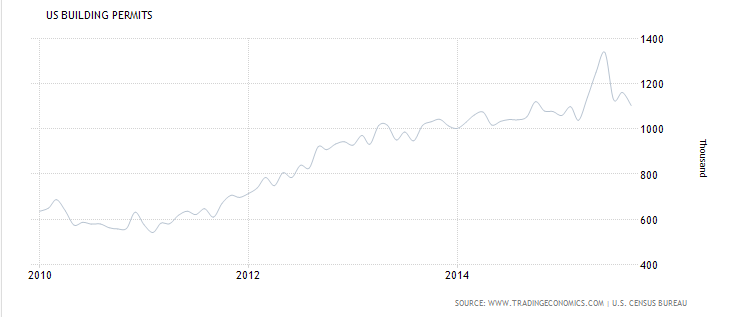

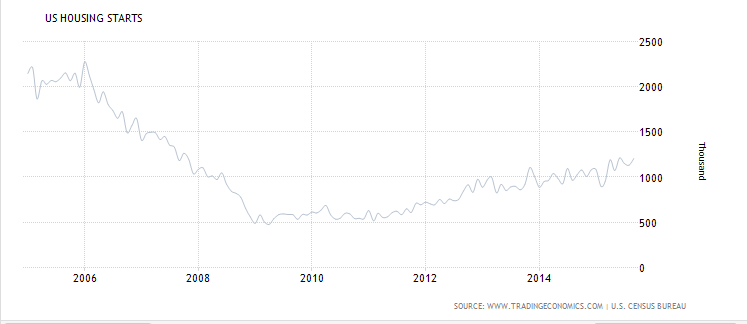

The spike in permits in front of the June 15 expiration of a NY tax break is running it’s course, as permits continue to fall. Starts follow permits and will soon be tapering off as well:

Housing Starts

Highlights

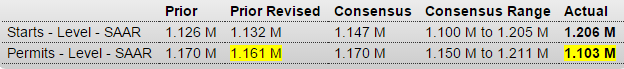

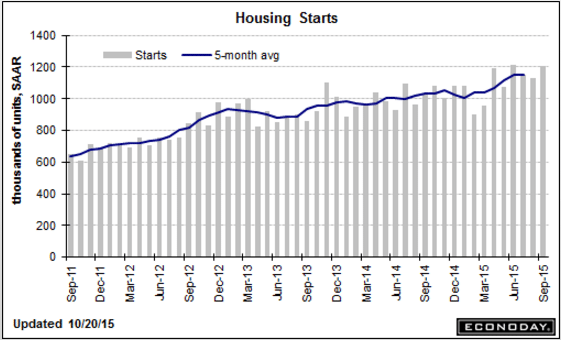

Starts, driven by a spike in multi-family units, came in much stronger than expected in September, news offset however by a significant decline in permits. Starts jumped 6.5 percent to a 1.206 million annual rate which is just outside Econoday’s high estimate. Multi-family starts surged 18.3 percent to 466,000 which follows large spikes in related permits in May and June. Single-family starts rose very slightly, up 0.3 percent to 740,000.

But it’s the permit side of the report that’s weak, down 5.0 percent to only 1.103 million which is well below Econoday’s low estimate. And it’s the multi-family component that’s especially weak, down 12.1 percent to 406,000 which is the lowest reading since March. Permits of single-family units are flat, down 0.3 percent to a 697,000 rate.

The West, a closely watched region for new homes, shows particular strength for starts with a monthly 25.4 percent surge and a 27.5 percent year-on-year gain. Starts have also been very strong in the South, which is the largest housing region, though permits here are lagging.

Taking the ups and downs all together, this report is probably in trend, pointing to an extended upward trend for construction though the abrupt downturn in permits does hint at slowing in the months ahead. Year-on-year, starts are up a very striking 17.5 percent with permits, however, up only 4.7 percent.

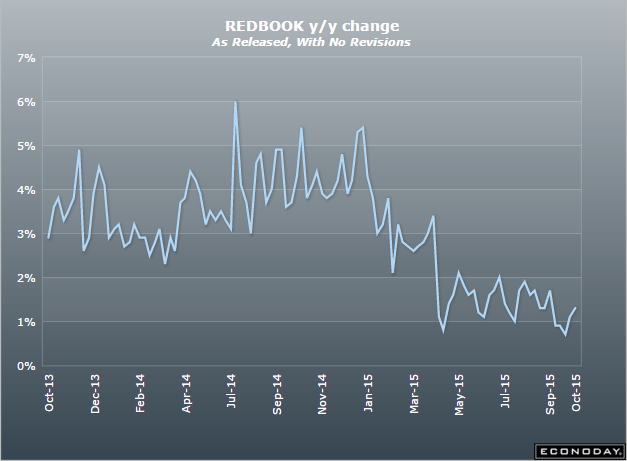

Still down, probably until the comparisons get ‘easier’ in January: