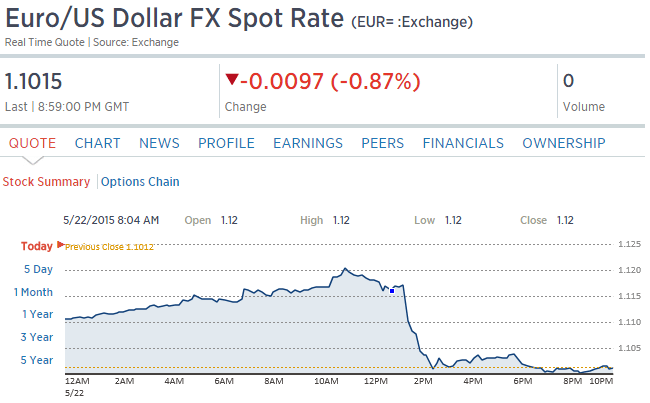

Today’s markets reacted entirely to the .3 increase in core CPI which was actually 0.26 which rounded to 0.3. This, for example, caused the dollar to gap up for the day vs the euro, as traders and portfolio managers acted on the beliefs that it made a Fed hike more likely to come earlier, and that higher rates would fundamentally support the dollar.

However, fundamentally, inflation is in fact a redefinition of a currency downward, as the same number of $ buy less. Likewise, higher domestic costs are a force that reduces exports and higher domestic incomes increases imports, both contributing to trade flows that weaken the currency in line with the loss of value due to inflation. And with floating exchange rates, changes in rates alter the difference between spot and forward price, but not the ‘general level’ of the currency. But no matter, in the near term technicals rule over potential longer term changes to trade flows and the dollar went up.

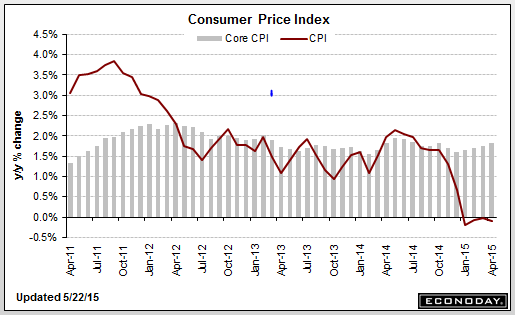

Consumer Price Index

Highlights

Pull forward that rate hike is what some of the hawks are thinking after reading today’s consumer price report where a benign looking headline, up only 0.1 percent in April, masks rising pressure through many components.

Excluding food and energy, core prices rose 0.3 percent which doesn’t seem that much but is outside Econoday’s high-end forecast for 0.2 percent. It is also the highest since January 2013. The year-on-year rate for the core is plus 1.8 percent which, after dipping to 1.6 percent earlier in the year, is closing in on the Fed’s general inflation target of 2.0 percent.

Readings showing pressure are outside energy including medical costs (up a very steep 0.7 percent in the month) and education costs (up 0.5 percent). Shelter costs, reflecting rising rents, came in at plus 0.3 percent for the 3rd time in 4 months which is the hottest streak for this reading since way back in late 2006 and early 2007. Also standing out are gains in furniture (up 1.3 percent) and used cars (up 0.6 percent).

Oil prices have been on the rise but not energy costs, at least in the April report which fell a heavy 1.3 percent. Gasoline fell 1.7 percent in the month. Two other readings also showed downward pressure: airfares (minus 1.3 percent) and apparel (minus 0.3 percent). Food costs were flat.

The headline CPI is down 0.2 percent year-on-year which looks downright deflationary. But the lack of pressure is due entirely to energy which is down a very deflationary 19.4 percent year-on-year. Energy prices are bound to firm given the recent move in oil from the high $40s for WTI to $60. That and emerging price pressures through the bulk of the consumer economy raise the risk that inflation may be brewing after all.