Prior month revised lower and this month lower

so Fed that much less likely to raise rates:

Labor Market Conditions Index

Highlights

Growth in the nation’s labor market remains subdued with the labor market conditions index at plus 0.8 in June vs a revised plus 0.9 in May. The reading is barely over zero and underscores last week’s soft employment report. The Fed won’t be any hurry to begin raising its overnight policy rate based on June’s employment data.

Ok, number but less than Q1, with export orders and employment growth slowing:

ISM Non-Mfg Index

Highlights

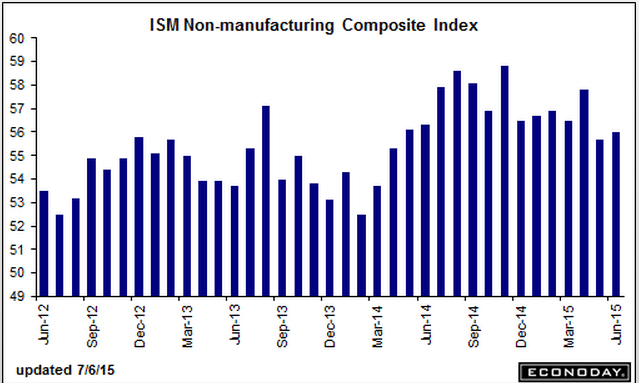

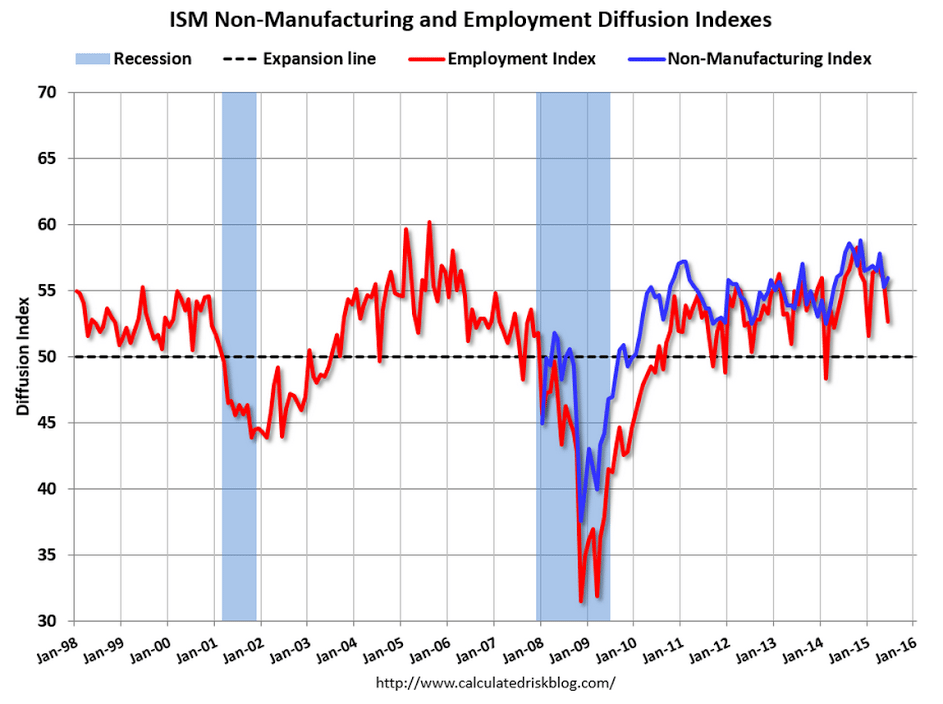

Rates of growth in ISM’s non-manufacturing report held steady and solid in June, at a composite index of 56.0 for a 3 tenths gain from May. New orders are strong, at 58.3 for a 4 tenths gain with backlogs back over 50 at 50.5 for a 2 point gain. Growth in export orders slowed but still held over 50 at 52.0 in a reminder that services exports, unlike goods exports, are in surplus.

Other readings include a strong reading for business activity, up 2.0 points to 61.5, a gain offset by slowing in employment to 52.7 from a strong four-month streak over the 55 level. The report’s price reading slowed slightly to 53.0, a soft level contrasting with inflationary signals in this morning’s PMI service report.

A strong signal in this report is wide breadth among 18 industries with 15 showing growth with two of the exceptions, however, including mining and construction. Contraction in the latter is a surprise given wide indications of growth in housing.

This report is solid but, together with the PMI services index, point to a lack of acceleration for the end of the second quarter.

To my point right after oil prices fell- banks will see large declines in the value of collateral backing their loans which could lead to capital write downs and institution specific lending restrictions, further dampening sales, output, and employment:

Banks Face Curbs on Oil, Gas Lending

By Gillian Tan, Ryan Tracy and Ryan Dezember

July 3 (WSJ) — U.S. regulators are sounding the alarm about banks’ exposure to oil-and-gas producers, a move that could limit their ability to lend to companies battered by a yearlong slump in prices.

The Federal Reserve, Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. are telling banks that a large number of loans they have issued to these companies are substandard, said people familiar with the matter, as they issue preliminary results of a joint national examination of major loan portfolios.

The substandard designation indicates regulators doubt a borrower’s ability to repay or question the value of the assets that back a loan. The designation typically limits banks’ ability to extend additional credit to the borrowers.

The move could add an extra obstacle to companies struggling with high debt loads amid lower prices for the oil and natural gas they produce. Banks have been flexible with troubled energy companies to avoid triggering a flood of defaults and bankruptcy filings, but regulatory pressure could force them to tighten the purse strings.

This year’s Shared National Credit review process contrasts with those in prior years, when regulators didn’t broadly disagree with the banks’ own ratings of credit facilities known as reserve-based loans, the people said. But regulators are paying closer attention to these loans amid worries that a sustained slump in energy prices could lead to big losses for banks, they added.

Twice a year, banks themselves review the value of oil and gas deposits that companies have the right to extract and use as collateral for bank loans. Declines in commodity prices can prompt lenders to reduce their commitments to companies. The effects of such reductions can cascade through energy companies’ capital structures and require them to look elsewhere for funds.

Earlier this year, a number of energy producers sold bonds, took out term loans or sold new shares to replace shrinking reserve-based loans. While some of those moves were forced, others were pre-emptive.

Large energy lenders include Wells Fargo & Co., J.P. Morgan Chase & Co. and Bank of America Corp.

Regulators declined to discuss their conversations with specific banks but have been raising concerns about energy loans. On Tuesday, the OCC, in a semiannual report on emerging risks, said it is monitoring oil-and-gas production loans and said the “significant decline in oil prices in 2014 could put pressure on loan portfolios.” The report didn’t detail the examination of reserve-based loans.

The latest effort comes amid a broader crackdown on lending that regulators consider risky. In 2013, the Fed, OCC and FDIC issued guidance to deter banks from issuing leveraged loans that would increase the companies’ debt loads to levels they consider too high.

Bankers said they are concerned that this latest effort could push some struggling borrowers over the edge, which could, in turn, create more pain for the banks.

“They’re taking a broad brush to the entire sector and not really differentiating between secured and unsecured loans,” one senior leveraged-finance banker said of regulators’ treatment of reserve-based loans.

A number of energy companies already have filed for bankruptcy protection, and others are exploring options to raise capital or restructure their debt loads.

So far, the suffering hasn’t been as widespread as was initially feared when prices plummeted last year.

Bankers are selectively appealing some substandard ratings, especially for companies that can reduce spending and pay down some debt, said people familiar with the matter.

But for the companies that retain the negative rating, any issuance of new debt will likely need to reflect an improvement in creditworthiness, the people said. Options include the addition of loan terms known as covenants, which protect lenders but can increase a company’s risk of default.

Banks may turn to equity or bonds to supply additional financing to borrowers with the substandard designation, some of the people said, though both are costlier for companies than loans.

Analysts expect the oil slump to begin taking a greater toll on companies this fall, when banks review their reserve-based loans. In a note to clients this week, Wells Fargo Securities analysts said that only 30% of the expected oil output in 2016 from the companies they track has been presold at above-market prices, versus 56% of crude production that was hedged this year.

The analysts also said the prolonged period of lower revenue could push more companies closer to violating agreements with creditors to maintain certain profitability levels, and that they expect stock investors to be “more discerning” when offered new shares from heavily indebted companies.

The ECB has begun the move to remove the eligibility of Greek debt as collateral for ECB loans:

ECB maintains emergency assistance for Greek banks, but adjusts haircut on collateral

By Everett Rosenfeld and Matt Clinch

Now that the EU realizes it doesn’t need Greece, the terms are unlikely to be altered. With Greek leadership still committed to staying with the euro and the EU, they take on the role of beggars.

“Even if it came to a collapse of some individual banks, the risk of contagion is relatively small,” Schaeuble told Bild. “The markets have reacted with restraint in the last few days. That shows that the problem is manageable.”

Greek Leaders Says Goal Is to Secure Country’s Financing

By By Eleni Chrepa and Constantine Courcoulas

July 5 (Bloomberg) — Greek party leaders seek solution that secures country’s financing needs, reforms, growth plan and talks on Greek debt sustainability, according to joint statement sent by the Greek president’s office.

Immediate priority is to restore liquidity for Greek economy in cooperation with the ECB

Joint statement signed by Greek PM Alexis Tsipras, acting New Democracy leader Evangelos Meimarakis, Potami party leader Stavros Theodorakis and Pasok party leader Fofi Gennimata

NOTE: Earlier, Greek Showdown Looms With Europe Demanding Tsipras Make Move Link

*GREEK LEADERS: REFERENDUM GIVES NO MANDATE FOR RUPTURE

The call for humanitarian aide puts Greece in a category with other depressed nations seeing that kind of assistance, as Greece turns into a footnote:

European Parliament president: Need to urgently discuss humanitarian aid for Greece

July 5 (CNBC) — European institutions need to urgently discuss a humanitarian aid program for Greece, the …