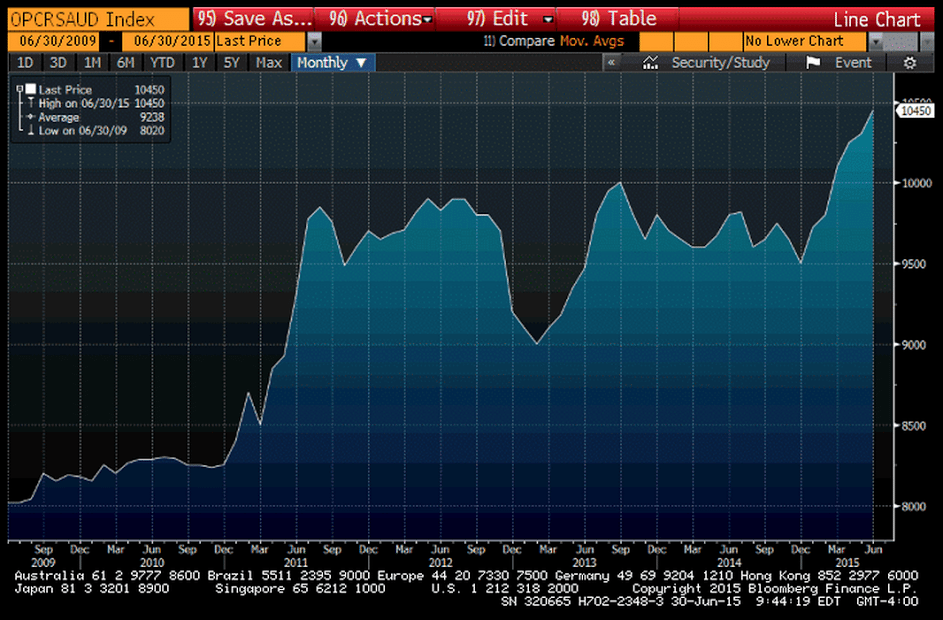

Saudis remain price setter:

Main theme: deflationary biases

Greece is a deflationary event, as EU aggregate demand is further restricted, with no sign of any possibility of fiscal relaxation.

Oil fell as Saudis increased discounts, further reducing global capex and related asset prices.

US oil production that gets sold counts as GDP, and for Q3 both production and prices look to be lower. Yes, the lower price also reduces the deflator, but the fall in the price of oil relative to other prices reduces GDP.

The decline in oil prices has also directly lowered income earned from oil sales, royalties, etc. plus ‘multipliers’ as that lost income would have been ‘respent’ etc. This loss has been at least 1% of GDP and completely ignored by analysts who have been over forecasting growth by several % since oil prices declined.

And the more than 50% decline in drilling due to the lower prices = declining production as oil (and gas) output from existing wells declines over time. This means both less GDP and higher imports, a negative bias for the dollar.

Trade flows remain euro friendly and are taking over the price action, and trade will continue to put upward pressure on the euro until the trade surplus is reversed.

The stronger euro vs the dollar initially helps US stock psychology via earnings translations, etc. but hurts euro zone stocks, exports, GDP, etc. reversing this year’s growth forecasts. And a weaker euro zone economy is also a negative for the US.

Oil capex is down and not coming back until prices rise, and the US budget deficit is down further as well, and I see nothing else stepping up to replace the reduced private and public deficit spending that was offsetting the demand leakages (unspent income) inherent in the institutional structure that grows continuously. So unlike last year, when oil capex did the heaving lifting, I expect any bounce in Q2 gdp from Q1 to be modest and transitory.

The Fed may raise rates some not because of the state of the economy, but due to fears that current policy somehow risks some kind of financial instability. No discussion, of course, that Japan has had a 0 rate policy for over 20 years with perhaps the highest level of financial stability in the history of the world, perhaps indicating that a 0 rate policy promotes financial stability…

Employment seems to have begun to decelerate as well, with fewer new jobs each month and claims beginning to rise.

Unlike the last recovery that ended suddenly with a financial crisis that cut off credit, this one is ending with a fall off in aggregate demand from oil capex due to the Saudis cutting oil prices, so the sequence of events has not been the same. But, as always, it’s just a simple unspent income story.