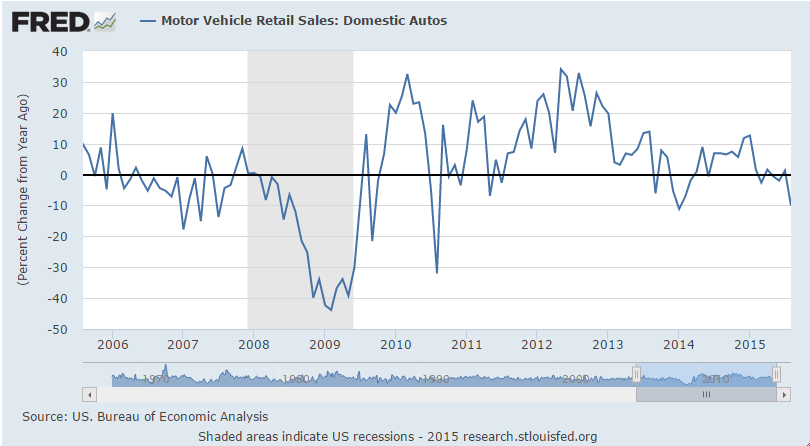

This is consistent with the US production and inventory numbers.

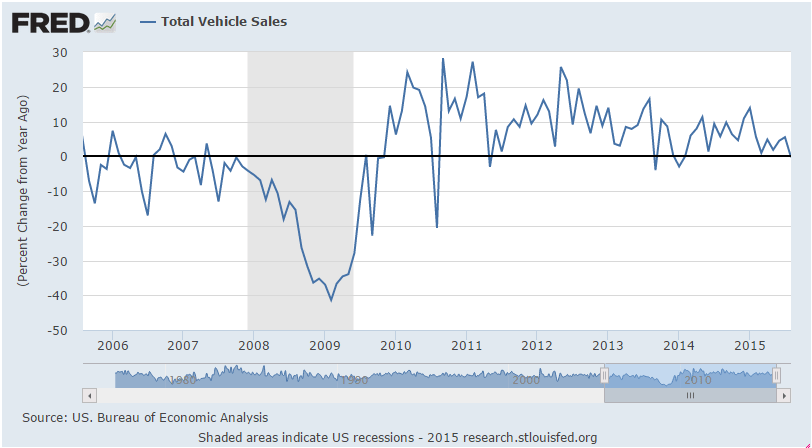

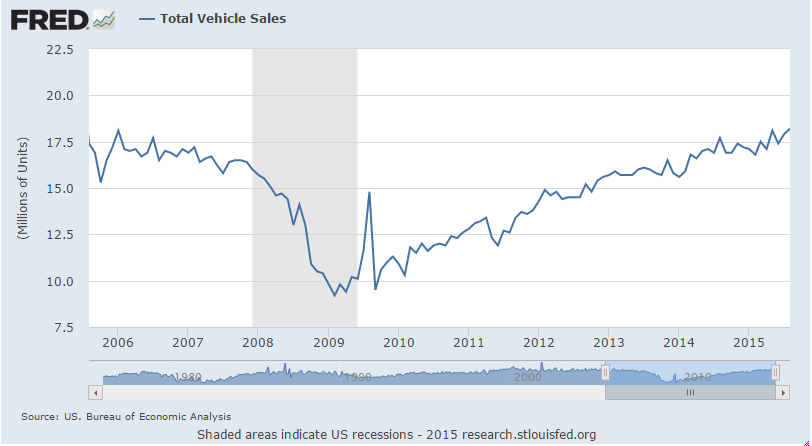

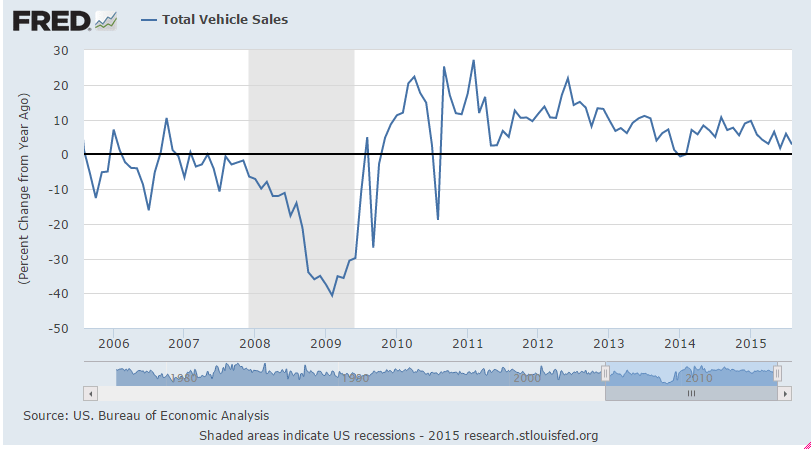

While the total vehicle sales rate was up a bit, the gains seem to be entirely in imported vehicles:

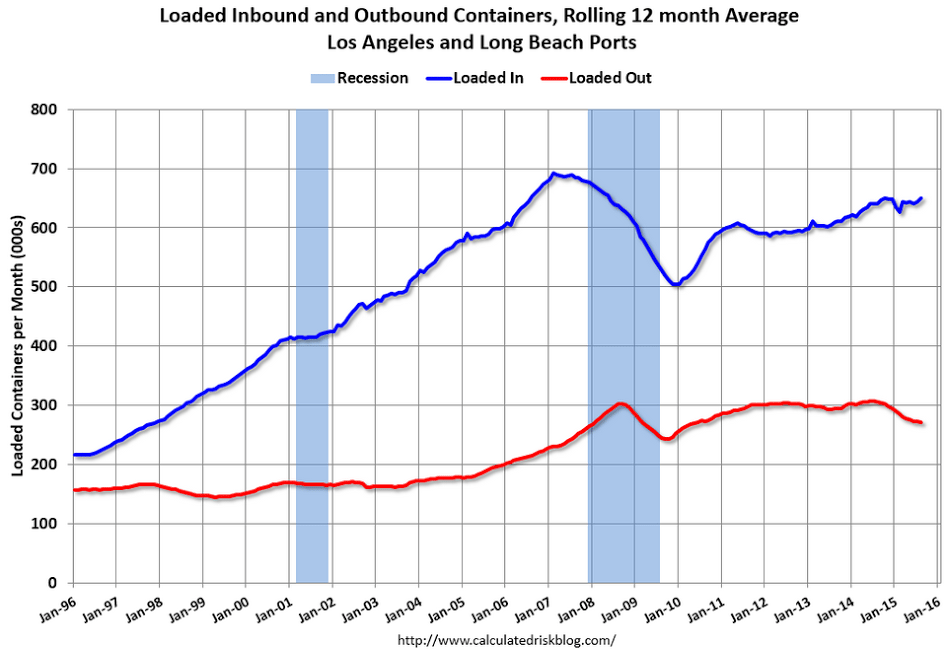

More anecdotal evidence of export softness:

August 2015 Sea Container Exports Still Lagging

By Steven Hansen

The data for this series continues to be less than spectacular – but imports improved this month while exports degraded. The year-to-date volumes are contracting for exports but imports are now in the green.

This continues to indicate weak economic conditions domestically and globally. Consider that imports final sales are added to GDP usually several months after import – while the import cost itself is subtracted from GDP in the month of import. Export final sales occur around the date of export. Container counts do not include bulk commodities such as oil or autos which are not shipped in containers.

Japan : Merchandise Trade

Highlights

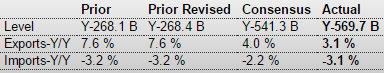

August’s merchandise trade deficit was a greater than anticipated ¥569.7 billion, much larger than July’s revised deficit of ¥268.4 billion. It was the fifth consecutive month that balance was negative. On the year, exports were up 3.1 percent while imports retreated 3.1 percent. Expectations were for an increase of 4 percent for exports and a decline of 2.2 percent for imports.

Exports to Asia were up 1.1 percent for the sixth straight increase. However, exports to China sank 4.6 percent for the first decline in six months. Exports to the EU slipped 0.2 percent for the first drop in nine months. Exports to the U.S. jumped 11.1 percent for the 12 straight increase.