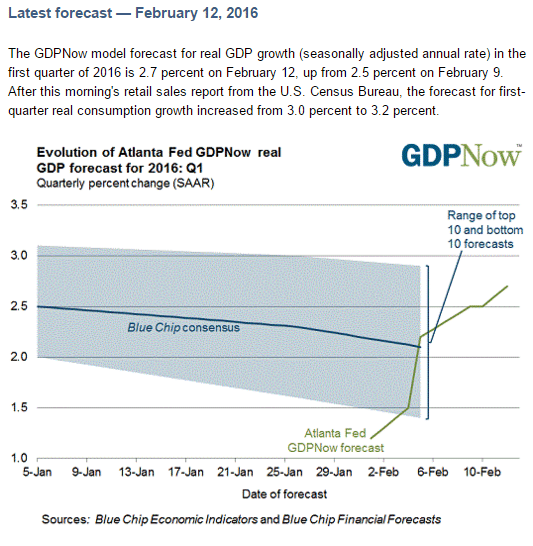

This is supported by increases in inventories that were already too high and likely to either be revised down or followed buy large declines for the rest of Q1. The retail sales number is also suspect and likely to revert to lower numbers:

The Myth Of The Resilient Consumer

By Lakshman Achuthan

The premise of incomes powering a consumer-driven pickup in U.S. economic growth is demonstrably false. And for people renting their homes the squeeze is even greater.

One clue is the extent of the increase in health care spending in recent years. Renters’ expenditures on health care as a percentage of after-tax income – after hovering around 4¾% for over a quarter century through 2011 – rose to 6.1% in 2013 before easing a bit in 2014 (top line). Homeowners also saw an analogous rise in health care spending as a percentage of after-tax income (not shown).

Similarly, spending on rent as a percentage of after-tax income – after staying fairly stable around 22% for over a quarter-century through 2012 – soared well above 25% in 2013 before slipping slightly (bottom line).

It follows that, on average in 2013-14, renters spent an extra 4½% of their after-tax incomes on rent and health care combined than in the previous quarter-century or so. Judging by the surge in consumer spending for health care, as well as the steady uptrend in rental inflation, renters’ share of spending on health care and rent would have risen even higher during 2015.

Rent and health care expenses are essentially non discretionary expenditures. Spending more on these items by an extra 5% or so of after-tax incomes puts a serious dent in discretionary spending budgets. This holds especially true given the double-digit declines in real average household income for the lion’s share of households since the turn of the century (USCO Essentials, October 2015).

In the context of this structural squeeze on family budgets, the current cyclical downturn in consumer spending growth is unwelcome news for anyone relying on the U.S. consumer to power economic growth in 2016.

In any event, it should be evident that the case for a full-blown Fed rate hike cycle cannot reasonably rest on the presumption of robust consumer spending, notwithstanding the decline in the unemployment rate to what the Fed considers “full employment.”

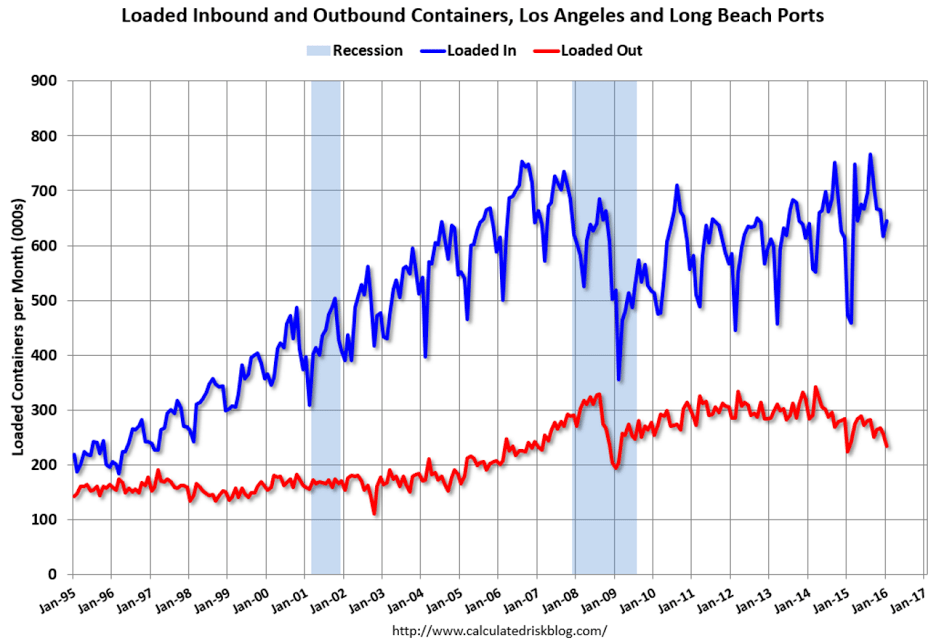

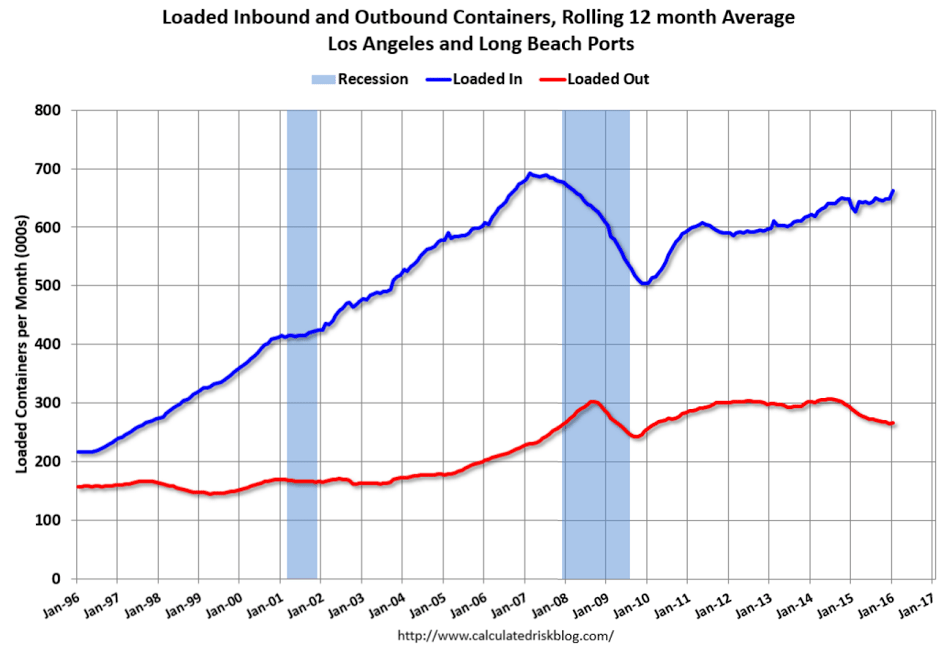

Looks like imports up and exports down- not good for GDP: