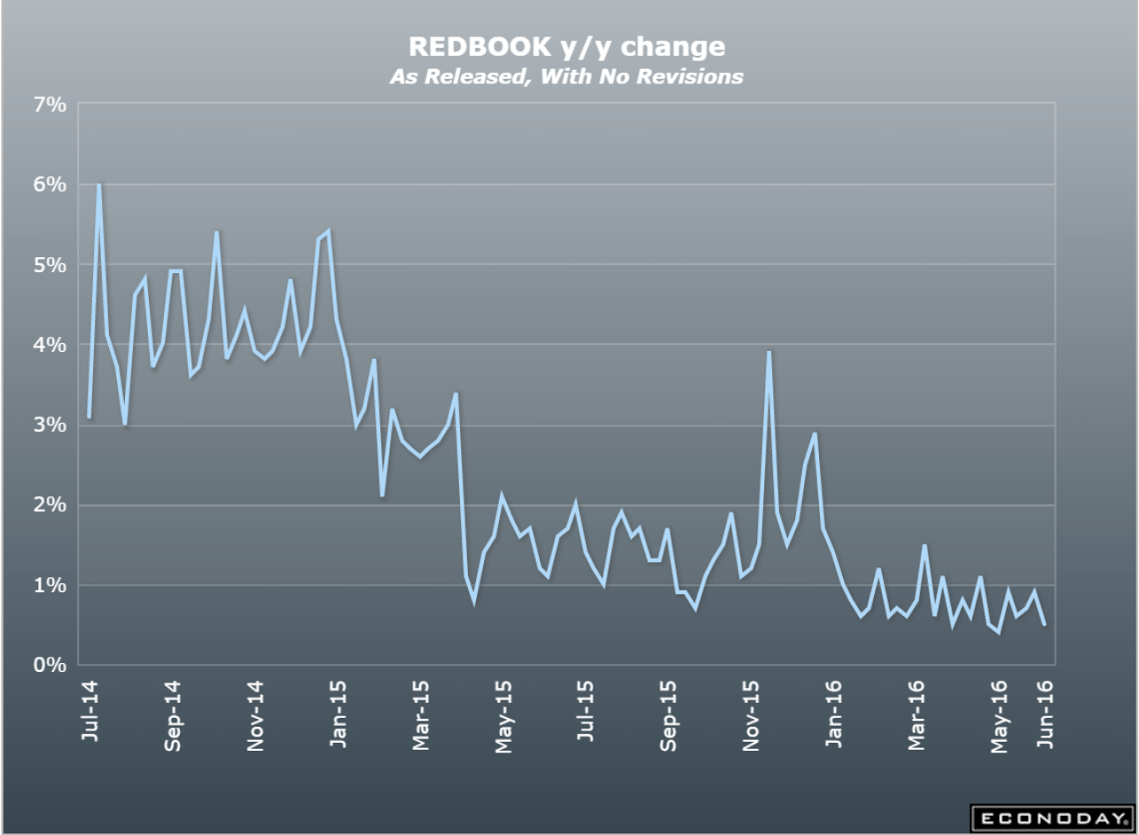

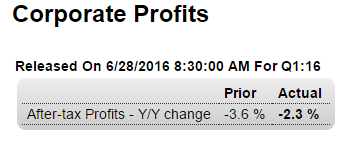

Still at recession levels:

Highlights

Corporate profits sank in the first quarter, revised to minus 2.3 percent year-on-year vs the initial estimate of minus 3.6 percent. Profits are after tax without inventory valuation or capital consumption adjustments.

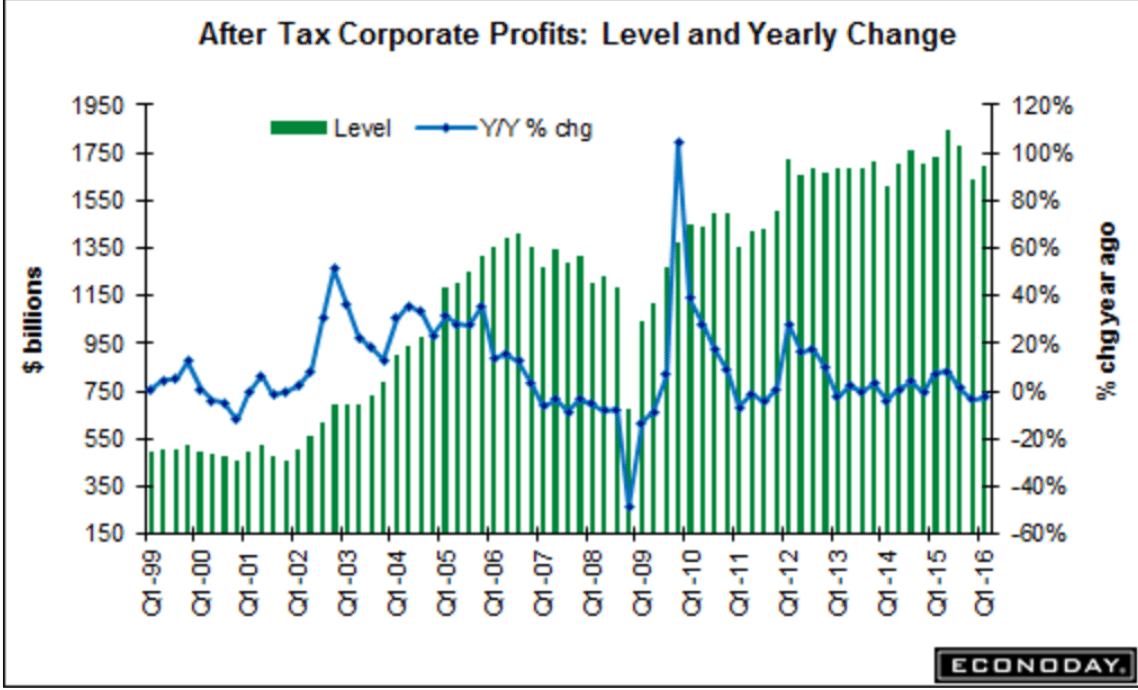

Revised up mainly due to residential investment, which isn’t looking so good in q2. And the downward revision to personal consumption weakens the ‘resilient consumer’ narrative, especially with employment softening in q2. Also, prices a bit softer than previously reported:

Highlights

Strength in net exports and less weakness in nonresidential fixed investment gave a boost to first-quarter GDP which rose 1.1 percent in the 3rd estimate vs plus 0.8 percent for the second estimate. Net exports added more than 1 tenth to GDP as exports rose slightly in the quarter and imports fell. An upward revision to software helped shave the negative contribution from nonresidential investment by 2 tenths to 6 tenths. On the downward side, the positive contribution from personal consumption expenditures was lowered by nearly 3 tenths to 1 percentage point as service spending was cut. Inventories were little changed in the revision, subtracting 2 tenths from GDP which is welcome news as inventories are poised to be restocked. Residential investment was a main positive in the quarter, adding 5 tenths to GDP. Early estimates for second-quarter GDP are running at about 2 percent, a more respectable rate but still far from robust especially with the third-quarter outlook clouded by Brexit.

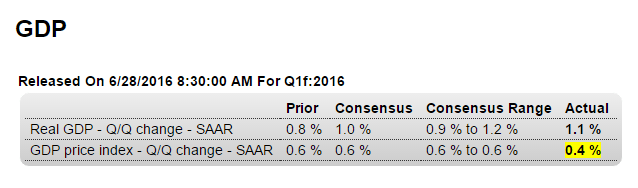

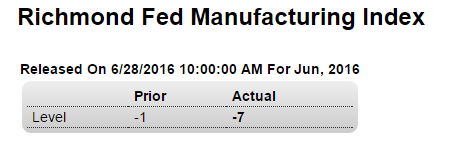

Another bad one:

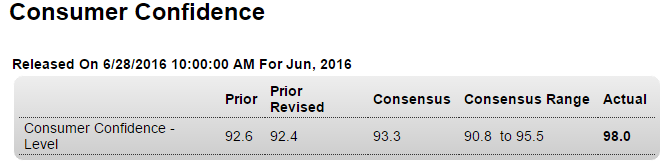

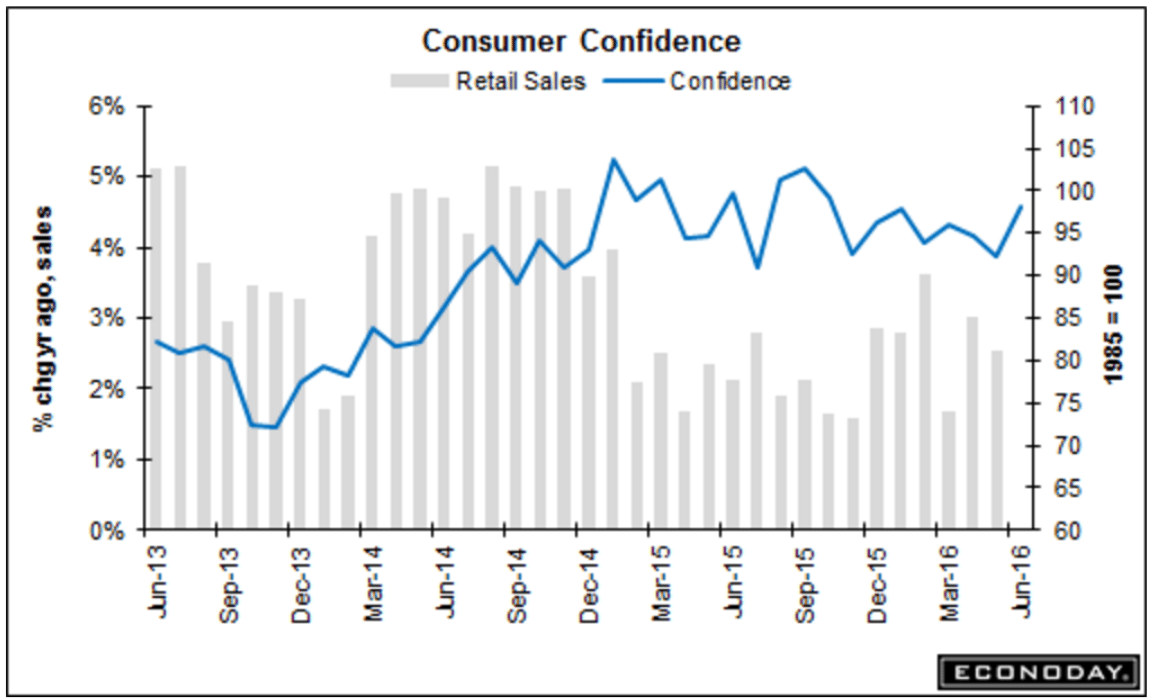

Upside surprise here! But hasn’t been much of a forecaster of retail sales since oil prices collapsed: