Crude inventory that used to pile up from high cost shale production is coming down as drilling is way down and existing well output declines some 70% in its first two years. Meanwhile, US imports increase as domestic production decreases:

Crude stocks at the Cushing delivery hub fell by 748,000 barrels, data from the industry group, the American Petroleum Institute, showed late on Tuesday.

Iraq’s southern oil exports have reached 3.10 million barrels so far this month, indicating continued high output from the larger members of the Organization of the Petroleum Exporting Countries.

The premium for crude for delivery in 12 months’ time over that for December delivery, or contango, rose to its highest in six weeks, often a sign that investors expect supply to be far more plentiful in the near term. LCOc12

On the physical market, the contango in the North Sea derivatives market, which underpins Brent futures, rose to its highest since early September this week, reflecting how excess barrels are weighing on near-term prices.

“The global glut is still very much weighing on investors minds at the moment,” said Ben le Brun, a market analyst at OptionsXpress in Sydney.

“Some of the major corporates such as BP are talking about sluggish prices through 2016,” he added.

BP (BP.L) on Tuesday announced further spending cuts and more asset sales over the coming years to tackle an extended period of low oil prices and help pay for its $54 billion U.S. oil spill settlement.

September 2015 Chemical Activity Barometer Continues to Decline

The Chemical Activity Barometer (CAB) dropped 0.3 percent in October, following a upwardly revised 0.3 percent decline in September and 0.1 percent decline in August.

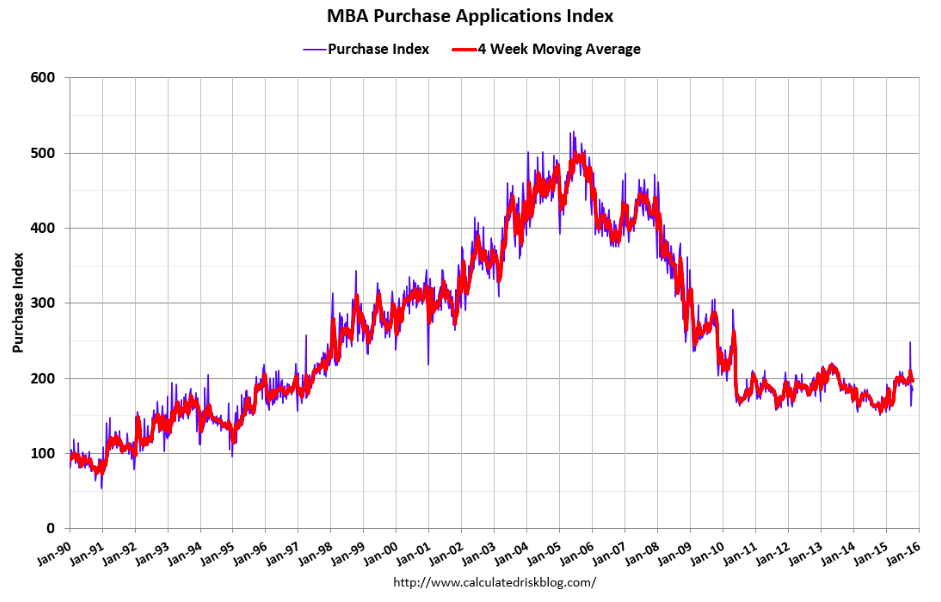

After a few wiggles due to govt changes purchase apps have settled back down and remain low and depressed:

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 23 percent higher than the same week one year ago.