Most notable is the market reaction- rates up, stocks down, as markets discount higher odds of a Fed rate hike into what markets think is a relatively weak economy, and I tend to agree.

Employment Situation

Highlights

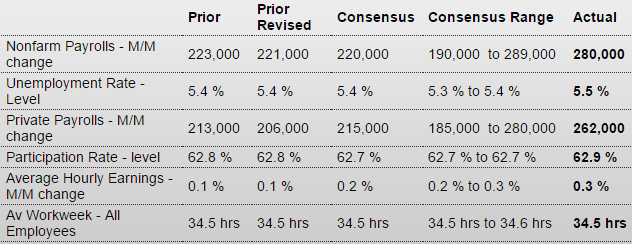

The hawks definitely have some ammunition for the June 16-17 FOMC meeting as the May employment report proved very strong led by payroll growth and, very importantly, an uptick in wage pressures. Non-farm payrolls rose 280,000, well above the Econoday consensus for 220,000 and near the top-end forecast of 289,000. Revisions added a net 32,000 to the two prior months.

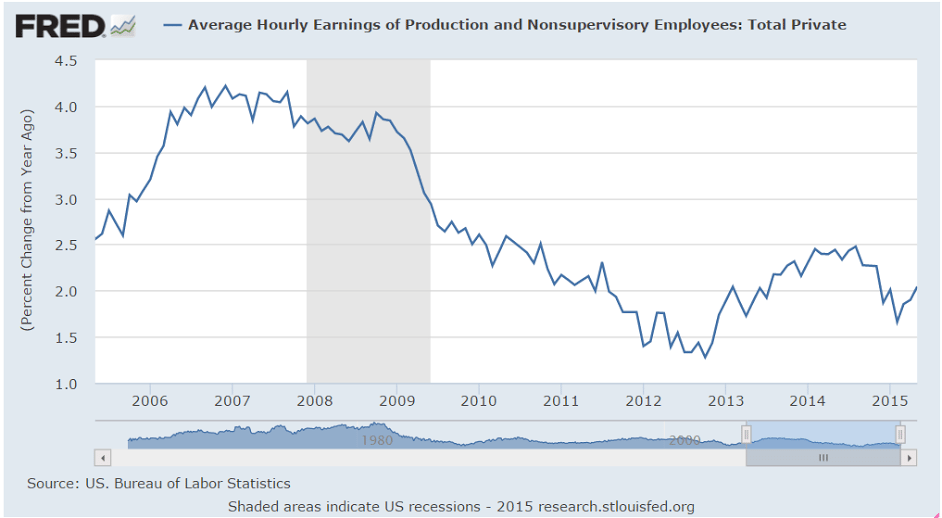

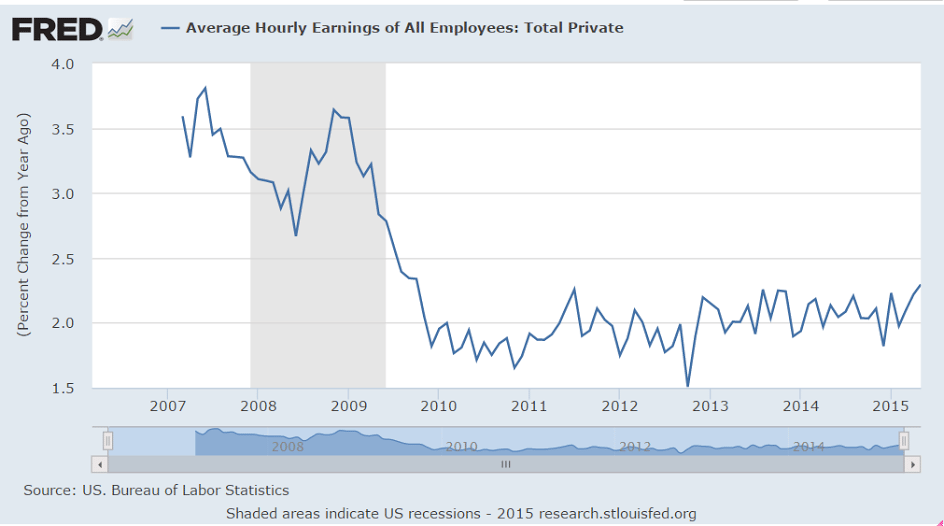

Average hourly earnings came in at the high end of expectations, up 1 tenth to plus 0.3 percent. Year-on-year earnings are up 2.3 percent, a rate only matched twice during the recovery, the last time back in August 2013. Pressure here will be the focus of the hawks’ arguments.

Another sign of strength includes the labor participation rate, up 1 tenth to 62.9 percent. The unemployment rate did tick 1 tenth higher to 5.5 percent which is unexpected but the gain reflects a solid gain in the labor force for both those who found a job and especially those who are now looking for a job.

Private payrolls are up 262,000 vs expectations for 215,000 and also near the high-end forecast. By industry, professional business services once again leads the list, up 63,000 following a 66,000 gain in April. Within this industry, the closely watched temporary help services sub-component is up 20,000 after two prior gains of 16,000. The rise in temporary hiring points to permanent hiring in the months ahead. Trade & transportation is up 50,000 followed by retail trade at a solid 31,000. Construction is up 17,000 but follows a 35,000 surge in April. Manufacturing, where exports are hurting, continues to lag, up only 7,000. And mining, which is being clobbered by contraction in the energy sector, is down 17,000 to extend a long run of declines.

Today’s results probably aren’t enough to raise expectations for a rate hike at this month’s FOMC but will be enough to raise talk for a hike at the September meeting. The approach of a rate hike is a wildcard for the financial markets, likely raising volatility including for the Treasury market where turbulence has been very heavy the last month.

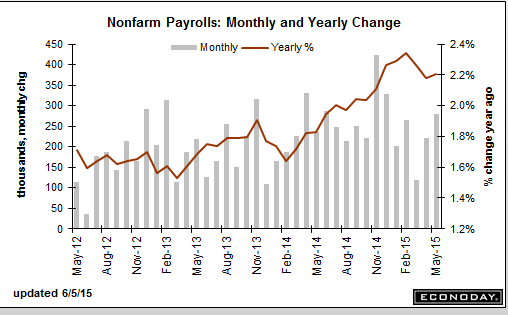

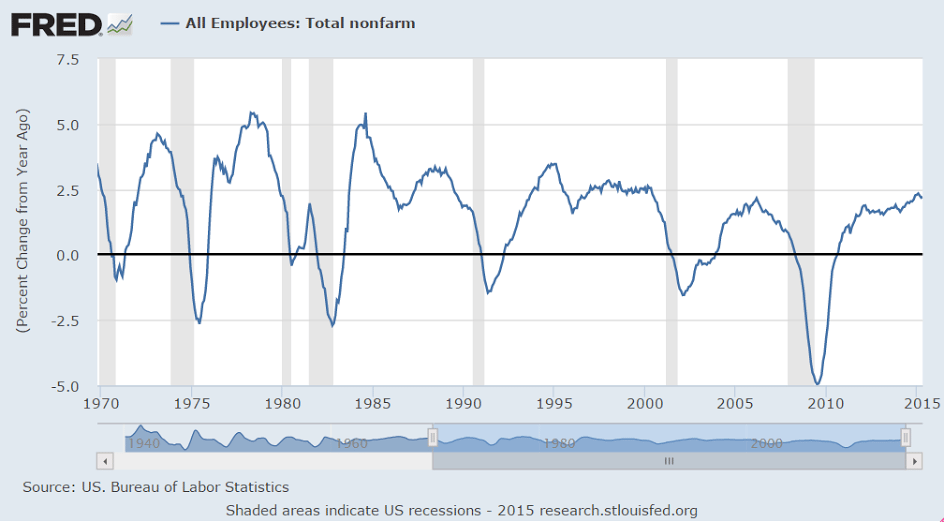

Can be said to be a minor rebound from the March dip when you average the last three months, and certainly not a sign of ‘acceleration’:

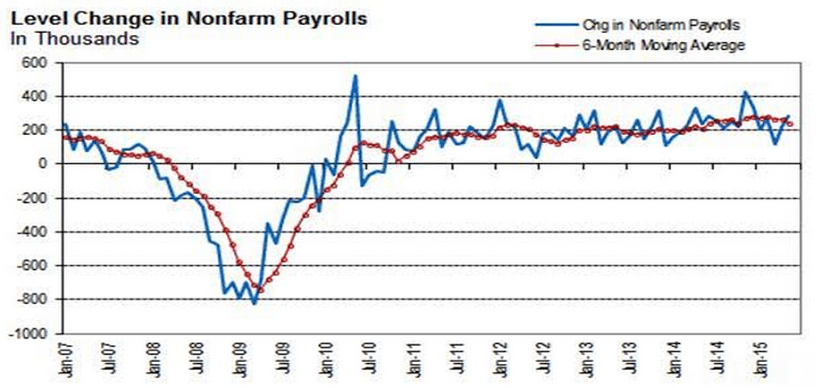

Not a lot of change, but the 6 month average is still bending down some:

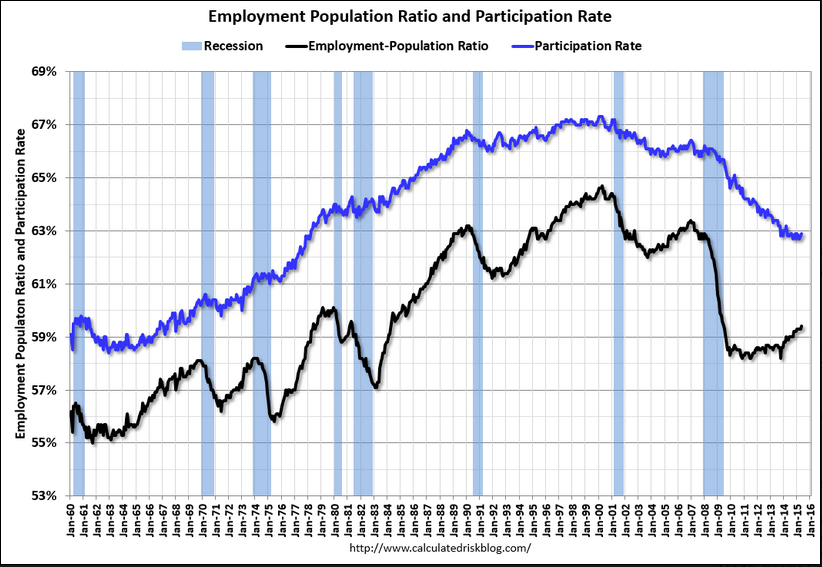

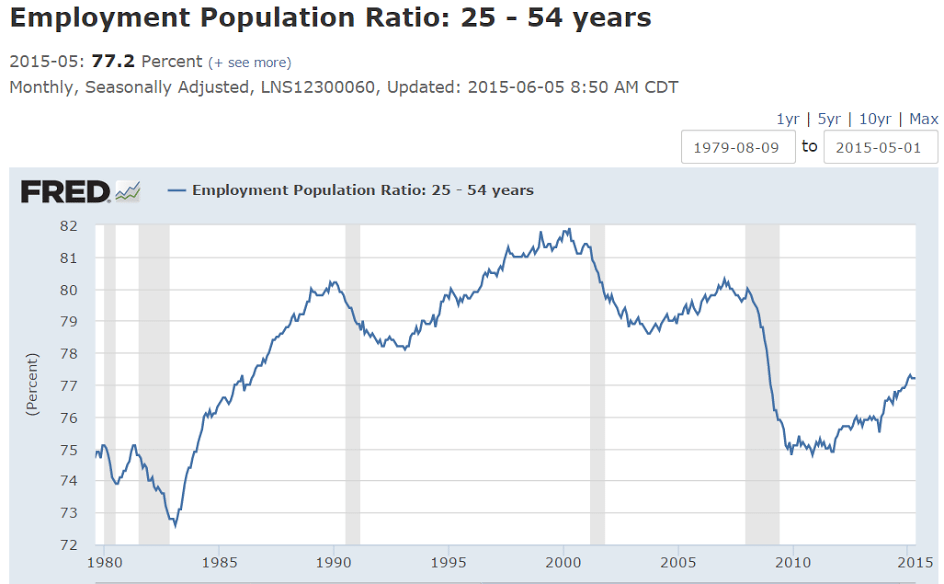

These are still telling me there is still a very large amount of slack in the ‘labor market’ and the gains all along have been relatively small:

If you think of the recessions of ‘digging a hole’ that was subsequently ‘filled in’ you can see the magnitude of the hole dug in the last recession and how it remains ‘unfilled in’, as per the participation rates:

When you look at this age group in isolation, the decline is all about aggregate demand, and not about aging:

This doesn’t look so good when you take it back a few years, and considering this is not adjusted for inflation and there’s been a 0 rate policy for 7 years and $3.5 trillion of QE ;)

Rail Week Ending 30 May 2015: Contraction Further Worsens On Rolling Averages. May 2015 Month Totals Show Contraction Year-over-Year.

(Econintersect) — Week 21 of 2015 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic improved year-over-year, which accounts for half of movements – but weekly railcar counts continues deep into contraction. A quote from the AAR data release:

The degree to which coal carloads have fallen has been a surprise, and the relative weakness in other carload categories is a sign that the economy is probably not yet in bounce-back mode after a dismal first quarter.